Deere & Company (ticker: DE)

2023-12-22

Deere & Company, operating under the brand name John Deere, is a global leader in the manufacturing and distribution of agriculture, construction, forestry machinery, diesel engines, drivetrains used in heavy equipment, and lawn care equipment. Traded under the ticker symbol DE on the New York Stock Exchange, the company has established a strong reputation for quality and innovation since its inception in 1837 by John Deere in Grand Detour, Illinois. Deere & Company's product line extends from tractors and combine harvesters to seeders and balers, catering to the myriad needs of modern agribusiness. It also provides financial services and other related activities to support its core operations. With its iconic green and yellow equipment, Deere has a significant presence in markets worldwide, leveraging a broad network of dealers and distributors to reach its customer base. The company's focus on technology and sustainability has seen it develop precision agriculture solutions to enhance productivity and reduce environmental impact. Deere & Company's commitment to quality and innovation has secured its position as a key player in the heavy equipment industry, shaping the agricultural landscape with its machinery and services.

Deere & Company, operating under the brand name John Deere, is a global leader in the manufacturing and distribution of agriculture, construction, forestry machinery, diesel engines, drivetrains used in heavy equipment, and lawn care equipment. Traded under the ticker symbol DE on the New York Stock Exchange, the company has established a strong reputation for quality and innovation since its inception in 1837 by John Deere in Grand Detour, Illinois. Deere & Company's product line extends from tractors and combine harvesters to seeders and balers, catering to the myriad needs of modern agribusiness. It also provides financial services and other related activities to support its core operations. With its iconic green and yellow equipment, Deere has a significant presence in markets worldwide, leveraging a broad network of dealers and distributors to reach its customer base. The company's focus on technology and sustainability has seen it develop precision agriculture solutions to enhance productivity and reduce environmental impact. Deere & Company's commitment to quality and innovation has secured its position as a key player in the heavy equipment industry, shaping the agricultural landscape with its machinery and services.

| As of Date: 12/22/2023Current | 10/31/2023 | 7/31/2023 | 4/30/2023 | 1/31/2023 | 10/31/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 110.24B | 105.22B | 123.73B | 112.02B | 125.30B | 118.26B |

| Enterprise Value | 165.52B | 159.98B | 176.00B | 161.56B | 171.99B | 164.41B |

| Trailing P/E | 11.36 | 10.83 | 14.45 | 14.05 | 18.16 | 19.78 |

| Forward P/E | 13.91 | 11.27 | 13.85 | 12.80 | 15.13 | 15.17 |

| PEG Ratio (5 yr expected) | 1.99 | 0.99 | 1.24 | 1.16 | 1.41 | 1.40 |

| Price/Sales (ttm) | 1.92 | 1.80 | 2.20 | 2.11 | 2.53 | 2.59 |

| Price/Book (mrq) | 5.06 | 4.57 | 5.52 | 5.20 | 6.18 | 6.21 |

| Enterprise Value/Revenue | 2.75 | 10.55 | 11.33 | 9.42 | 13.87 | 10.76 |

| Enterprise Value/EBITDA | 9.47 | 36.94 | 36.97 | 32.85 | 49.62 | 44.60 |

| Address | One John Deere Place | City | Moline | State | IL |

|---|---|---|---|---|---|

| Zip Code | 61265 | Country | United States | Phone | 309 765 8000 |

| Website | https://www.deere.com | Industry | Farm & Heavy Construction Machinery | Sector | Industrials |

| Full Time Employees | 83,000 | Previous Close | 393.34 | Open | 393.3 |

| Day Low | 393.1 | Day High | 397.725 | Dividend Rate | 5.88 |

| Dividend Yield | 0.0149 | Payout Ratio | 0.1458 | Five Year Avg Dividend Yield | 1.37 |

| Beta | 1.027 | Trailing PE | 11.473273 | Forward PE | 13.7878475 |

| Volume | 495,954 | Average Volume | 1,680,844 | Average Volume 10 days | 2,282,230 |

| Bid | 396.46 | Ask | 396.74 | Market Cap | 111,286,460,416 |

| 52 Week Low | 345.55 | 52 Week High | 450.0 | Price To Sales Trailing 12 Months | 1.8177528 |

| Trailing Annual Dividend Rate | 5.05 | Trailing Annual Dividend Yield | 0.012838766 | Enterprise Value | 169,280,667,648 |

| Profit Margins | 0.16605 | Total Revenue | 61,221,998,592 | Net Income To Common | 10,165,999,616 |

| Trailing EPS | 34.61 | Forward EPS | 28.8 | Peg Ratio | -2.75 |

| Last Split Factor | 2:1 | Enterprise To Revenue | 2.765 | Enterprise To Ebitda | 10.215 |

| 52 Week Change | -0.09976429 | Last Dividend Value | 1.35 | Current Price | 397.09 |

| Target High Price | 493.0 | Target Low Price | 375.0 | Target Mean Price | 423.0 |

| Target Median Price | 420.0 | Recommendation Mean | 2.1 | Number Of Analyst Opinions | 21 |

| Total Cash | 5,824,000,000 | Total Cash Per Share | 20.781 | Ebitda | 16,572,000,256 |

| Total Debt | 64,768,000,000 | Quick Ratio | 1.707 | Current Ratio | 1.914 |

| Debt To Equity | 295.933 | Revenue Per Share | 209.521 | Return On Assets | 0.10023 |

| Return On Equity | 0.48079 | Gross Profits | 14,486,000,000 | Free Cashflow | 3,228,000,000 |

| Operating Cashflow | 8,589,000,192 | Earnings Growth | 0.112 | Revenue Growth | -0.009 |

| Gross Margins | 0.34493 | Ebitda Margins | 0.27069 | Operating Margins | 0.33947 |

The technical and fundamental data provided for DE indicates a potentially bullish outlook for the stock in the upcoming months. The analysis of the technical indicators and company fundamentals reveals the following insights:

Technical Indicators: - The Adjusted Close price of $397.09 is above the 5-period Bollinger Band Middle (BBM) of $390.88, indicating bullish sentiment in the short term. - The Moving Average Convergence Divergence (MACD) is positive with a value of 5.36 and a rising histogram value of 3.45, suggesting a building bullish momentum. - The Relative Strength Index (RSI) at 63.82 is not in the overbought territory (>70), which provides room for further upside before becoming overextended. - The Stochastic Oscillator values (STOCHk and STOCHd) are high, with STOCHk at 90.89, which could indicate short-term overbought conditions; however, it also reflects strong upward momentum. - The Average Directional Index (ADX) of 28.04 implies a moderately strong trend. - The Chaikin Money Flow (CMF) is close to zero, indicating a relative balance between buying and selling pressure. - The William %R (WILLR) shows -1.51, which is near the overbought level, potentially signaling a pullback or consolidation in the near term. - The current stock price is above both the 50-day Exponential Moving Average (EMA_50) and the 20-day Simple Moving Average (SMA_20), suggesting a bullish trend in the medium term.

Fundamentals: - The Trailing P/E ratio of 11.36 is lower than previous months, indicating the stock is relatively undervalued compared to its recent earnings. - Forward P/E suggests expectations of earnings growth. - The Price/Sales (P/S) and Price/Book (P/B) ratios show an increase over the previous year, which might suggest the market is attributing a higher valuation to the company. - The reduction in Market Cap over the recent period might have been viewed as a buying opportunity if the fundamental performance of the company remained strong. - EBITDA and net income have shown significant growth, implying improved profitability and operational efficiency.

Financials: - A considerable increase in Normalized EBITDA and Operating Income suggests strong financial performance. - Net income figures are robust and show growth from previous periods. - Stability in costs and revenue growth support a healthy financial position.

Interpreting the data holistically, the robust financial performance of DE and positive momentum indicated by several technical indicators set the stage for a continuation of the upward trend. The stock holding above key averages and the positive MACD indicate enduring bullish sentiment. However, the slight overbought conditions signaled by the stochastic oscillator and WILLR might lead to intermittent pullbacks or consolidation before continuing the upward trend.

Investors may look for potential buy signals on dips toward key support levels, such as the SMA_20 or EMA_50. Further confirmation of trend continuation would be provided by the RSI remaining below overbought levels and the MACD histogram continuing to rise.

In conclusion, considering the strength in fundamental financial performance and favorable technical indicators, the stock is likely to continue its upward trajectory with possible intermittent consolidation in the next few months. Long-term investors could see the pullbacks as buying opportunities based on the analysis. As always with the stock market, it is crucial to continuously monitor any changes in market conditions or company-specific news that could affect this outlook.

Deere & Company, known globally as John Deere, has recently emerged in financial markets as an investment with compelling value, particularly in light of broader market turbulence. As financial analysts probe for undervalued stocks amidst a climate of inflated valuations, Deere stands out with its shares trading at approximately 11 times trailing earnings a metric suggesting the stock could be significantly undervalued. This particular valuation contrasts starkly with the overall market, suggesting that while many stocks may be reaching their peak prices, Deere may offer a substantial opportunity for investors.

Despite a valuation that implies undervaluation, Deere has been delivering solid financial performance, showcasing improved cash flow and strong earnings before interest and taxes (EBIT) across various segments. The company has seen its production and precision agriculture revenue more than double since fiscal 2019, demonstrating exceptional growth and the success of its business strategies. Deere's commitment to innovation and technology in manufacturing agricultural machinery has played a crucial role in achieving these financial milestones.

The company's success can be largely attributed to its dominant position in the industry and the increasing global demand for advanced machinery. John Deeres prowess in agriculture and construction machinery design, coupled with investments in technology, places it at the forefront of addressing key challenges such as ensuring efficient food production for the growing global population and catering to infrastructural developments.

A contributing factor to Deere's attractive valuation is the cyclical nature of its business, which tend to move in cycles of ups and downs aligned with economic conditions. However, despite cyclical challenges, the company's long-term outlook appears strong, supported by macroeconomic factors like population growth and urbanization which ensure a continued demand for its machinery.

In light of the market dynamics, investors have turned their focus to the more sensational high-profile growth stocks, often relegating stable, slower-growth companies like Deere to the sidelines. This has created a unique chance for long-term investors to acquire a fundamentally sound company at a price that could be considered a discount, potentially leading to attractive returns as market conditions fluctuate to a new norm.

The focus on financial fundamentals rather than market speculation has uncovered value in certain stocks that many investors may overlook. Deere's solid financials and position in the market offer a compelling narrative for those willing to take a contrarian view in the current environment.

Switching gears to discuss capital allocation, Deere's strategy stands in stark contrast to companies like Costco Wholesale, which has prioritized issuing special dividends sporadically. Deere has focused on growth and share buybacks, reflecting a strategic choice to invest in key areas like automation and artificial intelligence which are considered critical for the future of agriculture. This strategy highlights a long-term belief in shareholder value creation through enhancing the intrinsic value of the company.

Notably, companies such as Apple and Illinois Tool Works have also shown a preference for buybacks over dividends, and their substantial outperformance of the S&P 500 over the past decade could indicate the effectiveness of such a capital allocation strategy. Buybacks, by reducing the number of outstanding shares, can increase earnings per share, a critical metric for investors.

Dividend growth stocks have gained attention, with Deere & Company being spotlighted within this category. According to Seeking Alpha, stocks that exhibit rapid dividend growth and potential for continued earnings acceleration hold particular appeal for dividend growth investors. A robust track record of increasing dividends, backed by strong earnings growth, positions companies like Deere as ideal candidates for those seeking high-growth, low-yield opportunities.

Looking at portfolio construction, investors aiming for such high-growth dividend stocks can benefit from a strategic and disciplined approach. It involves segmenting capital investment, starting with a selection of top-rated stocks, and consistently monitoring and adjusting the portfolio based on market changes and sector performances.

John Deere, being identified as having a strong dividend growth trajectory, satisfies the criteria of having solid revenue and earnings growth potential. For dividend growth investors, the strategy entails quarterly reassessments to ensure the stocks maintain benchmarks indicative of high-growth profiles.

John Deere's evolution from a traditional manufacturer to a dividend growth stock combines the stability of a well-established company with the potential for continued growth. With The Motley Fool referencing Deere as an emblem of such financial fortitude, it provides investors with a balance of risk and reward in volatile markets. The company's ventures into innovative territories such as advanced farming technology underscore its ongoing commitment to evolving alongside market demands.

Considering a 52-week low stock valuation can serve as a signal for potential buying opportunities, especially if the low prices are contrasted with strong fundamentals and a history of consistent profitability like that of Deere. The dividend yield, in such scenarios, becomes more attractive, and for those looking into the income generation aspect of their investment portfolio, companies like Deere seem quite appealing.

Understanding the factors behind a decline to these lows is important in order to assess the investment's quality thoroughly. This might include company-specific issues or broader industry-wide challenges. However, for companies with a history of resilience and financial integrity, such as Deere, it might also represent an ideal time for investors to consider buying at a perceived discount.

Looking beyond the dividends, Deere & Company is also attracting attention for its progressiveness in areas like artificial intelligence. Its investment in fully automated tractors and harvesting equipment represents a significant shift away from traditional farming methodologies, positioning Deere as an unexpected but compelling AI investment. Such a move is not only about automation but encompasses a broader impact on crop yields and resource management, aiming to revolutionize the agricultural sector.

This advance into AI speaks volumes about John Deere's strategic direction, aligning it with a broader trend of non-traditional sectors embracing sophisticated technologies to innovate and remain competitive. It is this blend of conventional industrial presence and technological innovation that marks Deere as an interesting prospect for those looking to invest in the future of the agriculture industry.

Lastly, Deere's recent earnings report presented a complex picture for investors. Despite strong earnings performance, the projection of lower net income for the following fiscal year caused apprehension and led to a stock price fall. This reaction to mid-cycle guidance offers a notable insight into the investment mentality surrounding cyclical businesses. For investors focused on the long-term, this might be perceived as an opportunity to invest in a company that, despite expected variances in short-term earnings, has consistently demonstrated a commitment to delivering shareholder value over time.

In conclusion, Deere & Company's position as an undervalued stock against the backdrop of a strong financial core and a forward-looking approach to technological advancements places it favorably for investors with a long-term perspective. Its steady performance allows investment strategies to include a spectrum of opportunities, from dividend income to growth through innovation, making it not just a stock to watch but an investment to potentially hold.

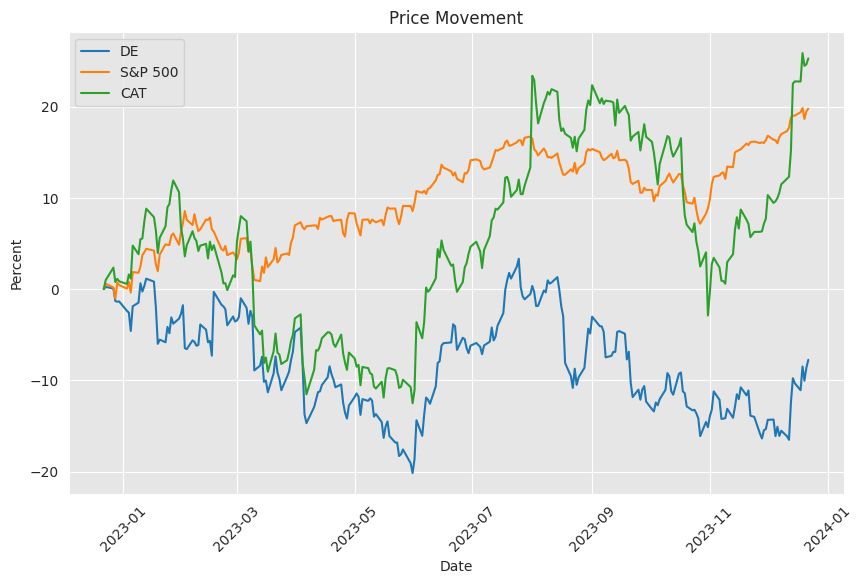

Similar Companies in Heavy Equipment & Engineering:

Report: Caterpillar Inc. (CAT), Caterpillar Inc. (CAT), AGCO Corporation (AGCO), CNH Industrial N.V. (CNHI), The Toro Company (TTC), Komatsu Ltd. (KMTUY)

News Links:

https://www.fool.com/investing/2023/12/22/3-stocks-that-are-absurdly-cheap-right-now/

https://www.fool.com/investing/2023/12/22/surprising-reason-costco-special-dividend-mistake/

https://seekingalpha.com/article/4657632-our-top-10-dividend-growth-stocks-december-2023

https://www.fool.com/investing/2023/12/15/4-growing-dividend-stocks-to-buy-now/

https://www.fool.com/investing/2023/12/09/3-dividend-stocks-trading-at-52-week-lows/

https://www.fool.com/investing/2023/12/04/3-magnificent-dividend-stocks-to-buy-in-december-f/

https://seekingalpha.com/article/4654898-why-i-made-big-changes-to-my-dividend-growth-portfolio

https://www.fool.com/investing/2023/11/26/10-surprising-artificial-intelligence-ai-stocks/

https://www.fool.com/investing/2023/11/22/why-deere-stock-plunged-after-earnings-today/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: 1K7ILsh