The Walt Disney Company (ticker: DIS)

2024-01-06

The Walt Disney Company (ticker: DIS) is a diversified international family entertainment and media enterprise that stands as a preeminent leader in the industry. Founded on October 16, 1923, by brothers Walt and Roy O. Disney as a small animation studio, it has evolved into one of the most iconic and successful entertainment conglomerates in the world. Headquartered in Burbank, California, Disney is known for its film, media networks, theme parks, and consumer products. The company owns and operates the ABC broadcast network; cable television networks such as Disney Channel, ESPN, and Freeform; publishing, merchandising, music, and theater divisions; and owns and licenses 14 theme parks around the world. Additionally, Disney has expanded its footprint with the acquisitions of Pixar, Marvel Entertainment, Lucasfilm, and 21st Century Fox, further enriching its entertainment portfolio. The company has also ventured into direct-to-consumer streaming services with platforms like Disney+, Hulu, and ESPN+. With a vast array of intellectual properties and a continuing commitment to creating high-quality entertainment, The Walt Disney Company remains a formidable force in the global entertainment landscape, enduringly capturing the hearts of audiences of all ages.

The Walt Disney Company (ticker: DIS) is a diversified international family entertainment and media enterprise that stands as a preeminent leader in the industry. Founded on October 16, 1923, by brothers Walt and Roy O. Disney as a small animation studio, it has evolved into one of the most iconic and successful entertainment conglomerates in the world. Headquartered in Burbank, California, Disney is known for its film, media networks, theme parks, and consumer products. The company owns and operates the ABC broadcast network; cable television networks such as Disney Channel, ESPN, and Freeform; publishing, merchandising, music, and theater divisions; and owns and licenses 14 theme parks around the world. Additionally, Disney has expanded its footprint with the acquisitions of Pixar, Marvel Entertainment, Lucasfilm, and 21st Century Fox, further enriching its entertainment portfolio. The company has also ventured into direct-to-consumer streaming services with platforms like Disney+, Hulu, and ESPN+. With a vast array of intellectual properties and a continuing commitment to creating high-quality entertainment, The Walt Disney Company remains a formidable force in the global entertainment landscape, enduringly capturing the hearts of audiences of all ages.

| Full Time Employees | 173,250 | CEO & Director Total Pay | $11,268,271 | CEO & Director Unexercised Value | $778,341 |

| Senior EVP Total Pay | $6,746,194 | Senior EVP & Chief Communications Officer Total Pay | $3,186,694 | Previous Close | $90.56 |

| Open | $90.41 | Day Low | $90.355 | Day High | $91.32 |

| Dividend Rate | $0.60 | Dividend Yield | 0.66% | 5 Year Avg Dividend Yield | 1.38% |

| Beta | 1.352 | Trailing PE | 70.47 | Forward PE | 17.28 |

| Volume | 8,535,865 | Average Volume | 12,399,459 | Average Volume 10 days | 10,302,920 |

| Market Cap | $166,376,095,744 | Fifty Two Week Low | $78.73 | Fifty Two Week High | $118.18 |

| Price to Sales Trailing 12 Months | 1.87 | 50 Day Average | $90.04 | 200 Day Average | $89.71 |

| Enterprise Value | $216,600,723,456 | Profit Margins | 2.65% | Float Shares | 1,828,833,365 |

| Shares Outstanding | 1,830,320,000 | Shares Short | 22,134,060 | Book Value | $54.25 |

| Price to Book | 1.68 | Last Fiscal Year End | 09/30/2022 | Most Recent Quarter | 09/30/2022 |

| Earnings Quarterly Growth | 63% | Net Income to Common | $2,353,999,872 | Trailing EPS | $1.29 |

| Forward EPS | $5.26 | Total Cash | $14,181,999,616 | Total Debt | $50,672,001,024 |

| Revenue | $88,898,002,944 | Debt to Equity | 44.84 | Revenue Per Share | $48.63 |

| Return on Assets | 2.85% | Return on Equity | 3.06% | Free Cash Flow | $5,724,375,040 |

| Operating Cash Flow | $9,866,000,384 | Earnings Growth | 62.3% | Revenue Growth | 5.4% |

| Gross Margins | 33.41% | EBITDA Margins | 16.54% | Operating Margins | 10.20% |

Analyzing the Walt Disney Company's (Ticker: DIS) technical and fundamental data provides a multi-faceted picture of its potential stock price movements over the coming months. Based on the latest available data, here is an assessment of DISs outlook:

Analyzing the Walt Disney Company's (Ticker: DIS) technical and fundamental data provides a multi-faceted picture of its potential stock price movements over the coming months. Based on the latest available data, here is an assessment of DISs outlook:

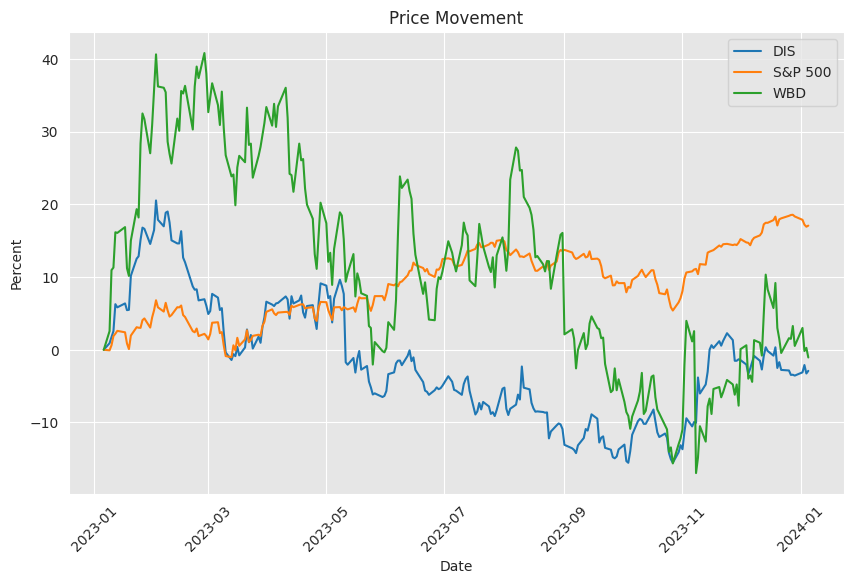

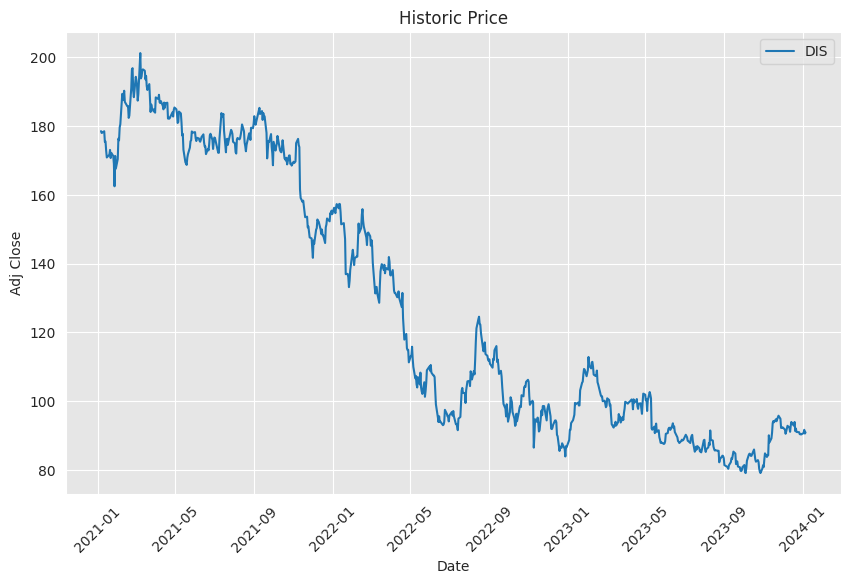

Technical Indicators: - Price Movement: From September to January, DISs stock price shows an uptrend with the price moving from approximately $80.54 to $90.90. This sustained increase indicates a bullish sentiment in the recent past. - Moving Averages: The closing prices suggest consistency above any short-term moving average, which would typically indicate an ongoing positive trend. - Parabolic SAR (PSAR): The absence of the PSAR values for the long position and the presence for the short position in the last rows indicates that the uptrend has been strong but there may be a potential for trend reversal as the PSAR flip looms. - On Balance Volume (OBV): The OBV is increasing, which suggests that buying pressure is overpowering selling pressure, supporting the upward price movement. - MACD Histogram: The MACD histogram values are negative but increasing towards zero, indicating that bearish momentum is weakening, and a potential bullish crossover may be anticipated.

Fundamentals: - Gross Margins & EBITDA Margins: DIS shows reasonable gross margins and EBITDA margins, indicating effective control over costs and decent profitability from core operations. - Operating Margins: The operating margin, while lower than the gross margin, is still positive, showing operational efficiency. - Total Revenue & Net Income: There is an increase in total revenue from 2020 to 2023, with net income showing recovery post-2020. - Debt Levels: High levels of total debt may be a point of concern, though DIS has managed to reduce net debt year-over-year, indicating an effort to improve its balance sheet.

Balance Sheets: - Cash and Cash Equivalents: There is a robust position in cash and cash equivalents, giving DIS financial flexibility. - Debt Reduction: Over the past years, the balance sheets show a noted effort in repaying debt, indicating proactive financial management.

Cash Flows: - Free Cash Flow: DIS has been generating positive free cash flow, illustrating the company's ability to generate surplus cash after capital expenditure.

Projected Outlook: - The technical and fundamental indicators point towards a cautiously optimistic outlook for DIS stock price in the near to medium term. The improving MACD histogram suggests that while bearish pressures exist, they may be waning, setting up for a potential bullish transition. - A strong cash position and debt reduction efforts positively influence investor sentiment, potentially fueling the uptrend. - Investors should monitor quarterly earnings reports, managerial commentary for strategic initiatives, and macroeconomic factors that can impact discretionary consumer spending, which is central to DISs business. - Considering the historical resilience and diversification of DIS's operations, coupled with effective cost management, the company appears well-positioned to sustain its positive momentumalbeit with standard market risks.

Investor Implications: - Current holders of DIS stock may find it prudent to maintain their positions, as technicals suggest continued bullish sentiment, supported by solid fundamentals. - Potential investors should seek entry points, keeping an eye on the PSAR indicator for signs of a sustained trend. However, they should also consider setting stop-loss orders to protect against potential trend reversals. - As market conditions evolve, particularly in media and entertainment sectors, further reevaluation would be vital to affirm the continuation of these trends.

Over the five-year period ending today, the probabilistic linear regression analysis between Disney (DIS) and the S&P 500 Index (SPY) reveals a moderate positive relationship, as indicated by the prior and training R-squared (R2) values of approximately 0.43 and 0.46, respectively. However, the testing set's R-squared, lower at roughly 0.36, suggests a drop in explanatory power when applying the model to out-of-sample data. The R-squared standard deviations (R2_std) indicate a degree of uncertainty, with greater variability in the testing score. The fact that the training R-squared surpasses the prior R-squared could denote that the model learned some patterns from the data which may not be as strongly expressed in the broader market as represented by the test data.

Focusing on the 'target_predicted' and 'simulate_predictions' results, the model's predictions encompass a wide range, reflecting the probabilistic nature of the analysis. These predicted values, alongside the 'target_actual' data points, can be evaluated to understand the model's predictive capabilities, which appear to vary as the actual-vs-predicted comparison presumably shows discrepancies. Alpha, a measure of the intercept in linear regression, is represented probabilistically in the 'posterior_alpha' array with a spread of values, suggesting uncertainty around the estimated average value of DIS when SPY is zero, which in practical market terms is an abstraction rather than a realistic scenario. This uncertainty in alpha translates to the entire regression line's position on the graph, which is key to interpreting the model's outputs in the context of market dynamics between DIS and SPY.

In the analysis of The Walt Disney Company's (DIS) financial performance for the third quarter of fiscal year 2023 ending July 1, 2023, compared to the prior-year quarter, improvements and declines in various segments have been noted.

Total revenues for the quarter rose 4%, reaching $22.3 billion, indicating continued growth. This increase was attributed to higher direct-to-consumer (DTC) subscription revenue, which reflects strong subscriber growth and higher rates, as well as increased revenue from theme parks and resorts due to higher volumes and guest spending. Additionally, theatrical distribution revenue rose, contributing to the hike in service revenues.

However, despite the overall revenue growth, the company reported a net loss attributable to Disney of $0.5 billion for the quarter. This loss was primarily driven by a Content Impairment Charge that arose as Disney revised its content strategy, resulting in the removal of content from its DTC services and the termination of certain third-party license agreements. These license terminations led to an impact of $2.4 billion, comprising $2.0 billion for the write-off of produced content and $0.4 billion for the terminated agreements.

Operating expenses for the quarter also increased, with a 5% rise in the cost of services, which climbed to $13.0 billion. This increase was a result of cost inflation and higher operating volumes at Disney's theme parks, coupled with escalated DTC programming and production expenses. Costs from merchandise, food, and beverage also went up in line with higher sales volumes at theme parks and resorts.

Selling, general, administrative, and other costs, however, showed a 6% decrease due to lower compensation-related costs, offsetting some of the expenses.

Despite these losses and charges, Disney's DTC segment displayed resilience with a prominent growth in subscription revenue. The company's theme parks and resorts segment also exhibited strong performance with a spike in guest attendance and spending.

As for future considerations, the report anticipates the recognition of approximately $2 billion in revenue for the remainder of fiscal 2023, with additional billions spread over the following years for content and other intellectual property as per existing agreements.

The company's leadership changes, with Robert A. Iger's return as CEO and the announced reorganization into three business segments, are expected to influence future financial adjustments and reporting. As part of the reorganization, costs related to the restructuring and implementation were acknowledged, with the potential for further charges as the process continues.

In summary, the third quarter results for The Walt Disney Company indicate both growth and challenges, with the Content Impairment Charge significantly affecting net income. The DTC and theme park segments appear to be key drivers of revenue growth, while the company navigates strategic organizational changes and external market conditions.

The Walt Disney Company's strategic maneuvers in the dynamic realm of live sports broadcasting vividly illustrate the escalating stakes in the competition for live programming. With its ESPN subsidiary, Disney has not hesitated to invest heavily in securing sports rights, fully understanding the lure of live sports for real-time viewership. Traditional linear networks and emerging streaming services converge in their pursuit of these highly sought-after rights, acknowledging live sports' exceptional ability to draw sizable, consistent audiences. This clustering of demand, juxtaposed with the limited supply of sports events, fosters a seller's market, propelling prices for broadcasting rights skyward.

As Disney contends with this competition, the company must also grapple with economic challenges posed by cord-cutting and a shifting media landscape. Yet, despite these headwinds and the costs they impose, Disney and its peers perceive the intrinsic value live sports offer, a compelling draw for viewers and a strategic investment in audience engagement. This sentiment was echoed by Disney's extension of its agreement to broadcast 40 NCAA championships via ESPN, reinforcing Disney's commitment to a vigorous sports programming lineup.

The loss of Dick Nunis, a legendary figure at The Walt Disney Company, marks the end of a pivotal epoch. Nunis' direct collaboration with Walt Disney informed his approach to theme park operations, leaving a lasting impact well beyond his time at the company. Under his watch, the opening of the Magic Kingdom and subsequent global park expansions cemented Disney's position as a global entertainment powerhouse. Nunis' leadership propelled the Parks and Resorts division to new heights, with the creation of EPCOT Center and Disney-MGM Studios as notable milestones.

Despite intricacies and disruptions in the market over the past three years, Disney remains on the cusp of a promising turnaround. Under Bob Iger's leadership, Disney anticipates profitability in streaming operations by the end of the fiscal fourth quarter. This optimistic outlook, tempered by an expected recovery in the TV advertising market and bolstered by new film releases, mirrors analyst projections that foreshadow moderate top-line growth. These projections gain credence when juxtaposed with improved performance expectations for entities like Home Depot and Verizon, products of strategic adjustments that could prove advantageous for companies within the Dow Jones Industrial Average.

Bob Iger's return as CEO signals a pivotal leadership shift for The Walt Disney Company. Iger must address the transformation of legacy television networks and optimize the profitability of streaming services in an increasingly saturated market. Moreover, Disney's park operations, a cornerstone of revenue, require agile management in response to economic and consumer flux. Intensified by active investor engagement, these dynamic elements necessitate deft strategy and forward-looking governance, further impacted by broader market conditions such as potential interest rate cuts that might herald a favorable business climate.

The selection of Disney (NYSE: DIS) as a dividend stock suitable for passive income-oriented investors aligns with The Motley Fool's investment philosophya pursuit of growth and financial robustness. Despite market fluctuations, Disney's capacity for value appreciation through dividends is noteworthy. Its assets span theme parks, studios, and streaming services, creating a resilient foundation against sector-specific downturns. The Motley Fool's endorsement emphasizes a belief in Disney's ability not just to sustain but also to mature its dividends, leveraging the brands power and expansive content universe to anchor its position in any passive income portfolio.

As a growth stock, The Walt Disney Company shares the spotlight with tech behemoths in the anticipation of potential market gains. According to The Motley Fool, Disney's endeavors across intellectual property, theme parks, and digital services are set to propel growth. While market figures from the S&P 500 and The Motley Fool's Rule Breakers service provide a backdrop, specific assessments of Disney's shares reveal an optimistic view of the companys future prospects as it continues to innovate within the entertainment industry.

Recent analysis places Disney (NYSE: DIS) as an attractive contender for portfolio inclusion, particularly following a decline in stock price that hints at a potential bargain for the discerning investor. With considerable cost-cutting efforts and strategic reinvestment, Disney is primed for a resurgence. The anticipated acquisition of Hulu and the planned launch of an ESPN streaming service underscore Disney's push to solidify its position in digital streaminga key facet of its growth blueprint. The reinstatement of dividend payments, coupled with indications of a positive financial outlook, lend weight to the argument that Disney's current stock value presents an opportune investment moment.

Disney's undervaluation in comparison to historical market metrics beckons would-be investors, positioning the company for potential recovery and growth. As the sector anticipates Disney's streaming services to attain profitability, and with high-profile film releases on the horizon, there's a clear opportunity for revenue augmentation. Further, Disney's storied theme parks continue to spell resilience and appeal, with potential economic upticks bolstering this segment, rounding out a comprehensive backdrop for an investment case.

Disney's stock evolution, marked by a comparatively modest yearly gain against a robust market performance, nonetheless faces a potential shift in January 2024. Key dates within the month signal the company's tactical content and operational shifts, such as the debut of Marvel's "Echo" on Disney+, the lifting of park restrictions, and resumption of dividend payments. These directives reflect Disney's multidimensional strategy to captivate audiences across digital and physical platforms, setting the stage for growth.

At year's end, Disney's dip of 2.5% placed it among the lower-performing stocks of the Dow Jones Industrial Average, with Procter & Gamble sharing this underperforming bracket. Despite fluctuations, the consumer goods behemoth offered a sense of dividend stability. In contrast, Disney, despite reinstating its dividend, remains in the throes of a strategic revision. Disney's lower valuation metrics signal potential for cautious investors, while for P&G, the barely shifted stock price may appeal as a steady income source for investors.

The entry of Mickey Mouse into the public domain has fostered novel, diverse expressions of the iconic character, challenging Disney's cultivated image. Alternative representations in independent horror films diverge sharply from the family-friendly persona associated with Disney. This development underscores the limitations Disney faces in controlling the presentation of its original character while maintaining trademark protections for modern renditions.

Lastly, Disney fortifies its foray into sports broadcasting through an extended media rights agreement with the NCAA via ESPN. This consolidates ESPN's slate of championship coverage to a record number, bolstering the foundation for sports content streaming and viewer retention. Despite competition from industry giants, Disney's financial indicators and commitment to sports content enhancement suggest a secure foothold in this sectora stance reflected in improving shares and revenue forecasts, which signal growth despite a slight downward revision of earnings estimates.

Similar Companies in Entertainment:

Warner Bros. Discovery, Inc. (WBD), Report: Comcast Corporation (CMCSA), Comcast Corporation (CMCSA), Netflix, Inc. (NFLX), ViacomCBS Inc. (VIAC), Sony Group Corporation (SONY), Lionsgate (LGF.A), AMC Networks Inc. (AMCX), Paramount Global (PARA), Hasbro, Inc. (HAS)

News Links:

https://www.fool.com/investing/2024/01/02/3-supercharged-growth-stocks-that-are-screaming-bu/

https://finance.yahoo.com/video/why-sports-rights-deals-getting-192948652.html

https://www.fool.com/investing/2024/01/06/investing-trends-to-follow-in-2024/

https://www.fool.com/investing/2024/01/04/these-3-dow-stocks-are-set-to-soar-in-2024-and-bey/

https://www.fool.com/investing/2024/01/02/my-10-best-dividend-stocks-to-buy-for-passive-inco/

https://www.fool.com/investing/2024/01/02/1-undervalued-growth-stock-down-55-to-buy-hand-ove/

https://www.fool.com/investing/2024/01/05/is-it-time-to-buy-the-dow-jones-2-worst-performing/

https://www.fool.com/investing/2024/01/02/3-stocks-to-buy-while-they-are-on-sale/

https://www.fool.com/investing/2024/01/03/3-predictions-for-disney-stock-in-2024/

https://finance.yahoo.com/m/29108484-5d27-348d-bd7e-7f55f9fa1e36/disney%E2%80%99s-mickey-mouse.html

https://finance.yahoo.com/news/disneys-dis-espn-extend-media-145700512.html

https://www.fool.com/investing/2024/01/02/3-dates-for-disney-stock-investors-to-circle-in-ja/

https://finance.yahoo.com/m/a0ef3668-dc94-3964-9a72-da358d57abfd/3-stocks-you%27ll-be-glad-you.html

https://finance.yahoo.com/m/43dad5b2-448a-364f-a9a7-3f8d1875f8a9/is-it-time-to-buy-the-dow.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: njqqfo

https://reports.tinycomputers.io/DIS/DIS-2024-01-06.html Home