Tesla, Inc. (ticker: TSLA)

2024-01-25

Tesla, Inc. (ticker: TSLA), an American electric vehicle (EV) and clean energy company headquartered in Palo Alto, California, has positioned itself as a leader in the transition towards sustainable transportation. Founded by a group of engineers in 2003 and currently under the leadership of its CEO Elon Musk, Tesla has expanded its product line beyond electric cars to include battery energy storage systems, solar panels, and solar roof tiles. The company's vehicle lineup features the Model S luxury sedan, Model 3 sedan, Model X SUV, and Model Y compact SUV, with future plans for the Cybertruck and Roadster. Tesla's vehicles are known for their innovative use of technology, including advanced driver-assistance systems. The company also operates an extensive network of Supercharger stations to facilitate long-distance EV travel. Additionally, Tesla's Gigafactories across the globe underscore its commitment to scaling up production and reducing the cost of batteries, key to the wider adoption of EVs. Tesla's influence on the automotive industry has been significant, challenging conventional automakers to accelerate their own EV development as part of a broader shift toward sustainable energy practices.

Tesla, Inc. (ticker: TSLA), an American electric vehicle (EV) and clean energy company headquartered in Palo Alto, California, has positioned itself as a leader in the transition towards sustainable transportation. Founded by a group of engineers in 2003 and currently under the leadership of its CEO Elon Musk, Tesla has expanded its product line beyond electric cars to include battery energy storage systems, solar panels, and solar roof tiles. The company's vehicle lineup features the Model S luxury sedan, Model 3 sedan, Model X SUV, and Model Y compact SUV, with future plans for the Cybertruck and Roadster. Tesla's vehicles are known for their innovative use of technology, including advanced driver-assistance systems. The company also operates an extensive network of Supercharger stations to facilitate long-distance EV travel. Additionally, Tesla's Gigafactories across the globe underscore its commitment to scaling up production and reducing the cost of batteries, key to the wider adoption of EVs. Tesla's influence on the automotive industry has been significant, challenging conventional automakers to accelerate their own EV development as part of a broader shift toward sustainable energy practices.

| Address | 1 Tesla Road | City | Austin | State | TX |

| ZIP | 78725 | Country | United States | Phone | 512 516 8177 |

| Website | https://www.tesla.com | Industry | Auto Manufacturers | Sector | Consumer Cyclical |

| Full Time Employees | 127,855 | Previous Close | 207.83 USD | Open | 189.70 USD |

| Day Low | 186.00 USD | Day High | 192.80 USD | Beta | 2.316 |

| PE Ratio (Trailing) | 60.41 | PE Ratio (Forward) | 39.01 | Volume | 71,436,585 |

| Average Volume | 116,501,713 | Average Volume (10 days) | 109,407,960 | Bid | 186.69 USD |

| Ask | 187.00 USD | Market Cap | 595,316,375,552 USD | 52-Week Low | 152.37 USD |

| 52-Week High | 299.29 USD | Price to Sales (Trailing 12 Months) | 6.21 | 50-Day Average | 236.92 USD |

| 200-Day Average | 231.99 USD | Enterprise Value | 643,814,260,736 USD | Profit Margins | 11.21% |

| Shares Outstanding | 3,178,919,936 | Shares Short | 80,466,304 | Percent Shares Out | 2.53% |

| Held Percent Insiders | 13.02% | Held Percent Institutions | 44.96% | Short Ratio | 0.73 |

| Book Value | 16.82 USD | Price to Book | 11.14 | Last Fiscal Year End | 12/31/2022 |

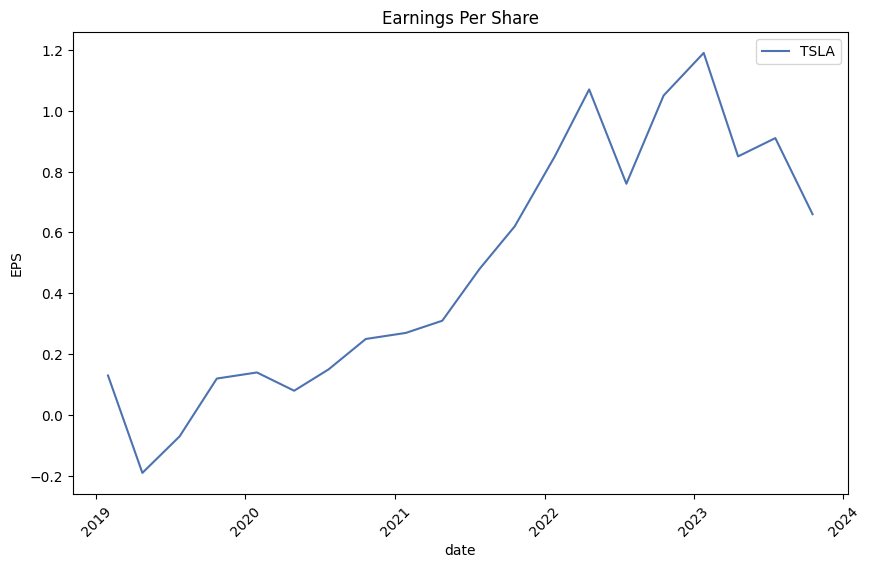

| Earnings Quarterly Growth | -43.7% | Net Income | 10,791,000,064 USD | EPS (Trailing) | 3.10 |

| EPS (Forward) | 4.80 | Revenue | 95,924,002,816 USD | Debt to Equity | 15.02 |

| Revenue per Share | 30.28 | Return on Assets | 7.96% | Return on Equity | 22.45% |

| Free Cashflow | 1,612,000,000 USD | Operating Cashflow | 12,163,999,744 USD | Revenue Growth | 8.8% |

| Gross Margins | 19.80% | EBITDA Margins | 15.79% | Operating Margins | 7.55% |

| Sharpe Ratio | -7.18337820080724 | Sortino Ratio | -117.67515713172163 |

| Treynor Ratio | 0.1750480112791902 | Calmar Ratio | 0.7916833393445849 |

Analyzing Tesla Inc. (TSLA) we incorporate recent technical indicators, fundamental analysis, balance sheets, and future expectations to forecast likely stock price movements in the upcoming months.

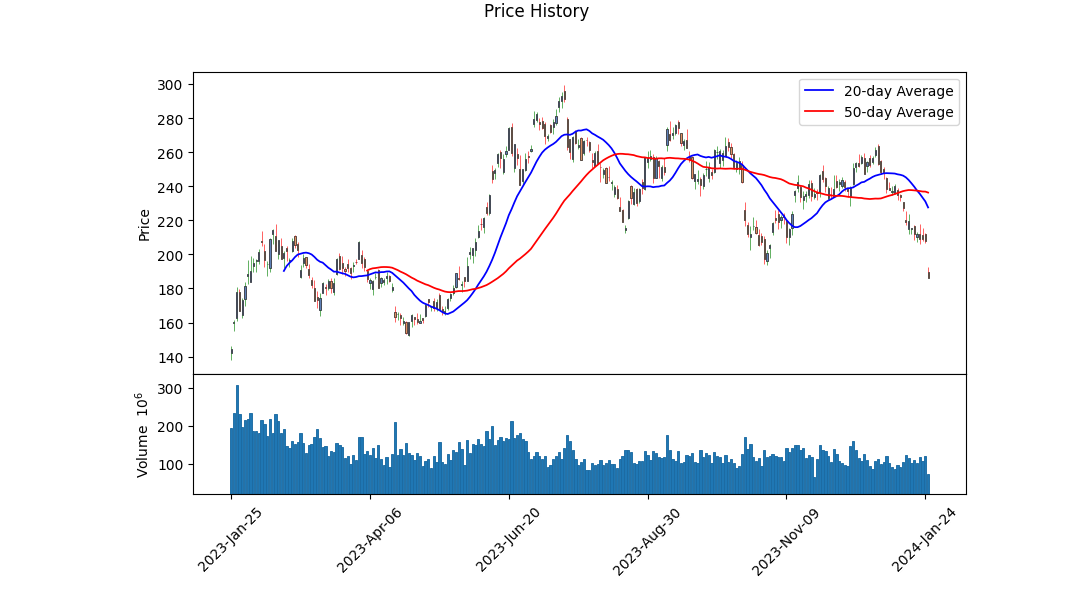

Technical Analysis: Upon examination of the technical indicators, the gradual decline in the On Balance Volume (OBV) demonstrates waning buying pressure following an initial increase, hinting at potential distribution. The absence of the MACD histogram for the majority of the time frame does preclude comprehensive momentum analysis. However, the negative values observed in late January suggest a bearish momentum which must be closely observed in the forthcoming period.

Fundamentals: Tesla's fundamentals reveal gross margins at 19.8%, along with operating margins noted at 7.55%. Efficiency in operations is paramount to maintaining profitability amidst competitive and manufacturing cost pressures. The strong Trailing PEG Ratio suggests investors are paying a higher price for growth compared to earnings, which may dampen an overly optimistic outlook, given stock price sustainability concerns.

Risk-Adjusted Return Measures: The risk-adjusted return measures signify caution. The Sharpe Ratio is deep in negative territory, indicating extremely poor risk-adjusted returns. Negative Sortino Ratio furthers this bearish outlook, emphasizing downside volatility. However, the positive Treynor and Calmar ratios suggest that the stock may offer some return per unit of systematic and maximum drawdown risk, albeit these ratios are overshadowed by the negative Sharpe and Sortino ratios.

Financials and Balance Sheet: Tesla's financials show robust revenue growth, tapering total debt, and a healthy balance of tangible book value. The increase in net income and EBITDA highlights operational efficacy. It is equally important to note the substantial amount of cash and short-term investments, indicating strong liquidity that Tesla can utilize for growth or weathering economic uncertainties.

Cash Flows: Cash flow analysis underscores solid operating cash flows and free cash flow generation, signifying the company's ability to self-finance operations and potential investments. The reduction in debt payments is encouraging, as it signifies a move towards a more sustainable capital structure.

Analyst Expectations and Growth Estimates: Analysts forecast a slight increase in average EPS for the next year, coupled with a significant average revenue estimate increase, indicating growth potential. The EPS revisions display slight upward adjustments which can be seen as a sign of growing positive sentiment among analysts.

Score Summary: The Altman Z-Score is robust, largely dismissing bankruptcy risks in the short term. A Piotroski score of 6 out of 9 points to relatively healthy financial conditions. The significant working capital and solid retained earnings reinforce Tesla's financial stability.

In conclusion, while the risk-adjusted return measures indicate poor past performance, Tesla's financial health, liquidity position, and expected growth suggest a potentially positive future outlook. However, the mixed signals from the technical indicators necessitate vigilance. Investors may experience volatility but with the company's strong fundamentals, liquidity, and growth prospects, a cautious but optimistic medium-to-long-term stance could be deemed reasonable. The upcoming months will demand a close watch on any fundamental changes, market conditions, and movements in technical metrics to reevaluate expectations accordingly.

| R-squared | 0.248 |

| Adj. R-squared | 0.247 |

| F-statistic | 413.6 |

| Prob (F-statistic) | 1.06e-79 |

| Log-Likelihood | -3,366.5 |

| AIC | 6,737 |

| BIC | 6,747 |

| No. Observations | 1,257 |

| Df Residuals | 1,255 |

| Df Model | 1 |

| Alpha | 0.1645 |

| Beta | 1.5364 |

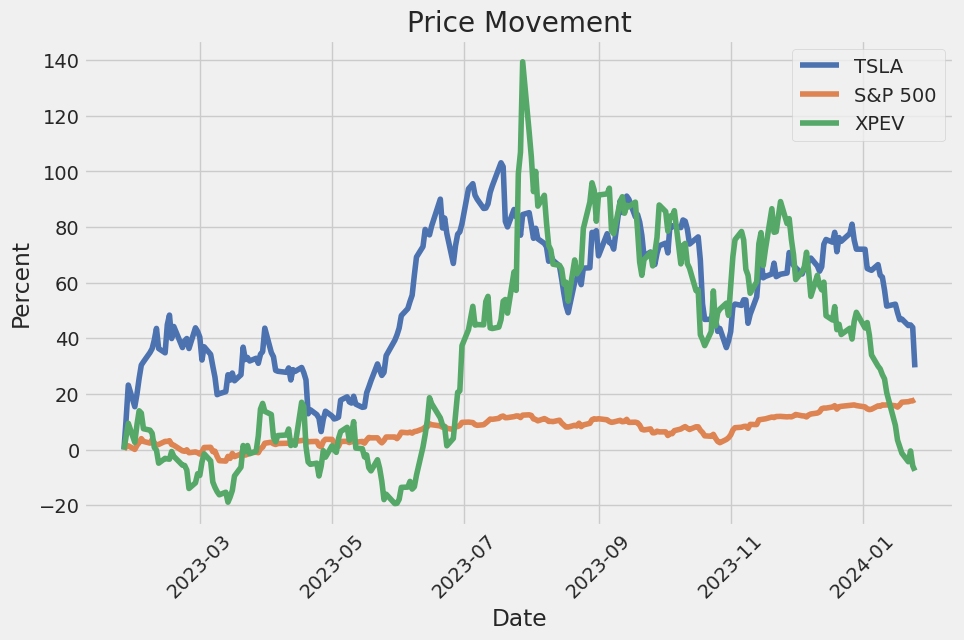

In reviewing the linear regression model between Tesla, Inc. (TSLA) and the SPDR S&P 500 ETF Trust (SPY), a notable feature is the intercept, or "alpha", which is the expected return on TSLA when the return on SPY is zero. The alpha for this model is approximately 0.1645 or 16.45%, suggesting that TSLA has a positive expected return even when the broader market, as represented by SPY, is neutral. This could be interpreted as a standalone return on the stock that is not explained by the market's movements, potentially indicating TSLA's unique factors at play that could generate returns.

While the R-squared value of the model is 0.248, which suggests that approximately 24.8% of the variability in TSLA's returns can be explained by SPY's returns, alpha is the performance metric of interest from an investment perspective. It represents TSLA's potential to outperform the market benchmark. A positive and statistically significant alpha, as we see in this model, would often be favored by investors, indicating that the stock might offer a premium above the market's performance, assuming that alpha is consistent across different time periods and market conditions.

Executive Summary

Tesla, Inc. (TSLA) held its Fourth Quarter 2023 Q&A Webcast, citing a record year for both vehicle production/deliveries and energy business growth. With over 1.8 million vehicles produced, Tesla has maintained a strong presence in the automotive industry. Model Y became the global bestseller with over 1.2 million units delivered, and the energy storage division tripled its battery deliveries year-over-year. Despite major expenses into future projects, Tesla exhibited a robust $4.4 billion free cash flow. Elon Musk hinted at exciting new projects, including the next-gen vehicle and full self-driving, as cornerstones in Tesla's vision for growth. Musk also discussed Tesla's potential in addressing affordability to become the world's most valuable company. CFO Vaibhav Taneja acknowledged the challenges of higher interest rates and inflation but remained positive thanks to customer loyalty and team resilience.

Operational and Financial Highlights

The company achieved record output with the Fremont factory producing more vehicles than any other automotive plant in North America. The energy sector saw significant growth with a nearly 150% increase in battery storage shipments. Financially, Tesla ended the year with over $96 billion in revenue and $29 billion in cash and investments, underscored by a $5.9 billion non-cash benefit from deferred tax assets recognition. The company's financial narrative was marked by improved auto gross margins despite early-stage costs arising from the Cybertruck ramp. The customer base expanded, with roughly 90% of buyers in 2023 being first-time Tesla owners. To stimulate demand, Tesla made strategic investments in digital campaigns and offered competitive leasing opportunities, reinforcing their market position.

Future Endeavors and Product Pipeline

Tesla is between two significant growth waves dedicating efforts to launch the next-generation vehicle platform and other initiatives. Focus areas include advanced vehicle, energy storage, and full self-driving technologies. Musk highlighted the architectural rewrite of Full Self-Driving Version 12, essentially converting raw photons into vehicle controls. The new Model 3, with substantive improvements, was released globally. Furthermore, Musk teased the next low-cost vehicle, emphasizing Tesla's advantage in manufacturing technology and efficiency. The production of this vehicle is slated to start in the Gigafactory in Austin, Texas, with Mexico likely to follow.

Manufacturing and Supply

Tesla is leading in artificial intelligence and inference efficiency, which is critical for the manufacture and operation of its products. They have developed next-generation manufacturing systems that outperform competitors. For the 4680 battery cells, Tesla's production is ahead of Cybertruck needs, and they are optimizing their manufacturing lines in Texas for cost and production ramping. Supplier relationships remain essential, with Tesla continuing to order from Panasonic, CATL, LG, and BYD to supplement their internal production.

Questions and Responses

Key Q&A topics included the anticipated production timeline for the next-gen compact vehicle, barriers to ramping 4680 cells, Tesla expanding AI and robotics, the future role of Dojo in FSD development, and Cybertruck orders and deliveries. Musk also addressed Tesla's advertising strategy, touching on campaign results and the ongoing need to balance awareness with spend effectiveness. Throughout the Q&A, a common theme was the commitment to advancing sustainable energy and transportation technologies, reducing costs, improving manufacturing processes, and optimizing designs for scalability and efficiency.

Tesla, Inc., an electric vehicle and clean energy company, filed its Form 10-Q quarterly report with the SEC disclosing financial and operational results for the quarter ended September 30, 2023. During this period, Tesla produced 1,350,996 consumer vehicles and delivered 1,324,074 units. The companys focus includes increasing vehicle production and capacity, reducing costs, innovating battery technology, localizing supply chains, and expanding global infrastructure.

Financially, Tesla saw a 9% increase in total revenues to $23.35 billion for the third quarter of 2023 compared to the same period in the previous year, with a year-over-year quarterly increase of $1.90 billion. This growth was attributed to an increase in vehicle deliveries, particularly of the Model 3 and Model Y due to global production ramping, although partially offset by a lower average selling price.

For the nine months ending September 30, 2023, total revenues rose by 25%, reaching $71.61 billion, boosted by a notable increase of 394,409 in combined Model 3 and Model Y deliveries. Automotive sales accounted for the majority of this revenue, although the company also recognized revenue from selling automotive regulatory credits and from its leasing business.

Net income attributable to common stockholders for the third quarter dropped to $1.85 billion, a $1.44 billion decrease from the same quarter in the previous year, with a nine-month net income of $7.07 billion, which also declined by $1.80 billion year over year. Despite the reduction in net income, Tesla ended the third quarter with a substantial cash and investment position of $26.08 billion, an increase of $3.89 billion since the end of 2022.

Tesla's cost of automotive sales rose by 20% to $15.66 billion for the third quarter and increased by 40% to $47.92 billion for the nine-month period, in line with the increase in deliveries. The cost of services and other revenue also saw substantial increases, linked to the expansion of Tesla's fleet and associated customer services.

Gross margin for the automotive sector decreased from 27.9% to 18.7% for the quarter and from 29.6% to 19.7% for the nine months, impacted by a lower average selling price of vehicles. However, energy generation and storage gross margin improved significantly, largely due to improved cost efficiencies in the production of the Megapack.

Research and development (R&D) expenses rose by 58% for the quarter and by 27% for the nine-month period, reflecting investments in new product development, particularly the Cybertruck and AI programs. Selling, general, and administrative expenses increased as well, with higher staffing costs and expanded facilities.

Tesla's operations yielded positive operating cash flow, although the nine-month figure showed a decline from the previous year. Capital expenditures reached $6.59 billion for the nine-month period, $1.29 billion higher than the previous year, indicating significant investment in growth initiatives like new manufacturing facilities and battery cell production.

Overall, Tesla's financials exhibit strong revenue growth driven by increasing vehicle production and delivery capabilities. While net income has reduced due to expanded cost of sales and increasing R&D expenditures, the company's robust cash reserves and positive operating cash flow position it well for ongoing expansion and innovation.

Tesla, Inc. (NASDAQ:TSLA) has become a focal point for investors and market spectators as discussions around its future valuation and growth prospects intensify. The company is lauded for its pioneering role in the electric vehicle (EV) revolution and is heralded by many as a vanguard that could reach a staggering market valuation of $1 trillion as early as 2024, as suggested by analysts at Wedbush. This heightened optimism, reflected in the increased price target from $310 to $350 with an Outperform rating on the stock, is founded on Teslas strategic initiatives and its performance in critical markets.

The bullish stance from Wedbush is largely influenced by Tesla's aggressive pricing strategy, especially in the Chinese market, which is anticipated to be a catalyst for increased volume and unit sales. Contradicting the bearish viewpoint of diminishing demand, analysts from the brokerage firm regard the global price cuts initiated by CEO Elon Musk as a smart move to bolster the company's market position. Indeed, these price adjustments may see Tesla deliver around 1.8 million units in 2023, underscoring their market strategy proficiency.

Tesla continues to navigate the regulatory landscape effectively despite recent safety concerns. The recall of 120,000 vehicles due to a defect that could see doors unlock during collisions as mandated by the NHTSA, and previous issues with Autopilot, have underscored the complexity of innovating in the auto space. Despite this, the company has managed to address these issues promptly through over-the-air software updates, showcasing its ability to remedy safety concerns swiftly.

Despite competition from domestic brands such as BYD, Tesla has managed to retain a significant market share in China, contributing to its growth momentum. The focus on strategic territories is not just limited to Tesla's automotive pursuits. The company's Full Self-Driving (FSD) technology is seen as an incremental value driver, akin to the ecosystem and service offerings that have propelled companies like Apple to new heights in years past.

Technology and innovation are at Teslas core, as evidenced by its approach to advanced driver-assistance systemsa feature that led Consumer Reports to scrutinize the companys efforts to prevent potential misuse of Autopilot. While some market segments formerly buzzed with hype, like drones, now seem passe compared to Tesla's industrial strides, it is clear that the EV manufacturer is deeply embedded in the most relevant and sustainable growth areas in technology.

Nevertheless, Tesla's narrative is also shaped by the activities and public persona of its CEO, Elon Musk, who is both celebrated for his bold leadership and critiqued for the controversies he stirs. Teslas stronghold remains intact even as it confronts a rapidly evolving industry and competition that strains its market share. The companys ambitious endeavors, including the Cybertruck and advanced battery technologies, are buttressed by a track record of innovation and profitability that continues to draw substantial interest from billionaire investors and retain a highly active retail investor base.

Looking ahead, Tesla is well-positioned to play a significant role in the broader EV market, which is expected to grow considerably by 2030, with EVs accounting for around 20% of all automobiles. As part of the next phase in growth, Teslas sales performance in key territories such as Europe and the ambitious Megapack project, which complements the renewable energy sector, stand out as promising developments that could solidify its industry stature.

Simultaneously, Tesla reflects a company adjusting to market demands, evidenced by necessary price reductions in preparation for the changes to federal EV tax credits coming in 2024. The expectation that Tesla's stock might stabilize sheds light on the robust performance borne throughout 2023 and investor valuation that captures the prospects of the company's innovative projects.

However, caution is advised as potential headwinds such as safety recalls, margin pressures, and a competitive market could spell periods of difficulty or a slowdown in stock value growth. Despite these concerns, the overall financial metrics suggest that Tesla's stock remains tempting for those confident in the company's capacity to navigate these challenges and continue its ascent in the automotive and clean energy sectors.

With companies like QuantumScape emerging as potential disruptors in the EV battery market and the shifting terrain of federal tax credits, it is clear that the landscape in which Tesla operates is in a state of dynamic change. As investors and market analysts speculate on Tesla's future, considering the company's past performance, present endeavors, and future projections is imperative for a well-rounded assessment of its potential.

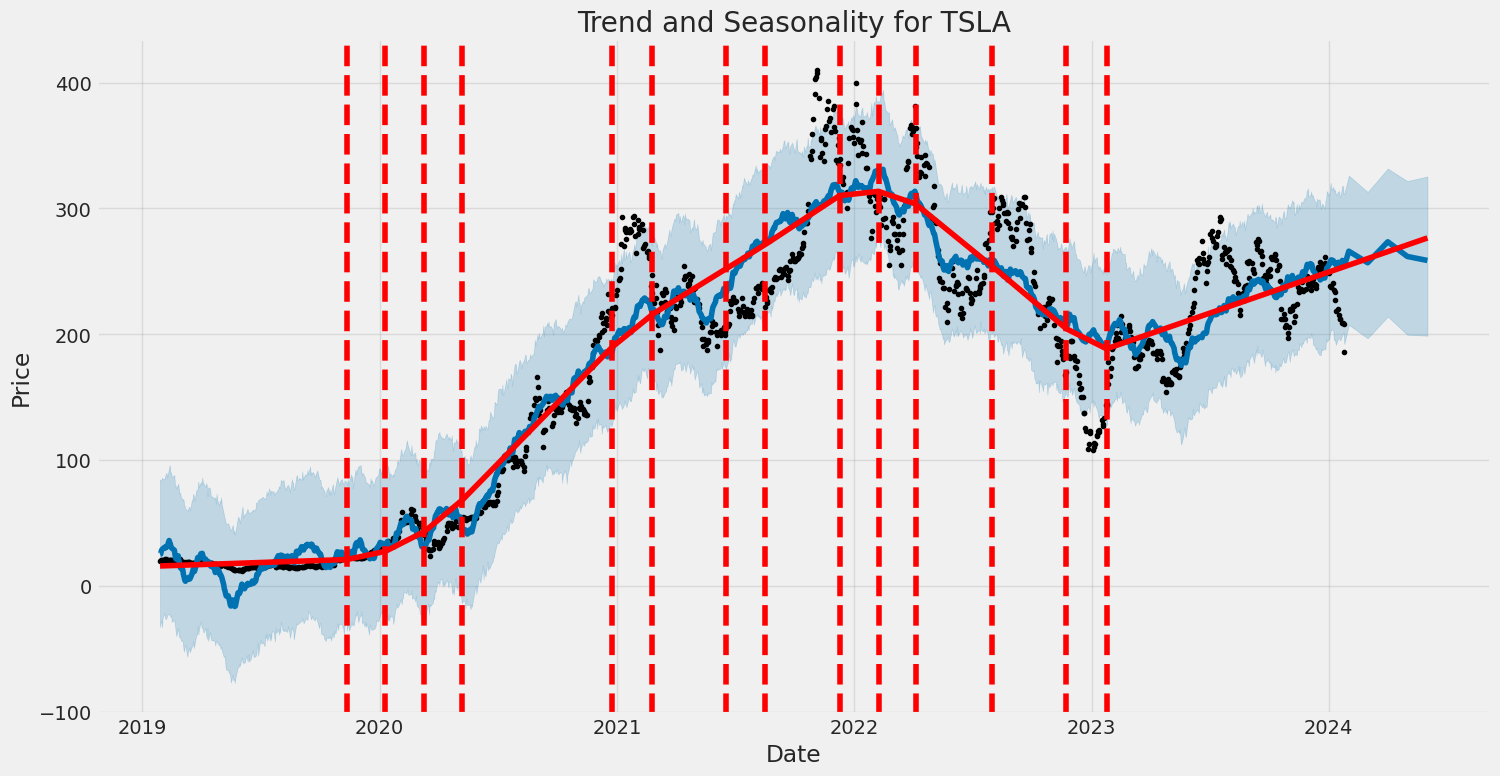

Between January 28, 2019, and January 25, 2024, Tesla, Inc. (TSLA) showcased significant volatility in its stock price, as evidenced by statistical analysis using an ARCH model. The model indicates that fluctuations in Tesla's stock returns were not explained by the model's mean (as per the R-squared value), implying that volatility was primarily random and could not be predicted by past returns. Key features of this volatility include a considerable constant volatility component (omega) and a significant effect of previous day's returns on current volatility (alpha).

| Statistic | Value |

|---|---|

| Dep. Variable | asset_returns |

| R-squared | 0.000 |

| Mean Model | Zero Mean |

| Adj. R-squared | 0.001 |

| Vol Model | ARCH |

| Log-Likelihood | -3,534.65 |

| AIC | 7,073.30 |

| BIC | 7,083.57 |

| No. Observations | 1,257 |

| Df Residuals | 1,257 |

| Df Model | 0 |

| omega | 14.9030 |

| alpha[1] | 0.0944 |

Analyzing the financial risk of a $10,000 investment in Tesla, Inc. over one year involves assessing the company's stock price behavior to forecast potential risks and returns. Volatility modeling techniques can be instrumental in understanding Tesla's stock volatility, which, in turn, is a crucial component of financial risk evaluation.

Volatility modeling is applied to the historical stock price data to estimate how much the price of Tesla's stock is expected to fluctuate in the future. This type of modeling helps in quantifying the scale of price movements, whether upward or downward, which can indicate the level of risk associated with the investment. The volatility model typically used in finance is the Generalized Autoregressive Conditional Heteroskedasticity approach, which excels at modeling financial time series data where volatility tends to cluster over time. By using past volatility and returns as inputs, the volatility model generates a forecast of future volatility. This calculated volatility is directly linked to the risk of holding Tesla's stocks as it represents the expected variation in returns.

On top of the volatility assessment, machine learning predictions are deployed to enhance the forecasting of Tesla's stock returns. Predictive models, especially those using ensemble learning methods, can capture complex patterns within the historical data that might not be immediately apparent. Machine learning models like these excel at integrating a multitude of variables and can use the output from volatility modeling as part of the feature set, along with other technical and fundamental indicators, to make predictions about future returns. Such an approach provides a more informed estimation of the range within which the stock price may move.

When it comes to the risk analysis results, the Value at Risk (VaR) metric is often employed. VaR measures the maximum expected loss over a specified time frame with a given level of confidence. For this investment in Tesla, the calculated VaR at a 95% confidence interval implies that there is a 5% chance that the investment could lose more than $529.49 over the one-year horizon. In other words, investors should be 95% confident that they will not lose more than this amount on their $10,000 investment under normal market conditions.

Integrating the volatility forecast with machine learning predictions provides a comprehensive analysis of the equity investment's potential risks. By accounting for both historical volatility patterns as well as possible future price movements informed by diverse indicators, the combination of these analytical methods enhances the accuracy of risk assessments like VaR, offering investors a robust risk management tool. This integrated approach is essential for investors to understand the dynamic landscape and make more informed decisions regarding equity investments like Tesla, Inc.

Similar Companies in Auto Manufacturers:

XPeng Inc. (XPEV), Li Auto Inc. (LI), Rivian Automotive, Inc. (RIVN), Lucid Group, Inc. (LCID), General Motors Company (GM), NIO Inc. (NIO), Ford Motor Company (F), Fisker Inc. (FSR), Mullen Automotive, Inc. (MULN), Nikola Corporation (NKLA), Lordstown Motors Corp. (RIDE), Canoo Inc. (GOEV)

https://www.zacks.com/stock/news/2201688/pcar-vs-tsla-which-stock-is-the-better-value-option

https://www.proactiveinvestors.com/companies/news/1037041?SNAPI

https://seekingalpha.com/article/4659300-tesla-cybertruck-is-an-asset-despite-short-term-negatives

https://www.youtube.com/watch?v=NF4pU0fATh0

https://www.fool.com/investing/2023/12/23/more-good-news-for-rivian-investors-at-teslas-expe/

https://www.fool.com/investing/2023/12/23/forget-tesla-1-ev-stock-that-could-make-you-rich/

https://seekingalpha.com/article/4659438-lithium-miners-news-for-december-2023

https://www.fool.com/investing/2023/12/24/3-red-hot-growth-stocks-that-have-doubled-this-yea/

https://www.fool.com/investing/2023/12/25/3-stock-split-stocks-billionaires-piling-into-2024/

https://www.fool.com/investing/2023/12/26/1-massive-change-in-2024-that-tesla-investors-must/

https://www.youtube.com/watch?v=irf8LjA9ny4

https://www.fool.com/investing/2023/12/26/tesla-bull-raises-price-target-for-2024-as-tesla-e/

https://seekingalpha.com/article/4659735-tesla-expect-margins-shrink-again-2024

https://www.sec.gov/Archives/edgar/data/1318605/000162828023034847/tsla-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: ZNMFUG

Cost: $0.95991

https://reports.tinycomputers.io/TSLA/TSLA-2024-01-25.html Home