HANNON ARMSTRONG SUSTAINABLE INFRASTRUCTURE CAPITAL INC (ticker: HASI)

2023-12-28

Hannon Armstrong Sustainable Infrastructure Capital Inc (ticker: HASI) is a significant player in the investment market for climate solutions and is renowned for its commitment to fostering sustainability through its financial services. Specializing as a capital provider to various projects and companies, HASI focuses on investments in energy efficiency, renewable energy, and other sustainable infrastructure projects across the United States. As a Real Estate Investment Trust (REIT), its financial structure allows for the distribution of a majority of its taxable income to shareholders in the form of dividends, potentially offering a stable income stream with a focus on environmentally beneficial assets. The company prides itself not only on the financial returns it provides to investors but also on the positive environmental impacts achieved through its investments. By targeting projects that reduce carbon emissions and improve energy efficiency, Hannon Armstrong positions itself as a key facilitator in the transition toward a more sustainable and low-carbon economy. Given the increasing global focus on sustainability, HASI's investment strategies are particularly relevant for stakeholders interested in aligning their portfolios with environmental goals while seeking competitive returns.

Hannon Armstrong Sustainable Infrastructure Capital Inc (ticker: HASI) is a significant player in the investment market for climate solutions and is renowned for its commitment to fostering sustainability through its financial services. Specializing as a capital provider to various projects and companies, HASI focuses on investments in energy efficiency, renewable energy, and other sustainable infrastructure projects across the United States. As a Real Estate Investment Trust (REIT), its financial structure allows for the distribution of a majority of its taxable income to shareholders in the form of dividends, potentially offering a stable income stream with a focus on environmentally beneficial assets. The company prides itself not only on the financial returns it provides to investors but also on the positive environmental impacts achieved through its investments. By targeting projects that reduce carbon emissions and improve energy efficiency, Hannon Armstrong positions itself as a key facilitator in the transition toward a more sustainable and low-carbon economy. Given the increasing global focus on sustainability, HASI's investment strategies are particularly relevant for stakeholders interested in aligning their portfolios with environmental goals while seeking competitive returns.

| As of Date: 12/27/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 3.15B | 2.27B | 2.67B | 2.62B | 2.58B | 2.66B |

| Enterprise Value | - | - | - | - | - | - |

| Trailing P/E | 78.69 | 38.55 | 125.00 | 60.85 | 20.55 | 29.93 |

| Forward P/E | 11.75 | 8.81 | 11.15 | 12.76 | 12.97 | 13.53 |

| PEG Ratio (5 yr expected) | 0.98 | 0.73 | 0.93 | 1.06 | 1.08 | 1.13 |

| Price/Sales (ttm) | 19.92 | 13.10 | 17.62 | 16.67 | 11.34 | 13.82 |

| Price/Book (mrq) | 1.53 | 1.16 | 1.65 | 1.61 | 1.63 | 1.71 |

| Enterprise Value/Revenue | 20.78 | - | - | - | - | - |

| Enterprise Value/EBITDA | - | - | - | - | - | - |

| Full Time Employees | 112 | Previous Close | $28.33 | Open | $28.35 |

|---|---|---|---|---|---|

| Day Low | $28.215 | Day High | $28.73 | Dividend Rate | $1.58 |

| Dividend Yield | 5.58% | Payout Ratio | 433.33% | Five Year Avg Dividend Yield | 4.29% |

| Beta | 1.858 | Trailing PE | 78.92 | Forward PE | 11.99 |

| Volume | 1,246,569 | Average Volume | 1,875,137 | Average Volume 10 days | 1,812,000 |

| Market Cap | $3,196,948,992 | Fifty Two Week Low | $13.22 | Fifty Two Week High | $39.67 |

| Price to Sales Trailing 12 Months | 26.29 | 50 Day Average | $22.5112 | 200 Day Average | $24.0899 |

| Enterprise Value | $6,704,535,040 | Profit Margins | 32.19% | Book Value | $18.489 |

| Price to Book | 1.54 | Net Income to Common | $38,146,000 | Trailing EPS | $0.36 |

| Forward EPS | $2.37 | PEG Ratio | 1.48 | Enterprise to Revenue | 55.14 |

| Last Dividend Value | $0.395 | Total Cash | $155,500,000 | Total Debt | $3,663,665,920 |

| Quick Ratio | 15.187 | Total Revenue | $121,600,000 | Debt to Equity | 174.469 |

| Return on Assets | 0.76% | Return on Equity | 2.11% | Gross Profits | $111,380,000 |

| Operating Cashflow | $28,595,000 | Earnings Growth | -48.7% | Revenue Growth | 11.2% |

| Gross Margins | 100% | Operating Margins | 37.43% | Current Price | $28.41 |

| Target High Price | $48.00 | Target Low Price | $23.00 | Target Mean Price | $32.17 |

| Target Median Price | $32.00 | Recommendation Mean | 2.0 | Number of Analyst Opinions | 12 |

Based on an analytical review of the technical data for HASI as of the last trading day and considering the company's fundamentals, here are the derived insights and potential trajectory for the stocks price movement over the next few months:

Technical Analysis: - The On-Balance Volume (OBV) trend has shown a steady increase, suggesting a build-up of buying pressure. An OBV reading in millions indicates robust participation and could potentially support an upward price trend. - The Open price on the last day is higher than the previous trading day, with the Close also trending upwards. This bullish signal could lead to further gains. - The most recent data points indicate that the MACD histogram is showing a negative trend. This divergence could signal a potential reversal or a slowdown in momentum, which might lead to consolidation or a potential pullback. - The absence of an overbought or oversold condition as indicated by RSI (relative strength index) data, which isn't provided, would be crucial in assessing whether the trend has room to continue.

Fundamental Analysis: - The trailing P/E ratio is quite high compared to historical figures, signaling that the stock might be overvalued from an earnings perspective. However, the forward P/E is considerably more attractive, which could attract investors who are willing to overlook short-term overvaluation for longer-term growth prospects. - The PEG ratio is close to 1, which typically suggests that the companys stock is correctly valued based on expected growth rates, further enabling a stable outlook for investors. - The Price/Sales ratio has increased significantly, which implies that the market is pricing in higher sales growth expectations or that the stock has become pricier relative to its sales. - Market Cap has shown growth, suggesting an increase in investor confidence and market valuation of the company.

Financial Snapshot: - An analysis of the financials indicates a significant interest income and high operational revenue, which demonstrates the company's effectiveness in generating income. - The company's net income has decreased from two years prior, but normalized income and operating revenue have been steady, suggesting consistent performance. - One should also consider any macroeconomic factors, industry trends, and the current market cycle, which could influence the performance of HASIs stock.

Projection: Taking into consideration the increase in OBV, a higher closing price compared to the opening, and stable growth in market capitalization, the stock appears to have positive momentum behind it. However, the negative MACD histogram may act as a counterbalance to this bullish sentiment and could signal caution among traders. Fundamentals point to a strong future P/E ratio and an expectation of growth as indicated by a PEG ratio close to one.

In the context of these observations, the upward price momentum of the stock may sustain in the short term, backed by buying pressure and market sentiment. Nevertheless, the potential price correction hinted at by the MACD histogram and the company's high valuation in terms of trailing P/E and Price/Sales ratios suggest that the stock could experience bouts of volatility with periods of consolidation.

Investors might remain optimistic due to favorable forward valuations and expected earnings growth, supporting an overall positive trend. However, close attention should be paid to shifts in market sentiment, financial results, and any external market shocks.

It is prudent for investors to keep abreast of the forthcoming financial results, which could greatly influence market sentiment, and monitor regular technical updates for signs of any trend reversal. Manage risk through careful position sizing and stop-loss orders to protect against an unexpected downturn.

Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI), a prominent player in the financing of sustainable infrastructure, has illustrated strong financial performance in the third quarter, surpassing analysts' expectations. The company reported revenue of $36.76 million, marking an 11.2% increase from the same quarter the previous year and notably surpassing the Zacks Consensus Estimate by 17.37%. The earnings per share (EPS) also demonstrated substantial growth, coming in at $0.62, a rise from the prior year's $0.49 and an EPS surprise of almost 17%. HASI's financial tenacity is evidenced not only by revenue growth but also by its strength in profitability.

The company's financials were buoyed by impressive gains in specific revenue streams. Interest income was a particularly strong area, reported at $54.30 million, outpacing three analysts average estimate of $49.46 million and displaying a significant 58.3% year-over-year hike. Conversely, rental income experienced a decline, falling short of expectations at $6.04 million. Alternatively, the gain on sale of receivables and investments climbed to $22.41 million, showing a positive year-over-year trajectory. These mixed results reflect the company's growth alongside certain challenges in specific market segments.

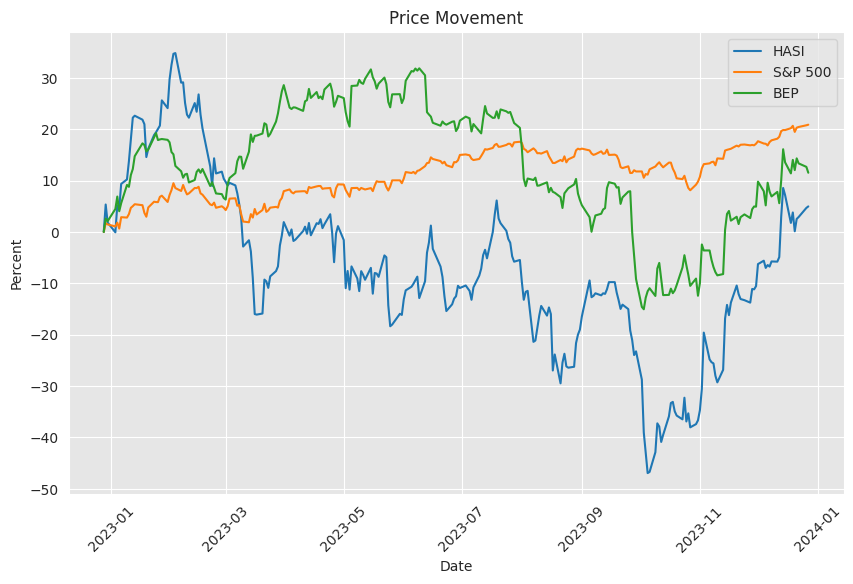

Despite generally favorable financial metrics, HASI has been given a Zacks Rank #4 (Sell), implying a potential underperformance in the market. This speculative forecast contrasts with the stock's recent positive return of 14.6%, which comfortably outperformed the S&P 500 composite. This dissonance suggests that while HASI demonstrates financial growth, there are underlying factors that have contributed to Zacks' cautious stance on the company's stock.

The overall performance of renewable energy stocks, including HASI, shed light on the sector's sensitivity to external economic forces. During a notable week, the shares of key industry players like Hannon Armstrong experienced substantial appreciations. HASI's stock, for instance, jumped by as much as 18.2% within the week. This resurgence was attributed partly to fluctuations in long-term interest rates, which have a direct impact on the economic viability of solar projects. A dip in the rates on 10-year U.S. Treasuries from over 4.8% to 4.63% reflected positively on companies engaged in solar financing and installation.

Moreover, the sector has been influenced by a shift in cost dynamics. For instance, preliminary reports from Maxeon Solar Technologies indicated that suppliers faced reduced profitability and decreased shipments, hinting at aggressive negotiations by solar installers to maintain margins. Concurrently, the ascent in energy commodities' prices, encouraging a competitive stance for renewable sources, has also impacted the sector, further reshaping the investment landscape.

Despite prevailing positive aspects of HASI's financial situation, a significant earnings shortfall was observed in Q3 2023, with an EPS of $0.0002, far below the anticipated $0.53. This discrepancy raises concerns but is juxtaposed against the company's assertion of the continued competitiveness of renewable energy projects amid heightened capital costs. The company cites strong demand and the ability to pass project costs to end-users as factors contributing to its optimistic outlook.

HASI's transaction volumes, nearing $1 billion for the quarter, indicate a high level of strategic capital allocation, reflective of annual volumes from preceding years. The diversified investment pipeline, showcasing investments with projected yields exceeding 10%, aligns with the company's continued growth expectations. This diversity underpins the company's resilience and commitment to long-term strategic planning within the sustainable infrastructure market.

On the subject of financial stability, HASI reported record distributable earnings and a significant uptick in its portfolio value. The company's leverage management and hedging of majority debt showcase a prudent and sustainable fiscal policy. These financial manoeuvrings highlight HASI's strategy of maintaining a healthy spread between investment yields and the cost of capital, ensuring returns on equity and shaping a solid path for both growth and profitability.

HASI announced conducting a private offering of $500 million in green senior unsecured notes, underlining a strategic intent to capitalize on investment opportunities. The company's goal aligns with environmental objectives, with proceeds from the offering being allocated towards eligible green projects which include a wide range of sustainable ventures from energy generations to nature conservation. This accumulated capital from green bonds outlines HASI's steadfast role in supporting sustainable projects that are both financially viable and environmentally sound.

These initiatives underscore HASI's expertise as a financier dedicated to sustainability, with the company actively maintaining a business model compatible with REIT taxation qualifications and ensuring an efficient capital allocation. The private offering provides a means for HASI to contribute significantly to the growing market for sustainable energy, which is especially pertinent given its diverse pipeline of investment opportunities.

HASIs careful financial strategy, including asset rotation and capital raising efforts, paints a picture of a company constantly seeking opportunities to fortify its balance sheet and maintain a sustainable trajectory for growth. This mirrors the company's tactical approach to navigating an uncertain market climate, which is notable in their concerted efforts to broaden their reach without overextending their equity.

The firm also makes strategic repositioning decisions, evident in its shift from a REIT to a C-Corporation, beginning January 1, 2024. While the implications of this change are yet to be fully realized, HASI's existing net operating losses are expected to preserve tax efficiency, thereby continuing to appeal to a range of investors and potential partners. HASIs transition reflects an adaptive corporate strategy designed to exploit the increasing market for clean energy across various sectors.

The reclassification to a C-Corporation is anticipated to confer HASI greater flexibility as it seeks to take full advantage of the growing opportunities within the energy transition space. The companys leadership expects this structural change to augment its participation in the clean energy sector, capitalizing on existing market trends and evolving policy landscapes. Despite the change in tax status, HASI reassures investors of continued commitment to its dividend policy.

HASI's current role as an investing conduit for sustainable infrastructure projects rests on a robust foundation of shareholder value. The company's focus on assets that directly support a low-carbon economy, paired with a substantial dividend yield, presents HASI as an inviting option for income-oriented investors. Given the anticipated influx of capital into clean energy transition, HASI's investments in a broad spectrum of renewable and efficiency-oriented infrastructure projects poised for substantial growth.

Nevertheless, the market for solar energy stocks has confronted turbulence, noting shifts in installation rates and increased costs leading to a depression of profits. HASI's position as a financier, rather than a direct participant in solar technology production, allows it some degree of isolation from such volatility. Nevertheless, an understanding of the intrinsic cyclicality of the sector is paramount for investors and HASI alike, emphasizing the need to harness the long-term growth trajectory amidst near-term challenges.

HASI's strategic orientation is geared towards investing in projects that reflect a longstanding commitment to environmental sustainability. As the investment company funnels capital into clean energy technologies, it showcases an ability to adapt and innovate in response to market trends. This strategically selective approach aims to ensure the longevity of investments and their alignment with environmental standards, while also securing reasonable, risk-adjusted returns for investors.

Hannon Armstrongs distinct approach to financing sustainable infrastructure offers both income through dividends and potential growth, reflecting the company's commitment to supporting a transition to more sustainable forms of energy. Central to its operations are long-term contracts that provide a level of predictability in investments, aiding in the delivery of dividends and boosting investor confidence.

Focused on a future where renewable solutions become central to energy infrastructure, HASI is structuring itself to effectively participate in the global clean energy movement. The transitioning market presents HASI with substantial opportunities to provide finance for infrastructure development, reinforcing its position as a significant facilitator of green investments.

As one evaluates investment routes in sustainable energy, avenues such as HASI provide alternatives to betting on specific energy technologies. The company's provision of loans ensures investor engagement in this transition through diversified, low-risk paths. HASI's steadily growing dividend and expansive investment pipeline also highlight its ability to offer a stable and potentially lucrative investment in the maturation of the renewable energy sector.

Hannon Armstrong's Q3 2023 earnings call echoes the sentiment of a profitable and impactful quarter, with a record-breaking distributable earnings performance. The management confidently discusses the operational achievements, emphasizing HASI's commitment to pushing the boundaries of the clean energy market. The assurance from company leaders about HASI's prospects, despite broader concerns about the economic environment and energy project costs, attests to a continuous strategic approach and financially resilient positioning.

With the expected long-term market developments in renewable energy squarely in view, Hannon Armstrong seems poised for expansion. Its expertise in sustainable infrastructure finance and the company's positioning to capitalize on this space fortify its prospects, as it seeks to navigate future industry shifts and economic currents effectively. The company's model, delivering environmentally beneficial projects alongside potentially appealing investment returns, stands as testament to HASI's potential as both a progressive and strategic player in the field of sustainable finance.

The versatility displayed by HASI through a variety of strategic moves reflects not only a response to current market conditions but also a forward-thinking approach to ensure ongoing alignment with the ever-evolving renewable energy landscape. Through its adjustments and adherence to a broad investment mandate, HASI aims to secure its standing as a diversified, resilient entity capable of supporting the future of clean energy infrastructure, even as it treads through the inherent volatility of the current financial environment.

Similar Companies in Renewable Electricity:

Brookfield Renewable Partners L.P. (BEP), Report: NextEra Energy, Inc. (NEE), NextEra Energy, Inc. (NEE), Atlantica Sustainable Infrastructure plc (AY), Clearway Energy, Inc. (CWEN), Sunrun Inc. (RUN), First Solar, Inc. (FSLR), Enphase Energy, Inc. (ENPH)

News Links:

https://finance.yahoo.com/news/hannon-armstrong-hasi-q3-earnings-000010554.html

https://finance.yahoo.com/news/hannon-armstrong-sustainable-infrastructure-capital-132732847.html

https://finance.yahoo.com/news/hasi-announces-proposed-private-offering-122600584.html

https://www.fool.com/investing/2023/10/13/why-renewable-energy-stocks-jumped-this-week/

https://finance.yahoo.com/news/14-best-short-term-stocks-144338037.html

https://www.fool.com/investing/2023/08/17/ultra-high-yield-stocks-help-retire-millionaire/

https://www.fool.com/investing/2023/06/23/3-top-solar-energy-stocks-to-buy-now/

https://finance.yahoo.com/news/hasi-announces-conversion-c-corporation-211500957.html

https://www.fool.com/investing/2023/11/07/solar-energy-stocks-everything-you-need-to-know-to/

https://www.fool.com/investing/2023/07/07/dont-have-to-pick-winner-clean-energy-bep/

https://www.fool.com/investing/2023/08/05/5-incredible-dividend-stocks-to-buy-now/

https://www.fool.com/investing/2023/08/31/5-dividend-stocks-i-love-right-now/

https://www.fool.com/investing/2023/12/03/you-dont-have-to-pick-a-winner-in-clean-energy-her/

https://finance.yahoo.com/news/q3-2023-hannon-armstrong-sustainable-110552046.html

https://www.fool.com/investing/2023/09/10/3-top-high-yield-stocks-to-buy-in-september/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: DePOse

https://reports.tinycomputers.io/HASI/HASI-2023-12-28.html Home