iShares 20+ Year Treasury Bond ETF (ticker: TLT)

2023-12-15

The iShares 20+ Year Treasury Bond ETF (ticker: TLT) is an exchange-traded fund that seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years. This ETF primarily aims to provide exposure to long-term U.S. Treasury bonds, which are deemed to be among the most secure fixed-income investments available, given that they are backed by the full faith and credit of the U.S. government. The fund is managed by BlackRock and is a popular choice for investors looking to gain direct access to the long end of the U.S. Treasury yield curve. TLT typically benefits from a flight to quality during times of market uncertainty, as investors seek safe-haven assets. However, because of the long-term nature of its holdings, TLT is also sensitive to interest rate fluctuations. An increase in interest rates generally leads to a decrease in bond prices, affecting the fund's performance negatively, while a decrease in interest rates can have the opposite effect. It is often used as a hedging instrument against market volatility, as part of a diversified investment portfolio, or for those seeking regular income, as it pays out monthly distributions reflecting the fund's accrued interest receipts.

The iShares 20+ Year Treasury Bond ETF (ticker: TLT) is an exchange-traded fund that seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years. This ETF primarily aims to provide exposure to long-term U.S. Treasury bonds, which are deemed to be among the most secure fixed-income investments available, given that they are backed by the full faith and credit of the U.S. government. The fund is managed by BlackRock and is a popular choice for investors looking to gain direct access to the long end of the U.S. Treasury yield curve. TLT typically benefits from a flight to quality during times of market uncertainty, as investors seek safe-haven assets. However, because of the long-term nature of its holdings, TLT is also sensitive to interest rate fluctuations. An increase in interest rates generally leads to a decrease in bond prices, affecting the fund's performance negatively, while a decrease in interest rates can have the opposite effect. It is often used as a hedging instrument against market volatility, as part of a diversified investment portfolio, or for those seeking regular income, as it pays out monthly distributions reflecting the fund's accrued interest receipts.

The following analysis provides an in-depth examination of the technical aspects and potential future price movement for TLT, referencing the latest available technical indicators.

The following analysis provides an in-depth examination of the technical aspects and potential future price movement for TLT, referencing the latest available technical indicators.

- The Adj Close has recently closed at 99.04.

- MACD (Moving Average Convergence Divergence) is currently positive at 2.216784, with the histogram at 0.414082, indicating bullish momentum.

- RSI (Relative Strength Index) is at 74.04, suggesting overbought conditions.

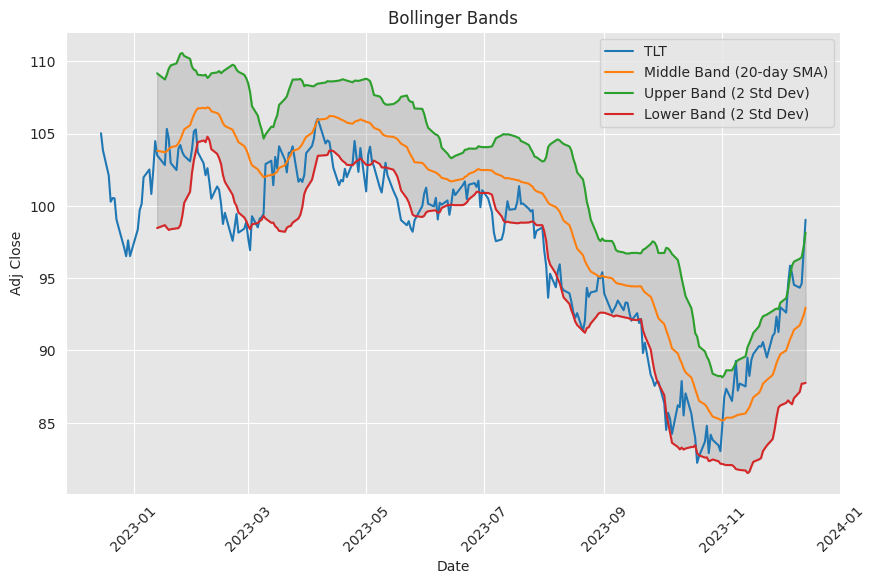

- Bollinger Bands show the closing price near the upper band with levels at 92.23 for the lower band, 95.88 for the middle band, and 99.53 for the upper band, indicating high price volatility.

- SMA (Simple Moving Average) 20-day is at 92.96, while the EMA (Exponential Moving Average) 50-day is at 91.46, both lower than the closing price, signalling an uptrend.

- OBV (On-Balance Volume) is at 32.79 million, which can be seen as bullish if it is increasing over time.

- STOCH (Stochastic Oscillator) is showing high momentum with STOCHk at 91.61 and STOCHd at 83.04, both indicating potential overbought conditions.

- ADX (Average Directional Index) is at 31.76, showing a strong trend is present.

- WILLR (Williams %R) is at 0.00, which typically signals the stock is in oversold territory, but this figure could be erroneous as it generally ranges between -100 and 0.

- CMF (Chaikin Money Flow) is positive at 0.551135, suggesting buying pressure.

- PSAR (Parabolic SAR) indicates the trend is upward as the PSAR lies below the price.

With the MACD above its signal line and the presence of a positive MACD histogram, there is clear evidence of bullish momentum. Meanwhile, the RSI currently stands above the typical threshold of 70, hinting that the stock may be overbought. This scenario often precedes a pullback or consolidation phase as traders may lock in profits, causing the price to stabilize or dip slightly.

The close alignment of Bollinger Bands with the current price near the upper band accentuates the recent price volatility and suggests a period of high trading activity. Such activity can sometimes lead to a potential short-term reversal if traders perceive the stock to be overextended.

The price also sits above the 20-day SMA and the 50-day EMA, highlighting ongoing bullish conditions. A continuation of this trend could see the price steadily appreciating over the next few months, barring any unexpected market shifts.

Adjoining these, the OBV shows significant volume following the price, signaling sustained interest and investment from the market.

The Stochastic Oscillator is in the overbought territory, meaning there's potential for a price correction in the near future. However, the ADX suggests that the prevailing trend is strong, which may help the price to maintain its current trajectory.

Given current technical readings and the lack of fundamentals and financials to further nuance the analysis, the immediate outlook for TLT appears bullish with potential risks linked to overbought conditions and volatility. Investors should keep an eye on volume trends provided by OBV and changes in the MACD and RSI for early indications of trend reversals or continuations in the given timeframe. It would be advisable to monitor the market for any fundamental changes that could impact this technical forecast.

In a rapidly fluctuating financial landscape, marked by frequent boom and bust cycles, investors seek strategies that not only promise robust returns but also provide peace of mind. The concept of a "Sleep Well" or Near Perfect Portfolio (NPP) strategy emerges as a tailored solution for such needs. This portfolio strategy hinges on a multi-bucket approach that diversifies holdings across different asset classes and investment strategies, thereby cushioning against market downturns while striving for above-inflationary growth.

Bucket 1, the Dividend Growth Investing (DGI) bucket, is allocated 40%-50% of the portfolio's assets. It is constructed with a dividend income target of over 3% and volatility lower than the broader market. For passive investors, recommendations highlight dividend-focused ETFs such as the Schwab U.S. Dividend Equity ETF (SCHD), Vanguard High Dividend Fund ETF (VYM), and Vanguard Dividend Appreciation Fund ETF (VIG) due to their low expense ratios and reasonable diversification. Active investors could opt for a bespoke portfolio of blue-chip dividend stocks, curating a mix of companies with a notable history of paying and growing dividends.

Bucket 2 is dedicated to a Rotational strategy, which constitutes 35%-45% of the asset allocation. Unlike traditional hedges that come with an ongoing cost, this portion of the NPP strategy incorporates a no-cost hedging mechanism that involves rotating investments among different asset classes monthly, based on their recent performance. Recommended assets for this part of the portfolio include high-growth stock indices (represented by ETFs such as QQQ), long-term Treasuries (such as TLT), and gold (through instruments like GLD).

The third bucket is tailored for high income. It targets an income yield of 8% or higher through investments in high-yield securities such as Closed-end funds (CEFs), Real Estate Investment Trusts (REITs), Business Development Companies (BDCs), and others that provide substantial income. This bucket's allocation is recommended at 15%-25% of the portfolio, depending on the investor’s need for income.

When assessing the strategy in a historical context, spanning the financial crisis of 2008 and the pandemic markets of 2020, the NPP strategy demonstrated resilience with lower drawdowns and volatility compared to the S&P 500. The combination of buckets and timely rebalancing accommodated market gyrations, thereby averting substantial portfolio erosion during downturns.

Moreover, the research acknowledges the infeasibility of accurately predicting market directions or economic conditions. Thus, it endorses a graduated investment approach rather than lump-sum investments, particularly in times of high uncertainty. The comprehensive philosophy behind the NPP strategy echoes a sentiment of cautious optimism, advocating for measured allocation across equities, bonds, and alternative income sources to weather the undulations of market cycles.

The iShares 20+ Year Treasury Bond ETF (TLT) tracks the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years. As such, TLT serves as a barometer for investor sentiment regarding long-term U.S. government paper. The performance of TLT is particularly sensitive to events that influence long-term interest rates and the broader bond market.

In the context of Powell's speech and its impact on the financial markets, it is noteworthy that TLT can be influenced by the direction of Federal Reserve policy. If the Fed's posture is regarded as relatively more hawkish, suggesting potentially higher interest rates to combat inflation, this could lead to a decrease in bond prices and an increase in yields, which would negatively impact TLT. Conversely, a dovish stance, or a signal that interest rates might not rise as aggressively, could support bond prices and lead to lower yields, potentially benefiting TLT.

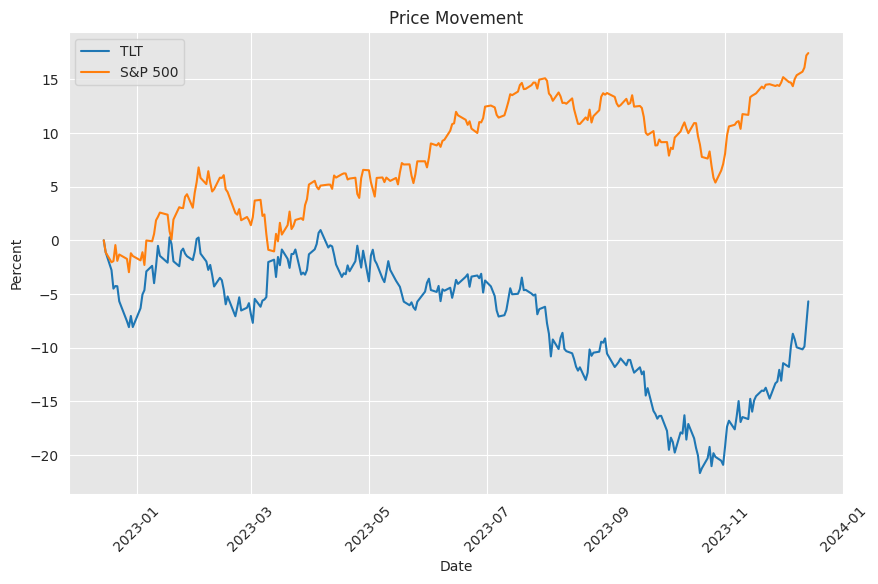

The recent rally in the stock market, exemplified by the S&P 500 (SPY) that saw a 10% climb in November, was driven largely by market participants' expectations of a Fed pause in interest rate hikes. These expectations were fueled by softening in jobs data and lower-than-expected CPI inflation data, along with corresponding decreases in the yield on 10Y and 2Y Treasury Bonds.

However, despite the dovish inclinations following the November 1st FOMC meeting, predictions about Fed Chair Powell's then-upcoming speech suggested a likely reversion to a more hawkish tone. Powell was expected to reiterate the necessity for tighter financial conditions to sustain inflation control, which could involve maintaining or even increasing interest rates.

If these predictions were to materialize, there would be significant implications for the bond market and TLT. As a more hawkish tone from the Fed could spell higher interest rates, TLT might face downward pressure due to the inverse relationship between bond prices and yields. This also would likely "kill" the ongoing rally in the equity markets, including the SPY, as higher interest rates generally have a cooling effect on stock valuations.

Market participants appeared to have engaged in extensive short-covering in November, which might have contributed to sharp increases in both asset classes' pricing. Nevertheless, the underlying economic conditions as interpreted by the Fed's communication would ultimately dictate the longer-term trends for ETFs like TLT.

In the interplay between inflation indicators, the Consumer Price Index (CPI), and financial markets, the association hinges on the perception of inflation trends as a determinant of monetary policy, which in turn influences asset prices.

Recent data showed that inflation figures came in softer than expected, which stirred a positive reaction in both U.S. Treasuries and the S&P 500. A soft CPI report suggests that inflation is not accelerating as previously feared, which could imply a less aggressive interest rate hike stance by the Federal Reserve. This kind of environment is typically favorable for both bonds and stocks since higher interest rates can be detrimental to the prices of existing bonds and can also limit the attractiveness of equities.

The immediate market reaction to a softer CPI was a rally in US Treasury securities. This was particularly beneficial for long-duration bond ETFs such as TLT. When bond prices increase due to a rally, the yields on these bonds fall. Since TLT is composed of long-term U.S. Treasury bonds with maturities greater than twenty years, their prices are highly sensitive to interest rate changes and thus can show significant gains when inflation fears subside.

The S&P 500, a broad representation of the U.S. equities market, also rallied following the soft CPI report. The logic here is twofold: Consumer prices have a direct impact on company earnings and consumer spending; and softening inflation could forestall aggressive rate hikes, maintaining a lower discount rate for future earnings in valuation models - thereby supporting higher stock prices.

The article mentioned the presence of a gap in the S&P 500 chart created by the rapid post-CPI rise, suggesting that the index might need to pull back to ‘fill the gap’ before it could mount a sustainable ascent. The RSI (Relative Strength Index), a momentum oscillator, has reached levels that are considered overbought, which often presages a potential short-term pullback in prices as overbought conditions are "worked off."

For bond ETFs like TLT, further potential gains were tied to the continuation of the trend in falling inflation. The speculation regarding inverse Head & Shoulder patterns in ETF charts like that of TLT and ZROZ (PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF) suggests a possible continuation of bullish trends in bond prices.

The market outlook isn’t only about the analysis of past events but also incorporates behavioral aspects of market participants. The sentiment can shift rapidly with new data or events, and as such, investment professionals closely watch trends and indicators for signs of changing dynamics that could affect asset prices. The behavioral aspect was captured by the article through the articulation of a potential bullish and bearish path for the S&P 500 based on technical analysis, highlighting the contingent nature of market forecasts.

The soft CPI reading has had a significant influence on financial markets, notably boosting S&P 500 and long-term U.S. Treasury bond ETFs like TLT. The linear relationship between a soft CPI report, a rally in treasuries, and consequently, a rally in the S&P 500 exemplifies the intricate dynamics between economic indicators and asset markets. However, the durability of this positive sentiment in the markets hinges on consistent patterns in the inflation data and the resulting monetary policy actions.

The iShares 20+ Year Treasury Bond ETF (TLT) represents a noteworthy mention among rare stock picks highlighted by discerning analysts in a Seeking Alpha article from November 2023. Martin Vlcek, a seasoned contributor, pointed out that long-dated U.S. Treasuries deserve investor attention, suggesting that they could be approaching a generational buying opportunity. The recommendation stands out in the broader landscape of stock picks, where only a subset of listed securities typically attracts consistent buy recommendations. Analysts included in the article each offered their first Buy or Strong Buy ratings over a period spanning the previous three months to six years, thereby giving weight to the selection’s potential for uniqueness and value.

Given that these recommendations emerged from the broader spectrum of contributors—some of whom rarely issue Buy recommendations—each pick could carry an implication of a strong conviction or an identified specific market opportunity. TLT, as a long-term Treasury ETF, holds particular significance as a barometer for fixed-income investor sentiment, positioning within rising or falling interest rate environments, and inflation expectations. Vlcek's call to consider TLT suggests a contrarian approach at a time when most attention might be riveted to more active equity opportunities.

The bond market's behavior, particularly the long end of the yield curve represented by TLT, is closely tied to monetary policy and broader economic trends, making it a strategic choice for portfolio diversification. The inclusion of TLT in Seeking Alpha’s Rare Stock Picks series indicates its potential as an investment opportunity but also calls for investors to assess the nuanced challenges that fixed-income instruments face in the current economic climate.

The iShares 20+ Year Treasury Bond ETF (TLT) operates within the broader context of the macroeconomic environment and can be affected by fluctuations in GDP growth, monetary policy, inflation, and other economic factors. The fourth quarter of the fiscal year has shown mixed signals, with a slow start potentially leading to a strong finish, as suggested by economic data and expert analyses.

October's economic figures were less than stellar, indicating a deceleration from earlier growth rates. Meanwhile, signs of improvement in the labor market and possible easing of inflation could pave the way for a different approach by the Federal Reserve. These developments leave ETFs like TLT particularly sensitive to interest rate movements and inflationary signals. How the fourth quarter concludes could give significant insights into the likely trajectory for bond markets and the TLT ETF in the upcoming year.

Avi Gilburt, a recognized expert on market analysis, has shared his insights regarding a potential major bear market on the horizon for the financial markets, highlighting the iShares 20+ Year Treasury Bond ETF (TLT) as an essential focus. Gilburt indicated a potential for a significant rally in TLT into 2024, suggesting a major move is imminent in Treasury bonds. If TLT rises to and then declines in a structured five-wave pattern, a bond market crash could be signaled, implying a substantial repositioning for investors. Gilburt’s methodology hinges on Elliott Wave Theory; however, he acknowledges the importance of tracking news that may serve as market catalysts.

Lastly, the recent discourse on TLT and the wider economy suggests a pivot back to a state of lower inflation and lower economic growth, reminiscent of the pre-pandemic era. The bond market appears to be signaling skepticism regarding the Fed's "higher for longer" narrative. Proponents of the inflation alarmist view may be facing pushback from the "Five Horsemen of Deflation," which contend with forces that could lead to a return to lower inflation rates and sluggish economic growth. These broader economic indicators bear important considerations for investors and policymakers alike. The investment implications of these trends may favor investments such as long-dated bond ETFs like TLT and dividend-paying companies in an environment of low to moderate inflation.

Copyright © 2023 Tiny Computers (email@tinycomputers.io) -

yIr43k