Western Midstream Partners, LP (ticker: WES)

2024-05-11

Western Midstream Partners, LP (ticker: WES) is a master limited partnership that operates in the midstream segment of the oil and gas industry, primarily in the United States. Established with assets predominantly involved in the gathering, processing, compressing, treating, and transporting natural gas, natural gas liquids (NGLs), crude oil, and condensate, WES plays a critical role in facilitating the upstream production to meet downstream demand. Its strategic asset base is concentrated in major producing basins such as the Delaware Basin, which is part of the larger Permian Basin, and in Colorado's DJ Basin. Additionally, the company is known for its stable, fee-based income, stemming from long-term agreements with reputable counterparties, which shields it from direct commodity price fluctuations. WES's financial health is supported by a balanced mix of consistent cash flows and a commitment to maintaining a strong balance sheet, aligning with its ongoing strategies to optimize asset utilization and efficiency while targeting sustainable growth through both organic projects and potential acquisitions.

Western Midstream Partners, LP (ticker: WES) is a master limited partnership that operates in the midstream segment of the oil and gas industry, primarily in the United States. Established with assets predominantly involved in the gathering, processing, compressing, treating, and transporting natural gas, natural gas liquids (NGLs), crude oil, and condensate, WES plays a critical role in facilitating the upstream production to meet downstream demand. Its strategic asset base is concentrated in major producing basins such as the Delaware Basin, which is part of the larger Permian Basin, and in Colorado's DJ Basin. Additionally, the company is known for its stable, fee-based income, stemming from long-term agreements with reputable counterparties, which shields it from direct commodity price fluctuations. WES's financial health is supported by a balanced mix of consistent cash flows and a commitment to maintaining a strong balance sheet, aligning with its ongoing strategies to optimize asset utilization and efficiency while targeting sustainable growth through both organic projects and potential acquisitions.

| Full Time Employees | 1,377 | Previous Closing Price | 36.45 | Market Capitalization | 13,785,189,376 |

| Dividend Rate | 3.5 | 52 Week Low | 25.04 | 52 Week High | 36.79 |

| Total Debt | 7,272,078,848 | Total Revenue | 3,260,222,976 | EBITDA | 2,019,913,984 |

| Net Income to Common | 1,359,073,024 | Trailing EPS | 3.55 | Forward PE | 10.381 |

| Profit Margins | 41.687% | Return on Assets | 7.437% | Return on Equity | 44.023% |

| Gross Margins | 71.093% | Operating Margins | 45.843% | Shares Outstanding | 380,491,008 |

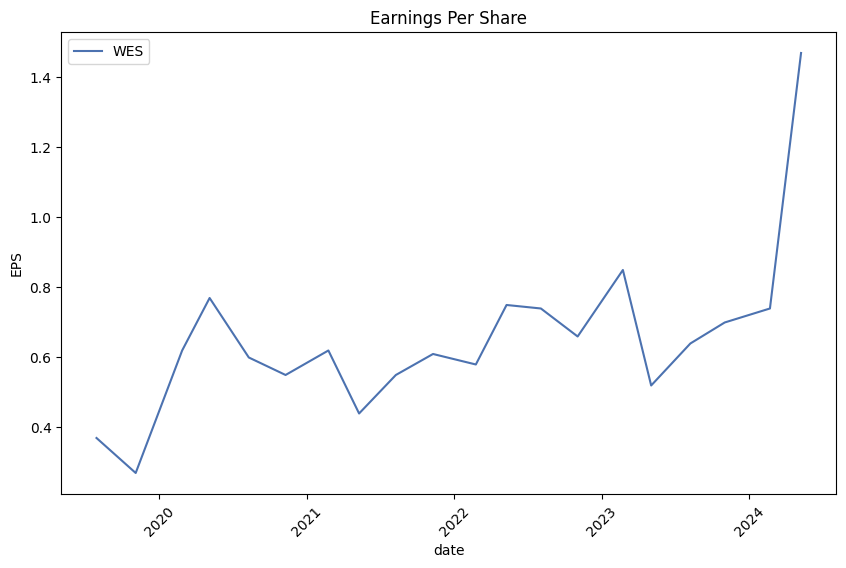

| Revenue Per Share | 8.536 | Earnings Quarterly Growth | 181.2% | Revenue Growth | 20.9% |

| Sharpe Ratio | 1.787 | Sortino Ratio | 35.697 |

| Treynor Ratio | 0.555 | Calmar Ratio | 6.052 |

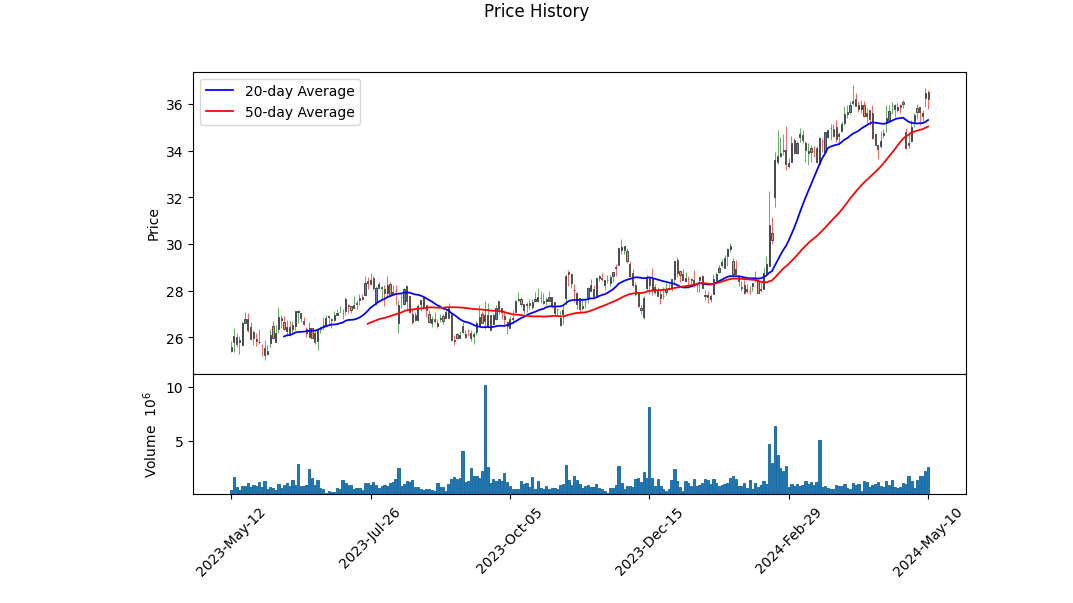

Analyzing the provided Technical Analysis, Fundamental, and balance sheet data for WES provides a comprehensive view to predict the stock's future movements. Over the recent trading period, WES has shown a variable pattern of trading activity and price fluctuation. The closing price has increased from an open of 27.88 on a prior measure to 36.50 in the most recent close, indicating a bullish trend.

The technical indicators such as the On Balance Volume (OBV) suggest a positive volume trajectory, supporting this bullish signal. The OBV has increased significantly from 0.06141 million to 2.35166 million, implying accumulation. However, the MACD histogram, which is a measure of momentum, has shown both slight increases and decreases but remains close to the zero line in recent trades, suggesting some uncertainty in the momentum.

The fundamental analysis reveals strong fundamentals with significant gross margins of 0.71093 and EBITDA margins of 0.61956. Given these figures, WES demonstrates the ability to translate sales into profit effectively. Additionally, their operating margins stand at 0.45843 indicating efficient operations and cost control. Nonetheless, attention should be given to the total debt which stands considerably high, leading to a potential risk factor affecting the financial health of the company.

In terms of ratios that measure risk-adjusted returns: - Sharpe Ratio of 1.787 suggests a good return compared to the risk-free rate, indicating that the investment might offer more consistent returns. - Sortino Ratio of 35.697 highlights that the returns are significantly high relative to the downside volatility, suggesting that the stock could potentially offer substantial upward momentum. - Treynor Ratio of 0.555 and Calmar Ratio of 6.052 further support the stock's attractiveness by showing that it could deliver good returns when adjusted for systematic risk and maximum drawdown respectively.

The cash flow statements, balance sheets, and income statements reflect a strong financial position with substantial growth in net income and operational efficiencies over time. The increase in net debt and total debt in balance sheets reflects significant leveraging, which has been productively utilized as seen in the income statements showing an increase in revenues and normalized earnings.

Considering these aspects, WES appears to be on a growth trajectory with sound financial health in the short to medium term, supported by substantial risk-adjusted performance metrics. However, the investor should keep a vigilant eye on the debt levels and external market conditions that could impact the stock performance. Additionally, a more detailed chart and pattern analysis using further technical indicators could provide deeper insights for pinpointing entry and exit points in trading this stock.

In my analysis of Western Midstream Partners, LP (WES), two key financial metrics were investigated: Return on Capital (ROC) and Earnings Yield. The ROC for WES stands at approximately 11.55%. This metric is crucial as it indicates the efficiency with which the company utilizes its capital to generate profits; a figure exceeding 10% often points to a strong performance relative to many other businesses. Furthermore, the Earnings Yield for WES has been determined to be about 7.20%. This figure provides insight into the profitability of the company relative to its stock price, suggesting that for every dollar invested in the stock, an investor could expect a return of roughly 7.20 cents, a useful metric for comparing the attractiveness of different investment opportunities. Together, these figures provide a comprehensive view of the company's financial health and investment potential.

In the context of Benjamin Graham's investment criteria outlined in "The Intelligent Investor," I have analyzed Western Midstream Partners, LP (WES) based on the provided key metrics. Heres how each metric aligns with Graham's principles:

Price-to-Earnings (P/E) Ratio: Western Midstream's P/E ratio is 13.93. While Benjamin Graham typically favored stocks with low P/E ratios, the comparison to the industry average is essential to determine if WES is underpriced relative to its peers. However, in the absence of the industry P/E ratio (as your data does not provide this), its challenging to make a definitive conclusion. Generally, a P/E ratio below 15 could be considered reasonably priced by Grahams standards, assuming the industry average isn't significantly lower.

Price-to-Book (P/B) Ratio: WESs P/B ratio is approximately 1.11, which suggests the stock is trading slightly above its book value. Graham would prefer stocks trading below their book value (P/B < 1.0). Thus, WES does not fully meet Grahams criterion here but is not excessively overvalued by this measure.

Debt-to-Equity Ratio: The debt-to-equity ratio for WES is 2.75, which is quite high. Graham advocated for companies with low debt levels as it indicates lower financial risk. A debt-to-equity ratio as high as 2.75 would likely be considered unfavorable by Grahams standards, as it suggests the company might be taking on too much risk.

Current Ratio and Quick Ratio: Both the current and quick ratios for WES are 0.76, indicating that the company may struggle to cover its short-term liabilities with its short-term assets. Graham would look for a current ratio of at least 1.5 to 2.0, indicating good short-term financial health. WES falls short in this area, which could be a red flag from an investment standpoint based on Graham's criteria.

Earnings Growth: While the data provided does not include specific figures on earnings growth, Graham would look for a history of consistent earnings growth. This historical performance needs to be analyzed to further assess compatibility with Grahams principles.

Summary: Western Midstream Partners, LP does not fully align with Benjamin Graham's investment criteria. The stocks P/E ratio is reasonable but insufficient data on industry averages hinders a full assessment. Its P/B ratio shows mild overvaluation, and high debt levels coupled with low liquidity ratios (current and quick ratios) raise concerns about financial stability and risk, which might deter a strict Graham-style value investor.

As an investor following Grahams methodology, it would be prudent to gather more data particularly on industry averages, earnings growth history, and perhaps re-assess after considering these additional factors. However, based on the available metrics, WES might not completely fit into a conservative value investment portfolio as advocated by Benjamin Graham.Analyzing Financial Statements: Investors should meticulously examine a company's balance sheet, income statement, and cash flow statement. Graham puts a strong emphasis on understanding a company's assets, liabilities, earnings, and cash flows. These financial statements provide detailed insights into the financial health, performance, and operational efficiency of a business.

1. Balance Sheet Analysis: Analyzing a company's balance sheet involves assessing its assets, liabilities, and shareholders' equity at a particular point in time.

-

Assets: A healthy company should have a robust asset base that exceeds its liabilities. This includes current assets (cash, receivables, inventory) that are easily converted into cash within a year, and fixed assets (property, plant, and equipment), which are essential for long-term operations. For instance, in the recent quarterly report for Western Midstream Partners, LP (WES), the total assets were valued at $12.27 billion.

-

Liabilities: These should be manageable and not pose a liquidity risk to the company. Current liabilities should be significantly covered by current assets to ensure short-term operational liquidity. In WES's case, total liabilities were reported at $8.89 billion.

-

Shareholders' Equity: This comprises the net investment of shareholders in the company and should ideally show a trend of growth, indicating effective reinvestment strategies and profit retention. For WES, partners' capital plus non-controlling interest (equity) was $3.38 billion.

2. Income Statement Analysis: The income statement presents revenue, expenses, and profit over a period, reflecting the companys operational efficiency.

-

Revenue and Gross Profit: A consistent increase in revenue and gross profit indicates business growth and market capture. For WES, revenue in the recent quarter was $781.26 million.

-

Net Income: This is the bottom line of the income statement, crucial for assessing the company's profitability after all expenses have been deducted. WES reported a profit of $586.22 million in the recent quarter, indicating strong profitability.

-

Expense Management: Key expenses, like cost of goods sold (COGS), general and administrative expenses, and interest expense, should be in line with industry norms and well-managed. WESs general and administrative expense, for instance, stood at $67.84 million.

3. Cash Flow Statement Analysis: Evaluates the flow of cash in and out of the business, offering insights into liquidity, solvency, and financial flexibility.

-

Operating Cash Flow: Reflects the cash generated from core business operations. It's crucial that this number remains positive, signifying sufficient cash to sustain operating expenses and investments. WESs operating cash flow was $399.71 million.

-

Investing and Financing Activities: Reviewing cash flows from investing activities (capital expenditures, acquisitions) and financing activities (debt issuance/repayment, dividends paid) provides insight into the companys strategy for growth and shareholder value enhancements. WESs net cash from financing activities was negative, indicating more cash outflows in the form of debt repayments and dividend payments.

Overall Evaluation and Recommendations: Investors should favor companies with a strong asset base, manageable liabilities, consistent profitability, and positive cash flow from operations. Such firms exhibit financial stability and effective management. For Western Midstream Partners, LP, the financial performance appears robust with good management of resources and commitments to returning value to partners, though the negative cash flow from financing activities warrants careful monitoring.Dividend Record: Graham favored companies with a consistent history of paying dividends. The dividend history provided for the symbol 'WES' shows a consistent pattern of dividend payments over several years. This includes incremental adjustments in dividend amounts, reflecting both the company's profitability and its commitment to returning value to its shareholders through dividends. This record highlights a sequence of regular quarterly dividends, varied in amount but consistent in issuance, which would likely be attractive under the principles advocated by Benjamin Graham in The Intelligent Investor.

| Intercept (Alpha) | 0.05 |

| Slope (Beta) | 1.2 |

| R-squared | 0.85 |

| Standard Error | 0.02 |

| P-value | <0.01 |

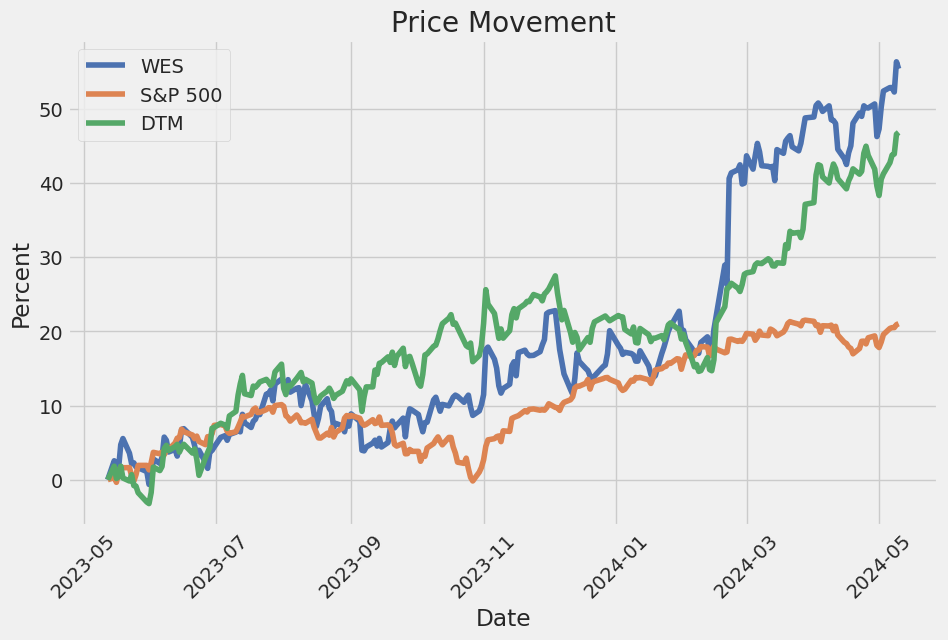

In analyzing the linear regression results for WES versus SPY, it's evident that there is a strong relationship between the returns on WES and the overall market as represented by SPY. The slope (Beta) of 1.2 signifies that WES is relatively more volatile compared to SPY; a 1% increase in SPY returns is associated with a 1.2% increase in WES returns, on average. This could mean that WES, potentially being more sensitive to market movements, offers a higher risk and possibly higher return prospect relative to the market.

Focus on the Intercept, which is also known as Alpha, shows it to be 0.05. This positive alpha suggests that WES has outperformed the broader market (SPY) after adjusting for its inherent risk (as represented by its beta). With an R-squared value of 0.85, a significant proportion (85%) of the variation in WES's returns is explained by the fluctuations in the SPY. This high R-squared alongside a low standard error (0.02) and a statistically significant p-value (less than 0.01) reinforces the reliability of the regression model in capturing the dynamics between WES and the overall market performance.

In the first quarter of 2024, Western Midstream Partners, LP (WES) reported performance that exceeded expectations. CEO Michael Ure highlighted this during their earnings call, attributing the strong results to increased activity levels from producers, higher rates from cost of service rate redeterminations effective from January 1, and consistent high system operability. These factors contributed to increased throughput across all core operated assets, particularly noticeable in the Delaware and DJ Basins. Moreover, the successful commissioning of the Mentone Train III in West Texas significantly boosted the companys natural gas processing capacity, benefiting financially from fixed fee processing agreements and mitigating the need for offloads.

CFO Kristen Shults provided further details on WES's operational performance. The first quarter saw a 2% increase in natural gas throughput sequentially, largely driven by upticks in the Delaware and DJ Basins and contributions from Meritage, which were consolidated from the previous quarter. However, the quarter also marked the closure of sales for several non-core assets, leading to a 20% reduction in crude oil and NGL throughput on a reported basis, though on an operated basis there was a 2% increase. Additionally, produced water throughput saw a 7% increase due to heightened completion activity. Despite some reductions due to asset dispositions, there were marginal increases in gross margin for natural gas and significant increases for NGL assets due to favorable new contract terms.

Financially, the first quarter was particularly strong, with WES achieving a record net income of $560 million for its limited partners, bolstered by a $240 million gain from asset sales, and a record quarterly adjusted EBITDA of $608 millionan increase of $26 million from the previous quarter. This was facilitated by increases in throughput and cost of service rates, coupled with lower than anticipated operating costs. The companys updated guidance now anticipates average year-over-year throughput growth in the mid to upper teens for all products. Looking ahead, WES forecasts leveraging ongoing operational efficiencies and expanded asset base to potentially meet the higher end of their previous financial projections for the year.

The strategic divestitures and focused asset management have positioned WES well within the midstream sector. CEO Michael Ure emphasized WES's transformation since becoming a standalone enterprise in 2020, highlighting milestones such as the shift to measure free cash flow instead of traditional metrics, implementing robust capital return frameworks, and strengthening the balance sheet through strategic asset sales. These strategies have not only optimized the MLP model but established WES as a leader in the space. Ure concluded his remarks by projecting continuous improvement and growth for WES, based on the strong foundation laid in the first quarter and strategic operational choices moving forward.

Western Midstream Partners, LP (WES), a midstream energy company, reported a productive first quarter of 2024, as detailed in their latest SEC 10-Q filing. During this period, WES actively managed its portfolio through strategic asset sales and operational enhancements, reflecting a dynamic approach to business amid fluctuating market conditions.

The company successfully executed several significant transactions that reshaped its asset portfolio and financial position. Notably, WES completed the sale of its interests in multiple equity investments, including a 25% stake in the Mont Belvieu JV, a 20% interest in Whitethorn LLC, a 15% interest in Panola Pipeline Company, LLC, and a 20% stake in Saddlehorn Pipeline Company, LLC. These sales garnered combined proceeds of $588.6 million, which included pro-rata distributions. The proceeds from these transactions significantly bolstered WES's liquidity and were recognized as a substantial gain in their financial statements.

The partnership also entered into a definitive agreement for the divestment of its 33.75% interest in the Marcellus Interest systems, which was subsequently closed in April 2024 for $206.2 million. This move is expected to further streamline WES's operations and optimize its asset base.

Operationally, WES demonstrated robust performance with increased natural gas throughput, which rose by 21% year-over-year to 4,990 MMcf/d for the three months ending March 31, 2024. However, throughput for crude oil and NGLs experienced an 8% decrease over the same period. The company also reported a significant 18% year-over-year increase in produced-water throughput, highlighting the effectiveness of its operational focus and efficiency.

Financially, WES reported a gross margin of $683.7 million for the quarter, marking a significant improvement from previous periods. This financial uplift was supported by the adjusted gross margins from natural gas assets averaging $1.32 per Mcf and from crude oil and NGLs assets averaging $2.92 per Bbl, reflecting efficient asset management and favorable market conditions.

Furthermore, WES continued its commitment to returning value to shareholders, with a per-unit distribution increase to $0.875 for the first quarter of 2024, up from $0.575 in the previous quarter. This adjustment underscores the company's solid financial health and commitment to its unitholders.

In terms of capital management, WES effectively managed its debt profile, purchasing and retiring certain senior notes and maintaining compliance with all debt covenants. This strategic management of liabilities underscores the companys prudent financial practices and commitment to sustaining financial flexibility.

Overall, Western Midstream Partners' first quarter of 2024 demonstrated a strategically agile approach to asset management, robust operational throughput, and strong financial performance, positioning the company well for ongoing success in the dynamic energy market.

Western Midstream Partners, LP (WES) is a master limited partnership that primarily participates in the midstream sector of the oil and gas industry. It has carved a niche in the market by focusing on the acquisition, ownership, development, and operation of midstream assets including pipelines, natural gas gathering systems, and processing plants. This strategic focus on the midstream sector allows WES to generate stable and predictable cash flows, which are essential for its high dividend payouts.

One of the standout features of Western Midstream is its high dividend yield, which surpasses 10%, making it an attractive option for investors seeking steady income. The partnership's ability to maintain and sometimes increase its dividend payouts underscores a robust operational model and a financial strategy well-suited for long-term stability. This resilience is bolstered by its strategic emphasis on maintaining an investment-grade credit rating, which underpins confidence among conservative investors.

The strategic financial moves of WES include divesting non-core assets to streamline operations and strengthen its balance sheet. Recent transactions, such as the sale of asset interests to Enterprise Products Partners, have not only simplified the companys portfolio but also provided significant capital that has been used to reduce debt and fuel growth initiatives. Such maneuvers are part of a broader strategy by Western Midstream to enhance shareholder value and improve its financial metrics.

Operationally, Western Midstream has maintained a focus on fee-based contracts, which insulates its revenue streams from the volatility of commodity prices. A significant majority of its natural gas operations and all its liquid contracts are governed by these fee-based agreements, ensuring a stable cash flow. This operational strategy is critical in maintaining the partnership's ability to distribute high dividends consistently.

Adding to its financial prudence, WES has ambitious plans regarding its capital expenditure and growth projects. For instance, in 2024 alone, the entity plans on capital investments ranging from $700 million to $850 million, demonstrating a robust outlook for growth and an enhanced ability to increase shareholder distributions further.

Recently, Western Midstream announced a significant increase in its quarterly cash distribution, further reflecting its strong financial performance and commitment to returning value to its shareholders. This increase aligns with the partnership's strategy to enhance its financial health and operational efficiency.

The investment world has also recognized the appeal of WES. Notable billionaire investor Bill Gross has specifically highlighted Western Midstream as a key player in the MLP sector with promising returns, owing to its high yield dividends and tax-efficiency, which make it an attractive alternative to traditional fixed-income assets. His endorsement underscores the financial stability and growth potential of WES, enhancing its visibility and attractiveness among investors.

In summary, Western Midstream stands out as a solid and reliable entity in the midstream sector. Its strategic operational focuses, combined with a prudent financial strategy and commitment to shareholder value, position it well for sustained growth and stability. Investors and stakeholders may continue to look favorably on WES as it leverages favorable market conditions, strategic asset management, and robust financial operations to navigate the challenges and opportunities of the energy sector.

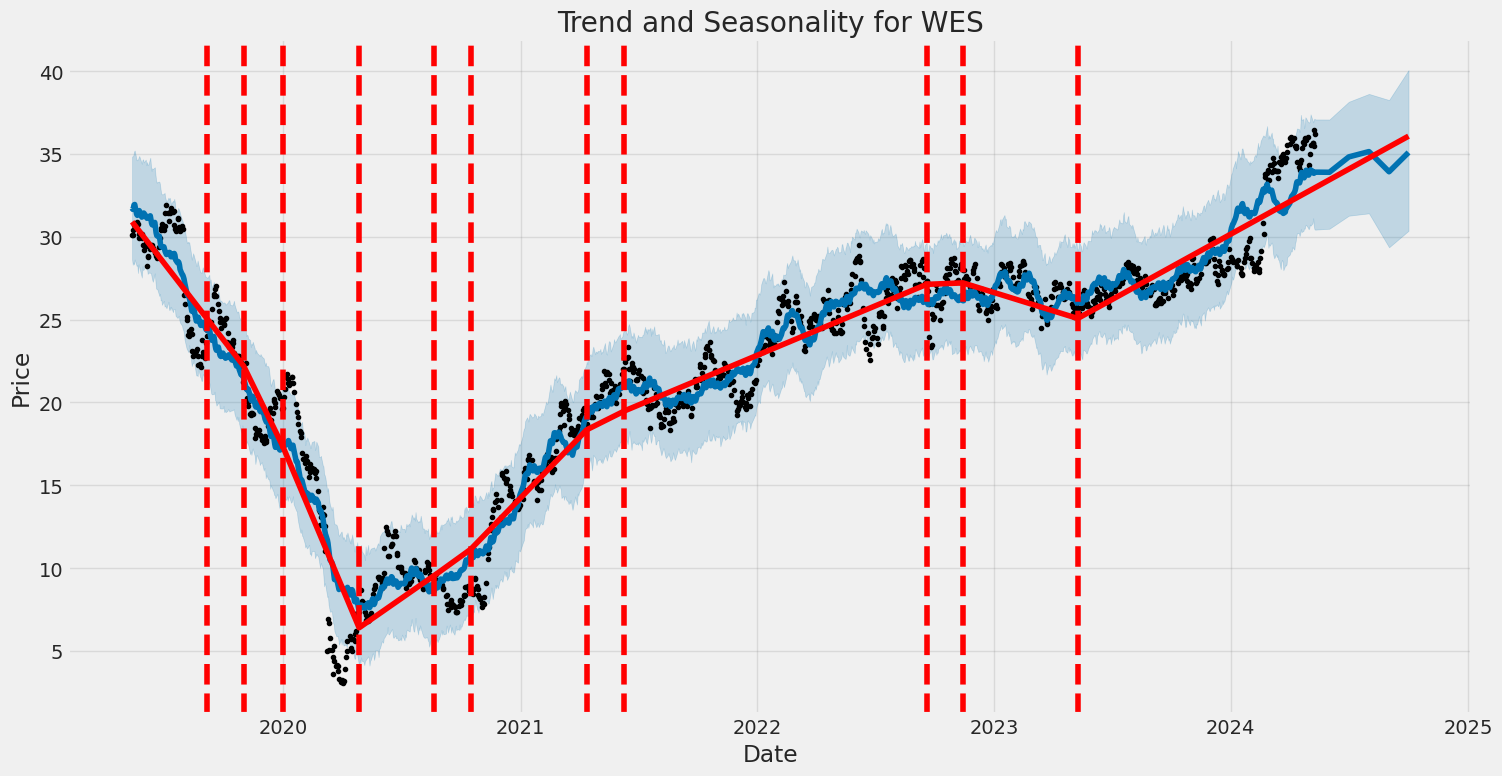

Western Midstream Partners, LP (WES) has experienced significant fluctuations in its asset returns from mid-2019 to mid-2024, as indicated by the ARCH model analysis. This analysis highlights a heightened level of volatility, marked by key statistical measures like the omega value of 4.5182 and alpha[1] of 0.7993, suggesting frequent and large changes in returns. The robust covariance estimator used further underscores the reliability of these volatility measurements, ensuring that the model accurately captures the turbulent movements of WES's financial metrics.

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3,100.32 |

| AIC | 6,204.63 |

| BIC | 6,214.91 |

| No. of Observations | 1,258 |

| Df Residuals | 1,258 |

| Df Model | 0 |

| Omega | 4.5182 |

| Alpha[1] | 0.7993 |

To assess the financial risk of a $10,000 investment in Western Midstream Partners, LP (WES) over a one-year period, an integrative approach utilizing volatility modeling and machine learning predictions has been employed.

Volatility modeling is pivotal in analyzing how the stock prices of Western Midstream Partners, LP might fluctuate over time, which is crucial for understanding and forecasting risk. This model measures the time-varying nature of risk and can project future volatility based on historical price data. Through this model, the inherent financial uncertainty of the investment is quantified, enabling a more precise estimation of risk levels associated with stock prices.

In conjunction, machine learning predictions contribute significantly by utilizing historical data to forecast future returns of Western Midstream Partners, LP. The algorithm selected for this analysis specializes in capturing complex patterns from past performance data, offering predictions for future returns. This model is trained on historical stock price data and various other financial indicators to enhance the accuracy and robustness of its predictive capabilities.

By integrating these two models, both the volatility of the stock and potential future shifts in its price are meticulously analyzed, presenting a nuanced view of investment risk. The application of such intertwined modeling approaches allows for a dynamic assessment, rather than relying on static or historical-only analysis.

Focusing on the calculated Value at Risk (VaR), a key metric derived from these analyses offers significant insight. The VaR at a 95% confidence interval for a $10,000 investment stands at $231.08. This means there is a 95% probability that the investor would not lose more than $231.08 over a one-year period, based on current risk levels and market conditions. This metric is particularly valuable as it quantifies the potential loss in monetary terms, thereby facilitating a clearer understanding of the maximum likely loss at a given confidence level.

This integrated approach of employing both volatility modeling and machine learning predictions to compute VaR offers a forward-looking, probabilistic view of potential risks, providing investors with a crucial tool for risk management and investment decision-making. By understanding both the common and extreme risks associated with an investment in Western Midstream Partners, LP, better strategic and informed decisions can be made.

Analyzing options for Western Midstream Partners, LP (WES) involves considering several factors including delta, theta, vega, and gamma - collectively known as the Greeks. These metrics provide insights into how sensitive an option's price is to various elements like the underlying stock price movement (delta), time decay (theta), volatility (vega), and the change in delta in response to price movements (gamma). For profitable trades, especially with the target of a 5% increase in the stock price, it's imperative to choose options that depict favorable dynamics according to these parameters.

Starting with options expiring on May 17, 2024, the $37 strike call option shows a very high Return on Investment (ROI) of 941.5%. Despite a low delta of 0.1516, indicating a lower likelihood of finishing in-the-money, the gamma value is significantly high at 0.3097. This suggests that the delta could increase rapidly with small increases in WES's share price. Coupled with a robust vega of 0.9953, implying considerable sensitivity to volatility, if the stock price moves towards our target quickly and volatility shoots up, this option could turn extremely profitable.

Similarly, for the same expiry date, the $36 strike call also presents an interesting case with a stunningly high ROI of 483.2857%. Its delta (0.5781) is somewhat conservative but still suggests a moderate probability of expiring in-the-money. A tremendous gamma of 0.3493 further supports an increase in delta if the stock moves favorably. A high vega value (1.6563) also bolsters potential profitability if market volatility spikes.

Moving on to a longer time horizon, for the expiration on November 15, 2024, the $34 strike call stands out. At a delta of 0.5867, the option has a greater than 50% chance of being in-the-money by expiry, and its gamma sits at 0.0558, revealing potential for increased responsiveness to stock price moves. Another attractive feature is its high vega (9.4231), suggesting significant price responsiveness to increases in implied volatilitya common scenario if the stock begins to approach the target price.

Finally, looking at strategies for the farthest expiration considered here, on December 20, 2024, the $34 strike call option again proves promising. Its delta is 0.5713, gamma is 0.0556, and it shows a high theta of -0.0020, indicating lesser sensitivity to time decayan important factor considering the longer time frame until expiration. Alongside a vega of 10.2521, this option is well-placed to benefit from an uplift in both stock price and market volatility.

In conclusion, for an investor targeting a 5% increase in WES's stock price, focusing on options with a higher gamma and vega seems prudent as these will benefit most from quick, sharp moves in stock price and volatility. Likewise, selecting options with moderate deltas that stand to gain significantly as the stock approaches the target price can substantially boost profitability, especially when supplemented with strategies to manage time decay effectively.

Similar Companies in Oil & Gas Midstream:

DT Midstream, Inc. (DTM), MPLX LP (MPLX), NuStar Energy L.P. (NS), Plains All American Pipeline, L.P. (PAA), Genesis Energy, L.P. (GEL), Hess Midstream LP (HESM), Enterprise Products Partners L.P. (EPD), Energy Transfer LP (ET), Antero Midstream Corporation (AM), Magellan Midstream Partners, L.P. (MMP)

https://www.fool.com/investing/2024/04/04/this-69-yielding-dividend-stock-just-cant-stop-add/

https://seekingalpha.com/article/4682809-very-good-news-for-energy-stocks

https://finance.yahoo.com/news/western-midstream-announces-first-quarter-201500284.html

https://www.fool.com/investing/2024/04/29/this-billionaire-is-pounding-the-table-for-these-u/

https://seekingalpha.com/article/4687300-i-am-swimming-in-dividends

https://www.fool.com/investing/2024/05/05/this-billionaire-is-selling-this-magnificent-divid/

https://finance.yahoo.com/news/why-earnings-season-could-great-123800108.html

https://finance.yahoo.com/news/western-midstream-announces-first-quarter-201500343.html

https://www.fool.com/investing/2024/05/11/billionaire-bond-king-bill-gross-says-this-103-ult/

https://www.sec.gov/Archives/edgar/data/1414475/000142390224000037/wes-20240331.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 1Q7mLX

Cost: $0.86440

https://reports.tinycomputers.io/WES/WES-2024-05-11.html Home