Schwab U.S. REIT ETF (ticker: SCHH)

2023-12-28

The Schwab U.S. REIT ETF (ticker: SCHH) is an exchange-traded fund offered by Charles Schwab that provides investors with a convenient and cost-effective way to gain exposure to the real estate sector of the United States stock market. The ETF primarily focuses on equities of real estate investment trusts (REITs) that are publicly traded in the U.S. Comprising a diversified portfolio that reflects the performance of the Dow Jones U.S. Select REIT Index, SCHH aims to deliver investment results that closely correspond, before fees and expenses, to the total return of that index. Investors consider SCHH as a means to diversify their holdings, hedge against inflation, or capture potential income through the dividend payments that REITs often provide. Additionally, this ETF offers the benefits of liquidity, low expense ratios, and transparent, market-driven pricing characteristic of Schwab's ETF offerings. Due to its targeted focus within the realm of real estate, the performance of SCHH may be influenced by factors such as property values, interest rate changes, and the health of the real estate market at large.

The Schwab U.S. REIT ETF (ticker: SCHH) is an exchange-traded fund offered by Charles Schwab that provides investors with a convenient and cost-effective way to gain exposure to the real estate sector of the United States stock market. The ETF primarily focuses on equities of real estate investment trusts (REITs) that are publicly traded in the U.S. Comprising a diversified portfolio that reflects the performance of the Dow Jones U.S. Select REIT Index, SCHH aims to deliver investment results that closely correspond, before fees and expenses, to the total return of that index. Investors consider SCHH as a means to diversify their holdings, hedge against inflation, or capture potential income through the dividend payments that REITs often provide. Additionally, this ETF offers the benefits of liquidity, low expense ratios, and transparent, market-driven pricing characteristic of Schwab's ETF offerings. Due to its targeted focus within the realm of real estate, the performance of SCHH may be influenced by factors such as property values, interest rate changes, and the health of the real estate market at large.

| Previous Close | 20.72 | Open | 20.72 | Day Low | 20.6422 |

| Day High | 20.83 | Trailing P/E | 29.36 | Volume | 2,695,253 |

| Average Volume | 3,866,914 | Average Volume 10 Days | 3,025,730 | Bid | 20.61 |

| Ask | 20.82 | Bid Size | 38,800 | Ask Size | 1,300 |

| Yield | 0.032 | Total Assets | 6,130,732,032 | 52 Week Low | 16.63 |

| 52 Week High | 21.99 | 50 Day Average | 18.6572 | 200 Day Average | 18.9597 |

| YTD Return | 0.113 | Beta 3 Year | 1.15 | 3 Year Average Return | 0.0618 |

| 5 Year Average Return | 0.0441 | Fund Family | Schwab ETFs | Fund Inception Date | 1294876800 |

| Legal Type | Exchange Traded Fund | Category | Real Estate | Currency | USD |

Based on the provided technical analysis data for SCHH, we have identified several key indicators that will help us evaluate its potential stock price movement over the next few months:

-

The On-Balance Volume (OBV) has shown a steady increase from -0.82858 million to 1.27838 million over the recorded period. This suggests that there is buying pressure and that volume is supporting the uptrend.

-

The Moving Average Convergence Divergence (MACD) histogram values are not provided until the last four entries, where they are positive and gradually decreasing. This indicates that while the short-term momentum has been gaining relative to the long-term momentum, it may start to lose strength.

Given this information, it appears SCHH could be poised for an uptrend movement in the next few months. The increase in OBV generally highlights positive volume flow which often precedes price increases. However, the decreasing MACD histogram values suggest that while the trend is currently bullish, the pace of the increase could slow down if the trend loses momentum.

It is important to note, however, that without access to company fundamentals and financials, the analysis lacks the context that might be provided by evaluating the companys financial health, growth prospects, and market position. In a typical scenario, a comprehensive analysis would incorporate such information to bolster the prediction accuracy.

Absent the fundamental and financial insights, we weigh the technical indicators heavily. The bullish signs presented by the OBV should be watched closely for continuation. Any divergence or plateauing of buying volume may indicate a possible trend reversal or pullback. Investors should couple these observations with wider market sentiment and news that could impact the real estate sector, which SCHH represents as a REIT ETF.

Therefore, remaining vigilant on external market influences and any changes in volume and momentum is imperative. Monitoring subsequent MACD histogram values will be crucial to assess the sustainability of the momentum. As we project into the coming months, if both the OBV continues to rise and the MACD histogram remains stable or increases, this will lend further credence to the bullish outlook. Conversely, a downturn in OBV paired with a negative MACD histogram could signal a price correction or consolidation phase for SCHH.

To sum up, the expected movement for SCHH over the next few months would be a generally uptrend subject to the noted caution regarding the momentum potentially losing strength. Close observation of volume trends and momentum indicators, as well as keeping an ear to the ground for sector-specific news, would be prudent for any market participant interested in SCHH.

The Schwab U.S. REIT ETF (SCHH) has recently become a focal point of interest amid investors' concerns about the general state of Real Estate Investment Trusts (REITs) in a market characterized by changing economic conditions and rising interest rates. This sentiment is largely influenced by predictions of potential declines in the REIT market, as highlighted by a slew of bearish articles, including a prominent piece from Seeking Alpha. The apprehensive forecast is premised on the argument that even with sinking share prices, REIT valuations have not yet hit a level that screams 'buy' to the market at large.

Contrasting the gloomy investor outlook, there's a silver lining emerging from other market analysis that offers a more sanguine view of the REIT landscape. Certain fundamental indicators such as strong balance sheets, increased cash flows, and predictions of growth for 2023 suggest that REITs are currently trading below their intrinsic value. Echoing past financial crises, some REITs are now trading at approximately 30% below their Net Asset Value (NAV), reminiscent of the discounts observed during the Great Financial Crisis.

This underpricing has not gone unnoticed by industry giants. Prominent private equity firms like Blackstone and Starwood are taking notice of the value proposition, seizing the opportunity to amass undervalued REIT shares. This aggressive purchasing is seen as a strong endorsement for the REIT market, signaling an optimistic outlook for savvy investors believing in the sector's rebound potential despite prevailing market pressures.

Despite this bifurcation in market sentiment, it is essential to touch on the conundrum of market timing. Many individuals aim to time their entry and exit from the market to maximize returns; however, this often futile endeavor tends to underperform compared to a longer-term, value-driven investment strategy. The pricing in financial markets is forward-looking, grappling with the incorporation of current and future information into asset valuations.

The SCHH, representing a significant cross-section of the REIT space, is therefore subject to these broader market forces and investor perceptions. When considering exposure to REITs through this ETF, the emphasis should not be on timing the market to perfection but rather on recognizing the intrinsic worth and future earnings potential of the underlying real estate assets.

High-yield investment opportunities, such as Brookfield Infrastructure and Brookfield Renewable, have presented themselves in light of these challenging market conditions. Both companies have experienced depreciations in stock value, but the fundamental needs they cater to essential infrastructure and renewable energy are expected to endure and grow, particularly considering the expanding global middle class and the push for sustainable energy solutions.

Moreover, apartment REITs have become a focal point for significant private equity interest, as the likes of Blackstone, Starwood, and KKR have identified undervaluation in the sector. Notable investments made during the pandemic proved lucrative for these groups, suggesting that a similar trend might be unfolding as these assets remain at price points well below their inherent value. Transactions in the space indicate that public market valuations for companies like Camden Property Trust and BSR REIT are not reflective of the prices being commanded in private markets, an observation that fuels optimism for price appreciation.

Concurrently, key figures in the investment world such as Charlie Munger and Elon Musk have expressed caution over segments of the real estate market, especially those related to commercial real estate such as office buildings. Yet, other sectors within the REIT market appear to be thriving consider public storage, suburban apartments, and infrastructure-related properties, which are experiencing increased demand.

Meanwhile, the broader economic outlook indicates that the U.S. has hit a plateau of high inflation, with rates expected to stabilize around the Feds target of 2% by 2024. This change in the inflation trajectory could render the interest rate environment more accommodating, which, in turn, would likely be a positive development for REITs and ETFs like SCHH.

Adding nuance to the debate is the notion that REITs should not be narrowly seen as proxies for bonds, which has been a contributory factor to the current undervaluation in the REIT market. A focus on total return both yield and capital gains is crucial when evaluating investments like VICI Properties, which anticipates robust growth through both dividends and operational cash flow.

A key player in this fabric is Realty Income Corporation, the 'Monthly Dividend Company.' Despite a decline in stock price, the company's strategic mix of tenants and strong financial positioning suggest it may be more resilient than the market is currently giving it credit for. Realty Income's situation epitomizes the broader market's perchance for underrating the REIT sector amidst the volatile rate environment.

As we approach the end of the fiscal year, the fourth quarter is particularly critical for understanding economic trends and their impact on investments such as the SCHH. A mixed array of economic signals from consumer spending trends and home prices to the job market and manufacturing data informs the investors' perspective on the potential trajectory of the REIT market as the year closes.

Finally, focusing on homebuilder stocks within the broader REIT landscape, the prospect of a valuation reset looms large over the horizon. This is grounded in the impact of heightened mortgage rates and constricting affordability that has led to diminished home sales and necessitated profitability reassessments among builders. Subsequently, for an investment entity like SCHH that comprises such stocks, keeping a close watch on the residential construction and sales prospects is crucial for investors looking to navigate the anticipated fluctuations in the REIT market.

As market conditions, economic policies, and investor sentiment evolve, the Schwab U.S. REIT ETF, reflective of these myriad factors, must be approached with a comprehensive understanding of both its inherent value and the external factors shaping its performance in the broader financial landscape.

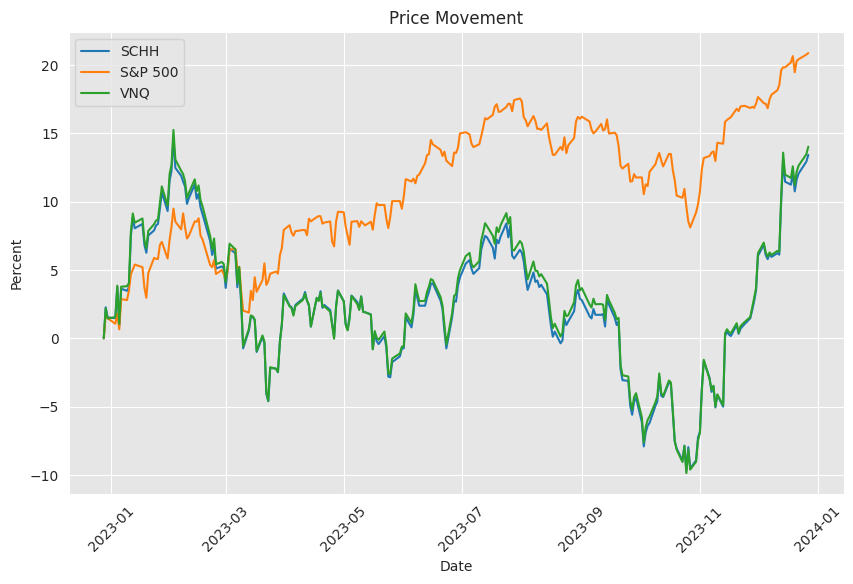

Similar Companies in Real Estate:

Vanguard Real Estate ETF (VNQ), iShares U.S. Real Estate ETF (IYR), Real Estate Select Sector SPDR Fund (XLRE), Nuveen Short-Term REIT ETF (NURE), Global X SuperDividend REIT ETF (SRET), Pacer Benchmark Industrial Real Estate SCTR ETF (INDS), iShares Residential Real Estate ETF (REZ), Fidelity MSCI Real Estate Index ETF (FREL), iShares Cohen & Steers REIT ETF (ICF), JPMorgan BetaBuilders MSCI US REIT ETF (BBRE)

News Links:

https://www.fool.com/investing/2023/09/10/down-31-and-58-why-i-cant-stop-buying-these-2-high/

https://seekingalpha.com/article/4607888-important-warning-for-reit-investors

https://seekingalpha.com/article/4630243-billionaire-investors-say-sell-real-estate

https://seekingalpha.com/article/4654268-buying-apartment-reits-hand-over-fist

https://seekingalpha.com/article/4650223-us-could-soon-see-2-percent-inflation

https://seekingalpha.com/article/4636705-urgent-warning-to-reit-investors

https://seekingalpha.com/article/4635605-the-market-has-gone-irrational-with-realty-income

https://seekingalpha.com/article/4655949-fourth-quarter-started-slow-but-it-may-finish-strong

https://seekingalpha.com/article/4624587-economic-and-financial-markets-review-july-2023

https://seekingalpha.com/article/4638853-a-big-homebuilder-stock-price-reset-is-coming

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: baZzn2

https://reports.tinycomputers.io/SCHH/SCHH-2023-12-28.html Home