Olympic Steel, Inc. (ticker: ZEUS)

2023-12-16

Olympic Steel, Inc. (ticker: ZEUS) is a leading United States metals service center that specializes in the distribution and processing of a wide array of metal products. The company's inventory includes a diverse range of carbon, stainless steel, aluminum, and specialty metals tailored to the needs of a variety of industries, such as automotive, heavy machinery, and construction. Founded in 1954 and headquartered in Bedford Heights, Ohio, Olympic Steel operates through several business segments: flat products, tubular and pipe products, and metals processing. With a strategic network of processing and distribution facilities across North America, the company delivers value-added services such as cutting-to-length, blanking, slitting, and shearing, enhancing its product offerings to meet the precise specifications of its clients. Furthermore, Olympic Steel's continual investment in technology, expansion of product lines, and commitment to high-quality inventory control have enabled it to consistently meet the dynamic demands of the metals industry while optimizing its operational efficiency.

Olympic Steel, Inc. (ticker: ZEUS) is a leading United States metals service center that specializes in the distribution and processing of a wide array of metal products. The company's inventory includes a diverse range of carbon, stainless steel, aluminum, and specialty metals tailored to the needs of a variety of industries, such as automotive, heavy machinery, and construction. Founded in 1954 and headquartered in Bedford Heights, Ohio, Olympic Steel operates through several business segments: flat products, tubular and pipe products, and metals processing. With a strategic network of processing and distribution facilities across North America, the company delivers value-added services such as cutting-to-length, blanking, slitting, and shearing, enhancing its product offerings to meet the precise specifications of its clients. Furthermore, Olympic Steel's continual investment in technology, expansion of product lines, and commitment to high-quality inventory control have enabled it to consistently meet the dynamic demands of the metals industry while optimizing its operational efficiency.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 660.05M | 625.76M | 545.49M | 581.23M | 373.74M | 253.82M |

| Enterprise Value | 881.69M | 883.25M | 821.78M | 763.45M | 635.69M | 561.23M |

| Trailing P/E | 16.70 | 15.92 | 8.93 | 6.63 | 3.47 | 1.82 |

| Forward P/E | 15.17 | 16.05 | 13.21 | 14.58 | 13.93 | 10.86 |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 0.31 | 0.28 | 0.23 | 0.24 | 0.15 | 0.10 |

| Price/Book (mrq) | 1.20 | 1.16 | 1.04 | 1.13 | 0.73 | 0.51 |

| Enterprise Value/Revenue | 0.40 | 1.68 | 1.44 | 1.33 | 1.22 | 0.88 |

| Enterprise Value/EBITDA | 9.14 | 32.66 | 25.51 | 31.93 | 49.62 | 23.65 |

Based on the last trading day technical analysis (TA) data for ZEUS and considering the fundamental outlook of the company, the following insights and stock price movement predictions can be made:

Based on the last trading day technical analysis (TA) data for ZEUS and considering the fundamental outlook of the company, the following insights and stock price movement predictions can be made:

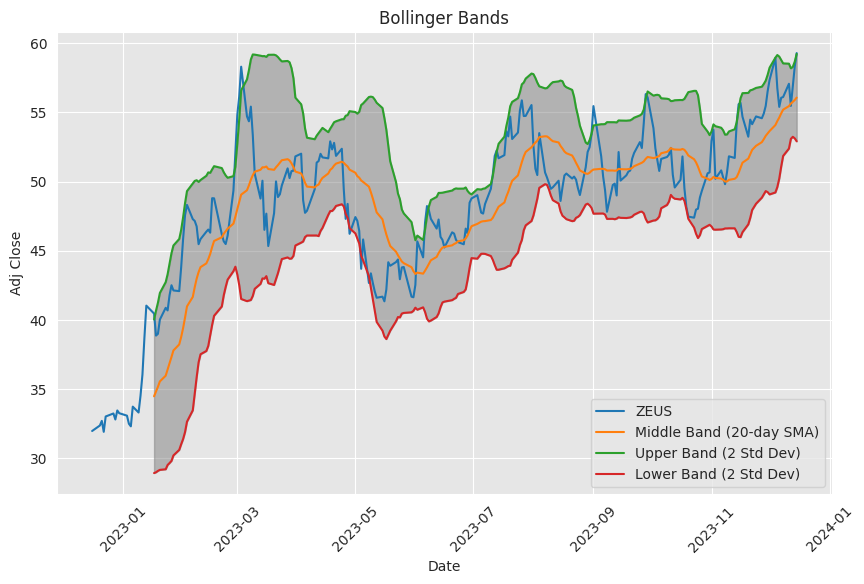

Technical Indicators: - The Moving Average Convergence Divergence (MACD) is positive, and the histogram is above the baseline, suggesting continued bullish momentum. - The Relative Strength Index (RSI) is at 64.29, indicating the stock is approaching overbought territory but not there yet, meaning there might be room for further growth before a potential pullback. - Bollinger Bands are relatively tight, with the closing price close to the upper band, showing strength in the current trend but also the potential for a mean reversion if volatility increases. - The share price is above both the 20-day Simple Moving Average (SMA) and the 50-day Exponential Moving Average (EMA), which is a bullish signal. - The On-Balance Volume (OBV) shows a slight increase, which can be interpreted as a sign of positive volume flow. - The Stochastic Oscillator %K is above %D, which is typically considered a bullish sign. - The Average Directional Index (ADX) is lower, suggesting that the trend strength is not particularly strong. - The Williams %R indicates an overbought condition that could precede a downturn. - The Chaikin Money Flow (CMF) is positive, which reflects buying pressure. - The Parabolic SAR is below the price, indicating an uptrend.

Fundamental Analysis: - The Market Cap has shown consistent growth over recent quarters. - Price/Earnings (P/E) ratios have increased, suggesting that investors may expect higher future earnings. - Price/Sales and Price/Book ratios are low, indicating that the stock may be undervalued in terms of sales and book value. - Enterprise Value/Revenue and Enterprise Value/EBITDA ratios are modest, which may appeal to value investors. - The financials reveal an increase in net income and EBITDA, which are favorable for fundamental strength.

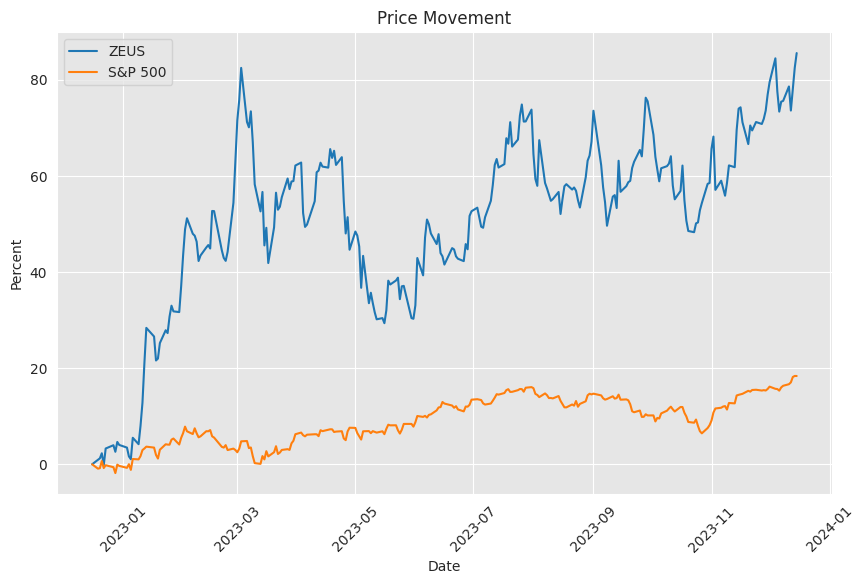

Taking into account the technical and fundamental perspectives, ZEUS looks to be in an overall bullish phase with strong momentum. However, given that several indicators are pointing toward potential overbought conditions, it may experience some short-term pullbacks or consolidation periods as part of its longer upward trend over the next few months. The progressive increase in market capitalization and improved financials should underpin investor confidence, potentially leading to continued share price appreciation.

Investors should watch for a sustainment of OBV growth and RSI levels to gauge ongoing demand strength. It would also be prudent to monitor the breadth of Bollinger Bands for signs of increased volatility or potential trend reversals. Given the modest ADX value, should there be a catalyst for increased trend strength, ZEUS's stock price could see accelerated movements.

In conclusion, ZEUS exhibits a strong bullish technical setup complemented by improving fundamentals, suggesting a positive outlook for stock price movement in the next few months. However, one should keep an eye on technical indicators for signs of overbought conditions that could precede short-term corrections within an overarching uptrend.

Olympic Steel, Inc., a leading national metals service center headquartered in Bedford Heights, Ohio, is a company that specializes in the distribution, processing, and fabrication of metals. Established in 1954, Olympic Steel has witnessed several market cycles and has adapted through a combination of strategic expansions and a customer-centric service model. The company primarily deals in flat-rolled, carbon, stainless and tubular steel products, and serves a wide range of industries including automotive, construction, and heavy equipment manufacturing.

Over the years, the company has emphasized diversifying its product offerings and services to mitigate dependence on any single market segment. This decision has contributed to the firm's resilience amidst changing economic landscapes. Olympic Steel operates through a network of facilities across the United States. Each location is strategically positioned to serve regional market demands efficiently while adhering to just-in-time delivery frameworks which are crucial in minimizing inventory costs and meeting customer expectations for prompt service.

The dynamics of the steel industry play a significant role in Olympic Steel's operations. The fluctuating costs of raw materials are a fundamental factor that impacts the company's profitability model. Steel prices are influenced by global supply and demand dynamics, tariffs, and the economic health of industries that require steel. Olympic Steel employs hedging strategies to protect against price volatility and maintains a robust supply chain engagement to ensure the availability of necessary inventory.

In terms of technology and innovation, Olympic Steel has invested in modern processing equipment to enhance its capabilities in cutting, welding, forming, and machining. These technological advancements improve the quality and precision of products, allowing Olympic Steel to meet specific customer requirements and maintain a competitive edge within the industry. The company's commitment to technology also includes investments in software and logistics systems that streamline operations and enhance efficiency across its distribution network.

Sustainability and environmental responsibility are integral to Olympic Steel's business ethos. With industry and public attention increasingly focused on the environmental footprint of manufacturing processes, Olympic Steel has acknowledged this concern and continues to work on minimizing the impact of its operations. Initiatives such as waste reduction, energy optimization, and recycling of materials are core aspects of the company's sustainability agenda. Ensuring environmental compliance is also pivotal in maintaining operational licenses and fostering positive community relations.

The workforce at Olympic Steel is another cornerstone of the company's long-term strategy. The firm realizes the importance of skilled labor and invests in continuous training and development programs. These initiatives are aimed at enhancing employee skill sets, aligning with the latest industry best practices, and driving innovation from within. Furthermore, the company has a strong focus on fostering a safety-first culture to ensure that employee well-being is prioritized in what is traditionally a high-risk industry.

Looking at financial performance, Olympic Steel has managed its balance sheet with prudence, focusing on maintaining healthy liquidity ratios while investing in growth opportunities. For investors and stakeholders, the company's financial policies signal a balance between responsible fiscal management and the pursuit of value-enhancing projects. The companys revenue streams have shown a level of stability due to its diversified customer base and adaptation to market demands.

Olympic Steel's engagement with the community and its corporate social responsibility actions are an important part of its brand. By participating in and sponsoring local events and charities, the company reinforces its commitment to the well-being of the communities in which it operates. This community engagement builds substantial goodwill and aligns with the company's overall ethical framework.

In terms of competition, Olympic Steel competes with both regional players and major global steel service centers. The ability to provide high-quality products and exceptional customer service has been pivotal to Olympic Steel's market position. Competitive pricing, turnaround times, and the ability to meet customer-specific demands are differentiators that have cemented the companys reputation in the steel service industry.

The companys executive leadership team has emphasized strategic growth, both organically and through acquisitions. These targeted acquisitions are carefully evaluated to complement existing capabilities and to extend market reach. Mergers and acquisitions have historically been an avenue for Olympic Steel to enter new markets and enhance its product and service capabilities.

To summarize, Olympic Steel, Inc.'s strategic operations, adherence to innovation, focus on sustainability, investment in its workforce, financial discretion, community engagement, and competitive standing, together forge a robust enterprise tuned to endure and succeed in the complex landscape of the steel industry. Despite cyclical challenges, the companys comprehensive approach positions it well to leverage opportunities for growth and to navigate the ever-evolving economic and industrial environments.

Similar Companies in Metals Service Centers and Other Metal Merchant Wholesalers:

Reliance Steel & Aluminum Co. (RS),Steel Dynamics, Inc. (STLD),Nucor Corporation (NUE),Commercial Metals Company (CMC),Worthington Industries, Inc. (WOR)

News Links:

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: DnPds6