Steel Dynamics Inc (ticker: STLD)

2023-12-16

Steel Dynamics, Inc. (STLD) is a prominent American steel producer and metal recycler that is well-established within its industry. Publicly traded and headquartered in Fort Wayne, Indiana, the company has carved out a significant market presence since its inception in 1993. Operating with a diverse product portfolio, Steel Dynamics specializes in the production of a range of steel materials such as flat rolled steel sheets, structural beams, and steel rails, amongst others. It also provides metals recycling services, which not only enhances its environmental credentials but also secures a cost-efficient supply of raw materials for steelmaking. With a series of both domestic and international facilities, STLD's strategic emphasis on both innovation and sustainability has contributed to its reputation as a reliable and progressive company within the highly competitive steel sector. The company's financial strength, underlined by consistent revenue growth and a solid balance sheet, positions it well to capitalize on the robust demand for steel while navigating cyclical industry challenges. Additionally, Steel Dynamics has been active in expanding its capabilities through strategic acquisitions, thus ensuring its ability to meet the evolving needs of its global customer base.

Steel Dynamics, Inc. (STLD) is a prominent American steel producer and metal recycler that is well-established within its industry. Publicly traded and headquartered in Fort Wayne, Indiana, the company has carved out a significant market presence since its inception in 1993. Operating with a diverse product portfolio, Steel Dynamics specializes in the production of a range of steel materials such as flat rolled steel sheets, structural beams, and steel rails, amongst others. It also provides metals recycling services, which not only enhances its environmental credentials but also secures a cost-efficient supply of raw materials for steelmaking. With a series of both domestic and international facilities, STLD's strategic emphasis on both innovation and sustainability has contributed to its reputation as a reliable and progressive company within the highly competitive steel sector. The company's financial strength, underlined by consistent revenue growth and a solid balance sheet, positions it well to capitalize on the robust demand for steel while navigating cyclical industry challenges. Additionally, Steel Dynamics has been active in expanding its capabilities through strategic acquisitions, thus ensuring its ability to meet the evolving needs of its global customer base.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 20.15B | 17.76B | 18.12B | 19.24B | 17.15B | 12.53B |

| Enterprise Value | 20.98B | 18.74B | 18.87B | 20.05B | 18.18B | 14.22B |

| Trailing P/E | 7.94 | 6.21 | 5.76 | 5.40 | 4.32 | 3.17 |

| Forward P/E | 14.06 | 12.11 | 6.77 | 7.17 | 6.64 | 5.34 |

| PEG Ratio (5 yr expected) | 10.91 | - | - | - | - | - |

| Price/Sales (ttm) | 1.10 | 0.92 | 0.91 | 0.94 | 0.82 | 0.63 |

| Price/Book (mrq) | 2.27 | 2.01 | 2.17 | 2.37 | 2.12 | 1.65 |

| Enterprise Value/Revenue | 1.08 | 4.09 | 3.71 | 4.10 | 3.77 | 2.52 |

| Enterprise Value/EBITDA | 5.31 | 21.29 | 15.64 | 20.50 | 20.56 | 10.67 |

Steel Dynamics, Inc. (STLD) presents an intricate landscape for technical analysis following the data available up to and including the last trading day. Examining the company's technical indicators in concert with their fundamental performance yields a multifaceted view of potential future movements in their stock price.

Steel Dynamics, Inc. (STLD) presents an intricate landscape for technical analysis following the data available up to and including the last trading day. Examining the company's technical indicators in concert with their fundamental performance yields a multifaceted view of potential future movements in their stock price.

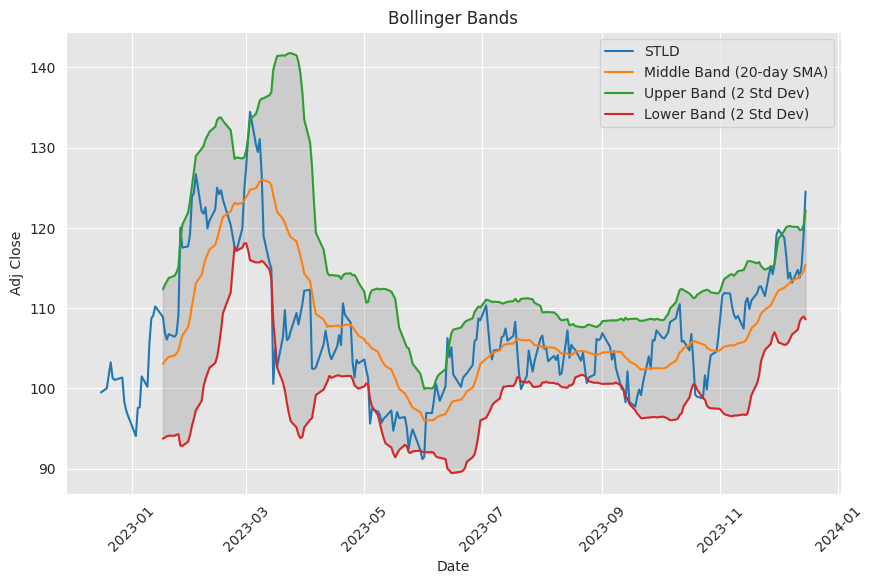

The Adjusted Closing price of $124.51 is affirmatively positioned above the 20-day Simple Moving Average (SMA_20 at $115.39) and even further above the 50-day Exponential Moving Average (EMA_50 at $111.50), illustrating a strong short- to medium-term uptrend. This bullish signal is further reinforced by the Moving Average Convergence Divergence (MACD), where the MACD line is above both the signal line and zero, putting the focus on the continuing momentum.

The Bollinger Bands also depict a bullish sentiment with the stock closing nearer the upper band. This is taken in tandem with a Relative Strength Index (RSI_14) reading close to 70. Although some might view an RSI near 70 as an overbought territory suggesting a possible retracement, it can also indicate strong buying pressure in the context of a prevalent uptrend.

Another momentum indicator, the Stochastic Oscillator (STOCHk_14_3_3 at 69.37), supports this interpretation since it, like the RSI, remains just below the typical 'overbought' threshold of 70. This similarity between oscillators supports the potential continuation of the upward movement, albeit raising caution for the near-term.

The Chaikin Money Flow (CMF_20 at 0.26) and On Balance Volume (OBV_in_million at 1.5874) both suggest that buying pressure has been dominant, a trend that could continue in the months to follow if sustained. The positive placement of the Parabolic SAR (PSARl_0.02_0.2 at $111.63) beneath the price also supports this continued uptrend.

Taking into account the company's fundamental data, the increase in Market Capitalization and Enterprise Value points towards a growing confidence from the investment community. The trailing Price-to-Earnings (P/E) ratio of 7.94 though having increased from the previous year, remains moderately low, which might attract value investors. Conversely, the forward P/E indicates expectations of profit normalization or contraction.

A notable increase in the Enterprise Value over recent quarters can be associated with expectations of increased leverage or growth opportunities via acquisitions or investments. The Price/Sales (ttm) and Price/Book (mrq) ratios, both in ascending order, authenticate an increased valuation of the company across multiple metrics, possibly translating into positive investor sentiment.

Furthermore, normalized EBITDA growth and the stability of net income underscore operational robustness. While the technicals strongly suggest a continuation of the positive price movement in the upcoming months, this perspective is bolstered by the company's solid financial performance, as seen in gradual increases in net income and EBITDA, suggestive of healthy profit reinvestment and fiscal prudence.

In sum, Steel Dynamics appears primed for continuation of its current trajectory with an overall strong bullish outlook for the months ahead, barring unaccounted macroeconomic shifts or industry-specific developments. The powerful amalgamation of healthy fundamental underpinnings and robust technical indicators posits a scenario where stock prices may trend higher in the forthcoming period. This analysis, while poignant now, is best revisited frequently given the markets ever-changing nature and susceptibility to external catalysts.

Steel Dynamics Inc. (STLD) has become a prominent figure in an industry that is continuously shaped by the forces of competition, innovation, and strategic corporate maneuvers. The unfolding story of potential mergers and acquisitions involving more traditional entities like United States Steel Corporation (X), alongside the aggressive acquisition activities of companies such as Cleveland-Cliffs (CLF), reveals an industry in flux. This environment of change offers both challenges and opportunities for companies like Steel Dynamics, poised to capitalize on its strengths and the possibilities that these market dynamics present.

In the midst of this shifting landscape, Steel Dynamics stands out not only for its reputation for high profitability but also for its potential to synergize with the assets of a company like United States Steel. The possibility of integrating these assets could substantially enhance Steel Dynamics' production capabilities and augment its profitability, which could redefine its competitive position in the steel market. This strategic positioning highlights Steel Dynamics adaptability and its readiness to seize pivotal industry opportunities.

Steel Dynamics financial health, exemplified by the strength of its balance sheet, marked by a cash position that supersedes its debt, demonstrates the company's capacity for potential growth through acquisition. Its enviable profitability metrics, which include net profit margin, EBITDA margin, and cash flow margin, signify a solid financial standing. Moreover, even marginal improvements in United States Steel's profitability through acquisition could lead to significant gains in net income for Steel Dynamics, illustrating the profound impact that strategic acquisitions could have on the company's financial performance.

The journey to a successful acquisition is, however, fraught with complexity, with formidable challengers such as ArcelorMittal (MT) and Nucor Corporation (NUE) also entering the bidding landscape. ArcelorMittals rumored cash offer and its more favorable leverage metrics pose a direct challenge to Steel Dynamics ambitions, adding another layer of complexity to the acquisition scenario.

Regulatory norms and antitrust laws ensure a level playing field within the industry, and any merger or acquisition is subject to scrutiny under these regulations. Where a bid from the industrys largest player, Nucor, might attract significant regulatory hindrance, Steel Dynamics diverse operations and focus on specialty products may provide some differentiation, potentially easing regulatory challenges.

Entering the fray at a time when Cleveland-Cliffs seeks to further cement its market presence through the acquisition of United States Steel, despite facing its own internal challenges subsequent to recent growth moves, is a bold yet calculated move for Steel Dynamics. Cleveland-Cliffs transformation from a mining entity to a major flat-rolled steel producer aimed to mitigate commodity price risks and solidify profit margins. However, the expected financial benefits of this strategy have not fully materialized, with the company facing increased costs and wage pressures, casting doubt on the immediate synergy benefits of acquiring U.S. Steel.

From a strategic viewpoint, Steel Dynamics might view these industry dynamics as setting the stage for increased competitive pressures and consolidation trends. Cleveland-Cliffs' focus on fixed-price contracts with the automotive sector could lead to openings for Steel Dynamics in other markets, or during periods where Cleveland-Cliffs fixed contracts are less advantageous amidst fluctuating market prices.

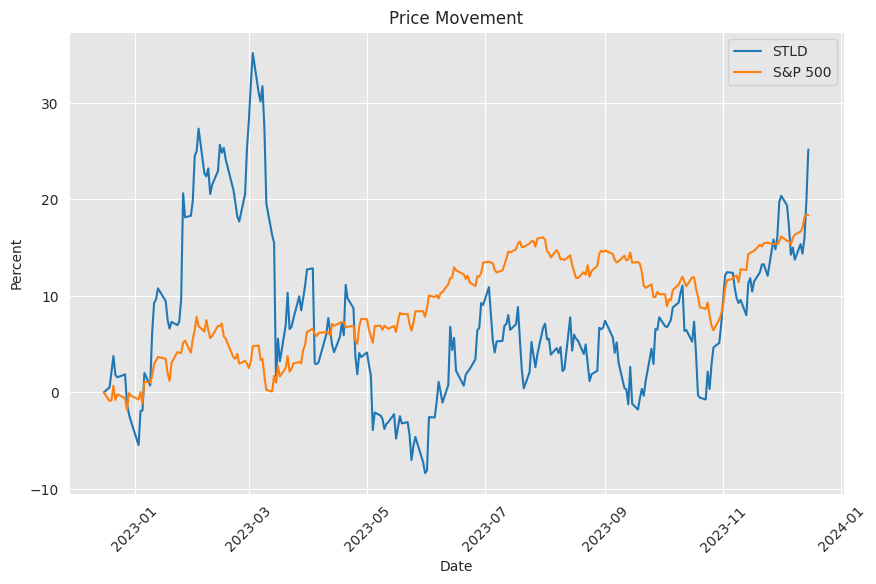

Moreover, developments in the industry, particularly the potential merger and acquisition activities, do not exist in isolation; they are part of the broader economic fabric. Market responses, such as the increase in Steel Dynamics stock price following the ripple effect of acquisition rumors, indicate the interconnectedness of industry events with financial markets. Thus, Steel Dynamics benefits from both industry-specific news and the overall economic sentiment, as evident from its ability to outperform in a financially tumultuous period.

Indeed, despite the adverse economic conditions marked by the Federal Reserve's hawkish policies leading to spikes in bond yields and the rise of crude oil prices, Steel Dynamics managed to secure a noticeable gain in its sector. Against market downturns that afflicted other stalwarts such as utilities and consumer staples, the steelmaker showcased the strength and resilience of its business model.

As financial markets displayed mixed signals globally, with commodity prices fluctuating and sectors reacting differently to economic headwinds, Steel Dynamics not only weathered but managed to capitalize on these conditions. Their adaptive business strategy, which favors efficient production and innovation, has allowed it to maintain robust demand for its steel products even amidst inflationary pressures and supply-chain issues prevalent in the post-pandemic economy.

This adaptability is further contrasted with the historical production modes of giants like United States Steel, which have faced challenging oscillations between profit and loss due to their reliance on traditional blast furnace operations. Steel Dynamics' focus on modern electric arc mini-mill technology has provided the operational flexibility to pivot production according to market needs while maintaining profitability.

Furthermore, the comparison between Steel Dynamics and United States Steel extends to their financial strategies and investment returns. Steel Dynamics' more progressive financial structure and willingness to invest in innovative technologieswithout the burden of legacy costshave translated into greater financial resilience and the potential for higher investment returns.

The current landscape paints a tumultuous yet opportunistic scene for Steel Dynamicsa scene in which strategic vision and strong fundamentals could propel the company to new heights. As it navigates the terrain marked by potential acquisitions and industry consolidation, its response will significantly impact both its own trajectory and that of the steel industry at large. In this pivotal time for the industry, Steel Dynamics' choices are set to determine its place in the annals of steel production history and its role in the unfolding future of the sector.

News Links:

https://seekingalpha.com/article/4636682-cleveland-cliffs-us-steel-step-too-far

https://www.fool.com/investing/2023/10/24/us-steel-stock-up-40-on-possible-acquisition-is-th/

https://seekingalpha.com/article/4638276-wall-street-breakfast-what-moved-markets

https://www.fool.com/investing/2023/09/30/if-you-invested-10000-in-us-steel-10-years-ago-thi/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: ex6Nl6