Oshkosh Corporation (ticker: OSK)

2024-01-19

Oshkosh Corporation (NYSE: OSK) is a diversified industrial manufacturer known for its specialty vehicles and vehicle bodies. With a history dating back to 1917, the Wisconsin-based company has grown to become a key player in designing and producing a wide array of high-quality trucks, military vehicles, and access equipment. Oshkosh's products include tactical vehicles for the defense sector, fire and emergency vehicles, concrete mixers, and aerial work platforms. One of Oshkosh Corporation's most recognized contributions has been the development of the Joint Light Tactical Vehicle (JLTV), which is considered the successor to the US military's Humvee. The company operates through multiple business segments that cater to different markets, ensuring a diversified revenue stream. Oshkosh's commitment to innovation, quality, and customer focus has enabled it to establish a strong brand reputation and win significant contracts, both domestically and internationally, contributing to its robust financial performance in the competitive industrial and defense sectors.

Oshkosh Corporation (NYSE: OSK) is a diversified industrial manufacturer known for its specialty vehicles and vehicle bodies. With a history dating back to 1917, the Wisconsin-based company has grown to become a key player in designing and producing a wide array of high-quality trucks, military vehicles, and access equipment. Oshkosh's products include tactical vehicles for the defense sector, fire and emergency vehicles, concrete mixers, and aerial work platforms. One of Oshkosh Corporation's most recognized contributions has been the development of the Joint Light Tactical Vehicle (JLTV), which is considered the successor to the US military's Humvee. The company operates through multiple business segments that cater to different markets, ensuring a diversified revenue stream. Oshkosh's commitment to innovation, quality, and customer focus has enabled it to establish a strong brand reputation and win significant contracts, both domestically and internationally, contributing to its robust financial performance in the competitive industrial and defense sectors.

| Address | 1917 Four Wheel Drive | City | Oshkosh | State | WI |

|---|---|---|---|---|---|

| Zip | 54902 | Country | United States | Phone | 920 502 3400 |

| Website | https://www.oshkoshcorp.com | Industry | Farm & Heavy Construction Machinery | Sector | Industrials |

| Full Time Employees | 15,000 | Previous Close | 104.78 | Open | 104.81 |

| Day Low | 103.615 | Day High | 106.72 | Dividend Rate | 1.64 |

| Dividend Yield | 1.57% | Payout Ratio | 19.61% | Five Year Avg Dividend Yield | 1.48 |

| Beta | 1.342 | Trailing PE | 13.07 | Forward PE | 10.35 |

| Volume | 408,394 | Average Volume | 484,936 | Market Cap | 6,978,312,192 |

| 52 Week Low | 72.09 | 52 Week High | 109.9 | Price To Sales Trailing 12 Months | 0.7428 |

| Fifty Day Average | 101.319 | Two Hundred Day Average | 91.73465 | Trailing Annual Dividend Rate | 1.6 |

| Trailing Annual Dividend Yield | 1.53% | Currency | USD | Enterprise Value | 7,850,426,880 |

| Profit Margins | 5.56% | Book Value | 54.194 | Price To Book | 1.9685 |

| Net Income To Common | 522,300,000 | Trailing Eps | 8.16 | Forward Eps | 10.31 |

| Peg Ratio | 0.2 | Total Cash | 106,100,000 | Total Cash Per Share | 1.622 |

| Ebitda | 952,000,000 | Total Debt | 1,102,499,968 | Quick Ratio | 0.773 |

| Current Ratio | 1.453 | Total Revenue | 9,394,700,288 | Debt To Equity | 31.115 |

| Revenue Per Share | 143.696 | Return On Assets | 6.479% | Return On Equity | 16.234% |

| Free Cash Flow | -128,612,496 | Operating Cash Flow | 583,000,000 | Earnings Growth | 173.5% |

| Revenue Growth | 21.4% | Gross Margins | 16.407% | Ebitda Margins | 10.133% |

| Operating Margins | 10.71% | Current Price | 106.68 | Target High Price | 137.00 |

| Target Low Price | 89.00 | Target Mean Price | 111.83 | Target Median Price | 114.00 |

| Recommendation Mean | 2.4 | Number Of Analyst Opinions | 15 | Earnings Quarterly Growth | 174.6% |

OSK (Oshkosh Corporation) Technical and Fundamental Analysis:

OSK (Oshkosh Corporation) Technical and Fundamental Analysis:

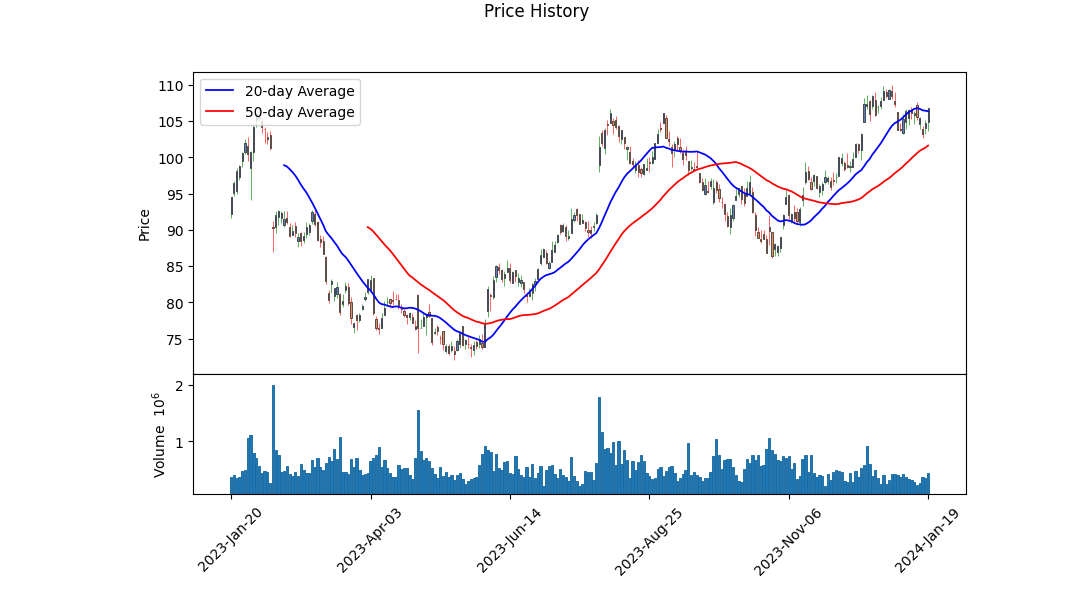

Technical Analysis: - On the last trading day, OSK opened at 104.81 and reached a high of 106.72. - The On-Balance Volume (OBV) indicator is slightly negative at -0.01638 million but has improved from the previous reading of -0.05727 million. - The Moving Average Convergence Divergence (MACD) histogram is at -0.485853, signifying potentially decreasing bearish momentum as it's less negative than the prior value of -0.653660.

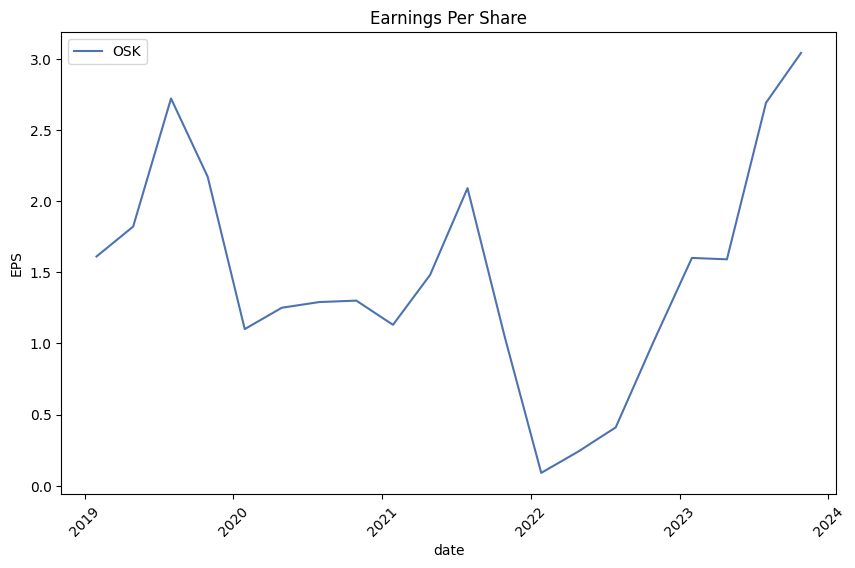

Fundamental Analysis: - The company is located in Oshkosh, WI, U.S, with a financial currency in USD. - Revenue for the latest fiscal year stands at approximately 8.28 billion USD with a gross profit of around 1.05 billion USD. - Operating income is observed at 380 million USD, while net income stands at 173.9 million USD. - The trailing price-to-earnings growth (PEG) ratio is 0.3829, indicating that the stock could be undervalued based on earnings growth expectations. - Margins are relatively stable with gross margins at 16.4%, EBITDA margins at 10.133%, and operating margins at 10.71%.

Balance Sheet Observables: - The total debt of OSK is 604.7 million USD, with no immediate indication of the net debt position due to missing data. - Cash and equivalents are strong at 805.9 million USD. - Accounts receivable stand at 1.162 billion USD, showing potential for significant incoming cash flows.

Cash Flow Statements: - Free cash flow is positive at 321.6 million USD. - The company has been actively managing its capital structure, shown by a repayment of debt of 225 million USD and a repurchase of capital stock amounting to -163.3 million USD. - Operating cash flow is robust at 601.3 million USD.

Analyst Expectations: - Analysts expect OSI to post earnings per share (EPS) of 10.31 USD next year, reflecting optimism about the company's profitability. - Revenue estimates for the next year stand at 10.11 billion USD, with an expected growth rate of 4.80%. - According to the earnings history, OSK has consistently beaten EPS estimates over the past four quarters, which could instill confidence in the market regarding the company's earnings abilities.

Future Stock Price Movement Expectation: Analyzing the data provided, multiple signals indicate a generally positive outlook for OSK's stock price in the coming months. The improving OBV suggests a growth in buying pressure, which can eventually lead to a rise in stock price. Even though the MACD is still negative, the reduction in negativity may hint at a diminishing downward momentum, further buoyed by stable fundamentals and strong cash flows.

The company exhibits solid fundamental health, with robust earnings performance and a conservative amount of debt. The current cash position allows for flexibility in operations and strategic investments. Additionally, the observed efficiency in managing working capital and generating free cash flow speaks to competent management practices.

Considering these factors, along with the constructive expectations from analysts, the current trend could see a continuation of stock price appreciation. Furthermore, the lower than average PEG ratio might lead to increased interest from value investors, reinforcing the bullish stance.

However, market conditions are subject to changes influenced by broader economic events, industry-specific developments, and geopolitical issues. Therefore, while the prognosis leans towards a positive trajectory for OSK, investors should closely monitor the aforementioned factors that may impact future stock performance.

| Statistic Name | Statistic Value |

| R-squared | 0.433 |

| Adj. R-squared | 0.432 |

| F-statistic | 957.5 |

| Prob (F-statistic) | 1.03e-156 |

| Log-Likelihood | -2438.2 |

| AIC | 4880. |

| BIC | 4891. |

| coef (const) | -0.0053 |

| t (const) | -0.112 |

| P>|t| (const) | 0.911 |

| [0.025 0.975] (const) | -0.099 0.088 |

| coef | 1.1167 |

| std err | 0.036 |

| t | 30.944 |

| P>|t| | 0.000 |

| [0.025 0.975] | 1.046 1.188 |

| Omnibus | 132.662 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 1033.145 |

| Skew | -0.026 |

| Prob(JB) | 4.52e-225 |

| Kurtosis | 7.441 |

| Cond. No. | 1.32 |

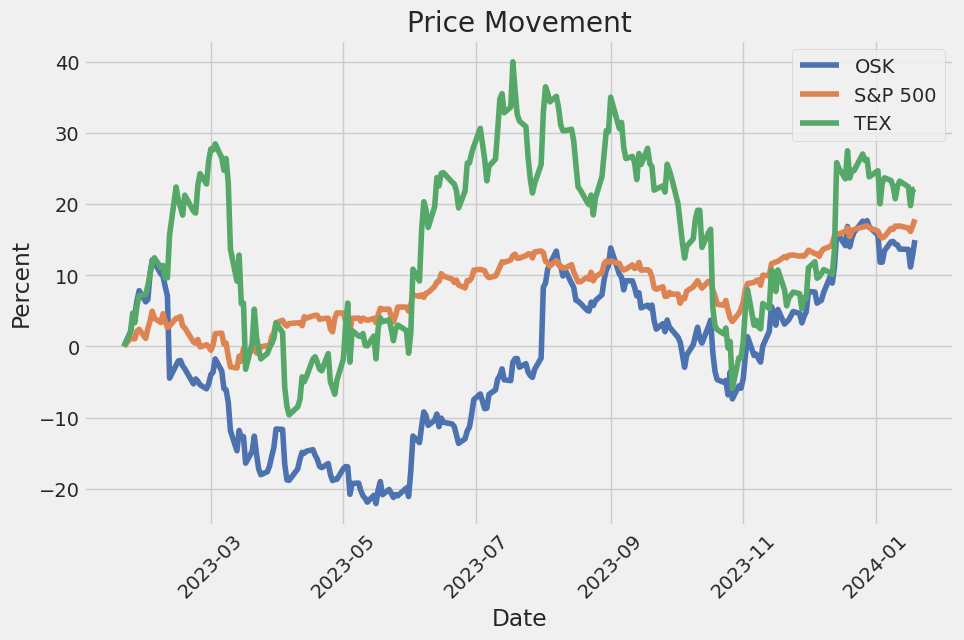

The linear regression model illustrates the relationship between Oshkosh Corporation (OSK) and the SPDR S&P 500 ETF Trust (SPY), with SPY serving as the market benchmark. The model informs investors and analysts about how changes in SPY are related to changes in OSK. The coefficient of the independent variable (SPY) is approximately 1.1167, implying that for every unit increase in SPY, OSK is expected to increase by 1.1167 units, holding other factors constant. With an R-squared value of 0.433, the model explains 43.3% of the variability in OSK's returns based on SPY's returns. This suggests moderate explanatory power but also indicates that more than half the variation in OSK is not explained by this model.

Alpha, or the intercept coefficient, measures the return of OSK when the return of SPY is zero. The estimated alpha for the model is -0.00531, suggesting that if SPY had a return of 0, OSK would be expected to have a slight negative returnnot statistically significant given the high p-value of 0.911. This is consistent with the notion that alpha represents the stock's performance unrelated to the market, showing that OSK's performance is majorly in line with the market forces represented by SPY. Overall, the model indicates that OSK has a significant positive relationship with SPY, and the market influences OSK's movements to a notable extent.

Oshkosh Corporation delivered a strong performance for the fiscal 2023 third quarter, with a 21% increase in revenue and a more than double increase in adjusted operating income and adjusted EPS to $276 million and $3.04, respectively. The company attributes its successful results to an improved supply chain, revenue, and earnings growth strategies, and benefits from recent acquisitions. There is a positive outlook for further growth opportunities as the supply chain continues to stabilize, acquisitions are integrated, and the vocational backlog and pre-inflationary price-cost dynamics improve. Orders are looking robust due to infrastructure spending and healthy municipal budgets, with the Access segment expecting strong orders in Q4, setting up a nearly fully booked outlook for 2024.

Oshkosh provided detailed updates on its segments, particularly noting the strong performance of the Access team, which achieved a 27% revenue growth and an adjusted operating margin of 17.6%. Demand for Access equipment remains high due to major projects, infrastructure investments, and industrial construction activities. There is confidence in future demand visibility extending beyond the current backlog, and the company is making strategic investments in product technologies and manufacturing processes. In addition, there's a leadership transition with Mahesh Narang stepping in to lead Access, bringing extensive global industrial experience.

The Defense segment faced a decline in revenue but achieved strong operating income as anticipated, with expectations that Q4 will be the year's strongest due to contract awards and a higher aftermarket parts mix. Significant developments include Oshkosh being selected for Phase I of the robotic combat vehicle program and receiving a $40 million contract for the unmanned ground vehicle ROGUE Fires. Furthermore, Oshkosh mentioned the sale of its snow removal equipment business to concentrate on core areas and the forthcoming production phase of the USPS' next-generation delivery vehicles.

On the Vocational front, the segment has gained momentum over the past two quarters, with a 35% revenue growth in Q3, including $116 million from AeroTech for the two months since acquisition. Notably, the segment achieved an adjusted double-digit operating margin, with strong contributions from AeroTech. Improved supply chain and operational performance have been key to the recent success, and there's optimism about the strength of the outlook for AeroTech, which is expected to see an increase in airport traffic and investment. Oshkosh received significant orders, including an order for 50 McNeilus Volterra ZSL units, North America's first fully integrated zero-emission electric refuse collection vehicle, signaling strong interest in EVs.

In the financial review, Mike Pack revealed that consolidated sales for Q3 were $2.5 billion, representing significant growth. The increase in revenue mainly comes from higher volume and pricing adjustments within the Access and Vocational segments, including AeroTech sales. Adjusted operating income saw a stark improvement due to favorable price-cost dynamics, volume increases, and improved mix, despite higher incentive compensation costs. Adjusted EPS rose significantly and supply chain improvements bolstered expectations for 2023. Oshkosh's projections for the full year anticipate an increase in sales and adjusted operating income, with sales expectations around $9.65 billion and adjusted operating income around $875 million. Adjusted EPS is forecasted to be about $9.50, boosted by the exclusion of non-cash amortization of purchased intangibles. Segment-wise, Access, Defense, and Vocational are all expected to show growth in both sales and operating margins.

CEO John Pfeifer concluded with a positive outlook, noting strong results and continued progress in supply chain efficiency and production throughput. The integration of AeroTech and strong market demand provides a bright picture, and the company anticipates successful growth and enhanced shareholder value. The Q&A session followed with analysts inquiring into the Access segment's bookings, the Vocational segment's order visibility, and specifics about AeroTech integration, among other concerns. Overall, Oshkosh's leadership expressed confidence in the company's direction and the exciting prospects ahead.

Oshkosh Corporation, in its recent 10-Q filing, highlighted various financial elements and operational endeavors for the period ending September 30, 2023. The filing detailed net sales which saw a significant increase to $2.509.9 billion compared to $2.066.7 billion in the prior year, attributing to robust revenues across the company's segments. Gross income rose to $468.1 million from $288.6 million in the previous year. Operating expenses also showed an upward trend, resulting in a total of $211.6 million compared to the prior year's $171.4 million. The operating income therefore stood at $256.5 million, a substantial rise from $117.2 million.

The report showed interest expenses at $19.6 million with interest income documented at $1.9 million. Additionally, there was miscellaneous net income of $2.6 million. Pre-tax income summed up to $241.4 million, and after provision for income taxes at $55.3 million, the net income reached $183.7 million.

The filing further elaborates on the sales segmentation where sales at the point of time equaled $1,840.1 million, and sales over time contributed to $669.8 million, totaling the $2,509.9 million net sales. The unsatisfied performance obligations related to contracts initially extending over a year amount to $10.69 billion, a considerable future revenue pipeline.

In the area of acquisitions, the filing notes significant expansion activities, including the acquisition of JBT AeroTech for $803.3 million and Hinowa S.p.A. for 171.8 million, both of which have started contributing to the revenues upon acquisition. These purchases were integral in adding $469.8 million of goodwill, primarily from the expected synergies, innovations, and operational benefits.

Regarding liquidity and capital resources, the report addresses the company's obligations under numerous financing agreements, such as a Revolving Credit Facility with an initial maximum aggregate amount of availability of $1.1 billion and unsecured senior notes totaling $600 million. As of the filing date, the company had a balance of $505.0 million under the Revolving Credit Facility.

The company's shareholder equity segment has also been described, revealing a repurchase of 265,795 shares of Common Stock for $22.6 million during the nine-month period. The authority to repurchase an additional 11,284,882 shares remained.

Lastly, the filing includes details on employee benefit plans, income taxes, earnings per share, receivables, inventories, property, plant and equipment, goodwill and purchased intangible assets, credit agreements, warranties, guarantee arrangements, and contingencies, all providing an in-depth financial health snapshot. Notably, if the financial situation of customers deteriorates, causing them to default on their payments, the collateral may not suffice to prevent losses significantly over the amounts reserved.

The various elements presented in the report paint a comprehensive picture of Oshkosh Corporation's performance, strength, and potential risk areas in the fiscal period leading up to and including September 30, 2023.

Oshkosh Corporation has been in the limelight for numerous positive reasons, from its accolades and corporate responsibility to its favorable financial metrics that are catching the eye of value and momentum investors alike. Foremost among these recognitions, the company was named as one of the 2023 Best for Vets Employers by Military Times on December 22, 2023. According to the company's senior vice president and chief human resources officer, Emma M. McTague, this underscores Oshkosh's People First culture and reflects its dedication to onboarding, coaching, and mentoring over 1,100 veterans and related family members within their workforce.

Oshkosh Corporation's partnership with the Hiring Our Heroes program epitomizes their commitment to veterans. Offering a 12-week fellowship during the final 180 days of active duty, transitioning service members gain professional training and experience crucial for civilian occupations. Furthermore, Oshkosh has been consistently recognized by organizations like VIQTORY, Ethisphere, Newsweek, and indices such as CEI and the Dow Jones Sustainability World Index for its efforts in veteran support and sustainability practices.

The corporation's success extends to financial markets as well. On December 22, 2023, Zacks Equity Research underscored Oshkosh as an attractive pick for bargain hunters and momentum investors due to a significant price change over varying periods. With a beta of 1.34, Oshkosh offers higher volatility, an aspect that can lead to larger gains. Bolstered by a 'B' Momentum Score from Zacks and a Zacks Rank #2 (Buy), the company presents both momentum and value investment opportunities. Financial figures such as the P/S ratio suggest that the company is undervalued, adding to its attractiveness for investors seeking stocks with price appreciation potential.

Adding to the bargain appeal, analysis from January 11, 2024, by Zacks highlights Oshkosh's P/E, P/B, P/S, and P/CF ratios indicating a strong value proposition to investors. These investment metrics, along with the positive earnings estimate revisions, paint the company as undervalued, a sentiment similarly echoed in an analysis dated January 5, 2024. The financial stability and strong earnings outlook position Oshkosh as a worthy candidate for inclusion in value investors' portfolios.

Oshkosh's commitment to sustainable practices is evident in its inclusion in the Dow Jones Sustainability World Index for the fifth year, as stated in a Business Wire report from December 19, 2023. This recognition aligns with the company's broader approach to caring for people, supporting communities, and providing reliable products.

As January 30, 2024, approaches, analysts await Oshkosh's Q4 earnings report with optimism, as suggested by Zacks Equity Research. Compared to Tesla, which faces uncertainty in its earnings outlook, Oshkosh displays a positive Earnings ESP and a favorable Zacks Rank, indicating a higher chance of surpassing earnings forecasts. The impending report could further solidify the financial reputation of this distinguished Wisconsin-based corporation.

Despite challenges in the auto equipment industry, such as supply chain disruptions and heightened costs, reports from Yahoo Finance on January 18, 2024, indicate that Oshkosh Corporation may prevail, supported by its strong backlog and strategic initiatives. The company, enjoying a Zacks Rank #2 (Buy) and a VGM Score of A, is expected to show year-over-year top and bottom-line growth.

Investors interested in the financial narrative of Oshkosh Corporation will find a host of resources at their disposal. Detailed insights are available through the company's official website and through numerous financial analyses by Zacks. Furthermore, the upcoming webcast for the full year 2023 financial results presents an opportunity for stakeholders to glean firsthand information about Oshkosh's performance and projections, a pertinent moment given the stock's appealing valuation in the eyes of investment research firms.

Oshkosh Corporation stands out as a solid blend of commendable corporate practices, civic responsibility, and financial opportunity, making it a notable entity within the purpose-built vehicles and equipment industry as well as a prospective choice for investors.

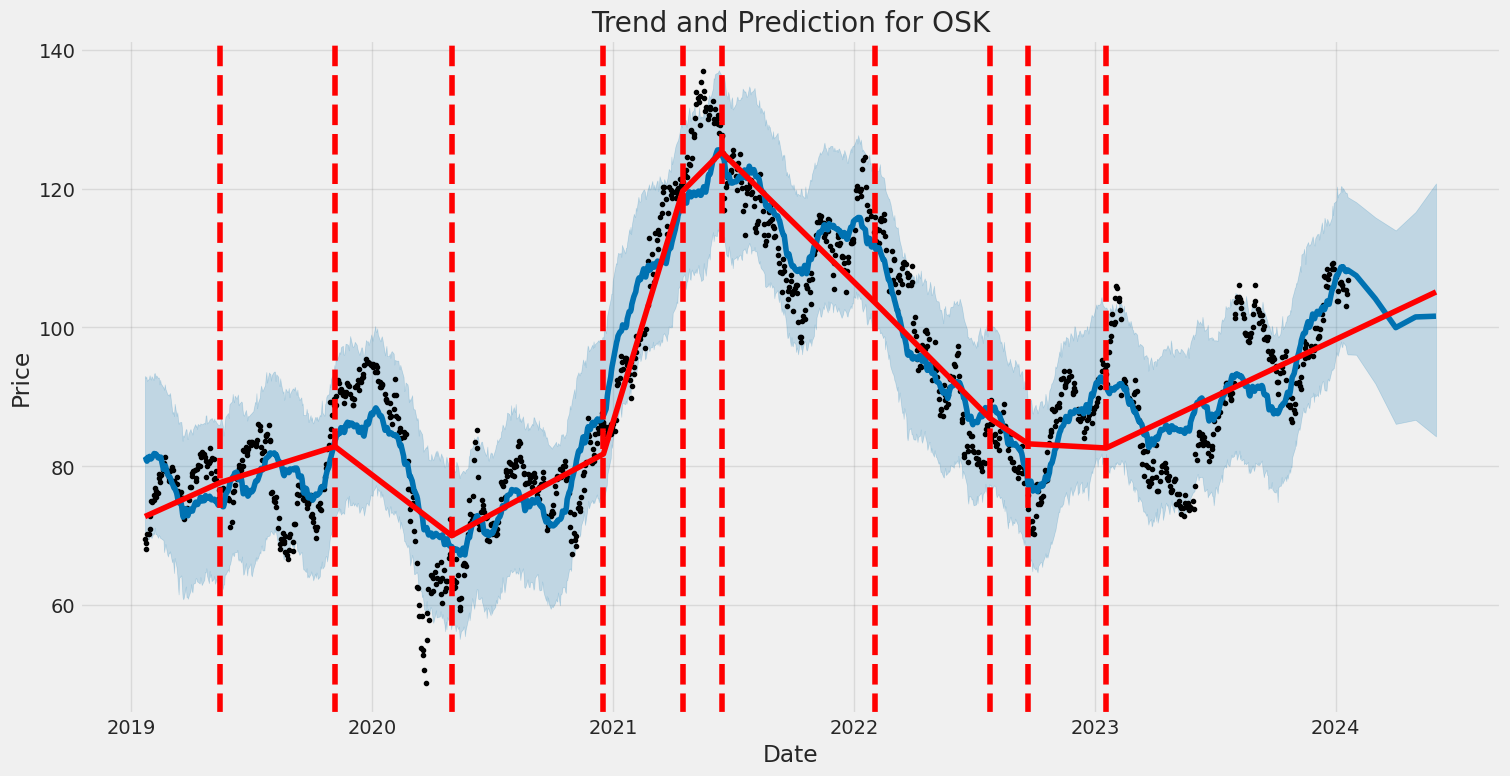

From January 22, 2019, to January 19, 2024, Oshkosh Corporation's stock showed a certain degree of volatility without a clear trend in returns, as indicated by an R-squared of 0.000. The ARCH model indicates that the volatility is persistent, with a significant omega coefficient of 3.4257 suggesting that there is a baseline level of fluctuation in the stock's returns. Additionally, the alpha[1] value of 0.3405 implies that past shocks to returns have a positive and significant effect on current volatility.

Here is the simplified explanation of the volatility characteristics for Oshkosh Corporation:

- The analysis reveals that Oshkosh Corporation's stock price fluctuations were unpredictable over the given period, with no apparent pattern to the returns.

- The stock exhibited a baseline level of volatility, which means that even without any new information or events, the returns tended to fluctuate to a certain degree.

- When the stock did experience changes in price, these changes had a lasting impact on future volatility, potentially leading to further fluctuations in the stock price.

| Statistic | Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2739.00 |

| AIC | 5481.99 |

| BIC | 5492.27 |

| No. Observations | 1,257 |

| omega | 3.4257 |

| alpha[1] | 0.3405 |

Assessing the financial risk associated with a $10,000 investment in Oshkosh Corporation (OSK) over one year involves quantifying the potential losses due to fluctuations in stock price. The analysis combines volatility modeling with machine learning predictions to forecast stock behavior and manage risk.

Volatility modeling is a statistical method used to estimate the future fluctuation rate of a stock's price. In this analysis, it deals with modeling conditional variance to understand how volatile the investment in OSK could be over the projected period. This model provides insights into the expected level of risk associated with the investment, taking into account the varying market conditions and the historical volatility of OSK's stock price.

On the other hand, machine learning predictions incorporate a broad set of data points, including past stock performance and other relevant financial indicators to forecast future stock returns. A specific ensemble method that uses decision trees is employed to handle non-linear relationships in the dataset. This approach captures complex patterns that may escape traditional linear models, providing a forecast of the expected returns on investment.

Integrating volatility modeling into the assessment supports a comprehensive understanding of the expected fluctuation in stock prices, while the insights from machine learning predictions contribute to estimating the potential return on the investment. When combined, these methodologies enable a robust forecast of the stock's performance.

The results of this integrated approach, focusing on the Value at Risk (VaR) metrics for OSK's stock, highlights the level of risk an investor would be exposed to when venture into this equity. A VaR at a 95% confidence level quantifies the maximum expected loss over a set period, which, for our $10,000 investment in OSK, would be $312.95. This figure suggests that there is a 5% chance that the investment could lose more than $312.95 within a year, under normal market conditions. It gives the investor a threshold for the potential downside risk, enabling better risk management and investment decision-making.

Overall, the combination of volatility modeling and machine learning predictions is instrumental in capturing the dynamic nature of equity risk. The calculated VaR at a 95% confidence interval provides a quantifiable measure of the investment risk, which is vital for investors looking to manage their portfolios proactively.

Similar Companies in Farm & Heavy Construction Machinery:

Terex Corporation (TEX), Astec Industries, Inc. (ASTE), Hyster-Yale Materials Handling, Inc. (HY), Manitex International, Inc. (MNTX), The Manitowoc Company, Inc. (MTW), Alamo Group Inc. (ALG), Wabash National Corporation (WNC), The Shyft Group, Inc. (SHYF), Titan International, Inc. (TWI), Report: CNH Industrial N.V. (CNHI), CNH Industrial N.V. (CNHI), AGCO Corporation (AGCO), Lindsay Corporation (LNN), Columbus McKinnon Corporation (CMCO), Lockheed Martin Corporation (LMT), General Dynamics Corporation (GD), Textron Inc. (TXT), The Boeing Company (BA), Northrop Grumman Corporation (NOC), Raytheon Technologies Corporation (RTX), BAE Systems plc (BAESY), Huntington Ingalls Industries, Inc. (HII)

https://www.zacks.com/stock/news/2194133/should-value-investors-buy-oshkosh-osk-stock

https://finance.yahoo.com/news/oshkosh-corporation-named-dow-jones-160600353.html

https://www.zacks.com/stock/news/2201547/should-value-investors-buy-oshkosh-osk-stock

https://finance.yahoo.com/news/oshkosh-corporation-recognized-military-times-175800567.html

https://finance.yahoo.com/news/us-108-time-put-oshkosh-165727814.html

https://finance.yahoo.com/news/value-investor-1-stock-could-144007430.html

https://www.zacks.com/stock/news/2208888/should-value-investors-buy-oshkosh-osk-stock

https://finance.yahoo.com/news/oshkosh-corporation-announce-fourth-quarter-160000581.html

https://finance.yahoo.com/news/2-auto-equipment-stocks-poised-153100500.html

https://finance.yahoo.com/news/zacks-industry-outlook-highlights-oshkosh-090500522.html

https://finance.yahoo.com/news/insights-expectations-teslas-tsla-q4-124700571.html

https://www.sec.gov/Archives/edgar/data/775158/000095017023055497/osk-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 4aaOelL

https://reports.tinycomputers.io/OSK/OSK-2024-01-19.html Home