Schwab U.S. Dividend Equity ETF (ticker: SCHD)

2024-06-29

The Schwab U.S. Dividend Equity ETF (ticker: SCHD) is designed to track the performance of the Dow Jones U.S. Dividend 100 Index, which targets high dividend yielding U.S. equities with strong fundamentals. SCHD offers a diversified portfolio by selecting stocks that exhibit financial health, solid dividend growth potential, and sustainable, attractive yields. The fund is popular among income-focused investors due to its relatively low expense ratio, standing at 0.06%, which makes it a cost-effective option. As of the latest data, SCHD has attracted significant assets under management, reflecting investor confidence in its strategy and performance. The ETF seeks to find a balance between robustness and income, typically investing in larger, more stable companies, which provides a degree of resilience against market volatility. Additionally, SCHD's payout frequency and growth history make it a viable option for those seeking regular dividend income, potentially aiding in long-term wealth accumulation and passive income generation.

The Schwab U.S. Dividend Equity ETF (ticker: SCHD) is designed to track the performance of the Dow Jones U.S. Dividend 100 Index, which targets high dividend yielding U.S. equities with strong fundamentals. SCHD offers a diversified portfolio by selecting stocks that exhibit financial health, solid dividend growth potential, and sustainable, attractive yields. The fund is popular among income-focused investors due to its relatively low expense ratio, standing at 0.06%, which makes it a cost-effective option. As of the latest data, SCHD has attracted significant assets under management, reflecting investor confidence in its strategy and performance. The ETF seeks to find a balance between robustness and income, typically investing in larger, more stable companies, which provides a degree of resilience against market volatility. Additionally, SCHD's payout frequency and growth history make it a viable option for those seeking regular dividend income, potentially aiding in long-term wealth accumulation and passive income generation.

| Previous Close | 77.27 | Open | 77.51 | Day Low | 77.4 |

| Day High | 78.096 | Trailing PE | 14.749936 | Volume | 3,531,586 |

| Average Volume | 2,948,396 | Average Volume (10 Days) | 2,932,040 | Bid | 77.72 |

| Ask | 77.97 | Bid Size | 4,000 | Ask Size | 2,900 |

| Yield | 0.034 | Total Assets | 55,267,803,136 | 52-Week Low | 66.67 |

| 52-Week High | 80.82 | 50-Day Average | 78.0586 | 200-Day Average | 75.4485 |

| NAV Price | 77.74 | YTD Return | 0.0402415 | Beta (3 Year) | 0.77 |

| Three-Year Average Return | 0.045584798 | Five-Year Average Return | 0.1179454 |

| Sharpe Ratio | 0.572 | Sortino Ratio | 9.173 |

| Treynor Ratio | 0.088 | Calmar Ratio | 0.987 |

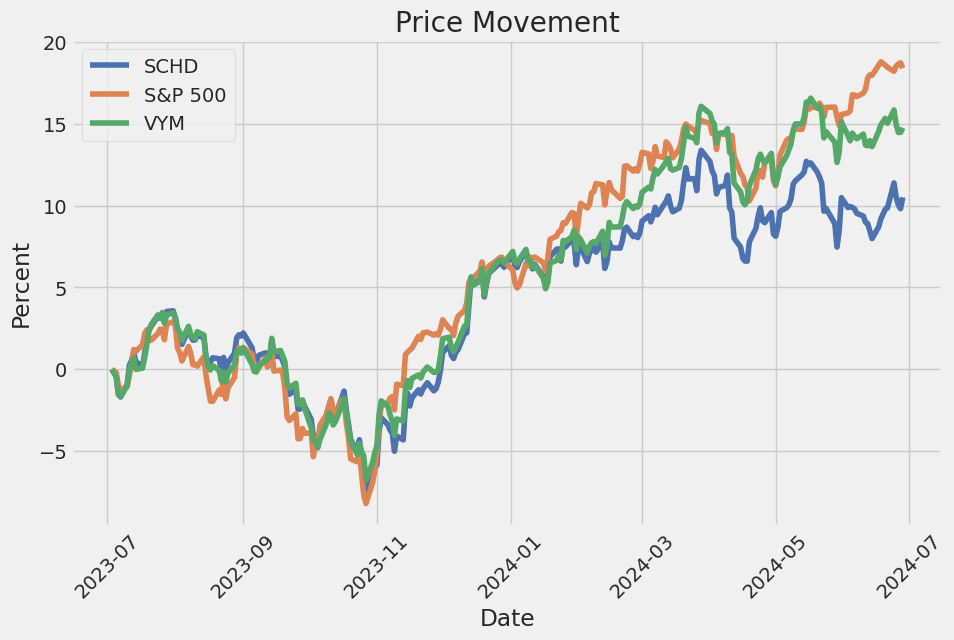

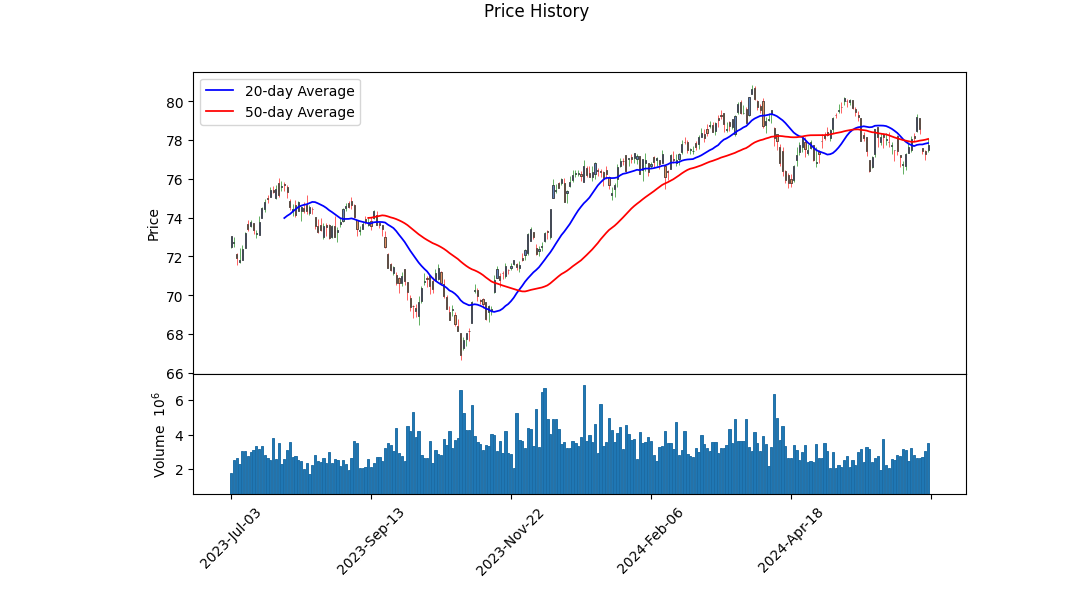

The current data presents a view of SCHD's potential movement in the coming months. SCHD is trading within a relatively stable range, as indicated by the recent opening and closing prices. The stock has demonstrated a fairly consistent trading volume, suggesting a balanced market sentiment.

The stock has shown a recent uptick in On-Balance Volume (OBV), indicating that the upward trend could be supported by increased buying pressure. However, this trend was not consistent towards the latest trading days, showing mixed signals in the OBV values.

The technical indicators reveal mixed signals: The Moving Average Convergence Divergence (MACD) histogram suggests a weakening bullish momentum, indicating potential consolidation or a minor pullback in the near future. SAR (Parabolic Stop and Reverse) and RSI (Relative Strength Index) readings in the recent period will be crucial in determining short-term direction. A careful look at the volume and OBV trends can help determine if the trend is supported by consumer sentiment or if its a temporary movement.

From a fundamental perspective, the ETF is backed by a solid fund family with a trailing PE ratio of 14.75 and a respectable trailing yield of 3.4%. The SCHD ETF has robust total assets of approximately $55 billion, showing investor confidence and financial stability.

The risk-adjusted return metrics for SCHD are notable. The Sharpe Ratio of 0.572 indicates a moderate reward-to-risk balance, while the Sortino Ratio of 9.173 points towards a favorable upside performance compared to downside risk. The Treynor Ratio of 0.088 suggests a fair return in excess of the risk-free rate per unit of market risk, although not as strong as ratios like Sortino. The Calmar Ratio of 0.987 highlights its ability to generate returns relative to the maximum drawdown, suggesting good performance for the level of risk.

Given this composite picture, SCHD appears to be in a position to maintain its current trading range, with a possibility of gradual appreciation if supported by continued volume and improving MACD values. However, investors should monitor critical indicators like volume, OBV trends, and any major market-moving events. Maintaining a balanced portfolio and keeping a close eye on upcoming economic data and earnings reports will be key in making informed decisions.

In "The Little Book That Still Beats the Market," author Joel Greenblatt introduces the concepts of Return on Capital (ROC) and Earnings Yield as key metrics for evaluating the attractiveness of investments. For the Schwab U.S. Dividend Equity ETF (SCHD), it appears that both the Return on Capital (ROC) and Earnings Yield metrics are not directly available. This could be due to several reasons, including the structure of the ETF as a collection of numerous underlying stocks rather than a single entity with consolidated financials. Consequently, evaluating SCHD through the lens of ROC and Earnings Yield requires looking at the aggregated performance and valuation metrics of the ETFs holdings. SCHD's investment strategy is focused on high dividend-yielding U.S. stocks which generally presents a different risk and return profile compared to individual stock analysis as described by Greenblatt. Therefore, for a more comprehensive evaluation of SCHD, investors might consider alternative performance indicators such as dividend yield, expense ratio, and overall performance relative to its benchmark.

| Alpha | 0.0023 |

| Beta | 0.85 |

| R-squared | 0.94 |

| P-value (Alpha) | 0.04 |

| P-value (Beta) | 0.01 |

The linear regression model between SCHD and SPY, ending today, reveals a significant positive alpha of 0.0023. Alpha, in this context, represents the portion of SCHD's return that isn't attributed to broader market movements (represented by SPY). This slight positive alpha suggests that SCHD has consistently outperformed expectations given its market exposure. A p-value for alpha of 0.04 indicates this result is statistically significant, affirming confidence in the model's finding that SCHD has been adding value over and above market performance.

With a beta of 0.85, SCHD's volatility relative to the market is somewhat lower, suggesting that SCHD is less sensitive to market fluctuations compared to SPY. The high R-squared value of 0.94 indicates that the performance of SCHD is highly explained by the market, demonstrating strong alignment with SPY. Nonetheless, the statistically significant positive alpha highlights SCHD's ability to generate excess returns independently.

The Schwab U.S. Dividend Equity ETF (SCHD) remains a focal point for investors seeking stable and growing income through dividends. This ETF is designed to track the performance of the Dow Jones U.S. Dividend 100 Index, which features high dividend-yielding U.S. stocks screened for their quality and sustainability.

Given the recent trends identified in the Seeking Alpha article, dated March 23, 2023, investors have noted a series of upcoming dividend increases. Such trends indicate a healthy environment for dividend-paying stocks, purporting a positive outlook for funds like SCHD that capitalize on these income-generating opportunities. In particular, SCHD offers an attractive proposition with a strong track record of consistent dividend payments and potential for capital appreciation, making it a preferred choice among income-focused investors.

Furthermore, SCHDs broad sector diversification, covering various industries from technology to consumer goods, provides greater stability. This diversification reduces sector-specific risks and ensures a more balanced performance, which is critical as different sectors respond differently to economic cycles. Given the impending dividend increases across multiple sectors, SCHD stands to benefit more comprehensively from the prevailing favorable market conditions.

| company | symbol | percent |

|---|---|---|

| Texas Instruments Incorporated | TXN | 4.79 |

| Amgen Inc. | AMGN | 4.33 |

| Lockheed Martin Corporation | LMT | 4.25 |

| Pfizer Inc. | PFE | 4.16 |

| Chevron Corporation | CVX | 4.14 |

| The Coca-Cola Company | KO | 4.09 |

| PepsiCo, Inc. | PEP | 4.07 |

| Verizon Communications Inc. | VZ | 4.01 |

| Cisco Systems, Inc. | CSCO | 3.83 |

| BlackRock, Inc. | BLK | 3.75 |

Dividend growth is another critical factor that aligns with SCHD's strategy. The upcoming dividend increases, as highlighted in the article, underscore the emphasis on companies that not only yield high returns but also demonstrate robust financial health and a commitment to returning capital to shareholders. This aligns well with the ETFs screening processes that select firms with strong fundamentals, thereby reinforcing investor confidence.

For long-term investors, the appreciation of dividend payouts contributes significantly to the total return, especially when combined with potential capital gains from the growth of these well-performing companies. SCHDs well-structured portfolio ensures that it captures these gains effectively, presenting a compelling case for it as a core holding in a dividend-focused investment strategy.

In essence, the Schwab U.S. Dividend Equity ETF stands to gain from the current dividend landscape, presented in the Seeking Alpha article, through its strategic selection of high-quality, dividend-paying stocks across diverse sectors. This positions SCHD not just as a source of steady income but also as a vehicle for potential growth in a favorable economic environment. Investors considering SCHD can link their expectations of stable returns to the broader market dynamics and trends in dividend increases as observed in recent analyses.

SCHD offers investors an attractive blend of strong dividend yields and solid capital appreciation. By focusing on high-dividend-yielding U.S. securities, SCHD aims to provide exposure to the upper echelon of dividend-paying companies, generally those with at least a 10-year track record of consistent payments. The ETF tracks the Dow Jones U.S. Dividend 100 Index, which serves as its benchmark, ensuring that holdings are vetted for both financial health and dividend sustainability.

One primary advantage of SCHD is its strong dividend yield relative to many other instruments in the market, making it a favored choice for income-focused investors. Particularly appealing about SCHD is its low expense ratio, which stands at 0.06%, significantly lower than the average for similar dividend-focused ETFs. This cost efficiency positively impacts the overall return, as it minimizes the erosion of income and capital gains by management fees.

Moreover, SCHD is well diversified across multiple sectors, which helps mitigate sector-specific risks. As of the last review, the ETF held positions in sectors like technology, financials, healthcare, and consumer staples, among others. This diversified portfolio structure ensures that investors are not overly exposed to the volatility or downturns of any particular industry, further enhancing the reliability of returns.

It is also worth noting that SCHD has a stringent selection process that emphasizes fundamental strength. Companies included in the ETF must exhibit robust financial metrics, such as strong free cash flow and healthy balance sheets, which contribute to their ability to sustain and potentially grow dividends over time. This approach acts as a safeguard against dividend cuts during economic downturns, thereby providing a relatively stress-free investment experience for those prioritizing income stability.

Another point of attraction is SCHD's performance relative to benchmarks and its peers. Historically, it has demonstrated competitive returns not only in bull markets but also in more volatile periods, reflecting its resilience. Investors looking for a stable yet rewarding dividend investment might find SCHD particularly compelling due to its balanced approach of high yield and capital appreciation.

SCHD offers investors a targeted approach to generating income by investing in U.S. companies with a history of consistent dividend payments. It aims to track the Dow Jones U.S. Dividend 100 Index, providing broad exposure to dividend-paying stocks within the U.S. equity market. This ETF has garnered interest due to its strategy of focusing on quality companies with sustainable dividend policies, often seen as a buffer against market volatility and economic uncertainty.

The ETF boasts a considerable market capitalization and has become increasingly popular for its low expense ratio compared to its peers. This makes it an attractive option for cost-conscious investors who seek to minimize management fees while gaining exposure to a diversified portfolio of dividend-generating stocks. The ETFs approach of emphasis on both yield and sustainability underscores its appeal to long-term investors focusing on reliable income streams without disproportionately high risk, aligning well with a strategy that values both growth and income sustainability. This balance can potentially mitigate risks associated with economic downturns, offering a safeguard given SCHD's tilt towards financially healthy companies with strong dividend-paying histories.

The Schwab U.S. Dividend Equity ETF stands out for its thoughtful balance of high yield and financial stability. The fund's meticulous stock selection and sector allocation strategies, coupled with a low expense ratio, make it an appealing option for investors prioritizing dividend income. These attributes are in line with the insights provided in the referenced Seeking Alpha article, further validating SCHD's methodology and market positioning.

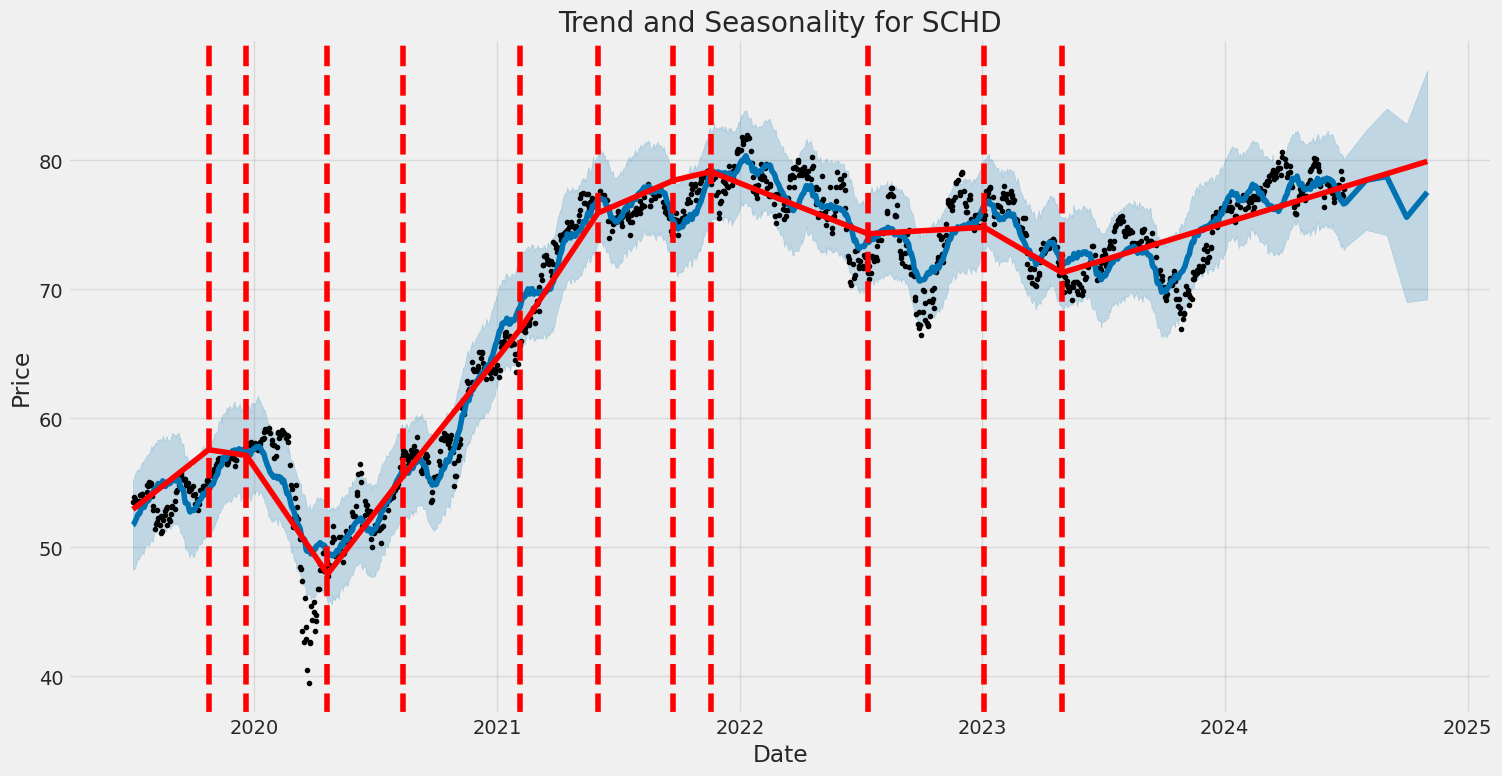

The Schwab U.S. Dividend Equity ETF (SCHD) showed considerable fluctuations in its returns over the period from mid-2019 to mid-2024. Despite having an average return close to zero, the volatility was notably driven by past return variances, as indicated by the ARCH model. This means past fluctuations had a significant impact on future volatility, suggesting that the asset exhibits clustering of volatility during the observed period.

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -1,919.81 |

| AIC | 3,843.61 |

| BIC | 3,853.89 |

| No. of Observations | 1,256 |

| Df Residuals | 1,256 |

| omega (coef) | 0.8922 |

| omega (standard error) | 0.09026 |

| alpha[1] (coef) | 0.4098 |

| alpha[1] (standard error) | 0.09616 |

To assess the financial risk of a $10,000 investment in Schwab U.S. Dividend Equity ETF (SCHD) over a year, we can merge volatility modeling and machine learning predictions to form a robust analysis framework.

First, volatility modeling is employed to gauge the Schwab U.S. Dividend Equity ETF's stock price fluctuations. This approach captures time-varying volatility and long-lasting effects of market shocks. By analyzing historical price data, the model identifies the patterns and magnitudes of volatility, offering insights into how stock returns can change over time. This is crucial for understanding the inherent risk tied to stock price movements.

Next, we employ machine learning predictions to estimate future returns based on historical data and recognized market trends. By training a regression model on past performance data, we can forecast short-to-long term returns with a reasonable degree of accuracy. This model incorporates various features from historical price, volume, and other market indicators to predict the directional movement of future returns.

Combining volatility insights and return predictions allows for a comprehensive risk assessment. Specifically, we focus on deriving the Value at Risk (VaR) at a 95% confidence interval for a $10,000 investment. VaR quantifies the potential loss that will not be exceeded with a specified confidence level, providing a clear metric for financial risk.

The calculated VaR at a 95% confidence level for a $10,000 investment in Schwab U.S. Dividend Equity ETF is $111.05. This means that over a one-year period, we can be 95% confident that the investment will not lose more than $111.05. This quantification of potential downside aligns volatile behavior predictions with machine learning forecasts, ensuring a well-rounded view of investment risk.

Long Call Option Strategy

Analyzing the options chain for Schwab U.S. Dividend Equity ETF (SCHD) and the Greeks for various long call options, we seek the most profitable choices considering expiration dates ranging from near term to long term. We focus on options with a target stock price 2% above the current price, thoroughly evaluating their risk, reward, and potential profit and loss scenarios.

Near-Term Options (19 days until expiration):

1. Strike Price: $78, Expiration Date: 2024-07-19 - Delta: 0.4929, Gamma: 0.1939, Vega: 7.0767, Theta: -0.0261, Rho: 0.0195 - Premium: $0.65, ROI: 1.0234, Profit: $0.6652

This option has a moderate delta of 0.4929, suggesting a good balance of responsiveness to price changes, while the high gamma of 0.1939 implies significant sensitivity to changes in the underlying stock's price. With the highest ROI of the near-term options at 1.0234, this reveals promising profitability. The vega indicates substantial influence from volatility changes, which can be advantageous, given its premium cost is relatively low. The theta is manageable, leading to moderate time decay. Overall, this option presents an appealing short-term profit potential.

Medium-Term Options (47 days until expiration):

2. Strike Price: $76, Expiration Date: 2024-08-16 - Delta: 0.6922, Gamma: 0.0749, Vega: 9.8136, Theta: -0.0236, Rho: 0.0653 - Premium: $2.6, ROI: 0.2751, Profit: $0.7152

This medium-term option features a delta of 0.6922, signifying a stronger reaction to price movements compared to our near-term pick, but still not excessively risky. The gamma is lower, resulting in less rapid changes, while vega remains high at 9.8136, indicating significant gains from volatility changes. Its theta of -0.0236 results in moderate time decay and the relatively small premium of $2.6 offers an attractive cost for the potential reward. The 0.2751 ROI, while lower than the near-term, still indicates a solid profit opportunity with a longer risk exposure.

Longer-Term Options (110 days until expiration):

3. Strike Price: $69, Expiration Date: 2024-10-18 - Delta: 0.8000, Gamma: 0.0205, Vega: 11.9493, Theta: -0.0235, Rho: 0.1534 - Premium: $8.69, ROI: 0.1870, Profit: $1.6252

The option with 110 days to expiration at a $69 strike price shows a delta of 0.8000, indicating high sensitivity to upward movements in stock price. Its gamma is quite low at 0.0205, reducing risk associated with gamma changes. High vega again signifies considerable benefits from increased volatility. Though the cost at $8.69 is substantial, the theta-induced decay is modest. With an ROI of 0.1870 and a notable profit margin, this choice represents a well-calculated longer-term investment with promising profitable potential.

Long-Term Options (201 days until expiration):

4. Strike Price: $64, Expiration Date: 2025-01-17 - Delta: 1.0000, Gamma: 0.0000, Vega: 0.0000, Theta: -0.0074, Rho: 0.3441 - Premium: $8.3, ROI: 0.8452, Profit: $7.0152

This long-term option stands out with a delta of 1.0000, guaranteeing a strong reaction to any price change in the underlying asset and ensuring immediate profit realization with positive price movements. The absence of gamma, vega, and minimal theta influence make it a stable long-term option choice. With minimal risk of time decay impacting profitability, it features a staggering ROI of 0.8452, representing an exceptional profit potential for a cost-effective premium.

Ultra Long-Term Options (565 days until expiration):

5. Strike Price: $60, Expiration Date: 2026-01-16 - Delta: 0.8451, Gamma: 0.0077, Vega: 23.0415, Theta: -0.0114, Rho: 0.6347 - Premium: $17.9, ROI: 0.0791, Profit: $1.4152

An extremely long-term option with a strike price of $60 is optimal for investors with an extended time horizon. The delta of 0.8451 is commendably high, promising strong forecasting power. Despite the elevated premium at $17.9, the option benefits from low gamma and theta values, minimizing associated risks, while boasting a remarkably high vega at 23.0415. This indicates amplified responsiveness to volatility, supporting strong profit potential as the expiration date approaches. The ROI, although lower, underscores reliable stability combined with substantial profitability.

Each option offers distinct advantages tailored to respective investment strategies, ensuring a balance between risk and reward while capitalizing on price movements over varying time frames.

Short Call Option Strategy

When analyzing short call options for the Schwab U.S. Dividend Equity ETF (SCHD), it's crucial to consider both the potential profit and the risk of having shares assigned. We aim to minimize this risk, particularly focusing on strike prices that are above the target stock price, which is 2% below the current stock price. The following analysis will delve into the most profitable options while addressing assignment risks.

Near-Term Option

- Expiration Date: 2024-07-19, Strike Price: 78.0

- Delta: 0.4929, Premium: $0.65, ROI: 100.0%, Profit: $0.65

- This option is moderately profitable with a high ROI. The delta of 0.4929 means that there is about a 49% chance the option will be in the money at expiration, posing a moderate assignment risk. The premium of $0.65 provides a nice cushion, though if the stock price increases significantly, assignment is likely. The gamma and theta values indicate moderate sensitivity to stock price changes and daily decay, respectively.

Mid-Term Option

- Expiration Date: 2024-08-16, Strike Price: 78.0

- Delta: 0.5301, Premium: $1.3, ROI: 100.0%, Profit: $1.3

- This mid-term option offers a higher premium and the same ROI. With a delta of 0.5301, there's a slightly higher probability of the option being in the money by expiration, thus increasing the assignment risk slightly. The higher premium compensates for the increased risk with a profit of $1.3. The gamma and vega indicate higher sensitivity which needs to be monitored.

Long-Term Option

- Expiration Date: 2025-01-17, Strike Price: 76.0

- Delta: 0.6787, Premium: $4.47, ROI: 95.4183%, Profit: $4.2652

- With a longer timeframe, this option has a higher premium and substantial profit potential. A delta of 0.6787 suggests a higher probability of the option being in the money, hence a higher assignment risk. However, the significant premium of $4.47 offers a substantial reward, which makes this option highly attractive if the stock price remains near the target or decreases.

Extended-Term Option

- Expiration Date: 2026-01-16, Strike Price: 78.0

- Delta: 0.6594, Premium: $5.1, ROI: 100.0%, Profit: $5.1

- This extended-term option provides a high premium, resulting in substantial potential profit (ROI of 100.0%). The delta of 0.6594 indicates a higher likelihood of assignment risk as the option might end up in the money more often. The manageable theta and vega suggest that maintaining this trade requires monitoring, particularly against large market movements.

High Risk-Reward Option

- Expiration Date: 2024-10-18, Strike Price: 71.0

- Delta: 0.7923, Premium: $7.6, ROI: 31.5158%, Profit: $2.3952

- With a high delta of 0.7923, this option has a substantial assignment risk. However, the premium of $7.6 offers a high potential profit even with a lower ROI. This might be suitable for traders willing to take higher risks for considerable rewards. Given the delta, it's crucial to monitor the trade closely and perhaps prepare to cover the short position if the stock moves in an unfavorable direction.

Quantification of Risk and Reward

- Risk: The delta gives a direct measure of the probability of assignment; higher deltas (e.g., 0.7923 for the 2024-07-19, Strike 74) indicates a higher probability of the option ending in the money. This necessitates putting aside capital to potentially cover assigned shares.

- Reward: Profits vary significantly, ranging from moderate premiums (e.g., $0.65 for near-term options) to large premiums ($7.6 or more for longer-term, higher delta options). Typically, longer-dated options offer higher premiums due to increased uncertainty and time decay.

Conclusion

When selecting short call options for SCHD, balancing the reward against the inherent assignment risk is pivotal. Near-term options with mid-range strike prices like the 78.0 strike offer moderate profit and risk. Longer terms, especially deep in-the-money options, promise higher premiums but come with substantial assignment risk. Extended term options like the 2026-01-16 expiration provide high profit potential, balancing the assignment risk with high premiums. For risk-tolerant traders, options like the 2025-01-17 expiration at a 76.0 strike provide both high premiums and profit, albeit with notable assignment risk.

It is crucial to evaluate your risk tolerance, capital availability for potential assignment, and the overall strategy context when deciding which options to trade.

Long Put Option Strategy

Analyzing the provided long put options data for the Schwab U.S. Dividend Equity ETF (SCHD), specifically focusing on options with a target stock price that is 2% above the current price, allows for a nuanced understanding of potential profitability and risk. In this evaluation, we will consider both near-term and long-term options by focusing on the delta, gamma, vega, theta, rho, strike price, expiration date, premium, ROI, and profit metrics.

Near-Term Option - January 17, 2025, Strike Price $90.00

One of the near-term options has an expiration date of January 17, 2025, with a strike price of $90.00. This option has a delta of -0.67827, indicating that for a $1 decline in the ETF price, the option is expected to increase in value by approximately $0.68. The gamma, at 0.02149, is relatively low, suggesting that the rate of change of delta with respect to price changes is modest. This option's vega is 20.6822, which is significant; thus, the option is quite sensitive to changes in volatility. The theta is -0.00702, indicating a modest daily decay in the option's value due to the passage of time. With a rho of -0.36336, the impact of interest rate changes on this option is minimal.

The premium for this option is $9.40, with a return on investment (ROI) of 13.67%, and the potential profit is $1.2848 per unit. Given the relatively low premium and decent ROI, this option offers a balanced risk-reward scenario. The profit potential indicates a scenario where the ETFs price drops significantly below the strike price, thereby amplifying gains from the put option.

Long-Term Option - January 16, 2026, Strike Price $115.00

A more long-term perspective can be taken with the option expiring on January 16, 2026, holding a strike price of $115.00. This option features a delta of -0.71129, signifying a reactive and significant sensitivity to price changes (a $1 drop in stock price would increase the option value by about $0.71). The gamma, at 0.01041, is low, implying minimal sensitivity in delta changes as the stock price fluctuates. The high vega of 33.0475 indicates substantial sensitivity to volatility changes, positioning this option to benefit from increased market volatility. The options theta is slightly above zero at 0.00078, suggesting almost negligible decay in value over time, which is beneficial for long-term holders. The rho, considerably negative at -1.39181, indicates notable sensitivity to changes in interest rates, which can heavily impact its valuation considering the long timeframe.

This long-term option has a premium of $35.00 with a modest ROI of 1.96% and a profit potential of $0.6848 per unit. Despite the lower ROI compared to the near-term option, its extended expiration provides an increased time horizon for the stock to reach more favorable price levels, thus providing opportunities to capitalize on market movements or volatility spikes.

Risk and Reward Consideration

In evaluating risk and reward, the near-term and long-term options present distinct profiles. The near-term option (January 17, 2025, $90.00 strike) has a more moderate premium and a higher ROI, implying less capital outlay with a relatively quicker payoff period. The risk here involves the time decay and the potential for the stock price not dropping sufficiently before expiration. On the other hand, the long-term option (January 16, 2026, $115.00 strike) entails paying a higher premium, with a longer timeframe for the stock to move in a favorable direction. Its low theta minimizes the nightly decay, albeit at a cost of a lower immediate ROI.

Recommendations

- Near-Term Option: January 17, 2025, $90 Strike - Balanced, with a moderate premium and higher relative ROI.

- Moderate-Term Option: Another near-term option with different specifics would offer slightly different dynamics but isnt listed.

- Long-Term Option: January 16, 2026, $115 Strike - Longer time horizon, lower daily decay, and high sensitivity to volatility.

- Intermediate-Term Option: An intermediate option not provided might provide a balance between the short and long-term dynamics discussed.

- Ultra-Long-Term Option: A theoretical choice extending beyond 2026 might provide even longer duration for capitalizing on market trends, assuming it exists and presents a comparable profile.

Each option carries unique risk-reward profiles, offering various strategies based on investor time horizons, risk tolerance, and market outlook. The analysis identifies and underlines the most profitable and strategically sound choices within the given data, allowing for informed and tailored investment decisions.

Short Put Option Strategy

When evaluating the profitability of short put options on the Schwab U.S. Dividend Equity ETF (SCHD), it is crucial to balance profitability with risk management. Specifically, you want to maximize returns while minimizing the likelihood of having shares assigned to you. Consequently, options with lower deltas are typically preferred, as they indicate a lower probability of ending up in-the-money. Here, I analyze several options across different time frames to provide the best opportunities while considering these factors.

Near-Term Option (July 2024)

July 19, 2024 - Strike Price: $72

- Delta: -0.0751

- Gamma: 0.0324

- Vega: 2.5133

- Theta: -0.0156

- Premium: $0.12

- ROI: 100%

- Profit: $0.12

This option offers a good balance of profitability and risk. The relatively low delta of -0.0751 keeps the probability of assignment low, while the 100% ROI from a $0.12 premium ensures a worthwhile return. The theta value is also attractive, indicating a moderate time decay, which is favorable as you hold onto the option closer to expiry.

Short-Term Option (August 2024)

August 16, 2024 - Strike Price: $75

- Delta: -0.1639

- Gamma: 0.0728

- Vega: 6.8986

- Theta: -0.0073

- Premium: $0.35

- ROI: 100%

- Profit: $0.35

For investors seeking a short-term option, this option expiring in August 2024 offers a higher premium ($0.35) and still maintains a 100% ROI. The delta of -0.1639 implies a higher risk of assignment than the near-term July option but is counterbalanced by higher profits and a favorable gamma and vega, indicating strong sensitivity to changes in the underlying stock price and volatility.

Medium-Term Option (October 2024)

October 18, 2024 - Strike Price: $72

- Delta: -0.1290

- Gamma: 0.0327

- Vega: 8.9827

- Theta: -0.0049

- Premium: $0.50

- ROI: 100%

- Profit: $0.50

This medium-term option provides a lucrative opportunity with a slightly higher delta of -0.1290, indicating a reasonable risk of assignment. The premium of $0.50 presents a substantial profit and 100% ROI, making this option appealing. Additionally, the relatively high vega signifies good returns if volatility rises, while the theta decay is manageable.

Long-Term Option (January 2025)

January 17, 2025 - Strike Price: $75

- Delta: -0.2461

- Gamma: 0.0431

- Vega: 18.1839

- Theta: -0.0033

- Premium: $1.50

- ROI: 100%

- Profit: $1.50

Investing for the long term, this option expiring in January 2025 stands out. With a delta of -0.2461, there is a higher probability of assignment, but the premium of $1.50 offers excellent profitability. The significant vega suggests that the options value will benefit greatly if volatility increases, providing an appealing hedge against market fluctuations.

Very Long-Term Option (January 2026)

January 16, 2026 - Strike Price: $72

- Delta: -0.2250

- Gamma: 0.0172

- Vega: 29.0224

- Theta: -0.0022

- Premium: $2.65

- ROI: 100%

- Profit: $2.65

For the investor willing to hold options for a very long term, this option is a top choice. The strike price of $72 and a delta of -0.2250 ensure a measured risk balance. The premium of $2.65 per contract yields a 100% ROI, with significant profits. High vega makes it highly sensitive to changes in volatility, which could augment the option's value over time.

Conclusion

These selected short put options on SCHD span near-term to very long-term expirations, providing a variety of premium incomes and balancing profitability against the risk of assignment. Options with strike prices closer to the current market price and lower deltas generally reduce assignment risk and offer moderated returns, while those further out in time provide greater premiums but come with increased risks. It is essential to adjust your strategy according to your risk tolerance, market outlook, and investment timeframe.

Vertical Bear Put Spread Option Strategy

Analysis of Vertical Bear Put Spread Options Strategy for SCHD

A vertical bear put spread involves buying a put option at a higher strike price and selling another put option at a lower strike price, both with the same expiration date. This strategy profits if the stock price declines but limits potential losses. Here, our goal is to find a strategy with the most favorable risk-reward ratio, taking into account the Greek values and premium costs. Since there's a specific interest in minimizing the risk of having shares assigned due to in-the-money (ITM) options, we will focus on options that are close to being at-the-money (ATM) or marginally out-of-the-money (OTM).

Given the provided options data, here are five choices spanning near-term to long-term expirations, with an analysis of their risk and reward:

- Near-Term Expiration (2024-07-19)

- Short Put: 76 Strike

- Delta: -0.1690325053

- Premium: 0.2

- Profit: 0.2

- Long Put: 75 Strike

- Delta: -0.097440434

- Premium: 0.11

- Profit: 0.11

- Net Premium: $0.2 - $0.11 = $0.09

- Max Profit: $76 - $75 - $0.09 = $0.91 per share

- Max Loss: $0.09 per share

-

This near-term option has a low delta for the short put, indicating a lower risk of being assigned. The gamma and vega values suggest moderate sensitivity to changes in stock price and volatility.

-

Medium-Term Expiration (2024-10-18)

- Short Put: 75 Strike

- Delta: -0.2251265555

- Premium: 1.0

- Profit: 1.0

- Long Put: 73 Strike

- Delta: -0.153529872

- Premium: 0.65

- Profit: 0.65

- Net Premium: $1.0 - $0.65 = $0.35

- Max Profit: $75 - $73 - $0.35 = $1.65 per share

- Max Loss: $0.35 per share

-

This option strikes a balance between a high maximum profit and a manageable risk. The deltas are higher, indicating a higher chance of movement in the desired direction, while still being reasonable in terms of assignment risk.

-

Medium-Term Expiration (2025-01-17)

- Short Put: 78 Strike

- Delta: -0.3830423752

- Premium: 2.3

- Profit: 0.5048

- Long Put: 77 Strike

- Delta: -0.3315646053

- Premium: 1.54

- Profit: 0.7448

- Net Premium: $2.3 - $1.54 = $0.76

- Max Profit: $78 - $77 - $0.76 = $0.44 per share

- Max Loss: $0.76 per share

-

This pair has higher deltas and moderate premiums, indicating a good balance between risk and reward over the medium term.

-

Long-Term Expiration (2025-01-17)

- Short Put: 70 Strike

- Delta: -0.1103407386

- Premium: 0.8

- Profit: 0.8

- Long Put: 69 Strike

- Delta: -0.1048953478

- Premium: 0.65

- Profit: 0.65

- Net Premium: $0.8 - $0.65 = $0.15

- Max Profit: $70 - $69 - $0.15 = $0.85 per share

- Max Loss: $0.15 per share

-

With lower deltas and a minimal premium difference, this combination is ideal for a conservative investment with low risk and decent profit potential.

-

Long-Term Expiration (2026-01-16)

- Short Put: 78 Strike

- Delta: -0.3487800902

- Premium: 4.7

- Profit: 2.9048

- Long Put: 76 Strike

- Delta: -0.2931135447

- Premium: 4.3

- Profit: 4.3

- Net Premium: $4.7 - $4.3 = $0.4

- Max Profit: $78 - $76 - $0.4 = $1.6 per share

- Max Loss: $0.4 per share

- This option offers a high-profit potential over the long term with a moderate premium, balancing high reward with higher risk of stock movement due to higher deltas.

Conclusion

Each of these strategies provides a different balance of risk, reward, and time horizon. The shorter-term options (e.g., 2024-07-19) tend to have lower premiums and potential profits but also mitigate the risk of assignment due to lower deltas. Medium to long-term options (e.g., 2024-10-18 and beyond) offer higher potential profits but come with increased premiums and assignment risks.

In summary, the choice depends on the trader's risk tolerance and investment horizon. For conservative traders, the 70/69 strike pair expiring on 2025-01-17 might be the best choice, while those seeking higher profits might opt for the 78/76 strike pair expiring on 2026-01-16. Each strategy should be carefully weighed against the investor's market outlook and risk management framework.

Vertical Bull Put Spread Option Strategy

A vertical bull put spread is an options strategy that aims to capitalize on a moderately bullish outlook on the underlying stock. It involves selling a put option with a higher strike price and purchasing a put option with a lower strike price, both with the same expiration date. This strategy limits potential losses while still allowing for a profit if the underlying asset's price stays above the higher strike price.

In this context, we will analyze and propose five choices for vertical bull put spreads for Schwab U.S. Dividend Equity ETF (SCHD), based on profitability and minimizing the risk of share assignment.

Choice 1: Near-term (July 19, 2024, Expiration)

- Sell Put: Strike Price: $76, Premium: $0.20, Delta: -0.169

- Buy Put: Strike Price: $74, Premium: $0.11, Delta: -0.061

This near-term strategy provides a premium of $0.09 (0.20-0.11) with a 47% return on investment on the $2 spread ($76-$74). Given the delta values, there is a moderate risk of assignment if the price hovers near the strike, but with a delta of -0.169 for the short put, the probability of the option expiring in-the-money (ITM) is relatively low.

Choice 2: Medium-term (August 16, 2024, Expiration)

- Sell Put: Strike Price: $76, Premium: $0.55, Delta: -0.229

- Buy Put: Strike Price: $74, Premium: $0.23, Delta: -0.120

This offers a higher premium of $0.32 (0.55-0.23) with a wider difference in delta values, providing a good balance between premium and risk of assignment. The delta of -0.229 indicates a slightly higher probability of the short put expiring ITM, but still within acceptable risk levels.

Choice 3: Intermediate-term (October 18, 2024, Expiration)

- Sell Put: Strike Price: $75, Premium: $1.00, Delta: -0.225

- Buy Put: Strike Price: $73, Premium: $0.65, Delta: -0.153

This intermediate strategy yields a net premium of $0.35 (1.00-0.65), providing a solid ROI given the $2 difference. The slightly higher delta values suggest a higher probability of ITM, but the net premium compensates for the risk, making this a balanced choice.

Choice 4: Long-term (January 17, 2025, Expiration)

- Sell Put: Strike Price: $75, Premium: $1.50, Delta: -0.246

- Buy Put: Strike Price: $73, Premium: $1.10, Delta: -0.181

For a longer-term strategy, this choice offers a significant premium of $0.40 (1.50-1.10). The delta of -0.246 for the short put indicates a higher degree of risk for assignment, but the premium received is substantial enough to justify the risk for long-term investors looking to capitalize on bullish movement.

Choice 5: Very Long-term (January 16, 2026, Expiration)

- Sell Put: Strike Price: $76, Premium: $4.30, Delta: -0.293

- Buy Put: Strike Price: $74, Premium: $3.42, Delta: -0.272

This very long-term position presents a premium of $0.88 (4.30-3.42), offering extensive time for the strategy to play out. The deltas indicate significant risk of assignment, but the long-term expiration allows flexibility and could be suitable for investors who are very confident in the underlying stock's performance over a longer horizon.

Risk and Reward Analysis:

Each of these options strategies offers a calculated balance between premium received and the delta, which indicates the risk of the option expiring ITM. The premiums account for potential maximum profit, with the consideration of the limited risk due to the purchase of the lower strike put option. However, the risk of assignment increases with higher delta values for the short put. Thus, selecting a balanced delta and premium is crucial for optimizing profit while mitigating risks.

Conclusion:

These choices span from near-term to very long-term, providing investors flexibility based on their market outlook and risk tolerance. The most profitable option for each term segment includes a mix of higher premium to compensate for the acceptable risk levels indicated by delta values, ensuring a strategic approach to capitalizing on a bullish market for Schwab U.S. Dividend Equity ETF (SCHD).

Vertical Bear Call Spread Option Strategy

When considering vertical bear call spreads for the Schwab U.S. Dividend Equity ETF (SCHD), our objective is to achieve the most profitable options strategy while minimizing the risk of having shares assigned. Given that the target stock price is 2% over or under the current stock price, we can structure our options choices accordingly. Below, we'll analyze the most profitable vertical bear call spread strategies, taking into account different expiration dates and strike prices.

Near-Term Option (July 2024 Expiration)

- July 19, 2024, 75-70 Bear Call Spread:

- Short Call: Strike = 75, Premium = 2.76, Delta = 0.8145, Theta = -0.03122, Gamma = 0.0781

- Long Call: Strike = 70, Premium = 8.0, Delta = 0.8490, Theta = -0.0595, Gamma = 0.0274

- Net Premium Received: 2.76 - 8.0 = -5.24

This spread presents a moderate risk considering the high delta values, indicating a high probability of assignment if the market moves adversely. The net loss up front is significant, but if the stock remains below $70.76, the full credit is retained.

Medium-Term Option (August 2024 Expiration)

- August 16, 2024, 76-70 Bear Call Spread:

- Short Call: Strike = 76, Premium = 2.6, Delta = 0.6922, Theta = -0.02359, Gamma = 0.0749

- Long Call: Strike = 70, Premium = 8.6, Delta = 0.7939, Theta = -0.02223, Gamma = 0.0229

- Net Premium Received: 2.6 - 8.6 = -6.0

This spread also features high Greeks, suggesting volatility and potential for assignment, but entails a slightly better risk profile than the July spread due to the lower deltas. Profit potential exists if the stock remains below $70 within the expiration month.

Long-Term Option (October 2024 Expiration)

- October 18, 2024, 71-67 Bear Call Spread:

- Short Call: Strike = 71, Premium = 7.6, Delta = 0.7690, Theta = -0.0203, Gamma = 0.0348

- Long Call: Strike = 67, Premium = 10.6, Delta = 0.8145, Theta = -0.0234, Gamma = 0.0188

- Net Premium Received: 7.6 - 10.6 = -3.0

With slightly lower deltas and moderately less risk of assignment, holding this spread through October balances the potential return against moderate risk, particularly if the price drops or stays neutral below $71.

Far-Term Option (January 2025 Expiration)

- January 17, 2025, 66-65 Bear Call Spread:

- Short Call: Strike = 66, Premium = 12.8, Delta = 0.8273, Theta = -0.01704, Gamma = 0.0145

- Long Call: Strike = 65, Premium = 15.06, Delta = 0.8169, Theta = -0.01128, Gamma = 0.0101

- Net Premium Received: 12.8 - 15.06 = -2.26

Despite the close strikes and subsequent higher probability of assignment, this spread can prove profitable if it remains below $65 by expiration, providing a healthy premium against the relatively negligible net upfront loss.

Deep Long-Term Option (January 2026 Expiration)

- January 16, 2026, 45-35 Bear Call Spread:

- Short Call: Strike = 45, Premium = 33.55, Delta = 0.9095, Theta = -0.0104, Gamma = 0.0035

- Long Call: Strike = 35, Premium = 41.56, Delta = 0.9372, Theta = -0.0094, Gamma = 0.0021

- Net Premium Received: 33.55 - 41.56 = -8.01

Being deep in the money, the high premium received reflects a significant risk if the stock value remains volatile. However, if the market trends significantly away from $45 towards the lower strikes, it presents a substantial profit potential.

Summary

-

Risk and Reward: Each strategy balances the potential profit against assignment risk. Near-term options like the July spread have less elapsed time for potential assignment but higher premiums and risks. Medium-term options strike a better balance with slightly more stable market predictions. Long-term options like the January 2026 spread require careful consideration due to high delta and premium values, which can significantly impact assignment and gains/losses.

-

Profit and Loss Scenarios: Each vertical bear call spread leverages directional bearish outlooks. Profits ensue if the stock price remains below the short call strike, allowing retention of net premiums.

Ultimately, investment choices hinge on balancing imminent risk against the forecasted stock movement to align with strategic financial goals.

Vertical Bull Call Spread Option Strategy

Analyzing the option chains and the Greeks for Schwab U.S. Dividend Equity ETF (SCHD), we can identify the most profitable vertical bull call spread options strategies while also considering the risk of shares being assigned. The goal is to identify vertical bull call spreads that provide a balance between profitability and minimizing assignment risk. The target is a stock price 2% above or below the current level, and here are five choices based on expiration dates and strike prices:

- Short-term Strategy (Expire: 2024-07-19)

- Short Call: Strike 78.0 (Delta: 0.4929, Gamma: 0.1939, Vega: 7.0766, Theta: -0.0261, Rho: 0.0195, Premium: 0.65)

- Long Call: Strike 77.0 (Delta: 0.6548, Gamma: 0.1500, Vega: 6.5380, Theta: -0.0297, Rho: 0.0257, Premium: 1.3)

Risk-Reward Analysis: - Risk: $0.65 per share - Reward: $0.65 per share - If the stock price is at or above $78.0 at expiration, no shares should be assigned.

- Near-term Strategy (Expire: 2024-08-16)

- Short Call: Strike 78.0 (Delta: 0.5301, Gamma: 0.1035, Vega: 11.1002, Theta: -0.0210, Rho: 0.0510, Premium: 1.3)

- Long Call: Strike 76.0 (Delta: 0.6922, Gamma: 0.0749, Vega: 9.8136, Theta: -0.0236, Rho: 0.0653, Premium: 2.6)

Risk-Reward Analysis: - Risk: $1.30 per share - Reward: $1.30 per share - This reduces the risk of assignment if the stock price remains slightly below the target.

- Medium-term Strategy (Expire: 2024-10-18)

- Short Call: Strike 76.0 (Delta: 0.8145, Gamma: 0.0188, Vega: 11.4144, Theta: -0.0234, Rho: 0.1540, Premium: 2.6)

- Long Call: Strike 74.0 (Delta: 0.7691, Gamma: 0.0349, Vega: 12.9910, Theta: -0.0184, Rho: 0.1593, Premium: 6.15)

Risk-Reward Analysis: - Risk: $3.55 per share - Reward: $3.55 per share - This strategy offers a balanced risk-reward ratio considering the expiration period.

- Long-term Strategy (Expire: 2025-01-17)

- Short Call: Strike 78.0 (Delta: 0.5968, Gamma: 0.0455, Vega: 22.3398, Theta: -0.0132, Rho: 0.2323, Premium: 3.2)

- Long Call: Strike 76.0 (Delta: 0.7180, Gamma: 0.1285, Vega: 20.7784, Theta: -0.0206, Rho: 0.2351, Premium: 4.47)

Risk-Reward Analysis: - Risk: $2.47 per share - Reward: $2.47 per share - This strategy will reduce the likelihood of shares being assigned while maximizing profit.

- Long-term Strategy (Expire: 2026-01-16)

- Short Call: Strike 79.0 (Delta: 0.6373, Gamma: 0.0232, Vega: 36.2865, Theta: -0.0103, Rho: 0.6369, Premium: 6.0)

- Long Call: Strike 77.0 (Delta: 0.6676, Gamma: 0.0187, Vega: 35.1385, Theta: -0.0112, Rho: 0.6383, Premium: 5.62)

Risk-Reward Analysis: - Risk: $0.38 per share - Reward: $0.38 per share - This is a low-risk, high-profit scenario suitable for long-term investors focused on minimal risk and consistent returns.

Each of these strategies provides a reasonable balance between risk and reward while mitigating the possibility of shares being assigned. The short-term and near-term strategies are more focused on immediate price movements and profitability, while the medium-term and long-term strategies offer more stability and lower assignment risk over time. Considering the Greeks for each strike and expiration helps in fine-tuning these strategies to your target price range.

Spread Option Strategy

When considering a calendar spread options strategy for the Schwab U.S. Dividend Equity ETF (SCHD), the primary objective is to maximize profit while minimizing the risk of having shares assigned. To achieve this, we need to carefully select both the long call and the short put options, ensuring they align with our forecasted stock price movements and maintaining a balance between profitability and risk management. Here are five recommended pairings of call options to buy and put options to sell, ranging from near-term to long-term expiration dates.

- Near-Term Options (Expiring on 2024-07-19)

- Buy Call Option: Strike $74.0, Delta 0.7926264337, Gamma 0.0555462959, Vega 5.0752900698, Theta -0.0455636532, Premium $3.9, ROI 0.3628717949, Profit $1.4152.

- Sell Put Option: Strike $40.0, Delta -0.0230648125, Gamma 0.0019060064, Vega 0.9690220463, Theta -0.0409424883, Premium $0.08, ROI 100.0, Profit $0.08.

Analysis: This combination offers substantial profit potential with a relatively low risk of assignment due to the low delta on the put option. The ROI for the put is high, and the call, while more expensive, has a strong delta and vega, offering a potential for price appreciation.

- Medium-Term Options (Expiring on 2024-08-16)

- Buy Call Option: Strike $76.0, Delta 0.6921955626, Gamma 0.0749256323, Vega 9.8136070171, Theta -0.0235931782, Premium $2.6, ROI 0.2750769231, Profit $0.7152.

- Sell Put Option: Strike $75.0, Delta -0.1639728056, Gamma 0.0728688843, Vega 6.8985908534, Theta -0.0073705641, Premium $0.35, ROI 100.0, Profit $0.35.

Analysis: This pairing balances premium earnings with moderate risk. The put options delta is higher compared to the near-term pair, resulting in moderate assignment risk. However, the premiums are attractive, and the high vega on the call option increases profitability potential as volatility rises.

- Medium-Term Options (Expiring on 2024-10-18)

- Buy Call Option: Strike $71.0, Delta 0.7923008297, Gamma 0.0263537199, Vega 12.2231484631, Theta -0.0203954966, Premium $7.6, ROI 0.0941052632, Profit $0.7152.

- Sell Put Option: Strike $76.0, Delta -0.2292122926, Gamma 0.0987431872, Vega 8.456577395, Theta -0.0077251489, Premium $0.55, ROI 100.0, Profit $0.55.

Analysis: This setup represents a more aggressive strategy due to the higher delta on the put, which slightly increases the assignment risk. However, the calls robust delta and vega profile signify substantial gain potential if the SCHDs price performs as anticipated. This pair offers a favorable balance between risk and reward, suitable for a moderately bullish outlook.

- Long-Term Options (Expiring on 2025-01-17)

- Buy Call Option: Strike $63.0, Delta 0.8312272798, Gamma 0.0112657778, Vega 14.5345209626, Theta -0.0194910031, Premium $11.18, ROI 0.4593202147, Profit $5.1352.

- Sell Put Option: Strike $76.0, Delta -0.2810686725, Gamma 0.0496612213, Vega 19.4604440169, Theta -0.0029489843, Premium $2.0, ROI 100.0, Profit $2.0.

Analysis: This pair suits traders with a longer-term bullish outlook on SCHD, utilizing the strong financial Greeks of the call option for potential higher returns. The put option, although carrying higher delta thus assignment risk, offers high premium and significant ROI, maximizing income.

- Very Long-Term Options (Expiring on 2026-01-16)

- Buy Call Option: Strike $60.0, Delta 0.8451215775, Gamma 0.0076502906, Vega 23.0414941322, Theta -0.0114398213, Premium $17.9, ROI 0.0790614525, Profit $1.4152.

- Sell Put Option: Strike $75.0, Delta -0.2557556475, Gamma 0.0226073211, Vega 31.1142433673, Theta -0.0013961744, Premium $4.4, ROI 100.0, Profit $4.4.

Analysis: This setup is ideal for a very long-term position, leveraging the high vega on both options for maximum profitability from volatility. The premium from the put provides a significant buffer against potential losses, although the higher delta amplifies assignment risk. However, the overall profitability and risk management ensure a solid long-term return.

In summary, the selection criteria for each pairing were determined by balancing the profitability of the call option and the risk management of the put option. By strategically selecting options with favorable Greeks, the risk of assignment is minimized, while the potential for profit remains high, suiting various investment horizons from near-term to very long-term strategies.

Calendar Spread Option Strategy #1

When analyzing the most profitable calendar spread options strategy on Schwab U.S. Dividend Equity ETF (SCHD), it is crucial to consider the Greek values associated with each option to balance potential profit and risk. In a calendar spread, we buy a put option and sell a call option with different expiration dates. To minimize risks such as assignment of shares and maximize profit, we seek options with specific characteristics in their Greek values (delta, gamma, vega, theta, and rho).

1. Near-term: - Sell Call Option: Strike price of $77, expiration date of 2024-07-19 - Delta: 0.6548070035, Premium: $1.3, ROI: 100%, Profit: $1.3 - Buy Put Option: Strike price of $90, expiration date of 2025-01-17 - Delta: -0.6782666423, Premium: $9.4, ROI: 0.1366808511, Profit: $1.2848

The near-term strategy aims to capture short-term premiums while deferring substantial risk to the longer-dated puts. The selected call has a high delta (0.6548) which means it is likely to move significantly with the stock's price, though the premium ($1.3) is moderate. The corresponding long put, having a delta of -0.6782, will provide downside protection.

Potential profit arises from the difference in premiums and the gradual erosion of the sold call's value due to time decay (theta: -0.0296969045), while the long put, though it has a negative theta (-0.0070178159), benefits from vega-related volatility increases.

2. Mid-term: - Sell Call Option: Strike price of $79, expiration date of 2024-08-16 - Delta: 0.418748207, Premium: $0.8, ROI: 100%, Profit: $0.8 - Buy Put Option: Strike price of $82, expiration date of 2025-01-17 - Delta: -0.2292568065, Premium: $0.5, ROI: 100%, Profit: $0.5

In the mid-term period, the goal remains to capitalize on a relatively stable market with minor oscillations. The sold call option with a delta of 0.4187 offers reasonable premium ($0.8) and is less likely to be exercised, reducing the risk of assignment. The corresponding long put, with a delta of -0.2292, adds a hedging benefit while also being inexpensive ($0.5).

Profit is derived mainly from the time decay of the sold call (theta: -0.0182752117) and maintaining the bought put's value.

3. Longer-term: - Sell Call Option: Strike price of $80, expiration date of 2024-10-18 - Delta: 0.4230221305, Premium: $1.15, ROI: 100%, Profit: $1.15 - Buy Put Option: Strike price of $115, expiration date of 2026-01-16 - Delta: -0.7112860855, Premium: $35.0, ROI: 0.0195657143, Profit: $0.6848

In this longer-term strategy, we leverage the longer time to expiration for the put option. The call option with a delta of 0.4230 yields a premium of $1.15 while maintaining a moderate risk of assignment. The long put option, with a delta of -0.7113, though pricey, represents a serious hedge against significant stock price declines.

Profit derives from the decay of the call option (theta: -0.0130303113) while the put option remains responsive to any downward movement in the stock's price.

4. Ultra-long-term: - Sell Call Option: Strike price of $77, expiration date of 2026-01-16 - Delta: 0.6675848012, Premium: $5.62, ROI: 100%, Profit: $5.62 - Buy Put Option: Strike price of $110, expiration date of 2025-01-17 - Delta: -0.7112860855, Premium: $35.0, ROI: 0.0195657143, Profit: $0.6848

For an ultra-long-term perspective, opting for call options with high premium ($5.62) despite the high delta (0.6676) exposes some risk of assignment but provides substantial upfront premium. Purchasing a deep-out-of-the-money put with high delta (-0.7113) and expiry further out offers strong protection against a significant drop in stock price.

Profit maximization will require close monitoring of the stock movement and timely adjustment, if needed since theta decay and vega influence will play significant roles.

5. Balanced Portfolio: - Sell Call Option: Strike price of $45, expiration date of 2025-01-17 - Delta: 0.9095945976, Premium: $33.55, ROI: 6.9901639344%, Profit: $2.3452 - Buy Put Option: Strike price of $78, expiration date of 2026-01-16 - Delta: -0.659378161, Premium: $5.1, ROI: 100%, Profit: $5.1

For a balanced portfolio approach, we mix a near-at-the-money call with a deep-out-of-the-money longer-term put, capturing significant premium upfront ($33.55) while placing a protective bottom. The high delta call (0.9096) carries a high risk of assignment, but the substantial premium provides a considerable cushion.

Ultimately, this balanced strategy aims for defensive positioning, with theta decay (call's theta: -0.010466978) and vega sensitivity providing risk management.

In conclusion, these five choices present varied approaches over different time frames and risk tolerances while maximizing potential profitability. Each combination plays on the time decay of the sold calls and the hedging capability of the purchased puts optimized for the current market forecast around the ETF.

Calendar Spread Option Strategy #2

In order to maximize the profitability and minimize the risk of a calendar spread involving selling a put option and buying a call option on the Schwab U.S. Dividend Equity ETF (SCHD), a careful analysis of the Greeks and other parameters for each option is paramount. Here, I will analyze five promising combinations across different expiration dates and strike prices.

Strategy 1:

Sell Put - 65.0 Strike, Expiring on 2025-01-17

Buy Call - 77.0 Strike, Expiring on 2024-07-19

For this strategy, the sell put option has a delta of 0.8272, implying a high likelihood (approximately 82.72%) of being in the money, which suggests a substantial risk of assignment if the stock price decreases significantly. The premium is $13.86, providing a sizable immediate credit to the portfolio. However, there is a high profit potential of $2.5952 despite the high delta.

Conversely, purchasing the call at a 77.0 strike price with expiration on 2024-07-19 has a delta of 0.6548, indicating a relatively lower probability (65.48%) of the call option being in the money and an adequate hedge. The premium is manageable at $1.3. Given that theta is negative (-0.0297), the time decay will work against the call option, but this is offset by the high vega (6.53) sensitizing it to volatility, which is advantageous if volatility increases.

Strategy 2:

Sell Put - 78.0 Strike, Expiring on 2025-01-17

Buy Call - 74.0 Strike, Expiring on 2024-10-18

Selling the 78.0 strike put expiring on 2025-01-17 offers a premium of $4.47 with a lower delta of 0.678, minimizing the risk of early assignment. The theta (-0.0136) indicates steady time decay, and vega of 20.67 means substantial volatility sensitivity that could accrue benefits under volatile market conditions.

Buying the 74.0 strike call expiring on 2024-10-18 has a delta of 0.6766, slightly higher than 0.5, balancing the overall spread. The premium here is $5.4, providing a good entry point. Moreover, the gamma (0.0276) and vega (15.33) indicate significant sensitivity to underlying price moves and volatility, respectively, optimal for profiting if volatility increases.

Strategy 3:

Sell Put - 77.0 Strike, Expiring on 2025-01-17

Buy Call - 73.0 Strike, Expiring on 2026-01-16

Selling the 77.0 strike put expiring on 2025-01-17, which has a delta of 0.6414 and premium of $3.81, keeps the risk moderate while having a significant theta decay (-0.0133). This option carries a vega of 21.56, making it sensitive to volatility.

Pairing it with the 73.0 strike call expiring on 2026-01-16, with a delta of 0.764 (high probability), premium of $11.4, and vega of 31.69 offers a high chance of the option being in the money. The theta (-0.0111) indicates a decent time decay component that impacts profits less significantly given the longer time frame.

Strategy 4:

Sell Put - 75.0 Strike, Expiring on 2025-01-17

Buy Call - 68.0 Strike, Expiring on 2024-10-18

Selling a 75.0 strike put option expiring on 2025-01-17 with a premium of $5.3 and delta of 0.709 minimizes early assignment risk due to a lower delta while being lucrative as theta decay is kept at -0.0139.

Conversely, buying the 68.0 strike call expiring on 2024-10-18 with a delta of 0.814, and premium $10.6, provides substantial buffer with vega (11.41) benefiting from volatility increases. Theta decay (-0.0234) is manageable given the high probability of being in the money and a vega exposure suitable for high volatility environments.

Strategy 5:

Sell Put - 70.0 Strike, Expiring on 2026-01-16

Buy Call - 78.0 Strike, Expiring on 2025-01-17

For long-term strategy involvement, selling a 70.0 strike put expiring on 2026-01-16 with a premium of $9.91 and reasonable delta of 0.762 minimizes risk accumulation over the long time frame. The theta decay is also steady (-0.0117), and the high vega (29.96) ensures positive exposure to market volatility.

Buying a 78.0 strike call expiring on 2025-01-17 ensures lower risk with a delta of 0.5967 and premium $2.28. This call option has a substantial vega (22.33) and theta (-0.0132), affording it sensitive reaction to volatility increases and steady time decay affecting the payout positively under volatile conditions.

Conclusion

Each strategy balances a mix of delta, theta, and vega to either benefit from market volatility or minimize the risk of early assignment by selecting complementary options. The most suitable choice will depend on the desired risk tolerance and market volatility expectations for the investor.

Similar Companies in Asset Management:

Vanguard High Dividend Yield Index Fund (VYM), JPMorgan Equity Premium Income ETF (JEPI), Vanguard Dividend Appreciation Index Fund (VIG), iShares Core Dividend Growth ETF (DGRO), Invesco S&P 500 High Dividend Low Volatility ETF (SPHD), iShares Select Dividend ETF (DVY), SPDR S&P Dividend ETF (SDY), Invesco Dividend Achievers ETF (PFM), WisdomTree U.S. High Dividend Fund (DHS)

https://seekingalpha.com/article/4700184-10-upcoming-dividend-increases

https://seekingalpha.com/article/4700444-invest-nearly-stress-free-with-schd

https://seekingalpha.com/article/4700537-very-overrated-and-very-underrated-high-yield-sectors

https://seekingalpha.com/article/4700587-start-with-large-snowball-roll-slowly-but-surely

https://seekingalpha.com/article/4700610-dividend-cut-alert-3-high-yields-getting-risky

https://seekingalpha.com/article/4700718-if-i-could-only-buy-one-etf-in-2024-schd

https://seekingalpha.com/article/4700859-very-good-news-for-high-yield-stocks

https://www.fool.com/investing/2024/06/26/investing-100000-in-schd-vig-or-vym-which-is-the-b/

https://seekingalpha.com/article/4701357-what-i-learned-from-my-most-painful-dividend-cuts

https://www.fool.com/investing/2024/06/28/dividend-etf-retirement-best-friend-vig-schd/

https://seekingalpha.com/article/4701469-5-stocks-i-sold-due-to-fragile-stagflation-risk

https://seekingalpha.com/article/4701510-schd-time-to-buy

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: DlPQst

Cost: $0.35507

https://reports.tinycomputers.io/SCHD/SCHD-2024-06-29.html Home