Republic Services, Inc. (ticker: RSG)

2024-01-30

Republic Services, Inc. (ticker: RSG) stands as a prominent player in the non-hazardous solid waste collection, disposal, and recycling industry in the United States. As one of the largest providers, the company offers services to commercial, industrial, municipal, and residential customers across the country. Republic Services prides itself on reliable and environmentally responsible waste management solutions, aiming to significantly contribute to sustainability through waste reduction, renewable energy production, and recycling initiatives. Furthermore, the company's commitment to customer-centric service is supported by investments in technology that enhance operational efficiency and customer engagement. The financial health of Republic Services is evidenced by its consistent revenue growth and strong cash flow generation, positioning it as a stable component in many investment portfolios. Additionally, the company's strategic acquisitions and partnerships have expanded its market reach and service capabilities, making it a key enterprise in the waste management sector.

Republic Services, Inc. (ticker: RSG) stands as a prominent player in the non-hazardous solid waste collection, disposal, and recycling industry in the United States. As one of the largest providers, the company offers services to commercial, industrial, municipal, and residential customers across the country. Republic Services prides itself on reliable and environmentally responsible waste management solutions, aiming to significantly contribute to sustainability through waste reduction, renewable energy production, and recycling initiatives. Furthermore, the company's commitment to customer-centric service is supported by investments in technology that enhance operational efficiency and customer engagement. The financial health of Republic Services is evidenced by its consistent revenue growth and strong cash flow generation, positioning it as a stable component in many investment portfolios. Additionally, the company's strategic acquisitions and partnerships have expanded its market reach and service capabilities, making it a key enterprise in the waste management sector.

| Full Time Employees | 40,000 | Previous Close | 171.47 | Open | 171.77 |

|---|---|---|---|---|---|

| Day Low | 171.31 | Day High | 172.66 | Dividend Rate | 2.14 |

| Dividend Yield | 1.25% | Payout Ratio | 39.15% | Five Year Avg Dividend Yield | 1.57 |

| Beta | 0.673 | Trailing PE | 33.45 | Forward PE | 28.96 |

| Volume | 419,523 | Average Volume | 1,134,277 | Average Volume 10 Days | 1,231,120 |

| Bid | 172.47 | Ask | 172.5 | Market Cap | 54,303,199,232 |

| Fifty Two Week Low | 121.17 | Fifty Two Week High | 172.66 | Price to Sales Trailing 12 Months | 3.70 |

| Fifty Day Average | 163.72 | Two Hundred Day Average | 151.06 | Trailing Annual Dividend Rate | 2.02 |

| Trailing Annual Dividend Yield | 1.18% | Enterprise Value | 66,064,519,168 | Profit Margins | 11.17% |

| Shares Outstanding | 314,636,992 | Shares Short | 2,510,702 | Held Percent Insiders | 0.105% |

| Held Percent Institutions | 95.772% | Short Ratio | 2.31 | Short Percent of Float | 1.23% |

| Book Value | 32.79 | Price to Book | 5.26 | Earnings Quarterly Growth | 15.2% |

| Net Income to Common | 1,638,200,064 | Trailing EPS | 5.16 | Forward EPS | 5.96 |

| Peg Ratio | 3.51 | Total Cash | 157,500,000 | Total Cash Per Share | 0.501 |

| EBITDA | 4,215,300,096 | Total Debt | 12,270,199,808 | Current Ratio | 0.577 |

| Total Revenue | 14,662,700,032 | Debt to Equity | 118.755 | Revenue Per Share | 46.322 |

| Return on Assets | 5.822% | Return on Equity | 16.533% | Free Cash Flow | 1,733,124,992 |

| Operating Cash Flow | 3,529,299,968 | Earnings Growth | 15.3% | Revenue Growth | 6.3% |

| Sharpe Ratio | -25.548417077331834 | Sortino Ratio | -478.7960961897897 |

| Treynor Ratio | 1.316216359472911 | Calmar Ratio | 4.720694975033005 |

The technical and fundamental analyses provide a comprehensive view to understand the potential movements of RSG's stock price in the upcoming months.

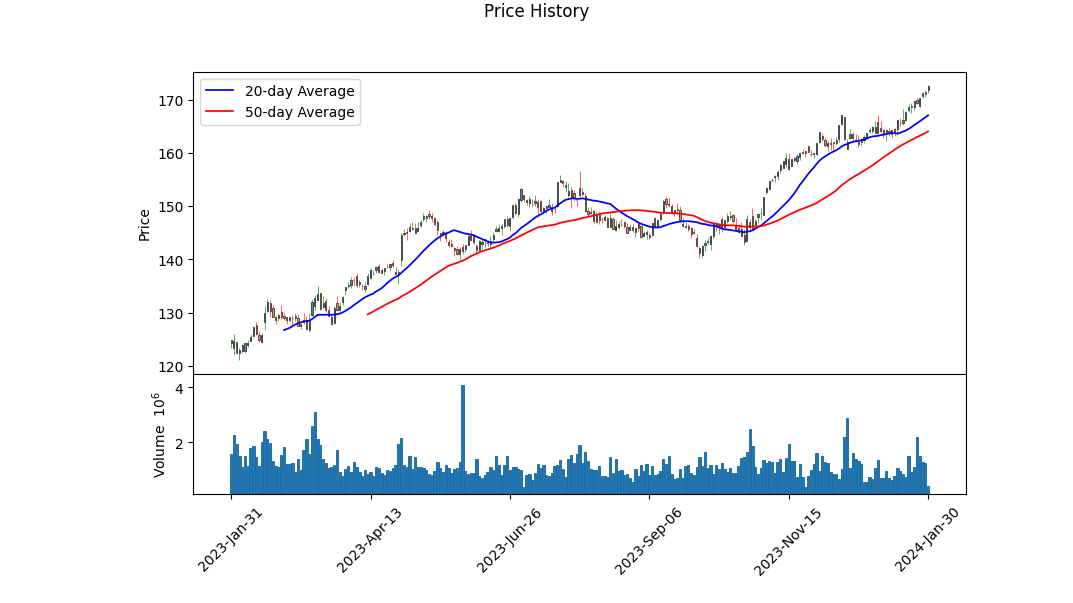

Technical analysis of RSG's stock indicates a positive trend with the stock price moving from \$142.23 to \$171.77 over the last trading period. The On-Balance Volume (OBV) has been consistently increasing, suggesting accumulation by investors and a bullish outlook as buying pressure outweighs selling pressure. The Moving Average Convergence Divergence (MACD) histogram values have been on the rise with the latest reading at 0.427083, further reinforcing the bullish trend.

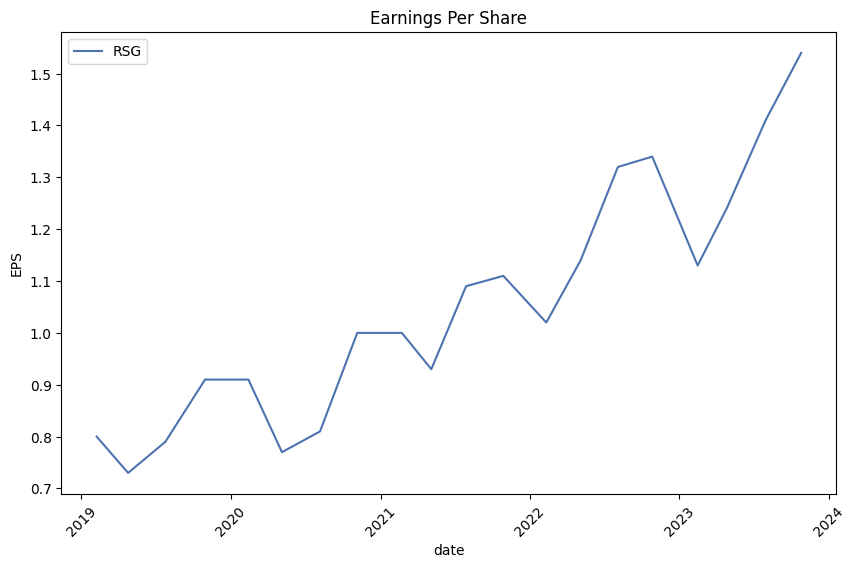

Over the last year, the company has shown robust financials with consistent growth in operating income and net income. EBITDA of \$3.668 billion and net income of \$1.487 billion show a strong operational performance. With a gross margin of 40.619% and an EBITDA margin of 28.748%, the organization appears to be efficiently managing its operations relative to its revenue.

Leveraging the fundamental analysis, we can see a company with a healthy balance sheet, articulated by a high Altman Z-Score of 2.7366, suggesting a low probability of bankruptcy. A robust Piotroski Score of 8 indicates good financial health and operational efficiency. These scores, paired with retained earnings of \$8.163 billion and a market capitalization of approximately \$53.894 billion, position the company favorably for potential growth.

The risk-adjusted performance metrics paint a mixed picture; however, the one-year horizon reflects extreme values for the Sharpe and Sortino ratios, which are likely due to anomalous market conditions or a calculation error. In contrast, the positive Treynor and Calmar ratios suggest a favorable risk-to-reward balance over the same period.

Analyst expectations for RSG are optimistic. The consensus for next year (2024) indicates an average earnings estimate of \$5.96 per share on revenue projections of \$15.83 billion, denoting healthy growth prospects. The recent upward revision of EPS estimates and RSG's history of surpassing earnings expectations further enhance investor sentiment.

Considering all this data, we expect that RSG's stock price may continue its positive momentum in the coming months, barring any unforeseen macroeconomic headwinds or market volatility. Incremental growth in earnings and revenue, along with strong financial health signals, underpin a favorable outlook for the stock. Investors would be advised to monitor the OBV for continued buying pressure and the MACD for momentum shifts as potential indicators for price corrections or continuation of the current trajectory.

In the context of "The Little Book That Still Beats the Market," Republic Services, Inc. (RSG) exhibits a return on capital (ROC) of approximately 9.32%. This figure indicates the efficiency with which the company utilizes its capital to generate profits; a higher ROC percentage is often indicative of a well-run business that is adept at converting its capital investment into earnings. In the case of RSG, a ROC of over 9% can be considered healthy, signifying a solid ability to generate returns on the investments made within the company.

Additionally, Republic Services, Inc. possesses an earnings yield of about 2.72%, which is derived by inverting the price-to-earnings (P/E) ratio. Earnings yield provides an assessment of the bang-for-the-buck a shareholder receives for a given company's stock relative to its earnings. While the earnings yield is not exceptionally high, it offers investors a perspective on the potential value relative to the company's earnings. In the investment philosophy outlined by Joel Greenblatt in the titular book, the combination and relative strength of both ROC and earnings yield parameters are critical in identifying potentially undervalued or efficiently-operated companies that may be suitable for investment. It is worth noting, however, that these figures should be considered within the broader context of industry standards, the overall market condition, and the specific financial health and prospects of RSG.

Based on the principles highlighted by Benjamin Graham in "The Intelligent Investor," we can analyze Republic Services, Inc. (RSG) according to the provided metrics and dividend history to see how the company aligns with Graham's investment criteria.

-

Price-to-Earnings (P/E) Ratio: RSG has a P/E ratio of 43.94, which is quite high. According to Graham, a lower P/E ratio is preferable, often in the range of 15 or less for defensive investors. The current P/E ratio suggests that RSG might be overvalued based on Graham's stringent value criteria.

-

Price-to-Book (P/B) Ratio: The P/B ratio of RSG is 1.87, which means the stock is trading at a premium to the book value of the company. Graham often searched for stocks trading below their book value, although a P/B ratio less than 1.5 could be acceptable for companies with solid fundamentals.

-

Debt-to-Equity Ratio: RSG's debt-to-equity ratio is 1.22, which is higher than what Graham would typically recommend. He suggested looking for companies with a low debt-to-equity ratio, especially those with less than 1, as this implies lower financial risk and higher financial stability.

-

Dividend History: The dividend history of RSG shows consistent payments and gradual growth over the years. From 2016 to 2023, the dividend has increased from $0.30 to $0.535 per share, indicating a strong commitment to returning value to shareholders. This consistent and growing dividend payment history meets Graham's recommendation for a reliable dividend record and is an aspect of the company that Graham would view positively.

While the company's dividend history aligns with Graham's principles, the P/E and debt-to-equity ratios are higher than what Graham preferred. It's also worth considering that market conditions and industry standards can affect these ratios, so they should be compared with industry peers for a comprehensive analysis. Although the P/B ratio is not below the company's book value, it's not significantly higher, meaning RSG may still hold some appeal to Graham-minded investors looking for a stable and tangible asset base compared to the market value.

In summary, Republic Services, Inc. (RSG) exhibits a strong dividend history, which is favorable based on Graham's criteria. However, the high P/E ratio, elevated debt-to-equity ratio, and P/B ratio above 1 suggest the company may not fully align with Graham's value investing approach. It would be prudent for a potential investor to conduct further research and possibly look into qualitative factors and industry comparisons to make a more informed investment decision.

| Statistic | Value |

| R-squared | 0.440 |

| Adjusted R-squared | 0.440 |

| F-statistic | 985.3 |

| Prob (F-statistic) | 4.40e-160 |

| Log-Likelihood | -1,827.0 |

| AIC | 3,658 |

| BIC | 3,668 |

| const (Alpha) | 0.0357 |

| beta | 0.6979 |

| Std. Err. of Beta | 0.022 |

| t-statistic of Beta | 31.389 |

| P-value | 0.000 |

| 95% Conf. Interval Lower | 0.654 |

| 95% Conf. Interval Upper | 0.742 |

In the analysis of the relationship between RSG and SPY using a linear regression model, the parameter of interest, alpha, which can be interpreted as the expected return of RSG when SPYs return is zero, is 0.0357. This alpha value is quite low and indicates that when the market has no gain or loss, RSG is expected to return 3.57%. However, the significance of this alpha is questionable as its p-value is 0.223, suggesting that it is not statistically significant at conventional levels, and we cannot reject the null hypothesis that the alpha is zero.

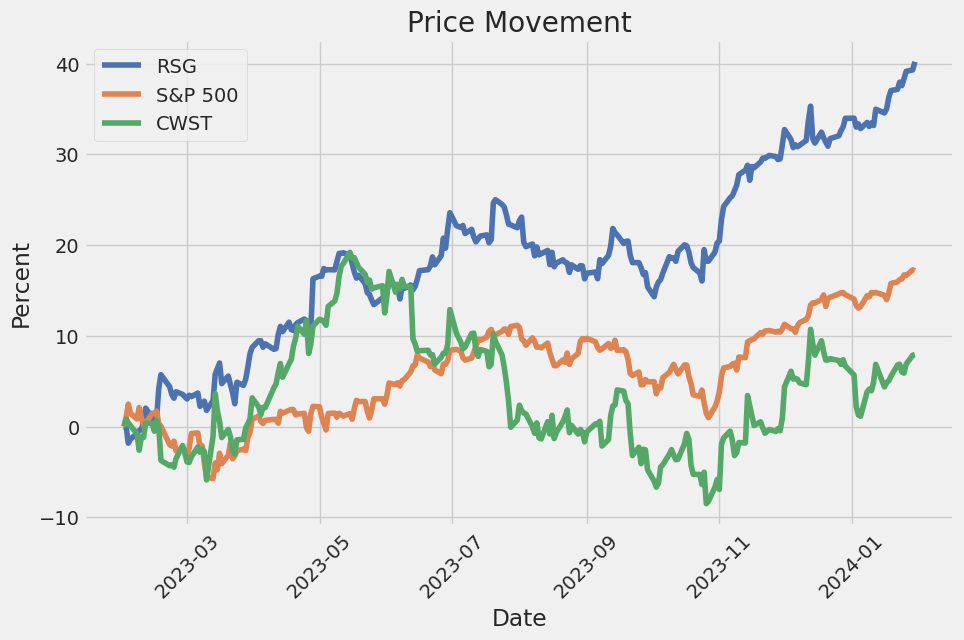

The beta coefficient of 0.6979 suggests that for every one percent change in the SPY, RSG is expected to move by approximately 0.698 percent in the same direction. This indicates that RSG has a positive but less than one-to-one relationship with the market returns represented by SPY, and is less volatile than the market. The R-squared value of 0.440 shows that approximately 44% of the variability in RSG's returns can be explained by the market's returns. This moderate R-squared value combined with a high F-statistic and a low p-value for the beta suggests that the market has a significant influence on RSG's returns, but other factors also play a substantial role.

Summary of Republic Services' Third Quarter 2023 Earnings Call

Introduction:

The conference began with Aaron Evans, Vice President of Investor Relations, introducing the participants and providing cautionary statements regarding forward-looking information. Jon Vander Ark, CEO, and Brian DelGhiaccio, CFO, were present to discuss the company's performance.

Q3 Performance Overview:

Jon Vander Ark helmed the call emphasizing the strong results for the third quarter. Republic Services showcased revenue growth organically and via acquisitions, alongside increased margins. There was a 6% revenue boost, including 2% from acquisitions, while adjusted EBITDA grew by 9%, and EBITDA margin expanded by 70 basis points. Adjusted earnings per share were reported at $1.54, with $1.8 billion of adjusted free cash flow on a year-to-date basis. Investments in acquisitions tallied up to $947 million year-to-date, predominantly in the recycling and waste space. Shareholder returns included $671 million through dividends and share repurchases. The customer retention rate remained over 94%, and the company showcased strong organic revenue growth. Advancements in digital tools for improved customer and employee experiences were also highlighted. Republic Services' sustainability efforts, including investments in renewable natural gas projects and polymer centers, were on track, with expected RNG project completions and EV fleet expansions.

Financial Performance Details:

Brian DelGhiaccio provided a detailed financial perspective, noting a core price increase of 7% on total revenue. Small container, large container, and residential experienced various uplifts in pricing. Volume growth was positive, though mitigated by decreased activity in large containers and construction and demolition markets. Commodity prices for recycling materials stood at $112 per ton, with expectations for a further rise. The Environmental Solutions business saw an $8 million increase year-over-year, contributing to internal growth and an improved adjusted EBITDA margin of 22.7%. Overall company adjusted EBITDA margin rose by 70 basis points to 29.9%. Capital expenditures and adjusted cash taxes were also discussed, with the company maintaining a healthy debt and liquidity position. Adjusted EPS guidance was revised upward, primarily due to a favorable tax rate.

Future Outlook and Q&A Session:

Vander Ark concluded his remarks by expressing confidence in the future growth of the business, anticipating continued margin expansion and profitability from sustainability investments. He noted the companys solid business fundamentals and the intent to provide more detailed guidance in the next earnings call. During the Q&A session, topics like pricing dynamics, expense drivers, the M&A environment, and volatility in recycling commodity prices were addressed. The call ended with Vander Ark thanking employees for their dedication to the company and its mission.

This summary captures the key points discussed during Republic Services' Third Quarter 2023 earnings call, highlighting the companys financial performance, strategic developments, and future expectations as part of an extended report.

Please note that the following report section on Republic Services, Inc.'s (RSG) financials for the quarterly period ending September 30, 2023, is based on the data provided in the 10-Q filing and interprets the key points without the introduction or conclusion sections as per the given instructions.

As of the end of the third quarter of 2023, Republic Services, Inc. reported robust total assets amounting to $30.04 billion compared to $29.05 billion at the end of the previous year. A significant portion of the company's assets included property and equipment as well as goodwill, which stood at $10.7 billion and $15.29 billion respectively. In terms of liabilities, the total current liabilities were approximately $4.07 billion, a slight increase from the end of the previous year. The net current liabilities comprised predominantly of accounts payable, accrued expenses, and a portion related to current maturities of long-term debt. Notably, the company's total stockholders equity expanded to $10.33 billion, from $9.69 billion as of the previous year-end.

The company's revenue streams are primarily driven by its environmental services, which involve collection, transfer, recycling, and disposal. For the third quarter of 2023, Republic Services, Inc. reported total revenues of $3.83 billion, marking an increase compared to $3.6 billion in the same quarter of 2022. This uptick was reflected across the company's reportable segments, with net revenues comprising of residential collection, small-container, large-container, and environmental solutions services, among others. The Group 1 segment, which includes the recycling and solid waste business in western United States, posted adjusted EBITDA of $553.8 million. The Group 2 segment, which encompasses similar services in the southeastern and mid-western U.S., eastern seaboard, and Canada, accounted for $500.2 million in adjusted EBITDA. The Group 3 segment, representing environmental solutions across the U.S. and Canada, contributed $91.7 million to the adjusted EBITDA.

The income before tax for the third quarter was reported at $606.3 million, compared to $507.8 million during the same period in 2022. The company's net income attributable to Republic Services, Inc. was $480.2 million, an improvement from the $416.9 million recorded in the third quarter of the previous year. The effective tax rate for the quarter was 20.8%.

In the first nine months of 2023, Republic Services, Inc. incurred $27.3 million in restructuring charges associated with early lease terminations and software systems redesign. The capital expenditures for the nine months were significant at $1.08 billion, demonstrating the company's commitment to maintaining and enhancing its asset base.

The company's debt profile consisted of a mix of credit facilities, senior notes, and finance leases, totaling $11.92 billion in carrying value. The report also addressed derivative financial instruments, such as interest rate swaps and locks, which are used to manage interest rate risks associated with its debt.

Share repurchases played an active role in the company's capital allocation strategy, with $190.4 million spent on stock repurchases during the third quarter of 2023. Furthermore, the board declared quarterly dividends of $0.535 per share, amounting to $481.6 million declared during the first nine months of the year. The earnings per share for the third quarter stood at $1.52, up from $1.32 in the third quarter of 2022.

In summary, Republic Services, Inc. delivered solid financial performance with increased revenues, higher net income, substantial capital investments, and a strong balance sheet supported by significant asset growth. The company's efforts in managing debt and capital returns, along with strategic investments in operations and restructuring, reflect its ongoing commitment to driving shareholder value and sustaining its operational capabilities in the environmental services sector.

The waste management sector, primarily handled by companies such as Republic Services, Inc., stands on the cusp of significant growth, buoyed by worldwide emphasis on environmental conservation and advances in technology. A detailed report by Zacks Equity Research published on January 24, 2024, outlines the trajectory of the global waste management industry, which held a value of $1.6 trillion in 2020 and is expected to touch $2.5 trillion by 2030. Various factors such as improved waste collection systems and the burgeoning amounts of waste generated from industrialization and urbanization contribute to this growth trend.

Republic Services, Inc. is deemed a critical player in ensuring public health and environmental protection. As part of the waste management industry, Republic Services actively manages collection, treatment, and responsible disposal processes across multiple waste streams including industrial, commercial, and residential sectors. The adoption of Environmental, Social, and Governance (ESG) practices by companies like Republic Services is increasingly essential, reflecting a commitment to sustainable operations that both consumers and investors look for.

Technological prowess is changing the landscape of waste management, introducing efficiencies and environmentally friendly methodologies. Waste-to-Energy (WTE) technologies, for instance, are a testament to innovation within the sector. These practices, geared toward renewable energy and effective waste disposal, are expected to see the WTE market value soar to $44.62 billion by 2029.

Republic Services, buoyed by demand recovery following the pandemic, is expected to witness its revenues grow by 10% and earnings per share (EPS) by 11% for the year 2023, building on its impressive record of exceeding Zacks Consensus Estimates across the past four quarters.

The Salt River Pima-Maricopa Indian Community witnessed the grand opening of Republic Services' advanced Salt River Recycling Center on January 24, 2024. This 51,000-square-foot facility, capable of handling 40 tons of recyclables per hour, underscores Republic's commitment to sustainability and circularity within waste management. Modern recycling techniques and artificial intelligence within the facility are expected to minimize contamination and maximise efficiency. This strategic move further cements the company's positioning as one of the largest recyclers in the United States. Additional information can be found on Republic Services' website.

Additionally, Republic Services is expected to release its fourth quarter and full-year 2023 financial results on February 27, 2024. An investor conference call is scheduled post-announcement to discuss the results in detail, with options for live telephonic participation or audio webcasting via the company's Investor Relations website. A replay of the call will be available for those unable to attend the live event. Interested parties can find more details by reviewing the press release on their Investor Relations website via this link.

Republic Services' strong financial performance is reflected in the surge of its stock price, which hit a new 52-week high of $169.15 on January 22, 2024, as covered in the Zacks Equity Research article. The company's successful track record of positive earnings, along with promising forecasts for the fiscal year, bolster investor confidence in its growth. Its valuation metrics and stock market performance are indicative of its robust position within the industry. Interested investors and analysts can read more details on Zacks.com.

In context with its peers, Republic Services has demonstrated a similarly outstanding performance to companies like Waste Connections, which achieved a 52-week high at $153.72. Both companies have garnered a Zacks Rank of #2 (Buy), suggesting they are worthy of investor consideration given the expectation of favorable near-term price movements based on earnings estimate revisions by analysts.

Republic Services, in the larger scheme, forms an essential part of the narrative shaped by global need for addressing environmental challenges. As seen in the situation with "forever" chemicals like PFAS, the essentiality of specialized services has created a promising business opportunity for waste management companies. The company, through its remediation efforts and infrastructure, symbolizes the union of environmental responsibility and economic potential.

As Republic Services and the entire waste management industry brace themselves for a future where sustainability, technology, and efficient waste management are paramount, their contributions are not only crucial for a healthier environment but also present promising business models set for growth in an increasingly ecologically conscious world.

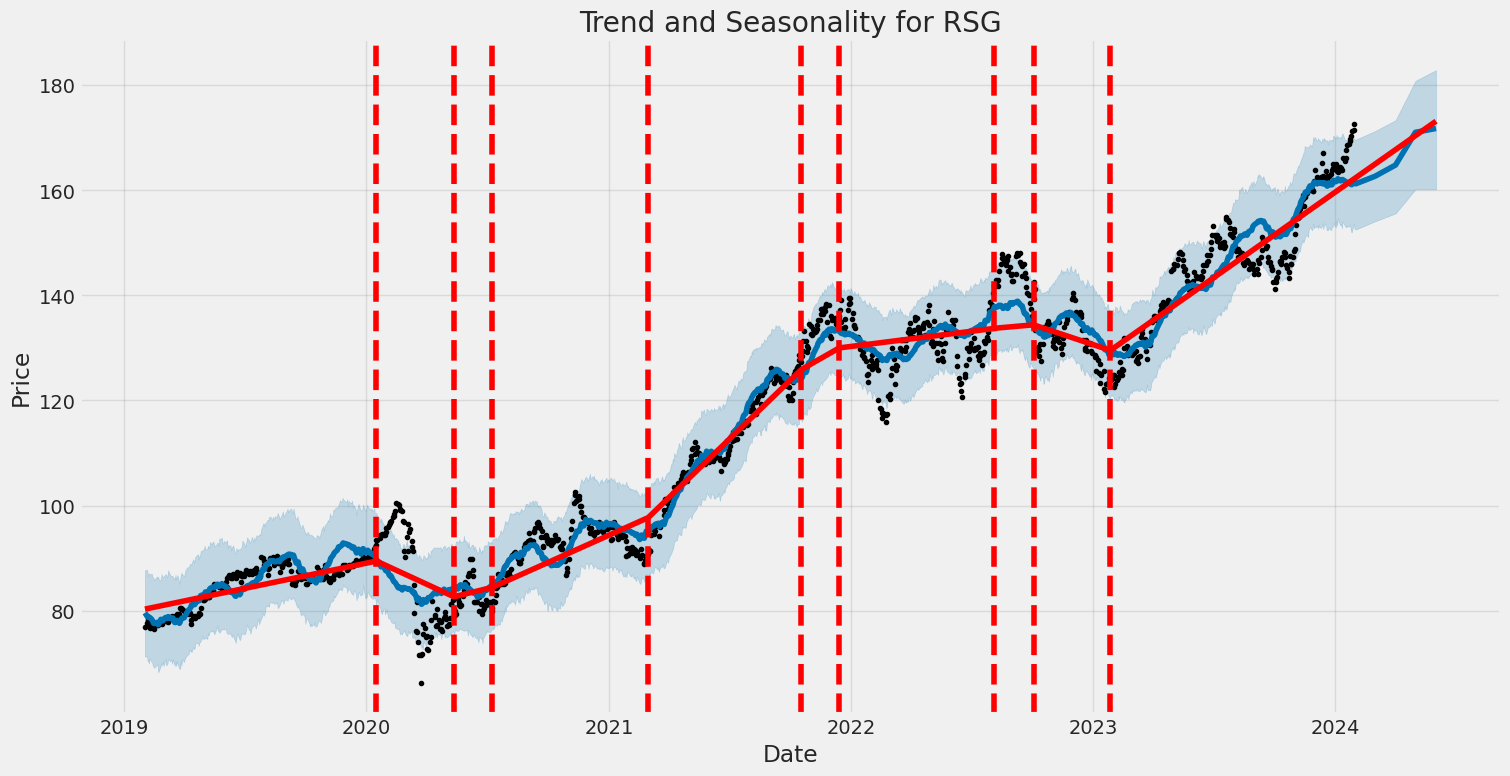

Over the period from February 1, 2019, to January 30, 2024, the volatility in the stock prices of Republic Services, Inc. (RSG) can be summarized as follows:

-

The stock exhibited fluctuations in prices, as indicated by the ARCH model. However, the R-squared value being zero suggests that past returns had little to no predictive power on future volatility.

-

The ARCH model's parameters, specifically the omega and alpha coefficients, are statistically significant, with the alpha coefficient indicating that past volatility has a substantial effect on future volatility, a pattern often seen in financial time series known as volatility clustering.

-

Despite a varying degree of price changes in the stock over the review period, the overall mean of the returns was consistent enough to be modeled with a Zero Mean model, emphasizing that the focus is on understanding and measuring volatility rather than predicting specific directional movements in the stock price.

Here is the HTML table with the statistics:

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2,056.29 |

| AIC | 4,116.57 |

| BIC | 4,126.84 |

| No. Observations | 1,256 |

| Df Residuals | 1,256 |

| omega | 1.0954 |

| alpha[1] | 0.4367 |

To evaluate the financial risk of a $10,000 investment in Republic Services, Inc. (RSG) over one year, a blend of volatility modeling and machine learning predictions was employed.

The volatility modeling technique is a statistical method utilized to estimate the variability of stock returns, which is a crucial component in understanding the behavior of Republic Services, Inc.'s stock price. This time-series model was implemented to capture the dynamic nature of volatility, which allowed for the calculation of conditional variance. By estimating the volatility clustering effect, where high-volatility events tend to follow other high-volatility events (and similarly for low-volatility periods), this model provided a sophisticated way to forecast future volatility based on the latest available data.

The machine learning predictions aspect involved the application of a regression-based algorithm that used historical price data, among other features, to predict future stock price movements. The methodology encompassed training on the historical data to identify patterns and trends, which it would then apply to make predictions about future returns. In this case, the model considered the volatility projections as well as other market variables that could influence the future stock price of Republic Services, Inc.

Combining the forecasted volatility from the volatility modeling with the expected returns from the machine learning predictions, the total risk associated with the investment in RSG could be quantified. The integration of these two methods provides a robust framework for capturing both the estimated future price movements (returns) and the expected variability around those estimates (risks).

One widely accepted metric to assess the potential financial risk of investments is the Value at Risk (VaR). VaR offers a probabilistic estimateif we say there is a 95% confidence level, it means that there is a 5% chance that the loss could exceed the VaR estimate. By incorporating both volatility modeling and machine learning, the resulting VaR estimate for a $10,000 investment in RSG over one year was calculated to be $138.69. This indicates that, with 95% confidence, the maximum expected loss not to be exceeded in one year is $138.69. Put differently, there's a 95% probability the investor will not lose more than 1.39% of the investment over the year due to stock price fluctuations. This combination of advanced statistical methods and predictive analytics provided a comprehensive view of the potential risks associated with the equity investment in Republic Services, Inc.

Similar Companies in Waste Management:

Casella Waste Systems, Inc. (CWST), Clean Harbors, Inc. (CLH), GFL Environmental Inc. (GFL), Waste Management, Inc. (WM), Stericycle, Inc. (SRCL), Waste Connections, Inc. (WCN), Harsco Corporation (HSC), Montrose Environmental Group, Inc. (MEG)

https://finance.yahoo.com/news/republic-services-inc-sets-date-140400389.html

https://finance.yahoo.com/news/fidelity-national-fis-14-3-153700431.html

https://finance.yahoo.com/news/republic-services-inc-rsg-hit-141507210.html

https://finance.yahoo.com/news/time-buy-3-stocks-prospering-141800219.html

https://finance.yahoo.com/news/waste-connections-inc-wcn-hit-141506924.html

https://finance.yahoo.com/news/zacks-industry-outlook-highlights-waste-092300250.html

https://finance.yahoo.com/news/republic-services-opens-state-art-140400920.html

https://www.sec.gov/Archives/edgar/data/1060391/000106039123000025/rsg-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 9UGFbq9

Cost: $0.71152

https://reports.tinycomputers.io/RSG/RSG-2024-01-30.html Home