Columbus McKinnon Corporation (ticker: CMCO)

2024-01-20

Columbus McKinnon Corporation (NASDAQ: CMCO) is a leading designer, manufacturer, and marketer of material handling products, systems, and services designed for commercial and industrial applications. The company's comprehensive portfolio includes hoists, rigging tools, cranes, actuators, and other related products that are essential for lifting, positioning, and securing valuable loads. Columbus McKinnon's offerings are pivotal in a diverse array of industries including manufacturing, energy, transportation, and construction. Established in 1875 and headquartered in Getzville, New York, the company has built a reputation for quality and reliability. Columbus McKinnon serves a global customer base, with operations spanning North America, Europe, and Asia. The company is committed to innovation, evidenced by its ongoing investments in research and development, aiming to provide smarter, safer, and more efficient material handling solutions to its customers. CMCO's strategic approach combines organic growth with strategic acquisitions, emphasizing an increase in their presence in emerging markets while harnessing growth opportunities in established ones.

Columbus McKinnon Corporation (NASDAQ: CMCO) is a leading designer, manufacturer, and marketer of material handling products, systems, and services designed for commercial and industrial applications. The company's comprehensive portfolio includes hoists, rigging tools, cranes, actuators, and other related products that are essential for lifting, positioning, and securing valuable loads. Columbus McKinnon's offerings are pivotal in a diverse array of industries including manufacturing, energy, transportation, and construction. Established in 1875 and headquartered in Getzville, New York, the company has built a reputation for quality and reliability. Columbus McKinnon serves a global customer base, with operations spanning North America, Europe, and Asia. The company is committed to innovation, evidenced by its ongoing investments in research and development, aiming to provide smarter, safer, and more efficient material handling solutions to its customers. CMCO's strategic approach combines organic growth with strategic acquisitions, emphasizing an increase in their presence in emerging markets while harnessing growth opportunities in established ones.

| Address | 205 Crosspoint Parkway | City | Buffalo | State | NY |

| ZIP | 14068 | Country | United States | Phone | 716 689 5400 |

| Website | https://www.columbusmckinnon.com | Industry | Farm & Heavy Construction Machinery | Sector | Industrials |

| Full Time Employees | 3,392 | Previous Close | 36.09 | Open | 36.37 |

| Day Low | 35.85 | Day High | 36.57 | Dividend Rate | 0.28 |

| Dividend Yield | 0.77% | Payout Ratio | 15.82% | Five Year Avg Dividend Yield | 0.67 |

| Beta | 1.319 | Trailing PE | 20.66 | Forward PE | 10.82 |

| Volume | 83,977 | Average Volume | 121,200 | Average Volume 10 days | 128,080 |

| Market Cap | 1,050,952,320 | Fifty Two Week Low | 30.29 | Fifty Two Week High | 42.87 |

| Price to Sales Trailing 12 Months | 1.074 | Fifty Day Average | 36.5674 | Two Hundred Day Average | 36.74045 |

| Trailing Annual Dividend Rate | 0.28 | Trailing Annual Dividend Yield | 0.7758% | Enterprise Value | 1,562,126,208 |

| Profit Margins | 5.215% | Float Shares | 28,055,618 | Shares Outstanding | 28,738,100 |

| Shares Short | 240,268 | Held Percent Insiders | 2.313% | Held Percent Institutions | 98.964995% |

| Short Ratio | 1.81 | Book Value | 29.75 | Price to Book | 1.229 |

| Net Income to Common | 51,012,000 | Trailing Eps | 1.77 | Forward Eps | 3.38 |

| Peg Ratio | 0.54 | Enterprise To Revenue | 1.597 | Enterprise To Ebitda | 10.893 |

| Total Cash | 108,519,000 | Total Cash Per Share | 3.78 | Total Debt | 620,830,976 |

| Quick Ratio | 1.053 | Current Ratio | 1.939 | Total Revenue | 978,105,024 |

| Debt To Equity | 72.697 | Revenue Per Share | 34.132 | Return On Assets | 3.689% |

| Return On Equity | 6.227% | Free Cash Flow | 74,113,504 | Operating Cash Flow | 76,929,000 |

| Earnings Growth | 12.2% | Revenue Growth | 11.5% | Gross Margins | 36.815% |

| Ebitda Margins | 14.661999% | Operating Margins | 12.652001% | Currency | USD |

| Sharpe Ratio | -13.832333708028786 | Sortino Ratio | -240.88604289664815 |

| Treynor Ratio | 0.06160944753853395 | Calmar Ratio | 0.1870581497296446 |

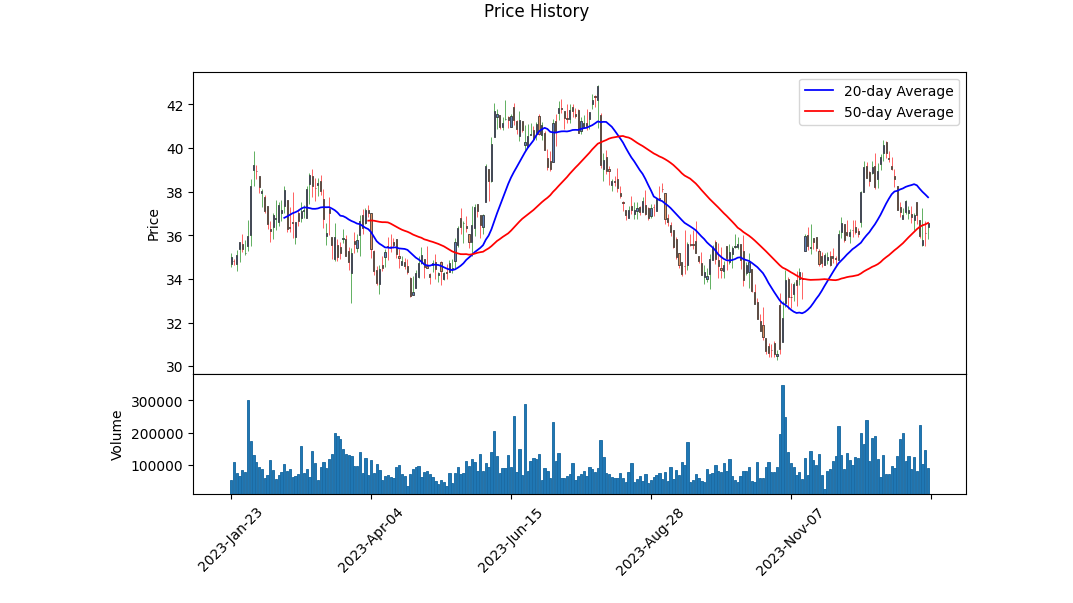

The technical analysis (TA) and fundamental analysis provide a multifaceted view of CMCO's potential future stock price movements. A review of the technical indicators shows the stock has seen some volatility, with the On-Balance Volume (OBV) fluctuating, although there seems to be a slight positive trend in the most recent observations. However, it should be noted that the MACD histogram is negative, which typically indicates bearish momentum.

The fundamentally bearish sentiment is echoed by the TA. The companys gross, EBITDA, and operating margins remain relatively stable, which indicates a steady operational efficiency that could pivot the stocks negative sentiment in the right market conditions. However, the high negative Sharpe and extremely negative Sortino ratios reflect a poor risk-adjusted performance over the past year, compared to the markets risk-free rate.

Looking at the balance sheet data, CMCO has a notable net debt position. This financial leverage is a double-edged sword; it can enhance returns when times are good but burdens the company during downturns. Although the company's tangible book value is negative, suggesting liabilities outweigh tangible assets, the net debt number shows an improvement in recent years, which can be an encouraging sign for investors looking for debt reduction.

The cash flow metrics present a mixed view. Free cash flow is positive, which is an encouraging sign for financial health, indicating that the company has cash after funding operations and capital expenditures. However, net income has decreased slightly compared to three years prior, which may concern long-term investors focused on profitability.

The analyst expectations reveal a consensus of moderate growth in earnings and revenue estimates, suggesting the market has future optimism regarding the company's performance. Nevertheless, the growth estimates indicate a short-term contraction before proceeding to a more positive outlook in the following year.

On the risk assessment front, the CMCO Altman Z-Score is below the typical threshold of 3, implying an elevated risk of financial distress, which could warrant investor caution. However, the Piotroski Score of 6 out of 9 is moderately positive, suggesting the financial position is stable.

In summary, CMCO presents a stock amid a transitional state with technical indicators showing short-term bearish momentum but with some underlying fundamental strength. The combination of improving debt levels, stable fundamentals, and positive free cash flow alongside modest growth projections for the future are potential catalysts that could reverse current sentiment, assuming the company responds effectively to market conditions. Nevertheless, significant caution is warranted due to the high risk-adjusted performance metrics and the cautious outlook from analysts. Investors would be wise to watch for improvements in the company's earnings reports, changes in the technical trend, and a strengthening of financial stability indicators before making long-term commitments to the stock.

| R-squared | 0.423 |

| Adj. R-squared | 0.422 |

| F-statistic | 918.9 |

| Prob (F-statistic) | 6.60e-152 |

| Log-Likelihood | -2,661.4 |

| No. Observations | 1,257 |

| AIC | 5,327 |

| BIC | 5,337 |

| coef (const) | -0.0380 |

| coef (CMCO) | 1.3065 |

| std err | 0.057 |

| t | 30.313 |

| P>|t| | 0.000 |

| [0.025 | 1.222 |

| 0.975] | 1.391 |

| Alpha | -0.0380 |

| Beta | 1.3065 |

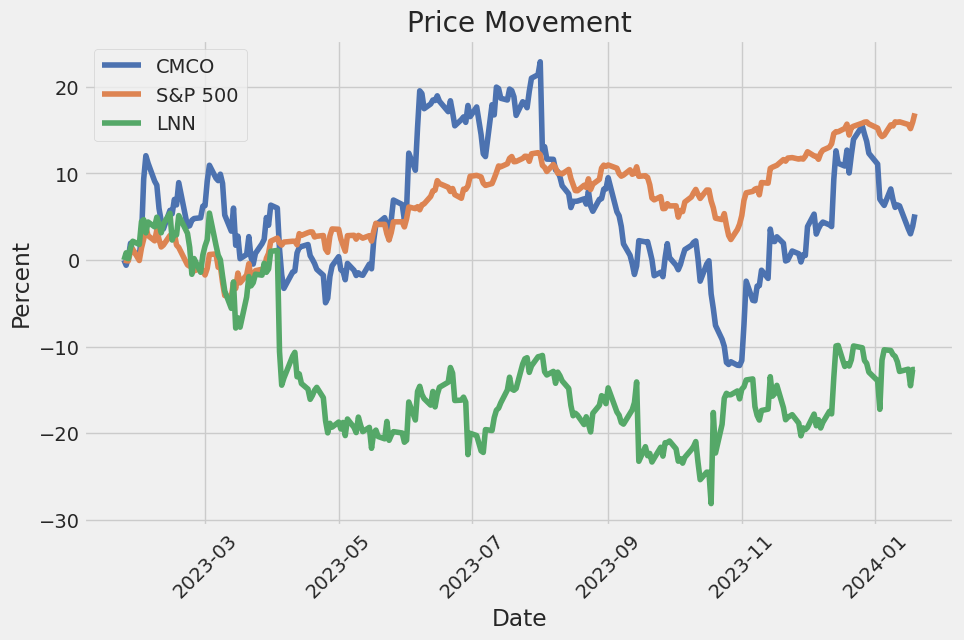

The linear regression analysis between CMCO and SPY demonstrates a significant relationship with an R-squared of 0.423, indicating that approximately 42.3% of the variability in CMCO can be explained by the market movements represented by SPY. The alpha, or intercept, is -0.0380, suggesting that when SPY is at zero, the expected value of CMCO is slightly negative. Nevertheless, given the p-value associated with alpha is 0.504, it is not statistically significant at conventional levels, which implies that the alpha estimate might not be different from zero in the population from which this sample was drawn.

Beta, the slope coefficient for CMCO, is positive at 1.3065, indicating that on average, a one-unit change in SPY is associated with a 1.3065 unit change in the same direction for CMCO. This beta coefficient is highly significant, with a t-statistic of 30.313 and a p-value effectively at zero. This positive beta suggests that CMCO has a tendency to move in the same direction as the overall market but with greater volatility. However, alpha, as the performance metric that captures the average return of CMCO when the market's return is zero, shows that CMCO does not have a statistically significant abnormal return independent of the market.

Columbus McKinnon Corporation (CMCO) reported strong financial results for the second quarter of fiscal year 2024, indicative of the company's ongoing transformation into a higher growth, less cyclical enterprise with more robust earnings power. During the earnings call, President and CEO David Wilson, along with CFO Gregory Rustowicz, highlighted record-setting performance in terms of sales, gross margin, operating income, and adjusted EBITDA. Sales for Q2 reached $258 million, which included contributions from the recent montratec acquisition, and gross margin achieved a historic high of 38.7%. CMCO has increased its focus on reducing interest rate exposure and accelerating debt repayment, with plans to reduce total debt by $50 million within the year.

With a company strategy focused on customer-led initiatives, the Columbus McKinnon Business System (CMBS) has proven effective in driving continuous improvement and discipline across operations. Emphasizing product line simplification, the company is optimizing financial performance, enhancing product offerings, and streamlining its factory footprint. These measures have led to improvements in capacity planning, material costs, and direct labor productivity, contributing to impressive gross margin results. The acquisition of montratec has leveraged strategic gains for gross margin performance, signaling positive momentum in the organization and the potential to expand gross margin by approximately 150 basis points year-over-year.

Regarding sales by region, the U.S. saw a 3.9% increase, while sales outside the U.S. increased by 23%, particularly buoyed by the montratec acquisition and solid performance across various verticals. Regarding gross profit and expenses, Rustowicz pointed out record gross margins, a result of pricing adjustments and montratec's high gross margin contribution. SG&A expenses constituted 22.9% of sales, moderated by acquisitions and strategic costs. Record operating income of $33.4 million further underscores the successful implementation of the company's strategic initiatives.

In closing, Wilson outlined a robust order pipeline and a healthy backlog, with a notable increase in order activity at the start of the third quarter, displaying confidence in sustained revenue expectations. The company anticipates Q3 sales to range between $245 million and $255 million and projects a net debt leverage ratio of approximately 2.3x by fiscal year-end, highlighting involvement in secular growth markets. Wilson and Rustowicz reiterated their commitment to executing their strategic plan and expressed enthusiasm for the company's advancement and potential.

Columbus McKinnon Corporation (CMCO), a leading global designer, manufacturer, and marketer of intelligent motion solutions, reported their financial performance for the second quarter ending on September 30, 2023, with a filed 10-Q report dated October 30, 2023. The company observed a significant increase in net sales reaching $258.4 million, an 11.5% rise from the previous year's corresponding quarter, driven by price increases, volume growth, and the recent acquisition of montratec GmbH, a provider of automation and transport systems.

Gross profit for the quarter was $99.9 million, up by 15.8% year-on-year, buoyed by pricing actions outpacing manufacturing cost changes, the positive impact of the montratec acquisition, and favorable sales volume mix. The gross margin expanded to 38.7% compared to the prior years 37.2%, thanks in part to a beneficial impact from foreign currency translation.

Operating expenses have seen varied dynamics. Selling expenses increased to $26.9 million primarily due to added costs from the new acquisition and realignment within the business, despite a slight decrease as a percentage of net sales. General and administrative expenses escalated to $25.7 million due to higher employee-related costs, the montratec acquisition, and acquisition-related and headquarter relocation costs. Simultaneously, research and development expenses rose to $6.5 million due to increased investment in new product development. Amortization of intangibles saw a lift due to the establishment of new intangible assets stemming from the montratec deal.

From a financing perspective, interest and debt expenses climbed to $10.2 million, brought about by a mix of higher variable interest rates and augmented borrowings to fund the montratec acquisition. Nonetheless, investment losses narrowed due to fluctuations in marketable securities' valuation.

Income before income tax expense was $20.9 million, a subtle increase from the previous year's $19.1 million. The tax expense for the quarter registered at $5.1 million, reflecting an effective tax rate of approximately 24%, mainly impacted by geographic distribution of income and changing statutory tax rates among international subsidiaries.

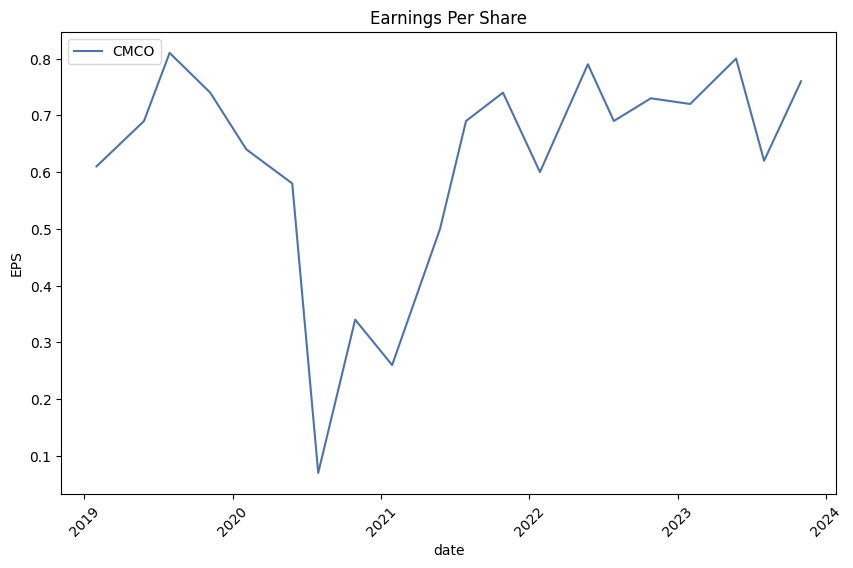

Net income for the quarter stood at $15.8 million, with basic and diluted earnings per share at $0.55. This is compared to the previous year's net income of $14.1 million. Furthermore, the company declared dividends of $0.07 per common share during the quarter.

Accumulated other comprehensive loss (AOCL) experienced a net increase, driven by foreign currency translation adjustments and changes in derivatives qualifying as hedges.

The company also emphasized their strategic focus on operational excellence, market-led growth, customer-centric innovation, and investment in technological advances that complement its portfolio of industrial motion and control solutions. The CMCO team continues to prioritize initiatives to enhance operating margins and ROIC, essential factors in long-term shareholder value creation.

Liquidity remains robust, supported by healthy free cash flows and a flexible debt structure, ensuring the company's ability to execute on strategic opportunities and navigate market conditions. Columbus McKinnon's strategy underscores a transformation towards a leading provider of high-tech automation solutions, possibly heralding continuous growth and market expansion in the coming periods.

Columbus McKinnon Corporation (CMCO), a notable name within the Industrial Products sector, has positioned itself as a strong player by outperforming in the stock market. As per Zacks Equity Research's December 19, 2023 report, it has achieved a year-to-date return of 18.6%, surpassing the sector's average return of 14.2%. Such performance, coupled with an upward revision of CMCO's earnings per share (EPS) estimate by 4.3% over the past three months, reflects a robust and optimistic earnings outlook.

The company, part of the niche 2-stock Manufacturing - Material Handling industry, belongs to a sector experiencing a 55.1% upswing this year. This growth trajectory reflects the material handling market segment's expansion and can have positive implications for companies like CMCO. With the Industry Rank being #14, as determined by Zacks Industry Rank, where a lower number represents potential market outperformance, there is a signal towards a fruitful horizon in this segment.

Amidst this sector-wide surge, CMCO has managed to stand out as an undervalued stock based on several valuation metrics. Trading with a P/E ratio of 11.06, below the industry average of 12.68, and a P/B ratio of 1.20 in contrast to the industry's 1.55, hints at an investment opportunity for value-oriented individuals. The 'A' grade for Value from the Style Scores system, alongside a Zacks Rank of #2 (Buy), embellishes this potential.

Kristine Moser's recent appointment as Vice President, Investor Relations and Treasurer, extends the companys commitment to strategic development. Moser brings over 15 years of experience from a range of reputable companies and will be a valuable asset in communicating Columbus McKinnon's business model and financial performance, ultimately fostering shareholder value. Gregory P. Rustowicz, the company's CFO, has expressed enthusiasm for the value Moser is expected to add to CMCO's investor relations and strategic initiatives.

Columbus McKinnon's corporate strategies aim to establish the company as a top-tier provider in intelligent motion solutions. Their offering includes a gamut of products like hoists, crane components, and digital motion control systems, purposed for safe and efficient material handling across industries. The company highlights forward looking intentions with due acknowledgment of the variable conditions that might impact business outcomes, reminding stakeholders of the potential risks and uncertainties that come with corporate forecasting.

The optimistic projection is further supported by the company's solid growth in earnings per share (EPS), having maintained a growth rate of 34% annually over three years. While the EBIT margins have remained steady over the last year, the 6.1% revenue increase to $978 million indicates an effective scaling of operations. The considerable shareholding by insiders, amounting to $18 million worth, suggests a strong conviction in the potential and trajectory of Columbus McKinnon's business.

Columbus McKinnon's financial results for the third quarter of fiscal year 2024 are much anticipated, with an earnings conference call scheduled for January 31, 2024. This event will provide a platform to review financial results and discuss strategies ahead. It will be readily accessible through a live webcast on the Investor Relations webpage or via a telephonic connection for interested stakeholders.

As for the stock's trading scenario, CMCO resides within a small cap category, which tends to experience less analyst coverage. This often creates opportunities for mispricing, considering fewer analysts influencing the price toward its fair value. The PE ratio of 21.67x reflects an industry-aligned valuation, suggesting the current share price is reasonable in the market context. Yet, potential investors are advised to scout for entry points below industry PE ratios or during price dips driven by market conditions.

While the future looks promising, with CMCO expecting a 30% surge in upcoming yearly earnings, prospective investors should proceed with caution. It is recommended that one should consider both quantitative and qualitative evaluations of the company carefully, including balance sheet health and future market conditions. This comprehensive approach will serve to mitigate any possible risks reflected in at least one warning sign noted in the stock analysis.

By piecing together valuation insights, strategic appointments, and the future financial outlook, Columbus McKinnon emerges as a potentially beneficial investment, highlighting key factors that might sway investor interest towards its stock. The informed reader can delve into the company further through the links provided in Zacks Equity Research and Simply Wall St articles.

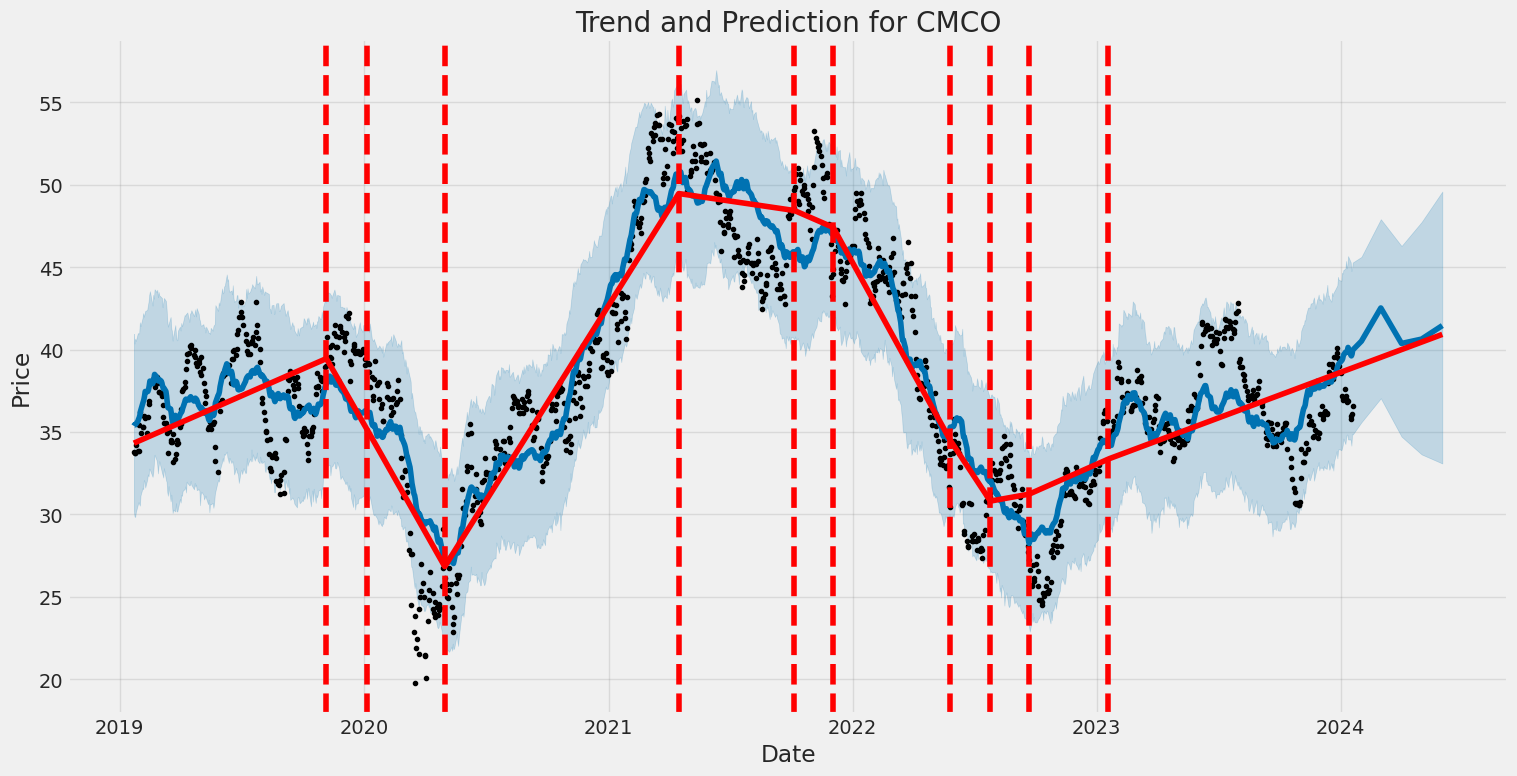

Columbus McKinnon Corporation (CMCO) experienced notable volatility from 2019 to 2024, as evidenced by an ARCH model analysis of its asset returns. The model indicates a high level of short-term volatility persistence, considering the significant alpha coefficient (0.4358), which suggests that past volatility has a strong influence on future volatility. Additionally, the baseline volatility (omega) was sizable at 4.3266, reinforcing the idea that the asset returns were quite unpredictable during this period.

Here is the HTML table with the table of statistics:

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -2,919.38 |

| AIC | 5,842.75 |

| BIC | 5,853.02 |

| No. Observations | 1,257 |

| Df Residuals | 1,257 |

| omega | 4.3266 |

| alpha[1] | 0.4358 |

To assess the financial risk of a $10,000 investment in Columbus McKinnon Corporation (CMCO) over a one-year horizon, a meticulous analysis is conducted utilizing volatility modeling and machine learning predictions. The volatility modeling technique is employed to measure and forecast the level of fluctuation in CMCO's stock price over time. This approach is particularly adept at capturing the clustering of volatility, a common phenomenon in financial markets where periods of high volatility are followed by high volatility and periods of low volatility are followed by low volatility.

The volatility modeling used in this analysis is adept at accounting for these inherent patterns by fitting a model that describes the conditional variance of the stock returns, based on both long term variance and recent shocks to return variance. This is crucial for understanding the behavior of Columbus McKinnon Corporation's stock volatility because it allows investors to obtain a dynamic view of risk that evolves with the latest market information.

In tandem with volatility modeling, machine learning predictions contribute to the analysis by incorporating a multitude of variables, without necessitating a prior specification of a functional form that links inputs to output. The machine learning algorithm chosen for this exercise synthesizes historical data on stock prices, trading volumes, and other relevant financial metrics to forecast future stock returns. By learning from intricate patterns within the data, the model can predict future returns with a degree of accuracy that can be highly valuable to investors.

When combining these two advanced techniques, a more robust prediction of future stock behaviour is obtained. The volatility model captures the dynamic risk profile associated with the equity, while the machine learning approach leverages large datasets to anticipate directional movements in stock returns.

Focusing on the probabilistic outcome derived from these models, the calculated Value at Risk (VaR) provides an estimate of the potential loss. For a $10,000 investment in CMCO, the annual VaR at a 95% confidence interval is $302.48. This signifies that there is a 5% chance that the investment could lose more than $302.48 over the one-year period.

Value at Risk (VaR) serves as a statistical measure that offers a specific threshold with a given level of confidence. In practical terms, the 95% confidence level implies that, over the course of many investment periods, one would expect to incur a loss exceeding the VaR amount only 5% of the time. It is a widely used risk metric that encapsulates the potential downside risks, summarizing the expected maximum loss over a specific timeframe given normal market conditions.

The integration of volatility modeling with machine learning predictions paints a comprehensive picture of the investment risk. By capturing both the dynamic risk embedded in the stocks price movements and forecasting future price movements, investors are provided an in-depth understanding of the potential risks and rewards associated with an equity investment in Columbus McKinnon Corporation.

Similar Companies in Farm & Heavy Construction Machinery:

Lindsay Corporation (LNN), Astec Industries, Inc. (ASTE), The Shyft Group, Inc. (SHYF), AGCO Corporation (AGCO), Alamo Group Inc. (ALG), Hyster-Yale Materials Handling, Inc. (HY), Titan International, Inc. (TWI), REV Group, Inc. (REVG), Gencor Industries, Inc. (GENC), The Manitowoc Company, Inc. (MTW), Wabash National Corporation (WNC), Terex Corporation (TEX), Konecranes Plc (KCR), Ingersoll Rand Inc. (IR), Report: Oshkosh Corporation (OSK), Oshkosh Corporation (OSK)

https://www.zacks.com/stock/news/2194767/are-investors-undervaluing-columbus-mckinnon-cmco-right-now

https://finance.yahoo.com/news/investors-undervaluing-columbus-mckinnon-cmco-144011383.html

https://finance.yahoo.com/news/industrial-products-stocks-lagging-assa-145008503.html

https://finance.yahoo.com/news/too-consider-buying-columbus-mckinnon-154410578.html

https://finance.yahoo.com/news/columbus-mckinnon-announces-kristine-moser-211500868.html

https://finance.yahoo.com/news/heres-why-think-columbus-mckinnon-103426430.html

https://finance.yahoo.com/news/columbus-mckinnon-host-third-quarter-133000307.html

https://www.sec.gov/Archives/edgar/data/1005229/000100522923000274/cmco-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 6QgJxz

Cost: $0.56342

https://reports.tinycomputers.io/CMCO/CMCO-2024-01-20.html Home