Crown Castle Inc. (ticker: CCI)

2023-12-24

Crown Castle Inc. (ticker: CCI) is a leading American telecommunications infrastructure company that operates an extensive network of cell towers, small cells, and fiber optic cable. With a primary focus on wireless communication, Crown Castle leases space on its towers to mobile network operators, enabling them to enhance their network coverage and capacity. The company's well-positioned assets are critical to supporting the growing demand for high-speed mobile data and ensuring the successful rollout of next-generation 5G networks across the United States. As of the knowledge cutoff, Crown Castle's business model is centered around long-term lease agreements, which provide a stable and predictable revenue stream. The company's strategic acquisition of towers, ongoing investment in small cells, and extensive fiber holdings not only serve current telecom needs but also position Crown Castle to capitalize on future technological advancements and increased connectivity demands.

Crown Castle Inc. (ticker: CCI) is a leading American telecommunications infrastructure company that operates an extensive network of cell towers, small cells, and fiber optic cable. With a primary focus on wireless communication, Crown Castle leases space on its towers to mobile network operators, enabling them to enhance their network coverage and capacity. The company's well-positioned assets are critical to supporting the growing demand for high-speed mobile data and ensuring the successful rollout of next-generation 5G networks across the United States. As of the knowledge cutoff, Crown Castle's business model is centered around long-term lease agreements, which provide a stable and predictable revenue stream. The company's strategic acquisition of towers, ongoing investment in small cells, and extensive fiber holdings not only serve current telecom needs but also position Crown Castle to capitalize on future technological advancements and increased connectivity demands.

| As of Date: 12/24/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 49.80B | 39.91B | 49.45B | 58.09B | 58.74B | 62.59B |

| Enterprise Value | 78.41B | 68.15B | 77.78B | 85.89B | 86.33B | 89.96B |

| Trailing P/E | 32.08 | 23.42 | 29.52 | 34.67 | 36.36 | 40.49 |

| Forward P/E | 28.74 | 22.99 | 29.50 | 34.72 | 34.97 | 34.84 |

| PEG Ratio (5 yr expected) | 3.78 | 3.03 | 3.75 | 5.10 | 3.25 | 2.65 |

| Price/Sales (ttm) | 7.05 | 5.59 | 7.05 | 8.31 | 8.56 | 9.30 |

| Price/Book (mrq) | 7.47 | 5.66 | 6.85 | 7.80 | 7.65 | 7.96 |

| Enterprise Value/Revenue | 11.09 | 40.88 | 41.66 | 48.44 | 48.94 | 51.52 |

| Enterprise Value/EBITDA | 19.06 | 74.07 | 70.20 | 81.72 | 83.66 | 87.93 |

| Address 1 | 8020 Katy Freeway | City | Houston | State | TX |

| Zip Code | 77024-1908 | Country | United States | Phone | 713 570 3000 |

| Fax | 713 570 3100 | Website | https://www.crowncastle.com | Industry | REIT - Specialty |

| Sector | Real Estate | Full Time Employees | 5,000 | Previous Close | 114.6 |

| Open Price | 115.17 | Day Low | 114.4 | Day High | 116.32 |

| Dividend Rate | 6.26 | Dividend Yield | 5.45% | Payout Ratio | 174.86% |

| 5 Year Average Dividend Yield | 3.6% | Beta | 0.763 | Trailing PE | 32.08 |

| Forward PE | 39.19 | Volume | 1,409,954 | Average Volume (10 days) | 4,810,930 |

| Bid | 111.0 | Ask | 114.82 | Market Cap | 49,800,507,392 |

| 52 Week Low | 84.72 | 52 Week High | 153.98 | Price to Sales (TTM) | 7.043 |

| Enterprise Value | 78,412,488,704 | Profit Margins | 21.96% | Shares Outstanding | 433,688,992 |

| Held Percent Insiders | 0.389% | Held Percent Institutions | 92.87% | Short Ratio | 1.46 |

| Book Value | 15.366 | Price to Book | 7.473 | Net Income To Common | 1,552,999,936 |

| Trailing EPS | 3.58 | Forward EPS | 2.93 | Total Cash | 117,000,000 |

| Total Debt | 28,728,999,936 | Total Revenue | 7,071,000,064 | Gross Profits | 4,918,000,000 |

| Free Cash Flow | 1,445,124,992 | Operating Cash Flow | 3,097,999,872 | Revenue Growth | -4.5% |

| Gross Margins | 71.051% | EBITDA Margins | 59.426% | Operating Margins | 33.953% |

Based on the provided Commodity Channel Index (CCI) and the stock's fundamentals, it appears that the stock has been experiencing a decrease in market cap and enterprise value over the past year. This decline may be indicative of market sentiment at large or specific to the company's recent performance. However, a closer look at the technical indicators and financials will help frame a more informed projection of the stock's likely movements.

Technical Analysis Perspective:

- The Moving Average Convergence Divergence (MACD) histogram is negative, which typically indicates downward pressure on the price or a bearish divergence.

- The Relative Strength Index (RSI) is at 61.77, which suggests that the stock is neither overbought nor oversold, leaning slightly towards overbought territory.

- Bollinger Bands show the closing price near the upper range, indicating potential overvaluation and a possible reversion to the mean.

- The Parabolic Stop and Reverse (PSAR) indicator signals a bullish trend as the PSAR is below the price.

- The ADX (Average Directional Movement Index) value is relatively high at 39.10, implying a strong trend, the direction of which needs to be determined in conjunction with other indicators.

- The Williams %R (WILLR), a momentum indicator, points to the stock being in the middle of its trading range, neither overbought nor oversold.

- The Chaikin Money Flow (CMF) shows a slight outflow of money, but it's not particularly strong.

Taking these technical indicators together, we see mixed signals with some leaning toward a bearish outlook based on the MACD histogram and others suggesting strength in the current trend with the ADX and PSAR. Given the closeness of the adjusted close to the upper Bollinger Band, some price retreat could happen in the short-term, making the scenario of ranging or slight downward pressure in the immediate future a possibility.

Fundamental Analysis Perspective:

The fundamental analysis shows trailing and forward Price-to-Earnings (P/E) ratios that are above industry averages, indicating potential overvaluation. The PEG ratio is relatively high, suggesting that the stock may not grow as quickly as the current price anticipates. High Price/Sales and Price/Book ratios further fortify the notion of overvaluation. The substantial reduction in Enterprise Value/Revenue and Enterprise Value/EBITDA from last year points to a recalibration of the company's valuation.

The financials reflect a stable gross profit and an increase in EBITDA, which are indicators of healthy operations. At the same time, the presence of special charges could be viewed negatively, but they do not appear to have had a significant long-term negative impact on net income considering the data from the past few years.

Therefore, taking both the technical and fundamental analyses into consideration, the next few months may depict a trend of price consolidation or mild correction. The market may begin to adjust the stock price to better reflect the fundamentals unless there are strong future earnings or growth catalysts. Should earnings fail to impress or market sentiment shift, we might expect to see the price trend lower, potentially finding support at levels of significant moving averages such as the EMA_50. On the upside, should the price maintain its current level or advance, a clear break above the upper Bollinger Band on increased volume could invalidate the bearish scenario and could suggest continuation of the upward trend.

Crown Castle Inc. (CCI) is widely recognized as a prominent real estate investment trust (REIT) with a specialization in telecommunications infrastructure, including cell towers and fiber networksa key segment that is poised to pick up momentum given the current economic landscape and investor anticipation around interest rate cuts. This report aims to explore Crown Castle's strategic position, market performance, and the potential implications of interest rate cuts on its operations and investor returns.

The speculation about potential interest rate cuts, potentially occurring as early as the first quarter of 2024 as highlighted by billionaire investor Bill Ackman, has drawn considerable attention to sectors known to be sensitive to such changesREITs being one such sector. For Crown Castle, lower interest rates can imply reduced borrowing costs and may amplify property valuations, which is particularly significant as the company frequently invests heavily in capital-intensive infrastructure. In this environment, REITs like Crown Castle tend to become more attractive due to their typically higher dividend yields, turning the spotlight more brightly on the company's financial health and prospects for sustained returns to investors.

Crown Castle's expansive infrastructure portfolio, composed of over 40,000 cell towers, 120,000 small cells, and an 85,000 route miles fiber network, establish it as a formidable player in the telecommunications space, positioned well to capitalize on an interest rate cut scenario. Any decision to strategically realign its fiber segment will have implications on its financials and may unlock additional value for shareholders, a fact not unnoticed by activist investors like Elliott Management.

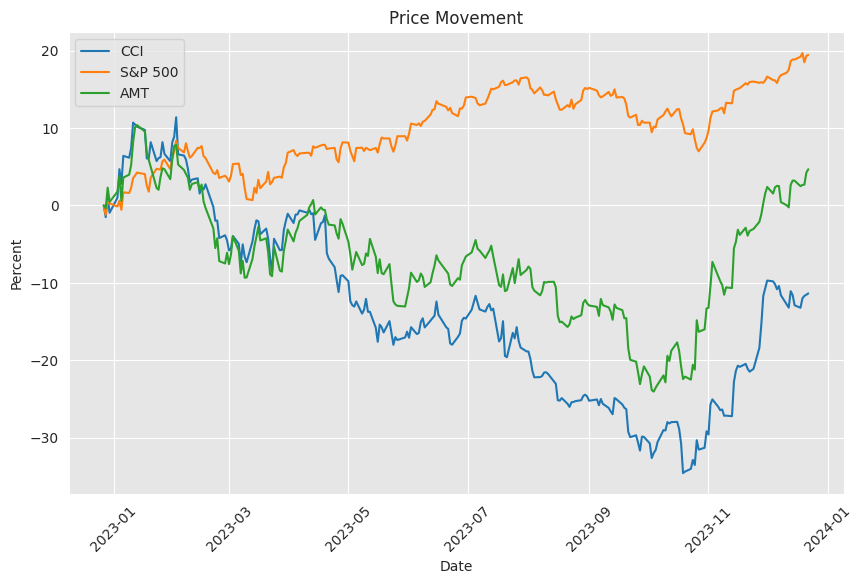

Amid the broader market optimism, Crown Castle's recent performance in the equity market has been impressive, distinguishing itself as one of S&P 500's top gainersparticularly following the Federal Reserve's hints at reaching peak interest rates. Despite a general downturn in the telecommunications sector, Crown Castle experienced a surge in its market value, an affirmation of the market's positive response to the companys robust fundamentals and potential to thrive amidst evolving macroeconomic factors.

The strategic maneuvers within Crown Castle, including the pause in its rapid dividend growth strategy in response to market challenges, lend insight into the company's thoughtful approach to maintaining financial stability while also ensuring attractive shareholder returns. Even so, the company's continued commitment to achieving its dividend growth rate aligned with the rollout of 5G infrastructure underscores their adaptability and confidence in the company's long-term growth trajectory.

Crown Castle's dividend history presents a compelling component of its investment case, with a relatively high dividend yield of 5.49% and consistent increases over the years. Nonetheless, while the payout ratio may appear high, Crown Castles rank in profitability remains strongit boasts a profitability score of 9 out of 10. Coupled with healthy growth metrics, these indicators provide a degree of confidence in the sustainability of dividends, making Crown Castle an enticing pick for income-focused investors.

The valuation of Crown Castle warrants attention as well, given the company's balance sheet strength and rent revenue growth. While REITs as a whole trade at discounts and are perceived to be below intrinsic values, Crown Castle's high valuation amidst this landscape poses questions. It's critical to recognize that operational performance and market valuation can diverge, and continuous scrutiny of these metrics will help investors align with key market sentiments and ensure that their expectations for long-term growth and value creation are met.

Another aspect that magnifies Crown Castle's appeal is its resilience within the context of a turbulent real estate sector. Despite challenges faced by commercial and office real estate, Crown Castle is leveraged with a focus on the telecommunications infrastructurea market segment that remains robust due to the constant demand for enhanced wireless services and the technological push towards 5G networks. This differentiator also attracts the eye of prominent investors, showcasing Crown Castle as a steady choice amongst the most profitable real estate stocks in the market.

The company's response to investor influence, most notably the campaign led by Elliott Investment Management, dubbed "Restoring the Castle," stresses the investor pressure to overhaul the strategic direction of the fiber network business. Elliott's active participation reflects a call for new leadershipevidenced by changes within Crown Castle's Board and the consequent focus on strategic reviewsto steer the company into a period of increased efficiency and shareholder return maximization.

As this strategic narrative unfolds, the wider market has been responsive to other fiscal developments. For instance, Brandywine Realty Trust's observed share price rally demonstrates an environment that is lending favor to REITs like Crown Castle, with the Federal Reserve's rate pause and hints at future decreases lending optimism to the entire sector. Such context supports Crown Castle's position in the market, helping to buoy its performance despite previous setbacks.

In light of the overarching trends and strategies, the anticipation of growth for REITs remains optimistic. Experts suggest that REITs may witness a turnaround from recent underperformance, particularly those that are well-positioned to take advantage of a post-pandemic landscape. Specialty sectors that Crown Castle is part of, such as cell towers and data centers, are especially promising due to their indispensable role in our current digital erasolidifying the company's positioning for potential growth.

Lastly, the adjustment within Crown Castle's board, brought about by negotiations with Elliott Management, and the strategic reviews being undertaken, add a layer of corporate governance that is likely to influence the path Crown Castle takes moving forward. The board's refreshed composition and the intensified focus on the fiber business strategy underscore the company's proactive behavior in driving forward changes that could reflect an increased alignment with shareholder interests and marketplace demands.

In summary, Crown Castle International Corp. presents an interesting investment narrative, especially as the market contemplates the implications of anticipated interest rate cuts. Its robust infrastructure portfolio, financial health, and market position afford it a valuable proposition for investors. The ongoing strategic evaluations and changes in leadership further emphasize the company's ability to adapt and align with emerging opportunities, maintaining its attractiveness as a staple in the communications infrastructure sector.

Similar Companies in REIT - Specialty:

American Tower Corporation (AMT), SBA Communications Corporation (SBAC), Uniti Group Inc. (UNIT), AT&T Inc. (T), Report: Verizon Communications Inc. (VZ), Verizon Communications Inc. (VZ)

News Links:

https://seekingalpha.com/article/4655580-wall-street-breakfast-what-moved-markets

https://www.fool.com/investing/2023/11/28/could-these-3-ultra-high-yield-stocks-help-you-ret/

https://finance.yahoo.com/news/crown-castle-incs-dividend-analysis-101150787.html

https://seekingalpha.com/article/4654356-sell-alert-2-reits-getting-risky

https://finance.yahoo.com/news/13-most-profitable-real-estate-103956623.html

https://finance.yahoo.com/news/brandywine-realty-trust-bdn-moves-152100641.html

https://finance.yahoo.com/news/crown-castle-announces-comprehensive-fiber-130000513.html

https://www.fool.com/investing/2023/11/27/these-2-stocks-are-sharing-the-holiday-spirit/

https://seekingalpha.com/article/4654992-rip-charlie-munger-the-most-important-lesson-he-taught-me

https://finance.yahoo.com/news/crown-castle-gives-elliotts-demands-145640716.html

https://www.fool.com/investing/2023/12/12/10-of-the-best-reits-for-2024/

https://finance.yahoo.com/news/crown-castle-gives-elliotts-pressure-055817233.html

https://finance.yahoo.com/news/crown-castle-cci-surpasses-market-230019876.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: bSZCnm8

https://reports.tinycomputers.io/CCI/CCI-2023-12-24.html Home