Sprott Physical Platinum and Palladium Trust (ticker: SPPP)

2024-03-25

The Sprott Physical Platinum and Palladium Trust (ticker: SPPP) is a specialized investment instrument that provides investors with a direct opportunity to invest in physical platinum and palladium. The trust is designed to hold nearly all of its assets in physical platinum and palladium bullion, offering an investment option that reflects the performance of these precious metals' prices, less the Trust's expenses. This investment vehicle is particularly attractive for those looking to diversify their portfolio with precious metals without the complexity of futures contracts or the inconvenience of holding physical bullion directly. The Trust's physical metals are securely stored in vaults, and the trust's structure allows for the potential tax advantages over other forms of investing in platinum and palladium. Due to the specific focus on just two metals, the performance of SPPP can be significantly influenced by the supply and demand dynamics specific to the platinum and palladium markets, including industrial use in automotive catalytic converters, jewelry, and investment demand. As such, the Trust offers an interesting option for investors bullish on these particular precious metals or those seeking a hedge against inflation or currency devaluation.

The Sprott Physical Platinum and Palladium Trust (ticker: SPPP) is a specialized investment instrument that provides investors with a direct opportunity to invest in physical platinum and palladium. The trust is designed to hold nearly all of its assets in physical platinum and palladium bullion, offering an investment option that reflects the performance of these precious metals' prices, less the Trust's expenses. This investment vehicle is particularly attractive for those looking to diversify their portfolio with precious metals without the complexity of futures contracts or the inconvenience of holding physical bullion directly. The Trust's physical metals are securely stored in vaults, and the trust's structure allows for the potential tax advantages over other forms of investing in platinum and palladium. Due to the specific focus on just two metals, the performance of SPPP can be significantly influenced by the supply and demand dynamics specific to the platinum and palladium markets, including industrial use in automotive catalytic converters, jewelry, and investment demand. As such, the Trust offers an interesting option for investors bullish on these particular precious metals or those seeking a hedge against inflation or currency devaluation.

| Previous Close | 9.62 | Open | 9.53 | Day Low | 9.4201 |

| Day High | 9.58 | Volume | 76,775 | Average Volume | 110,381 |

| Average Volume 10 days | 135,390 | Bid | 9.47 | Ask | 10.3 |

| Bid Size | 1,300 | Ask Size | 3,200 | Market Cap | 98,754,112 |

| Fifty Two Week Low | 8.55 | Fifty Two Week High | 13.59 | Fifty Day Average | 9.3214 |

| Two Hundred Day Average | 10.28115 | Exchange | ASE | Quote Type | EQUITY |

| Sharpe Ratio | -0.9554197795170519 | Sortino Ratio | -14.687291115958306 |

| Treynor Ratio | -0.48110255454453393 | Calmar Ratio | -0.5584834108802612 |

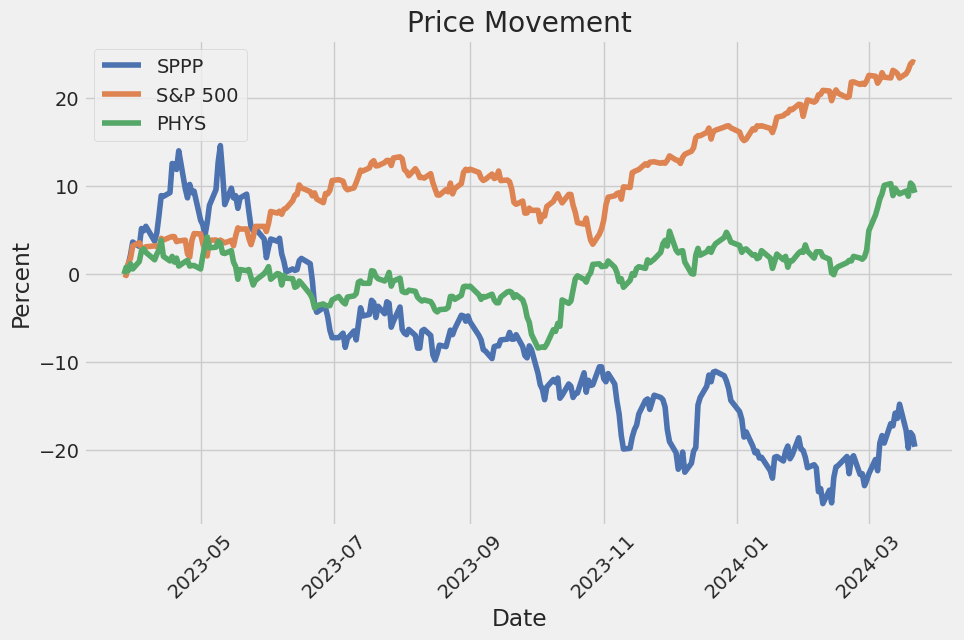

The financial landscape for Sprott Physical Platinum & Palladium Trust (SPPP), as reflected through technical indicators, fundamentals, and risk-adjusted performance metrics, indicates a challenging environment for the security's price in the coming months. The meticulous dissection of provided data reveals subtleties that forecast upcoming price movements with a nuanced understanding.

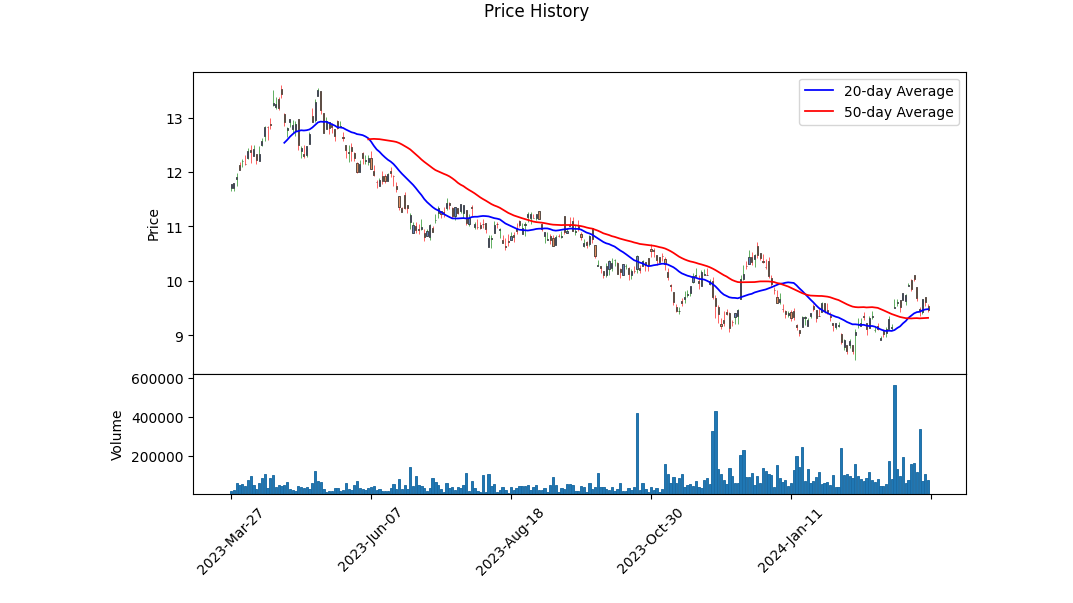

Technical analysis of SPPP's recent performance shows a downtrend, with a decrease in its On-Balance Volume (OBV) to -0.04269 million and a shift to a negative Moving Average Convergence Divergence (MACD) histogram of -0.011203 by the last data point. This suggests declining buying pressure and a potential continuation of bearish sentiment in the short-term trajectory.

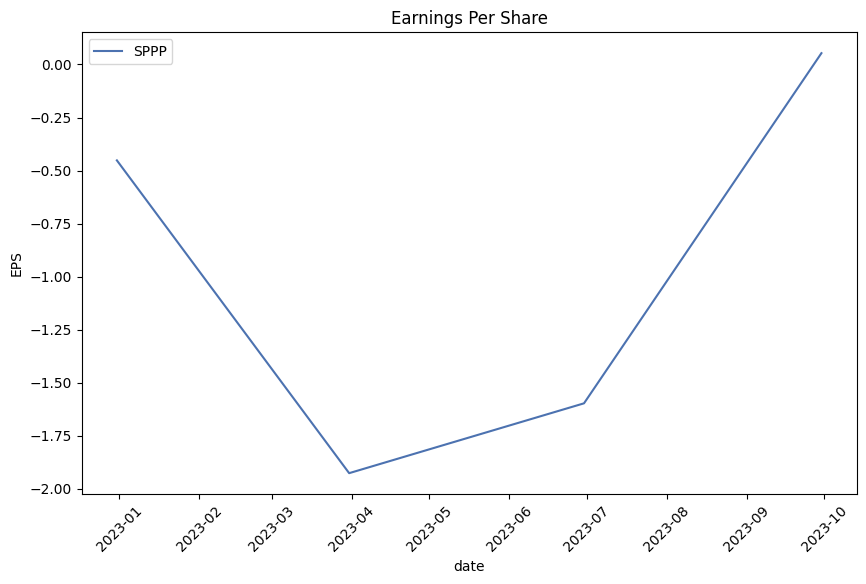

The fundamental analysis further consolidates this outlook. SPPP's recent financial summaries elucidate pressing concerns, notably a net income slide from a positive tenor two years ago to adverse outcomes in the latest fiscal disclosures. This decline is complemented by a decrease in cash flow operations, a pressing concern for maintaining operational stability and growth prospects. Furthermore, the balance sheet unfurls a stable yet cautious tale, with somewhat stagnant increases in tangible book value and equity, juxtaposing the securities and investments growth against a backdrop of modest total asset changes.

The risk-adjusted performance ratios - the Sharpe, Sortino, Treynor, and Calmar ratios - all record negative values. Such metrics accentuate not only the underperformance compared to a risk-free benchmark but also suggest that the return does not compensate adequately for the risk undertaken by investors. A particularly striking figure is the Sortino ratio, which accentuates the downturn risks are significantly penalized in the performance chart, potentially discouraging for risk-averse investors.

Moreover, the financial metrics including the Altman Z-Score and the Piotroski Score from the Summary of Score add an extra layer of concern. The Altman Z-Score, though significantly high, might be skewed due to the nature of SPPP's assets, primarily consisting of physical commodities. The Piotroski Score at 1, on the lower end, raises flags about financial health and operational efficiency.

Given these elements, SPPP appears poised for a muted or potentially negative performance in the upcoming months. The intersection of discouraging technical indicators, weak fundamental performance, negative risk-adjusted return measures, and concerning financial health scores provides a sobering prospect for the stock. Investors and analysts must tread cautiously, keeping an eye on these multifaceted signals for future movements.

In evaluating Sprott Physical Platinum and Palladium Trust (SPPP) through the lenses of Return on Capital (ROC) and Earnings Yield, it's evident that the investment exhibits certain financial pressures that are paramount for investors to consider. The Return on Capital (ROC), calculated at -3.871630220988083, suggests that SPPP is currently generating a negative return from its invested capital. This indicates that the entity is not efficiently utilizing its capital to generate profit, a critical aspect for long-term sustainability and growth. Concurrently, the Earnings Yield, quantified at -5.70221752903907, underscores a negative performance metric. This essentially reflects the company's inability to generate earnings compared to its share price, making it less attractive from an earnings perspective. Both metrics are vital in assessing the financial health and operational effectiveness of Sprott Physical Platinum and Palladium Trust, guiding investors towards a more nuanced understanding of its current market position and future potentials. Given these figures, potential investors should tread carefully, recognizing that these negative indicators might hint at underlying challenges in SPPP's business model or operational sphere, impacting its attractiveness as an investment in the short to medium term.

| Statistic Name | Statistic Value |

| R-squared | 0.084 |

| Adj. R-squared | 0.083 |

| F-statistic | 115.0 |

| Prob (F-statistic) | 9.72e-26 |

| Log-Likelihood | -2753.4 |

| AIC | 5511. |

| BIC | 5521. |

| coef (const) | -0.0197 |

| coef (0) | 0.4980 |

| P>|t| (const) | 0.748 |

| P>|t| (0) | 0.000 |

| [0.025 0.975] (const) | -0.140 0.101 |

| [0.025 0.975] (0) | 0.407 0.589 |

| Omnibus | 283.096 |

| Prob(Omnibus) | 0.000 |

| Skew | -0.618 |

| Kurtosis | 11.790 |

| Cond. No. | 1.32 |

The relationship between SPPP and SPY, represented through linear regression analysis, shows a beta (the coefficient for the market variable) of approximately 0.4980, suggesting that for every 1% change in SPY, SPPP is expected to change by about 0.4980%. The alpha, or intercept, value of approximately -0.0197 indicates that SPPP underperforms the benchmark SPY when the market's performance is zero. Nonetheless, the statistical significance of the beta is supported by a very low p-value (P>|t| = 0.000 for the market variable), affirming a reliable positive relationship between SPPP and SPY throughout the observed time period.

However, the R-squared value of 0.084, accompanied by an Adjusted R-squared of 0.083, suggests that only a small fraction of the variability in SPPP's returns is explained by the changes in the SPY. This implies that while there is a positive association between the two variables, a significant amount of SPPP's performance can be attributed to factors other than the overall market trend represented by SPY. These results highlight the complexities of predicting SPPPs movements based solely on broad market movements, emphasizing the importance of considering other variables or employing different models for a more comprehensive analysis.

The Sprott Physical Platinum and Palladium Trust, established as a closed-end investment vehicle, offers a unique opportunity for investors looking to gain exposure to physical platinum and palladium. These precious metals are known for their industrial applications, particularly in the automotive industry for catalytic converters, as well as their investment allure. The Trust's main objective is to give investors direct ownership of physical platinum and palladium, securely stored in vaults, allowing for a more tangible investment compared to derivative instruments.

One notable aspect of the Sprott Trust is its structure that seeks to provide a secure and efficient way for investors to access the underlying value of the physical metals without the inherent challenges of personal storage and insurance. The Trust stores its physical platinum and palladium in fully allocated, segregated storage spaces in Canada and other approved locations, ensuring safety and compliance with high-security standards. This logistical setup not only mitigates risks associated with physical possession but also simplifies the investment process for those looking to add precious metals to their portfolios.

The tax implications for investors are a critical component to understand. Unlike some investments in precious metals, the Sprott Physical Platinum and Palladium Trust is treated as a Passive Foreign Investment Company (PFIC) for U.S. tax purposes. This classification has specific tax implications that could be advantageous depending on the investors tax situation, offering potential long-term tax benefits that are not typically available with other precious metals investments.

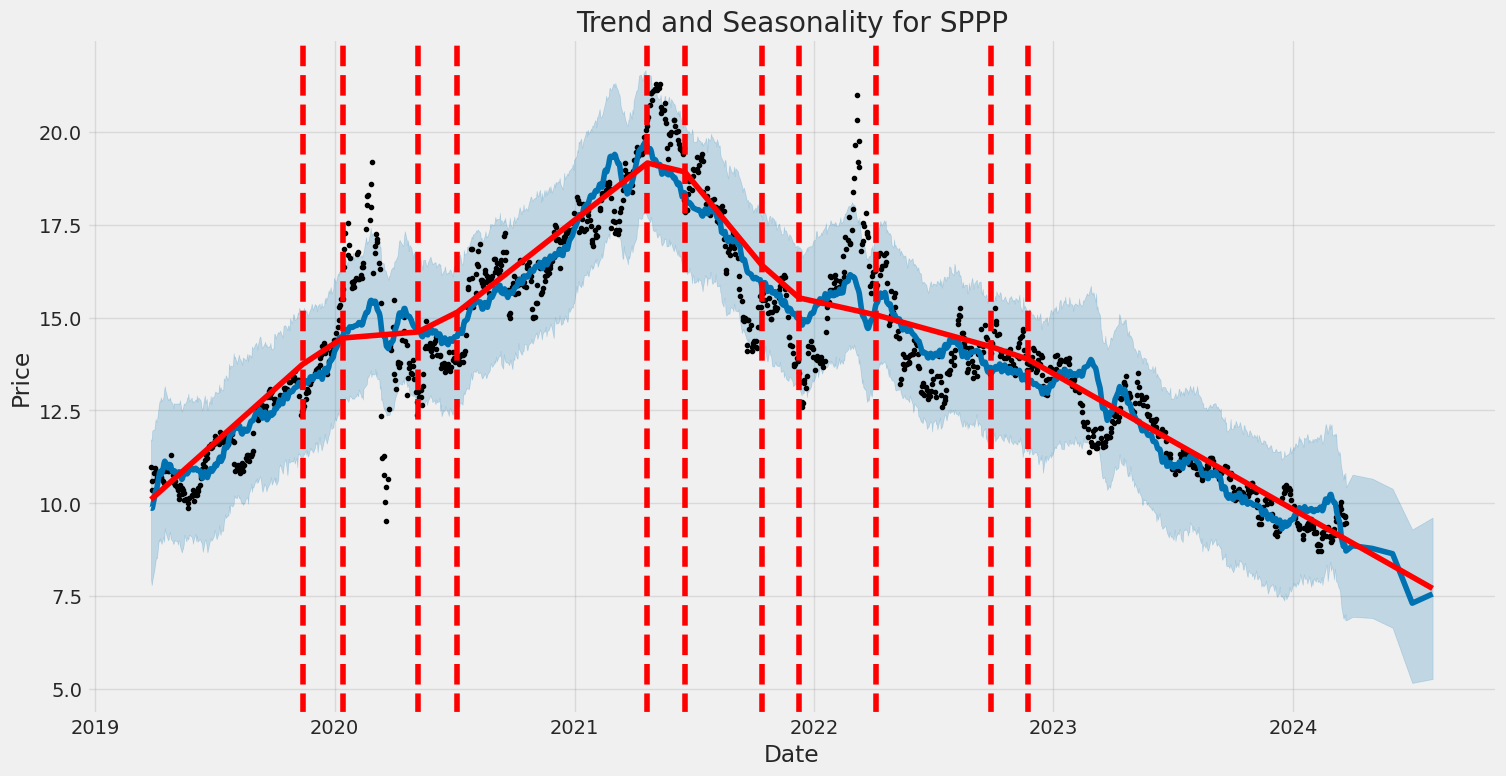

The performance of the Trust is closely tied to the spot prices of platinum and palladium, which are influenced by a variety of global factors. These could include changes in automotive industry demand, particularly for catalytic converters, geopolitical tensions that affect mining output, and broader economic indicators that influence investment demand. As such, the Trust's asset value can experience volatility, reflective of fluctuations in these metals market prices.

Moreover, the Trust provides an audited bar list, available on its website (Sprott's website), which details its holdings, offering transparent insight into its inventory. This transparency is vital for investors, as it not only provides a clear view of the Trust's physical holdings but also instills confidence in the accuracy of the Trusts reported assets.

Investing in the Sprott Physical Platinum and Palladium Trust also comes with certain considerations. The Trust's performance is subject to the administrative and storage costs that can impact overall returns. Additionally, since the Trust holds physical assets, its market price can deviate from the net asset value (NAV) due to supply and demand forces in the market. This could result in the shares trading at a premium or discount to the NAV at any given time, which investors need to be mindful of when making investment decisions.

Market conditions and trends play a crucial role in the investment potential of precious metals. Recent years have seen an increase in investor interest towards commodities as a hedge against inflation and currency depreciation. Platinum and palladium, with their extensive industrial use and limited supply, present a compelling case for inclusion in diversified investment portfolios. Factors such as advancements in automotive technologies, emission standards regulations, and the shift towards green energy are likely to influence demand for these metals.

In conclusion, the Sprott Physical Platinum and Palladium Trust represents an attractive investment for those looking to diversify their portfolio with precious metals. The Trusts focus on physical platinum and palladium offers a tangible investment that benefits from market demand for these metals, while also providing certain tax efficiencies for U.S. investors. As with all investments, individuals should conduct thorough due diligence and consider their financial situation, investment objectives, and tax implications before investing in the Trust.

The Sprott Physical Platinum and Palladium Trust (SPPP) exhibits significant volatility as shown by the ARCH model analysis between March 27, 2019, and March 22, 2024. The model highlights that the asset returns fluctuated widely with an omega parameter of 3.3024, indicating the basic level of variance in the asset's returns is quite high. Additionally, the alpha parameter is at 0.4015, suggesting that past squared returns are strongly influencing the current volatility, pointing towards a somewhat predictable pattern in the way volatility clusters over time.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2729.17 |

| AIC | 5462.34 |

| BIC | 5472.61 |

| No. Observations | 1256 |

| omega | 3.3024 |

| alpha[1] | 0.4015 |

Investing $10,000 in Sprott Physical Platinum and Palladium Trust (SPPP) introduces various risks, particularly in its stock price volatility and unpredictable market returns. To assess these risks, a blend of volatility modeling and machine learning predictions offers a comprehensive approach. By examining the financial risk over a one-year period, this analysis leverages the strengths of both methods to forecast future returns and understand the trust's inherent volatility.

Firstly, volatility modeling is key to analyzing the stock price fluctuations of SPPP. This method is adept at capturing the conditional variance in the trust's returns, indicating how much SPPP's price can swing over time. By applying this approach, we delve into the stock's historical price movements to estimate future volatility. The usefulness of this model lies in its ability to adapt to changes in volatility, making it a critical tool for assessing the risk of price movements that could affect the value of a $10,000 investment in SPPP.

In parallel, machine learning predictions provide a forward-looking perspective by leveraging past performance data to forecast future returns of SPPP. Specifically, a machine learning model adept at regression tasks is utilized to predict the trust's stock price based on historical data. This model processes various features, including past prices, volume, and other relevant market indicators, to make informed predictions about future performance. The strength of this approach lies in its ability to learn from patterns in historical data, thereby providing an estimate of potential returns on the investment.

Combining the insights from volatility modeling and machine learning predictions offers a robust analysis of the potential financial risks associated with investing in SPPP. Specifically, by calculating the Value at Risk (VaR) at a 95% confidence interval, the analysis quantifies the maximum expected loss over a one-year period, under normal market conditions. For a $10,000 investment in SPPP, the annual VaR is determined to be $262.10. This figure signifies that there is a 5% chance that the investment could lose more than $262.10 over the course of a year due to normal market fluctuations.

This combined approach, utilizing both the volatility modeling to understand price variability and machine learning predictions to forecast returns, provides a nuanced view of the financial risk. It highlights the effectiveness of integrating two sophisticated analytical methods to evaluate the risk-return dynamics of an investment in Sprott Physical Platinum and Palladium Trust. Through this methodology, investors can gain insights into both the expected volatility and potential future returns, enhancing their ability to make informed decisions regarding their investment in SPPP.

Similar Companies in Asset Management:

Sprott Physical Gold Trust (PHYS), Sprott Physical Silver Trust (PSLV), Sprott Inc. (SII), BlackRock ESG Capital Allocation Trust (ECAT), Sprott Physical Gold and Silver Trust (CEF), Blue Owl Capital Inc. (OWL), Ares Management Corporation (ARES), Invesco Value Municipal Income Trust (IIM), Diamond Hill Investment Group, Inc. (DHIL), General American Investors Company, Inc. (GAM), Virtus Equity & Convertible Income Fund (NIE), Brookfield Real Assets Income Fund Inc. (RA), Blackrock Resources & Commodities Strategy Trust (BCX), BlackRock Enhanced International Dividend Trust (BGY), BlackRock Health Sciences Trust (BME), BlackRock Enhanced Capital and Income Fund, Inc. (CII), Guggenheim Taxable Municipal Bond & Investment Grade Debt Trust (GBAB), Aberdeen Standard Physical Platinum Shares ETF (PPLT), Aberdeen Standard Physical Precious Metals Basket Shares ETF (GLTR), Wheaton Precious Metals Corp. (WPM), Anglo American Platinum Limited (ANGPY), Sibanye Stillwater Limited (SBSW)

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: V8XsmY

Cost: $0.09395

https://reports.tinycomputers.io/SPPP/SPPP-2024-03-25.html Home