Verizon Communications (ticker: VZ)

2023-12-15

Verizon Communications Inc. (ticker: VZ) is a global leader in delivering wireless and wireline communications services to consumer, business, government, and wholesale customers. Verizon Wireless operates America’s most reliable wireless network, with a significant presence in the U.S. market where it offers mobile phone and data services. The company also provides converged communications, information, and entertainment services over America's most advanced fiber-optic network, and delivers integrated business solutions to customers worldwide. Verizon’s wireline segment includes local telephone, long-distance, broadband and video services. Headquartered in New York City, Verizon was formed on June 30, 2000, with the merger of Bell Atlantic Corp. and GTE Corp., and it trades on the New York Stock Exchange under the ticker symbol VZ. As a major part of its business strategy, Verizon continually invests in network infrastructure, is actively involved in the development and deployment of 5G networks, and seeks to expand its capabilities through innovation and strategic acquisitions. The company is known for its strong dividend yield and steady performance, making it a staple for income-seeking investors.

Verizon Communications Inc. (ticker: VZ) is a global leader in delivering wireless and wireline communications services to consumer, business, government, and wholesale customers. Verizon Wireless operates America’s most reliable wireless network, with a significant presence in the U.S. market where it offers mobile phone and data services. The company also provides converged communications, information, and entertainment services over America's most advanced fiber-optic network, and delivers integrated business solutions to customers worldwide. Verizon’s wireline segment includes local telephone, long-distance, broadband and video services. Headquartered in New York City, Verizon was formed on June 30, 2000, with the merger of Bell Atlantic Corp. and GTE Corp., and it trades on the New York Stock Exchange under the ticker symbol VZ. As a major part of its business strategy, Verizon continually invests in network infrastructure, is actively involved in the development and deployment of 5G networks, and seeks to expand its capabilities through innovation and strategic acquisitions. The company is known for its strong dividend yield and steady performance, making it a staple for income-seeking investors.

| As of Date: 12/15/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 159.21B | 136.25B | 156.35B | 163.49B | 165.47B | 159.47B |

| Enterprise Value | 327.07B | 309.10B | 332.45B | 337.22B | 337.43B | 333.18B |

| Trailing P/E | 7.62 | 6.48 | 7.24 | 7.69 | 8.57 | 7.62 |

| Forward P/E | 8.16 | 6.85 | 7.93 | 8.27 | 7.88 | 7.20 |

| PEG Ratio (5 yr expected) | 6.80 | 6.23 | 6.29 | 6.84 | 5.88 | 4.52 |

| Price/Sales (ttm) | 1.19 | 1.01 | 1.15 | 1.19 | 1.22 | 1.18 |

| Price/Book (mrq) | 1.63 | 1.43 | 1.68 | 1.79 | 1.89 | 1.85 |

| Enterprise Value/Revenue | 2.44 | 9.27 | 10.20 | 10.25 | 9.57 | 9.73 |

| Enterprise Value/EBITDA | 6.55 | 25.64 | 28.28 | 28.04 | 23.87 | 28.28 |

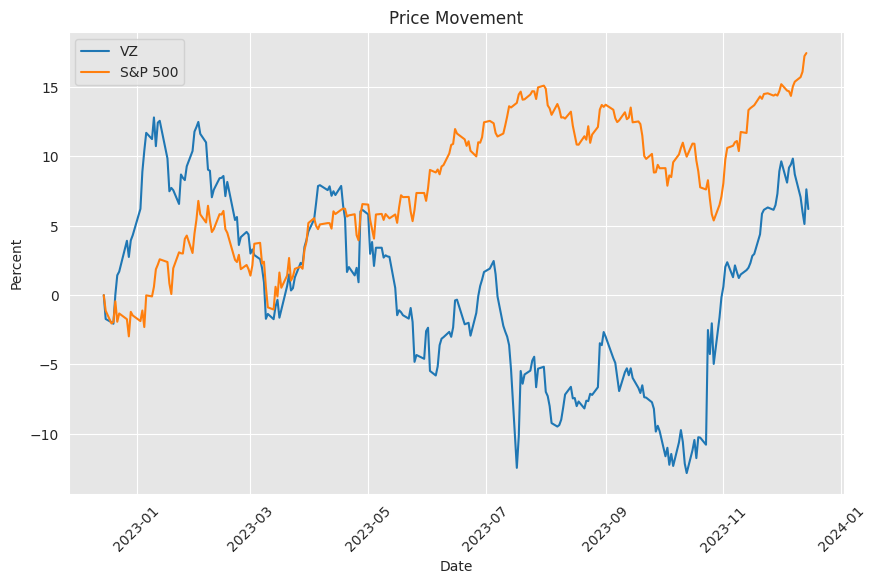

Upon evaluating Verizon Communications Inc. (ticker: VZ) using the provided technical analysis data alongside the summary of company fundamentals and recent financials, it is possible to ascertain potential future stock price movements within the context of prevailing market conditions.

Upon evaluating Verizon Communications Inc. (ticker: VZ) using the provided technical analysis data alongside the summary of company fundamentals and recent financials, it is possible to ascertain potential future stock price movements within the context of prevailing market conditions.

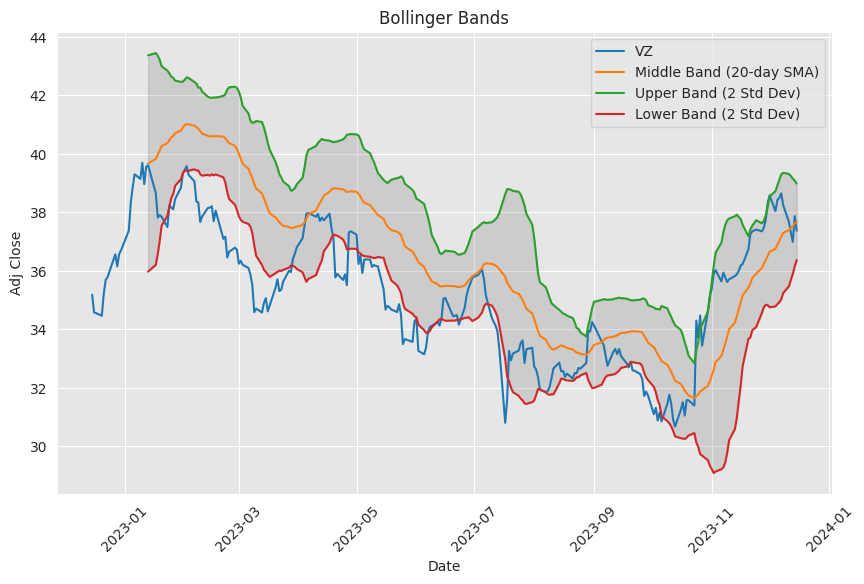

Technical Analysis: - The Adjusted Close price of $37.369999 signifies the recent trading level. - The Moving Average Convergence Divergence (MACD) presents a value of 0.568995 with a negative histogram value of -0.229807, implying a loss of momentum in the current trend which could signal an impending change or consolidation. - The Relative Strength Index (RSI) at 53.473400, indicates a neutral stance, neither overbought nor oversold. - Bollinger Bands® display the stock trading between its middle band (BBM) at $37.439999 and the lower band (BBL) at $36.830214, not giving clear signals of a strong trend. - The Simple Moving Average (SMA) over 20 days is nearly the same as the current adjusted close price, while the Exponential Moving Average (EMA) over 50 days is lower, possibly indicating a potential uptrend. - On-balance Volume (OBV) at 13.249 million suggests a relatively stable interest in the stock. - Stochastic oscillators (STOCHk and STOCHd) are somewhat low, indicating that the stock is nearing the lower end of its price range in the time period considered, hinting at possible overselling. - The Average Directional Index (ADX) at 38.797349 signifies a strong trend, which in the context of other indicators, might suggest consolidation. - The Chaikin Money Flow (CMF) of 0.153438 indicates some buying pressure. - Parabolic SAR (PSAR) currently indicates a possible downtrend with the stop-and-reverse (PSARs) positioned above the price.

Fundamentals: - Market Capitalization shows a recent decline from $163.49B to $159.21B, a sign of reduced market valuation. - Forward and Trailing Price-to-Earnings (P/E) ratios are relatively low, hinting at a potentially undervalued stock considering earnings. - The PEG Ratio is high, questioning future growth relative to the P/E ratio. - Valuation measures like Price/Sales and Price/Book are within reasonable levels, and Enterprise Value multiples are in line with industry averages, indicating no extreme over or undervaluation. - Financials show robust EBITDA and Operating Income, suggesting a strong underlying business.

In consideration of the technicals and fundamentals, possible trends for Verizon's stock over the coming months can be anticipated. The neutral to slightly bullish stance suggested by technical indicators, coupled with strong fundamental performance, may translate into potential stock price stability or moderate growth in the next few months. Of particular note is the reasonable valuation based on P/E and Price/Sales ratios, as well as the company's considerable operating income and EBITDA, which could entice investors seeking value and solid company performance.

Moreover, the strong EBITDA combined with an ADX indicating the presence of a strong trend may imply that any price movement could be significant, albeit the MACD indicates that the current trend is losing momentum. The relatively neutral RSI and potential buying pressure evident in the CMF could reinforce a potential uptrend, assuming no significant negative market or company-specific events emerge.

Given the recent decline in Verizon's market capitalization and slight negative sentiment reflected in the MACD histogram, investors may exercise caution that could result in a more sideways movement. This perspective nevertheless leaves room for an upward movement should Verizon continue to demonstrate operational efficiency and profitability that may attract further investment.

The evidence suggests a guarded positive outlook. While the technical indicators point to possible consolidation in the near term, the strong fundamental financials of the company could potentially lead to value realization over the coming months. Investors would do well to monitor volume-related indicators such as OBV for confirmation of trend strength and direction, alongside watching for any news that could affect the company's strong operating income and EBITDA.

Verizon Communications Inc. (VZ) and AT&T Inc. (T) represent two titans in the telecommunications landscape, yet both have faced considerable challenges in providing strong returns for their shareholders. Despite their reputation for offering substantial dividend yields, which entice income-focused investors, their market performance has generally been lackluster over both short and long terms. In light of these uninspiring returns, a shift in investment strategy towards alternatives, such as real estate investment trusts (REITs), might be advisable for those seeking improved income streams and yield opportunities.

With a market capitalization hovering around $159 billion, Verizon's shares fell by 1.32%, equivalent to $0.50, to close at $37.37 as of December 15, 2023. This downturn reflects broader challenges within the telecom sector, including fierce competition and the significant capital outlay required for infrastructure advancements like 5G network deployments, intensifying the financial pressure telecom companies face.

Given these disappointing investment returns, attention has turned to alternative opportunities such as Realty Income Corp. (O) and One Liberty Properties Inc. (OLP), both in the real estate sector. The stability and reliability of their revenue, derived from property rent, bestow upon these REITs a lower volatility profile compared to telecom stocks. Historically, they have provided investors with steady yields, proving to be a solid source of income.

Motley Fool contributors Jason Hall and Tyler Crowe have underpinned this sentiment by indicating that the historical performance of these REITs shows a firm commitment to enhancing shareholder value via consistent dividend payouts and sturdy property portfolios. In contrast, the telecom industry's income stream seems more susceptible to cyclicity due to the rapidly changing nature of technology and consumer demands. Realty Income and One Liberty Properties are thus commended for their attractiveness to shareholders seeking less fluctuating income sources.

Investors contemplating an infusion into companies like Realty Income and One Liberty Properties can expect a safer dividend investment route, possibly yielding stable income today and nurturing long-term wealth compounding. Although past performance does not guarantee future results, these REITs seem poised to offer a promising alternative to the somewhat vexing returns currently associated with telecom giants like Verizon and AT&T.

When observing Verizon Communications from a dividend investment perspective, it is evident that the company, despite the bearish outlook due to rising interest rates and stiff competition, has been steadfast in maintaining a strong dividend track record. With a high dividend yield of about 6.9%, Verizon is among the highest in the S&P 500 for yield, attracting income investors. The company has a commendable streak of dividend increases spanning 17 years, showcasing an enduring promise to shareholder returns.

Verizon's financial health is noteworthy, with the company's cash flow robust enough to sustain around $11 billion in dividends in the current fiscal year while generating an estimated $18 billion in free cash flow. This solid foundation not only enables the company to continue servicing its debt but also fortifies its financial resilience. Given that its price-to-earnings ratio is below 8.5 times for the year's earnings, the stock may be undervalued, thus presenting an attractive proposition for investors seeking reliable dividends at a reasonable price.

While Verizon may not offer the rapid earnings growth some investors seek, its established market presence and stable cash flow provision offer a stable foundation for dividend investors, particularly appealing in today's environment where consistent income streams are highly valued. Within a diversified investment portfolio, which aims to balance growth prospects with steady income, Verizon's financial indicators, historical dividend performance, and market valuation suggest that the company may be an appropriate pick for those investing with a long-term, buy-and-hold approach. The company's robust competitive advantage in the telecommunications sector and consistency in dividend payments could provide investors with stable passive income across market cycles.

Meanwhile, Verizon Communications has recently made strides in Kentucky, enhancing wireless service capabilities. As part of a significant network transformation project, the company is improving 4G and 5G Ultra Wideband coverage, with upgrades in Barbourville, Falmouth, Mt. Eden, and Salem. These improvements aim to deliver better connectivity to the residents and businesses of these areas, underscoring the company’s dedication to addressing the connectivity needs in diverse regions, including more rural locations.

The expansion of services includes improved coverage and capacity, which should augment personal and business communications, the overall customer experience, and even the public safety capabilities via Verizon Frontline solutions. Additionally, Verizon's Home Internet and Business Internet services now offer truly unlimited broadband service, catering to households and businesses with high-speed connectivity without data caps. These advancements are part of Verizon’s commitment to extending 5G to over 230 million people, illustrating the company's focus on bolstering technology within their network and enabling customer and enterprise innovations.

Verizon Business has further deepened its technological footprint by partnering with Zebra Technologies. This strategic alliance, focused on optimizing mobile device and software solutions for Verizon Private 5G and LTE networks, exemplifies the company's push into enterprise solutions. The partnership is expected to enhance operations in various commercial industries by integrating Zebra's rugged enterprise tablets and mobile computers with Verizon's cutting-edge network capabilities. The collaborative effort promises to bring notable benefits across several sectors, such as in retail with mobile point of sale and inventory systems, in manufacturing with improved warehouse and order fulfillment management, and in logistics with refined asset tracking and inventory control. This alliance exemplifies the drive towards digitalizing operational processes, lending businesses remarkable efficiency gains through the durability and sophistication of the combined technological offerings.

Verizon Communications has sustained a commanding position in the tech and communication sphere since its inception on June 30, 2000. With headquarters in New York City and revenues reaching $136.8 billion in 2022, Verizon persistently meets customer demands for high-quality data, video, and voice services over its acclaimed platforms, addressing the ongoing need for mobility, reliable networking, and bolstered security.

In a similar vein of technical innovation and community impact, Verizon made substantial strides toward addressing the digital divide in Greater St. Louis by augmenting its partnership with TechSTL. This coalition is buttressed by the Verizon Forward Community Enhancement Award and is on a mission to provide crucial digital skills training to approximately 10,000 underserved residents in St. Louis. This program is part of Verizon’s broader objective to prepare half a million individuals for future jobs by 2030, underscoring the company’s commitment to digital inclusion and the advancement of community development through corporate responsibility.

Verizon Communications Inc., recognized in investment circles as a constituent of a "Sleep Well" investment portfolio, has been praised for its ability to weather economic headwinds while delivering returns that keep pace with or exceed inflation. Verizon's status as a dependable dividend payer, with a consistent history of dividend growth, makes it a prime candidate for inclusion in the Dividend Growth Investment Core of the Near Perfect Portfolio (NPP) strategy. This strategy is designed to balance income generation, capital appreciation, and downside protection. Verizon's involvement in dividend-focused ETFs, like the Vanguard High Dividend Yield ETF, underscores its importance to income investors seeking lower volatility and consistent yield. As part of a multi-faceted investment approach, Verizon stands as a blue-chip stock catering to risk-averse investors, complementing the NPP strategy’s focus on securing long-term passive income and preserving capital against market swings.

Adding to its credentials, Verizon presents a compelling investment case for those seeking passive income through dividends. With investor attention due to its high yield, and a cash flow robust enough to sustain its generous payouts, Verizon remains a prominent figure in the dividend stock sphere. Its forward payout ratio indicates sustainable dividends, and the 17-year streak of dividend growth showcases a strong commitment to shareholder returns. Valuations signal a potential buy opportunity for those desiring reliable income in the form of dividend payouts, supported by a business model poised for steady performance even amid sectorial challenges.

Following the affirmation of its shareholder value enrichment strategy, Verizon's board declared a consistent quarterly dividend, indicating the company’s solid financial footing and disciplined management. Publicly trading over 4 billion shares, Verizon's liquidity in the financial markets is considerable, and its revenue success is a testament to its operational efficacy and robust service offerings. With transparent and disciplined financial communications managed by Eric Wilkens, the company carries its legacy as a respected, investor-friendly entity in the industry.

Finally, amidst the dynamic telecommunications market, Verizon Communications Inc. retains its grasp as a substantial dividend stock. Its enviable dividend yield and proven dividend enhancement record, along with considerable investment in its 5G infrastructure, paint a stable financial picture for the company. Moreover, the proactive cost-cutting measures are poised to bolster free cash flow and fortify Verizon's capacity for dividend distributions. Looking forward, Verizon's strategic adaptations to technological and market shifts suggest a favorable outlook for sustainable dividend payouts and long-term shareholder value creation. As a result, Verizon stands out in its sector for both its dividend reliability and competitiveness, making it an attractive option for long-term, income-focused investors.

News Links:

https://www.fool.com/investing/2023/12/07/att-or-verizon-for-high-yields-2-better-stocks-for/

https://www.fool.com/investing/2023/12/05/500-dividend-stocks-buy-now-and-hold-forever/

https://www.fool.com/investing/2023/12/04/1-warren-buffett-stock-to-buy-and-hold-forever/

https://seekingalpha.com/article/4656349-how-to-invest-100000-today-in-a-sleep-well-portfolio

https://www.fool.com/investing/2023/12/13/want-500-in-passive-income-invest-11000-in-stocks/

https://www.fool.com/investing/2023/12/10/4-top-dividend-stocks-yielding-more-than-4-to-buy/

Copyright © 2023 Tiny Computers (email@tinycomputers.io) -

FXG5X0