ASML Holding N.V. (ticker: ASML)

2024-01-27

ASML Holding N.V., an acronym for Advanced Semiconductor Materials Lithography, is a pivotal player in the semiconductor industry, renowned for its sophisticated photolithography systems that are integral to microchip fabrication. With its headquarters in Veldhoven, the Netherlands, the company monopolizes the market for extreme ultraviolet (EUV) lithography systems, which are vital for manufacturing advanced microprocessors and memory chips with ever-decreasing feature sizes. ASML's technology is a cornerstone for major semiconductor manufacturers aiming to progress Moore's Law, thus driving the cutting-edge capabilities of electronic devices. The company's ticker, ASML, is widely traded on global stock exchanges, including Euronext Amsterdam and NASDAQ, underscoring its significant role in technology and investment communities. As of the knowledge cutoff date in 2023, ASML's prowess in nanolithography preserved its status as an essential supplier to the semiconductor industry, reaping the benefits of high demand for more powerful and energy-efficient semiconductors across a multitude of applications, from consumer electronics to high-performance computing and artificial intelligence.

ASML Holding N.V., an acronym for Advanced Semiconductor Materials Lithography, is a pivotal player in the semiconductor industry, renowned for its sophisticated photolithography systems that are integral to microchip fabrication. With its headquarters in Veldhoven, the Netherlands, the company monopolizes the market for extreme ultraviolet (EUV) lithography systems, which are vital for manufacturing advanced microprocessors and memory chips with ever-decreasing feature sizes. ASML's technology is a cornerstone for major semiconductor manufacturers aiming to progress Moore's Law, thus driving the cutting-edge capabilities of electronic devices. The company's ticker, ASML, is widely traded on global stock exchanges, including Euronext Amsterdam and NASDAQ, underscoring its significant role in technology and investment communities. As of the knowledge cutoff date in 2023, ASML's prowess in nanolithography preserved its status as an essential supplier to the semiconductor industry, reaping the benefits of high demand for more powerful and energy-efficient semiconductors across a multitude of applications, from consumer electronics to high-performance computing and artificial intelligence.

| Full Time Employees | 39,850 | Previous Close | 869.08 | Day Low | 853.205 |

| Day High | 873.19 | Dividend Rate | 6.12 | Dividend Yield | 0.72% |

| Payout Ratio | 29.89% | Five Year Avg Dividend Yield | 0.87% | Beta | 1.13 |

| Trailing PE | 40.17 | Forward PE | 29.85 | Volume | 1,613,750 |

| Average Volume | 1,052,273 | Average Volume 10 days | 2,239,210 | Market Cap | 342,405,480,448 |

| 52 Week Low | 564.00 | 52 Week High | 883.28 | Price to Sales TTM | 12.799 |

| Price to Book | 28.46 | Enterprise Value | 333,353,549,824 | Profit Margins | 28.437% |

| Float Shares | 393,230,838 | Shares Outstanding | 394,590,016 | Shares Short | 1,381,328 |

| Held Percent Insiders | 0.002% | Held Percent Institutions | 20.025% | Short Ratio | 1.79 |

| Book Value | 30.49 | Current Price | 867.75 | Target High Price | 1,099.39 |

| Target Low Price | 478.59 | Target Mean Price | 859.73 | Target Median Price | 868.52 |

| Earnings Quarterly Growth | 11.3% | Net Income To Common | 7,607,399,936 | Trailing EPS | 21.6 |

| Forward EPS | 29.07 | PEG Ratio | 1.63 | Total Cash | 4,980,899,840 |

| Total Cash Per Share | 12.661 | EBITDA | 9,398,800,384 | Total Debt | 5,002,699,776 |

| Quick Ratio | 0.697 | Current Ratio | 1.328 | Total Revenue | 26,751,700,992 |

| Debt to Equity | 41.707 | Revenue Per Share | 1.22418 | Return On Assets | 15.598% |

| Return On Equity | 76.265% | Free Cashflow | 4,567,062,528 | Operating Cashflow | 7,596,899,840 |

| Earnings Growth | 12.1% | Revenue Growth | 15.5% | Gross Margins | 51.323% |

| EBITDA Margins | 35.133% | Operating Margins | 32.705% |

| Sharpe Ratio | -12.17300780275144 | Sortino Ratio | -201.78684835367935 |

| Treynor Ratio | 0.19701156392155503 | Calmar Ratio | 1.2856584096550943 |

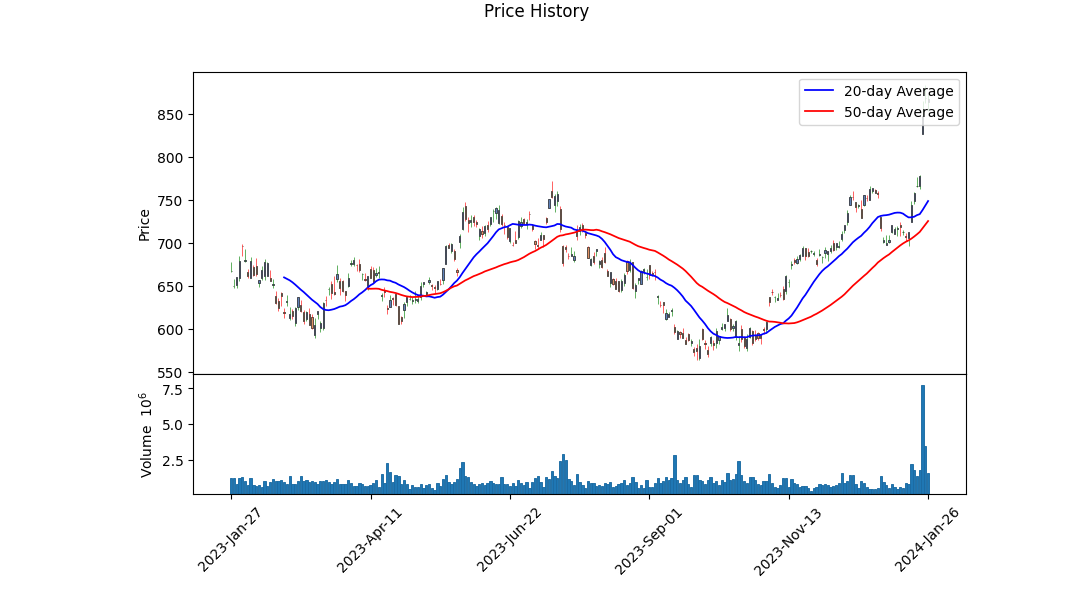

ASML's recent technical indicators present a burgeoning upward trend with a robust increase in On-Balance Volume (OBV), which signals a strong buyer commitment. The momentum measured by the MACD histogram also denotes a substantial bullish momentum over the represented period. As a result, the recent closing price has shown an appreciable upswing, which may be indicative of ongoing positive sentiment in the market.

Fundamentally, ASML's gross margins and operating margins are significant, showing the company's ability to manage its costs effectively and retain a solid profit from its revenues. These margins bolster the bullish sentiment derived from technical analysis.

Although ASML's risk-adjusted performance metrics, like the Sharpe and Sortino ratios, are deeply negative, reflecting high volatility and downside risk, these figures alone do not always capture the nuances of the market's directionality or sentiment. Conversely, the Treynor and Calmar ratios are positive, suggesting that on a risk-adjusted basis, the stock has performed well in relation to its systematic risk and has provided sufficient returns during the periods of negative market movement.

The financials project a healthy financial status with increasing free cash flow, which is a good sign for potential growth and reinvestment. Moreover, the relatively stable cash flow management witnessed in the recent year supports the ability of the firm to fund operations and potential dividend payments.

Balance sheet analyses divulge a solid asset base compared to their liabilities, a foundational element encouraging investor confidence. The cash position is robust, which facilitates operational flexibility and strategic initiatives.

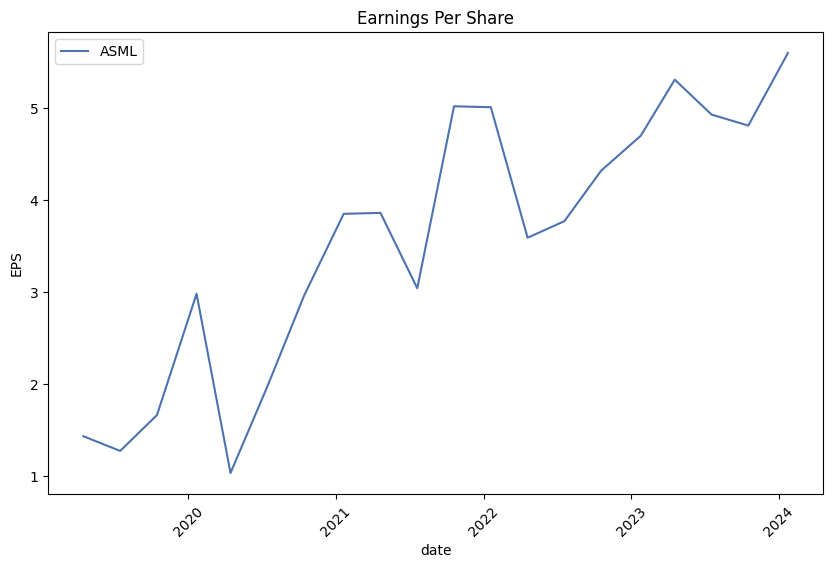

While historical earnings have outperformed expectations, the analysts project accelerated growth in the forthcoming year, including a notable projected uptick in earnings per share and revenue estimates for 2025. The consensus reflects a positive outlook among the analyst community, which often sways market sentiment and can act as a self-fulfilling prophecy in the short-to-medium term.

Considering these factors collectively, it's reasonable to forecast that ASML's stock price may experience continued appreciation in the subsequent months. Support from strong fundamentals, bullish technical signals, and positive analyst expectations could fuel further gains. However, given the high-risk measures indicated by the Sharpe and Sortino ratios, investors should be prudent of potential volatility and be prepared for potential downside risks amidst the stock's upward momentum. Maintaining a focus on any changes in market conditions, industry dynamics, and broader economic indicators will be crucial in fine-tuning any such forecasts.

| Statistic Name | Statistic Value |

| R-squared | 0.532 |

| Adj. R-squared | 0.532 |

| F-statistic | 1,429 |

| Prob (F-statistic) | 1.89e-209 |

| Log-Likelihood | -2,483.1 |

| AIC | 4,970 |

| BIC | 4,980 |

| Alpha | 0.0753 |

| Beta | 1.4119 |

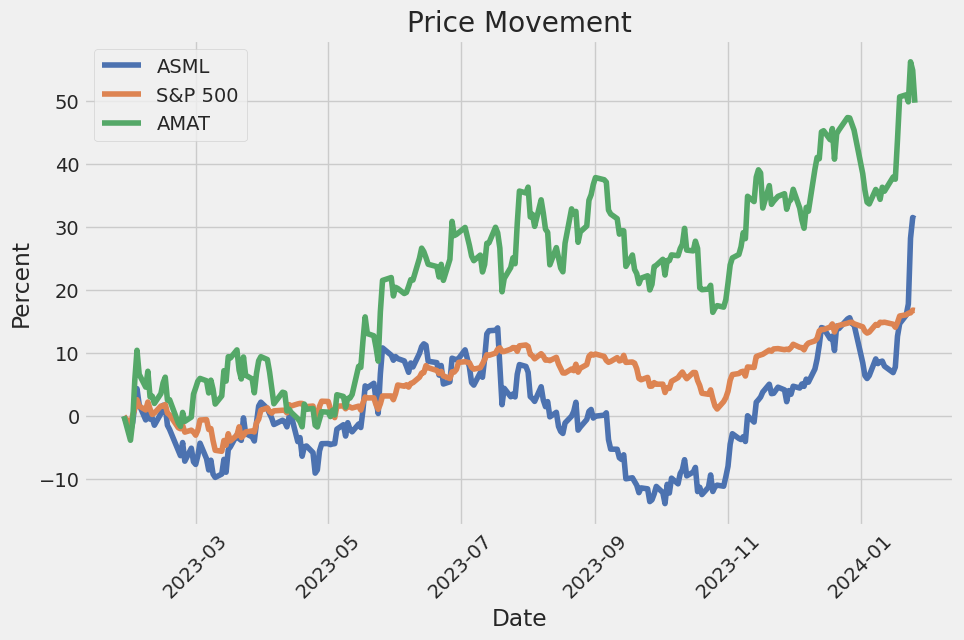

In the linear regression model analyzing the relationship between ASML (a leading supplier in the semiconductor industry) and SPY (which tracks the S&P 500 and is considered a proxy for the market), alpha represents the model's intercept, which is 0.0753. It signifies the expected return of ASML when the SPY is static; hence, a positive alpha of this magnitude suggests that ASML outperforms the broader market's average returns when the market does not move. This alpha, however, even if it indicates outperformance compared to the market, does not significantly differ from zero at the standard confidence levels, given the P-value of 0.126, suggesting that it could be statistically insignificant and that the outperformance cannot be confidently attributed to anything other than chance fluctuations.

Moreover, the beta coefficient for ASML in relation to SPY is 1.4119, indicating that for every point of movement in the SPY, ASML is expected to move by approximately 1.4119 points in the same direction. This is a measure of ASML's volatility in comparison with the market. A beta greater than one suggests that ASML's stock price is more volatile than the market. With an R-squared value of 0.532, the model explains that approximately 53.2% of the variability in ASML's return can be accounted for by the returns of SPY. This implies that while a significant portion of ASML's performance can be attributed to market movements, there is still a considerable amount of variation that is due to other factors or may be specific to ASML.

ASML Holding N.V. Earnings Call Summary for Q4 2023 and Full Year Results

ASML Holding N.V. conducted its Q4 2023 and full year financial results conference call on January 24, 2024. Skip Miller, Vice President of Investor Relations, introduced the call which also featured CEO Peter Wennink and CFO Roger Dassen. The call lasted an hour, and management provided an overview of financial performance, short-term outlook, and commentary on the industry environment and business prospects.

CFO Roger Dassen reviewed the Q4 and full year financial achievements, with Q4 net sales exceeding guidance at 7.2 billion, driven primarily by installed base business and sales weighted towards logic at 63%. The company shipped 10 EUV systems, with revenues from 13 systems amounting to 2.3 billion. Gross margin for Q4 was 51.4%, surpassing guidance due to additional service and upgrade sales. The full year saw 30% growth in net sales to 27.6 billion, with a gross margin of 51.3%. EUV system sales grew by 30%, with 42 units shipped. Memory system revenue saw a 9% increase from the previous year, while installed base management sales slightly decreased. For 2024, first quarter net sales are expected between 5 billion and 5.5 billion, with gross margins between 48% and 49%, reflecting lower EUV volume and installed base business.

CEO Peter Wennink provided insights into the current business environment and the future business outlook. Despite global macro concerns and industry downturns, ASML anticipates recovery across the year, bolstered by strong Q4 order intake. The expectation for 2024 is preparing for strong demand in 2025, with investments made in capacity ramp and technology. While conservative views prevail, there are signs of a slow recovery throughout 2024. Wennink indicated that AI-related demand is driving growth in both Logic and Memory and that EUV revenue growth is expected in 2024. Geopolitical factors, including U.S. government export control regulations, have impacted business with China, with an estimated financial impact of 10-15% of 2023 China system revenue. Longer-term outlooks remain optimistic, with growth opportunities driven by semiconductor market expansions and new fabs globally, implying a robust 2025.

In the Q&A session, management engaged in discussions about the memory market recovery, EUV order patterns, High-NA EUV bookings, and anticipation of future fab needs. Management stressed that High-NA EUV was the most cost-effective solution for future technology nodes and confirmed strong demand for mid-critical and mature nodes in China. There was also an emphasis on the company's readiness for upcoming market recovery and potential upside for 2024 based on continued improvement in utilization levels and customer investments in preparation for 2025.

The call concluded with a reminder about ASML's upcoming Investor Day in November 2024, where further updates on outlook and business strategies will be provided.

ASML Holding N.V. has established itself as a critical player in the semiconductor industry, which is projected to exceed $1 trillion in revenue by 2030. As the sole supplier of extreme ultraviolet lithography (EUV) machines necessary for fabricating advanced chips, ASML is poised to harness significant market growth, with a projected revenue increase of $37 billion by 2030 for the EUV technology market alone. This places ASML at the heart of the most innovative segments within the tech industry, where the demand spans across mobile devices, computers, and AI servers.

Analysts are bullish about ASML's prospects, forecasting a 30% revenue increase for the year 2023. This optimism is mirrored in the anticipation that the company could sustain an impressive annual earnings growth rate over the next few years, possibly reaching nearly $60 per share by 2028. If ASML continues to trade at its historical earnings multiple, its stock valuation could soar. Wall Street's strong bullish sentiment is underscored by an Average Brokerage Recommendation (ABR) of 1.57, where the majority suggest a "Strong Buy."

However, investments grounded solely on ABRs carry risks due to potential positive biases among analysts. Therefore, cross-referencing ABR with other investment tools like the Zacks Rank, which factors in earnings estimate revisions and their correlation to stock price movements, comes highly recommended. In fact, ASML's consensus estimate for its current year's earnings has been revised upward, earning it a favorable Zacks Rank #2 (Buy).

ASML's stock closed at $744.72 on a key trading day, underperforming compared to the broader market indices. This temporal slip, however, contrasts with the stock's superior month-long performance, which outstripped sector and market averages. Anticipated growth of 8.09% in earnings per share, alongside an 11.76% increase in revenue, fosters the claim that ASML remains a resilient investment.

The stock's Forward P/E ratio signals a market expectation of continued earnings growth, although premium to the industry average. ASML's position in the Computer and Technology sector is further bolstered by a high Zacks Industry Rank, which implies superior performance compared to its peers.

In assessing ASML's investment potential, it is crucial to consider geopolitical dynamics. Recent actions by the Dutch government, under the influence of the United States, resulted in the revoking of export licenses for some of ASML's chip-making equipment to China. This move illustrates the geopolitical chess game affecting global tech industries and points to the delicate balance ASML must maintain between navigating export restrictions and fulfilling its substantial backlog of orders.

ASML's role in modern chipmaking processes is further emphasized through its relationship with companies like Photronics. As ASML overcomes production bottlenecks to address demand, suppliers of photomasks like Photronics benefit. With a steady sales outlook and attractive valuation, Photronics exemplifies the latent potential in ASML's supply chain, even as ASML itself faces a momentary expectation management for limited growth in 2024.

Yet, the significance of ASMLs technology for companies like Intel and TSMC in leading-edge chip production for AI cannot be overstated, even in the context of not only a premium valuation but also temporary setbacks due to trade tensions and cautious financial forecasts. ASMLs anticipated instrumental role in enabling the next wave of advanced semiconductor fabrication remains a strong point of interest for investors.

ASML's technical pattern is showing another promising sign; the "golden cross" indicates a bullish trend, conforming well to the positive earnings estimates revisions over the past days. These indications, combined with a strong EPS outlook and robust demand for leading-edge semiconductor production, reinforce the narrative that ASML holds attractive long-term growth potential.

Moreover, ASML's impressive order backlog value is a testament to the central role it plays in empowering chip manufacturers to meet the upsurge in demand for semiconductor production, a clear sign that the company is poised to continue thriving as the industry recovers and technology advances. Despite the stock's premium valuation, ASML's financial forecast, historical earnings growth, and strategic importance within the semiconductor sector present persuasive reasons for considering it an enticing investment opportunity in the burgeoning AI landscape.

For those looking to gain exposure to the semiconductor manufacturing sector, ASML represents a potential vehicle for robust returns, substantiated not only by its pivotal role and substantial backlog but also by its valuation compared to historical norms. Amidst an industry recovery and a climbing demand for advanced chips, ASML is well-positioned to prosper and yield significant shareholder returns.

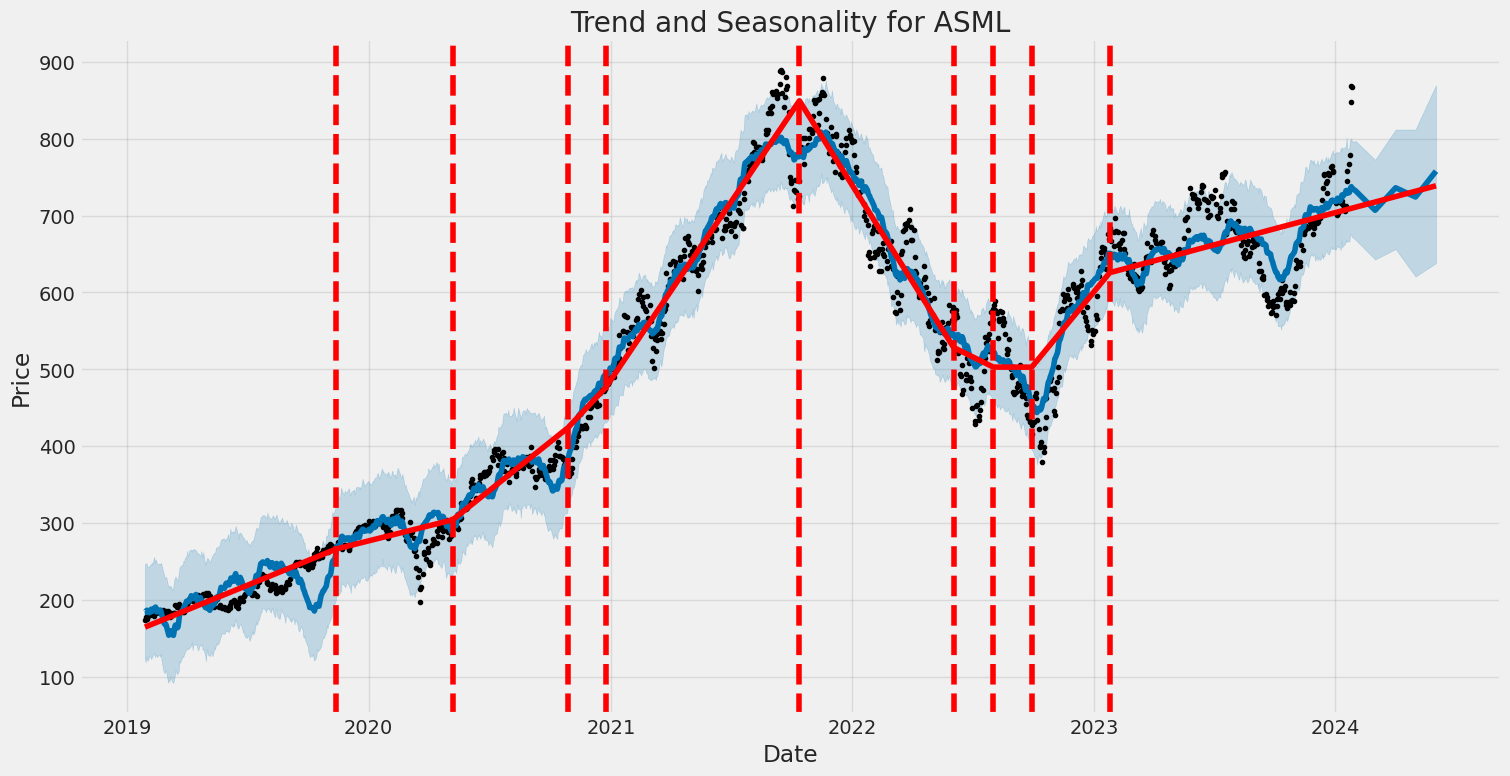

Between January 28, 2019, and January 26, 2024, the volatility of ASML Holding N.V. (ASML) was modeled using a Zero Mean - ARCH model, indicating significant fluctuations in its stock return volatility. The model reveals that the constant term (omega) in the volatility equation is significantly different from zero, suggesting a baseline level of volatility. Moreover, the coefficient for the first lag of the return series (alpha[1]) is also statistically significant, pointing to past returns having a noticeable impact on current volatility.

Here is the HTML table summarizing the ARCH model results:

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2929.93 |

| AIC | 5863.87 |

| BIC | 5874.14 |

| No. Observations | 1,258 |

| Df Residuals | 1258 |

| omega | 4.9585 |

| alpha[1] | 0.2528 |

To analyze the financial risk associated with a $10,000 investment in ASML Holding N.V. (ASML) over a one-year period, we employ a two-pronged methodological approach integrating volatility modeling and machine learning predictions.

Volatility modeling is central to understanding the stock volatility of ASML. For this analysis, the method used for volatility modeling helps quantify the variability of stock returns over time, which is essential to estimate risk measures like Value at Risk (VaR). This model inherently adjusts to market dynamics by setting past volatilities and returns to forecast future variance. To assess the investment's potential fluctuations, we look at historical price movements and standard deviations, predicting how volatile the investment could be moving forward.

To complement volatility modeling, machine learning predictions provide an advanced analytical technique to anticipate the direction of the stock's future returns. The applied algorithm, a non-linear regression tool, is particularly adept at capturing complex patterns from historical data and translating these into forward-looking projections. It considers numerous features, such as price movements, volume changes, macroeconomic indicators, and more, to predict returns. By doing so, the machine learning model is an essential component in enriching the risk assessment process and providing a more comprehensive outlook for the investment's potential performance.

Bringing these approaches together offers a robust assessment of the financial risk for the investment in ASML. The volatility model helps determine the distribution of possible returns, and the machine learning predictions aid in fine-tuning these estimates by providing likely future return scenarios.

Focusing on the results obtained from the integrated analysis, especially the calculated VaR, we can address the investment's risk profile. The VaR indicates that at a 95% confidence interval, we can expect that the maximum expected loss for a $10,000 investment would not exceed $317.48 over the one-year period. This implies that there is a 5% chance that the investment may incur a loss greater than $317.48. As such, the VaR is a crucial figure for an investor as it encapsulates the potential downside risk of the investment, providing a quantitative measure that can be used for decision-making.

The effectiveness of combining volatility modeling with machine learning predictions in this manner is evident in the tailored risk estimations it produces. The integration of the two methods allows for a nuanced view of ASML's potential risk, encompassing both the inherent market volatility and the predictive insights on future stock performance. This comprehensive view equips investors with a deeper understanding of the potential risks in equity investment, and specifically, in this case, the financial exposure associated with ASML Holding N.V.

Similar Companies in Semiconductor Equipment & Materials:

Applied Materials, Inc. (AMAT), KLA Corporation (KLAC), Axcelis Technologies, Inc. (ACLS), Teradyne, Inc. (TER), Report: Lam Research Corporation (LRCX), Lam Research Corporation (LRCX), Aehr Test Systems (AEHR), Photronics, Inc. (PLAB), Kulicke and Soffa Industries, Inc. (KLIC), Entegris, Inc. (ENTG), IPG Photonics Corporation (IPGP), Canon Inc. (CAJ), Nikon Corporation (NINOY), Tokyo Electron Limited (TOELY)

https://www.fool.com/investing/2023/12/13/2-phenomenal-chip-stocks-to-buy-in-2024/

https://www.zacks.com/stock/news/2200198/asml-asml-advances-but-underperforms-market-key-facts

https://www.fool.com/investing/2023/12/21/3-growth-stocks-to-buy-that-could-be-massive-long/

https://www.zacks.com/stock/news/2202206/asml-asml-now-trades-above-golden-cross-time-to-buy

https://www.zacks.com/stock/news/2203034/4-stocks-to-consider-as-the-semiconductor-market-rebounds

https://www.fool.com/investing/2023/12/31/3-great-ai-stocks-to-own-in-2024/

https://www.fool.com/investing/2023/12/31/worried-about-risks-to-asml-in-2024-dont-overlook/

https://www.youtube.com/watch?v=iHV_gLd43Yg

https://www.fool.com/investing/2024/01/02/1-monster-opportunity-in-the-global-chip-shortage/

https://www.youtube.com/watch?v=Wtc-sf_m3WY

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: yzrJ31

Cost: $0.87796

https://reports.tinycomputers.io/ASML/ASML-2024-01-27.html Home