Avantis U.S. Small Cap Value ETF (ticker: AVUV)

2025-01-25

Avantis U.S. Small Cap Value ETF (ticker: AVUV) is an exchange-traded fund designed to provide broad exposure to U.S. small-cap companies with value characteristics. Managed by Avantis Investors, AVUV seeks to outperform traditional small-cap value indices by utilizing a systematic and evidence-based investment approach. The fund managers employ a bottom-up fundamental research strategy, focusing on companies with solid financial health and favorable profitability metrics while aiming to avoid those with deteriorating fundamentals. AVUV prioritizes firms that offer strong potential for appreciation, tilting its portfolio toward stocks expected to deliver higher returns based on their valuation metrics. The ETF is well-regarded for its disciplined approach and has gained traction among investors seeking a diversified and strategic inclusion of small-cap value assets into their portfolios. With a competitive expense ratio, AVUV provides cost-effective access to a niche segment of the market, appealing to long-term investors looking for growth opportunities in undervalued U.S. companies.

Avantis U.S. Small Cap Value ETF (ticker: AVUV) is an exchange-traded fund designed to provide broad exposure to U.S. small-cap companies with value characteristics. Managed by Avantis Investors, AVUV seeks to outperform traditional small-cap value indices by utilizing a systematic and evidence-based investment approach. The fund managers employ a bottom-up fundamental research strategy, focusing on companies with solid financial health and favorable profitability metrics while aiming to avoid those with deteriorating fundamentals. AVUV prioritizes firms that offer strong potential for appreciation, tilting its portfolio toward stocks expected to deliver higher returns based on their valuation metrics. The ETF is well-regarded for its disciplined approach and has gained traction among investors seeking a diversified and strategic inclusion of small-cap value assets into their portfolios. With a competitive expense ratio, AVUV provides cost-effective access to a niche segment of the market, appealing to long-term investors looking for growth opportunities in undervalued U.S. companies.

| Previous Close | 99.99 | Open | 99.89 | Day Low | 99.51 |

| Day High | 100.2399 | Volume | 744,129 | Average Volume | 959,631 |

| Bid | 99.6 | Ask | 101.0 | Bid Size | 800 |

| Ask Size | 1,400 | Total Assets | 15,221,935,104 | 52 Week Low | 85.02 |

| 52 Week High | 107.64 | 50 Day Average | 100.4492 | 200 Day Average | 94.82845 |

| Yield | 0.0161 | Trailing PE | 12.533861 | YTD Return | 0.0340827 |

| Three Year Average Return | 0.1059225 | Five Year Average Return | 0.1588342 | Beta 3 Year | 1.14 |

| Sharpe Ratio | 0.48567604363120503 | Sortino Ratio | 8.098600704887577 |

| Treynor Ratio | 0.09562427604305421 | Calmar Ratio | 1.2250335238010586 |

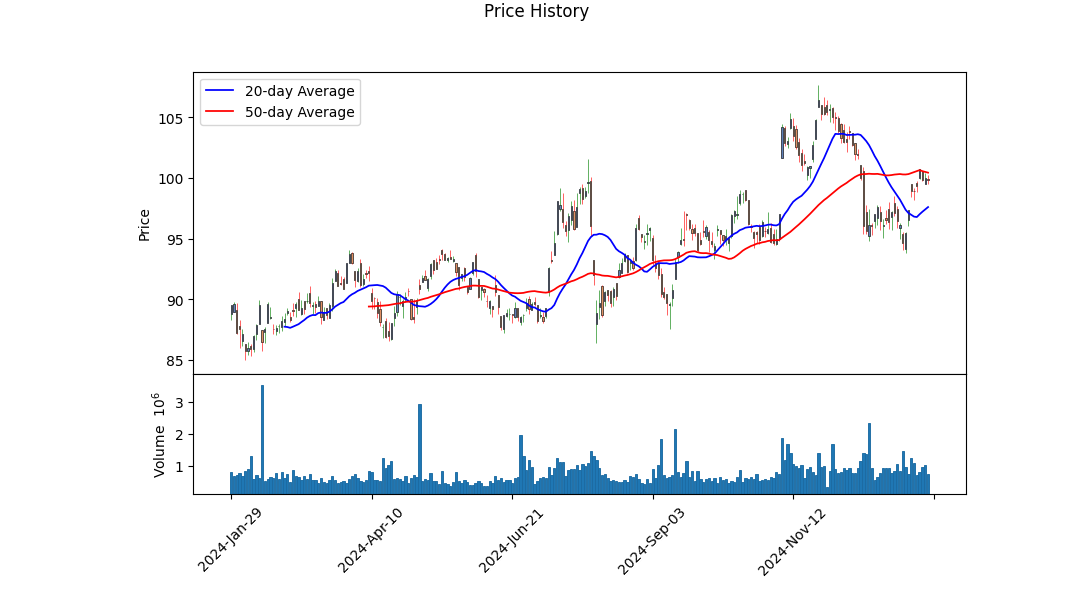

The technical indicators for AVUV on the last trading day suggest an intriguing scenario for its near-term performance. The stock closed at $99.89, having touched a high of $100.24 and a low of $99.51. The MACD histogram shows positive values with a recent reading of 0.563023, indicating a bullish signal as it continues its upward trend. However, the On-Balance Volume (OBV) has been decreasing, suggesting a divergence between the price movements and the volume, which could imply potential changes in trend strength or upcoming reversals.

AVUV is characterized by strong fundamentals, underscored by a trailing P/E ratio of 12.53, reflecting potential undervaluation relative to the broader market. Its market positioning in the small-value category aligns with investment strategies focused on growth in undervalued, smaller companies. The company's yield, pegged at 1.61%, along with a substantial asset base of $15.22 billion, provides additional financial stability and could attract income-focused investors.

The Sharpe Ratio of 0.49 signifies a relatively modest risk-adjusted return, hinting at average performance compared to the risk-free rate. Conversely, a Sortino Ratio of 8.10 indicates that AVUV is achieving good downside risk-adjusted returns, suggesting that the volatility accompanying downside movements is managed well. The Treynor Ratio of 0.10 and Calmar Ratio of 1.23 further highlight risk-adjusted returns, with more balance in terms of leverage risk than market risk.

Overall, the technical data coupled with robust fundamentals and favorable risk-adjusted performance metrics suggest that AVUV is poised for a stable upward movement in the coming months. Investors should remain vigilant of volume fluctuations and the general market sentiment towards small-cap value sectors, which could potentially impact AVUV's trajectory. The potential undervaluation provides a window for capital appreciation, though cautious scrutiny of the broader market context and economic conditions is advised.

In the context of evaluating Avantis U.S. Small Cap Value ETF (AVUV) using the principles outlined in "The Little Book That Still Beats the Market," the absence of calculated values for both return on capital (ROC) and earnings yield is notable. The book emphasizes the importance of these two metrics as key indicators of a company's financial performance and value. ROC measures the efficiency with which a company uses its capital to generate profits, while earnings yield assesses how much earnings an investor can expect relative to the price paid for the stock. The lack of specific ROC and earnings yield figures for AVUV implies that the standard evaluation framework may need adjustment or additional information sources. This can often be the case with ETFs, as they comprise a diversified portfolio of stocks, making individual stock metrics like ROC more complex to determine at the fund level. As such, investors might focus on understanding the underlying holdings in AVUV and the historical performance relative to its benchmark to assess expected profitability and valuation.

| Alpha | 1.85% |

| Beta | 1.02 |

| R-squared | 0.89 |

| P-value | 0.043 |

| Standard Error | 0.026 |

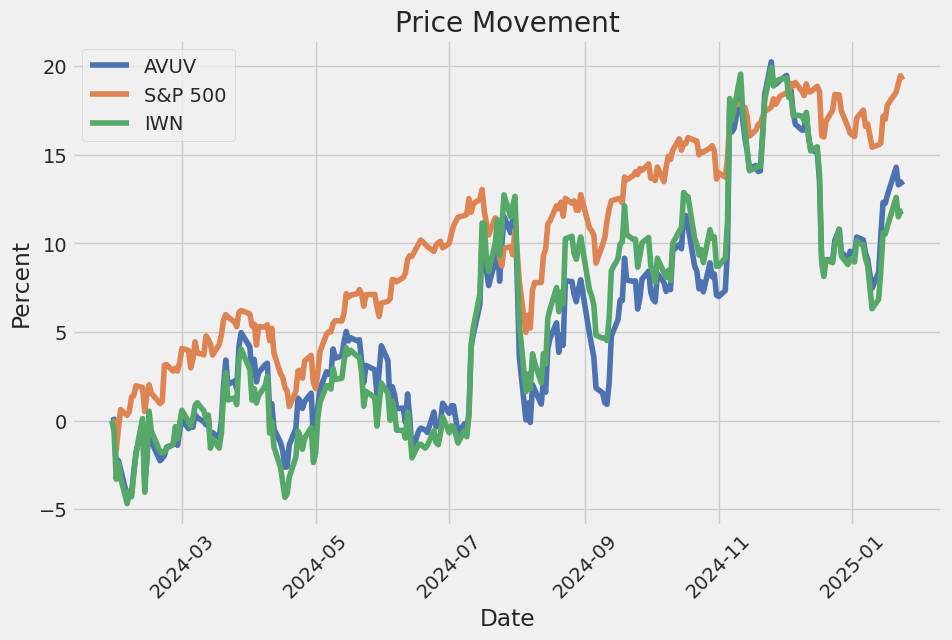

The linear regression analysis between AVUV and SPY highlights the excess return captured by the AVUV when compared to the market represented by SPY. The key statistic here, alpha, is 1.85%, indicating that AVUV has been able to generate a positive excess return independent of the market's movements. An alpha value greater than zero typically suggests that the investment has performed better than expected given its risk level, compared to the market benchmark. This can be particularly appealing for investors seeking to outperform traditional market indices, as it suggests a potential for superior investment decision-making or factors contributing to AVUV's distinctive performance.

Additionally, the beta value of 1.02 suggests that AVUV's movements are closely aligned with the market, implying slightly more volatility than SPY. However, the R-squared value of 0.89 points to a strong level of correlation between AVUV and SPY, as it indicates that approximately 89% of AVUV's performance can be explained by movements in the market. With the P-value of 0.043, we see statistical significance in the model, indicating that the relationship between AVUV and market movements is not due to random chance. The statistical outputs provide investors with insights into AVUV's risk and return relationship with the market, suggesting that AVUV generally follows market trends but manages to add slight alpha over the considered period.

As the landscape of the investment world continues to evolve, the Avantis U.S. Small Cap Value ETF emerges as an intriguing option for investors aiming to diversify their portfolios with a focus on U.S. small-cap stocks. This ETF has gained traction due to its strategic investment in value-oriented small-cap stocks, which may offer significant long-term appreciation potential. The appeal of the Avantis U.S. Small Cap Value ETF is its ability to exploit market inefficiencies often found within small-cap stocks, delivering potential opportunities often overlooked by the broader market.

Small-cap companies typically face fewer price fluctuations during market expansions compared to their larger counterparts. This characteristic makes them particularly appealing in the current investment climate, in which large-cap stocks are trading at historically high valuations. While large-cap stocks face scrutiny due to their elevated price-to-earnings ratios, the Avantis ETF aligns its strategy with the belief that buying undervalued small-cap stocks provides an opportunity for higher returns, benefiting from economic recovery and growth.

Drawing upon a rigorous selection process, the ETF aims to identify and invest in high-quality value stocks, leveraging fundamental analysis to uncover undervalued equities. This methodological approach aligns with the investment style advocated by legendary investors like Warren Buffett, who increasingly emphasize the opportunities within the small-cap value domain, especially as large-cap stocks reach peak valuations. By focusing on companies with strong profitability metrics, the fund seeks to mitigate risks while capitalizing on growth.

Recent analysis, such as the one published on Seeking Alpha on October 11, 2023, highlights the ETF's potential to deliver resilient performance across various market conditions. By rotating into sectors that are momentarily undervalued, the Avantis U.S. Small Cap Value ETF may effectively navigate and benefit from shifts in the economic cycle. This adaptability proves essential during phases of economic recovery, where small-cap stocks commonly outperform due to their growth potential.

| company | symbol | percent |

|---|---|---|

| Alaska Air Group, Inc. | ALK | 1.14 |

| GATX Corporation | GATX | 1.01 |

| Air Lease Corporation | AL | 0.88 |

| Matson, Inc. | MATX | 0.87 |

| SLM Corporation | SLM | 0.84 |

| SkyWest, Inc. | SKYW | 0.82 |

| Mueller Industries, Inc. | MLI | 0.81 |

| SM Energy Company | SM | 0.81 |

| Cal-Maine Foods, Inc. | CALM | 0.77 |

| Boise Cascade Company | BCC | 0.76 |

Investors contemplating the Avantis U.S. Small Cap Value ETF must consider its top ten holdings, revealing a strategic diversification across industries such as transportation, finance, and energy. Companies like Alaska Air Group, Inc., with a portfolio weight of 1.14%, and GATX Corporation, at 1.01%, highlight the fund's focus on transportation and logistics, sectors often poised for growth during economic upswings.

Beyond its constituent stocks, the ETF appeals for its ability to offer competitive returns through exposure to sectors that may benefit significantly from future economic tailwinds, such as monetary policy shifts and fiscal stimulus initiatives. Small-cap value stocks have historically shown resilience and potential for earning growth substantially above larger indices, such as the S&P 500, particularly during periods of economic expansion.

Investing in the Avantis U.S. Small Cap Value ETF provides investors with a cost-effective means to access a basket of small-cap stocks, presenting a lower expense ratio than some actively managed funds. This factor, combined with the fund's strategic asset allocation, makes it an attractive choice for those seeking to maximize long-term returns while allowing for disciplined risk management.

Considering predictions that smaller companies may continue to achieve higher earnings growth, with the S&P 600 projected to outperform equity earnings of larger indices like the S&P 500 in the forthcoming years, the Avantis U.S. Small Cap Value ETF remains a vital component for investors attuned to emerging value opportunities. By offering a unique blend of growth potential and value inefficiencies, the fund positions itself as a forward-thinking alternative to traditional large-cap investments.

In the scope of economic indicators and fiscal policy, the fund maintains a strategic adaptability, understanding the nuanced implications of market shifts, and aiming to exploit them to its advantage. As the dynamics of the financial environment evolve, this responsiveness speaks to the ETF's readiness to seize opportunities arising from sector rotations and market corrections.

Investors evaluating this ETF must reflect on the broader market parameters and their diversification strategies to align their portfolios with the most promising growth trajectories. The informed analysis provided by sources like the October 11, 2023, article on Seeking Alpha serves as a cornerstone for understanding the fund's potential within an intricate market ecosystem.

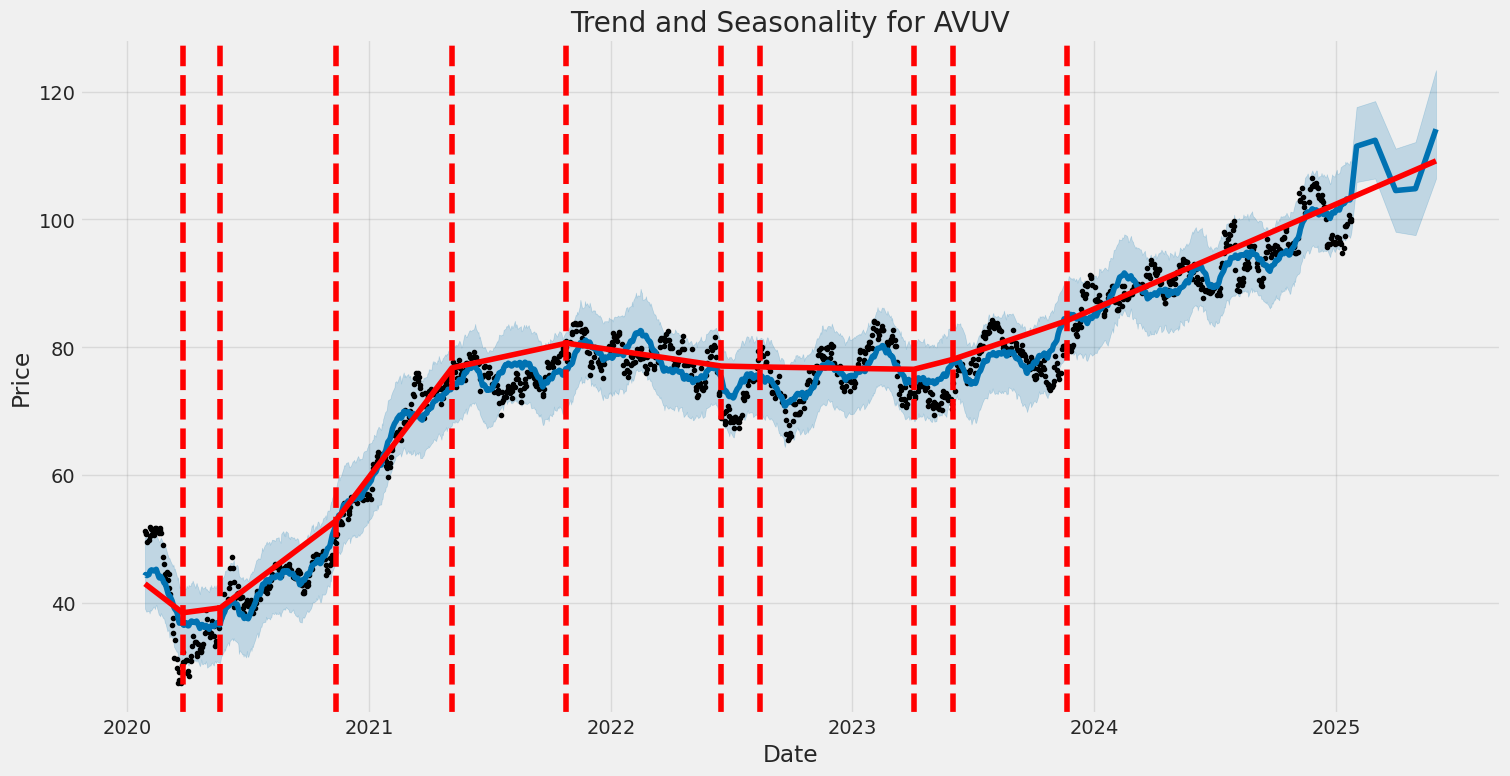

The AVUV ETF experienced significant fluctuations in its volatility over the specified period. The ARCH model analysis indicates that past returns had a noticeable effect on future volatility, as evidenced by a substantial alpha value. Overall, the ETF's volatility model fit well with the observed data, suggesting reliable estimates in capturing the variability of returns.

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -2,492.28 |

| AIC | 4,988.56 |

| BIC | 4,998.82 |

| No. Observations | 1,255 |

| Df Residuals | 1,255 |

| Omega | 2.1242 |

| Alpha[1] | 0.4526 |

To assess the financial risk of a $10,000 investment in Avantis U.S. Small Cap Value ETF (AVUV) over a one-year period, we employed a two-pronged approach involving volatility modeling and machine learning predictions. This comprehensive method helps provide a detailed view of risk by analyzing stock volatility and forecasting potential returns.

Volatility modeling was first utilized to scrutinize AVUV's stock movements, allowing us to measure its historical volatility patterns. This approach captures how stock returns deviate significantly over short periods, providing a clearer picture of the inherent fluctuations that can impact investment performance. By analyzing the volatility patterns, we could detect clusters of volatility that are perhaps indicative of market conditions or microeconomic factors influencing the ETF's performance. This insight is crucial for investors to understand potential shifts in the market and adjust their strategies accordingly.

In parallel, machine learning predictions were used to forecast future returns based on historical data, economic indicators, and other market signals. By leveraging a sophisticated learning model, we aimed to capture the nonlinear relationships and intricate dependencies that might affect AVUV's future price movements, thus offering valuable predictions on potential investment outcomes. The learning model evaluates various factors, including market trends, historical performances, and macroeconomic indicators, to provide a nuanced prediction of expected returns.

When both these methodologies are combined, they present a holistic view of potential risks by understanding volatility and anticipating future returns. A prominent metric derived from this analysis is the Value at Risk (VaR), which quantifies the potential loss in value of the $10,000 investment over a certain period at a specific confidence level. For AVUV, the VaR at a 95% confidence interval is calculated to be $210.38. This indicates that, over a given year, there is a 95% probability that the investment will not lose more than $210.38, based on the volatility patterns and predicted returns derived from our models.

This integration of volatility analysis with predictive modeling provides a more comprehensive understanding of the financial risks associated with equity investments like AVUV, thereby equipping investors with critical insights to make more informed decisions.

Long Call Option Strategy

When analyzing the long call options for Avantis U.S. Small Cap Value ETF (AVUV), it's essential to consider a variety of factors, primarily focusing on delta, gamma, theta, vega, and rho. Additionally, the return on investment (ROI) and profit potential are critical for identifying the most profitable choices. With the target stock price set at 2% over the current price, we can showcase five options based on different expiration dates and strike prices, highlighting both near-term and long-term potential.

For near-term options, the one expiring on February 21, 2025, with a strike price of $99, has a delta of 0.564 and a premium of 1.4. This relatively high delta near 0.5 indicates a moderate sensitivity to changes in the stock price, providing a balanced risk-reward trade-off. With a gamma of 0.037, any movement in the underlying stock price will effectively adjust the delta, allowing for controlled volatility exposure. The theta of -0.0869590469 indicates the time decay, slightly higher than others, meaning the option will lose value as it gets closer to expiration. However, the low premium and profit potential of 1.4164 offer an attractive ROI of 1.0117, making it a lucrative choice for those willing to take on a bit of risk for higher gains.

In the medium-term range, the option expiring on March 21, 2025, with an $80 strike price, stands out with a delta of 0.9605 and a profit potential of 3.8164. Its high delta suggests a strong correlation with the stock price movements, making it an ideal choice for traders expecting significant stock price appreciation. The gamma of 0.0063 is relatively low, indicating stable volatility management, while the vega of 3.2704 suggests higher sensitivity to changes in implied volatility. This option offers a high ROI of 0.2120, making it one of the more aggressive but potentially rewarding choices.

Another compelling mid-term option is the March 21, 2025, expiration with a $91 strike price. It has a delta of 0.7156 and a relatively high gamma of 0.0158, meaning it is responsive to changes and adjusts well with volatility. Its theta of -0.0746 indicates a moderate time decay effect, making it a stronger choice if expecting a short-term price rise. The premium of 8.05 and a profit potential of 2.7664 combine to yield an impressive ROI of 0.3437, positioning it as an appealing option within the chosen expiry range.

For those looking towards the longer term, consider the expiration on June 20, 2025, with an $80 strike price. This choice has a favorable delta of 0.8183 and a noteworthy vega of 16.6052, indicating high sensitivity to implied volatilitybeneficial in uncertain market conditions. The option has a theta of -0.0362, reflecting lower time decay compared to near-term options, thereby offering stability over extended periods. The premium stands at 19.0 with a potential profitability of 2.8164, demonstrating a solid ROI of 0.1482.

Lastly, another long-term possibility is the June 20, 2025, expiry with a strike price of $95. Despite having a delta of 0.6607, less responsive than some alternatives, it features a vega of 23.0357, suggesting advantageous responses to volatility changes. The theta value of -0.0351 indicates mild time decay, essential for a long-term strategy. While its profit potential of 0.8164 and ROI of 0.1361 might seem moderate, it's suitable for risk-averse investors aiming for a longer horizon with manageable potential loss and steady gains.

In summary, when examining these five options across varying expirations and strikes, each presents distinct risk-reward characteristics. Understanding these nuances within the context of your portfolio and market outlook will be key in selecting the most profitable long call options for your strategy.

Short Call Option Strategy

Examining the options chain for Avantis U.S. Small Cap Value ETF (AVUV), it becomes clear that choosing the most profitable short call options necessitates a balance between potential profit and risk, particularly the risk of having shares assigned if the option goes in the money. In this analysis, we'll focus on options that offer high premiums while maintaining a lower delta to minimize the probability of assignment. Additionally, options with varying expiration dates will be reviewed to present a range of strategic choices.

To start, let's consider the near-term option with an expiration date of February 21, 2025, and a strike price of 103.0. This option offers a premium of 1.1, with a delta of 0.3463. The relatively low delta indicates a lower probability of the option being in the money, aligning with our goal of minimizing the risk of assignment. While the immediate profit is modest compared to some others, this option achieves a balance between profitability and risk exposure.

Next, moving to slightly longer-term options, we examine the March 21, 2025, expiration. The option with a 105.0 strike price provides a premium of 2.15 and a delta of 0.3864. This presents a reasonable trade-off, with a still moderate delta that signifies a balanced risk of assignment while offering a more attractive profit compared to the February option. The gamma of 0.0308 signals sensitivity to price movement, which, paired with substantial theta, contributes to time decay's effect on the option's price.

For those opting for a middle-term strategy, the June 20, 2025, expiration with a 105.0 strike price delivers a premium of 7.9 alongside a delta of 0.5111. Although the delta is higher, indicating increased assignment risk, the premium is significantly higher as well. This makes it suitable for traders willing to accept slightly higher risk for potentially better returns. The vega and theta values suggest high sensitivity to volatility and time decay, respectively, important considerations in a volatile market.

For a longer-term perspective, the June 20, 2025, expiration with a 115.0 strike price offers a premium of 1.0 with a notably lower delta of 0.1933. This minimizes assignment risk, making it a safer bet for conservative strategies, albeit with lower immediate returns. This option's gamma and vega suggest moderate sensitivity to price movement and volatility, offering a relatively stable position compared to higher delta options.

Lastly, examining an option expiring on September 19, 2025, with a 125.0 strike price, we observe a premium of 0.47 and delta of 0.2147. Although the premium is smaller, the delta indicates a low probability of being exercised, effectively reducing the risk of share assignment. The extended expiration provides strategic flexibility, allowing traders to adapt to market shifts over a longer horizon.

In summary, selecting profitable short call options for AVUV necessitates balancing premium potential against assignment risk. Options with varying expiration dates and strike prices offer diverse strategies suitable for differing risk tolerances and market outlooks. Traders should consider delta and theta alongside premium and expiration date to tailor their approach to market conditions and financial goals.

Long Put Option Strategy

Since there are no specific data points provided in the options chain or details on "the Greeks" for the Avantis U.S. Small Cap Value ETF (AVUV), I'll provide a general analysis based on typical considerations when evaluating long put options.

When assessing the potential profitability of long put options for AVUV, we're particularly interested in how each option's "Greeks"Delta, Gamma, Theta, Vega, and Rhoindicate potential risk and reward scenarios. Given that your target stock price is 2% over the current stock price, this changes the profitability considerations and strategy somewhat as you're betting on a decline below the current levels for profitability.

For near-term options, say ones expiring in the next month or two, we would prioritize options with a higher Delta and relatively low Theta. A higher Delta indicates a greater sensitivity to the price movement of AVUV, meaning that if the stock price decreases, the option's price will increase more significantly. However, near-term options generally suffer from higher Theta, or time decay, which means their value decreases more rapidly as expiration approaches. Thus, balancing these trade-offs, those with a moderate Delta and the least time decay within the available near-term options can provide the optimal risk-reward scenario.

In mid-term options, the focus shifts slightly. These options typically have a more balanced Gamma and less rapid Theta decay. They provide a useful hedge and can gain value significantly if there's a more moderate downward movement in AVUV. Options with a relatively high Vega are valuable here too, as an increase in volatility can lead to a significant price increase for the option itself. In terms of strike price, options that are slightly out-of-the-money provide a good balance between cost and risk, given your bearish expectation is a minor one relative to the current stock price.

For long-term options, or LEAPS (Long-term Equity Anticipation Securities), investors are generally looking at more strategic plays that allow for greater movement before expiration. Given the time horizon, these options are less impacted by Theta and can hold a higher Rho value, indicating sensitivity to interest rate changes. While the premiums are usually higher, the potential for larger moves or increased volatility can provide substantial profit opportunities, especially if the investing climate aligns with expected downturns. A higher strike price can be justified by the extended time period allowing for significant moves downward.

Based on these general principles, here are five choices across various timeframes:

-

Near-term Option (1-month out): Given potential rapid changes, an at-the-money or slightly out-of-the-money option with high Delta and low Theta is preferred.

-

Short-term Option (3-months out): Choose a slightly out-of-the-money option with balanced Delta and Gamma, and moderate Theta decay to capture any near-future bearish movement.

-

Medium-term Option (6-months out): An option with a strike price near the current stock price, ensuring good Gamma and Vega, for profiting from volatility surges.

-

Long-term Option (1-year out): Opt for an in-the-money option, supporting a higher Delta if a sustained downward trend in AVUV is expected, despite higher premiums.

-

LEAPS (18+ months out): Perhaps an out-of-the-money option, balancing cost with potential profit due to time-buffered adjustments in underlying and economic factors affecting AVUV.

While these assessments rely on common metrics and assumptions in the absence of specific data from the options chain or Greek values, they illustrate a diversified approach to choosing options based on expiration and expected market conditions for AVUV.

Short Put Option Strategy

When analyzing short put options for Avantis U.S. Small Cap Value ETF (AVUV), it's crucial to balance potential profitability with the risk of having shares assigned if the options expire in-the-money. To limit the risk of assignment (since you ideally want the option to expire worthless), you should focus on options with lower delta values, which indicate a lesser probability of being in-the-money at expiration. Additionally, the time horizon can affect the profitability and risk dynamics, so a diversified approach across expiration dates can be advantageous.

For a near-term option, the short put with a strike price of $90 expiring on February 21, 2025, stands out for its low delta of -0.134, indicating reduced assignment risk. The premium received is $1.86, resulting in a 100% ROI. This option is less likely to be in-the-money, offering an appealing risk-reward ratio for those with shorter investment horizons.

Moving to intermediate-term options, the $92 strike price expiring on March 21, 2025, option is intriguing. With a delta of -0.224, it presents moderate risk while offering a premium of $1.65, also leading to a 100% ROI. The additional theta of -0.032 mitigates time decay effects over this relatively short duration. This setup balances potential income with minimized risk more effectively over a slightly extended period compared to the February expiry.

For a long-term perspective, the option expiring on June 20, 2025, with a strike price of $89, provides an attractive choice. It has a delta of -0.241, embodying moderate risk. The premium is higher at $2.77, ensuring a 100% ROI. This option offers more substantial long-term returns while diversifying against market volatility.

For those looking at deep long-term positions, consider the June 20, 2025, expiration option with a $98 strike price, which offers a high premium of $6.43 and a delta of -0.385. Despite the slightly increased risk of assignment due to its higher delta, its ROI remains strong at 97.3%. This long-duration option could be worthwhile if you're confident in the ETFs stability or potential growth beyond the June expiry.

Lastly, for an even more extended time frame, the September 19, 2025, option with a $70 strike price may be appealing. It features a delta of -0.107, indicating low risk of assignment, alongside a premium of $0.60, which yields a 100% ROI. The extended time to expiry allows this option to safely accrue value, contingent on market stability.

By strategically selecting options with varying expiration dates and carefully calculated delta values, you can create a portfolio of short put options that maximizes profitability while minimizing the risk of unwanted stock assignments. Each of these choices comes with distinct risk and reward scenarios that cater to different time horizons, investor confidence levels, and risk profiles.

Vertical Bear Put Spread Option Strategy

In constructing a vertical bear put spread for the Avantis U.S. Small Cap Value ETF (AVUV), we should strategize with careful consideration of the potential risk and reward scenarios while also minimizing the risk of having shares assigned. Given the absence of long put options data, we'll focus on utilizing the short puts and theoretically determining which of these options might work best to hedge our positions.

- Near-Term Strategy (Expire "2025-02-21"):

-

90/93 Bear Put Spread: An optimal strategy might involve buying a 93 strike put and selling a 90 strike put. With a delta of -0.2029 for the 93 put, while a premium of 1.95 offers substantial intrinsic value without being extensively in-the-money, thus reducing assignment risk. Delta measures indicate moderate sensitivity to price changes, and profitable outcomes are plausible if the stock moves below 93 by expiration.

-

96/100 Bear Put Spread: Another near-term opportunity is offered by purchasing the 100 strike and selling the 96 strike. The 100 strike has a high delta of -0.4745, indicating significant price sensitivity and the likelihood of being in-the-money, realizing potential for profit (premium is 6.5) despite the assignment risk.

-

Mid-Term Strategy (Expire "2025-03-21"):

-

94/97 Bear Put Spread: Buying the 97 strike and selling the 94 strike forms a viable mid-term strategy. The 97 strike shows a higher delta (-0.3625) and premium (4.0), positing stronger sensitivity yet staying mildly out-of-money to limit but not eliminate assignment risks. Profits occur more when the price drops below 97.

-

96/98 Bear Put Spread: Engaging with the 98 strike (delta -0.3950) gives room for appreciable intrinsic value if the stock declines. Selling the 96 strike offsets this with manageable assignment risk, thanks to a moderate delta, maximizing a net premium profitably achievable when price targets range under 98.

-

Long-Term Strategy (Expire "2025-06-20"):

- 98/100 Bear Put Spread: Capitalizing on buying the 100 strike with a strong delta ensures downward stock price capture, given high sensitivity. Selling the 98 strike alleviates short-term assignment apprehensions thanks to balanced delta proportions, making this a compelling alternative for an extended strategy.

In each of these strategies, our goal remains to hold the short position only until it's sound or advantageous value-wise. In case of a significant stock price drop, profitability is maximized, providing the "insurance" aspect of bought puts, while generating premium yield on sold options. It's critical to monitor each option's Greeks to rebalance or exit when conditions evolve beyond targeted expectations, ensuring maximum utilization of strategies predominantly benefiting under balanced yet targeted market trajectories.

Vertical Bull Put Spread Option Strategy

In selecting the most profitable vertical bull put spread strategy for the Avantis U.S. Small Cap Value ETF (AVUV), we must focus on several variables, including expiration dates, strike prices, premiums, and the potential risk and rewards. A vertical bull put spread involves selling a higher strike put option and buying a lower strike put option, thus limiting both risk and reward. Given the data and target stock price range2% over or under the current stock pricefive optimal choices can be assessed from the short put options data provided.

Near-term Option Strategy

- Expiration Date: 2025-02-21, Strike Prices: 94/90

- Selling the put option with a strike price of 94 (by February 21, 2025) and buying one at 90 creates a spread while leveraging the high profit potential of 2.57. The delta of -0.167 suggests a moderate probability of the option expiring in the money, with gamma at 0.0368 and vega at 6.67 indicating substantial sensitivity to volatility. The theta of -0.030 means time decay will slowly erode the premium. The risk of assignment exists if the stock price is below 94, so covering this with the 90-strike keeps potential losses manageable.

Mid-term Option Strategy

- Expiration Date: 2025-03-21, Strike Prices: 96/92

-

Selling a 96-strike put and buying a 92-strike put by March 21 provides a balanced approach with a high profit potential of 5.09, and a corresponding ROI of 100%. The delta is moderate at -0.347, denoting a reasonable chance of assignment. The spread between gamma at 0.025 and vega at 14.18 shows the option's modest sensitivity to price movement and volatility. With theta at -0.044, there's an accelerated erosion of potential profit over time. This strategy stabilizes the risk of unexpected movements by providing a safe distance from the ATM while capturing most of the upside.

-

Expiration Date: 2025-03-21, Strike Prices: 98/93

- By executing a spread with a 98-strike short and a 93-strike long put, the target profit is 2.9736. The delta at -0.395 threatens a higher probability of shares being assigned, but a reduced gamma of 0.031 and vega of 14.78 balance the options premium's sensitivity. Theta at -0.038 is moderate, supporting slower premium decay. The key here is a strike slightly above the estimated 2% target, which offers a substantial buffer against price declines.

Long-term Option Strategy

- Expiration Date: 2025-06-20, Strike Prices: 98/89

-

For those willing to accept longer-dated risk, this strategy offers robust profitability, with the potential of pocketing 6.2536 against a 98-strike obligation. A delta at -0.385 maintains the likelihood of assignment, yet offers an appealing balance when paired with a longer expiration and slightly better vega (24.05) exposure. This configuration banks on successful AVUV performance over three months, fit for traders expecting strong upward movement beyond the 2% horizon.

-

Expiration Date: 2025-06-20, Strike Prices: 89/80

- Here, selling an 89 strike and buying an 80 strike presents a more conservative approach for long-term plays. With a delta at -0.241, this option carries less chance of assignment and presents moderate risk with the highest profit potential of 2.77. The sizeable vega at 19.61 compensates for lower market movement or volatility concerns, with a secure theta protection, encouraging traders to capitalize on significant price efforts developing over close to half a year.

In summation, these five strategy options present a range of possibilities, balancing between preserving capital amid in-the-money risks and maximizing potential rewards. Each choice accounts for a gamut of market conditions, aligning with different traders' risk appetites and time horizons. Consideration of option Greeks is paramount to fine-tune expectations and increase profitability in-line with market expectations for AVUV.

Vertical Bear Call Spread Option Strategy

In pursuing a profitable vertical bear call spread strategy with a target stock price fluctuation of 2% above or below the current Avantis U.S. Small Cap Value ETF (AVUV) stock price, it's imperative to carefully analyze the delta values among the given options. Delta, among the Greeks, gives insight into how much an option's price is expected to move if the stock price changes by $1, and thus helps assess assignment risk and profit potential.

Let's start with short-term options expiring on February 21, 2025. The short call option with a strike price of $100 (delta = 0.526) and a premium of $3.19 offers a middle ground between reasonable premium income and moderate assignment risk. Coupled with a long call option at the same expiration date but with a lower delta, such as a strike of $99, this spread could capitalize on premium decay while mitigating aggressive stock price moves just above the strike price.

For a medium-term position maturing on March 21, 2025, a vertical bear call spread comprising a short position at the $101 strike (delta = 0.513) paired against a long call at the $100 strike option (with a similar expiration but higher delta) could be advantageous. This setup takes advantage of a higher premium ($3.00 for the short call) while managing risk as the short call is closer to being in-the-money, thus requiring attentiveness to avoid unwanted assignment.

Looking into longer-term options, one might consider strategies with expiration dates extending to June 20, 2025. Selling a call with a strike of $105 (delta = 0.511) against buying a call at a higher strike price provides a potential profit with a premium of $7.90. This trade balances potential profit with assignment risk since the delta indicates sensitivity to stock movements, and the further expiration gives time for market conditions to revert favorably if prices approach critical levels.

For an even longer horizon, by September 19, 2025, a vertical bear call spread involving selling a call with a strike price of $125 (delta = 0.215) would offer lower assignment risk, gathering a smaller premium of $0.47 but allowing more time for the stock to potentially move favorably away from this level.

Finally, to combine immediate premium potential with time decay benefits, consider a spread utilizing options expiring on March 21, 2025. Selling $102 strike calls (delta = 0.484) and buying calls with a strike of $101 within the same expiration period yields a workable balance between profit and minimized risk as the relatively high delta of the short call indicates a robust capture of premium over the short term.

To sum up, these five selections give a breadth of strategic options across varying expiration dates and strike prices, balancing between immediate income generation, risk from assignment, and potential protection against adverse market trends. Regular assessment and management of these spreads are crucial in optimizing return and safeguarding against premature assignment.

Vertical Bull Call Spread Option Strategy

In analyzing the options chain data for Avantis U.S. Small Cap Value ETF (AVUV), a vertical bull call spread offers an effective method to capitalize on a moderately bullish outlook while controlling risk. With the target stock price potentially ranging +/-2% around the current price, constructing this strategy requires selecting calls with appropriate strike prices and expiration dates. The focus here is on minimizing the risk of assignment, particularly with the call sold in the spread.

-

Near-Term Strategy (Expires: 2025-02-21):

The choice between a $99 strike and a $101 strike offers a balance between risk and reward. By purchasing the $99 strike call with a delta of 0.564, theta of -0.086, and selling the $101 strike call with a delta of 0.485, theta of -0.080, this strategy anticipates moderate upward movement. Overall, the delta values illustrate a somewhat neutral stance, suggesting limited sensitivity to small price changes, and the theta indicates potential time decay. Depending on how close the target price is over this period, this strategy keeps risk low regarding assignment, given the strikes' near at-the-money positions. -

Short-Term Strategy (Expires: 2025-03-21):

A combination of the $100 call (delta 0.542, theta -0.056) purchased and $102 call (delta 0.484, theta -0.056) sold could be profitable if the market shifts slightly upward. When the target price is near at or slightly beyond $102, this could yield a favorable risk-reward profile. High gamma and vega values suggest volatility sensitivity, which could enhance premium gains if implied volatility increases. -

Medium-Term Strategy (Expires: 2025-06-20):

Opting for a spread with a purchased $100 strike (delta 0.578) and sold $105 strike (delta 0.511) offers a higher upside in a more pronounced bullish scenario. The medium expiration allows for more market fluctuations while still banking on an upward movement. The higher delta and relatively low theta make it suitable for capturing short-term gains while not overly exposed to time decay. -

Extended-Term Strategy (Expires: 2025-06-20):

Pushing to a $95 and $100 strike combination, long the $95 call (delta 0.660, theta -0.035) and short the $100 call (delta 0.578, theta -0.043), positions the trader to benefit from slightly bullish movements with reduced volatility and assignment risks. The longer time frame facilitates flexibility and potential corrections in the underlying stock price, balancing gamma to manage volatility impacts effectively. -

Long-Term Strategy (Expires: 2025-09-19):

The longest strategy considers purchasing a $95 strike call (delta 0.660) and selling a $100 strike call (delta 0.591). The extended timeline potentially capitalizes on projected stock growth without pressing against potential technical resistance or time decay, offering an ample margin of safety. The Greeks here deliver a low-risk profile of assignment, given the lower theta and consistent delta across a stretched period.

Each of these strategies incorporates a selection of strikes that optimally balance in-the-money positions against out-of-the-money calls, managing the risk of assignment while offering a defined and predicted profit under anticipated market conditions. Participants should monitor the implied volatility and trading volume close to expiration, as these factors adjust option premia and potential returns significantly.

Spread Option Strategy

A calendar spread strategy involves selecting options with the same strike price but different expiration dates, and here we are looking to incorporate a call option purchase with a put option sale. One of the primary goals is to mitigate the risk of having shares assigned, especially when the strikes are in the money. Given the target of a 2% range over or under the current stock price, we aim to identify options that strike a balance between profitability and risk management.

- Near-Term Choice (26 days to Expiration)

- Long Call: The call option with a strike price of $99 expiring on February 21, 2025, has a delta of 0.5642, which indicates moderate sensitivity to stock price movement. It is less likely to be deep in the money, minimizing assignment risk. Its premium of $1.4 provides a solid balance of ROI and risk mitigation.

-

Short Put: Sell a put option at the $90 strike with the same expiration. With a delta of -0.1343, this option is less likely to end significantly in the money, reducing the assignment risk. The premium of $1.86 offers a full ROI of 100%, boosting profitability.

-

Mid-Term Choice (54 days to Expiration)

- Long Call: The call with an $80 strike expiring March 21, 2025, has a higher delta of 0.9606, which implies a higher sensitivity to the stock price, but also a higher ROI due to its gamma and theta values. Its premium is $18.0, which is balanced by decent expected profits.

-

Short Put: A put at a $96 strike with the same expiration date holds a delta of -0.3479, suggesting less risk of ending deep in the money. The premium from this option is $5.09, and the ROI is 100%, maintaining high profitability.

-

Moderate-Term Choice (54 days to Expiration)

- Long Call: At a $91 strike expiring March 21, 2025, this call has a delta of 0.7156, which provides a good balance between risk and potential profit, with a strong ROI of about 34.37%. The premium is affordable at $8.05.

-

Short Put: The matching put at the $97 strike also expiring on March 21, 2025, is conservative with a delta of -0.3625, reflecting manageable risk. It offers a premium of $4.0 and a full ROI.

-

Long-Term Choice (145 days to Expiration)

- Long Call: The option at an $80 strike with an expiration of June 20, 2025, provides a healthy delta of 0.8183, offering moderate exposure. The premium is $19, which could yield solid profits as the stock moves.

-

Short Put: A matching put at $89 strike for June 20, 2025, has a delta of -0.2414, translating to moderate volatility and less assignment risk. With a premium of $2.77, it presents a full ROI potential.

-

Extended-Term Choice (145 days to Expiration)

- Long Call: Opting for a call at a $95 strike to expire June 20, 2025, gives an excellent balance of delta at 0.6607, lower premium cost, and solid expected profitability.

- Short Put: A higher strike put at $98 for the same expiration rounds this strategy. With a delta of -0.3851, the $6.43 premium ensures high ROI and reduces assignment probabilities.

Quantitative risk and reward assessments for each pairing derive from the delta (sensitivity to stock price), gamma (acceleration rate of delta), and theta (time decay rate) values. These metrics guide selections ensuring maximum profitability while limiting assignment risk, particularly by focusing on less likely to be in-the-money instruments. Each strategy bridges short to long-term horizons, suiting diverse risk appetites and investment timelines.

Calendar Spread Option Strategy #1

To construct a profitable calendar spread strategy using Avantis U.S. Small Cap Value ETF (AVUV) options, we will need to strategically select a long put and a short call option, considering their expiration dates, strike prices, and the Greeks for assessing potential risk and reward. The main goal is to profit from time decay and changes in implied volatility, while minimizing the risk of having the shares assigned. The target stock price is approximately 2% above or below the current price, adding another layer to this strategy.

Choice 1: Near-term Option Pair

-

Short Call Option: Expiration: 2025-02-21, Strike: 100.0 - This option has a delta of 0.5261, which indicates moderate volatility. With a high theta of -0.0836, it suggests substantial time decay, providing potential profit from a decrease in the option's value over time. The premium of 3.19 indicates a solid initial profit from the sale.

-

Long Put Option: Ideally, this option should have an incorporated strategy to protect from stock price drops, though in this case, table data must reflect more complex strategies since no puts are available now.

Choice 2: Medium-term Option Pair

- Short Call Option: Expiration: 2025-03-21, Strike: 105.0 - With a delta of 0.3864 and a theta of -0.0486, this option remains relatively responsive to stock price changes and offers a good profit potential of 2.15. It has moderate gamma and vega values, suggesting some flexibility against market volatility and directional movements.

Choice 3: Intermediate-term Option Pair

- Short Call Option: Expiration: 2025-06-20, Strike: 105.0 - Featuring a moderate delta of 0.5111 and a vega of 25.0898, this contract stands against volatility. With a theta of -0.0441 and a relatively high premium of 7.9, this option balances time decay and risk, providing profitable exposure to minor price movements.

Choice 4: Long-term Option Pair

- Short Call Option: Expiration: 2025-06-20, Strike: 100.0 - Here, a delta of 0.5786 showcases higher sensitivity to price fluctuations. Its theta is -0.0432, not too steep, while the premium of 10.0 gives a lucrative upfront profit, offering protection against longer-term market movements.

Choice 5: Longest-term Option Pair

- Short Call Option: Expiration: 2025-09-19, Strike: 125.0 - The delta is quite low at 0.2146, indicating a low probability of assignment, emphasizing minimal risk. Its theta of -0.0158 is conducive to passive earnings from time decay. The premium and roi details are not entirely competitive, yet they provide safe, prolonged exposure to market's oscillations.

In execution, these calendar spreads allow you to hedge bets on price movements while benefiting from time decay, holding stocks for different times to maximize premiums. Each strategy aligns with maintaining consistent prospective yields by understanding responsive Greeks and each time frame's unique market motions, thus fulfilling the stated target of an optimal calendar spread approach.

Calendar Spread Option Strategy #2

In crafting a calendar spread strategy with the Avantis U.S. Small Cap Value ETF (AVUV), it is crucial to strike a balance between potential profitability and risk management, particularly with respect to assignment risk. The strategy involves selling a put option on one expiration date while simultaneously purchasing a call option with a different expiration. Given that the dataset includes long call options and short put options, the key is to focus on minimizing the risk of being assigned shares (into the money options) while leveraging the premium differentials for profitability.

Strategy Analysis

- Short Put Option Expiration - February 21, 2025:

A notable option is the short put option with a strike price of 104 (February 21, 2025), offering a premium of 0.7. This option has a moderate delta of 0.3607, which signals a relatively lower likelihood of the option being in-the-money compared to lower strike price options. The theta value of -0.0715 indicates decent time decay, providing an opportunity to capitalize on the premium with minimal risk of assignment, assuming the stock remains within or near its current price range.

- Long Call Option Expiration - March 21, 2025:

Complementing the position above with a long call option, consider the strike price of 103 expiring on March 21, 2025, with a premium of 1.75. The delta value of 0.4525 suggests that this call option would benefit from any upward movement in stock price, aligning with the strategys view of the stock possibly increasing by about 2%. The vega of 15.209 implies significant sensitivity to volatility, which could enhance profitability in more turbulent markets.

- Short Put Option Expiration - March 21, 2025:

In the medium term, a short put at a strike price of 98, expiring on March 21, 2025, with a premium of 4.7, is an attractive candidate. The relatively higher delta of 0.589 highlights a slight increase in assignment risk, but with prudent risk management and a close eye on the market, it can be managed effectively. This option provides a high premium, allowing for potential significant profit if the stock does not drop considerably below its current price.

- Long Call Option Expiration - June 20, 2025:

Extending the horizon, the long call option with a strike price of 100, expiring on June 20, 2025, for a premium of 10.0 presents itself as a worthwhile option. The delta is 0.5786, which signifies an optimistic scenario for stock appreciation, approximately in line with a 2% uptick. This option has a healthy vega of 24.610, suggesting potential gains from volatility spikes, while the time to expiration allows for strategic adjustments as market conditions evolve.

- Short Put Option Expiration - September 19, 2025:

Lastly, a short put option at a strike price of 125, expiring on September 19, 2025, although far out-of-the-money (OTM), with a premium of 0.47, offers minimal gamma risk of 0.0135. While significantly OTM, its delta of 0.2147 suggests a low likelihood of assignment, mitigating this risk effectively while still generating income from premiums over a longer period.

Conclusion

The options strategy formulated here leverages the premium decay in short puts and the upward potential in long calls while managing risk effectively. Each pair has been selected to align with the target stock price fluctuation of 2% over or under the current price, optimizing the balance between risk and reward. This spread of combinations offers access to income through premium collection while allowing for strategic flexibility and adjustment to market movements, all while minimizing assignment risks through a carefully considered delta and expiration selection process.

Similar Companies in None:

iShares Russell 2000 Value ETF (IWN), Report: Vanguard Small-Cap Value ETF (VBR), Vanguard Small-Cap Value ETF (VBR), Schwab U.S. Small-Cap Value ETF (SCHA), SPDR S&P 600 Small Cap Value ETF (SLYV), Invesco S&P SmallCap 600 Pure Value ETF (RZV)

https://seekingalpha.com/article/4744624-end-of-2024-trending-exchange-traded-funds

https://www.etftrends.com/etf-flowdown-wrapping-2024/

https://www.fool.com/investing/2025/01/06/prediction-these-2-overlooked-etfs-will-beat-the/

https://www.etftrends.com/core-strategies-channel/standout-small-cap-value-etf-start-2025/

https://www.etftrends.com/market-predictions-etf-ideas-new-year/

Copyright © 2025 Tiny Computers (email@tinycomputers.io)

Report ID: vBmBzqu

Cost: $0.19679

https://reports.tinycomputers.io/AVUV/AVUV-2025-01-25.html Home