Starbucks Corp (ticker: SBUX)

2023-12-15

Starbucks Corporation, trading under the ticker SBUX on the NASDAQ, is a globally recognized leader in specialty coffee retail. Founded in 1971 in Seattle, Washington, Starbucks has grown beyond its original location to become a multinational chain with over 30,000 locations spread across more than 80 markets as of my knowledge cutoff in early 2023. The company operates and licenses coffee shops that offer a variety of coffee and tea beverages, along with an assortment of fresh food items, pre-packaged food offerings, and coffee-related accessories and equipment. Under its brand umbrella, Starbucks also sells goods and services under brands such as Teavana, Seattle's Best Coffee, and Evolution Fresh. Starbucks has been innovative in its approach, particularly in leveraging digital engagement through its mobile app and loyalty program, which contributes significantly to its income. As a corporate entity, Starbucks emphasizes its commitment to ethical sourcing and sustainability, aiming to strengthen its socially responsible image while navigating the complex and competitive landscape of global coffee retail.

Starbucks Corporation, trading under the ticker SBUX on the NASDAQ, is a globally recognized leader in specialty coffee retail. Founded in 1971 in Seattle, Washington, Starbucks has grown beyond its original location to become a multinational chain with over 30,000 locations spread across more than 80 markets as of my knowledge cutoff in early 2023. The company operates and licenses coffee shops that offer a variety of coffee and tea beverages, along with an assortment of fresh food items, pre-packaged food offerings, and coffee-related accessories and equipment. Under its brand umbrella, Starbucks also sells goods and services under brands such as Teavana, Seattle's Best Coffee, and Evolution Fresh. Starbucks has been innovative in its approach, particularly in leveraging digital engagement through its mobile app and loyalty program, which contributes significantly to its income. As a corporate entity, Starbucks emphasizes its commitment to ethical sourcing and sustainability, aiming to strengthen its socially responsible image while navigating the complex and competitive landscape of global coffee retail.

| As of Date: 12/15/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 111.21B | 104.54B | 113.56B | 119.68B | 113.86B | 96.68B |

| Enterprise Value | 131.86B | 125.29B | 134.62B | 140.19B | 134.48B | 117.32B |

| Trailing P/E | 27.33 | 27.83 | 32.16 | 36.16 | 35.05 | 23.74 |

| Forward P/E | 23.58 | 22.42 | 24.33 | 30.86 | 29.15 | 25.06 |

| PEG Ratio (5 yr expected) | 1.34 | 1.26 | 1.37 | 1.75 | 1.68 | 1.87 |

| Price/Sales (ttm) | 3.13 | 3.00 | 3.36 | 3.65 | 3.56 | 3.08 |

| Price/Book (mrq) | - | - | - | - | - | - |

| Enterprise Value/Revenue | 3.67 | 13.37 | 14.68 | 16.08 | 15.43 | 13.94 |

| Enterprise Value/EBITDA | 17.81 | 59.30 | 68.35 | 81.85 | 83.68 | 74.07 |

Based on the provided technical analysis data and fundamentals for Starbucks Corporation (SBUX), we can classify the current stock sentiment and project the potential future price movement. Here's a targeted breakdown of the technical indicators before we integrate fundamental analysis for a comprehensive forecast:

Based on the provided technical analysis data and fundamentals for Starbucks Corporation (SBUX), we can classify the current stock sentiment and project the potential future price movement. Here's a targeted breakdown of the technical indicators before we integrate fundamental analysis for a comprehensive forecast:

-

MACD (Moving Average Convergence Divergence): The MACD is below zero, indicating bearish momentum. The negative MACD histogram further confirms the bearish sentiment. The stock could be in a downtrend or experiencing a pullback in an overall uptrend.

-

RSI (Relative Strength Index): With an RSI of 44.83, SBUX is neither oversold nor overbought. This suggests there's room for the stock to move in either direction without extreme pressure from buyers or sellers.

-

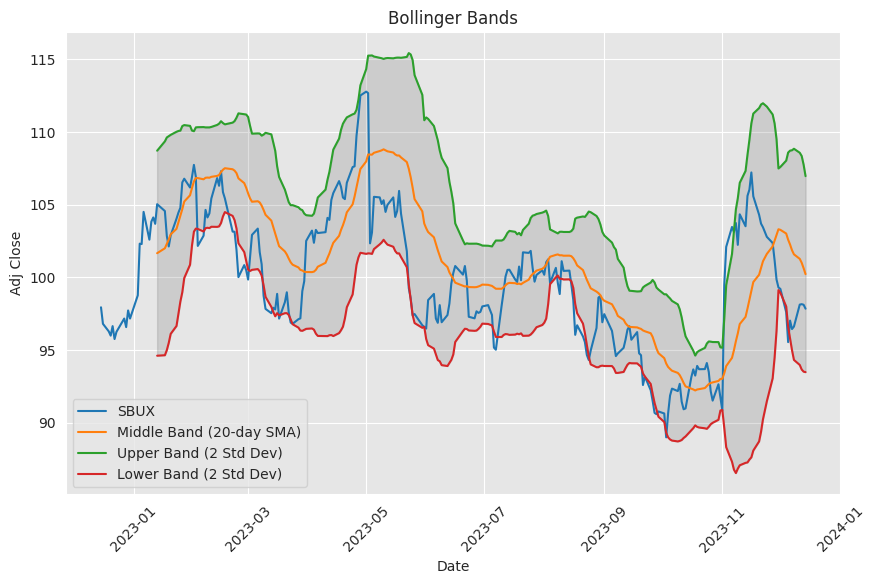

Bollinger Bands: The recent closing price is nearer to the lower band than the upper, potentially indicating oversold conditions. This can sometimes precede a reversal if buyers step in.

-

SMA (Simple Moving Average) and EMA (Exponential Moving Average): The closing price is below both the SMA_20 and EMA_50, which may suggest bearish sentiment in the short to medium term.

-

OBV (On-Balance Volume): A negative OBV indicates that volume is heavier on down days than on up days, which could be a bearish sign, as it suggests selling pressure.

-

Stochastic Oscillator: The STOCHk and STOCHd are below 50, which typically suggests bearish momentum.

-

ADX (Average Directional Index): An ADX of 23.24 points to a market that is not trending strongly. This index indicates the strength of a trend and a figure below 25 usually signifies a weak or non-existent trend.

-

Williams %R: The WILLR indicates the stock is not in oversold territory, suggesting there is capacity for further downward movement.

-

CMF (Chaikin Money Flow): A negative CMF indicates selling pressure, which could be interpreted as bearish.

-

PSAR (Parabolic SAR): Currently, PSAR indicates a bearish trend since there is no upper PSAR value.

Now examining the fundamentals:

-

Market Cap: SBUX's market capitalization has shown volatility but is currently above the figures from earlier quarters, suggesting an overall market confidence in the company.

-

P/E Ratios: The trailing P/E has reduced compared to the previous quarter, indicating improved earnings or adjusted stock price levels. The forward P/E also suggests expectations of growth in earnings.

-

PEG Ratio: The current PEG ratio indicates that the stock may be fairly valued, considering expected growth rates.

-

Price/Sales: This ratio is modest and has decreased from the previous quarter, which could be attractive to investors.

-

Enterprise Value/Revenue and EBITDA: The ratios appear high, but without comparative industry figures, it's difficult to determine the sentiment from these figures alone.

-

Earnings: Earnings have grown year-on-year, showing the company's ability to increase profitability—a positive sign for investors.

Integrating these insights, SBUX's short-term technical indicators lean bearish. The price could remain under pressure or consolidate before establishing a clear direction. However, fundamentals reveal a company that has been improving its profitability and earnings growth, which may provide a counterbalance to short-term technical weaknesses.

Investors may remain cautious in the short term due to technical indicators but optimistic for the medium to long term based on the company's solid fundamentals. It is also possible that the market has not fully priced in the strong fundamentals into the current stock price, providing potential for a price correction to the upside in the following months.

In conclusion, the outlook for SBUX suggests potential volatility in the near term with room for upward movement influenced by positive earnings growth over a longer time frame. Traders should monitor volumes and the development of the mentioned indicators to confirm reversals or continuation of the trend. With improving fundamentals, a shift in sentiment favoring a bullish perspective could occur, leading to a gradual increase in the stock price.

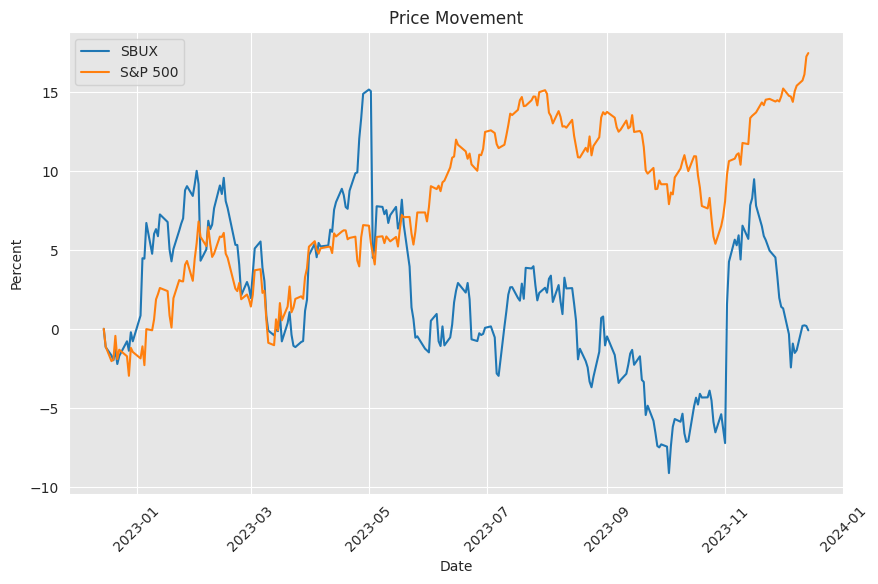

In the fiscal fourth quarter report released in early November, Starbucks Corporation (NASDAQ: SBUX) unveiled strong operational and financial performance, signaling a positive trajectory for the renowned global coffee chain in the upcoming year. Despite a broader market that was underperforming in 2023, Starbucks' stock exhibited resilience post-earnings announcement, buoyed by impressive double-digit sales growth and a sizable jump in profitability. This fiscal robustness is a promising sign for the company's prospective developments.

Starbucks' success is noteworthy, especially because it is not solely riding on price escalations, which is a particularly salient point considering the moderating inflation rates. The brand experienced an invigorating spurt in customer visits, with a 2% increase observed, underscoring strong market resilience and brand loyalty. These figures are all the more impressive considering the contrasting trend of competitors such as McDonald’s. The balanced growth stems in part from Starbucks' introduction of new beverage options that have resonated well with customers.

Financial indicators for Starbucks also showed marked improvement; the net profit margin swelled significantly, exceeding 18% of sales, a leap from the previous year's 14%. These earnings are rooted in more than just elevated prices; they also reflect cost reductions and enhancements in operational efficiency. In particular, the Starbucks digital ordering app has played a pivotal role in streamlining operations and reinforcing customer loyalty.

Looking ahead, CEO Laxman Narasimhan has indicated an optimistic stance towards the company's growth, both at home and overseas. Even with an anticipated modest slowing in comparable store sales growth to a range of 5% to 7%, projections for a strong fiscal year stand firm, supported by a continued surge in profit margins. This forecast promises not just an earnings boost but additional capital allocation for consistent dividends, demonstrating Starbucks' commitment to shareholder returns, which have been consistently augmented for over a decade.

In terms of valuation, Starbucks holds a substantial market cap of $111 billion with a stock trading at a more appealing price-to-sales ratio than seen at the year's commencement. The company's strategic emphasis on balancing price management with operational efficiency and market share gains provides a strong foundation for sustainable performance in the next fiscal year.

When juxtaposed with its rival McDonald's, Starbucks and the fast-food monolith have both witnessed their shares increasing by approximately 50% over the past five years, albeit trailing behind the S&P 500's 65% gain. McDonald's has showcased resilient performance, but Starbucks outshone Wall Street expectations in its latest quarter, underpinned by an 11.4% revenue increase and a significant jump in net income. Starbucks' growth prospects, bolstered by a persistent emphasis on brand recognition and a large-scale international expansion plan, appear to edge out McDonald's, offering a more attractive investment opportunity.

Starbucks has successfully navigated a year marked by strong global comparable store sales growth, demonstrating its ability to draw customers and increase spending. This growth is in stark contrast to competitors’ reliance on mere pricing strategies. With robust U.S. growth and a positive upturn in China, Starbucks has shown strength in both key markets, reflecting in an 11% revenue jump to $9.4 billion and an uptick in operating margins. The loyalty program further accentuates this success, with a 14% rise in active U.S. rewards members, harnessing future sales potential.

In strategic terms, CEO Narasimhan has articulated a comprehensive plan—titled "Triple Shot"—aimed at propelling brand presence, digital capabilities, and global penetration, alongside uplifting the company culture. This plan anticipates continued growth as evidenced by expected sales and earnings projections for fiscal 2024. Such clarity in direction and strength in performance signal a brand in prime health, actively expanding its growth avenues.

However, amid generally positive trends, Starbucks recorded a decline in share values within the reporting period ending November 25, 2023. U.S. stocks showed minor gains overall, but Starbucks found itself among the top losers in the S&P 500 for that week, reflecting the volatility and challenges of retail stocks specifically. Economic factors, including a softening labor market and the anticipatory nature of investors and consumers in light of Federal Reserve's interest rate policies, influenced Starbucks' share price.

The company is not only facing immediate economic pressures but is also operating in a competitive landscape undergoing rapid technological shifts. While these factors impacted Starbucks' market performance in the short term, the brand's long-term growth plans and loyalty to shareholder returns suggest a capacity to overcome these transient challenges.

Continuing with shareholder interests, Starbucks has upheld its commitment to returning value through consistent dividend payments, thereby attracting income-focused investors. The company quickly adapted to the challenges of the COVID-19 pandemic and reached all-time high revenues and record-level earnings. Accentuating its appeal is Starbucks' dividend history of reliable growth since 2010. The company’s new "master plan" indicates a transformation into a dynamic, scalable business, leveraging technology to attract long-term growth that supports its dividend policy.

Bridgewater Associates, known for its diversified investment strategy, also reflected on its engagement with Starbucks shares during the third quarter of 2023. While the hedge fund trimmed its Starbucks holdings by 7%, this move is part of Bridgewater's all-weather strategy, which mirrors a nuanced adjustment to the market and company performance. Starbucks retained its place within Bridgewater’s significant stakes but the reduced holding showcases the fund’s responsive risk management approach.

Amid these fluctuations, The Motley Fool has identified Starbucks as one of the "Top Stocks That Just Went on Sale." The month-over-month price dip might represent a buying opportunity, given the company's strong quarter and ongoing growth trends. Starbucks is trading at a forward P/E ratio that might be seen as a discount, making it a viable candidate for investment, especially in light of its strategic progression and market resilience.

The substantial reframing of a dividend growth portfolio also encompasses investment decisions involving Starbucks Corp. Driven by a significant life event, an investor rationalized a portfolio realignment to fund a new home purchase, underscoring the importance of balancing personal financial goals with investment objectives. The selling strategy was methodical, aimed at retaining high-quality growth stocks like Starbucks while ensuring flexibility to meet immediate and long-term financial needs.

Starbucks demonstrates an impressive blend of strategic growth initiatives, efficient store management, and profitability, which reinforces its position as an attractive investment option. A combination of heightened operational metrics, sustainable international growth, and a shareholder-friendly dividend policy affirms Starbucks as an asset with promising prospects for income and revenue growth amidst challenging financial market conditions.

In conclusion, Starbucks upholds its reputation as a lucrative dividend growth opportunity, marrying an expanding global network with an ingenious operational efficiency model and strategic financial management to deliver an appealing investment profile. As the company forges ahead, its investment narrative remains compelling, catering to those who favor dividend growth with potential for capital appreciation.

News Links:

https://www.fool.com/investing/2023/11/09/1-big-green-flag-for-starbucks-stock/

https://www.fool.com/investing/2023/12/01/better-buy-mcdonalds-vs-starbucks/

https://www.fool.com/investing/2023/11/11/firing-on-all-cylinders-indeed/

https://seekingalpha.com/article/4654122-wall-street-breakfast-what-moved-markets

https://www.fool.com/investing/2023/12/03/3-safe-dividend-stocks-with-growing-payouts/

https://www.fool.com/investing/2023/12/11/3-top-stocks-that-just-went-on-sale/

https://seekingalpha.com/article/4654898-why-i-made-big-changes-to-my-dividend-growth-portfolio

https://www.fool.com/investing/2023/11/09/2-no-brainer-dividend-stocks-to-buy-hand-over-fist/

https://www.fool.com/investing/2023/11/09/3-excellent-dividend-growth-stocks-that-show-no-si/

Copyright © 2023 Tiny Computers (email@tinycomputers.io) -

zFcIw5