Tesla, Inc. Common Stock (ticker: TSLA)

2023-12-17

Tesla, Inc., listed under the ticker symbol TSLA, is a prominent player in the electric vehicle (EV) and clean energy market. Founded by Elon Musk and a group of engineers in 2003, Tesla has risen to fame not only for its electric cars but also for its innovations in battery energy storage and renewable energy solutions, such as solar panels and solar roof tiles. TSLA began trading on the NASDAQ stock exchange in 2010, and since then, the stock has experienced substantial volatility, often driven by the company's performance, industry trends, and Musk's visible presence on social media. Investors consider Tesla's market capitalization, financial reports, and industry position when assessing the stock's potential value. Tesla's commitment to sustainability, aggressive expansion plans, and the growing global demand for EVs have kept TSLA in the limelight for both retail and institutional investors. Despite the risks inherent in the auto industry and the company's high valuation, Tesla continues to draw attention for its forward-thinking approach to transportation and energy.

Tesla, Inc., listed under the ticker symbol TSLA, is a prominent player in the electric vehicle (EV) and clean energy market. Founded by Elon Musk and a group of engineers in 2003, Tesla has risen to fame not only for its electric cars but also for its innovations in battery energy storage and renewable energy solutions, such as solar panels and solar roof tiles. TSLA began trading on the NASDAQ stock exchange in 2010, and since then, the stock has experienced substantial volatility, often driven by the company's performance, industry trends, and Musk's visible presence on social media. Investors consider Tesla's market capitalization, financial reports, and industry position when assessing the stock's potential value. Tesla's commitment to sustainability, aggressive expansion plans, and the growing global demand for EVs have kept TSLA in the limelight for both retail and institutional investors. Despite the risks inherent in the auto industry and the company's high valuation, Tesla continues to draw attention for its forward-thinking approach to transportation and energy.

| As of Date: 12/18/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 805.22B | 794.20B | 830.86B | 657.44B | 388.97B | 837.66B |

| Enterprise Value | 787.33B | 776.93B | 814.03B | 641.00B | 373.74B | 825.41B |

| Trailing P/E | 81.71 | 71.29 | 76.99 | 57.31 | 38.10 | 95.76 |

| Forward P/E | 69.93 | 55.25 | 76.34 | 54.05 | 24.27 | 45.05 |

| PEG Ratio (5 yr expected) | 2.86 | 2.13 | 2.89 | 1.89 | 1.08 | 1.26 |

| Price/Sales (ttm) | 9.19 | 9.25 | 10.57 | 8.85 | 5.68 | 13.55 |

| Price/Book (mrq) | 15.06 | 15.56 | 17.29 | 14.71 | 9.78 | 23.03 |

| Enterprise Value/Revenue | 8.21 | 33.27 | 32.66 | 27.48 | 15.37 | 38.47 |

| Enterprise Value/EBITDA | 48.25 | 234.16 | 197.63 | 165.42 | 74.67 | 177.70 |

| Full Time Employees | 127,855 | Previous Close | $251.05 | Market Cap | $805,856,215,040 |

|---|---|---|---|---|---|

| Open | $251.21 | Day Low | $248.30 | Day High | $254.13 |

| Payout Ratio | 0.0 | Beta | 2.262 | Trailing PE | 82.03883 |

| Forward PE | 72.42857 | Volume | 135,932,762 | Average Volume | 121,256,447 |

| Average Volume 10 days | 121,470,800 | Bid | $253.30 | Ask | $253.32 |

| Bid Size | 3,100 | Ask Size | 1,800 | Fifty Two Week Low | $101.81 |

| Fifty Two Week High | $299.29 | Price to Sales Trailing 12 Months | 8.400986 | Fifty Day Average | $233.397 |

| Two Hundred Day Average | $226.0615 | Trailing Annual Dividend Rate | $0.0 | Trailing Annual Dividend Yield | 0.0 |

| Enterprise Value | $788,995,571,712 | Profit Margins | 0.11213 | Net Income to Common | $10,791,000,064 |

| Trailing EPS | 3.09 | Forward EPS | 3.5 | Peg Ratio | 53.48 |

| Last Split Factor | "3:1" | Enterprise to Revenue | 8.225 | Enterprise to EBITDA | 52.072 |

| 52 Week Change | 0.691466 | Current Price | $253.5 | Total Cash | $26,076,999,680 |

| Total Cash Per Share | 8.203 | EBITDA | $15,152,000,000 | Total Debt | $8,186,999,808 |

| Quick Ratio | 1.08 | Current Ratio | 1.69 | Total Revenue | $95,924,002,816 |

| Debt to Equity | 15.023 | Revenue Per Share | 30.277 | Return on Assets | 0.07965 |

| Return on Equity | 0.22459999 | Gross Profits | $20,853,000,000 | Free Cash Flow | $1,612,000,000 |

| Operating Cash Flow | $12,163,999,744 | Earnings Growth | -0.442 | Revenue Growth | 0.088 |

| Gross Margins | 0.19805999 | EBITDA Margins | 0.15796 | Operating Margins | 0.07555 |

Based on the provided technical analysis (TA) data for Tesla (TSLA) and incorporating the company's fundamentals, the following is an assessment of the near-term stock price movement:

Technical Analysis Overview:

- The Adjusted Closing Price is at $253.50.

- The MACD is positive at 4.112646 with a histogram value of 1.023344, indicating bullish momentum.

- The Relative Strength Index (RSI) is at 63.599618, suggesting strength in the current trend without being overbought.

- Bollinger Bands show the price near the upper band, indicating potential resistance at the Upper Bollinger Band (BBU) level of 257.655350.

- The stock is trading above both the Simple Moving Average (SMA_20) at 240.367500 and the Exponential Moving Average (EMA_50) at 239.122500, which is a positive sign.

- The On-Balance Volume (OBV) is high at 121.69659 million, indicating good buying pressure.

- Stochastic Oscillator values, with STOCHk at 77.241069 and STOCHd at 55.851678, show overbought conditions which might precede a pullback.

- The Average Directional Index (ADX_14) is 14.098803, suggesting a weak trend.

- The Williams %R (WILLR_14) is at -2.429636, also signaling an overbought condition similarly to the Stochastic Oscillator.

- The Chaikin Money Flow (CMF_20) at 0.206872 indicates bullish buying pressure.

- Parabolic SAR (stop and reverse) indicators with the PSARl at 228.199997 show the trend is upwards.

Fundamentals Overview:

- Market Capitalization shows a consistent upward trend, indicative of a strong and growing interest by investors in TSLA.

- The trailing Price to Earnings (P/E) ratio is high at 81.71, signaling that the stock may be overvalued compared to earnings, a common trait in growth stocks.

- The Forward P/E ratio at 69.93 is an improvement but still indicates high growth expectations by the market.

- The PEG Ratio and Price/Sales are relatively high, typically associated with expectations of high future growth.

- Enterprise Value multiples are significant but have decreased, suggesting that the stock's valuation has potentially become more grounded in its revenue and EBITDA figures.

Financials Summary:

- Positive Net Income trend over the past four years characterizes TSLA as a profitable and growing company.

- Increasing Total Revenue and Gross Profit point to successful scaling and potential for further growth.

- Consistent investment in Research and Development may indicate a commitment to innovation.

Price Movement Prediction:

Given the consolidation of various TA indicators, TSLA stock appears to be in a bullish phase. The positive MACD, with prices above key moving averages, suggests an ongoing uptrend. However, potential resistance near the BBU, the overbought conditions indicated by the Stochastic Oscillator and Williams %R, and the relatively low ADX may indicate that while the overall trend could continue upward, there could be a pullback or period of consolidation in the near future.

Considering the company's solid fundamentals with consistent revenue growth, profitability, and R&D investment, the outlook remains positive. High valuation multiples are a testament to the market's high expectations, and as long as TSLA continues to meet or exceed these expectations, the stock may continue on an upward trajectory for the next few months.

Investors should monitor the company's performance closely, especially any news related to earnings reports, product launches, or macroeconomic factors that could affect investor sentiment. The technical and fundamental indicators suggest TSLA is well-positioned to build on its upward trend, albeit with the usual price volatility inherent in the stock market.

Tesla, Inc. (NASDAQ: TSLA) stands out in the electric vehicle (EV) landscape not merely as an automaker but also as a technology innovator. A recent week encapsulated a microcosm of developments that illustrate the dynamism of the automaker and the market's response to its actions. Sales figures from China and Europe offered insights into Tesla's international market presence, and its foray into humanoid robots suggested an ambitious widening of its technological remit. These developments prime the narrative for Tesla's strategic direction and financial outlook heading into 2024.

Tesla's performance in two major markets, China and Europe, is indispensable in apprehending its global competitiveness. Interestingly, the sales data from these regions portray the multinational's prowess in gaining substantial market penetration, providing investors with pivotal insights into its international growth strategy's efficacy. Tesla's ability to maintain its positioning moored in booming international markets is a strong signal to its resilience and adaptability in varied geographic and economic climates.

Attention was also piqued by Tesla's venture into AI with the development of humanoid robots, demonstrating the company's investment in disciplines at the crossroads of automation and intelligence. This new direction hints at potential growth avenues and diversification strategies that could mitigate the risks associated with a focus solely on automotive sales.

Investors, looking to piece together Tesla's 2024 road map, were confronted with cues hinting at production goals, new model releases, and developments in existing products. Of particular investor curiosity is the Cybertruck, with implications for Tesla's product ecosystem and strategic leverage in the burgeoning EV pickup segment. Announcements of this nature play a critical role in steering stock trajectories and investor sentiment.

In sync with the broader narrative, the shares of TSLA witnessed technical analysis by market experts. Such analysis is essential in crystallizing investor sentiment and Teslas perceived value in a fluctuating marketplace. It serves as a yardstick to measure Tesla's standing and assists investors in shaping their investment strategies around the high-profile stock.

As the figures stood firm on December 15, 2023, Tesla's market capitalization was recorded at $806 billion, in lieu of a small downward adjustment in stock price to $253.50 a modest decrement by 0.98%. This valuation is associated with market acknowledgment of Tesla's unequivocal stature in the EV sector and its future growth prospects, particularly within burgeoning tech arenas.

The endorsement by The Motley Fool, holding positions in and recommending Tesla, is indicative of confidence in its long-term outlook. The guidance from such analytical services could play an instrumental role for investors contemplating their next move with TSLA stocks.

Tesla's trajectory has struck a chord across the international markets, its AI ambitions, and detailed forward-looking strategies for 2024, contributing to an intricate investment tableau. Despite the subtlety in stock price fluctuations, underlying actions signify a company forward-thrusting into new territories, sowing seeds for future opportunities. It remains pivotal for investors as they calibrate Tesla's prospects against the fast-paced evolution of technology and the automotive realm.

Tesla's continuing growth in foreign markets and its exploration into AI with humanoid robots signal a dynamic narrative. These facets are underscored by the guidance of analytical firms such as The Motley Fool, bolstering confidence in Tesla's strategic direction. Notably, Cathie Woods Ark Invest, having placed a prosperous bet on Tesla, maintains an optimistic outlook, indicative of a belief in the automaker's capability to innovate and dominate amidst economic challenges.

Ark Invest, led by the forward-thinking Cathie Wood, aligns with companies spearheading artificial intelligence, robotics, and autonomysectors in which Tesla is a significant player. Wood's consistent backing of Tesla, despite the cyclic pressures on high-growth stocks, shines light on Ark's investment philosophy that bets on transformational entities. Tesla's pioneering stance in the EV revolution and its forays into renewable energy sync with Ark's criteria for investment, signaling shared visions for industry leadership and innovation.

The market landscape has been volatile, as highlighted by the S&P 500's performance amidst continuous rate hikes by the Federal Reserve. This environment has witnessed a flight towards tech giants, including Teslaforming a narrative hinged on the promise of AI technologies. Conversely, Verizon Communications Inc. (NYSE: VZ) saw relative underperformance due to sector-specific challenges and a market pivot towards growth narratives.

Despite its underperformance, Verizon showcases robust business health, as evidenced by impressive free cash flow and revenue growth in core segments. These reflect stable business fundamentals and financial savvy, even as it faces subdued short-term stock price growth. With a focus on manageable growth projections and an undervalued stock assessment, Verizon attracts as a stable investment, especially considering its appealing dividend yield.

Amidst the larger market backdrop, Tesla encountered an obstacle with a mass recall of vehicles concerning its Autopilot system. As the markets reacted to the Federal Reserve's signals and global events such as the COP28 climate summit, Tesla's recall might influence consumer trust and regulatory perception. Nevertheless, the company's future continues to align with sustainable technology, despite these short-term challenges.

The broader market experienced consecutive gains, reflecting positive sentiment among investors. The inclusion of Tesla in discussions alongside major market indices and significant commodities highlights its integral role and the shifting investment climate. Moving forward, macroeconomic indicators like personal consumption expenditures index will potentially sway investor attention.

Tesla's growth trajectory is punctuated by its blending of technological advancement with transformative leadership. Its continuing revenue expansion, despite macroeconomic challenges, and its widened scope beyond the automotive sector, position Tesla as a growth stock with significant long-term potential. The company's ability to innovate and Elon Musks track record contribute to Tesla as an attractive investment option, particularly when considering industries at the cusp of technological evolution.

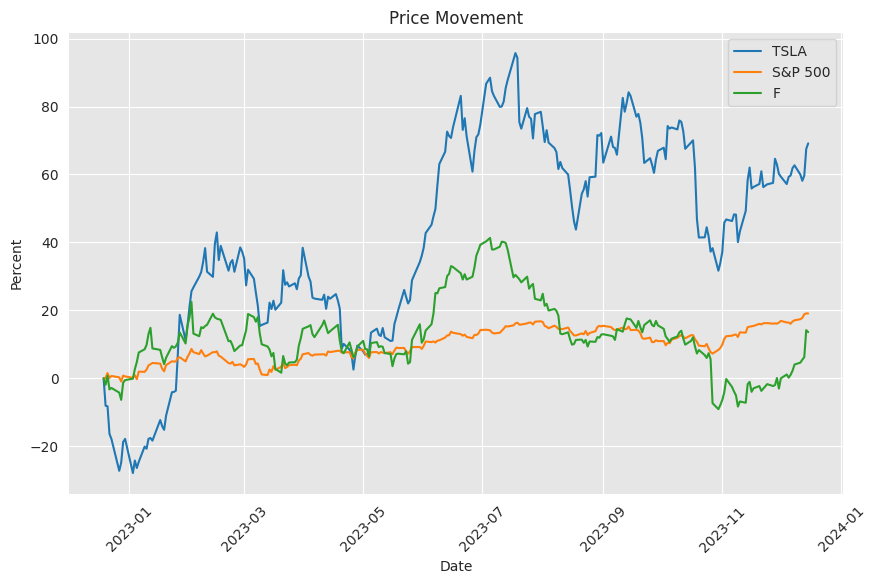

Tesla's share price surge by 94% in 2023 sets an impressive precedent but encourages a forward-looking approach among investors. The company's substantial market cap begs questions about valuation but echoes high future expectations. Key factors including Tesla's competition, perceived technological leadership, legislative development, and global expansion strategies will be scrutinized as investors contemplate its 2024 momentum.

In the spotlight is Tesla's risk of losing an important consumer tax credit in 2024, which may affect EV sales and investor sentiment. Despite this challenge, Tesla has seen substantial stock growth, and strategies to counterbalance the impact are likely to focus on production efficiency, broadening market reach, and technological leadership. The company's expansion plans and prominent branding suggest a continued investor interest, even amid changing legislative landscapes.

Tesla, along with other mega-cap technology stocks referred to as the "Magnificent Seven," has recently come under scrutiny from renowned investors speculating overvaluation. This context is important for ETFs like the JPMorgan Equity Premium Income ETF (JEPI) and the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) that employ covered call strategies. Given the contrasting implications of JEPI's diversified investment strategy and JEPQ's tech-centric focus, market trends may favor JEPI's conservative approach amidst uncertain valuations of tech giants.

Tesla, as a top tech stock, commands attention due to its leadership in the EV market, underpinned by near-term catalysts like new tax credits, accommodating monetary policy, and an eagerly awaited Cybertruck release. Investors are encouraged to consider Tesla's short-term growth and long-term vision, spearheaded by Elon Musk's transformative potential, while navigating market volatility and valuation considerations.

Lastly, Tesla's recent enticement of substantial government incentives to construct a gigafactory in Mexico illustrates the automaker's strategic expansion efforts. The Nuevo Leon government's comprehensive offering paves the way for Tesla's increased production capacity and competitive advantage. Amid global efforts to enhance sustainable technologies, Tesla's growth maneuvers significantly shape investor insight, stock performance, and broader industry standards.

Similar Companies in Automobile Manufacturers:

Ford Motor Company (F), General Motors Company (GM), Rivian Automotive, Inc. (RIVN), Lucid Group, Inc. (LCID), NIO Inc. (NIO), Li Auto Inc. (LI), XPeng Inc. (XPEV), Fisker Inc. (FSR), Lordstown Motors Corp. (RIDE), Nikola Corporation (NKLA), Canoo Inc. (GOEV), BYD Company Limited (BYDDY), Toyota Motor Corporation (TM), Volkswagen AG (VWAGY), BMW AG (BMWYY)

News Links:

https://www.fool.com/investing/2023/12/17/exciting-news-for-tesla-stock-investors/

https://www.fool.com/investing/2023/12/17/1-supercharged-growth-stock-cathie-wood-ark-invest/

https://seekingalpha.com/article/4658232-wall-street-breakfast-what-moved-markets

https://www.fool.com/investing/2023/12/16/3-growth-stocks-to-buy-and-hold-forever/

https://www.fool.com/investing/2023/12/16/up-94-in-2023-can-tesla-stock-maintain-the-momentu/

https://www.fool.com/investing/2023/12/15/unfortunate-news-for-tesla-stock-investors/

https://www.fool.com/investing/2023/12/15/3-top-tech-stocks-to-buy-right-now/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: ojlEr7

https://reports.tinycomputers.io/TSLA/TSLA-2023-12-17.html Home