Xerox Holdings Corporation Common Stock (ticker: XRX)

2023-12-24

Xerox Holdings Corporation, trading under the ticker XRX, is a multinational corporation widely recognized for its extensive portfolio of printers, digital printing technologies, and related services. Xerox has historically been at the forefront of office automation, having invented the photocopier and laser printing, among other technologies. Over the years, the company has evolved by diversifying its offerings to include document management solutions, content management, and workflow automation, aiming to optimize business operations for its clients. Xerox Holdings Corporation operates in a competitive industry that demands constant innovation and adaptability in response to the changing needs of both digital and print communication markets. The company's stock performance is influenced by its financial health, technological advancements, strategic partnerships, and market dynamics, thus making it a subject of interest for investors who follow the technology and business services sectors. As of the knowledge cutoff date, Xerox continues to streamline its operations while pushing towards growth areas such as digital services and IT solutions in order to sustain its market position and shareholder value.

Xerox Holdings Corporation, trading under the ticker XRX, is a multinational corporation widely recognized for its extensive portfolio of printers, digital printing technologies, and related services. Xerox has historically been at the forefront of office automation, having invented the photocopier and laser printing, among other technologies. Over the years, the company has evolved by diversifying its offerings to include document management solutions, content management, and workflow automation, aiming to optimize business operations for its clients. Xerox Holdings Corporation operates in a competitive industry that demands constant innovation and adaptability in response to the changing needs of both digital and print communication markets. The company's stock performance is influenced by its financial health, technological advancements, strategic partnerships, and market dynamics, thus making it a subject of interest for investors who follow the technology and business services sectors. As of the knowledge cutoff date, Xerox continues to streamline its operations while pushing towards growth areas such as digital services and IT solutions in order to sustain its market position and shareholder value.

| As of Date: 12/24/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 2.30B | 2.47B | 2.34B | 2.42B | 2.27B | 2.03B |

| Enterprise Value | 5.38B | 5.10B | 5.03B | 5.34B | 5.09B | 4.76B |

| Trailing P/E | 17.64 | - | - | - | - | - |

| Forward P/E | 9.75 | 8.18 | 10.79 | 9.72 | 7.52 | 6.17 |

| PEG Ratio (5 yr expected) | 0.45 | 0.36 | 0.63 | 0.47 | 0.24 | 0.31 |

| Price/Sales (ttm) | 0.42 | 0.34 | 0.33 | 0.34 | 0.34 | 0.31 |

| Price/Book (mrq) | 0.82 | 0.57 | 0.68 | 0.72 | 0.70 | 0.53 |

| Enterprise Value/Revenue | 0.76 | 3.09 | 2.87 | 3.12 | 2.62 | 2.72 |

| Enterprise Value/EBITDA | 10.40 | 36.46 | -335.15 | 32.78 | 22.21 | -16.18 |

| Statistic Name | Statistic Value | Statistic Name | Statistic Value | Statistic Name | Statistic Value |

|---|---|---|---|---|---|

| Full Time Employees | 20,100 | CEO & Director Pay | $1,461,250 | President & COO Pay | $746,678 |

| Executive VP & CFO Pay | $1,029,274 | Executive VP & President of America Pay | $926,524 | Dividend Rate | 1.0 |

| Dividend Yield | 5.35% | Payout Ratio | 94.34% | Five Year Avg Dividend Yield | 5.03% |

| Beta | 1.737 | Trailing PE | 17.64 | Forward PE | 10.22 |

| Volume | 1,223,103 | Average Volume | 2,159,443 | Average Volume 10 Days | 4,270,130 |

| Market Cap | $2,306,944,256 | Fifty Two Week Low | $12.06 | Fifty Two Week High | $18.9 |

| Price to Sales Trailing 12 Months | 0.3267 | Trailing Annual Dividend Yield | 5.33% | Enterprise Value | $5,798,342,144 |

| Profit Margins | 2.55% | Float Shares | 113,806,039 | Shares Outstanding | 122,906,000 |

| Shares Short | 10,290,779 | Held Percent Insiders | 7.27% | Held Percent Institutions | 87.27% |

| Short Ratio | 6.4 | Book Value | 22.692 | Price to Book | 0.8241 |

| Net Income to Common | $166,000,000 | Trailing EPS | 1.06 | Forward EPS | 1.83 |

| PEG Ratio | 1.45 | Enterprise to Revenue | 0.821 | Enterprise to EBITDA | 9.322 |

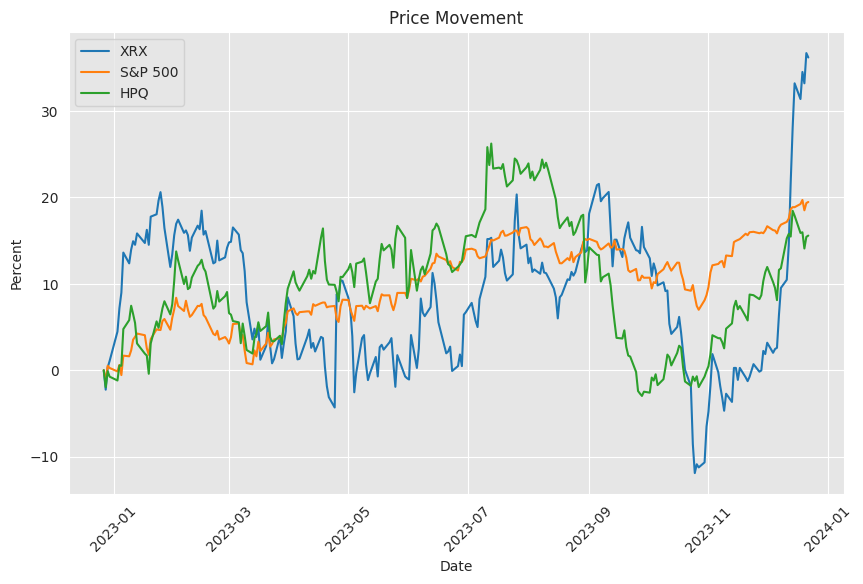

| 52 Week Change | 27.21% | Total Cash | $532,000,000 | Total Cash Per Share | 4.329 |

| EBITDA | $622,000,000 | Total Debt | $3,799,000,064 | Quick Ratio | 0.798 |

| Current Ratio | 1.116 | Total Revenue | $7,062,000,128 | Debt to Equity | 125.711 |

| Revenue Per Share | 45.026 | Return on Assets | 2.33% | Return on Equity | 5.60% |

| Gross Profits | $2,318,000,000 | Free Cash Flow | $508,124,992 | Operating Cash Flow | $483,000,000 |

| Revenue Growth | -5.70% | Gross Margins | 33.94% | EBITDA Margins | 8.81% |

| Operating Margins | 3.15% | Trailing Price to Earnings Growth Ratio | 0.4456 | Current Price | $18.7 |

Based on the provided technical analysis data for Xerox Holdings Corporation (NYSE: XRX), the stock exhibits strong bullish indicators on the last trading day. The analysis of technical indicators combined with a review of the company's financial fundamentals suggests potential price movements for the upcoming months.

Technical Indicators:

- The Adjusted Close of $18.70 indicates the price level at the end of the last session.

- The Moving Average Convergence Divergence (MACD) shows a value of 1.277851 with a positive histogram value of 0.345639, signaling a strong upward momentum.

- The Relative Strength Index (RSI) of 81.77 is above the overbought threshold of 70, which might normally suggest a potential pullback or consolidation in the near term. However, strong RSI levels can also persist during strong trends.

- Bollinger Bands show the stock price is above the upper band (BBU_5_2.0 at $18.989851), which could indicate the stock is in overbought territory on a short-term basis.

- Moving averages, such as the SMA_20 at $15.859500 and EMA_50 at $15.454839, are both below the current price, indicating an upward trend.

- On Balance Volume (OBV) in millions is at 3.062830, which, if moving in the same direction as the price, confirms the existing price trend.

- The Stochastic Oscillator (STOCHk_14_3_3 at 96.146439) also reflects an overbought condition, which aligns with the RSI.

- The Average Directional Index (ADX_14 at 43.981630) indicates a very strong trend presence.

- The Williams %R (WILLR_14 at -3.898614) is in the overbought area, which is consistent with other oscillators.

- The Chaikin Money Flow (CMF_20 at 0.426882) suggests strong buying pressure.

- Parabolic SAR (PSAR) also reaffirms the bullish trend with PSARl_0.02_0.2 at $17.326308 and no value for PSARs_0.02_0.2, indicating the absence of a sell signal.

Fundamentals:

- Xerox Holdings Corporation has a Market Cap of $2.30B, showing it is a mid-cap stock, which can be subject to greater volatility.

- A relatively low Price-to-Earnings (P/E) ratio, both trailing at 17.64 and forward at 9.75, suggests the stock is not overly expensive relative to earnings. However, it's important to note that the P/E ratios do not have historic data for comparison.

- The PEG Ratio (5 yr expected) at 0.45 indicates potential undervaluation based on expected growth rates.

- The Price/Sales (ttm) ratio at 0.42 and the Price/Book (mrq) at 0.82 suggest the companys stock is reasonably valued relative to sales and book value.

- The Enterprise Value/Revenue at 0.76 and Enterprise Value/EBITDA at 10.40 are modest, but past data shows significant volatility in these ratios.

- The financials reveal some concerns, such as a negative Net Income and substantial Total Unusual Items, which may point to instability or non-recurring costs affecting profitability.

Synthesizing the technical indicators and the fundamentals, XRX's stock exhibits robust bullish behavior in the technical analysis for the last trading day, which could presage a continued upward movement in the short term. However, due to the high RSI and the overbought Stochastic and Williams %R indications, investors might watch for a potential retracement or consolidation before any further rise.

The upward price trend is supported by the positive OBV and strong ADX, suggesting that the bullish trend has solid backing and could have the stamina for continuation. However, since the price is currently above the upper Bollinger Band, some volatility and short-term pullbacks may occur.

Fundamentally, Xerox appears to have reasonable valuations based on P/S, P/B, and PEG ratios, indicating that the stock is not overly expensive. However, the company's recent negative net income could be a concern, but without additional context on the nature of the unusual items and whether these are expected to recur, the full impact on future price cannot be readily quantified.

Considering all factors, the TA evidence points toward a positive outlook for the stock price in the coming months, assuming the broader market conditions support the continuation of current trends. However, investors need to closely monitor company performance and market sentiment, given the potential for pullbacks signaled by overbought conditions and the need for clarity on the fundamentals, particularly unusual items impacting the financial statements.

Xerox Holdings Corporation, an enduring presence within the realms of printing and digital services, has long been shaping the landscape of workplace technology. Renowned for its influential role in office and production printing technology, Xerox has continuously evolved to meet the changing demands of a modern, globally distributed workforce. This dedication to innovation has been recognized by Quocirca in its 2023 Sustainability Leaders Report, celebrating Xerox's efforts in environmental sustainability and corporate responsibility.

The company's commitment to reducing its environmental footprint is exemplified through initiatives such as leveraging artificial intelligence (AI) and augmented reality (AR) to enhance operational efficiency. CareAR, a Xerox subsidiary, has implemented AR technology that significantly reduces the need for on-site service visits, effectively lowering CO2 emissions, a testament to Xerox's sustainable business practices.

Xerox's product portfolio is reflective of its dedication to sustainability. With a comprehensive array of services including efficient hardware devices, remanufacturing, refurbishing, and recycling programs, Xerox has fortified its position as an eco-conscious brand. Digital workflow solutions by Xerox, such as Xerox Workflow Central and Xerox Accounts Payable Services, exemplify the company's support for clients in their journeys from paper-heavy processes to streamlined digital workflows.

The company's product development strategy underlines its commitment to waste reduction and resource reuse. Through the Green World Alliance supplies take-back program, Xerox has produced over 1.6 million toner cartridges with recovered materials, demonstrating the firm's dedication to closing the loop in product lifecycles. Partnering with PrintReleaf to provide carbon offset programs enables Xerox to offer clients tailored environmental assessments, facilitating the minimization of ecological impacts across print infrastructures.

Xerox continues to advance workplace technology with a focus on sustainability, maintaining its prominence in empowering diverse working environments. Moreover, the company's social media engagement and emphasis on diversity and inclusion further solidify its position as an architect for a sustainable and inclusive corporate framework.

As a testament to its acknowledgment of market expectations, Xerox has declared a generous dividend payout scheduled for late January. The 7.4% dividend yield stands considerably higher than the industry average, signifying an attractive return for investors. This payout is financially tenable, with the company's solid free cash flow adequate to support the dividend while enabling further business reinvestment.

Despite operating at a loss, forward-looking estimates indicate a strong projected growth in earnings per share (EPS), suggesting potential pressure on the company's financials in the future. Historical dividend growth has been modest, but the recent decision to maintain a dividend speaks volumes of the company's confidence in its financial health and its respect for shareholder value.

Xerox's stock price has experienced substantial movement on the NASDAQGS, attracting significant interest from the investment community. The company trades at a P/E ratio that is attractively lower than the industry average, indicating a potentially undervalued stock. With predictions of a considerable earnings increase on the horizon, stakeholders maintain a cautiously optimistic outlook on the company's financial future.

Meanwhile, the third-quarter results for 2023 revealed challenges and triumphs. A downturn in revenue contrasted with heightened profitability and cash flow signaled Xerox's adept management strategies. The introduction of the Xerox Reinvention initiative aims to align the company more closely with emerging client needs, focusing on sustainable profits and revenue growth.

As Xerox navigates through an evolving economic landscape, the company exhibits resilience and strategic agility. By maintaining a positive cash flow outlook and projecting stability in revenue, Xerox highlights the effectiveness of its efficiency measures and strategic initiatives in the face of external volatility.

The company's proactive engagement with its stakeholders is further exemplified in its planned participation in the UBS Global Technology Conference. High-level executives will represent Xerox, discussing strategic plans and providing updates on initiatives, emphasizing the company's commitment to transparency and investor relations.

Xerox's pledge to innovation extends to an array of digital solutions and financial services that are increasingly vital to businesses operating in varied environments. Engagement in a series of investor events, including the upcoming Raymond James TMT and Consumer Conference and the Wolfe Small and Mid-Cap Conference, underscores Xeroxs active investor relations strategy, reflecting the management's efforts to foster confidence and attract investments.

Despite its profitability and improvements in cash flow, Xerox has witnessed a dissonance between its financial growth and stock market performance. The share price declined significantly over a five-year window, indicating that market perceptions may not fully reflect the company's improved earnings trajectory. While changes in revenue streams and market conditions present challenges, dividends have proven a source of value, mitigating the less favorable TSR witnessed over the years.

As the company looks forward, strategic plans such as the Reinvention program and consistent communication of its performance and outlook are expected to play key roles in addressing the shifts within the industry. Xerox Holdings Corporation remains committed to demonstrating that an innovative and adaptive strategy can lead to success within the dynamic landscape of technology and document management.

Similar Companies in Computer Hardware:

HP Inc. (HPQ), Canon Inc. (CAJ), Lexmark International, Inc. (LXK), Brother Industries, Ltd. (BRTHY), Konica Minolta, Inc. (KNCAY), Seiko Epson Corporation (SEKEY), Ricoh Company, Ltd. (RICOY), Kyocera Corporation (KYOCY)

News Links:

https://finance.yahoo.com/news/xerox-recognized-quocirca-2023-sustainability-174200320.html

https://finance.yahoo.com/news/xerox-holdings-nasdaq-xrx-dividend-100708494.html

https://finance.yahoo.com/news/too-consider-buying-xerox-holdings-125424261.html

https://finance.yahoo.com/news/xerox-holdings-corp-xrx-q3-133615956.html

https://finance.yahoo.com/news/xerox-announces-participation-upcoming-investor-140000911.html

https://finance.yahoo.com/news/positive-earnings-growth-hasnt-enough-112148960.html

https://finance.yahoo.com/news/xerox-delivers-growth-profitability-cash-103000794.html

https://finance.yahoo.com/news/xerox-announces-participation-upcoming-investor-170000708.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: UYLkWo

https://reports.tinycomputers.io/XRX/XRX-2023-12-24.html Home