The Sherwin-Williams Company (ticker: SHW)

2023-12-17

The Sherwin-Williams Company (ticker: SHW) stands as one of the largest global leaders in the manufacturing, development, and sale of coatings and related products to professional, industrial, commercial, and retail customers. Founded in 1866 and headquartered in Cleveland, Ohio, Sherwin-Williams boasts a vast portfolio of well-established brands, including its namesake Sherwin-Williams paints, Valspar, Dutch Boy, Minwax, and Thompson's WaterSeal, among others. The company operates in three segments: The Americas Group, Consumer Brands Group, and Performance Coatings Group, serving diverse markets and providing a wide range of coating products. Sherwin-Williams commands a robust distribution network that includes thousands of retail stores across North America and further extends its reach through other customer outlets worldwide. Through its commitment to innovation, sustainability, and superior quality, SHW continues to grow its influence in the coatings industry, leveraging its strong brand equity and extensive distribution channels to maintain its position as a market leader in paint and coating solutions.

The Sherwin-Williams Company (ticker: SHW) stands as one of the largest global leaders in the manufacturing, development, and sale of coatings and related products to professional, industrial, commercial, and retail customers. Founded in 1866 and headquartered in Cleveland, Ohio, Sherwin-Williams boasts a vast portfolio of well-established brands, including its namesake Sherwin-Williams paints, Valspar, Dutch Boy, Minwax, and Thompson's WaterSeal, among others. The company operates in three segments: The Americas Group, Consumer Brands Group, and Performance Coatings Group, serving diverse markets and providing a wide range of coating products. Sherwin-Williams commands a robust distribution network that includes thousands of retail stores across North America and further extends its reach through other customer outlets worldwide. Through its commitment to innovation, sustainability, and superior quality, SHW continues to grow its influence in the coatings industry, leveraging its strong brand equity and extensive distribution channels to maintain its position as a market leader in paint and coating solutions.

| As of Date: 12/17/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 79.29B | 65.59B | 68.28B | 57.97B | 61.50B | 53.06B |

| Enterprise Value | 90.67B | 77.72B | 81.13B | 70.28B | 73.82B | 65.25B |

| Trailing P/E | 33.17 | 28.31 | 32.58 | 29.12 | 32.12 | 30.74 |

| Forward P/E | 27.86 | 24.27 | 31.95 | 26.53 | 22.73 | 19.49 |

| PEG Ratio (5 yr expected) | 2.58 | 2.56 | 3.57 | 2.42 | 1.96 | 1.70 |

| Price/Sales (ttm) | 3.49 | 2.89 | 3.07 | 2.66 | 2.88 | 2.60 |

| Price/Book (mrq) | 20.98 | 17.98 | 21.56 | 18.69 | 23.65 | 23.85 |

| Enterprise Value/Revenue | 3.94 | 12.71 | 13.00 | 12.91 | 14.11 | 10.79 |

| Enterprise Value/EBITDA | 21.70 | 69.96 | 72.19 | 97.05 | 108.16 | 58.05 |

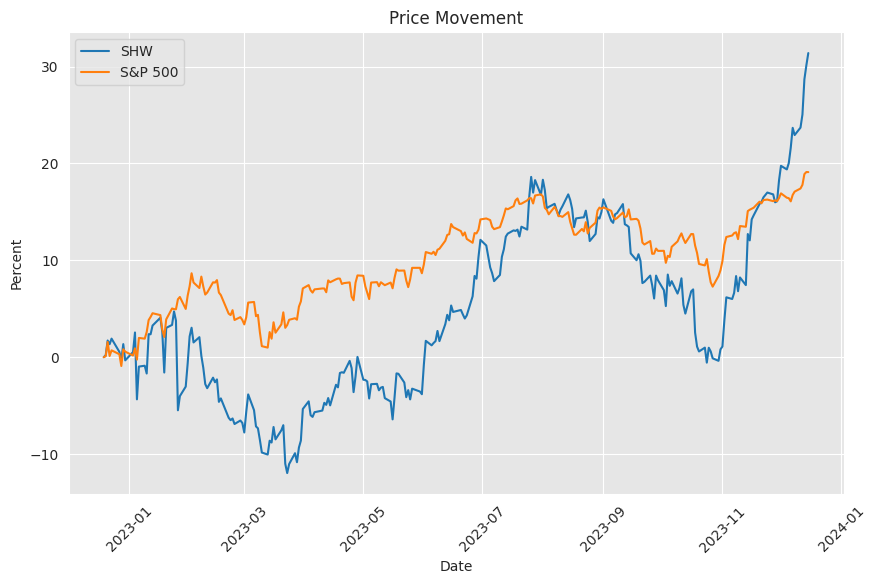

Analyzing the technical indicators and fundamentals, a comprehensive outlook on the potential price movement for the stock of Sherwin-Williams (SHW) over the next few months can be provided. The technical indicators on the last trading day suggest the following:

Analyzing the technical indicators and fundamentals, a comprehensive outlook on the potential price movement for the stock of Sherwin-Williams (SHW) over the next few months can be provided. The technical indicators on the last trading day suggest the following:

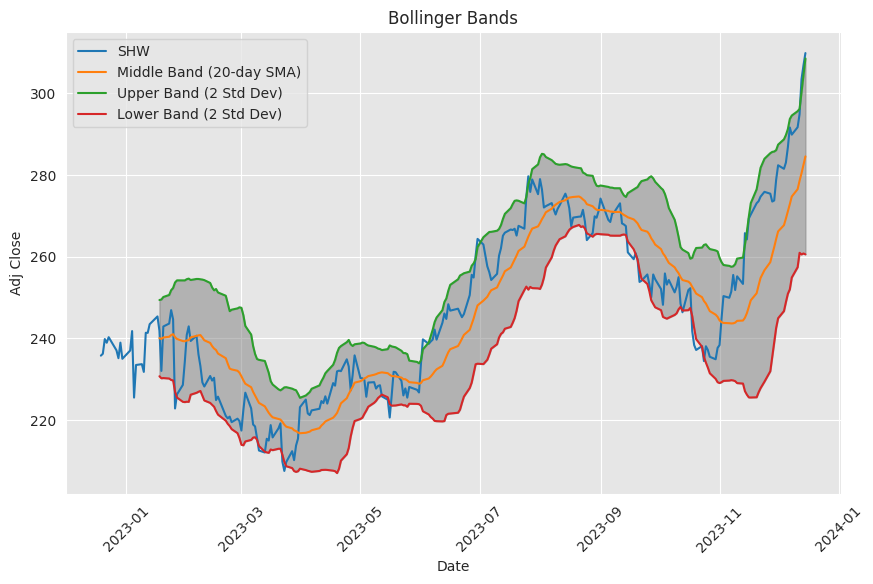

- The stocks Adjusted Close is set at 309.77.

- MACD (Moving Average Convergence Divergence) values indicate a bullish trend with a positive MACD line of 11.76 and a histogram value of 2.08, which suggests that the current momentum may continue.

- RSI (Relative Strength Index) is at an extremely high level of 86, which is generally considered to be overbought and may signal upcoming price retracement or consolidation.

- Bollinger Bands indicate that the closing price is above the upper band, which could indicate that the stock is overextended in the short term.

- The SMA (Simple Moving Average) and EMA (Exponential Moving Average) both show the stock price is well above these averages, confirming the uptrend.

- OBV (On Balance Volume) shows a value of 2.06 million, indicating strong buying pressure behind the price move.

- Stochastic Oscillator readings with STOCHk and STOCHd well above 80 are indicative of an overbought condition.

- ADX (Average Directional Index) is at a level of 58.62, signifying a strong trend.

- The Williams %R is at -5.31, which is in overbought territory.

- The CMF (Chaikin Money Flow) shows buying pressure with a positive value.

- PSAR (Parabolic SAR) is below the price, signaling an uptrend.

The fundamental analysis shows:

- An increase in Market Cap, Enterprise Value over time.

- A fairly high current Trailing P/E ratio of 33.17, suggesting investor optimism about future earnings but also a relatively high stock price compared to earnings.

- A Forward P/E of 27.86 indicative of expected growth in earnings.

- PEG Ratio also suggests growth expectations but might signal overvaluation if growth doesnt meet expectations.

- A healthy EV/EBITDA which is currently 21.70, lower than previous periods, pointing towards increased profitability.

- Financials demonstrate consistent growth in Net Income and Operational Revenue.

Based on the technical analysis, the stock is currently in a strong uptrend, but showing potential signs of being overbought. This typically warrants caution as the price may experience a short-term pullback or go through a consolidation phase before continuing its trend or reversing. The overbought RSI and placement above the upper Bollinger Band highlight the urgency for potential price correction. Meanwhile, the solid volume indicators like OBV along with a positive MACD suggest the trend has been supported by investor enthusiasm, indicating potential continuation once any retracement stabilizes.

The strong trend indicated by the ADX adds weight to the bullish sentiment but does also suggest potential volatility could be ahead given the extremity of the current price movements. Given these conditions, potential strategies could involve looking for consolidation patterns or mild pullbacks to support levels as opportunities for entry.

Fundamentals provide a mixed but generally positive outlook: the relatively high valuation metrics could be a concern for those who believe the market may correct these. However, strong financials, increases in Market Cap, and Enterprise Value combined with expected growth in earnings suggest a bullish outlook is not unfounded.

Over the next few months, based on the current data, it is likely that:

- The price may initially experience a short-term pullback due to the overbought condition.

- Post-correction, the stock could continue its uptrend, supported by solid fundamentals unless there is a substantial change in market conditions or company performance.

Market sentiment, based on both technicals and fundamentals, seems to favor bullish continuation, albeit with caution due to the overstretched technicals which could foresee short-term volatility. Monitoring key technical levels and company performance closely will be essential for investors looking to capitalize on this trend.

The Sherwin-Williams Company (SHW), a paint and coating manufacturing behemoth, not only garners the attention of investors and market spectators for its vibrant catalog of products but also for its sterling reputation as a dividend aristocrat. With an uninterrupted streak of dividends spanning over four decades, the company has been a beacon of financial dependability, making it a popular choice among income-focused investors. This history of rewarding shareholders is not only a testament to its financial acumen but also to its strategic foresight in navigating through the volatile landscape of the market.

For 44 years, Sherwin-Williams has solidified its position as an investor favorite, by not just maintaining but consistently increasing its dividend payouts. This persistent upward trend speaks volumes about the companys underlying financial strength and its ability to generate ample cash flows, which are reinvested into the business to fuel operations and strategic growth while ensuring a steady stream of income for its shareholders.

The current quarterly dividend offering standing at $0.605 per share might yield a seemingly modest 0.91% annual dividend; however, the guarded payout ratio of 26% paints an encouraging picture for future prospects. Sherwin-Williams isnt simply content with paying dividends; it is strategically positioning itself to sustain and potentially expand these dividends. A low payout ratio indicates the companys room for maneuverability, setting the stage for future growth without jeopardizing its financial soundness.

Sherwin-Williams's financial performance transcends its robust dividend program. In the third quarter of 2023, the company demonstrated operational prowess with a significant expansion in its gross profit margin to 47.7%, up from 42.8% in the preceding year. Such profitability can be credited to its pricing strategy and favorable raw material cost trends, further solidifying its standing as an industry frontrunner, capable of turning challenging economic conditions into profitable outcomes.

Despite its successes, Sherwin-Williams has had to navigate financial challenges, such as the substantial debt incurred from the acquisition of Valspar in 2017. This move, while accretive to the business in the long run, led to an initial net debt surpassing $9 billion. Yet through proactive fiscal management, the company has been diligently chipping away at this debt, mitigating the associated interest expenses that have risen alongside increasing rates.

Investors looking at valuation metrics will find Sherwin-Williams's stock attractive, especially when considering the relatively low price-to-earnings (P/E) ratio of 28, which is below its five-year average. This, combined with a historical perspective as an industry trailblazer and a disciplined approach to capital allocation, elevates Sherwin-Williams in the eyes of investors who prioritize a resilient dividend track record alongside capital appreciation potential.

Turning the lens on individual investment decisions, an anecdote from a Seeking Alpha investor provides a narrative on the intrinsic value of Sherwin-Williams as part of a meticulously constructed dividend portfolio. This investor, looking to access liquidity for a significant personal investment, offered a lens into the strategic pivots that shareholders may undertake. A rise in mortgage rates to 8% steered the decision-making process, with the investor weighing the merits of selling stock to fund a property purchase against accepting a steep mortgage rate. This meticulous approach to personal asset management underlines the flexibility required in personal finance, particularly when responding to varying macroeconomic conditions such as fluctuating interest rates.

When distilling the decision-making criteria for which stocks to sell, a strategic approach took precedence. Rather than indiscriminately trimming profitable positions, the focus was on culling lower conviction holdings, thus optimizing the quality of the portfolio. The rationale for disinvestment wasnt to exit winners but to discard underperformers or those with cloudy futures. This fine-tuning not only offered tax advantages through offsetting losses against capital gains but also positioned the investor to streamline their portfolio management, potentially increasing stakes in high-conviction stocks such as Air Products and Chemicals (APD).

This investor's narrative underscores a complex interplay of individual investment goals, market sensitivity, and personal financial planning. It magnifies the depth of analysis that the investor places on company fundamentals. For Sherwin-Williams, such investors are a cornerstone, reflecting the trust placed upon the company's dividend promise and overall financial health in a fluctuating market economy.

Further considering the company's outlook, The Motley Fool's endorsement is leveraged upon not just performance but also the projection of future ascendancy. Recognizing Sherwin-Williams as a favorable pick in case of a market dip is a substantial nod to the company's business model and capacity for progress amidst market uncertainties.

Sherwin-Williams' operational scale is vast, with a global footprint that is both a testament to its historical legacy and its present vigor. With annual revenue circling $23 billion, alongside a dedicated workforce and extensive operational network, Sherwin-Williams operates at the higher echelons of its market segment. The notable expansion in same-store sales and earnings per share amidst the contemporary stressors of high interest rates and inflationary trends further evidences its sturdy market position.

Analysts remain cautiously optimistic, predicting stabilizations and recoveries that could see Sherwin-Williams thrive in a more congenial business environment. The dividend remains pivotala modest yet steadily increasing disbursement that could prime the company as a tantalizing fixture within long-term investment portfolios.

Evaluated further through its investment metrics, Sherwin-Williams carries a forward P/E ratio, reflective of both historical performance and expected growth. This suggests that during episodes of market dips, SHW could be a judicious addition to diversified portfolios, poised for aggregation during opportune moments of lowered stock prices.

In broader strokes, when Sherwin-Williams is placed under the thorough scrutiny of financial filters, it emerges as a diamond in the rough for dividend growth investing. A large-cap entity with a market cap that towers over the $10 billion benchmark, it fulfills essential criteriadividend growth, liquidity, and marketabilitythat investors hold in high regard.

Sherwin-Williams ardently caters to investors with its dual objectivesproviding an income stream that keeps pace with or exceeds inflationary pressures and upholding a capital growth aim that vies to secure a 9-10% total return. This appeals to a diverse investor segment, from retirees to those vested in DGI tactics.

When subjected to an evaluative framework, Sherwin-Williams displays a composite of attributescurrent yield, dividend history, payout ratio, earnings growth, and debt structurethat coalesce to form a portrait of financial desirability. The company's Dividend Quality Score remains particularly illuminative, underscoring the safety and steadfastness of its dividends. The valuation methodologies employed also signal that Sherwin-Williams may be currently undervalued, indicating an opportune juncture for acquisition by perceptive investors.

Investors are continually seeking stability and consistency within their portfolios, especially against a backdrop of market volatilities. Here, Sherwin-Williams distinguishes itself as a particularly astute choice for those pursuing dividends as a path to financial security. Its portrayal on a curated list of dividend-yielding stocks accentuates its suitability and fortifies its case as an investment bastion, embedded with the capacity for sustained yields and capital protection.

The resonance of dividends in spurring passive income cannot be overstatedtraditional wisdom and empirical research both herald companies with a legacy of dividend increases as formidable market performers. Analysis drawing upon observations from the Hartford Funds places dividend growers and initiators in an enviable position, projecting average annualized returns that eclipse those of their non-dividend paying counterparts. Importantly, lower volatility levels reflect a reduced risk profile, further solidifying the attractiveness of such investment choices.

Not being limited to individual stock selections, the avenue of Exchange-Traded Funds (ETFs) offers a widened expanse for investors to tap into a diversified pool of dividend payers. The ProShares S&P 500 Dividend Aristocrats ETF exemplifies such an investment vehicle, dedicated to companies with an established record of growing dividends for over 25 years. Sherwin-Williams, as a constituent of this ETF, adds to the eclectic mix of companies across varied sectors, furnishing investors with a broad spectrum of stable growth potentials.

Choosing to invest in such ETFs necessitates an appraisal of expense ratios, which determinately impact returns. Adhering to an expense ratio lower than the industry benchmark, the ProShares S&P 500 Dividend Aristocrats ETF presents itself as a cost-effective strategy to harness the cumulative growth benefits attributed to reinvested dividends.

Moreover, in an environment conditioned by rate-related apprehension, dividend aristocrats like Sherwin-Williams have surfaced as sanctuaries for investment capital. Acknowledged as a relatively safe and well-priced dividend stock, Sherwin-Williams is spotlighted for its steadfastness in tumultuous times. Positioned as a conservative choice, the company offers discernible value, aligning with goals of financial liberty through sustained dividend income. Despite macroeconomic headwinds and consumer behavior uncertainties, Sherwin-Williamss commitment to dividend enhancement weaves a narrative of long-term investment prudence.

Ultimately, Sherwin-Williams represents an ironclad offering within a portfolioits ability to persistently raise and payout dividends is not merely an act of tradition but a declaration of its financial resilience and strategic dexterity. In an epoch where consistency is as cherished as growth, Sherwin-Williams stands as a testament to the enduring power of well-managed corporations in delivering shareholder value amidst unyielding economic evolution.

Similar Companies in Specialty Chemicals:

PPG Industries, Inc. (PPG), Akzo Nobel N.V. (AKZA.AS), RPM International Inc. (RPM), Axalta Coating Systems Ltd. (AXTA), Masco Corporation (MAS)

News Links:

https://www.fool.com/investing/2023/11/18/if-you-like-dividends-should-love-these-3-stocks/

https://seekingalpha.com/article/4654898-why-i-made-big-changes-to-my-dividend-growth-portfolio

https://www.fool.com/investing/2023/11/27/3-stocks-to-buy-if-they-take-a-dip/

https://www.fool.com/investing/2023/12/07/not-sure-which-dividend-stock-you-should-own-buy/

https://seekingalpha.com/article/4639167-5-relatively-safe-cheap-dividend-stocks-october-2023

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: 4UOolB

https://reports.tinycomputers.io/SHW/SHW-2023-12-17.html Home