Vanguard Total Stock Market ETF (ticker: VTI)

2023-12-28

The Vanguard Total Stock Market ETF (ticker: VTI) is a widely recognized exchange-traded fund (ETF) that offers investors exposure to a broad swath of the U.S. equity market by seeking to track the performance of the CRSP US Total Market Index. This index encompasses a diverse range of U.S. stocks, spanning across small, mid, and large-cap sectors, thereby representing virtually the entire investable U.S. stock market. As of the latest data, VTI is characterized by a low expense ratio, typical of Vanguard's ethos of providing cost-efficient investment options. The fund employs a passive, index-sampling strategy, aiming to replicate the index's performance by investing in a representative sample of stocks. It is a popular choice for investors seeking diversified, long-term growth and has become a staple in many investment portfolios for its straightforward approach to accessing the broad U.S. equity market. Launched in May 2001, VTI has grown to be one of the largest ETFs by assets under management, illustrating the trust and preference it has garnered from the investor community.

The Vanguard Total Stock Market ETF (ticker: VTI) is a widely recognized exchange-traded fund (ETF) that offers investors exposure to a broad swath of the U.S. equity market by seeking to track the performance of the CRSP US Total Market Index. This index encompasses a diverse range of U.S. stocks, spanning across small, mid, and large-cap sectors, thereby representing virtually the entire investable U.S. stock market. As of the latest data, VTI is characterized by a low expense ratio, typical of Vanguard's ethos of providing cost-efficient investment options. The fund employs a passive, index-sampling strategy, aiming to replicate the index's performance by investing in a representative sample of stocks. It is a popular choice for investors seeking diversified, long-term growth and has become a staple in many investment portfolios for its straightforward approach to accessing the broad U.S. equity market. Launched in May 2001, VTI has grown to be one of the largest ETFs by assets under management, illustrating the trust and preference it has garnered from the investor community.

| Previous Close | 237.8 | Open | 238.0 | Day Low | 237.47 |

| Day High | 238.44 | Trailing P/E | 22.406818 | Volume | 5,090,289 |

| Average Volume | 3,510,442 | Average Volume 10 Days | 4,141,320 | Bid | 238.05 |

| Ask | 238.51 | Bid Size | 800 | Ask Size | 800 |

| Yield | 0.0148 | Total Assets | 1,387,784,962,048 | 52 Week Low | 188.93 |

| 52 Week High | 238.69 | 50 Day Average | 221.686 | 200 Day Average | 215.25885 |

| Trailing Annual Dividend Rate | 2.802 | Trailing Annual Dividend Yield | 0.011783011 | NAV Price | 237.74 |

| Category | Large Blend | YTD Return | 0.2636012 | Beta (3 Year) | 1.0 |

| Three Year Average Return | 0.0886417 | Five Year Average Return | 0.1550885 |

Utilizing the provided technical indicators and the absence of company fundamentals and financials, we will discuss potential price movement for VTI over the next few months. We will look at the significance and implications of the data we have, including the Opening Price (Open), Highest Price of the day (High), On-Balance Volume (OBV), and Moving Average Convergence Divergence (MACD) histogram.

- The Open price on the last day was at $238.00, with the stock reaching a High of $238.44. This narrow range suggests a consolidation period with limited volatility.

- OBV has shown a significant increase over time, ending at 3.808 million on the last day recorded. This indicates growing buying pressure and could signal continued bullish sentiment.

- The MACD histogram value has been positive, but the value is diminishing as it decreased to 0.120751 on the last day. This may imply that the bullish momentum is slowing down.

Based on these technical indicators, we can infer that VTI has experienced a rising OBV, which typically suggests an accumulation of volume and positive sentiment. Therefore, a bullish outlook could be maintained in the short to medium term as long as the OBV remains on an upward trend and volume supports upward price movements.

The MACD histogram being in positive territory indicates that the short-term momentum has been stronger than the long-term momentum and the trend has been bullish. However, the declining values of the MACD histogram suggest that the momentum may be waning, and caution is warranted. Traders and investors might look for the MACD to either plateau or begin increasing again to confirm that the bullish trend will persist.

Given the lack of fundamental data, it is essential to note that while the above indicators show a positive technical picture, external factors such as market sentiment, economic data, and geopolitical events could affect the stock price movement significantly. Furthermore, the absence of fundamentals and financials in the analysis means that assessments are made purely on past price and volume behavior, which does not always predict future movements accurately.

The technical indicators present a cautiously optimistic outlook for VTI over the next few months if the positive OBV trend continues and the MACD histogram stabilizes or increases, confirming the bullish momentum. However, it is imperative for investors to monitor these indicators closely and consider broader market signals to adapt to any changes in the trend.

The prevailing bullish sentiment surrounding the S&P 500 Index heading into 2024 is bolstered by a potent mix of projected earnings, favorable monetary policy adjustments, and shifting macroeconomic indicators. With P/E multiple expansion to approximately 22 and forecasted earnings around $240, the S&P 500 Index is envisioned to ascend towards 5300 in 2024. Significant contributors to this advancement include sectors like Healthcare, Technology, Communications, and Discretionary, which are positioned to capitalize on the anticipated 10.9% growth in S&P 500 earnings. Despite a prevalent view that the S&P 500 is currently overvalued, it is the expected monetary policy easing that primes the index for an uptick, characterized by potential gains enticing to investors.

The role of the Federal Reserve in sculpting this promising market landscape cannot be overemphasized. Predicted rate cuts are on the horizon, with reductions to 3.9% in 2024 and a further drop to 3.25% in 2025 anticipated. These cuts are aligned with the market's assumption of a disinflationary environment manifesting throughout the first half of 2024, thus, cultivating favorable conditions for earnings growth. This forecast aligns squarely with the bullish outlook that underpins market optimism for the S&P 500 Index in the ensuing year.

Despite an overall positive trajectory, the forecast for the market is not devoid of volatility. Market fluctuations are anticipated due to uncertainties associated with the disinflation process and shifts in Federal Reserve policy. Furthermore, the specter of a potential economic "slump" looms if inflation persists alongside a deceleration of economic growth, particularly during the summer months.

Nonetheless, prospects of a recession appear to wane as consensus expectations lean towards a continuation of the disinflationary trend complemented by Fed rate reductions. These elements are likely to cultivate a business-friendly backdrop conducive to earnings growth and yield curve steepening. An additional metric buttressing investor confidence is the prognosis for a more manageable government budget deficit.

However, the luminous outlook for the S&P 500 Index is fraught with substantial risk factors. A brake in the disinflationary progression could compel the Fed to uphold higher interest rates over a more extended stretch, potentially triggering a recession and prompting earnings revisions. Additionally, volatility may be spurred by unforeseen geopolitical events or domestic political uncertainties, such as U.S. elections or government shutdowns.

Shifting focus to inflation trends, a decline in core CPI to about 3.3% by June is anticipated, contingent on the monthly pace of the reduction. Post-June, the battle to attain the Federal Reserve's 2% inflation target is expected to intensify. With shelter costsa crucial component of core CPI calculationspredicting a descent due to falling real-time rents, the foundation for the disinflation trend seems sturdy.

Amid these conditions, tactical purchasing of S&P 500 dips is recommended, while preserving a constant long exposure until the baseline scenario alters. A significant market correction is plausible in the event that inflation does not subside and growth prospects dim. However, the market is presently exhibiting a "pump" phase, with awareness that the transition to a "dump" phase post-June remains a possibility.

In the broader investment domain, exchange-traded funds (ETFs) like the Vanguard Total Stock Market ETF (VTI) have gained traction as preferred instruments for investors forging a path to retirement wealth. The all-encompassing exposure afforded by VTI to the U.S. stock market promotes it as an essential tool for investors. Amid an environment of anticipated market growth, such ETFs can significantly shape retirement portfolios over the long term, especially when taking advantage of compounding interest.

Consistent investment over several decades in ETFs, such as VTI, stands to generate sufficient retirement funds. Assuming an average 8% return and $10,000 annual investments, the snowball effect of compounding could be substantial. Yet, the eventual outcome is colored by the prevailing market. Given VTI's diverse coverage across varying sectors, the fund is well-placed to capitalize on anticipated index growth.

Vanguard's suite of ETFs, designed to mirror the U.S. market's performance, provides investors with multiple paths to achieving potentially lucrative returns. Retail investors are provided options like the Vanguard S&P 500 ETF (VOO), Vanguard Growth ETF (VUG), and the comprehensive VTI. Each product has its unique features, accommodating varied investor preferences ranging from targeting the 500 largest U.S. corporations to embracing a wider market spectrum, including small and mid-cap entities.

Investing in these ETFs has historically presented returns comparable to or surpassing the market's historical average, indicating the potential of disciplined investment over time. These ETFs' performance bolsters the premise that sustained investment, coupled with low fees, can be a potent combination for wealth generation over the long haul.

Amid this rosily painted future for the S&P 500 Index, it is imperative not to overlook potential financial system stressors that could disrupt market conditions. For instance, after the unsettling strains on regional banks in the previous year, caution is advised given the substantial outstanding debt within commercial real estate (CRE). Valuations are divergent across diverse property types, with office spaces enduring significant reductions in value. Regional banks, particularly vulnerable due to their substantial holdings in CRE debt, could become catalysts for more widespread credit turbulence if destabilization events in CRE ensue.

In preparation for potential downturns, investors might contemplate diversifying into long-duration bonds as hedges or allocating funds to emerging asset classes like Bitcoin, posited as a hedge against systemic risk. Moreover, opportunities may lie with larger banks poised to acquire assets at reduced values in a declining rate environment.

Ultimately, despite the favorable outlook for the S&P 500 Index, investors should be cognizant of the complexities inherent in market dynamics. Balancing investment vehicles like VTI, which offer extensive exposure to the U.S. stock market, with safeguards designed to mitigate potential risks remains a judicious approach to investing. While the Vanguard Total Stock Market ETF encapsulates a range of stocks reflective of the overall economy, thereby offering a promising vehicle for wealth creation, it is but one component in a well-rounded investment portfolio crafted to withstand and potentially capitalize on market movements.

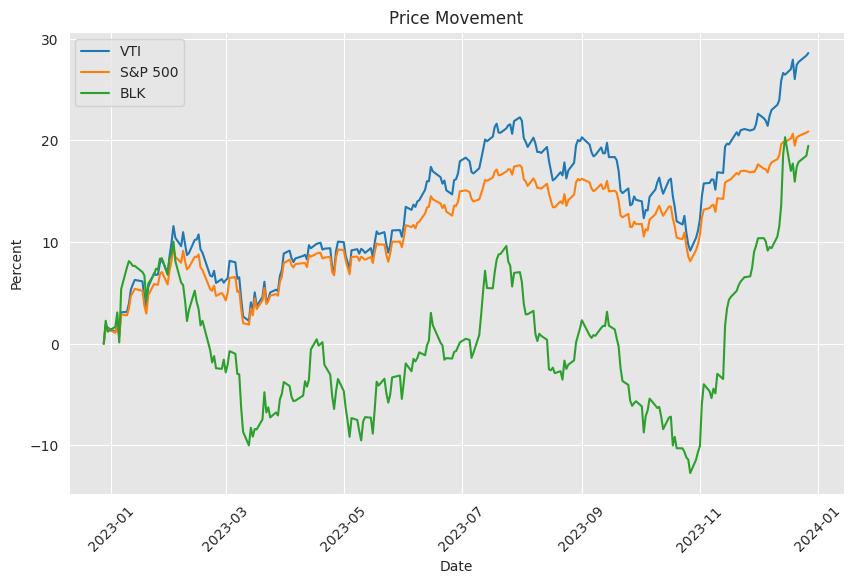

Similar Companies in Asset Management:

BlackRock (BLK), State Street Corporation (STT), Charles Schwab (SCHW), Fidelity Investments (FIS), Invesco (IVZ)

News Links:

https://seekingalpha.com/article/4658906-sp500-market-outlook-for-2024-pump-and-dump

https://seekingalpha.com/article/4659193-6-trillion-black-swan-everyone-forgot

https://www.fool.com/investing/2023/12/14/1-no-brainer-investment-you-must-make-before-2023/

https://www.fool.com/investing/2023/11/05/3-vanguard-etfs-to-help-you-retire-a-millionaire/

https://www.fool.com/retirement/2023/12/14/before-you-buy-a-target-date-fund-consider-this-si/

https://www.fool.com/investing/2023/12/20/got-500-invest-in-stocks-put-it-index-fund-vti/

https://www.fool.com/investing/2023/12/13/4-vanguard-etfs-may-help-you-retire-a-millionaire/

https://seekingalpha.com/article/4643839-the-new-bull-market-is-over

https://www.fool.com/investing/2023/12/05/vanguard-largest-fund-closing-in-on-all-time-high/

https://www.fool.com/retirement/2023/12/19/3-ways-to-grow-100000-into-1-million-retirement/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: Xnbvbv

https://reports.tinycomputers.io/VTI/VTI-2023-12-28.html Home