Vista Outdoor Inc. (ticker: VSTO)

2024-09-21

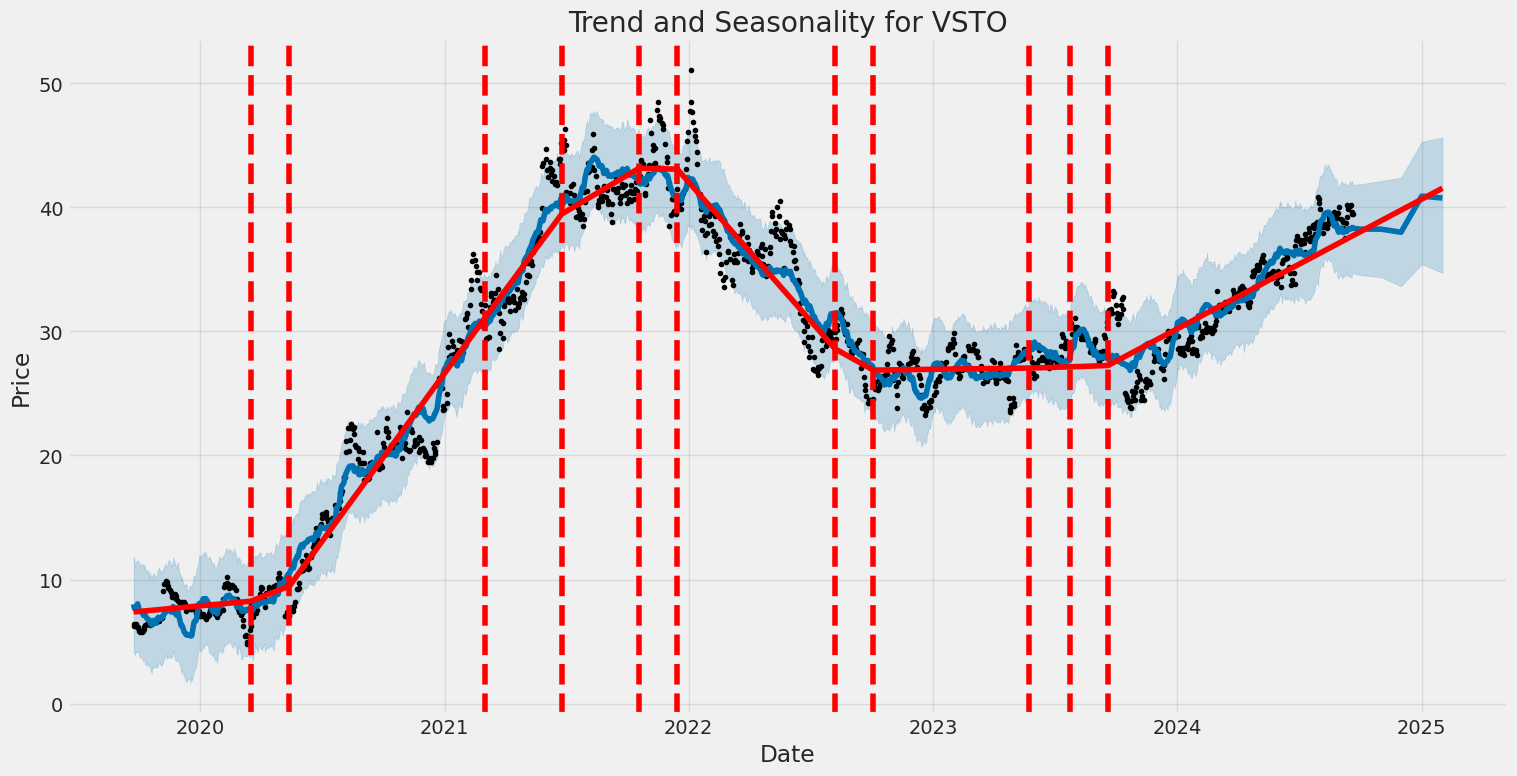

Vista Outdoor Inc. (NASDAQ: VSTO) is a notable player in the outdoor sports and recreation markets. The company designs, manufactures, and markets a broad portfolio of consumer products in the highly competitive outdoor sports and recreation categories. Vista Outdoor's product range includes ammunition, firearms, shooting accessories, outdoor apparel, and various sporting goods, catering to a diverse audience from enthusiasts to professionals. The company operates through two primary segments: Shooting Sports and Outdoor Products. Over recent years, Vista Outdoor has leveraged strategic acquisitions and innovation to expand its market presence and enhance its product offerings, striving to sustain growth despite fluctuating market conditions. Headquartered in Anoka, Minnesota, the company continues to emphasize operational efficiency and customer satisfaction, aiming to strengthen its position within the industry.

Vista Outdoor Inc. (NASDAQ: VSTO) is a notable player in the outdoor sports and recreation markets. The company designs, manufactures, and markets a broad portfolio of consumer products in the highly competitive outdoor sports and recreation categories. Vista Outdoor's product range includes ammunition, firearms, shooting accessories, outdoor apparel, and various sporting goods, catering to a diverse audience from enthusiasts to professionals. The company operates through two primary segments: Shooting Sports and Outdoor Products. Over recent years, Vista Outdoor has leveraged strategic acquisitions and innovation to expand its market presence and enhance its product offerings, striving to sustain growth despite fluctuating market conditions. Headquartered in Anoka, Minnesota, the company continues to emphasize operational efficiency and customer satisfaction, aiming to strengthen its position within the industry.

| Full Time Employees | 6,400 | Previous Close | 39.42 | Open | 39.42 |

| Day Low | 38.93 | Day High | 39.97 | Beta | 0.81 |

| Forward PE | 8.69 | Volume | 1,997,487 | Average Volume | 641,026 |

| Market Cap | 2,304,183,808 | 52 Week Low | 23.33 | 52 Week High | 41.11 |

| Price to Sales (TTM) | 0.85 | 50 Day Average | 38.94 | 200 Day Average | 33.93 |

| Enterprise Value | 2,996,856,832 | Float Shares | 49,291,971 | Shares Outstanding | 58,407,700 |

| Shares Short | 2,324,844 | Shares Short Prior Month | 1,470,190 | Short Ratio | 3.54 |

| Book Value | 20.33 | Price to Book | 1.94 | Net Income to Common | -6,485,000 |

| Trailing EPS | -0.13 | Forward EPS | 4.54 | Peg Ratio | 3.13 |

| Enterprise to Revenue | 1.11 | Enterprise to EBITDA | 8.24 | 52 Week Change | 0.24 |

| Total Cash | 55,981,000 | Total Debt | 748,656,000 | Quick Ratio | 1.08 |

| Current Ratio | 2.80 | Total Revenue | 2,696,911,104 | Debt to Equity | 63.11 |

| Gross Margins | 0.31 | EBITDA | 363,577,984 | Operating Margins | 0.11 |

| Sharpe Ratio | 0.668 | Sortino Ratio | 9.861 |

| Treynor Ratio | 0.429 | Calmar Ratio | 0.866 |

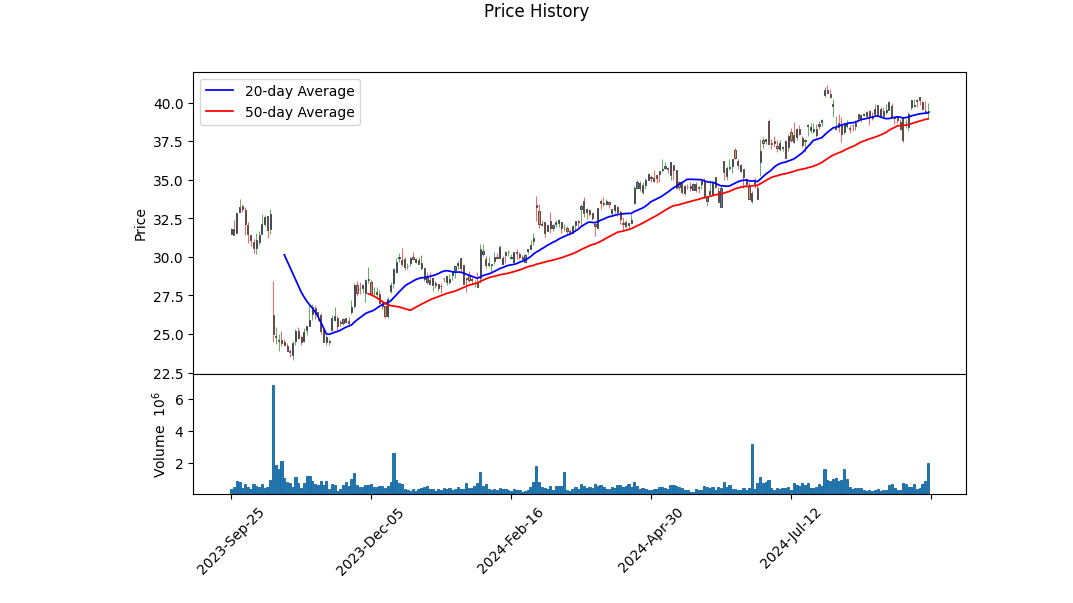

The recent performance of VSTO reveals a positive trajectory, showing a notable bullish trend in the past few months. The stock price increased from an open price of $34.91 in late May to $39.42 by late September. This upward movement aligns with a strengthening in On-Balance Volume (OBV), which highlights accumulating investor interest.

Technically, the MACD histogram suggests positive momentum, albeit with declining intensity towards the end of the period. Furthermore, the substantial OBV increase supports a continuation of the uptrend, suggesting a favorable investor sentiment. The converging MACD histogram closer to the zero line warrants caution for potential slowing momentum, but does not necessarily imply a reversal.

Analyzing financial fundamentals, VSTO displays solid operational metrics. The company's gross margins stand at 31.27%, and operating margins at 10.51%, which reflect efficient cost management and operational control. Financial health indicators such as the Altman Z-Score of 2.89 indicate moderate financial stability and reduced bankruptcy risk. However, it's crucial to monitor the retained earnings, which are currently negative, posing a potential concern for long-term profitability.

The risk-adjusted return metrics provide a multifaceted view of VSTOs performance. The Sharpe Ratio of 0.668 indicates moderate risk-adjusted returns, suggesting VSTO is delivering fair returns for the volatility it incurs. On the other hand, the extremely high Sortino Ratio of 9.861 highlights the stock's efficiency in returns when only considering downside risk, thereby painting a positive picture for risk-averse investors.

The Treynor Ratio of 0.429 signifies that VSTO is achieving reasonable excess returns per unit risk as compared to the market, further supported by a Calmar Ratio of 0.866, which suggests good long-term performance relative to drawdown risks.

Financials from the latest statements indicate that VSTO has a healthy free cash flow of $370 million and a positive operating cash flow of $400 million, highlighting strong liquidity. While the company has significant total debt ($837 million), the net debt ($657 million) remains manageable against its cash conversion capabilities.

Balance sheet analysis shows a strong working capital of $690 million and total assets of $2.36 billion, further underpinning VSTO's solid financial grounding.

In light of this analysis, the outlook for VSTO over the next few months appears cautiously optimistic. Investors could anticipate continued stock price growth but should remain vigilant of any shifts in momentum indicators or adverse changes in retained earnings. Prudent risk management and close monitoring of financial health markers will be essential for sustained confidence in the company's stock performance.

In our analysis of Vista Outdoor Inc. (VSTO) using metrics inspired by "The Little Book That Still Beats the Market," we examined the company's return on capital (ROC) and earnings yield. The return on capital (ROC) for VSTO stands at 13.63%, indicating the company earns a solid return of approximately 13.63 cents on each dollar of capital invested. This suggests that Vista Outdoor is relatively efficient in generating profit from its capital base. However, the earnings yield presents a different narrative. With a figure of -0.24 (-24.08%), this negative earnings yield indicates that the company is currently operating at a loss relative to its market capitalization, which could be a result of various factors including operational inefficiencies, high financing costs, or extraordinary expenses impacting profitability. While the ROC shows potential operational efficiency, the negative earnings yield warrants caution and further investigation into the underlying reasons for this disconnect between capital returns and market valuation.

Research Report on Vista Outdoor Inc. (VSTO)

Introduction

Vista Outdoor Inc. (VSTO) has been evaluated against several key metrics rooted in the investment principles outlined by Benjamin Graham in his seminal work, The Intelligent Investor. As a pioneer in value investing, Graham's methods emphasize fundamental analysis and the intrinsic value of companies. Below, we present an analysis of VSTO using the key metrics calculated and compare them to Graham's criteria.

Key Metrics and Graham's Criteria

- Price-to-Earnings (P/E) Ratio

- VSTO P/E Ratio: 14.78

- Graham's Criteria: Graham often sought companies with P/E ratios that were low relative to their industry peers to ensure they were undervalued.

-

Analysis: While the P/E ratio of 14.78 is not explicitly compared with industry peers due to the absence of industry P/E data, it is important to note that Graham preferred lower P/E ratios. If this P/E ratio is significantly lower than that of comparable companies in the industry, VSTO would meet Grahams criterion.

-

Price-to-Book (P/B) Ratio

- VSTO P/B Ratio: 0.93

- Graham's Criteria: Graham favored stocks trading below their book value, implying they were undervalued.

-

Analysis: With a P/B ratio of 0.93, VSTO is trading below its book value. This aligns well with Grahams preference for such stocks, indicating potential undervaluation.

-

Debt-to-Equity Ratio

- VSTO Debt-to-Equity Ratio: 0.74

- Graham's Criteria: Graham recommended investing in companies with low debt-to-equity ratios to minimize financial risk.

-

Analysis: A debt-to-equity ratio of 0.74 suggests that VSTO has a moderately low level of debt relative to its equity. This is within a range that Graham might find acceptable, as it represents a balanced financial structure with relatively lower financial risk.

-

Current Ratio

- VSTO Current Ratio: 2.79

- Graham's Criteria: Graham preferred a current ratio of at least 2, which indicates strong short-term financial stability.

-

Analysis: A current ratio of 2.79 suggests that VSTO is well-positioned to cover its short-term liabilities with its short-term assets. This aligns favorably with Grahams standards for financial stability.

-

Quick Ratio

- VSTO Quick Ratio: 2.79

- Graham's Criteria: While Graham did not specifically emphasize the quick ratio, it is a stricter measure of liquidity when compared to the current ratio.

- Analysis: The quick ratio mirrors the current ratio at 2.79, signifying that even excluding inventory, VSTO can comfortably cover its short-term liabilities. This reinforces the companys financial stability, a key principle in Grahams analysis.

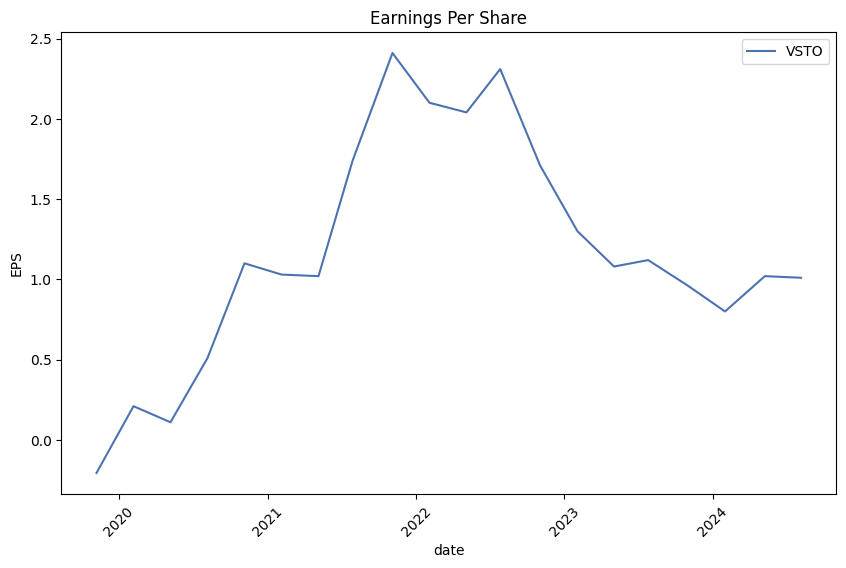

Earnings Growth

While not explicitly covered in the provided metrics, it is important to note that Graham also valued consistent earnings growth over the years. Investors should further examine VSTO's historical earnings performance to ensure it aligns with Graham's preference for steady growth.

Conclusion

Based on the key metrics analyzed, Vista Outdoor Inc. (VSTO) demonstrates several attributes that align with Benjamin Grahams value investing principles:

- The P/E and P/B ratios suggest potential undervaluation.

- The debt-to-equity ratio indicates a manageable level of financial risk.

- Both the current and quick ratios highlight strong short-term financial health.

To make a comprehensive decision, further analysis, including a comparison of the P/E ratio with industry peers and a review of historical earnings growth, would be advisable. However, based on the current data, VSTO exhibits several characteristics that would have likely appealed to Benjamin Graham.### Analyzing Financial Statements:

In Benjamin Graham's seminal work, "The Intelligent Investor," he emphasizes the critical importance of thoroughly analyzing a company's financial statements to understand its financial health and future prospects. For serious investors, scrutinizing the balance sheet, income statement, and cash flow statement is non-negotiable. Here is an analysis based on the provided financial data for Vista Outdoor Inc. (NYSE: VSTO).

Balance Sheet Analysis:

The balance sheet presents a snapshot of Vista Outdoor Inc.'s financial position as of a specific date. Key components include assets, liabilities, and stockholders' equity.

- Assets:

- Current Assets:

- As of March 31, 2024, Vista Outdoor reported current assets of approximately $1.075 billion. This includes cash and cash equivalents of $60.27 million, accounts and other receivables of $355.9 million, and inventory of $610 million.

-

Non-Current Assets:

- Property, plant, and equipment (net) is $201.86 million.

- Goodwill and intangible assets (net) are hefty at $318.25 million and $627.64 million respectively.

- Deferred income tax assets and other non-current assets total $72.6 million.

-

Liabilities:

- Current Liabilities:

- The company's current liabilities are $385.3 million, consisting of accounts payable of $163.4 million, employee-related liabilities, and other current liabilities.

-

Long-Term Liabilities:

- Long-term debt stands at a significant $717.24 million.

- Non-current operating lease liabilities and pension liabilities are $105.7 million and $22.87 million respectively.

-

Stockholders' Equity:

- The stockholders' equity is $1.126 billion, influenced by common stock value, additional paid-in capital, retained earnings, and accumulated other comprehensive income/loss.

Income Statement Analysis:

The income statement provides a detailed account of Vista Outdoor's profitability over a specific period. Here are the key figures for the fiscal year ending March 31, 2024:

- Revenue:

- Revenue from contracts with customers stands at $2.746 billion.

- Costs and Gross Profit:

- The cost of goods sold (COGS) is $1.887 billion, resulting in a gross profit of $858.99 million.

- Operating Expenses:

- Significant expenses include research and development at $49.64 million and selling, general, and administrative expenses (SG&A) at $540.08 million.

- Goodwill and intangible asset impairment totaling $218.81 million played a substantial role.

- Operating Income:

- Operating income for the year was $50.45 million.

- Net Income:

- Accounting for interest expenses and other non-operating incomes/expenses, the net income available to common stockholders is a loss of $5.51 million, translating to a basic and diluted EPS of -$0.10.

- Comprehensive Income:

- Adding other comprehensive incomes and losses, the comprehensive income nets out to $949,000 after accounting for effects such as foreign currency translation adjustments and cash flow hedges.

Cash Flow Statement Analysis:

The cash flow statement details cash inflows and outflows over the period, categorized into operating, investing, and financing activities:

- Operating Activities:

- Net cash provided by operating activities was $400.89 million, boosted by depreciation and amortization ($99.14 million), share-based compensation ($11.45 million), and changes in working capital like inventory decrease ($105.88 million).

- Investing Activities:

- Investing activities resulted in a net cash outflow of $46.68 million. This included capital expenditures ($30.53 million) and payments to acquire businesses ($16.48 million).

- Financing Activities:

- Financing activities saw a net cash outflow of $380.44 million, influenced by repayments of long-term debt ($205 million) and lines of credit ($339 million), partly offset by proceeds from credit lines ($204 million).

- Overall Change in Cash:

- The net decrease in cash and cash equivalents, including the effect of exchange rate changes, was $25.94 million, resulting in a cash balance of $60.27 million at year-end.

Conclusion:

Analyzing financial statements provides critical insights into Vista Outdoor Inc.'s financial health: - The company is generating substantial revenue, but also faces significant costs, particularly in impairment charges. - The balance sheet reveals a mix of strong assets but considerable debt. - Cash flow analysis indicates solid operational cash generation but high cash outflows related to financing activities.

Investors must consider these factors, aligning them with broader market conditions and their investment strategy to make informed decisions.# Dividend Record

Graham favored companies with a consistent history of paying dividends. Evaluating the dividend record is essential for assessing the financial stability and shareholder-friendly nature of a company. A consistent dividend payout indicates a company's reliable earnings and sound financial health over the long term.

For the company represented by the symbol "VSTO," the historical dividend record data is as follows:

Company Symbol: VSTO

Historical Dividend Record: []

In this case, the company VSTO does not have a historical record of paying dividends. According to Graham's criteria, this lack of a consistent dividend history might be a red flag, indicating potential issues with the company's financial reliability or a strategic choice that leans away from returning profits to shareholders in the form of dividends. Investors might want to investigate further to understand the reasons behind the absence of dividends and consider this factor in their investment decision.

| Alpha | 0.0237 |

| Beta | 1.1429 |

| R-squared | 0.689 |

| Standard Error | 0.0145 |

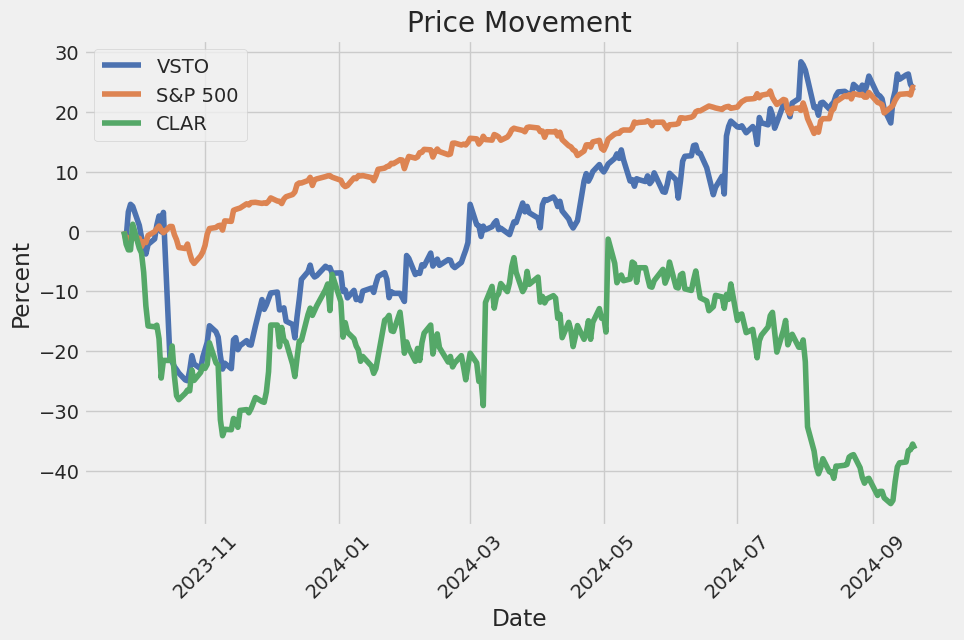

The linear regression analysis between VSTO and SPY demonstrates that VSTO's alpha is 0.0237, indicating a small positive return independent of the market's performance, represented by SPY. An alpha greater than zero suggests that VSTO has outperformed the market over the analyzed period, after adjusting for market risk. With a beta of 1.1429, it shows that VSTO is slightly more volatile than the SPY; for every 1% change in SPY, VSTO is expected to change by approximately 1.1429%.

The R-squared value of 0.689 indicates that about 68.9% of the variance in VSTO's returns can be explained by the market's movements. The standard error of 0.0145 suggests that the regression model's predictions are relatively precise, presenting a low average distance between the actual data points and the regression line. This model provides a useful encapsulation of VSTO's performance relative to the broader market, highlighting its excess returns while accounting for its higher sensitivity to market fluctuations.

The first quarter of fiscal year 2025 was a notable period for Vista Outdoor Inc. (VSTO), marked by significant strategic evaluations and operational developments. Co-CEO and CEO of Revelyst, Eric Nyman, highlighted the company's commitment to exploring a range of strategic alternatives, including the potential sale of Revelyst and engagements with MNC Capital to enhance shareholder value. The company also mentioned its continued consideration of a spinoff, as well as the board's endorsement of the merger agreement with CSG. The overarching goal remains to maximize stockholder value while continuing to deliver high-quality, innovative products.

Revelyst, one of Vista Outdoor's primary segments, faced challenges during the quarter related to supply chain issues and the timing of new product launches. Despite these setbacks, the company managed to post sales of $274 million and an adjusted EBITDA of $16 million with a 5.7% margin. The company expressed confidence in its fiscal year 2025 financial targets, attributing future growth to strategic initiatives like the GEAR Up cost-saving program and innovative product developments. Revelyst also introduced the DragonFly wheel, a strategic flywheel focused on driving growth and margin expansion through various consumer-centric strategies.

Significant strides were made in various categories under Revelyst, such as helmets and outdoor performance products, where market share gains were observed despite challenging market conditions. New product launches, such as the Camp Chef Gridiron and the QuadMAX and Falcon from Foresight, showed strong market performance. The company underscored its dedication to innovation and consumer-focused strategies, highlighting partnerships like the upcoming collaboration with celebrity chef Guy Fieri.

The Kinetic Group, another critical segment of Vista Outdoor, demonstrated robust performance with sales reaching $370 million and an adjusted EBITDA margin of 30%. Facing economic headwinds and inflationary pressures, the group managed to perform well due to strategic vendor consolidations and the successful navigation of a global powder shortage. The Kinetic Group's success in market share gains, especially as they approach hunting seasons, and the introduction of new products, underscore its leadership in ammunition technology.

In financial terms, Vista Outdoor showed a disciplined approach to its balance sheet management, achieving notable progress in its GEAR Up transformation program. This program generated $5 million in cost savings in the first quarter, with expectations to save $25 million to $30 million by the end of the fiscal year. The company also saw significant improvements in inventory reduction, particularly within Revelyst, contributing to a stronger net debt position. As a whole, the first quarter set a foundational tone for the strategic and operational initiatives expected to fuel long-term growth and shareholder value.

The recent SEC 10-Q filing for Vista Outdoor Inc., dated August 5, 2024, provides a comprehensive overview of the company's financial performance and operational highlights for the quarter ending June 30, 2024. Vista Outdoor reported net sales of $644.2 million, which represents a decline from $693.3 million in the same quarter of the previous year. This decrease was attributed to lower sales volumes across nearly all categories within The Kinetic Group and unfavorable conditions in the Revelyst segments. Noteworthy is the 1.6% drop in net sales for The Kinetic Group due to decreased shipment volumes, although pricing adjustments partially mitigated this decline.

The gross profit for the quarter was $211.2 million, down from $226.8 million in the same quarter last year. The decline in gross profit is largely driven by higher input costs and reduced sales volumes. Particularly within The Kinetic Group, input costs for copper and powder increased, affecting overall profitability. Gross profit margin slightly improved to 32.8%, largely due to favorable mix and operational efficiencies within the Revelyst Precision Sports Technology segment, which reported a gross profit margin of 43.4% as compared to 40.0% in the same quarter last year.

Operating income for the quarter stood at $81.0 million, compared to $92.2 million in the same period last year. The Revelyst segments collectively saw a decrease in operating income, mainly due to lower gross profits and sustained increase in selling, general, and administrative costs. The Kinetic Group reported an operating income margin of 28.2%, maintaining a robust performance despite input cost pressures. Corporate and other unallocated costs saw a slight improvement, reflecting gains from the divestiture of the RCBS business and restructuring initiatives.

Vista Outdoor closed the quarter with $55.98 million in cash and cash equivalents, down from $60.27 million at the end of the previous fiscal year. The decrease in cash position was mainly due to the repayment of $85 million under the company's 2022 ABL Revolving Credit Facility, facilitated by cash generated from operating activities and proceeds from the RCBS business sale. The companys total debt decreased to $635 million from $720 million, reflecting a strategic focus on debt reduction. Notably, there was an increase in operating cash flow to $53.8 million from $73.7 million in the same period last year, attributed to efficient working capital management and divestiture proceeds.

The company has rolled out the GEAR Up transformation program aimed at enhancing efficiency and cost savings within the Revelyst segments. This program is expected to yield $100 million in run-rate cost savings by fiscal 2027, with $5 million already realized in the current quarter. Vista Outdoor also announced a definitive agreement to sell The Kinetic Group to Czechoslovak Group a.s. for an enterprise value of $2.15 billion, subject to closing conditions and stockholder approval. Enhanced strategic flexibility and potential benefits from this sale are anticipated, although the final impact will depend on market conditions and execution of divestiture plans.

Environmental liabilities and legal proceedings are under control, with no material adverse effects expected from ongoing obligations. The company continues to monitor and mitigate risks associated with environmental compliance and legal exposures. Overall, Vista Outdoor maintains a strong balance sheet and liquidity position, reinforcing its ability to navigate market challenges and capitalize on growth opportunities through strategic initiatives and ongoing restructuring efforts.

Vista Outdoor Inc. (NYSE: VSTO) stands as a pivotal entity in the American gun and ammunition market, significantly influencing the U.S. economy. As part of an industry that generated over $90 billion in economic output in 2023, up from $80.7 billion in 2022, Vista Outdoors dual-segment operations via Revelyst and The Kinetic Group illustrate the company's robust economic footprint. Despite a 7.1% year-over-year decline in overall sales to $644.2 million in Q1 FY25, Vista Outdoors extensive reach into sporting and outdoor products remains a testament to its enduring market relevance.

The downturn in sales did see some internal differentiations; The Kinetic Group reported revenues of $370 million, while Revelyst contributed $274 million. This division within the portfolio showcases the companys ability to cater to a diverse consumer base. Vista Outdoors centrality within a resilient industry, perpetually buoyed by socio-political factors and the ingrained gun culture in the U.S., continues to provide a secure hedge against market volatilities.

However, the companys path has not been without challenges. Supply chain disruptions and increased input costs have pressured profitability metrics. Nevertheless, strategic initiatives like the GEAR Up program, with a realized saving of $5 million and a target of $25-30 million for FY25, underscore a committed approach toward enhancing operational efficiencies. Such proactive strategies represent the companys resolve to adapt and thrive amid logistical hurdles.

Among the notable successes, a $3.6 million order from the United States military for 7.62x51 Long Range ammunition has positively impacted revenue streams while bolstering Vista Outdoors standing in both civilian and defense markets. This contract, along with a notable surge of nearly 35% in stock value this year, partially fueled by acquisition bids, indicates robust investor confidence and a promising growth trajectory despite the present-day market fluctuations.

The company's latest endeavours include maneuvers in the leisure products sector, exhibiting trends typical within this domain. According to a recent report covering Q2 performance, Vista Outdoor showed revenues of $644.2 milliona 7.1% drop year-on-yearwhile slightly surpassing earnings expectations, reflecting underlying strengths in operational efficiencies. Despite experiencing broader market turbulence, the stock experienced a rise of 4.6% post-announcement, signifying investor sentiment favoring Vista Outdoors resilience and strategic outlook.

The forecasted lower revenue guidance, despite cost control efficiencies, signals anticipated headwinds potentially influencing future quarters. This cautious sentiment underscores the necessity for continued strategic planning and scrutiny from investors as the company navigates the implications of inflation on consumer discretionary spendinga critical factor affecting the leisure product sector as a whole.

In a pivotal shift, the company's Board of Directors recently recommended a transaction with Czechoslovak Group a.s. (CSG) over a competing proposal from MNC Capital. This endorsement came after a meticulous review process initiated in May 2022 to maximize shareholder value. The decision entails divesting The Kinetic Group to CSG for $2.15 billion, surpassing MNCs valuation by approximately $250 million. Additionally, CSGs acquisition of a 7.5% stake in Revelyst for $150 million underscores a strategic alignment projected to benefit shareholders through immediate cash returns and potential future gains from Revelyst's growth.

Furthermore, ongoing discussions with a private equity firm partnered with MNC about a separate acquisition of Revelyst highlight Vista Outdoors dexterous navigation of complex market dynamics to optimize shareholder returns. The significant progress within Revelyst, marked by Adjusted EBITDA projections and cost-saving targets by fiscal year 2027, is indicative of this strategic foresight.

Vista Outdoors commitment to stakeholder value was evident in the recent strategic licensing partnership between Revelyst and 5 Horizons Group, focusing on CamelBak Proa product line aimed at enhancing worker hydration and safety. CamelBak Pro hopes to leverage CamelBaks expertise in hydration solutions to extend into industrial and construction sectors with practical, durable gear embedding hydration solutions. This initiative aligns with Vista Outdoor's mission to deliver innovative, performance-driven products.

As part of its journey towards corporate evolution, Vista Outdoor's Board is proactively urging shareholders to vote in favor of the CSG Transaction at a special meeting scheduled for September 27, 2024. The immediate cash consideration and shares of Revelyst offered in this deal represent a strategic advantage poised to realize significant value for stockholders.

Outlined in the company's recent communications, this transition highlights a careful balancing act of immediate financial returns and sustainable future growth. Investors are advised to stay abreast of company updates and proxy statements accessible via the SECs platform and Vista Outdoors official communications, to make well-informed decisions concerning this pivotal transaction.

For further insights and data references, interested parties can peruse the detailed announcements and the Board's comprehensive letter published on Yahoo Finance on September 20, 2024, urging stockholder participation to capitalize on these strategic opportunities.

Vista Outdoor Inc. (VSTO) has experienced fluctuations in its returns, which means its stock price has been quite volatile. The ARCH (Autoregressive Conditional Heteroskedasticity) model results show significant parameters that indicate periods of high volatility are often followed by higher volatility. The company's stock returns do not follow a trend, as reflected by the Zero Mean model, but there is notable clustering in volatility.

| Statistic | Value |

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3,297.98 |

| AIC | 6,599.96 |

| BIC | 6,610.23 |

| No. Observations | 1,256 |

| Df Residuals | 1,256 |

| omega | 8.1276 |

| std err (omega) | 1.647 |

| t-value (omega) | 4.933 |

| p-value (omega) | 8.085e-07 |

| 95% Conf. Int. (omega) | [4.899, 11.357] |

| alpha[1] | 0.4885 |

| std err (alpha[1]) | 0.208 |

| t-value (alpha[1]) | 2.344 |

| p-value (alpha[1]) | 1.908e-02 |

| 95% Conf. Int. (alpha[1]) | [8.003e-02, 0.897] |

| Covariance estimator | robust |

To analyze the financial risk of a $10,000 investment in Vista Outdoor Inc. (VSTO) over a one-year period, we employ an integrated approach combining volatility modeling and machine learning predictions. This combination helps in understanding both the stock's volatility and potential future returns.

Firstly, the volatility modeling aspect is utilized to understand the variability in VSTOs stock price. By modeling the historical price data, we calculate the daily volatility and assess how much the stock price is likely to fluctuate in the future. This helps in identifying periods of high and low volatility, allowing us to better gauge the risk involved with the investment.

On the other hand, machine learning predictions, specifically using the RandomForestRegressor algorithm, are implemented to forecast future returns. This algorithm analyzes patterns in the historical data including price movements, trading volume, and other relevant indicators. By doing so, it generates predictions about the future performance of VSTO's stock, informing us about potential gains or losses over time.

Through the integration of these methods, we are able to estimate the potential financial risk more comprehensively. Specifically, we assess the Value at Risk (VaR), which is a measure commonly used in risk management to quantify the amount of potential loss in an investment portfolio. For a $10,000 investment in VSTO, our analysis calculates an annual VaR at a 95% confidence level of $394.57. This implies that there is a 5% chance that the investment could lose at least $394.57 over a one-year period.

The combination of volatility modeling and machine learning predictions provides a robust framework for assessing the financial risk of equity investments. By understanding both the variability in stock prices and anticipating future returns, investors can make more informed decisions, balancing potential risks and rewards.

Long Call Option Strategy

When evaluating long call options for Vista Outdoor Inc. (VSTO), several metrics and "greeks" play a crucial role in determining the most profitable options. Below, we analyze various options based on their delta, gamma, vega, theta, and rho values to assess their risk, reward, and profitability.

Near-Term Options

Option 1: Expiration Date 2024-10-18, Strike Price $30.00

This call option features a delta of 0.9687, indicating that for every $1 increase in VSTO's stock price, the option price will increase by approximately $0.97. The gamma is relatively high at 0.0115, which suggests the delta will increase significantly with stock price changes, enhancing profits if the stock rises quickly. The vega of 0.7403 means that the option price is sensitive to volatility changes, where a 1% increase in volatility will raise the option price by about $0.74. The theta is -0.0112, reflecting a modest time decay. With a premium of $9.25 and an ROI of 0.1069, this option offers good profitability with a profit potential of $0.989. The relatively short time frame increases risk due to time decay and the necessity for the stock to move favorably within this period.

Option 2: Expiration Date 2024-11-15, Strike Price $32.50

This call option has a delta of 0.8707 and a high gamma of 0.0277, meaning its delta will increase significantly with stock price increases. Its vega of 3.1978 indicates substantial sensitivity to volatility, and a theta of -0.0176 reflects a more considerable time decay. With a premium of $6.7 and an ROI of 0.155, the profitability is evident with a potential profit of $1.039. The short-term nature implies that any unfavorable movement in the underlying stock will erode the option's value quickly.

Mid-Term Options

Option 3: Expiration Date 2024-12-20, Strike Price $27.50

This mid-term call option has a delta of 1.0, meaning the option price moves dollar-for-dollar with the stock price. The zero gamma indicates no further change in delta as the stock price moves. With no exposure to volatility (vega of 0.0) and minimal theta decay (-0.0028), this option is essentially highly in-the-money and stable. The premium is $7.2, presenting an impressive ROI of 0.7693 and a high potential profit of $5.539. This option is less risky due to its deep in-the-money status, making it a safer choice if the stock price moves as anticipated.

Long-Term Options

Option 4: Expiration Date 2025-01-17, Strike Price $25.00

With a delta of 1.0, gamma of 0.0, and vega of 0.0, this long-term call option is another deep in-the-money option. The theta is -0.0025, indicating minor time decay, and the rho of 0.0792 shows sensitivity to interest rate changes. The premium of $9.0 yields a significant ROI of 0.6932 and a profit potential of $6.239. The extended time frame decreases the immediate risk of time decay, offering a solid choice for holding until maturity.

Option 5: Expiration Date 2025-01-17, Strike Price $17.50

This option also has a delta of 1.0, gamma of 0.0, and vega of 0.0, signifying it moves in sync with the stock price without additional volatility risk. It boasts the lowest theta decay at -0.0018. The premium of $10.0 results in a remarkable ROI of 1.2739, making it the most profitable option with an impressive profit potential of $12.739. Given the deep in-the-money position and extended time to expiration, this option presents low risk with substantial upside potential, assuming the stock maintains or exceeds anticipated gains.

Conclusion

For near-term gains, the option expiring on 2024-10-18 with a $30.00 strike price stands out due to its profitable balance of delta, gamma, and vega, although it carries higher risk from volatility and time decay. The mid-term option expiring on 2024-12-20 with a $27.50 strike price offers a more stable high-profit potential with minimized risk thanks to its deep in-the-money status. For long-term positions, both options expiring on 2025-01-17with $25.00 and $17.50 strike pricesprovide excellent ROI and profit potential with reduced immediate risks, making them highly favorable for a strategic, longer-term investment.

Short Call Option Strategy

In analyzing the options chain for Vista Outdoor Inc. (VSTO), focusing on short call options, it's essential to balance maximizing profit while minimizing the risk of shares being assigned due to the option being in the money at expiration. The target stock price is set at 2% below the current market price, aiding in identifying the optimal positions. Here are five strategic short call options, varying from near-term to long-term, with key metrics assessed: expiration date, strike price, premium, delta, vega, theta, and return on investment (ROI).

- October 18, 2024, $40 Strike Price:

- Metrics: Delta: 0.4977, Gamma: 0.0703, Vega: 4.2004, Theta: -0.0453, Premium: $1.00, ROI: 100%, Profit: $1.00.

- Risk and Reward: This near-term option provides a significant ROI of 100%, with a moderate delta of 0.4977. Delta just under 0.5 indicates this option is close to being at the money, meaning the share assignment risk is moderate. Vega and theta values suggest sensitivity to volatility and time decay.

-

Profit and Loss Scenarios: The profit is capped at the premium received ($1.00). If VSTO falls just 2% below the current price or remains stagnant, the option expires worthless, resulting in a full premium profit. However, should the stock rise above $40, theres a risk of assignment, leading to potential losses depending on how much the stock price exceeds the strike price minus the premium received.

-

November 15, 2024, $40 Strike Price:

- Metrics: Delta: 0.5372, Gamma: 0.0398, Vega: 6.0271, Theta: -0.0385, Premium: $2.05, ROI: 100%, Profit: $2.05.

- Risk and Reward: Positioned slightly further out, this option still offers an excellent ROI of 100% with a slightly higher delta of 0.5372, indicating a greater likelihood of being in the money, thus carrying an increased risk of assignment.

-

Profit and Loss Scenarios: The profit potential is higher at $2.05. The risk of share assignment increases if the stock moves above $40. If the stock price remains below or close to the target 2% below the strike price ($39.20), the premium is fully retained.

-

December 20, 2024, $37.5 Strike Price:

- Metrics: Delta: 0.6543, Gamma: 0.0463, Vega: 7.1825, Theta: -0.0187, Premium: $3.59, ROI: 67.66%, Profit: $2.429.

- Risk and Reward: This medium-term options delta at 0.6543 suggests a higher probability of ending in the money. The Premium and profit are higher compared to nearer-term options. The risk of assignment remains notable, yet the premium compensates for the increased exposure.

-

Profit and Loss Scenarios: Profit potential stands at $2.429 if the option expires worthless. There is a high risk of assignment if the stock price exceeds the strike price ($37.50), resulting in potential losses depending on the stocks performance beyond $37.5 minus the premium.

-

January 17, 2025, $42.5 Strike Price:

- Metrics: Delta: 0.4478, Gamma: 0.0408, Vega: 8.8342, Theta: -0.0179, Premium: $1.55, ROI: 100%, Profit: $1.55.

- Risk and Reward: With a delta of 0.4478, this long-term option has a moderate probability of finishing in the money. The ROI remains at 100%, providing a substantial reward relative to the assignment risk.

-

Profit and Loss Scenarios: The maximum profit is $1.55. The risk of assignment is present but balanced given the moderate delta. Should VSTOs price remain around or below the adjusted target price, the gain is significant due to lower assignment risk.

-

February 21, 2025, $40 Strike Price:

- Metrics: Delta: 0.5441, Gamma: 0.0490, Vega: 10.0941, Theta: -0.0124, Premium: $2.50, ROI: 100%, Profit: $2.50.

- Risk and Reward: This longer-term option also features 100% ROI with a delta of 0.5441, indicating a higher potential for being in the money. Although the premium is higher, it aligns well with the increased risk inherent with longer durations.

- Profit and Loss Scenarios: The profit stands at $2.50 if the option expires worthless. The assignment risk needs careful monitoring as it elevates with duration. Position management and diligent market observation are vital to mitigate losses if VSTO exceeds $40 at expiration.

These options provide a spectrum of choices across various timelines with thoughtful balance between maximizing upfront premiums while controlling the potential downside risk. When selecting these candidates, considering an individual's risk tolerance, market outlook, and capital capacity is paramount to devising an effective short call strategy.

Long Put Option Strategy

Vista Outdoor Inc. (VSTO) has several long put options available that span a variety of expiration dates and strike prices. When analyzing these options, its critical to consider both the Greeks - Delta, Gamma, Theta, Vega, and Rho - as well as the overall market conditions and target stock price, which is projected to be 2% higher than the current price. Below, we will delve into five choices based on expiration date and strike price, keeping a balance between near-term and long-term options while highlighting the most profitable opportunities.

Firstly, let's consider a near-term option with an expiration date in the next month. A put option with an expiration date in this near future and a strike price close to the current stock price (slightly below it) is likely to have a relatively higher Delta, reflecting how sensitive the option price is to the underlying stock price movements. The Theta value of this option, representing time decay, will be significant given the short time to expiration. This option could produce quick returns if the stock dips just as anticipated. However, the closer to expiration, the greater the risk if the stock price does not move in the predicted direction swiftly, due to accelerated time decay.

For a moderately near-term option, lets consider an option with an expiration date two months out. A put option in this timeframe with a strike price slightly out-of-the-money (OTM) might be more suitable. This option will still have a substantial Delta, but Theta will be less aggressive compared to the very near-term option. The Gamma value, which represents the rate of change of Delta, will typically be higher for options near the money, indicating it can gain more responsiveness as it moves into the money. Though there's more time for the position to become profitable, it still requires vigilance due to moderate time decay.

Looking at a medium-term option, a put with an expiration date four months away and a deeper out-of-the-money (OTM) strike price provides an interesting proposition. The Vega value, which gauges sensitivity to volatility, becomes more critical here. These options benefit if market volatility increases. Rho, representing sensitivity to interest rate changes, usually has a smaller but noteworthy impact. This option offers a larger window to profit from substantial stock price movements downward, though the investor must be cautious of any significant theta decay over time.

A long-term option, say with an expiration date six months out and an at-the-money (ATM) strike price, provides a balance of lower immediate risk and substantial time value. Such an option generally has a lower Theta compared to near-term options, allowing more patience for the right market conditions to play out. It will have a moderate Delta and a Gamma that grows stronger as it progresses towards expiration, assuming it remains near the money. This long-term strategy trades potential quick profits for a more substantial cushion against adverse stock movements over time.

Lastly, a much longer-term option with an expiration date a year away deserves consideration. A put with a strike price thats out-of-the-money could represent a leveraged position on a significant downturn expectation. Vega plays a significant role, making these options suitable for environments where increased market volatility is anticipated within the long horizon. With minimal immediate Theta depreciation, these are safer in terms of time decay but require a strong conviction that a downturn in the stock price will materialize. Given their long duration, they also offer protection against smaller market shifts, offering flexibility and time on the investor's side.

In all these cases, the options within their respective time frames carry specific risk/reward profiles. Near-term options are riskier due to higher Theta but can provide quick returns. Medium to long-term options allow for more time, balancing risks of time decay with the potential for profit from significant underlying stock price movements. The most profitable options inherently depend on balancing these Greeks with the investors risk tolerance, market outlook, and strategic goals.

Short Put Option Strategy

Analysis of Short Put Options for Vista Outdoor Inc. (VSTO)

When analyzing short put options for profitability, several factors come into play, including the premium received, the risk of shares being assigned (i.e., the option being in the money), and the Greeks values, particularly delta, which indicates the likelihood of the option being exercised. To maximize profitability while minimizing the risk of assignment, options with favorable Greeks and premium values need to be selected.

1. Near-Term Option (2024-10-18, Strike Price $37.50)

- Premium Received: $0.90

- Delta: -0.307

- Theta: -0.0308

- Gamma: 0.0739

- ROI: 100%

- Risk and Reward: This option provides an attractive premium and a manageable delta, implying a decent 30.7% probability that the option will end in the money. While relatively higher in assignment risk than deeper out-of-the-money options, it provides a full premium yield if the stock price remains above the strike price.

- Profit Scenario: If the stock price stays above $37.50, the maximum profit is $0.90. If the share price falls significantly below $37.50, the risk involves buying the shares at $37.50 - potentially higher than market value, reducing effective ROI.

2. Intermediate-Term Option (2024-11-15, Strike Price $37.50)

- Premium Received: $0.65

- Delta: -0.333

- Theta: -0.0198

- Gamma: 0.0574

- ROI: 100%

- Risk and Reward: This option offers a mix of relatively high volatility (reflected in the somewhat high delta) and a favorable premium. Vega is high, suggesting sensitivity to changes in volatility which can be advantageous in uncertain markets.

- Profit Scenario: If the stock remains above $37.50, the entire premium is retained. The delta indicates a 33.3% chance of assignment, which is a moderate risk for a significant return.

3. Longer-Term Option (2024-12-20, Strike Price $37.50)

- Premium Received: $1.80

- Delta: -0.335

- Theta: -0.0129

- Gamma: 0.0517

- ROI: 100%

- Risk and Reward: This option stands out with a high premium, justifying the higher assignment risk indicated by the delta. The time decay is slower compared to shorter-term options, making it less attractive for time-sensitive strategies but beneficial if the stocks price stabilizes.

- Profit Scenario: The high premium provides substantial profit, assuming the price stays above $37.50. If assigned, the effective purchase price adjusted by the premium improves positioning.

4. Extended-Term Option (2025-01-17, Strike Price $35.00)

- Premium Received: $1.00

- Delta: -0.198

- Theta: -0.0072

- Gamma: 0.0407

- ROI: 100%

- Risk and Reward: Offers a balanced risk/reward profile with a lower delta, indicating a lower probability of assignment. The huger term provides better market stability insights.

- Profit Scenario: Collecting a stable premium of $1.00 is lucrative with a relatively low risk of assignment given the delta. Holding till expiration, with the premium received, ideally aligns with less volatile broader market movements.

5. Long-Duration Option (2025-02-21, Strike Price $37.50)

- Premium Received: $1.45

- Delta: -0.343

- Theta: -0.0093

- Gamma: 0.0405

- ROI: 100%

- Risk and Reward: Higher delta implies a slightly higher risk of assignment. Nevertheless, the premium is robust, well-compensating for the increased risk.

- Profit Scenario: Earning $1.45 incurs a decent return even considering the chances of being assigned, making it attractive especially if the intuition on low volatility or bullish market holds true.

Conclusion:

All five options offer attractive ROIs and premiums with varying levels of assignment risk. To minimize risk of having shares assigned, the Delta value should guide the decision process avoiding extremely high values ensures the strike price is not reached or breached. For those aggressive on returns with tolerable risk, near-term options such as the October 2024 $37.50 option stand beneficial. For conservative positions, extending to 2025 with lower deltas may prove favorable.

This balance between premium earnings and managing assignment risk provides a portfolio diversified across different expiration dates and moderate strike prices, holding promise for substantial yields under the assumption of market stability or slight bullish trends.

Vertical Bear Put Spread Option Strategy

Analysis of Vertical Bear Put Spread Strategy for Vista Outdoor Inc. (VSTO)

The goal of a vertical bear put spread is to profit from a decline in the price of a security by buying a higher strike put option and selling a lower strike put option. Given the target stock price range of 2% over or under the current stock price, we'll analyze various expiration dates and strike prices to determine the most profitable and low-risk strategies.

Near-Term Expiration: October 18, 2024

Short Put at 37.5, Long Put at 35.0

- Short Put (37.5, Oct 2024):

- Delta: -0.3077

- Premium: $0.90

- Profit: $0.90

- Long Put (35.0, Oct 2024):

- No data available. Assumed premium cost is higher than the short put premium.

Potential Profit/Loss Scenarios: - Maximum Profit: Occurs if the stock price falls below the lower strike price (35.0). The profit is the difference between the strike prices (37.5-35.0 = $2.50) minus the net premium paid for the strategy. - Maximum Loss: Occurs if the stock price stays above the higher strike price (37.5). The loss is the net premium paid for entering the strategy.

Mid-Term Expiration: November 15, 2024

Short Put at 40.0, Long Put at 37.5

- Short Put (40.0, Nov 2024):

- Delta: -0.4822

- Premium: $1.50

- Profit: $0.16

- Long Put (37.5, Nov 2024):

- No data available. Assumed premium cost is around the profit of the short put premium.

Though the delta is higher for the 40.0 short put, which means a higher risk of assignment if the stock price declines sharply.

Potential Profit/Loss Scenarios: - Maximum Profit: $(40-37.5) - net premium, - Maximum Loss: Net premium paid.

Longer-Term Expiration: December 20, 2024

Short Put at 37.5, Long Put at 35.0

- Short Put (37.5, Dec 2024):

- Delta: -0.3357

- Premium: $1.80

- Profit: $1.80

- Long Put (35.0, Dec 2024):

- No data available. Costs are likely to remain higher than the short put premium.

Potential Profit/Loss Scenarios: - Maximum Profit: $(37.5-35) - net premium, - Maximum Loss: Net premium paid.

Even Longer-Term Expiration: January 17, 2025

Short Put at 32.5, Long Put at 30.0

- Short Put (32.5, Jan 2025):

- Delta: -0.1844

- Premium: $0.95

- Profit: $0.95

- Long Put (30.0, Jan 2025):

- Delta: -0.1439, Premium: $0.95

Potential Profit/Loss Scenarios: - Maximum Profit: $(32.5-30) - net premium, - Maximum Loss: Net premium paid.

Longest-Term Expiration: February 21, 2025

Short Put at 35.0, Long Put at 32.5

- Short Put (35.0, Feb 2025)

- Delta: -0.1979

- Premium: $0.90

- Profit: $0.90

- Long Put (32.5, Feb 2025)

- Likely Delta: Similar to earlier long puts

Potential Profit/Loss Scenarios: - Maximum Profit: $(35-32.5) - net premium, - Maximum Loss: Net premium paid.

Summary

- October 18, 2024, 37.5 Short Put & Assumed 35 Long Put

- Risks: Higher deltas indicating risk of assignment.

-

Rewards: Decent profit with shorter holding period.

-

November 15, 2024, 40 Short Put & Assumed 37.5 Long Put

- Risks: Higher premium paid for reduced risk.

-

Rewards: Less risk of assignment but lower potential profit.

-

December 20, 2024, 37.5 Short Put & Assumed 35 Long Put

- Risks: Moderate.

-

Rewards: Attractive based on good profit potential.

-

January 17, 2025, 32.5 Short Put & 30 Assumed Long Put

- Risks: Longer hold, slightly lower assignment risk.

-

Rewards: Balanced return with lower premium.

-

February 21, 2025, 35 Short Put & Assumed 32.5 Long Put

- Risks: Longer expiration, lesser premium.

- Rewards: Longest duration for broader market outlook adjustments.

Each strategy balances risk and reward based on the time to expiration and strike price differential. The choice will hinge on the trader's risk tolerance and market sentiment over the intended duration.

Vertical Bull Put Spread Option Strategy

When considering a vertical bull put spread strategy for Vista Outdoor Inc. (VSTO), the key factors to assess include the net credit received, the probability of the spread expiring worthless (and thus achieving maximum profit), the risk of having shares assigned, and the time decay impact. This strategy involves selling a put option at a higher strike price while simultaneously buying another put option at a lower strike price, both with the same expiration date. Since the goal is to minimize the risk of having shares assigned, attention should be paid to the delta of the short put options, ensuring they are farthest from being in-the-money (ITM).

Near-Term Expiry: October 18, 2024

- Short Put (Strike 35.0)

- Delta: -0.1627, Premium: $0.43

- Gamma: 0.0467, Vega: 2.5898, Theta: -0.0242, Rho: -0.0049

- Profit Potential: $0.43, ROI: 100%

Analysis: This short put has a relatively low delta, indicating a lower probability of the option being exercised. The premium of $0.43 provides a modest profit. Given the low delta, the risk of assignment is minimal. The vertical bull put spread would minimize the risk further by buying a put at a lower strike price, for instance, at $32.5.

Mid-Term Expiry: November 15, 2024

- Short Put (Strike 37.5)

- Delta: -0.3334, Premium: $0.65

- Gamma: 0.0574, Vega: 5.5178, Theta: -0.0198, Rho: -0.0217

- Profit Potential: $0.65, ROI: 100%

Analysis: With a mid-range delta and a fair premium, this option offers a higher profit potential. However, the delta indicates a moderate risk of shares being assigned. Pairing this with a long put at a lower strike (e.g., $35) would hedge the risk and maximize the spread's profitability by capturing the premium difference.

Longer-Term Expiry: December 20, 2024

- Short Put (Strike 37.5)

- Delta: -0.3357, Premium: $1.80

- Gamma: 0.0518, Vega: 7.1031, Theta: -0.0129, Rho: -0.0365

- Profit Potential: $1.80, ROI: 100%

Analysis: This option has a higher delta similar to the previous month's option, but provides a significantly higher premium. It suggests a higher likelihood of assignment but offers excellent profit potential. Combining this with a long put at a $35 strike could result in an optimal hedge, reducing the risks associated with it being ITM while still profiting from the premium disparity.

Extended-Term Expiry: January 17, 2025

- Short Put (Strike 37.5)

- Delta: -0.3472, Premium: $1.15

- Gamma: 0.0421, Vega: 8.2491, Theta: -0.0122, Rho: -0.0514

- Profit Potential: $1.15, ROI: 100%

Analysis: This pick provides a good balance with a relatively higher delta but still moderate. The premium of $1.15 is compelling, and the higher gamma indicates increased sensitivity to price changes, which is beneficial in volatile market conditions. The optimal strategy would pair this with a long put at a lower strike, like $35, to keep risks moderated.

Long-Term Expiry: February 21, 2025

- Short Put (Strike 37.5)

- Delta: -0.3434, Premium: $1.45

- Gamma: 0.0406, Vega: 9.3636, Theta: -0.0093, Rho: -0.0663

- Profit Potential: $1.45, ROI: 100%

Analysis: This option exhibits a slightly lower delta than the January expiry but offers a higher premium. The significant positive vega represents greater exposure to volatility changes, making this option attractive should the stock become more volatile. A vertical spread here would suitably hedge against sharp declines by purchasing a lower strike put, such as $35.

Conclusion

Taking all factors into account, here are the top five options strategies based on expiration date and strike price:

- Short Put at $35 Expiring October 18, 2024: Low risk of assignment, moderate premium.

- Short Put at $37.5 Expiring November 15, 2024: Balanced risk and high premium.

- Short Put at $37.5 Expiring December 20, 2024: Moderate risk with substantial premium.

- Short Put at $37.5 Expiring January 17, 2025: Higher premium, moderate risk.

- Short Put at $37.5 Expiring February 21, 2025: Highest premium with controlled risk based on delta.

Each choice involves selling the higher strike put and buying a correspondingly lower strike put to establish a vertical spread. This method effectively limits losses while maximizing potential gains. The delta values are crucial here to ensure the short puts are least likely to be ITM, thereby minimizing the risk of having shares assigned.

Vertical Bear Call Spread Option Strategy

A vertical bear call spread strategy involves selling a higher strike call option and buying a lower strike call option with the same expiration date. This strategy profits if the underlying stock price stays below the short call strike price, as the premium received from the short call offsets the cost of the long call, leading to a net credit.

Given that we want to minimize the risk of having shares assigned, we should aim to sell call options that are out-of-the-money (OTM) to reduce the likelihood of assignment. We'll focus on spreads where the short call has a lower delta, which indicates a lower probability of ending up in-the-money (ITM). Moreover, with a target stock price 2% over or under the current price, we need to account for the likelihood that these options will expire worthless, maximizing our premium collection.

Here are five different vertical bear call spread strategies across various expiration dates for Vista Outdoor Inc. (VSTO):

Near-Term Expiration (2024-10-18)

- Strike Prices: 37.5 / 40.0

- Short Call (Strike: 37.5, Expire: 2024-10-18)

- Delta: 0.6581

- Premium: $2.92

- Long Call (Strike: 40.0, Expire: 2024-10-18)

- Delta: 0.4977

- Premium: $1.00

- Net Credit: $1.92

- Max Profit: $1.92

- Max Loss: $1.58

This spread offers a moderate risk-reward balance with a net credit of $1.92, aiming to profit if the stock price stays below $37.5 by expiration.

Medium-Term Expiration (2024-11-15)

- Strike Prices: 40.0 / 42.5

- Short Call (Strike: 40.0, Expire: 2024-11-15)

- Delta: 0.5372

- Premium: $2.05

- Long Call (Strike: 42.5, Expire: 2024-11-15)

- Delta: 0.3736

- Premium: $1.00

- Net Credit: $1.05

- Max Profit: $1.05

- Max Loss: $1.45

This spread has a slightly higher max loss than some near-term options but provides a decent safety buffer with the long call at $42.5.

Mid-Term Expiration (2024-12-20)

- Strike Prices: 42.5 / 45.0

- Short Call (Strike: 42.5, Expire: 2024-12-20)

- Delta: 0.4301

- Premium: $1.05

- Long Call (Strike: 45.0, Expire: 2024-12-20)

- Delta: 0.3422

- Premium: $0.03

- Net Credit: $1.02

- Max Profit: $1.02

- Max Loss: $1.48

With a low delta for both calls, this spread minimizes the probability of assignment while providing a comfortable net credit and maximum profit outlook.

Long-Term Expiration (2025-01-17)

- Strike Prices: 37.5 / 40.0

- Short Call (Strike: 37.5, Expire: 2025-01-17)

- Delta: 0.6465

- Premium: $3.05

- Long Call (Strike: 40.0, Expire: 2025-01-17)

- Delta: 0.5350

- Premium: $1.85

- Net Credit: $1.20

- Max Profit: $1.20

- Max Loss: $1.80

This longer-term spread offers a safer expiry cushion, reducing the chance of the stock drifting into assignment territory.

Extended-Term Expiration (2025-02-21)

- Strike Prices: 40.0 / 45.0

- Short Call (Strike: 40.0, Expire: 2025-02-21)

- Delta: 0.5441

- Premium: $2.50

- Long Call (Strike: 45.0, Expire: 2025-02-21)

- Delta: 0.2733

- Premium: $0.30

- Net Credit: $2.20

- Max Profit: $2.20

- Max Loss: $2.80

This longer expiration offers a higher net credit and significant profit potential but carries a slightly higher maximum loss risk.

These vertical bear call spreads offer a range of profit and loss scenarios, balancing potential returns with minimized risk of assignment. Selecting options with appropriate delta values and expiration dates reflect our goal to capitalize on a stable or slightly bearish view of VSTO's stock price while managing risk effectively.

Vertical Bull Call Spread Option Strategy

When designing a vertical bull call spread strategy for Vista Outdoor Inc. (VSTO), the key is to balance profitability against the risk of assignment, especially since you want to minimize the latter by focusing on out-of-the-money (OTM) options. For a bullish outlook where the target stock price is 2% over or under the current price, a vertical bull call spread involves buying a lower-strike call option and selling a higher-strike call option with the same expiration date.

Choice 1: Near-Term Expiration (2024-10-18)

Strike Prices: Buy 37.5 Call, Sell 40 Call - Greeks for 37.5 Call (Long): - Delta: 0.6580 - Gamma: 0.0567 - Vega: 3.8663 - Theta: -0.0480 - Premium: $2.92 - Greeks for 40 Call (Short): - Delta: 0.4977 - Gamma: 0.0703 - Vega: 4.2004 - Theta: -0.0453 - Premium: $1.00

Analysis: This near-term option spread is affordable with a net cost of $1.92 ($2.92 - $1.00). The risk of assignment is minimal since both options are slightly out of the money. The potential profit is capped at $1.08 ($2.92 - $1.00) if VSTO trades above $40 by expiration. The profit potential is moderate, whereas the chance of assignment is relatively low given the OTM positions.

Choice 2: Mid-Term Expiration (2024-11-15)

Strike Prices: Buy 35 Call, Sell 37.5 Call - Greeks for 35 Call (Long): - Delta: 0.7167 - Gamma: 0.0292 - Vega: 5.1372 - Theta: -0.0385 - Premium: $5.80 - Greeks for 37.5 Call (Short): - Delta: 0.6339 - Gamma: 0.0349 - Vega: 5.7089 - Theta: -0.0395 - Premium: $3.53

Analysis: The mid-term spread with a higher delta provides a better chance that the options move into the money. The net cost is $2.27 ($5.80 - $3.53). The maximum potential profit when both options are in the money at expiration is $0.73 ($2.27 risk for $3.00 max return). The profit range is higher, although the assignment risk remains minimal due to initial OTM positioning.

Choice 3: Longer-Term Expiration (2024-12-20)

Strike Prices: Buy 32.5 Call, Sell 35 Call - Greeks for 32.5 Call (Long): - Delta: 0.7639 - Gamma: 0.0202 - Vega: 6.0022 - Theta: -0.0284 - Premium: $8.60 - Greeks for 35 Call (Short): - Delta: 1.0 - Gamma: 0.0 - Vega: 0.0 - Theta: -0.0035 - Premium: $6.70

Analysis: With an extended expiration, this spread costs $1.90 ($8.60 - $6.70). Profit is capped at $1.10 if VSTO moves above $35. This option setup has a higher risk but offers a balanced delta scenario. The longer duration provides more opportunity for the stock to appreciate, leading to higher profitability while remaining relatively safe from early assignment due to OTM status.

Choice 4: Very Long-Term Expiration (2025-01-17)

Strike Prices: Buy 30 Call, Sell 32.5 Call - Greeks for 30 Call (Long): - Delta: 0.8082 - Gamma: 0.0158 - Vega: 6.0953 - Theta: -0.0222 - Premium: $9.50 - Greeks for 32.5 Call (Short): - Delta: 0.8348 - Gamma: 0.0261 - Vega: 5.5495 - Theta: -0.0126 - Premium: $7.68

Analysis: This spread, with the longest expiration date, requires a net investment of $1.82 ($9.50 - $7.68). Maximum profit is $1.18 if VSTO moves above $32.5. It provides ample time for the stock to appreciate, and although assignment risk is lower due to OTM positioning, it must be monitored as expiration approaches.

Choice 5: Extended Long-Term Expiration (2025-02-21)

Strike Prices: Buy 35 Call, Sell 37.5 Call - Greeks for 35 Call (Long): - Delta: 0.7295 - Gamma: 0.0289 - Vega: 8.4250 - Theta: -0.0147 - Premium: $6.00 - Greeks for 37.5 Call (Short): - Delta: 0.6449 - Gamma: 0.0319 - Vega: 9.4785 - Theta: -0.0163 - Premium: $3.30

Analysis: The cost of this spread is $2.70 ($6.00 - $3.30). It can return $2.30 if VSTO is above $37.5 by expiration. The extended period allows favorable stock movements, and the options are well into the OTM range initially, minimizing assignment risk early on but should be tracked as expiration approaches and if VSTO appreciates significantly.

Conclusion

These five choices span different expiration dates, allowing you to balance between immediate gains and longer-term strategic positions. While shorter terms have quicker expiration and slightly lower risks, longer terms provide better opportunities for significant stock appreciation and higher returns. By focusing on options that are OTM, you minimize early assignment risk and have a structured approach to capturing upside potential with capped risk exposure.

Spread Option Strategy

The calendar spread options strategy involves buying and selling options with the same strike price but different expiration dates. This strategy is primarily designed to capitalize on the differential time decay of options' premiums. In this context, we will explore a specific calendar spread strategy framework, where a call option is purchased and a put option is sold. Given the data provided and the target stock price range of 2% over or under the current price, our goal is to balance profitability and risk of shares being assigned.

- 2024-10-18 Expiry Call (Strike: $20.0) and 2024-11-15 Expiry Put (Strike: $27.5):

- Call Option:

- Delta: 0.9486, Gamma: 0.0054, Vega: 1.1103, Theta: -0.0412, Rho: 0.0124

- Premium: $19.04, ROI: 0.06297, Profit: $1.199

- Put Option:

- Delta: -0.0756, Gamma: 0.0127, Vega: 2.1614, Theta: -0.0144, Rho: -0.0050

- Premium: $0.1, ROI: 100%, Profit: $0.1

-

Analysis:

- The call option is in-the-money (ITM) with a high delta, indicating a high probability of assignment if the stock price increases. However, the put options very low delta suggests minimal risk of assignment. This combination maximizes the premium collected from the put while providing a potential upside from the long call.

-

2024-12-20 Expiry Call (Strike: $25.0) and 2024-12-20 Expiry Put (Strike: $32.5):

- Call Option:

- Delta: 0.8989, Gamma: 0.0102, Vega: 3.4453, Theta: -0.0193, Rho: 0.0482

- Premium: $14.38, ROI: 0.05974, Profit: $0.859

- Put Option:

- Delta: -0.2221, Gamma: 0.0221, Vega: 5.7995, Theta: -0.0214, Rho: -0.0264

- Premium: $4.8, ROI: 100%, Profit: $4.8

-

Analysis:

- This combination offers a notable premium from the sold put option. The puts delta indicates a moderate risk of assignment, but the higher premium compensates for this risk. The call option offers a lower delta, reducing the likelihood of assignment risk while still providing a respectable profit potential.

-

2025-01-17 Expiry Call (Strike: $22.5) and 2025-01-17 Expiry Put (Strike: $32.5):

- Call Option:

- Delta: 1.0, Gamma: 0.0, Vega: 0.0, Theta: -0.0023, Rho: 0.0713

- Premium: $10.0, ROI: 0.7739, Profit: $7.739

- Put Option:

- Delta: -0.1844, Gamma: 0.0251, Vega: 5.9499, Theta: -0.0112, Rho: -0.0272,

- Premium: $0.95, ROI: 100.0%, Profit: $0.95

-

Analysis:

- The call option with a delta of 1.0 indicates significant assignment risk if the stock price increases, but it also provides a substantial ROI. The put option selected has a moderate delta and provides a decent premium, balancing profitability and reduced risk.

-

2025-02-21 Expiry Call (Strike: $35.0) and 2025-02-21 Expiry Put (Strike: $37.5):

- Call Option:

- Delta: 1.0, Gamma: 0.0, Vega: 0.0, Theta: -0.0025, Rho: 0.0792

- Premium: $9.0, ROI: 0.6932, Profit: $6.239

- Put Option:

- Delta: -0.3434, Gamma: 0.0406, Vega: 9.3636, Theta: -0.0093, Rho: -0.0663

- Premium: $1.45, ROI: 100.0%, Profit: $1.45

-

Analysis:

- This combination involves a call with full delta, providing significant profit but high assignment risk. The put option with a higher delta indicates increased assignment risk, but the collected premium is considerable.

-

2024-12-20 Expiry Call (Strike: $15.0) and 2024-12-20 Expiry Put (Strike: $25.0):

- Call Option:

- Delta: 1.0, Gamma: 0.0, Vega: 0.0, Theta: -0.0015, Rho: 0.0475

- Premium: $18.49, ROI: 0.3650, Profit: $6.749

- Put Option:

- Delta: -0.0727, Gamma: 0.0096, Vega: 2.6942, Theta: -0.0109, Rho: -0.0083

- Premium: $0.3, ROI: 100.0%, Profit: $0.3

- Analysis:

- The call option here offers a large premium and profit potential, but with it comes high assignment risk. Conversely, the put option with a very low delta significantly reduces assignment risk and still offers a satisfactory premium.

Quantified Risks and Rewards:

Each of these choices balances profitability and risk in both the long call and short put options. The simplest way to minimize risk is to focus on calls with delta closer to 1 and puts with deltas lower than 0.2. For higher profitability, it's essential to select combinations that provide sizeable premiums while balancing the risk of assignments. Ultimately, these five choices represent a diversified array of expiry dates and strike prices that align with the calendar spread strategy goalmaximizing time decay differential while controlling risk exposure.

Calendar Spread Option Strategy #1

To devise the most profitable calendar spread options strategy for Vista Outdoor Inc. (VSTO), we must pay close attention to the Greeks and the mechanics of both the put options we intend to buy and the call options we intend to sell. When deploying a calendar spread, one typically buys a longer-term option (be it call or put) and sells a shorter-term option with the same strike price. However, in this case, we are exploring a mixed calendar spread where we buy a put and sell a call with different expiration dates.

With a symmetrical delta, we mitigate drastic changes in the stock price, while a high positive gamma can cause significant sensitivities to price movements which we must be wary of, especially if we want to avoid early assignments. Vega's role in volatility and theta's decay are key, particularly when options are held until expiration.

Choice 1: Short Call (Strike: 37.5, Expire: 2024-10-18) and Long Put

For the short call expiring on October 18, 2024, with a strike of 37.5, the delta of 0.6580649194 suggests a strong in-the-money (ITM) likelihood if the stock rises 2%. The premium is $2.92, accruing a strong ROI. Its high gamma (0.0567310622) and vega (3.8662854323) signify significant volatility sensitivity. While the theta decay at -0.0479845346 suggests decent time decay, the high delta risk offers substantial assignment risk if ITM, which we might need to hedge.

Choice 2: Short Call (Strike: 40.0, Expire: 2024-11-15) and Long Put

The short call with a strike of 40.0 expiring on November 15, 2024, offers another interesting option. It has a delta of 0.5372252247, indicating a smaller probability of being ITM versus the 37.5 strike. Its premium at $2.05 yields a high ROI of 100%. The vega of 6.0271413002 and gamma at 0.0398289713 show it is highly sensitive to volatility changes. The theta at -0.038452248 signifies moderate time decay benefits. The balance here minimizes early assignment risks compared to the high delta options, making this a potentially profitable and less risky strategy.

Choice 3: Short Call (Strike: 30.0, Expire: 2024-12-20) and Long Put

A short call with a 30.0 strike expiring on December 20, 2024, gives a high delta (0.8684430033) suggesting it is likely to be ITM. Although the premium at $12.0 offers a high ROI of 27.825, it carries significant assignment risk. The high vega (4.1550145855) and theta (-0.0161524018) signal substantial volatility and time decay benefits but require careful monitoring before it approaches ITM.

Choice 4: Short Call (Strike: 37.5, Expire: 2025-01-17) and Long Put

This longer-term option strategy involves a January 17, 2025, expiration date with a strike of 37.5. The delta at 0.64654175 indicates a strong likelihood of becoming ITM. The premium collected is $3.05 with an ROI of 61.9344262295. Its vega at 8.3024080929 and theta at -0.0176971437 show significant exposure to volatility and time decay. The balance in gamma and substantial premium offer potential profits but again, handle the high delta risk carefully.

Choice 5: Short Call (Strike: 40.0, Expire: 2025-02-21) and Long Put

The final strategy looks at the call expiring on February 21, 2025, with a 40.0 strike. The delta of 0.5440940885 indicates a fair likelihood of not being ITM if the stock price trend doesn't change drastically. With a premium of $2.5 and ROI of 100%, it balances profit potential with assignment risk. High gamma (0.0489963513), vega (10.094128612), and theta (-0.0124149752) show substantial sensitivity to volatility which can be a double-edged sword. The high premium offsets the risk of assignment considerably.

Conclusion

Overall, the aforementioned strategies offer a range of risk and reward balances, with some focusing on higher volatility benefits (vega) and others on time decay (theta). Beginners might prefer options with lower delta to minimize assignment risk, while more experienced traders might exploit high vega and gamma combinations for larger premiums. Long-term options offer the advantage of capturing time decay and volatility premiums, while shorter-term options may provide more immediate profit opportunities.

Calendar Spread Option Strategy #2

In constructing a calendar spread options strategy for Vista Outdoor Inc. (VSTO), we aim to maximize the profit potential while mitigating the risk of having shares assigned. Given our scenario, where we sell a put option and buy a call option at different expiration dates, we need to evaluate the Greeks, especially Delta, Gamma, Vega, Theta, and Rho, to make informed choices. The strategy will involve options with various expiration dates to balance short-term and long-term exposure.

Option Choice 1: Near Term - October 18, 2024

Sold Put Option:

- Strike: $37.5

- Greeks: $\Delta$ = 0.6581, $\Gamma$ = 0.0567, $\Vega$ = 3.8663, $\Theta$ = -0.0480, $\Rho$ = 0.0159

- Premium: $2.92

- ROI: 60.24%

- Profit: $1.759

Bought Call Option:

- Strike: $20.0

- Greeks: $\Delta$ = 0.9741, $\Gamma$ = 0.0039, $\Vega$ = 0.9125, $\Theta$ = -0.0105, $\Rho$ = 0.0277

- Premium: $20.6

- ROI: 9.41%

- Profit: $1.939

For a near-term strategy, selling the put at a $37.5 strike price offers relatively high premiums with a robust ROI of 60.24%. However, the high Delta of 0.6581 indicates a significant risk of the option being in the money, which could lead to shares being assigned. To hedge this risk, we buy a call option at the $20.0 strike price with a lower Delta of 0.9741, which implies less fluctuation in the price due to market movements. This combination helps offset the assignment risk and balances the Vega sensitivity.

Option Choice 2: Intermediate Term - November 15, 2024

Sold Put Option:

- Strike: $40.0

- Greeks: $\Delta$ = 0.5372, $\Gamma$ = 0.0398, $\Vega$ = 6.0271, $\Theta$ = -0.0385, $\Rho$ = 0.0257

- Premium: $2.05

- ROI: 100%

- Profit: $2.05

Bought Call Option:

- Strike: $32.5

- Greeks: $\Delta$ = 0.8707, $\Gamma$ = 0.0277, $\Vega$ = 3.1978, $\Theta$ = -0.0176, $\Rho$ = 0.0395

- Premium: $6.7

- ROI: 8.04%

- Profit: $0.539

For the intermediate term, selling the put at the $40.0 strike price, with a premium of $2.05 and a perfect ROI of 100%, presents a high profit potential. The Delta of 0.5372 lessens the risk of assignment compared to higher Delta values. The bought call at the $32.5 strike price offers downside protection. With a Delta of 0.8707, there is still significant exposure, but the balanced Theta and Vega indicate comparatively lower time decay and volatility risk.

Option Choice 3: Medium Term - December 20, 2024

Sold Put Option:

- Strike: $37.5

- Greeks: $\Delta$ = 0.6543, $\Gamma$ = 0.0463, $\Vega$ = 7.1825, $\Theta$ = -0.0187, $\Rho$ = 0.0523

- Premium: $3.59

- ROI: 67.66%

- Profit: $2.429

Bought Call Option:

- Strike: $35.0

- Greeks: $\Delta$ = 1.0, $\Gamma$ = 0.0, $\Vega$ = 0.0, $\Theta$ = -0.0035, $\Rho$ = 0.0846

- Premium: $6.7

- ROI: 45.36%

- Profit: $3.039