British American Tobacco p.l.c. American Depositary Shares, American Depositary Shares, each representing one Ordinary Share (ticker: BTI)

2023-12-21

British American Tobacco p.l.c. (BAT) is a multinational company that is among the world's largest tobacco and nicotine products manufacturers. The company is headquartered in London, England, and operates in a multitude of countries worldwide. BAT's American Depositary Shares (ADS) trade on the New York Stock Exchange under the ticker symbol BTI. Each ADS represents one ordinary share of British American Tobacco, effectively allowing U.S. investors to hold equity in the company with ease. The ADS structure provides a channel for American investors to invest in foreign companies while receiving dividend payments and having the ability to trade in U.S. dollars during U.S. trading hours. BAT's product range includes traditional tobacco products such as cigarettes and cigars, alongside an increasing focus on potentially reduced-risk products like vapour and tobacco heating products, as the company adapts to an evolving market with increased health consciousness and regulatory changes regarding tobacco use.

British American Tobacco p.l.c. (BAT) is a multinational company that is among the world's largest tobacco and nicotine products manufacturers. The company is headquartered in London, England, and operates in a multitude of countries worldwide. BAT's American Depositary Shares (ADS) trade on the New York Stock Exchange under the ticker symbol BTI. Each ADS represents one ordinary share of British American Tobacco, effectively allowing U.S. investors to hold equity in the company with ease. The ADS structure provides a channel for American investors to invest in foreign companies while receiving dividend payments and having the ability to trade in U.S. dollars during U.S. trading hours. BAT's product range includes traditional tobacco products such as cigarettes and cigars, alongside an increasing focus on potentially reduced-risk products like vapour and tobacco heating products, as the company adapts to an evolving market with increased health consciousness and regulatory changes regarding tobacco use.

| As of Date: 12/20/2023Current | |

|---|---|

| Market Cap (intraday) | 65.68B |

| Enterprise Value | 113.79B |

| Trailing P/E | 6.10 |

| Forward P/E | 6.35 |

| PEG Ratio (5 yr expected) | 3.00 |

| Price/Sales (ttm) | 1.88 |

| Price/Book (mrq) | 0.73 |

| Enterprise Value/Revenue | 4.03 |

| Enterprise Value/EBITDA | 7.82 |

| Statistic Name | Statistic Value | Statistic Name | Statistic Value | Statistic Name | Statistic Value |

|---|---|---|---|---|---|

| Full Time Employees | 52,077 | Previous Close | 29.89 | Open | 29.81 |

| Day Low | 29.49 | Day High | 29.83 | Dividend Rate | 2.80 |

| Dividend Yield | 0.0938 | Payout Ratio | 0.5913 | Five Year Avg Dividend Yield | 7.36 |

| Beta | 0.319 | Trailing PE | 6.0183673 | Forward PE | 7.4282117 |

| Volume | 7,280,493 | Average Volume | 4,731,558 | Average Volume 10 Days | 8,082,730 |

| Bid | 29.6 | Ask | 29.6 | Bid Size | 3,100 |

| Ask Size | 1,300 | Market Cap | 65,951,731,712 | Fifty Two Week Low | 28.35 |

| Fifty Two Week High | 41.21 | Price to Sales Trailing 12 Months | 2.3364768 | Fifty Day Average | 30.5866 |

| Two Hundred Day Average | 32.98185 | Trailing Annual Dividend Rate | 2.243 | Trailing Annual Dividend Yield | 0.07504182 |

| Enterprise Value | 104,100,208,640 | Profit Margins | 0.31055 | Float Shares | 1,991,700,660 |

| Shares Outstanding | 2,236,410,112 | Shares Short | 2,607,882 | Shares Short Prior Month | 2,811,450 |

| Shares Percent Shares Out | 0.0011999999 | Held Percent Insiders | 0.00274 | Held Percent Institutions | 0.07525 |

| Short Ratio | 0.74 | Implied Shares Outstanding | 2,266,700,032 | Book Value | 31.679 |

| Price to Book | 0.9309006 | Last Fiscal Year End | 1672444800 | Next Fiscal Year End | 1703980800 |

| Most Recent Quarter | 1688083200 | Earnings Quarterly Growth | 1.13 | Net Income to Common | 8,718,000,128 |

| Trailing EPS | 4.9 | Forward EPS | 3.97 | Last Split Factor | "2:1" |

| Last Split Date | 1487030400 | Enterprise to Revenue | 3.688 | Enterprise to Ebitda | 7.248 |

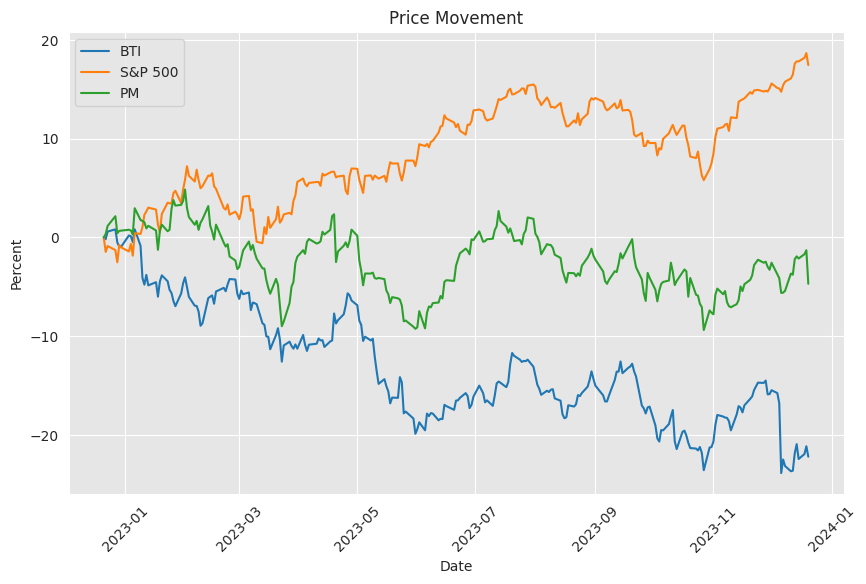

| 52 Week Change | -0.27274936 | S&P 52 Week Change | 0.22945571 | Last Dividend Value | 0.701 |

| Last Dividend Date | 1695859200 | Current Price | 29.49 | Target High Price | 57.34 |

| Target Low Price | 30.0 | Target Mean Price | 41.11 | Target Median Price | 36.0 |

| Recommendation Mean | 2.2 | Number of Analyst Opinions | 3 | Total Cash | 4,132,000,000 |

| Total Cash Per Share | 1.854 | Ebitda | 14,362,000,384 | Total Debt | 42,168,999,936 |

| Quick Ratio | 0.526 | Current Ratio | 0.932 | Total Revenue | 28,227,000,320 |

| Debt to Equity | 58.062 | Revenue Per Share | 2.5208 | Return on Assets | 0.05696 |

| Return on Equity | 0.121920004 | Gross Profits | 22,851,000,000 | Free Cashflow | 6,848,625,152 |

| Operating Cashflow | 10,547,999,744 | Earnings Growth | 1.178 | Revenue Growth | 0.044 |

| Gross Margins | 0.82658 | Ebitda Margins | 0.5088 | Operating Margins | 0.44162998 |

Analyzing the technical indicators for the stock in question on the last trading day reveals a nuanced picture of the potential future price movement. With an adjusted closing price of $29.49, the stock has shown a slight downtrend as indicated by the MACD (Moving Average Convergence Divergence). The MACD value at -0.457669 coupled with a negative MACD histogram value of -0.083608 suggests a bearish momentum. Meanwhile, the RSI (Relative Strength Index) of 41.3 does not indicate an oversold condition but suggests the stock has some bearish sentiment.

The Bollinger Bands show the stock trading near the lower band with a BBL of $29.22 and the closing price just above it. While this could sometimes be a signal for an impending upside correction, the middle band (BBM) at $29.668 and the upper band (BBU) at $30.115 are in close proximity, reflecting low volatility and a potentially tight trading range.

The current price also resides below both the SMA (Simple Moving Average) 20-day ($30.58) and the EMA (Exponential Moving Average) 50-day ($30.833485), reinforcing the bearish trend outlook over the intermediate term. Additionally, the OBV (On-Balance Volume) in million at -5.446329 indicates that there is substantial selling pressure, as volume is often considered a confirmation of the trend.

Stochastic oscillators, with the STOCHk at 34.36 and the STOCHd at 32.98, are not currently in oversold territory; however, the potential for a bullish crossover exists if both indicators rise from these levels. The ADX (Average Directional Index) at 24.25 points to a market that is neither trending strongly nor in a range-bound state but could be on the edge of a trend formation.

In terms of investor sentiment and liquidity, the Chaikin Money Flow (CMF) at 0.193 shows moderate buying pressure. This is somewhat countered by the William's %R (WILLR) at -69.6, which indicates the stock is not in an oversold position, leaving room for further downside.

Considering the absent PSAR (Parabolic Stop and Reverse) bullish indicator and the presence of a bearish PSAR at $30.544912, the technical indicators present a moderately bearish outlook. The challenge for the stock will be to reverse the negative momentum indicated by the indicators and move above the key resistance points laid out by the Bollinger Bands and moving averages.

When evaluating the stock's fundamentals, the figures present a staple backdrop for our technical analysis. With a trailing P/E of 6.10 and a forward P/E of 6.35, the stock shows attractiveness from a valuation standpoint, being priced lower than the general market's valuation ratios. Moreover, the Price/Book (P/B) ratio at 0.73 signals undervaluation. The company has maintained robust EBITDA figures and net income in recent years, signifying financial health.

Despite these strengths, the high Enterprise Value (EV) to Revenue ratio of 4.03 and EV/EBITDA of 7.82 indicate the company is possibly carrying a significant amount of debt given the EV far exceeds the market cap, and the operating earnings multiples also appear quite leveraged. These concerns might weigh on investor sentiment, especially if market conditions are risk-averse.

Looking ahead over the next few months, the stock price movement might experience a tussle between the relatively strong fundamentals and the negative technical indicator signals. While the attractive valuations could provide a floor to the stock's downside risk, the technical indicators would need to show improvement particularly, a positive shift in momentum indicators and a breakout above resistance levels outlined by the SMA and EMA. If the bearish signals persist, especially if the ADX strengthens on the downside or the stock price remains clamped by the moving averages, the stock might continue to face downward pressure or at best enter into a consolidation phase.

Investors would be well-served to monitor changes in the financial markets and macroeconomic environment that may influence risk appetite and further impact the stock's technical and fundamental dynamics. Potential catalysts for trend reversal include stronger-than-expected earnings reports, positive industry news, or shifts in economic indicators that could reinvigorate buying interest in the market.

British American Tobacco (BAT) p.l.c. and Pfizer Inc. represent two stalwart entities with significant prominence in their respective industries. Regarded as blue-chip stocks, they offer attractive dividend yields, spotlighting them as essential players in the global market. Despite operating in distinct sectorstobacco and pharmaceuticalsboth companies have encountered their fair share of obstacles, which have undoubtedly influenced their strategies and performance.

BAT is a foremost player in the tobacco industry, catering to a variety of consumer preferences through products that range from traditional cigarettes to vaping items. The global downturn in smoking rates presents a formidable challenge to the tobacco giant. However, BAT's strategic redirection toward alternative tobacco products signals an attempt to adapt to evolving consumer behaviors. With an alluring dividend yield of 9.4% based on the current stock price and projected P/E ratio of 6.28 for the year 2024, BAT stock offers an enticingly high yield. Nevertheless, the yield stands as a stark reflection of the risks posed by the tobacco sector's enduring decline.

Pfizer is no stranger to industry-specific challenges, as evidenced by the recent downturn in revenue driven by diminishing demand for its COVID-19 products. Management at Pfizer has been vigorously pursuing avenues for rejuvenating growth, focusing on the development and acquisition of new pharmaceutical assets. Pfizer's standing as a leading dividend payer in the pharmaceutical space is accentuated by its yield of 6.2% and an appealing 9.4 times projected P/E ratio for 2024. Investors may find the valuation compelling, given the company's firm free cash flows and consistent history of dividend disbursement.

The pharmaceutical industry, where Pfizer asserts its dominance, is perceived as a growth-oriented sector with promising prospects for long-term value appreciation. Pfizer's active push to bolster its drug portfolio continues to make headlines, with strategic acquisitions like the proposed deal with Seagen forming a crux of its approach to combat potential revenue stagnation.

BAT, listed on the New York Stock Exchange under the ticker BTI, is an established entity in the global tobacco segment. The company actively manages the gradual decline of traditional tobacco products by expanding its portfolio to include vaping and tobacco-heating options, such as Vuse and Glo. These products have seen sales increases, suggesting that BAT can navigate the traditional smoking downturn for the foreseeable future. Proponents highlight BAT's notable dividend yield of 9.6%, hinting at the firm's profitability and economic resilience.

Investors observing the shifting economic milieu might note that value stocks like BTI are gaining appeal. With rising interest rates tilting the scales slightly against growth stocks, BTI's established business and robust cash flow suggest a possible outperformance despite challenges like the recent substantial write-down in the value of its U.S. cigarette brands.

Following the announcement of a $31 billion write-down amidst pressures in the U.S. cigarette market, BTI's stock price experienced a precipitous fall. Though such a write-down affects the perception of BAT's value, it does not directly impact the company's core earnings or cash flows. Hence, the adjustment may offer an opportune moment for investment at an advantageous price-to-earnings ratio and a high dividend yield.

BAT's approach to the changing landscape involves a strategic pivot towards non-traditional categories, such as its intention to derive 50% of revenues from these segments by 2035. Despite inherent risks and potential future legal complications, the analysis shows that the market may have overreacted, presenting a chance to buy into a high-yield stock with a formidable portfolio.

BAT recently took a bold step by impairing the value of its U.S. cigarette brands, an accounting-based decision that seized market attention. Reflecting a reaction to market dynamism, the impairment points to BAT's adaptation strategy, focusing on innovative products. Analysts and investors have pinpointed the selloff as possibly an overreaction, potentially marking an opportunity driven by the company's positive growth outlook and commitment to capital allocation, despite the momentary volatility.

BAT's announcement of a substantial write-down in asset value highlights the company's strategic adjustment, signifying the company's acknowledgment of industry trends and an adaptative approach. While the write-down introduces financial statement implications, the forward-looking transformation goals reveal a blend of strategic reinforcements aimed to cater to shifting consumer trends and to ensure long-term business sustainability.

BAT's naming as a sin stock doesn't diminish its stature as a significant player in the investment world. Though 'sin stocks' spark ethical scrutiny, BAT's expansive range of products and strategic orientation toward reduced-risk products demonstrate its adaptive capacity in a changing industry landscape. With this in mind, historical and projected earnings growth, an investment-grade credit rating, and strong dividend payments attest to BTI's financial resilience, irrespective of its industry classification.

Even amid a sizeable non-cash impairment, BAT showcases its corporate robustness. With a dividend yield nearing 10%, investors are prompted to dissect the security of this income stream. The impairment, while monumental, offers a window into BAT's strategy and its transition toward a diverse portfolio, earmarked for providing sustainable revenue and adjusting for market contingencies.

BTI's alignment with the sin stock category comes amid a backdrop of high dividend yields and scrutiny by income-focused investors. Despite concerns around the tobacco industry's outlook, BAT's latest financial developments and strategic shifts underscore its commitment to portfolio diversification and proactive market positioning. For investors eyeing the dividend yield and broader industry metrics, BTI presents a multifaceted case for consideration.

The valuation shift experienced by BAT p.l.c. on the heels of a major write-down announcement represents a critical juncture for the company. While bearing significant weight on BTI's stock price, this non-cash adjustment creates a divergence between market sentiment and operational reality, which could signal an investment opportunity for those less influenced by fleeting market perceptions.

British American Tobacco found itself at a crossroads following a substantial 25 billion impairment charge, casting a highlight on its strategic reality and foreseeable future. With BTIs stock taking an 8% hit, the market's immediate response underscores the perceived risks within the U.S. tobacco industry while also potentially opening up a window for value investment, provided BAT's counterstrategies and intact dividend promise.

Similar Companies in Tobacco:

Philip Morris International Inc. (PM), Report: Altria Group, Inc. (MO), Altria Group, Inc. (MO), Imperial Brands PLC (IMBBY), 22nd Century Group, Inc (XXII), Turning Point Brands, Inc. (TPB)

News Links:

https://www.fool.com/investing/2023/12/20/better-dividend-stock-pfizer-or-british-american-t/

https://www.fool.com/investing/2023/12/13/3-reasons-to-buy-british-american-tobacco-stock-li/

https://www.fool.com/investing/2023/12/09/what-british-american-tobaccos-31-billion-mea-culp/

https://seekingalpha.com/article/4656898-4-sin-stocks-with-moral-implications

https://www.fool.com/investing/2023/12/07/is-british-american-tobaccos-985-dividend-yield-sa/

https://seekingalpha.com/article/4656531-british-american-tobacco-be-greedy-when-others-are-fearful

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: couzaH

https://reports.tinycomputers.io/BTI/BTI-2023-12-21.html Home