Welltower Inc. (ticker: WELL)

2023-12-28

Welltower Inc. (ticker: WELL) is a prominent real estate investment trust (REIT) that primarily invests in healthcare infrastructure and has established itself as a leader in the space of aging population services. The company owns a diversified portfolio of properties, including senior living communities, outpatient medical facilities, and health system infrastructure. Welltower partners with leading operators to manage its properties and utilizes its scale and real estate expertise to drive value and innovation in the healthcare sector. By focusing on high-quality real estate, Welltower aims to provide stable and growing income streams, and capitalize on the demographic trend of an aging population, which is expected to drive demand for healthcare and senior living services over the long term. Investors typically look to Welltower for its potential to offer steady dividends, as is common with REITs, and for its strategic positioning in a critical and growing segment of the real estate market.

Welltower Inc. (ticker: WELL) is a prominent real estate investment trust (REIT) that primarily invests in healthcare infrastructure and has established itself as a leader in the space of aging population services. The company owns a diversified portfolio of properties, including senior living communities, outpatient medical facilities, and health system infrastructure. Welltower partners with leading operators to manage its properties and utilizes its scale and real estate expertise to drive value and innovation in the healthcare sector. By focusing on high-quality real estate, Welltower aims to provide stable and growing income streams, and capitalize on the demographic trend of an aging population, which is expected to drive demand for healthcare and senior living services over the long term. Investors typically look to Welltower for its potential to offer steady dividends, as is common with REITs, and for its strategic positioning in a critical and growing segment of the real estate market.

| As of Date: 12/27/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 50.07B | 42.49B | 41.11B | 35.58B | 30.97B | 30.39B |

| Enterprise Value | 63.68B | 56.63B | 55.91B | 49.91B | 46.14B | 45.47B |

| Trailing P/E | 170.68 | 315.08 | 311.12 | 204.83 | 131.10 | 67.00 |

| Forward P/E | 74.07 | 67.11 | 107.53 | 89.29 | 25.45 | 23.04 |

| PEG Ratio (5 yr expected) | 1.84 | 1.67 | 2.56 | 2.12 | 0.59 | 0.53 |

| Price/Sales (ttm) | 7.09 | 6.42 | 6.39 | 5.69 | 5.26 | 5.27 |

| Price/Book (mrq) | 2.18 | 2.06 | 2.01 | 1.75 | 1.68 | 1.64 |

| Enterprise Value/Revenue | 9.94 | 34.07 | 33.57 | 31.98 | 30.39 | 30.85 |

| Enterprise Value/EBITDA | 28.14 | 99.69 | 86.46 | 95.70 | 94.27 | 91.02 |

| Address | 4500 Dorr Street | City | Toledo | State | OH |

| Zip Code | 43615-4040 | Country | United States | Phone | 419 247 2800 |

| Fax | 419 247 2826 | Website | https://www.welltower.com | Industry | REIT - Healthcare Facilities |

| Sector | Real Estate | Full Time Employees | 514 | CEO & Director | Mr. Shankh S. Mitra |

| CEO Pay | 3,812,686 | Executive VP & CFO | Mr. Timothy G. McHugh | CFO Pay | 1,858,326 |

| Executive VP & COO | Mr. John F. Burkart | COO Pay | 1,637,350 | Executive VP, General Counsel & Corporate Secretary | Mr. Matthew Grant McQueen J.D. |

| General Counsel Pay | 1,248,839 | Executive Vice President of Wellness Housing & Development | Ms. Ayesha M. Menon | Executive VP of Wellness Pay | 1,206,198 |

| Previous Close | 90.46 | Open | 90.42 | Day Low | 90.19 |

| Day High | 91.07 | Dividend Rate | 2.44 | Dividend Yield | 2.7% |

| Payout Ratio | 460.38% | Five Year Avg Dividend Yield | 3.87% | Beta | 1.055 |

| Trailing PE | 171.79 | Forward PE | 75.88 | Volume | 1,330,681 |

| Average Volume | 3,271,137 | Average Volume 10 days | 3,083,350 | Bid | 90.77 |

| Ask | 91.59 | Market Cap | 50,393,354,240 | Fifty Two Week Low | 64.63 |

| Fifty Two Week High | 93.42 | Price To Sales | 7.97 | Fifty Day Average | 87.29 |

| Two Hundred Day Average | 80.95 | Enterprise Value | 63,042,469,888 | Profit Margins | 3.993% |

| Float Shares | 535,470,670 | Shares Outstanding | 553,468,992 | Shares Short | 7,070,913 |

| Held Percent Insiders | 0.106% | Held Percent Institutions | 92.428% | Short Ratio | 1.89 |

| Book Value | 43.13 | Price To Book | 2.11 | Last Fiscal Year End | 2022 |

| Net Income To Common | 252,455,008 | Trailing EPS | 0.53 | Forward EPS | 1.20 |

| PEG Ratio | 1.86 | Enterprise To Revenue | 9.97 | Enterprise To EBITDA | 26.27 |

| Last Dividend Value | 0.61 | Total Cash | 2,582,036,992 | Total Cash Per Share | 4.818 |

| EBITDA | 2,400,262,912 | Total Debt | 16,276,159,488 | Quick Ratio | 1.818 |

| Current Ratio | 2.515 | Total Revenue | 6,322,204,160 | Debt To Equity | 68.334 |

| Revenue Per Share | 12.665 | Return On Assets | 1.581% | Return On Equity | 1.226% |

| Gross Profits | 2,304,610,000 | Free Cash Flow | 2,472,070,912 | Operating Cash Flow | 1,484,744,960 |

| Revenue Growth | 12.8% | Gross Margins | 40.155% | EBITDA Margins | 37.966% |

| Operating Margins | 16.387% | Currency | USD | Current Price | 91.05 |

Based on the provided technical analysis data and company fundamentals, the following report outlines the potential stock price movement for WELL in the coming months.

Technical Indicators: - The most recent On-Balance Volume (OBV) shows an increase, indicating that volume is following the price upwards which can be a bullish sign. The increasing OBV suggests that the stock may be gaining accumulation and buying interest. - The Moving Average Convergence Divergence (MACD) histogram is showing negative values but is increasing towards zero, hinting at a weakening bearish momentum and a possible trend reversal in the near future.

Fundamentals: - The Market Cap has seen a substantial increase from 30.39B to 50.07B, suggesting investor confidence and a potential undervalued status in previous periods. - The Trailing P/E is very high at 170.68, indicating that the stock is currently expensive relative to earnings. This could signal caution among value-oriented investors. - The Forward P/E is significantly lower than the Trailing P/E, which could mean that investors expect earnings to grow, making for a better valuation in the future. - The PEG Ratio has increased, which may suggest that the stock's price is outpacing earnings growth projections, warranting a careful approach when evaluating potential for future growth. - The Enterprise Value multiples are relatively high, which could either indicate expected growth or showcase the market pricing in high future earnings.

Financial Health: - The financials indicate a consistent Net Income and a relatively stable EBITDA, suggesting that the company has sound operations with manageable profitability levels. - The company has seen a substantial rise in the Non-Operating Interest Expense, which reflects higher levels of debt or financing costs, possibly impacting future profitability.

Taking the above into consideration, the combination of improving technical indicators and mixed fundamentals suggests that WELL's stock price could experience an upward trend in the short term due to positive technical signals like increasing OBV and a potentially reversing MACD. However, the high valuation ratios call for cautious optimism as they point to a stock price that may already account for some future growth expectations.

Regarding the long-term movement, investors may need to weigh the high valuations against the companys financial health, trend in revenues, and profit margins. Assuming the company can improve its earnings and justify its valuation, there may be potential for upward price movement, but if the market reassesses the growth prospects and finds them lacking, the price could adjust downward.

Market participants should closely monitor the company's upcoming earnings announcements, any changes in interest rates (affecting debt servicing costs), and industry-specific news, which could significantly influence stock price movements. Investors must also consider market conditions, as the stock's movement will not occur in isolation but will be affected by overall market sentiment and economic climate.

Welltower Inc., a real estate investment trust focused on healthcare infrastructure, has experienced mixed analyst sentiment despite a general recognition of its growth potential. The RBC Capital downgrade from Outperform to Sector Perform was somewhat cushioned by a slight increase in their price target from $92.00 to $97.00, acknowledging the company's expansion and acquisition strategies in healthcare real estate. However, Welltower's adjusted funds from operations (AFFO) multiple and current macroeconomic conditions have been noted concerns, raising questions about the valuation of their stock and the impact of interest rate stabilization on the companys market performance.

The sector in which Welltower operates has seen considerable analyst activity, with companies like Shopify, ChargePoint, and American Axle & Manufacturing Holdings facing downgrades due to individual operational concerns and broader market outlooks. Shopifys reduction in price target by Piper Sandler, ChargePoint's downgrade from UBS, and American Axle's status change by BofA Securities are indicative of the intricate relationship between company-specific performances against a backdrop of economic currents.

Conversely, some industry peers have experienced positive momentum from analyst firms, as evidenced by JP Morgan's upgrades for six different REITs to overweight status. These REITs upgrades suggest renewed confidence in their outperformance potential, with each company boasting distinct aspects of their operations fostering such optimism. Welltower's pivotal role in healthcare facilities capital provision aligns with this positive sentiment, reflecting the aging demographic's increasing support for the healthcare REIT subsector.

Welltower itself has made strides to optimize its portfolio through strategic decisions. The JV dissolution with Chartwell is projected to improve operator alignment and boost net operating income. This nuanced shift is expected to deliver a low-double-digit unlevered internal rate of return upon completion of the transactions. This maneuver points towards an acute focus on managing assets for greater financial performance.

The company has maintained momentum in SHO portfolio occupancy since the third quarter of 2023, with strong levels of rate growth continuing. Acquisitions worth $3 billion, with additional assets under contract, reinforce Welltowers commitment to enhancing shareholder value through strategic investments in urban markets.

Welltowers financial robustness is evident in its strong balance sheet and liquidity stance. With $6.6 billion in liquidity by the end of October, the company sits comfortably to invest in future growth opportunities. This fiscal advantage, along with age demographic changes and new healthcare spending habits, propels the SHO portfolio's potential prosperity. The effect of higher interest rates, leading to reduced construction starts, further intensifies the likelihood of improved SHO occupancy rates.

The aforementioned factors contribute to a Zacks Rank #2 (Buy) for Welltower, with the Zacks Consensus Estimate for the companys FFO per share undergoing upwards revisions. This bullish perspective has been echoed industry-wide as other REITs like EastGroup Properties, Stag Industrial, and Park Hotels & Resorts have displayed similar optimism.

Welltowers positive trajectory is further supported by the insights of Seeking Alphas analyst Brad Thomas, who projects a recovery and growth potential within the REIT sector. Thomas points towards scale and cost of capital advantages that could set the stage for long-term success in well-managed REITs. He encourages investors to differentiate among REITs based on financial health, sector-specific vulnerabilities, and M&A possibilities, paving the road for a cautiously optimistic outlook for 2024.

The demographically driven demand for healthcare-related real estate positions Welltower advantageously within this landscape. The solid FFO per share results and favorable NOI margin expansion only bolster the view that Welltower is navigating the industry adeptly. The companys strategic dispositions and acquisitions, coupled with robust financial health and strategic debt maturity scheduling, further reinforce its market position.

However, not all financial observers were unanimous in their appraisal of Welltower's potential. While Raymond James analyst Jonathan Hughes boosted Welltower's rating to "buy" with a target of $101, indicating an expected upside, broader market performance in the healthcare REIT segment did not uniformly reflect this optimistic view. Competitors like Ventas demonstrated why comparative stock performance assessments remain integral to understanding market dynamics and valuations.

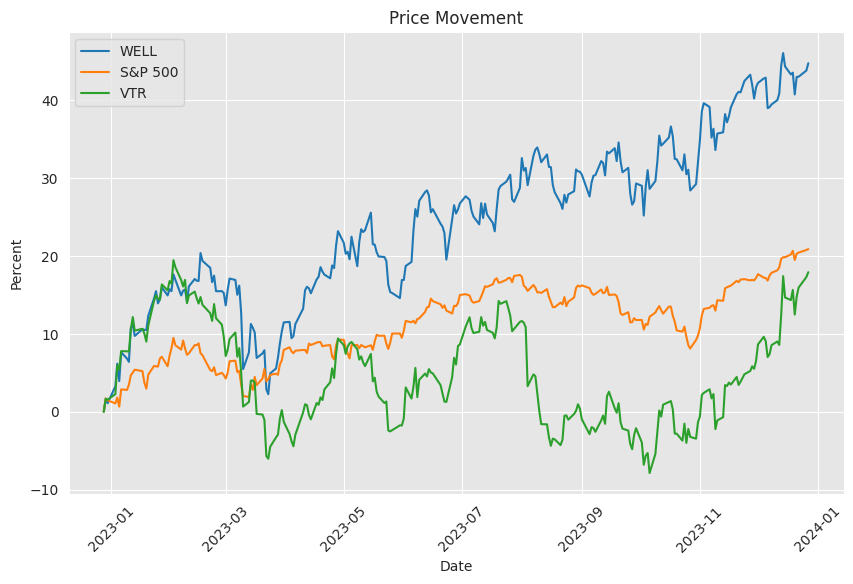

Welltower witnessed a share price increase following its Q3 earnings report, reflecting investors upbeat reaction to its financial per share figures, which bettered the Zacks Consensus Estimate and sustained growth in its SHO. Despite market indices such as the S&P 500 outperforming the company in the same period, Welltower's revenue and SSNOI growth propels a bright outlook for the REIT's portfolio.

The moves by Welltower, from its earnings performance to strategic restructurings and analyst ratings, illustrate the multifaceted journey of a leading healthcare infrastructure REIT. The company's proactive management and capitalization on demographic trends and healthcare demands suggest resilience amidst fluctuating market conditions. Each of these elements, as seen through the lens of market professionals and analysts evaluations, casts Welltower as a prominent figure navigating the complexities of real estate investment within the healthcare sector.

Similar Companies in Healthcare REIT:

Ventas, Inc. (VTR), Healthpeak Properties, Inc. (PEAK), Medical Properties Trust (MPW), Omega Healthcare Investors (OHI), Sabra Health Care REIT (SBRA), Senior Housing Properties Trust (DHC), LTC Properties, Inc. (LTC), National Health Investors (NHI), Physicians Realty Trust (DOC), CareTrust REIT (CTRE)

News Links:

https://finance.yahoo.com/news/jp-morgan-upgrades-six-reits-164225328.html

https://finance.yahoo.com/news/welltower-well-dissolve-chartwell-jv-163600719.html

https://finance.yahoo.com/news/shopify-downgraded-underweight-piper-sandler-080255031.html

https://finance.yahoo.com/news/key-reasons-add-welltower-well-175100370.html

https://finance.yahoo.com/news/why-welltower-well-6-8-163025059.html

https://finance.yahoo.com/news/analyst-upgrades-7-stocks-just-044348207.html

https://finance.yahoo.com/news/welltower-issues-business-210500078.html

https://finance.yahoo.com/news/welltowers-well-stock-soars-36-152800830.html

https://www.fool.com/investing/2023/11/12/you-cant-control-analyst-upgrades-and-downgrades-b/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: 0BT2tz

https://reports.tinycomputers.io/WELL/WELL-2023-12-28.html Home