Vanguard Small-Cap Value ETF (ticker: VBR)

2024-01-01

The Vanguard Small-Cap Value ETF (ticker: VBR) offers investors exposure to the small-cap sector of the U.S. equity market, emphasizing stocks that are considered to be value-oriented relative to their fundamentals. As of the knowledge cutoff in early 2023, VBR tracks the performance of the CRSP US Small Cap Value Index, which includes small-cap companies with lower price-to-book ratios and slower expected growth rates compared to their peers. The fund is structured as an exchange-traded fund (ETF), allowing for trading throughout the day on the open market, much like individual stocks. Vanguard, known for its low-cost investment options, manages VBR and provides the added benefit of a low expense ratio to its shareholders. By investing in a diversified basket of small-cap value stocks, investors in VBR may benefit from the potential for high returns associated with undervalued companies along with the historical trend of small-caps outperforming larger companies over long time horizons. However, like all investments in equities, VBR involves risks, including market volatility and sector concentration, which should be carefully considered by investors.

The Vanguard Small-Cap Value ETF (ticker: VBR) offers investors exposure to the small-cap sector of the U.S. equity market, emphasizing stocks that are considered to be value-oriented relative to their fundamentals. As of the knowledge cutoff in early 2023, VBR tracks the performance of the CRSP US Small Cap Value Index, which includes small-cap companies with lower price-to-book ratios and slower expected growth rates compared to their peers. The fund is structured as an exchange-traded fund (ETF), allowing for trading throughout the day on the open market, much like individual stocks. Vanguard, known for its low-cost investment options, manages VBR and provides the added benefit of a low expense ratio to its shareholders. By investing in a diversified basket of small-cap value stocks, investors in VBR may benefit from the potential for high returns associated with undervalued companies along with the historical trend of small-caps outperforming larger companies over long time horizons. However, like all investments in equities, VBR involves risks, including market volatility and sector concentration, which should be carefully considered by investors.

| Previous Close | 181.94 | Open | 181.48 | Day Low | 179.9 |

| Day High | 181.79 | PE Ratio (TTM) | 11.39 | Volume | 434,964 |

| Average Volume | 536,600 | Average Volume 10 Days | 525,540 | Bid | 179.61 |

| Ask | 180.4 | Bid Size | 800 | Ask Size | 900 |

| Yield | 2.29% | Total Assets | 47,538,696,192 | 52 Week Low | 147.94 |

| 52 Week High | 182.37 | 50 Day Average | 164.9064 | 200 Day Average | 162.1421 |

| Trailing Annual Dividend Rate | 3.131 | Trailing Annual Dividend Yield | 1.72% | NAV Price | 180.0 |

| YTD Return | 17.28% | 3 Year Average Return | 10.89% | 5 Year Average Return | 12.25% |

Examining the technical and fundamental data for VBR (Vanguard Small-Cap Value ETF) yields insights into potential future price movements. The following analysis draws upon the latest available technical indicators and fundamental figures to forecast the stock's trajectory in the coming months.

Examining the technical and fundamental data for VBR (Vanguard Small-Cap Value ETF) yields insights into potential future price movements. The following analysis draws upon the latest available technical indicators and fundamental figures to forecast the stock's trajectory in the coming months.

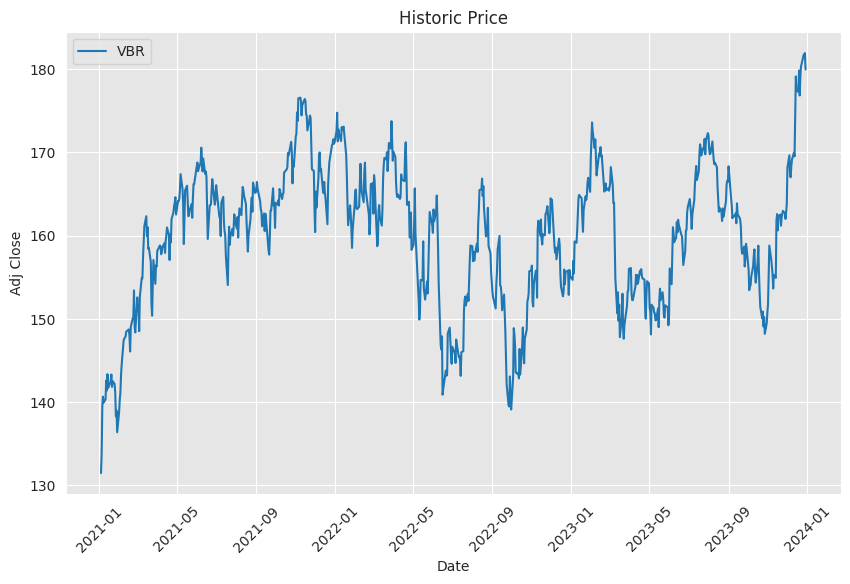

Technical Indicators: - The ETF has recently been trading above its two-hundred-day moving average (200-DMA) of 162.1421, while the fifty-day moving average (50-DMA) is 164.9064, which is indicative of a short to medium-term upward trend. - A notable presence of increasing On-Balance Volume (OBV) suggests accumulating volume and potential continued buying interest. The upturn in OBV from -0.03472 million to 0.10467 million emphasizes this bullish sentiment. - Parabolic SAR (PSAR) values being placed below price action consistently throughout the analysis period confirms an ongoing uptrend. - The Moving Average Convergence Divergence (MACD) histogram values at the end of the period exhibit a positive divergence, though the last value shown (0.007147) indicates potential slowing momentum.

Fundamental Figures: - VBR boasts an attractive trailing Price-to-Earnings (PE) ratio of 11.39035, suggesting that it is reasonably valued in terms of earnings. - A yield of 2.29% and positive year-to-date (YTD) returns of 17.2834% reflect a favorable income-generating and growth component. - The fund manages a considerable total asset pool of approximately $47.53 billion, an indicator of its size and the trust it has garnered from investors. - VBR's bid-ask spread is relatively tight, indicative of good liquidity which bodes well for investor entry and exit flexibility.

Considering both technical and fundamental perspectives, unless there are significant macroeconomic shifts or market-wide corrections, VBR is likely to continue its current upward momentum in the short to medium term. Prices have consistently stayed above key moving averages, reinforcing the strength of the uptrend. Additionally, the ETF's solid fundamentals, with a healthy PE ratio, moderate yield, and robust total asset size, underpin its appeal to investors seeking value.

Market participants should be observant of key technical levels such as the 50-DMA and 200-DMA; sustained trading above these averages is likely to support the continuation of the bullish trend. Furthermore, it is recommended to monitor the progression of the MACD histogram for signs of dwindling momentum which could precede price consolidations or pullbacks.

In summary, while no analysis can predict market movements with certainty, the fusion of favorable technical indicators and solid fundamentals presents a compelling case for VBR's capacity to sustain its upward trajectory over the next few months. Investors should maintain diligence, observing market conditions and indicator developments to validate this outlook.

The Vanguard Small-Cap Value ETF (VBR) is a significant option for investors keen on gaining exposure to small-cap value stocks. This ETF offers a diverse portfolio that is invested in approximately 840 small-cap companies that show attractive valuation metrics. The interest in small-cap ETFs like VBR stems from the historical performance of small-cap stocks, especially those in the value category, which have shown the potential to offer strong returns when compared to the broader market. Typically, small-cap stocks have traded at significant discounts, allowing for an attractive entry point for investors to tap into potentially undervalued assets.

Current market trends and economic indicators are setting a favorable backdrop for small-cap stocks. With the Federal Reserve signaling a likely reduction in interest rates at the start of 2024, small-cap companies are poised to benefit. These companies are generally more sensitive to interest rate changes, and a decrease in rates could suggest a period of accelerated growth for small caps. Vanguard's Small-Cap Value ETF, with its competitive low annual expense ratio of just 0.07%, adheres closely to Warren Buffett's advice to invest in low-cost index funds. The ETF's modest management fees and extensive market coverage align well with a cost-conscious investment approach.

When considering ETF investment, it's important for investors to align their choices with their individual goals and strategies. For example, those with a primary focus on income may be drawn to high-yield dividend ETFs or bond ETFs. However, investors with a longer-term perspective could find that small-cap ETFs, including Vanguard's VBR alongside S&P 500 ETFs, could deliver substantial returns over an extended timeline.

ETFs like VBR offer the advantage of diversification and reduce the complexity associated with picking individual stocks. They grant investors the opportunity to participate in a wider range of stocks within a managed, diversified portfolio. The growing popularity of these ETFs is attributable to their mix of risk balance, cost-effectiveness, and potential for strong investment performance.

Throughout 2023, Vanguard's suite of ETFs maintained its popularity among investors, with over $155 billion added across its range a strong endorsement of Vanguard's reputation and standing in the investment community. Noteworthy is that Vanguard's ETFs like the Vanguard 500 (VOO) and the Total Bond Market ETF (BND) saw substantial inflows of approximately $39.8 billion and $16.2 billion, respectively. These inflows signify strong investor confidence in Vanguard's ability to provide reliable index fund options. The Vanguard 500 ETF tracks the S&P 500, offering low management fees, while the Vanguard Total Bond Market ETF provides a diversified approach to the bond market.

Amid various options, a fund that underperformed in inflows in 2023 but presents significant potential looking forward is the Vanguard Small-Cap Value ETF (VBR). This ETF, despite broader market challenges that often impact small-cap stocks more severely, presents an opportunity for seasoned investors versed in the historical tendency of small-cap value stocks to outperform their large-cap counterparts over the long haul.

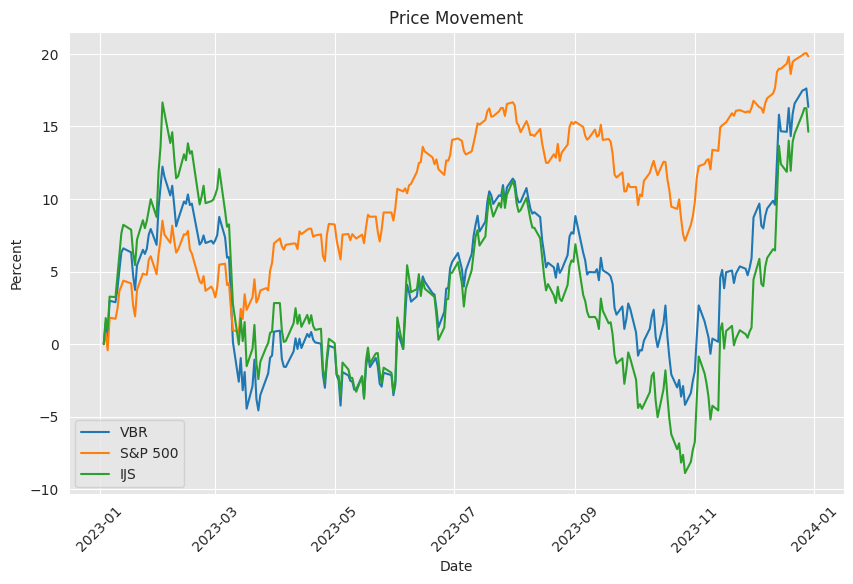

Small-cap value stocks, as found within the VBR, encountered headwinds during 2023 due to economic uncertainties and increasing interest rates. These factors influence small-cap companies more heavily, primarily due to their higher reliance on debt for growth and greater sensitivity to valuation models' future earnings discount rates. Nonetheless, with the anticipation of a downward shift in interest rates in 2024, small-cap stocks and the ETFs which represent them, such as VBR, could see a substantial upswing, making them promising for investors looking for diversification and prospective gains in this segment of the market.

While VBR ostensibly presents an attractive investment choice for incorporating small-cap stocks, its mandate is to replicate the performance of the CRSP US Small-Cap Value Index. It covers a wide range of U.S. stocks identified as small-cap based on market capitalization and deemed as 'value' based on their valuation metrics. Unlike the narrow classification which confines small-cap stocks to a specific market cap range, the index uses a broader system to include companies.

VBR's portfolio currently features a total of 853 stocks with a median market cap of $5.6 billion and an average P/E ratio standing at 11.4 times. Coupled with an already attractive low expense ratio, these facts illustrate that VBR is designed to be appealing for the cost-aware investor. Despite lagging behind Vanguard's 500 Index Fund ETF (VOO) in the past decade, historical trends support the long-term advantage of investing in small-cap value stocks. Research has shown that, over extended periods, small-cap value stocks have generated the most potent returns among differing asset classes.

| company | symbol | percent |

|---|---|---|

| Builders FirstSource Inc | BLDR | 0.63 |

| Bunge Global SA | BG | 0.62 |

| Booz Allen Hamilton Holding Corp Class A | BAH | 0.62 |

| Reliance Steel & Aluminum Co | RS | 0.61 |

| Atmos Energy Corp | ATO | 0.59 |

| IDEX Corp | IEX | 0.57 |

| First Citizens BancShares Inc Class A | FCNCA | 0.56 |

| Jabil Inc | JBL | 0.54 |

| Carlisle Companies Inc | CSL | 0.53 |

| RPM International Inc | RPM | 0.50 |

Financial analysts from firms like T. Rowe Price recommend being cognizant of the current market landscape, and they suggest small-cap value equities may harness exceptional performance in the prevailing economic climate. The Vanguard Small-Cap Value Index Fund ETF is posited to yield satisfactory outcomes for long-term investors, making it a prudent choice for those seeking a judicious investment opportunity in October and beyond.

Vanguard's S&P 500 ETF (VOO) has been widely embraced by index investors, returning about 17% in the year 2023. The performance was largely dictated by a small number of mega-cap stocks, highlighting the contrast between the concentrated gains in large-cap stocks and the typically more diversified, but currently subdued, small-cap stock sector.

Conversations are now pivoting towards the promising allure of small-cap stocks. Historically, they have outperformed large-cap equities over more extended periods, and present small-cap valuations are at record lows, as observed in indices such as the S&P 600. Small-cap stocks' vulnerability to economic upheavals and central bank policies like rate hikes has played a role in their current valuation status. However, an impending change in the Federal Reserve's stance on interest rates could tip the scales in favor of small-caps, potentially resulting in increased earnings growth and strengthening investor appeal for the small-cap sector.

Investors who are open to diversification and willing to venture into the small-cap space might opt for ETFs catering to this market segment. Among those, VBR stands out due to its focus on value-oriented small-cap stocks that have faced significant market retractions but are historically primed for market outperformance. Additionally, products like the SPDR Portfolio S&P 600 Small Cap ETF (SPSM) and the Avantis US Small Cap Value ETF (AVUV) offer similar small-cap exposure with their individual investment nuances.

VBR's investment strategy centers on unearthing small companies that are deemed undervalued when compared to their industry peers. The aim is to replicate the results of the CRSP U.S. Small-Cap Value Index. VBR boasts a notable low expense ratio and has exhibited a robust 10-year annualized return. Its expansive collection of companies spans all major sectors, offering extensive diversification benefits.

Despite recent performance challenges due to macroeconomic shifts, the quality of VBR's portfolio, with an impressive average annual earnings growth rate and a comparatively attractive P/E ratio, holds promise for growth as economic conditions ameliorate.

In contrast, The Vanguard Growth Index Fund (VUG) focuses on large-cap companies with potential high growth prospects, characterized by an equally competitive expense ratio and compelling historical returns. The substantial performance differences of VUG, particularly in recent times, illustrate the diversity of outcomes within Vanguard's ETF offerings.

Ultimately, both VBR and VUG are flagged by financial analysts as sound long-term investment choices. These ETFs are a part of Vanguard's celebrated lineup that promises cost efficiency and robust performance, catering to various investor preferences, from high-growth to value-oriented investments.

In the realm of small-cap ETFs, the recent shift in Federal Reserve policy projections has sparked a renewed focus on this segment. The anticipated reduction in interest rates in 2024 may lead to a reversal of fortunes for small-cap stocks, guiding investors to scrutinize small-cap ETFs for investment opportunities with high growth potential.

A composite view of four high-performing ETFs, including those such as the Pacer US Small Cap Cash Cows 100 ETF and the Schwab US Small-Cap ETF, offers a glimpse into the range of options available. Despite differences in performance, expense ratios, dividend yields, and turnover, each fund presents its unique benefits.

Nestled among these funds, the Vanguard Small-Cap Value ETF (VBR), distinguished by its small-cap value orientation, stands out. Its strategic focus on stocks with lower valuation multiples, impressive five-year total return, low cost structure, and steady dividend yield position it as a balanced and potentially prudent choice for the value-seeking investor.

Similar Companies in Exchange-Traded Fund:

iShares S&P Small-Cap 600 Value ETF (IJS), SPDR S&P 600 Small Cap Value ETF (SLYV), iShares Russell 2000 Value ETF (IWN), WisdomTree U.S. SmallCap Dividend Fund (DES), Schwab U.S. Small-Cap Value ETF (SCLV)

News Links:

https://www.fool.com/investing/2023/11/18/before-buy-vanguard-sp-500-etf-vbr-avuv-spsm/

https://www.fool.com/investing/2023/10/04/1-no-brainer-etf-to-buy-in-october/

https://www.fool.com/investing/2023/12/04/whats-the-best-etf-to-buy-right-now/

https://www.fool.com/investing/2023/12/17/vanguard-etf-investors-get-enough-2023-buy/

https://www.fool.com/investing/2023/10/21/2-vanguard-etfs-to-buy-and-hold-forever/

https://www.fool.com/investing/2023/12/23/what-is-the-best-small-cap-etf-to-buy/

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 0bTVtA

https://reports.tinycomputers.io/VBR/VBR-2024-01-01.html Home