Schlumberger Limited (ticker: SLB)

2024-01-15

Schlumberger Limited (ticker: SLB) is a preeminent company in the energy services sector, providing a vast array of technologies and solutions for the global oil and gas industry. With its headquarters in Houston, Texas, and Paris, France, the corporation has established a significant presence in more than 120 countries, emphasizing its international reach and cross-border expertise. Schlumberger's operations are broadly diversified across multiple segments, including drilling, production, reservoir characterization, and well services. The company has a storied history of innovation and technological advancements, which have contributed greatly to its reputation as a leader in oilfield services. It is known for pushing the boundaries in areas such as seismic acquisition and processing, formation evaluation, well testing, and wellbore interventions. Schlumberger's commitment to research and development anchors its competitive edge and aligns with its strategic focus on efficient resource extraction and sustainability within the industry. The firm's financial performance, industry partnerships, and strategic investments are closely monitored by investors and industry analysts, reflecting its influential role in shaping the direction of energy production and services worldwide.

Schlumberger Limited (ticker: SLB) is a preeminent company in the energy services sector, providing a vast array of technologies and solutions for the global oil and gas industry. With its headquarters in Houston, Texas, and Paris, France, the corporation has established a significant presence in more than 120 countries, emphasizing its international reach and cross-border expertise. Schlumberger's operations are broadly diversified across multiple segments, including drilling, production, reservoir characterization, and well services. The company has a storied history of innovation and technological advancements, which have contributed greatly to its reputation as a leader in oilfield services. It is known for pushing the boundaries in areas such as seismic acquisition and processing, formation evaluation, well testing, and wellbore interventions. Schlumberger's commitment to research and development anchors its competitive edge and aligns with its strategic focus on efficient resource extraction and sustainability within the industry. The firm's financial performance, industry partnerships, and strategic investments are closely monitored by investors and industry analysts, reflecting its influential role in shaping the direction of energy production and services worldwide.

| City | Houston | State | TX | Zip Code | 77056 |

|---|---|---|---|---|---|

| Country | United States | Phone | 713 513 2000 | Website | https://www.slb.com |

| Industry | Oil & Gas Equipment & Services | Sector | Energy | Full Time Employees | 99,000 |

| CEO Name | Mr. Olivier Le Peuch | CEO Total Pay | $3,713,808 | CFO Name | Mr. Stephane Biguet |

| CFO Total Pay | $1,679,977 | Previous Close | $48.80 | Dividend Rate | $1.00 |

| Dividend Yield | 2% | Payout Ratio | 32.12% | Five Year Avg Dividend Yield | 3.43% |

| Beta | 1.658 | Trailing PE | 17.34 | Forward PE | 15.32 |

| Volume | 12,732,772 | Average Volume | 9,412,216 | Market Cap | $71,351,582,720 |

| 52 Week Low | $42.73 | 52 Week High | $62.12 | Enterprise Value | $81,071,857,664 |

| Profit Margins | 12.975% | Shares Outstanding | 1,428,460,032 | Book Value | $13.619 |

| Price to Book | 3.66767 | Net Income to Common | $4,155,000,064 | Trailing EPS | $2.88 |

| Forward EPS | $3.26 | PEG Ratio | 0.71 | Last Split Factor | 2:1 |

| Enterprise To Revenue | 2.532 | Enterprise To Ebitda | 11.511 | Total Cash | $3,735,000,064 |

| Total Cash Per Share | $2.624 | Ebitda | $7,042,999,808 | Total Debt | $13,386,000,384 |

| Quick Ratio | 0.941 | Current Ratio | 1.36 | Total Revenue | $32,022,999,040 |

| Debt To Equity | 67.925 | Revenue Per Share | $22.496 | Return On Assets | 7.326% |

| Return On Equity | 22.618% | Gross Profits | $5,161,000,000 | Free Cash Flow | $1,541,374,976 |

| Operating Cash Flow | $5,229,000,192 | Earnings Growth | 23.8% | Revenue Growth | 11.1% |

| Gross Margins | 19.792% | Ebitda Margins | 21.993% | Operating Margins | 17.461% |

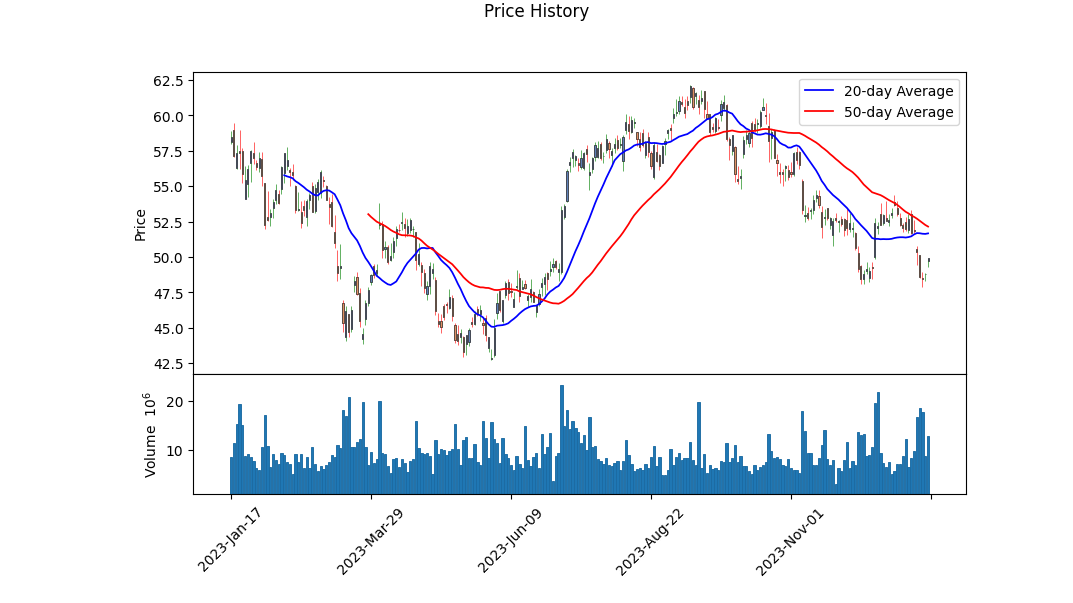

An analytical review of Schlumberger Limited (ticker: SLB) reveals a comprehensive picture shaped by technical analysis, fundamental analysis, and a thorough examination of the balance sheet and cash flow statements. The recent technical data illustrates a challenging period for SLB with the last closing price (49.95 on 2024-01-12) beneath its opening value (50.59 on 2024-01-08) almost a week prior. Noteworthy are the indicators like the Parabolic SAR (PSAR) showing a bearish trend and the Moving Average Convergence Divergence (MACD) with a negative histogram value, both suggestive of downward momentum. The On-Balance Volume (OBV) has seen a decrease, reinforcing the strength of the current downtrend.

An analytical review of Schlumberger Limited (ticker: SLB) reveals a comprehensive picture shaped by technical analysis, fundamental analysis, and a thorough examination of the balance sheet and cash flow statements. The recent technical data illustrates a challenging period for SLB with the last closing price (49.95 on 2024-01-12) beneath its opening value (50.59 on 2024-01-08) almost a week prior. Noteworthy are the indicators like the Parabolic SAR (PSAR) showing a bearish trend and the Moving Average Convergence Divergence (MACD) with a negative histogram value, both suggestive of downward momentum. The On-Balance Volume (OBV) has seen a decrease, reinforcing the strength of the current downtrend.

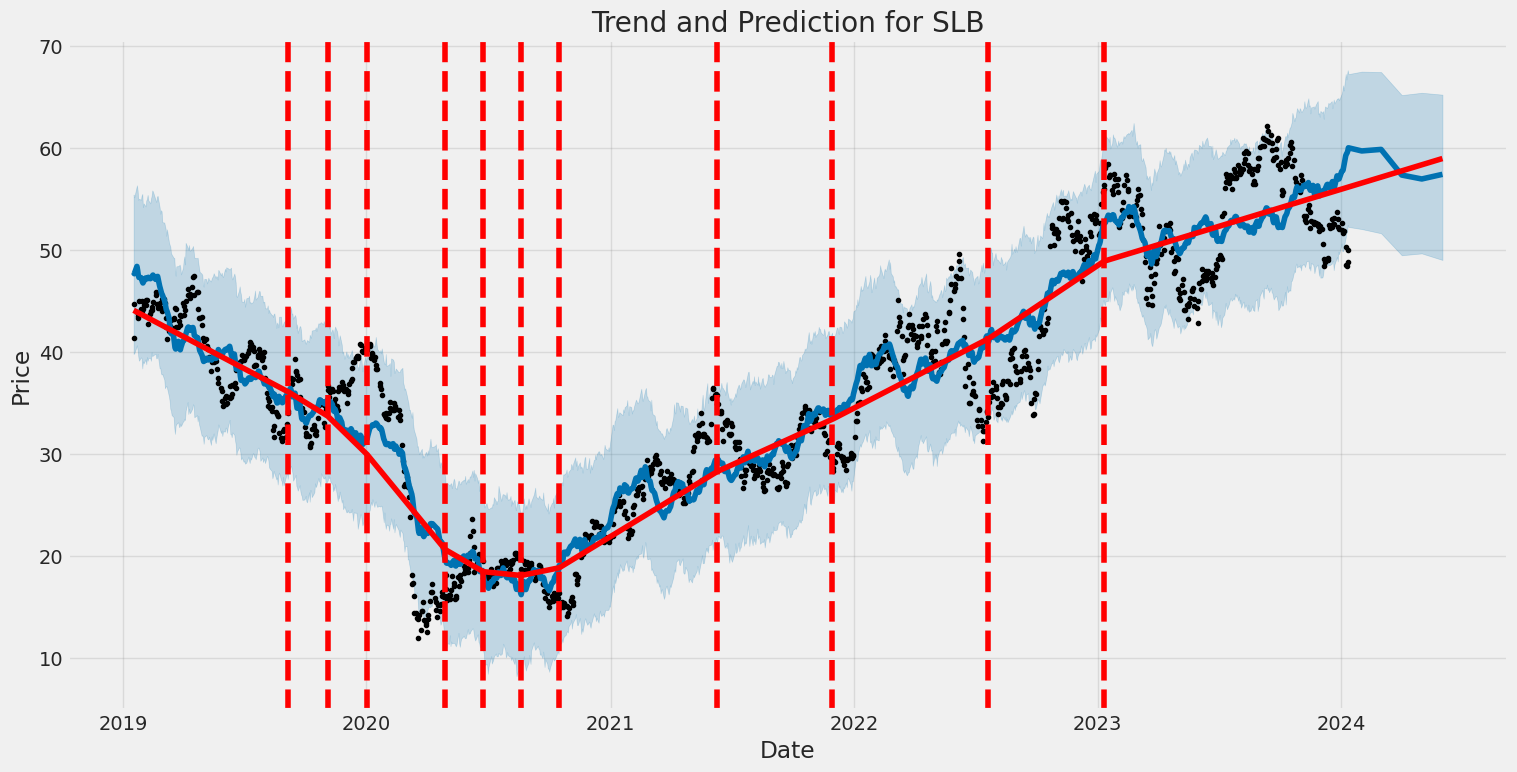

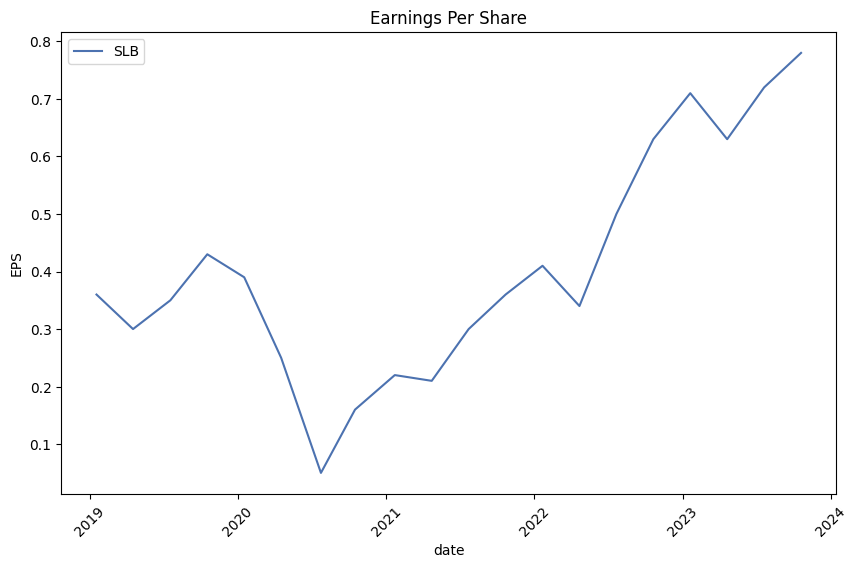

From a fundamental perspective, the company demonstrates solid financial health with improving margins, as indicated by the EBITDA, operating, and gross margins. An upward trend in net income and normalized EBITDA over the past three years is a positive signal, reflecting operational efficiency and robust profitability. The significant reduction in net debt from 2020 to 2022 is a testament to prudent financial management, which strengthens the company's balance sheet.

The company's cash flow position, as indicated by free cash flows, shows capability for liquidity and potential for reinvestment or shareholder returns, though a decrease from the previous year may warrant attention to understand the underpinnings of this change. Notably, capital expenditure has increased, signaling ongoing investments in the company's growth.

Looking at the analyst expectations, the earnings and revenue estimates for the upcoming quarters are positive with expected increases year over year, suggesting that the market has confidence in the companys ability to grow earnings and revenue. However, EPS revisions suggest that some analysts have reduced their expectations recently, which may reflect a more conservative outlook or a response to external market conditions.

Considering this multifaceted analysis, the portrait that emerges for SLB over the next few months is one colored by cautious optimism. The technical indicators suggest that the stock may experience further downward pressure in the short term, and investors might be watchful for a potential reversal pattern before considering entry points. Nonetheless, the fundamental strength demonstrated by improving margins, robust profitability, and successful deleveraging efforts paint a promising picture for the medium to longer term.

Additionally, with analyst expectations for future earnings and revenue on an upward trajectory, market sentiment may eventually turn favorable to support a recovery in the stock price. Investors should align their strategy with a consideration of both macroeconomic conditions and industry-specific catalysts that could influence the stock's performance. As always, diversification and risk management remain critical, ensuring that decisions made today withstand the tests of market volatility.

| Statistic Name | Statistic Value |

| R-squared | 0.263 |

| Adj. R-squared | 0.262 |

| F-statistic | 446.4 |

| Prob (F-statistic) | 5.26e-85 |

| Log-Likelihood | -3026.5 |

| No. Observations | 1,255 |

| AIC | 6,057 |

| BIC | 6,067 |

| Const | 0.0002 |

| Beta | 1.222 |

| Alpha | 0.000248 |

| Omnibus | 153.501 |

| Prob(Omnibus) | 0.000 |

| Skew | 0.265 |

| Kurtosis | 7.727 |

| Cond. No. | 1.32 |

The linear regression model analyzing the relationship between Schlumberger Limited (SLB) and the S&P 500 Index (SPY) yields an alpha of approximately 0.000248. This statistic, also known as the intercept, indicates the expected performance of SLB independent of the market; its near-zero value suggests that SLB's performance is closely tied to the market, displaying minimal idiosyncratic behavior. The positive beta coefficient of 1.222 suggests that SLB tends to move in the same direction as the overall market (represented by SPY), but with amplified volatility. A beta greater than one implies that SLB is more sensitive to market movements than the average market participant.

The R-squared value of 0.263 expresses that around 26.3% of SLB's price variation can be explained by the movements in SPY. The relatively low R-squared indicates that there are other factors affecting SLB's price outside the market performance as encapsulated by SPY. The models F-statistic is significant, showing the overall model is a good fit in a statistical sense, whereas the comparison of the probability of the F-statistic to a low p-value (5.26e-85) confirms the overall relationship between SLB and SPY is statistically significant. Despite this statistical significance, the relatively low R-squared value signifies that a considerable portion of SLB's price movement is due to influences not captured by SPY's performance.

Schlumberger Limited Q3 2023 Earnings Call Summary

Introduction: - The earnings call was conducted from New York City and hosted by James McDonald, the SVP of Investor Relations and Industry Affairs. - Participants were Olivier Le Peuch, CEO, and Stephane Biguet, CFO. - Forward-looking statements disclaimer and reference to non-GAAP financial measures were made.

Financial Results Overview by CEO Olivier Le Peuch: - Schlumberger experienced growth in revenue and adjusted EBITDA year-over-year and sequentially. - The third quarter showcased strong international revenue, marking the highest since 2015, with significant contributions from the Middle East & Asia. - Notable growth in Saudi Arabia, UAE, Kuwait, and Egypt. - Offshore investments in Africa, Brazil, and Scandinavia were resilient, offering substantial opportunities. - In North America, revenue decreased sequentially due to lower activity; however, year-on-year growth outperformed the rig count. - Margins expanded, with EBITDA margin hitting a new cycle high of 25%, and pre-tax segment operating margin increased for the 11th consecutive quarter year-on-year.

Engines of Growth: Core, Digital, and New Energy: - The oil and gas sector is benefiting from a multiyear growth cycle supported by long-cycle developments, production capacity expansions, exploration, and gas as an energy transition fuel. - Core business grew 22% year-to-date with expanded margins. - Strong performance driven by a diverse portfolio, leading technology, and integration capabilities. - The company anticipates continued investment offshore and highlighted the OneSubsea Joint Venture with Aker Solutions and Subsea7, which will enhance their market position. - The Digital platform Delfi saw user and compute hour increase year-over-year. Digital technology adoption is rising, evidenced by recent agreements and contracts. - New Energy business and Transition Technologies focus on decarbonizing operations, addressing methane emissions, and scaling CCUS (Carbon Capture, Utilization, and Storage).

Outlook: - Fourth-quarter expectations include sequential revenue growth driven by Digital sales and seasonal product and equipment sales in the Production Systems segment. - High-single-digit sequential revenue growth is anticipated, maintaining strong global pre-tax segment operating and EBITDA margins. - Full year financial targets are on track, with revenue increasing by 15% and EBITDA in the mid-20s, excluding OneSubsea joint venture impacts.

Financial Details by CFO Stephane Biguet: - Q3 earnings per share increased sequentially and year-over-year. - Revenue of $8.3 billion, up 3% sequentially, with international growth leading. - Adjusted EBITDA margin reached 25%, the highest since 2015. - Revenue and margin increase across divisions with a standout performance by Reservoir Performance. - Cash flow from operations generated $1.7 billion and free cash flow of over $1 billion. - Net debt reduced sequentially to $9.4 billion. - Capital investments expected to be between $2.5 to $2.6 billion for the full year. - Share repurchasing remained targeted to return $2 billion to shareholders. - Fourth-quarter guidance includes revenue growth and margin maintenance, taking into account the Aker subsea business contribution. - The Aker subsea business is predicted to contribute $400-500 million of incremental revenue in Q4 with low-teen pre-tax operating margins. - The OneSubsea joint venture is expected to be slightly accretive to Q4 earnings per share, excluding charges and credits.

Closing Remarks by CEO Olivier Le Peuch: - The oil and gas cycle aligns with Schlumberger's business strategy, emphasizing core offerings, digital enhancements, and New Energy investments. - International growth, particularly from the OneSubsea joint venture, drives financial performance. - Confidence in achieving full-year targets and through-cycle financial goals. - Positioned for success across all time horizons and committed to shareholder value.

Additional Points from Q&A:

- Oliver Le Peuch addressed rising opportunities in the Middle East, the positive market cycle, and the role of AI and digital transformation in future growth.

- Stephane Biguet provided additional insights into foreign exchange impacts, free cash flow performance, margin expansion, and organic pre-tax operating margins.

Schlumberger Limited (SLB) SEC Form 10-Q Filing Summary for Quarter Ended September 30, 2023

Schlumberger Limited reported robust financial performance with year-on-year growth seen in the third quarter of 2023. The quarter's results highlighted a stark 19% increase in revenue driven by positive trends in the international markets, marking the ninth consecutive quarter of double-digit annual revenue growth abroad. The international arena witnessed a 12% revenue uplift, contrasted by North America's 6% rise, contributing to an overall 11% global revenue augmentation for the third quarter when compared to the same period the previous year.

The company's margin performance also showed improvement, with pretax segment operating margin expanding to 20%, up by 153 basis points compared to the same quarter in the prior year. The sequential quarter-over-quarter revenue growth was 3%, mainly inflamed by an 8% rise in the Middle East & Asia sectors, which corroborates persistent investment vigor in these regions. The quarter's performance was underpinned by widespread growth in countries such as Saudi Arabia, the United Arab Emirates, Indonesia, China, Malaysia, Kuwait, and Oman.

For the quarter, the company's pretax segment operating margin saw an uptick of 73 basis points, bolstering its financial robustness. Moving forward, Schlumberger anticipates that the market fundamentals for its operations remain firm, with the oil and gas industry benefiting from a multiyear growth phase pivoting towards the international and offshore marketsa domain where Schlumberger primely leads.

Division-wise, the Digital & Integration segment expanded by 4% sequentially due to heightened Asset Performance Solutions (APS) revenue and digital sales. However, the segment's pretax operating margin contracted by 200 basis points due to weaker APS performance.

The Reservoir Performance segment experienced a 2% sequential rise in revenue thanks to boosted evaluation and stimulation activities internationally. Consequently, the segment's pretax operating margin enhanced by 190 basis points.

Well Construction's revenue climbed 2% sequentially, steered by Middle Eastern and Asian growth, albeit North American revenues edged down by 8%.

Production Systems segment witnessed a 2% uptick in revenue sequentially, propelled by upswings in completions and artificial lift sales, counterbalanced by a subsea activity decrease in North America.

Interest & other income during the quarter stood at $73 million, bolstered by increased profitability from seismic-related equity investments compared to the same period last year. Research & engineering and general & administrative expenses tagged at 2.2% and 1.0% of revenue respectively in the third quarter of 2023. Furthermore, the effective tax rate for the third quarter and first nine months of 2023 remained consistent at 19%. The slight uptick in the effective tax rate for the first nine months compared to the previous year was attributed to tax benefits realized in 2022, which included a pretax gain from selling shares in Liberty Energy Inc.

A significant emphasis for Schlumberger in 2023 was the management of its net debt, which marginally increased from the end of 2022, reaching $(9,410) million at the close of the third quarter. Yet, the company maintained a robust liquidity position with $3.74 billion in cash and short-term investments on hand, and unused committed credit facility agreements of $6.54 billion as of quarter-end.

Schlumberger also addresses its continued focus on the evolving geopolitical landscape, including its decision to suspend new investments in Russia in 2023 and stopping shipments into the country in response to expanding sanctions. Despite Russia accounting for 5% of Schlumberger's global revenue during the first nine months of 2023, the company has adopted measures in compliance with sanctions and positioned itself to adapt to changes arising from the ongoing conflict in Ukraine.

Capital investments during the first nine months of 2023 summed up to $1.9 billion, primed for a slight increase over the full year compared to 2022's total capital investments of $2.3 billion. The share repurchase activity remained active, with Schlumberger repurchasing 11.5 million shares for $594 million during the same period, a part of its $10 billion share repurchase program.

Lastly, the third quarter of 2023 saw the closure of a joint venture comprising Schlumberger's subsea business, Aker Solutions' subsea business, and Subsea7. The expectation is that this joint venture, owning Schlumberger's 70% stake, will drive innovation and efficiency within the subsea production space.

The financial details in this summary are based on Schlumberger's SEC Form 10-Q filed for the quarter ended September 30, 2023, and do not reflect any subsequent events or transactions.

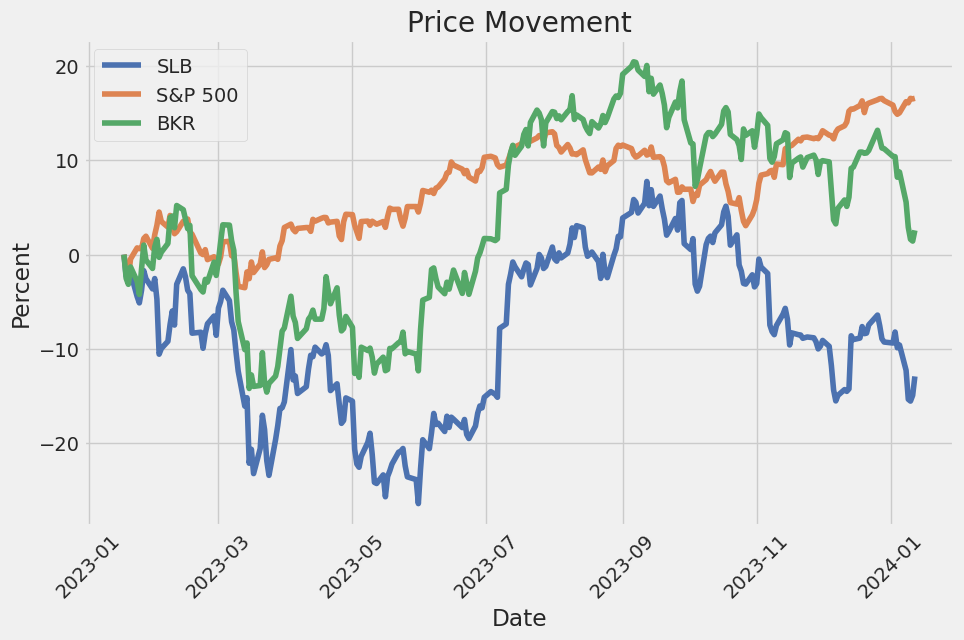

Schlumberger Limited (SLB) is navigating through a challenging market environment marked by fluctuations in stock performance. In a recent trading session on December 4, 2023, SLB's shares closed at $52.03, reflecting a 0.69% decline that surpassed the S&P 500's daily loss of 0.54%. This follows a broader downtrend for the company, which posted a 7.88% loss over the past month. This trend emerges against the backdrop of an Oils-Energy sector that gained 1.44% and an S&P 500 that increased by 8.62%, underscoring SLB's struggles to keep pace with its industry and the broader market.

Investors are closely watching Schlumberger's anticipated earnings report. Analysts expect the company to deliver earnings of $0.84 per share, which would mark year-over-year growth of 18.31%. Revenue expectations are also significant, with a projection of $9 billion, up 14.21% compared to the same quarter in the prior year. For the full fiscal year, earnings are estimated at $2.97 per share with a total revenue of $33.12 billion. These projections represent positive changes of 36.24% for earnings and 17.91% for revenue.

SLB's stock valuation metrics are of keen interest. The Forward P/E stands at 17.66, suggesting a premium relative to the industry average. The PEG ratio is 0.71, in line with the industry average for the Oil and Gas - Field Services sector. According to the Zacks Rank model, incorporating earnings estimate changes, SLB is assigned a #3 (Hold) Rank, indicative of a neutral projection for the stock's near-term price movement. The Zacks Industry Rank places the company within the bottom 24% of over 250 industries, pointing to a challenging position relative to other industry groups.

An interview with SLB CEO Olivier Le Peuch highlighted the company's approach to environmental concerns, notably methane emissions. SLB endorses robust regulatory frameworks aligned with the Oil and Gas Methane Partnership and the "Aiming for Zero Methane Emissions" initiative targeting near-zero emissions by 2030. While technical capabilities exist to achieve these objectives, regulatory fragmentation presents a challenge. The company is committed to transitioning towards low-carbon solutions and renewable energy, aiming to transform its business focus away from fossil fuels.

SLB, the leading oilfield services company, saw its stock decline by 8.4% over a month, contrasting with the S&P 500's 5.3% change. Future earnings and unchanged earnings projections are central to predicting the stock's trajectory. The stock valuation reveals a Zacks Value Style Score of B, suggesting an undervalued status and potential appeal for investors.

Despite marginal fluctuations in recent trading sessions, the anticipation around SLB's earnings report, with projected EPS growth and revenue increase, remains high. The company's valuation ratios, whether Forward P/E or PEG, affirm its competitiveness within the industry. While ranked lower within the Zacks Industry Rank system, Schlumberger's historical performance and continued financial stability merit investor attention.

Year-to-date, SLB's stock observed a 10.7% increase, outpacing the industry growth. Notable international revenue growth, resilience in offshore markets, and expanding EBITDA margins reflect strategic investments in digital and new energy sectors. However, exposure to volatile commodity prices and significant debt remain considerations for investors.

In a comparison analysis by Zacks Equity Research, SLB and Liberty Oilfield Services (LBRT) were assessed for their value. SLB holds a Zacks Rank #3 (Hold), with LBRT carrying a Rank of #2 (Buy), indicating potentially more positive earnings trends for LBRT. Necessary valuation measures indicate LBRT might present a higher value opportunity compared to SLB.

Despite a modest uptick in a recent session, SLB experienced a broader decline over the preceding month. Earnings and revenue projections for the anticipated report are positively set, with the stock's valuation metrics and industry ranking providing a nuanced perspective for potential investors. Schlumberger is balancing financial strength with strategic positioning to cater to industry trends, and while the market exhibits challenges, the company's efforts to adapt are evident.

Zacks Equity Research reports a 10.7% year-to-date growth for SLB's stock, surpassing industry peers. The company is buoyed by strong international revenue and offshore market resilience. Schlumberger's digital platform expansion and new energy investments point to a strategic shift, notwithstanding the inherent risks in the energy sector. For dividend-seekers, alternative companies with higher Zacks Rank are recommended.

Recently, Schlumberger's performance has contrasted with the broader market gains. Earnings expectations are set high, with thorough financial projections indicating robust growth. Consistent analyst estimates and stable revenue growth outlook suggest an appealing investment, keeping a Zacks Rank #3 (Hold).

The analysis from Forbes on December 27, 2023, provides insights into SLB's performanceshowcasing revenue growth despite industry headwinds. The company's strategic moves and operational success are apparent, though the stock's slightly underwhelming return in 2023, compared to significant growth in previous years, paints a picture of both stability and subdued dynamism.

Ads from Zacks.com highlight Schlumberger as a potential buy based on earnings revisions, revenue projections, historical performance, and favorable valuation. With a Zacks Rank #2 (Buy), the company is expected to outperform the market in the near term.

Schlumberger's shares have subtly underperformed against the S&P 500, but the well-received adjustments to earnings estimates and financial health add merit to the narrative that Schlumberger is an intriguing option for investment consideration. This trend is documented by Zacks Equity Research, indicating stability and potential for growth.

A subsequent trading session saw a decline for SLB amid market gains. Despite the downturn, analysts and investors maintain high expectations for the upcoming earnings release. Schlumberger's unchanged analyst estimates and a Zacks Rank #3 (Buy) suggest a positive future outlook.

According to a Zacks.com's analysis, despite a general downturn, Schlumberger emerges as a top energy growth stock. The company's growth prospects and robust EPS growth rate outshine the industry average, bolstered by a Zacks Rank #2 (Buy) and a Growth Score of 'B'. The market's volatility implies a decisive moment for growth investment, with Schlumberger aptly positioned.

In the face of marginal daily stock movements, the consensus among analysts is optimistic, with a focus on earnings and revenue projections. Valuation metrics resonate with industry averages, while the industry rank indicates potential future challenges. These factors are significant for investors monitoring Schlumberger's performance.

In the latest analysis, Schlumberger held its valuation as a leading oil and gas industry services provider. Despite headwinds, robust year-over-year revenue, a reduced debt profile, equity growth, and the anticipation of a strong 2024 continue to underline Schlumberger as a 'Buy'.

Schlumberger's stock has seen a rise over the past month, showcasing stability in its earnings forecasts and potential for future growth. However, revenue estimates and past financial reports point to ongoing expansion, coupled with a favorable valuation score that positions Schlumberger for sustainable progress within its industry.

Based on the summarized volatility data for Schlumberger Limited (SLB) for the given date range, the following key points are noted:

- The volatility model used for SLB indicates that there is a constant average value of fluctuations in return, suggesting the mean returns are typically around zero.

- The parameter omega, with a coefficient of approximately 7.17, implies that there is a baseline volatility in the stock's returns which is significant and not negligible.

- The alpha parameter in the ARCH model is around 0.28, indicating that past returns have a moderate impact on predicting future volatility, with sudden large returns likely increasing the forecasted volatility.

Here is the requested HTML table:

| Statistic Name | Statistic Value |

|---|---|

| Dep. Variable | asset_returns |

| R-squared | 0.000 |

| Mean Model | Zero Mean |

| Adj. R-squared | 0.001 |

| Vol Model | ARCH |

| Log-Likelihood | -3,161.22 |

| AIC | 6,326.44 |

| BIC | 6,336.71 |

| No. Observations | 1,255 |

| Df Residuals | 1,255 |

| Df Model | 0 |

| Omega | 7.1730 |

| Alpha[1] | 0.2795 |

| Conf. Int. for Omega | [5.990, 8.356] |

| P-value for Omega | <0.0001 |

| P-value for Alpha[1] | 0.002475 |

The table presents various statistical values from the ARCH model that describe the volatility of Schlumberger Limited without specific dates or times of calculations.

To evaluate the financial risk of a $10,000 investment in Schlumberger Limited (SLB) over a one-year period, an approach that combines volatility modeling and machine learning predictions can be implemented.

Initially, volatility modeling is critical in understanding and quantifying the degree of variability in Schlumberger Limited's stock price. It is a statistical approach that assesses the changes in the price of the stock over time, which can be quite erratic due to market dynamics, geopolitical events, and company-specific news, among other factors. This method provides an estimation of the expected level of fluctuation of the stock price and projects it into the future. Through this model, it is possible to capture the persistence of volatility over time and the impact of shocks to previous time periods on current predictions.

In parallel, machine learning predictions can be employed to analyze historical price data of Schlumberger Limiteds stock and forecast future returns. A machine learning regressor, specifically a decision-tree-based ensemble method, can be utilized for this task. The regressor learns from the historical price movements and other relevant financial indicators to make predictions about the future direction and magnitude of stock prices movements. This approach benefits from the ability to identify complex nonlinear patterns in the data that might not be apparent or adequately captured by traditional statistical methods.

Combining these two methods can present a more nuanced picture of potential investment risks. The calculated Value at Risk (VaR) informs us of the potential loss on our $10,000 investment in Schlumberger Limited over a specified period, with a certain confidence level. In this instance, the assessed Value at Risk at a 95% confidence interval is $354.37. This figure suggests that there is a 5% chance that the investment could suffer a loss exceeding $354.37 over the one-year period.

When interpreting the results, we draw insights into the investment risks by looking at the tightness of the confidence interval derived from the volatility modeling, alongside the predictive accuracy of the machine learning predictions. The volatility modeling, in particular, underpins the VaR calculation by providing an estimate of maximum expected movement in the stock price.

These tools, when integrated, therefore offer a sophisticated perspective on financial risk. The volatility model provides a necessary foundation by quantifying the expected swings in price, which is pivotal for calculating the VaR. Meanwhile, machine learning predictions can enhance the analysis by projecting future returns, incorporating the insights drawn from the volatility model. This integrated approach delivers a thorough assessment of the equity investment risk in Schlumberger Limited, demonstrating an in-depth understanding of both the possible volatility and expected returns on the investment.

Similar Companies in Oil & Gas Equipment & Services:

Baker Hughes Company (BKR), NOV Inc. (NOV), Weatherford International plc (WFRD), Tenaris S.A. (TS), Halliburton Company (HAL), ChampionX Corporation (CHX), TechnipFMC plc (FTI), NOW Inc. (DNOW), Oceaneering International, Inc. (OII), Cactus, Inc. (WHD), Weatherford International plc (WFTUF), Tidewater Inc. (TDW), Valaris Limited (VAL), Expro Group Holdings N.V. (XPRO), Halliburton Company (HAL), Baker Hughes Company (BKR), Weatherford International plc (WFRD), National Oilwell Varco, Inc. (NOV), TechnipFMC plc (FTI)

https://www.youtube.com/watch?v=C1cQAUU2puo

https://www.zacks.com/stock/news/2196437/schlumberger-slb-rises-higher-than-market-key-facts

https://www.zacks.com/stock/news/2198849/lbrt-or-slb-which-is-the-better-value-stock-right-now

https://www.zacks.com/stock/news/2202565/is-trending-stock-schlumberger-limited-slb-a-buy-now

https://finance.yahoo.com/news/trending-stock-schlumberger-limited-slb-140006030.html

https://finance.yahoo.com/news/schlumberger-slb-stock-sinks-market-230020493.html

https://www.zacks.com/stock/news/2203031/5-top-energy-growth-stocks-that-you-need-to-buy-for-2024

https://finance.yahoo.com/news/schlumberger-slb-stock-moves-0-225020254.html

https://seekingalpha.com/article/4661349-schlumberger-double-digit-earnings-growth-tailwinds-in-2024

https://www.sec.gov/Archives/edgar/data/0000087347/000095017023055042/slb-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: e866lH

https://reports.tinycomputers.io/SLB/SLB-2024-01-15.html Home