United States Steel Corporation (ticker: X)

2023-12-15

United States Steel Corporation (ticker: X), founded in 1901 and headquartered in Pittsburgh, Pennsylvania, stands as one of the leading steel producers in the United States. The company engages in the manufacturing and selling of steel products, including flat-rolled and tubular products primarily for the automotive, construction, appliance, energy, and packaging industries. U.S. Steel operates through several business segments, including North American Flat-Rolled (NAFR), U.S. Steel Europe (USSE), and Tubular Products (Tubular), each catering to different markets and customer needs. Positioned as an integrated steel producer, U.S. Steel has historically focused on the benefits of economies of scale through large blast furnace operations. However, in response to evolving market conditions and competitiveness within the industry, U.S. Steel is investing in new technologies and more sustainable production processes, like electric arc furnace (EAF) technology, to improve efficiency, reduce costs, and lower its environmental impact. The corporation's strategic initiatives also reflect an increased emphasis on innovation, such as the development of advanced high-strength steel grades to meet the demanding requirements of modern applications. As of the knowledge cutoff in 2023, United States Steel Corporation continues to play a critical role in global steel production and innovation, facing challenges such as fluctuating demand, trade policies, raw material prices, and the need for environmental sustainability.

United States Steel Corporation (ticker: X), founded in 1901 and headquartered in Pittsburgh, Pennsylvania, stands as one of the leading steel producers in the United States. The company engages in the manufacturing and selling of steel products, including flat-rolled and tubular products primarily for the automotive, construction, appliance, energy, and packaging industries. U.S. Steel operates through several business segments, including North American Flat-Rolled (NAFR), U.S. Steel Europe (USSE), and Tubular Products (Tubular), each catering to different markets and customer needs. Positioned as an integrated steel producer, U.S. Steel has historically focused on the benefits of economies of scale through large blast furnace operations. However, in response to evolving market conditions and competitiveness within the industry, U.S. Steel is investing in new technologies and more sustainable production processes, like electric arc furnace (EAF) technology, to improve efficiency, reduce costs, and lower its environmental impact. The corporation's strategic initiatives also reflect an increased emphasis on innovation, such as the development of advanced high-strength steel grades to meet the demanding requirements of modern applications. As of the knowledge cutoff in 2023, United States Steel Corporation continues to play a critical role in global steel production and innovation, facing challenges such as fluctuating demand, trade policies, raw material prices, and the need for environmental sustainability.

| As of Date: 12/15/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 8.67B | 7.24B | 5.60B | 5.93B | 5.87B | 4.24B |

| Enterprise Value | 9.80B | 8.55B | 6.90B | 6.55B | 6.59B | 5.30B |

| Trailing P/E | 8.38 | 6.04 | 3.61 | 2.85 | 2.07 | 1.05 |

| Forward P/E | 13.64 | 16.23 | 6.22 | 6.36 | 6.11 | 4.42 |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 0.55 | 0.44 | 0.33 | 0.34 | 0.32 | 0.23 |

| Price/Book (mrq) | 0.79 | 0.68 | 0.54 | 0.58 | 0.55 | 0.42 |

| Enterprise Value/Revenue | 0.54 | 1.93 | 1.38 | 1.47 | 1.52 | 1.02 |

| Enterprise Value/EBITDA | 4.07 | 18.04 | 9.17 | 15.39 | 20.66 | 7.00 |

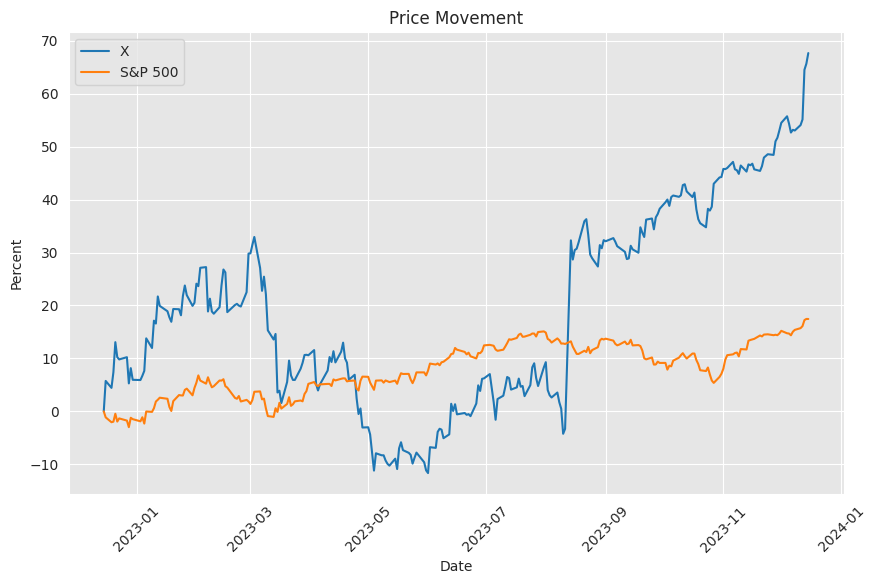

Based on the technical analysis (TA) data and underlying company fundamentals provided for the subject company, we can extrapolate potential stock price movements over the coming months. It is essential to integrate insights from both the technical indicators and the fundamental financial data to develop a comprehensive outlook. Here is a breakdown of the current situation and the derived prediction:

Based on the technical analysis (TA) data and underlying company fundamentals provided for the subject company, we can extrapolate potential stock price movements over the coming months. It is essential to integrate insights from both the technical indicators and the fundamental financial data to develop a comprehensive outlook. Here is a breakdown of the current situation and the derived prediction:

-

Strength and Momentum: The stock has a high Relative Strength Index (RSI) of 84.94, which indicates it is currently in an overbought territory. Traditionally, this could foresee a potential retracement or consolidation period as the stock may be perceived as overvalued at current levels. Furthermore, the Stochastic indicators (STOCHk and STOCHd) are also signaling overbought conditions, supporting the RSI's indication.

-

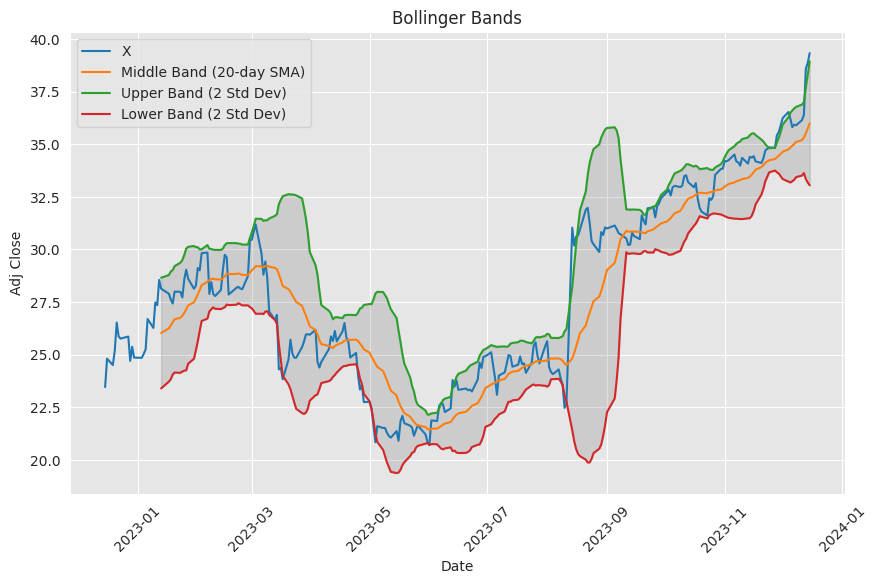

Moving Averages and Channels: The stock price is currently above its 20-day Simple Moving Average (SMA_20), 50-day Exponential Moving Average (EMA_50), and all the Bollinger Bands (BBL, BBM, BBU), suggesting an ongoing uptrend. These indicators confirm strong bullish momentum, but the proximity to the upper Bollinger Band could also imply upcoming price volatility or a potential pullback.

-

Volume and Accumulation: The On Balance Volume (OBV) shows substantial trading volume in the stock, which, in combination with the positive Chaikin Money Flow (CMF), suggests that buying pressure is currently outweighing selling pressure.

-

Trend Intensity: The Average Directional Index (ADX) is at 52.67, indicating that the current trend is strong and likely to continue. However, given the extremely strong trend, there might be a risk of trend exhaustion in the near-term.

-

Mean Reversion Indicators: The MACD line is positive and above its signal line, and the histogram is also positive, which typically confirms bullish momentum. Nonetheless, the potential for a mean reversion increases as these indicators reach extreme values, which could possibly happen in the ensuing terms if the divergence between the MACD and its signal line decreases.

Turning to the fundamentals, we observe a significant increase in the Market Cap over the previous year, which correlates with the bullish momentum seen in the TA data. The Trailing P/E ratio is relatively low at 8.38, suggesting the company may still be undervalued based on its earnings, which could support further price appreciation. However, it's noteworthy that the Forward P/E ratio has increased, which may indicate slowing earnings growth or heightened investor expectations.

Considering the historical financial metrics, the company has improved its EBITDA and Net Income significantly over the past two years, suggesting better operational efficiency or growth in its business segments. Cost control seems to be effective, and this could bolster investor confidence in its ability to sustain profitability.

In conclusion, the technical data coupled with the fundamental outlook suggests that the stock is likely to continue its bullish trend in the short-term, but investors should remain cautious of potential price corrections due to overbought conditions. The strong financial performance and reasonable valuation metrics may provide a cushion to support ongoing price increases. Over the medium-term, careful monitoring of changes in price momentum, trading volumes, and company earnings will be essential to reassess the direction and sustainability of the trend. It's always prudent for investors to watch for changes in the broader market and sector-specific developments that may affect the subject company's stock price.

United States Steel Corporation (NYSE: X), widely recognized as U.S. Steel, is a titan of the steel industry, with a legacy dating back to the turn of the 20th century. The company's sway in the American industrial space has been monumental, aligning closely with the infrastructural growth of the nation. Yet, the path to maintaining its industrial hegemony has encountered numerous challenges, primarily stemming from the cyclical nature of the steel industry and the evolution of production technologies.

For years, U.S. Steel has been synonymous with large-scale blast furnace operations, a method steeped in traditionyet marked with high capital and operational costs. Unfortunately, this model's efficiency wanes during industry downturns, leading to fluctuations in the company's performance. Recognizing this vulnerability, U.S. Steel has judiciously pivoted towards the incorporation of electric arc mini-mill technology. This shift aligns the company with leaner and more adaptive competitors, such as Nucor and Steel Dynamics, which have long leveraged these technologies for strategic advantages.

The adoption of these mini-mills signifies U.S. Steels commitment to innovation, aiming to resort to more agile operations that can swiftly adjust output in response to shifting demand curves. This approach can potentially shield the company from the full impact of the industry's cyclical downturns, offering a smoother financial trajectory and a more resilient market position.

U.S. Steel's evolution has not gone unnoticed. The murmurs of potential acquisitions have turned into concrete interest, underscored by a bid from Cleveland-Cliffs at $32.53 per share. While this offer was initially rebuffed by the U.S. Steels management, it opened the floodgates to speculation about the companys acquisition prospects. Not long after, reports of competing bids from industry majors such as ArcelorMittal, with a potential all-cash deal that might ascend to $45 per share, indicated a belief in the latent value within U.S. Steel's evolving business model.

Smaller competitors like Steel Dynamics have surfaced in this maelstrom of acquisition intrigue, recognized for operational efficiencies that, if combined with U.S. Steel's assets, could yield substantial synergies. Further stirring the pot, rumors of Nucors interestthough focused on specific assets rather than an outright purchasehave added to the complexity of prospective deal-making.

The acquisition frenzy has triggered a surge in investor interest, manifesting in a ballooning of U.S. Steels stock price. Speculators and strategic investors, assessing the scenarios, have driven volatility and a marked upsurge in the company's market value. For instance, investor Daniel Jones's substantial holding in U.S. Steel might bear considerable fruit should a high-stakes acquisition be realized.

This flurry of acquisition bids has placed U.S. Steel's valuation on a pedestal that looms above historical market expectations. The bids reflect a premium, ostensibly built on the inherent strategic positioning of U.S. Steel within the industry's future landscape. However, the realization of any such deal remains enigmatic, layered with possible regulatory and market hurdles that need to be navigated with astute corporate strategizing.

U.S. Steels approach to modernization and its resultant capture of investor attention emphasizes the dynamic and transformative tenets of the steel industry. This movement towards modern mini-mill technology is not only indicative of the company seeking resilience in cyclicality but is also a symbolic tipping point; it's a pivotal moment when U.S. Steel might transition either to an acquisitions fold or reemerge invigorated with a technologically competitive edge.

The prevailing scenario fosters a jittery market sentiment, wherein the strategic moves of U.S. Steel and its suitors are closely watched. From a financial vantage point, U.S. Steel's initiatives to modernize via capital investments in electric arc technology have set a tone of expectancy. The investments in advanced steel-making technology signal the companys foresighted adaptation efforts and a step towards meeting the ever-growing demand for versatility in steel production.

In weighing the conjecture surrounding U.S. Steel's future, investors have notably shifted their perspectives, contemplating the implications of a successful acquisition. Despite the depth of strategic bidders circling U.S. Steel, the steelmaker's board remains meticulous, with its eyes set firmly on value creation for its shareholders. This corporate ethos is reflected in the company's handling of its portfolio, striving for operational excellence while navigating the purchasing interests it has attracted.

Meanwhile, U.S. Steel's management maintains a vigilant stance on its comprehensive transformation agenda. Though the third quarter of 2023 has been encouraging, with respectable earnings and progress on capital projects, the coming year is poised to be paramount. The fruition of strategic investments, including the completion of key projects, will likely bolster U.S. Steel's EBITDA and mark an inflection point in its financial narrative.

The investor community, thus, remains on tenterhooks, balancing short-term speculative opportunities with a focus on long-term strategic growth. U.S. Steel's narrative is a testament to the intricate dynamics of legacy industries striving to stay relevant in an age of rapid technological shifts and market consolidation, painting a vivid picture of a company at a significant crossroads. As such, the chapters yet unwritten in U.S. Steels history will undoubtedly continue to captivate market analysts, investors, and industry observers alike.

News Links:

https://www.fool.com/investing/2023/10/07/united-states-steel-buy-sell-or-hold/

https://www.fool.com/investing/2023/11/09/3-things-you-need-to-know-if-you-buy-united-states/

https://www.fool.com/investing/2023/09/30/if-you-invested-10000-in-us-steel-10-years-ago-thi/

https://www.fool.com/investing/2023/10/24/us-steel-stock-up-40-on-possible-acquisition-is-th/

https://www.fool.com/investing/2023/11/09/this-industrial-stock-is-finally-ready-to-shine-is/

Copyright © 2023 Tiny Computers (email@tinycomputers.io) -

EXhcxn