Commercial Metals Company (ticker: CMC)

2023-12-16

Commercial Metals Company (CMC) is a global manufacturer and recycler of steel and metal products, renowned for its vertically integrated operations that encompass both the manufacturing of steel and metal products and the recycling of scrap metal. With a strong presence in multiple countries, including the United States, CMC operates through various segments such as Americas Recycling, Americas Mills, Americas Fabrication, and International Mill. The company is recognized for manufacturing a wide range of products including reinforcing bar (rebar), structural shapes, flat rolled steel, and wire rod, which are utilized extensively in the construction, automotive, industrial, and consumer goods sectors. Commercial Metals Company is committed to sustainable practices, focusing on recycling to reduce waste and conserve resources. The strength of CMC's business model is showcased in its robust supply chain which has allowed the company to maintain a competitive edge by ensuring efficient production and distribution of its products. Trading on the New York Stock Exchange under the ticker CMC, the company has shown a sound financial performance characterized by consistent revenue growth and a stable financial position, which secures its reputation as a stable investment choice in the metals sector.

Commercial Metals Company (CMC) is a global manufacturer and recycler of steel and metal products, renowned for its vertically integrated operations that encompass both the manufacturing of steel and metal products and the recycling of scrap metal. With a strong presence in multiple countries, including the United States, CMC operates through various segments such as Americas Recycling, Americas Mills, Americas Fabrication, and International Mill. The company is recognized for manufacturing a wide range of products including reinforcing bar (rebar), structural shapes, flat rolled steel, and wire rod, which are utilized extensively in the construction, automotive, industrial, and consumer goods sectors. Commercial Metals Company is committed to sustainable practices, focusing on recycling to reduce waste and conserve resources. The strength of CMC's business model is showcased in its robust supply chain which has allowed the company to maintain a competitive edge by ensuring efficient production and distribution of its products. Trading on the New York Stock Exchange under the ticker CMC, the company has shown a sound financial performance characterized by consistent revenue growth and a stable financial position, which secures its reputation as a stable investment choice in the metals sector.

| As of Date: 12/16/2023Current | 8/31/2023 | 5/31/2023 | 2/28/2023 | 11/30/2022 | |

|---|---|---|---|---|---|

| Market Cap (intraday) | 5.61B | 6.56B | 5.00B | 6.07B | 5.77B |

| Enterprise Value | 6.17B | 7.24B | 5.76B | 6.82B | 6.60B |

| Trailing P/E | 6.61 | 6.96 | 4.95 | 5.05 | 4.95 |

| Forward P/E | 7.98 | 9.90 | 9.19 | 8.91 | 8.48 |

| PEG Ratio (5 yr expected) | 12.25 | - | - | - | - |

| Price/Sales (ttm) | 0.65 | 0.75 | 0.56 | 0.69 | 0.68 |

| Price/Book (mrq) | 1.36 | 1.63 | 1.32 | 1.69 | 1.76 |

| Enterprise Value/Revenue | 0.70 | 3.28 | 2.45 | 3.38 | 2.96 |

| Enterprise Value/EBITDA | 4.47 | 23.55 | 15.39 | 22.98 | 16.39 |

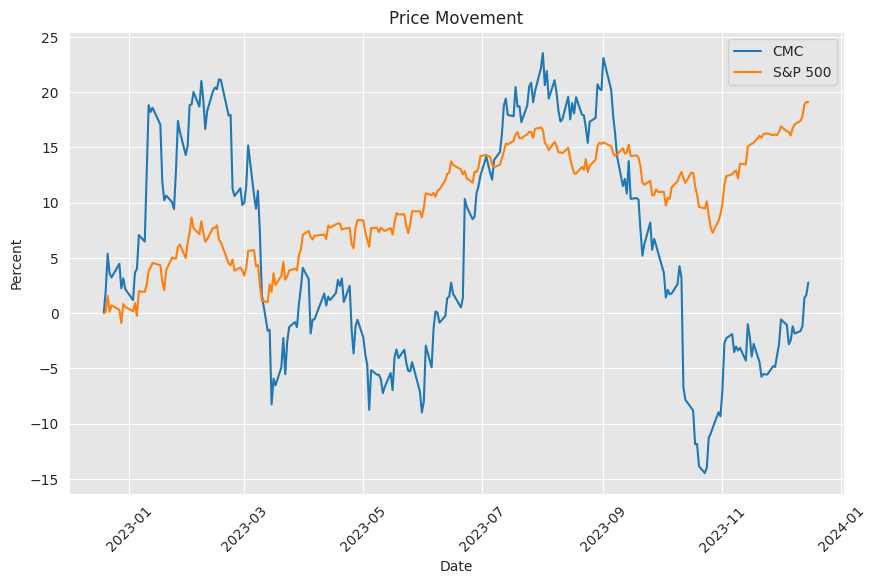

The technical analysis data for CMC highlights several indicators that point towards potential future price movement. The adjusted close price stands at $47.94, with a recent bullish crossover in the MACD (Moving Average Convergence Divergence) as indicated by a positive MACD value of 0.600023 and a MACD histogram value of 0.285679. This suggests a building momentum in the upward direction.

The technical analysis data for CMC highlights several indicators that point towards potential future price movement. The adjusted close price stands at $47.94, with a recent bullish crossover in the MACD (Moving Average Convergence Divergence) as indicated by a positive MACD value of 0.600023 and a MACD histogram value of 0.285679. This suggests a building momentum in the upward direction.

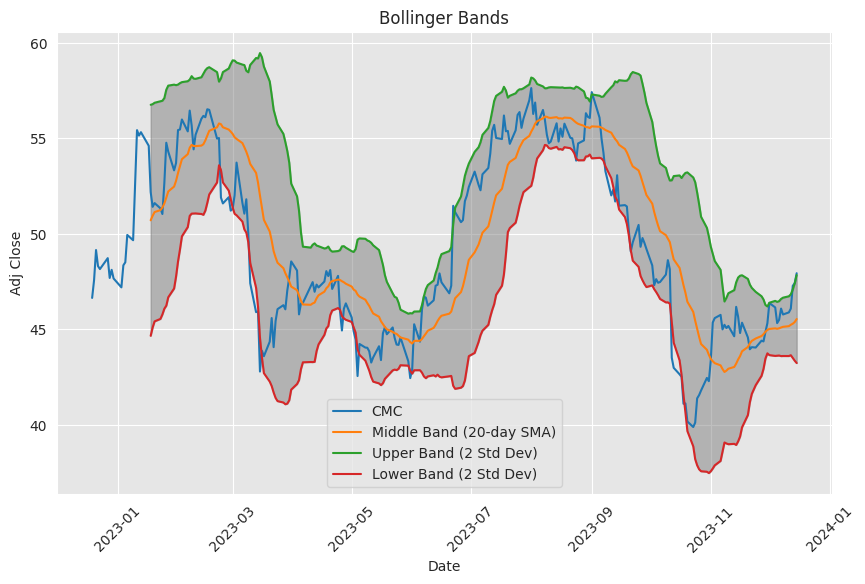

The RSI (Relative Strength Index) at 67.24 is nearing the overbought territory, which can often precede a pullback or consolidation phase if the market perceives the stock to be overvalued at these levels. However, the Bollinger Bands, with values at BBL_5_2.0 of $45.33, BBM_5_2.0 of $46.92, and BBU_5_2.0 of $48.52 indicate a relatively tight range suggesting a breakout could be imminent. The stock is currently trading close to the upper Bollinger Band, enhancing the suggestion of a continued upwards price movement in the short term.

The stock's price is also above both the short-term and intermediate-term moving averages (SMA_20 at $45.54 and EMA_50 at $46.58 respectively), which often acts as support levels and indicates a bullish trend. The OBV (On-Balance Volume) has a negative reading which may be a cause for concern, suggesting that there is not significant volume supporting the upward price movement, which could indicate weakness in the trend.

The Stochastic Oscillator values (STOCHk_14_3_3 at 80.30 and STOCHd_14_3_3 at 79.88) are high and imply the stock may be overbought, which could lead to a retracement. However, the ADX (Average Directional Index) at 17.58 is relatively low, which points to a lack of strong trend - bullish or bearish. The Williams %R (WILLR_14) is positioned at -22.31, reinforcing the overbought condition.

The CMF (Chaikin Money Flow) at -0.167203 shows that money flow could be better as its on the negative side, and the lack of a PSARs (Parabolic SAR - short) signal aligns with the absence of a bearish trend.

Assessing the company's fundamentals, the trailing P/E ratio is low at 6.61, suggesting that the stock may be undervalued by the market, especially compared to historical valuation metrics. The forward P/E has increased, potentially indicating expectations of decreasing earnings or a re-rating of the stock's value by the market. The Enterprise Value multiples also present an attractive picture, with EV/Revenue and EV/EBITDA ratios reflecting efficient pricing against revenues and earnings before interest, taxes, depreciation, and amortization.

The company has shown a robust normalized EBITDA, indicating healthy profitability and improving financial health. With a substantial increase in operating revenue and a significant gross profit, the company appears to be growing. These fundamentals, when combined with the technical indicators, suggest that the stock is in a strong position.

Given these factors, the possible price movement for the next few months can be expected to show continued bullish pressure in the short term, albeit with the real possibility of pullbacks or consolidation given the overbought conditions on some indicators. The fundamental strength provides a reasonable basis to assume that any retracement might be short-lived and provide buying opportunities. Investors could monitor support levels at the moving averages and indicators like the MACD and PSAR for alignment before taking positions. It should be noted that market dynamics are subject to change due to various external factors, and ongoing evaluation of these indicators and fundamentals must be maintained to adjust perspective and strategy accordingly.

Commercial Metals Company (CMC), a key player in the manufacture and recycling of steel and metal products, operates within an intricate and competitive steel industry landscape characterized by market consolidation and strategic acquisitions that play pivotal roles in shaping market leadership and financial outcomes.

In the context of such an industry dynamic, Cleveland-Cliffs Inc. (CLF), initially a mining company, has emerged as a formidable competitor following its purchases of AK Steel and ArcelorMittal USA in 2020. These moves not only positioned CLF as North America's largest producer of flat-rolled steel but also as the primary steel provider to the automotive sector. CLF's emphasis on vertical integration has been an attempt to manage raw material costs and bolster profit margins. Nevertheless, despite its strategic positioning, CLF's profitability has not matched expectations, fueling skepticism about whether the synergies from these acquisitions are truly being harnessed.

Amid these industry shifts, CLF has been eyeing U.S. Steel (X) for acquisition, a deal if realized, would substantially uplift their market stance. However, restraining factors such as CLF's limited cash reserves and reliance on the financial resources of U.S. Steel itself cast doubt on the proposed merger's financial viability. Moreover, the need for successful incorporation of its earlier purchases further complicates the decision to pursue another large-scale acquisition.

The proposed takeover surfaced regulatory concerns and questioned CLF's capacity to manage the costs without endangering its financial stability. Although U.S. Steel rebuffed CLF's initial tender, referring to the offer's unsuitable conditions and indicating a lack of due diligence, it does reflect on CLF's assertive acquisition aspirations within the industry.

Operationally, despite across-the-board price increases for steel, CLF reported a slump in net income and adjusted EBITDA for 2022, attributed to escalated expenditure for raw materials, utilities, upkeep, workforce, and the interest on their revolving credit facility. These challenges suggest that the anticipated benefits of vertical integration have not yet proven protective against the volatility of commodity prices. Notably, labor costs, with set wage hikes for upcoming years, continue to pose significant challenges, likely to exert further pressure on profit margins.

Commercial Metals Company, on the other hand, unveiled its fourth-quarter fiscal 2023 earnings, underlining key financial achievements and providing insight into current industry conditions and its strategic undertakings. CMC reported net earnings of $184.2 million or $1.56 per diluted share, on net sales of $2.2 billion. Despite a decrease when compared to prior-year metrics, the core EBITDA of $340 million signifies enduring financial strength.

In North America, CMC's operations showed commendable persistence with 11 successive quarters of year-on-year adjusted EBITDA growth, signaling consistent demand for rebar along with an increase in finished steel volumes. Although import pressures persist, promising signals from new downstream bid volumes point to a substantial cache of forthcoming construction projects.

Looking forward, the Infrastructure Investment and Jobs Act (IIJA) pledges to drive rebar consumption up by 1.5 million tons per year, despite the slow commencement of related spending. Even with a slight decline in project awards likely stemming from the tight labor pool and constricting credit conditions, CMC maintains an uncharacteristically large downstream backlog.

However, CMC's European operations grappled with adversity, resulting in an adjusted EBITDA loss for Q4 2023, amid flagging demand and squeezed pricing. To mitigate the impact, the company executed cost adjustments and cut production to correspond with market demand.

Strategic growth projects like the Arizona 2 micro-mill, now operational, are integral to CMC's continued expansion. The facility emphasizes an annual output target of 500,000 tons, with projections of nearly 400,000 tons for fiscal 2024. Additionally, the Tensar division posted its most profitable quarter to date, thanks to strong customer acceptance and product innovation.

CMC's projections for Q1 of fiscal 2024 suggest a solid financial showing, albeit slightly subdued due to the anticipated seasonal reduction in shipments, contracted margins in North America, and the protracted issues in Europe. Nonetheless, the European segment is expected to receive a $60 million windfall from government rebates.

CMC's quarter has not been without its trials, as evidenced by the quarterly earnings announcement. In spite of robust demand for its North American steel products, a dip in new contracts impacted the company's volumes and backlog, leading to a downturn in stock value. The Q4 adjusted earnings of $1.69 per share fell short of the forecasted $1.81 per share, although revenues outperformed expectations. The annual earnings portrayed a slight diminution versus the preceding year, and the narrower EBITDA mirrors the subtle downturn from the record performance of the previous fiscal year.

Amid variable global steel market conditions, intensified by economic uncertainty, CMC's CEO Peter Matt underscored the dichotomy of regional market temperatures, particularly the vibrant demand in North America opposed to the tepid European appetite. This discrepancy underscores the unpredictable and tumultuous state of the global steel domain.

The company retains resilience in the face of economic fluctuations, boasting a cash balance of $592.3 million and $1.6 billion in available liquidity, fortifying its capital position to combat economic challenges. The share repurchase further attests to CMC's proactive capital management. However, as growth catalysts appear limited, investor sentiment appears to be recalibrating in alignment with current company performance and overarching market context. Commercial Metals Company's Q3 2023 earnings call revealed one of its strongest quarterly financial displays, wherein the company publicized net earnings of $234 million. This success can be pinned to the company's sound resilience amidst inflation, supply disarray, and shifting demand. The attention to strategic growth is evident in the operational commencement of its Arizona 2 micro mill and the planned establishment of the Steel West Virginia projectboth reflective of the company's expansion intentions and infrastructure development.

The strong product demand, sustained by a considerable downstream backlog and an array of infrastructure and reshoring initiatives, creates a promising avenue for market-driven growth. Especially notable are the Buy America provisions that are expected to benefit domestic companies like CMC.

CMC's management has shown agility in dealing with divergent market conditions, carving out a leading cost position even as it confronts the European market's difficulties. Even so, CMC anticipates continued robust performance for Q4, relying on stable demand and profitability prospects. With strong capital management, low debt levels, and considerable liquidity on hand, Commercial Metals Company marches forward, intent on harnessing market opportunities and sustaining its growth trajectory amid a shifting steel industry landscape.

Similar Companies in Steel:

Nucor Corporation (NUE), Steel Dynamics, Inc. (STLD), Reliance Steel & Aluminum Co. (RS), Carpenter Technology Corporation (CRS), Report: United States Steel Corporation (X), United States Steel Corporation (X)

News Links:

https://seekingalpha.com/article/4636682-cleveland-cliffs-us-steel-step-too-far

https://www.fool.com/investing/2023/10/12/why-commercial-metals-stock-is-down-big-today/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: mExV3u