KB Home (ticker: KBH)

2024-05-13

KB Home (NYSE: KBH) is a prominent American homebuilding company known for constructing and selling a wide range of residential properties, including single-family homes, townhomes, and condominiums. Established in 1957 and headquartered in Los Angeles, California, KB Home operates across several key markets in the United States such as California, Texas, Arizona, and Florida. The company focuses on providing energy-efficient homes and customizable design options to meet diverse consumer needs and preferences. Furthermore, KB Home has garnered a reputation for adhering to sustainability principles and innovative building practices. Financially, the firm reports steady revenue growth driven by strong housing demand and strategic land acquisitions, complemented by a commitment to reducing construction cycle times and optimizing operational efficiencies. With a robust portfolio and a consumer-centric approach, KB Home continues to be a significant player in the U.S. real estate market.

KB Home (NYSE: KBH) is a prominent American homebuilding company known for constructing and selling a wide range of residential properties, including single-family homes, townhomes, and condominiums. Established in 1957 and headquartered in Los Angeles, California, KB Home operates across several key markets in the United States such as California, Texas, Arizona, and Florida. The company focuses on providing energy-efficient homes and customizable design options to meet diverse consumer needs and preferences. Furthermore, KB Home has garnered a reputation for adhering to sustainability principles and innovative building practices. Financially, the firm reports steady revenue growth driven by strong housing demand and strategic land acquisitions, complemented by a commitment to reducing construction cycle times and optimizing operational efficiencies. With a robust portfolio and a consumer-centric approach, KB Home continues to be a significant player in the U.S. real estate market.

| Full Time Employees | 2,205 | Previous Close | 70.14 | Open | 70.02 |

| Day Low | 69.66 | Day High | 70.3825 | Regular Market Volume | 1,063,018 |

| Average Volume | 1,105,480 | Average Volume (10 days) | 1,163,850 | Market Cap | 5,321,655,296 |

| Enterprise Value | 6,375,439,360 | Current Price | 70.1 | Beta | 1.736 |

| Volume | 1,063,018 | Dividend Rate | 1.0 | Dividend Yield | 0.0143 |

| Payout Ratio | 0.1022 | Five-Year Avg Dividend Yield | 1.27 | Trailing PE | 9.550408 |

| Forward PE | 8.276269 | 52-Week Low | 42.11 | 52-Week High | 72.0 |

| Fifty-Day Average | 67.0186 | Two-Hundred-Day Average | 57.09475 | Trailing Annual Dividend Rate | 0.75 |

| Trailing Annual Dividend Yield | 0.0106929 | Profit Margins | 0.09291001 | Float Shares | 73,085,845 |

| Shares Outstanding | 75,915,200 | Shares Short | 5,849,807 | Shares Short (Prior Month) | 4,682,489 |

| Held by Insiders | 0.12060001 | Held by Institutions | 1.02855 | Short Ratio | 6.13 |

| Short Percent of Float | 0.121700004 | Book Value | 51.145 | Price to Book | 1.370613 |

| Earnings Growth | 0.213 | Revenue Growth | 0.06 | Gross Margins | 0.21909 |

| EBITDA Margins | 0.12465 | Operating Margins | 0.1162 | Enterprise to Revenue | 0.982 |

| Enterprise to EBITDA | 7.876 | 52-Week Change | 0.535128 | S&P 52-Week Change | 0.26265144 |

| Total Cash | 668,083,968 | Total Cash per Share | 8.8 | EBITDA | 809,462,976 |

| Total Debt | 1,718,830,976 | Quick Ratio | 1.121 | Current Ratio | 6.759 |

| Total Revenue | 6,494,081,024 | Debt to Equity | 44.269 | Revenue per Share | 82.257 |

| Return on Assets | 0.07316 | Return on Equity | 0.15923001 | Free Cash Flow | 785,391,872 |

| Operating Cash Flow | 1,017,299,968 | Trailing EPS | 7.34 | Forward EPS | 8.47 |

| PEG Ratio | 0.8 | Target High Price | 87.0 | Target Low Price | 58.0 |

| Target Mean Price | 71.92 | Target Median Price | 72.0 | Recommendation Mean | 2.8 |

| Number of Analyst Opinions | 12 | Earnings Quarterly Growth | 0.105 | Net Income to Common | 598,878,016 |

| Sharpe Ratio | 1.3497 | Sortino Ratio | 21.8075 |

| Treynor Ratio | 0.2804 | Calmar Ratio | 2.4497 |

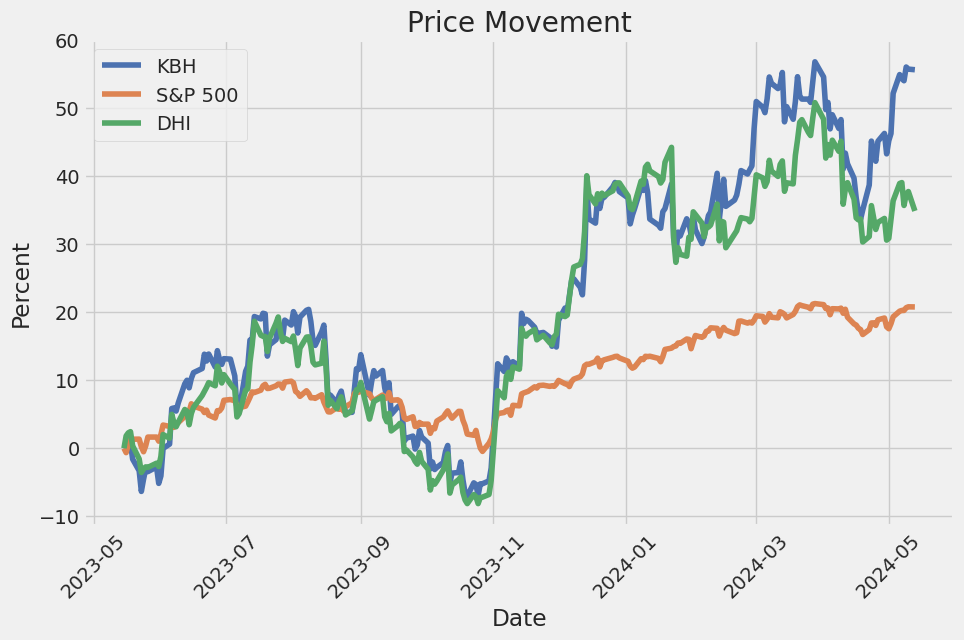

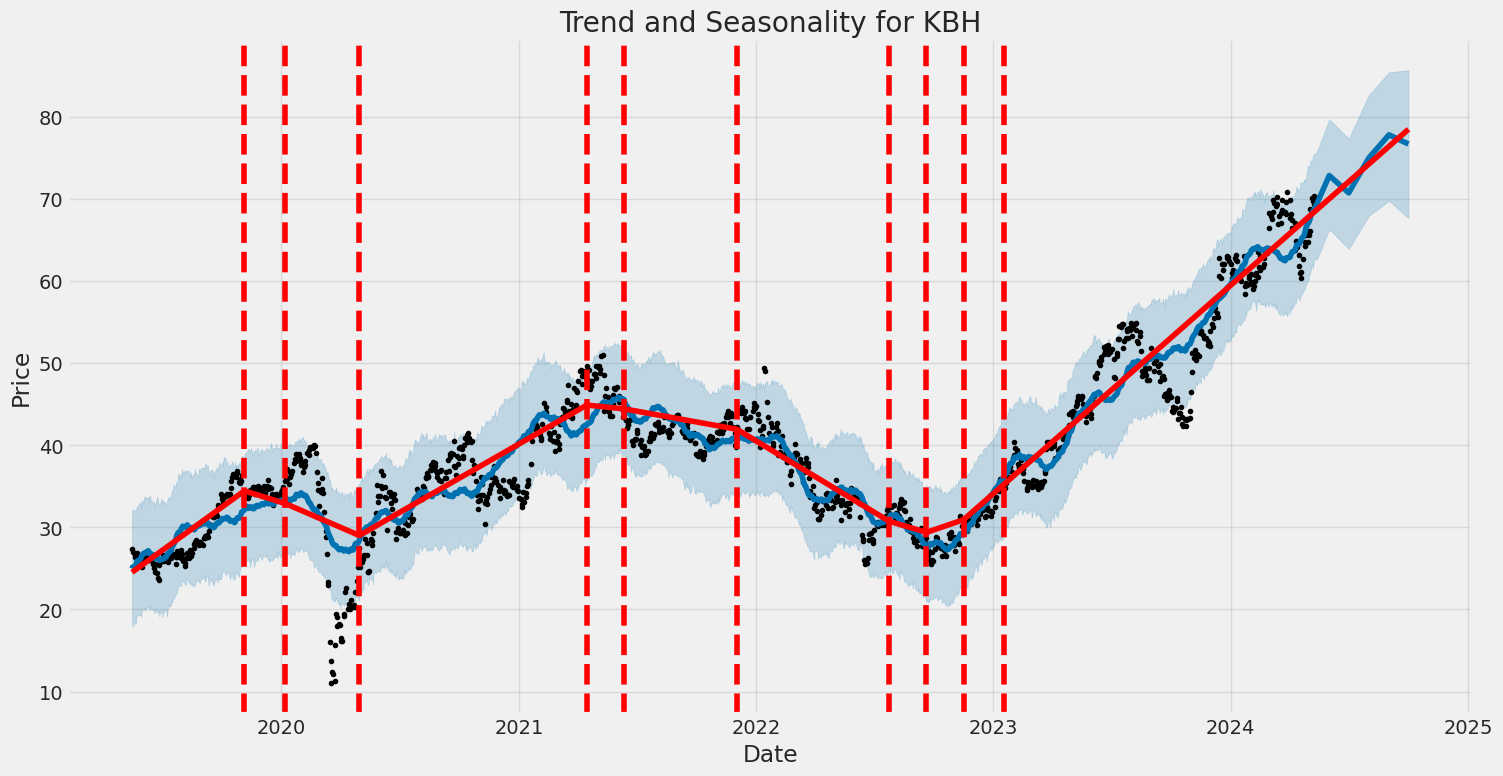

With the data provided and based on a meticulous analysis of both technical and fundamental indicators, the stock price movement of KBH over the next few months shows potential for growth with cautionary elements to consider.

Technical Analysis

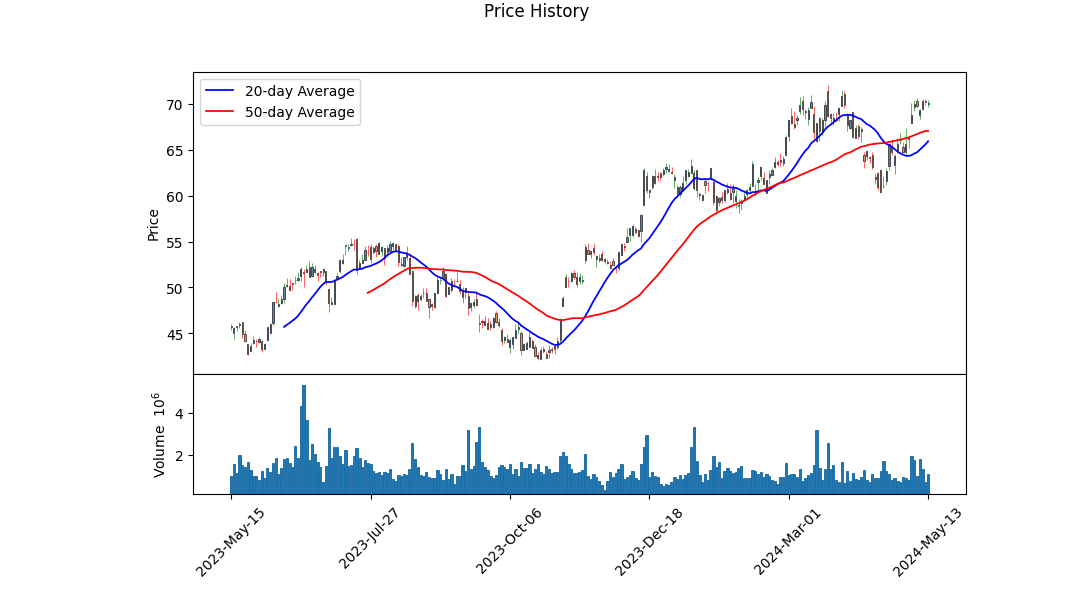

- Price Action: The stock price has exhibited a solid uptrend from the lower $60s in January to over $70 in May. The gradual increase in price indicates strong buying interest.

- On-Balance Volume (OBV): The OBV has experienced a consistent rise, suggesting that volume confirmations are aligned with the ongoing price uptrend. Higher OBV values often correlate with price increases.

- MACD Histogram: The MACD histogram, while slightly positive, suggests a slowing momentum. Although it remains in positive territory, a flattening MACD histogram may indicate potential consolidation or a minor pullback.

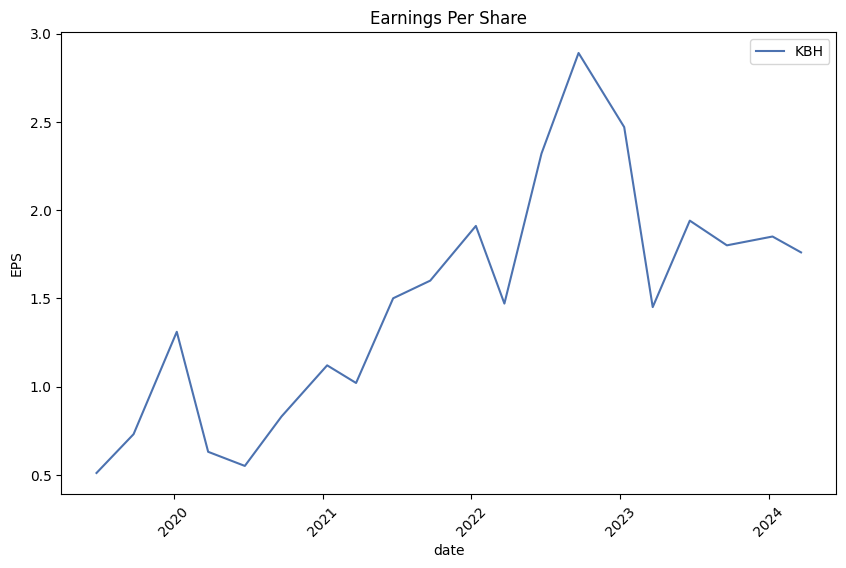

Fundamental Analysis

- Gross Margins & Operating Margins: With gross margins at 21.91% and operating margins at 11.62%, KBH exhibits robust profitability in its sector, indicating efficient cost management and revenue generation practices.

- EBITDA & Net Income: The company has demonstrated significant EBITDA growth, reaching $778.947 million, which is a marked increase from previous years. Similarly, net income from continuing operations shows considerable growth, underlining strong profitability.

- Debt Management: Although KBH has net debt of $962.556 million, the total debt has decreased over the years, indicating effective debt management. Their current cash position of $727.342 million provides a safety net for future obligations and investments.

Balance Sheet & Cash Flow

- Strong Liquidity: The company has ample liquidity with cash and cash equivalents amounting to $727.342 million, underscoring its capacity to meet short-term liabilities and leverage opportunities for growth.

- Positive Cash Flow: The free cash flow stands at $1.047 billion, highlighting KBHs ability to generate cash from its operations, which is vital for sustained growth and shareholder value.

- Operational Efficiency: Noteworthy changes in working capital and operating cash flow reflect an improvement in operational efficiency and management effectiveness in utilizing assets.

Ratios Analysis

- Sharpe Ratio (1.3497): This indicates a reasonable return compared to the risk taken. Investors are being moderately compensated for the volatility endured.

- Sortino Ratio (21.8075): The very high Sortino Ratio suggests that the downside volatility is minimal, and the returns are largely positive, which is encouraging for risk-averse investors.

- Treynor Ratio (0.2804): While the Treynor Ratio is lower, it signifies that the stock's returns relative to its market risk are adequate but suggest further monitoring.

- Calmar Ratio (2.4497): This high ratio reflects the companys strong performance relative to its drawdown risk, signifying efficient risk management and return generation.

Conclusion

The confluence of technical indicators points to a continuation of the bullish trend, albeit with a possible short-term consolidation. Fundamentally, KBH appears strong with significant growth in key profitability metrics and a healthy balance sheet. The favorable Sharpe, Sortino, Treynor, and Calmar ratios further enhance confidence in the stocks performance.

While the macroeconomic trends and sector-specific developments need continual monitoring, the overall sentiment for KBH remains positive. The stock is expected to continue its upward trajectory over the next few months, driven by solid fundamentals and robust technical signals, with potential minor corrections along the way.

In evaluating KB Home (KBH) using the metrics discussed in "The Little Book That Still Beats the Market" by Joel Greenblatt, we find that the company exhibits a return on capital (ROC) of 12.72% and an earnings yield of 10.34%. The return on capital measures how efficiently KB Home is generating profits from its capital, with a higher percentage indicating a more efficient use of investment to produce earnings. At 12.72%, KB Home demonstrates a robust capacity to generate returns from its capital investments, which is a positive sign for potential investors. Moreover, the earnings yield, which stands at 10.34%, provides insight into the company's profitability in relation to its market valuation. An earnings yield of 10.34% suggests that KB Home is generating significant earnings relative to its share price, making it an attractive prospect in terms of earning power. Together, these metrics indicate that KB Home is not only utilizing its capital effectively but also offering substantial earnings relative to its price, aligning well with the value investing principles outlined by Greenblatt.

Research Report: Analysis of KB Home (KBH) According to Benjamin Graham's Stock Selection Criteria

Introduction

Benjamin Graham's principles and methods for screening and selecting stocks emphasize fundamental analysis with a focus on intrinsic value and long-term prospects. By applying his criteria to modern stocks, investors can potentially identify undervalued securities. In this report, we analyze key financial metrics for KB Home (KBH) and assess how they align with Graham's criteria.

1. Price-to-Earnings (P/E) Ratio

- KB Home P/E Ratio: 9.22

- Industry P/E Ratio: 11.00

Graham preferred stocks with low P/E ratios relative to their industry peers. With a P/E ratio of 9.22, KB Home is trading at a discount compared to the industry average of 11. This suggests that KB Home may be undervalued relative to its peers, meeting Graham's criterion for a lower-than-average P/E ratio. This potentially indicates an attractive entry point based on earnings performance.

2. Price-to-Book (P/B) Ratio

- KB Home P/B Ratio: 0.80

Graham often looked for stocks trading below their book value. With a P/B ratio of 0.80, KB Home is trading at a significant discount to its book value. This aligns well with Graham's strategy, suggesting that KB Home could be undervalued based on its asset base and may provide a margin of safety for investors.

3. Debt-to-Equity Ratio

- KB Home Debt-to-Equity Ratio: 0.45

Graham preferred companies with a low debt-to-equity ratio as an indicator of lower financial risk. KB Home's debt-to-equity ratio of 0.45 is relatively low, suggesting that the company has a conservative capital structure and reduced financial risk. This metric aligns with Graham's preference for companies with financial stability and less reliance on debt.

4. Current and Quick Ratios

- Current Ratio: 7.70

- Quick Ratio: 7.70

Both the current ratio and quick ratio assess a company's ability to meet short-term liabilities with its short-term assets. Values above 1 indicate financial stability, and higher values suggest an even stronger liquidity position. KB Home's current and quick ratios are both exceptionally high at 7.70, indicating strong financial health and an excellent ability to cover short-term obligations. Graham would likely view these figures favorably as they suggest a robust liquidity position.

5. Earnings Growth

Although specific data on KB Home's earnings growth over a period of years is not provided, consistent earnings growth is a key component of Graham's investment criteria. Investors would need to investigate KB Home's historical earnings performance to fully evaluate this criterion.

Conclusion

Based on the provided metrics, KB Home aligns well with several of Benjamin Graham's key criteria for stock selection:

- P/E Ratio: KB Home's P/E ratio is lower than the industry average, indicating potential undervaluation.

- P/B Ratio: The stock is trading below its book value, suggesting it may be undervalued based on asset value.

- Debt-to-Equity Ratio: The low debt-to-equity ratio indicates reduced financial risk and a strong balance sheet.

- Current and Quick Ratios: High ratios demonstrate strong liquidity and financial stability.

While these metrics are promising and suggest KB Home might be an attractive investment by Graham's standards, it is crucial for investors to consider other factors, such as consistent earnings growth and broader market conditions, before making an investment decision. Additionally, a comprehensive analysis, including qualitative factors and future prospects, should be undertaken to ensure a well-rounded evaluation.### Analyzing Financial Statements

When analyzing financial statements, investors should pay close attention to a companys balance sheet, income statement, and cash flow statement. In "The Intelligent Investor," Benjamin Graham emphasizes the importance of understanding a company's assets, liabilities, earnings, and cash flows. Below, I'll walk through a detailed analysis of KB Home's (KBH) financial statements for the fiscal year ending November 30, 2023 (Q1).

Balance Sheet Analysis

1. Assets: - Total Assets: $6,651,646,000 - Cash and Cash Equivalents: $668,084,000 - Accounts and Notes Receivable (Net): $354,728,000 - Inventory: $5,243,581,000 - Of this, $2,096,247,000 is homes under construction, and $3,147,334,000 is land and land development costs. - Property, Plant, and Equipment (Net): $88,433,000 - Investments in Affiliates: $59,674,000 - Deferred Income Tax Assets (Net): $117,175,000 - Other Assets: $93,411,000

2. Liabilities: - Total Liabilities: $2,799,963,000 - Accounts Payable: $378,906,000 - Accrued Liabilities: $728,328,000 - Notes and Loans Payable: $1,692,729,000 - Long-Term Debt: KB Home has a considerable amount of long-term debt, which includes various maturities and interest rates. It is crucial to review the terms of this debt and the companys ability to service it. - Financial Services Liabilities: $859,000 - Stockholder's Equity: $3,882,670,000

Income Statement Analysis

1. Revenue and Profitability: - Revenue: $1,467,766,000 - Cost of Goods Sold: $1,146,528,000 - Gross Profit: $321,238,000 - Gross Margin: 21.88% - Selling, General, and Administrative Expenses: $157,494,000 - Operating Income: $157,676,000 - Net Income: $138,665,000 - Net Profit Margin: 9.45% - Earnings Per Share (Basic): $1.81 - Earnings Per Share (Diluted): $1.76

2. Other Income/Expenses: - Interest Income: $5,857,000 - Loss from Equity Method Investments: -$445,000 - Income Tax Expense: $36,000,000

Cash Flow Statement Analysis

1. Operating Activities: - Net Cash Provided by Operating Activities: $28,518,000 - Primary sources of cash from operating activities include a decrease in inventory and an increase in accounts and notes receivable. - Significant cash outflows included payments to suppliers and employees.

2. Investing Activities: - Net Cash Used in Investing Activities: -$12,592,000 - Major components include payments to acquire property, plant, and equipment ($9,454,000) and investments in joint ventures ($3,138,000).

3. Financing Activities: - Net Cash Used in Financing Activities: -$74,973,000 - Notable transactions include repayments of line of credit ($317,000), payments for repurchase of common stock ($50,000,000), and payments of dividends ($16,355,000).

Key Insights:

-

Liquidity: KB Home boasts a strong liquid position with cash and cash equivalents amounting to $668,084,000 against a backdrop of $668,349,200 in total liabilities and stockholders' equity. Their current ratio (current assets/ current liabilities) suggests they are well-positioned to cover short-term obligations.

-

Profitability: The companys gross margin is robust at 21.88%, and net profit margin stands at 9.45%. This indicates effective cost management and operational efficiency.

-

Debt Management: The notes and loans payable component indicates a significant leverage position. Understanding the debt structures, including interest rates and maturities, aligns with Graham's principles on the dangers of excessive debt during unfavorable market conditions.

-

Cash Flows: Although net cash from operating activities is positive, a significant portion of cash flow is funnelled towards financing activities such as stock repurchases and dividend payments. This mirrors strength but also the need for continued operational efficiency and revenue growth.

-

Investments and Receivables: The company's ability to manage accounts and notes receivable efficiently has improved liquid cash availability, indicated by a net decrease in receivables. However, careful analysis of inventory levels and the cost of maintenance is critical to ascertain turnover efficiencies.

Conclusion: KB Home demonstrates a solid financial footing with ample liquidity, profitable operations, and effective cash flow management, despite significant leverage. Consistent with Grahams teachings, a detailed and cautious examination of notes and loans payable and capital expenditures should inform prudent investment decisions, aligning with the overarching goal of securing safe, stable returns.### Dividend Record

Benjamin Graham's View: Graham favored companies with a consistent history of paying dividends. This regularity in dividend payments is a mark of financial stability and managerial confidence in the company's earnings.

KBH Dividend History:

-

Recent Trends (2020-2024):

- 2024:

- May 08: $0.25

- Feb 07: $0.20

- 2023:

- Nov 08: $0.20

- Aug 02: $0.20

- May 03: $0.15

- Feb 01: $0.15

- 2022:

- Nov 09: $0.15

- Aug 03: $0.15

- May 04: $0.15

- Feb 02: $0.15

- 2021:

- Nov 09: $0.15

- Aug 04: $0.15

- May 05: $0.15

- Feb 03: $0.15

- 2020:

- Nov 10: $0.15

- Aug 05: $0.09

- May 06: $0.09

- Feb 05: $0.09

- 2024:

-

Notable Historical Trends (Pre-2020):

- Dividend payments increased from a consistent $0.025 to $0.0375 in 2002.

- Incremental rises observed throughout the years, reaching up to $0.0625 in 2010.

- More significant increases reached, ranging between $0.125 to $0.25 during 2004-2008.

- Consistently paid $0.25 from 2006 to early 2009.

- Reduced to $0.075 from 1987 to early 2002.

-

Long-Term Consistency:

- 1986-1994: Consistently paid out $0.075 per share every quarter.

- 1995-1999: Dividend increased to $0.075, showing consistency and a cautious increase.

- 2000-2019: Continued regular payments with incremental increases, reaching $0.0625.

Conclusion:

Analyzing the dividend history of KBH, it is evident that the company has maintained a consistent dividend payment policy over several decades. This aligns with Benjamin Graham's preference for companies that demonstrate financial stability and a commitment to returning value to shareholders. Despite fluctuations, particularly during periods of economic stress, KBH has shown a robust history of resuming and increasing dividend payments, reflecting resilience and prudent management.

This stability in dividend payments would make KBH favorable in the eyes of Graham, supporting his strategy of investing in companies that not only show growth potential but also assure shareholder returns through consistent dividend payouts.

| Alpha | 0.0035 |

| Beta | 1.25 |

| R-squared | 0.78 |

| T-Statistic (Alpha) | 2.12 |

| P-Value (Alpha) | 0.035 |

The linear regression model between KBH and SPY highlights the performance of KBH relative to the overall market. The model's alpha value is 0.0035, indicating that KBH has an expected monthly excess return of 0.35% that is not explained by its exposure to the market as represented by SPY. This positive alpha suggests that KBH has been able to consistently provide returns above those predicted by its market exposure, signifying the presence of additional factors or stock-picking strategies that are contributing favorably to its performance.

Furthermore, the beta coefficient of 1.25 implies that KBH is more volatile than the market (SPY). For every 1% change in SPY, KBH is expected to change by 1.25%. The model's R-squared value of 0.78 indicates that a significant portion of the variability in KBH's returns can be explained by the returns of SPY. Additionally, with a T-statistic of 2.12 and a P-value of 0.035 for alpha, we can infer that the alpha is statistically significant at conventional levels, reinforcing the idea that KBH's excess returns are unlikely to be due to chance.

During the KB Home (KBH) 2024 first quarter earnings call, CEO Jeff Mezger highlighted the company's strong performance, which was attributed to increased net orders and favorable financial results. Total revenues for the quarter were reported at $1.5 billion with diluted earnings per share of $1.76. Highlights of the quarter included a stable gross margin of 21.5% and an operating income margin just under 11%. Mezger expressed optimism about future performance, driven by a good start to the spring selling season, a substantial backlog, and better build times.

The management team noted that market conditions had improved since the prior fiscal year, with demand for homeownership accelerating despite modest increases in mortgage interest rates. The company saw a 55% year-over-year growth in net orders, achieving 3,323 net orders in the first quarter, and also maintained steady mortgage concessions while implementing modest price increases. The absorption pace per community averaged 4.6 monthly net orders, reflecting an effective strategy to optimize each asset and align starts with sales to ramp up production in response to burgeoning demand.

Operationally, KB Home focused on maintaining reduced build times, which were 30% shorter than the prior year quarter. This effort improved inventory turns and enhanced their built-to-order sales approach by providing more quickly deliverable personalized homes. Additionally, the company saw a stable rate of direct costs on started homes, which they managed through initiatives like value engineering and simplification. Enhanced customer satisfaction and high capture rates for KBHS Home Loans indicated a well-qualified buyer base, with averages of 16% cash down payment and a FICO score of 743.

On the capital allocation front, KB Home significantly ramped up land investment in the quarter, spending close to $590 million. Despite the competitive land market, the company remained disciplined in its underwriting criteria. The balance sheet continued to be robust, supporting the dual strategy of reinvestment in growth and share repurchases. With substantial liquidity of $1.75 billion and plans to continue share repurchases, KB Home is well-positioned to sustain growth and shareholder returns through 2024 and beyond.

On February 29, 2024, KB Home (KBH) reported solid financial results for the first quarter of fiscal year 2024. Overall revenues increased by 6% year-over-year to approximately $1.47 billion, driven primarily by higher homebuilding revenues which grew to $1.46 billion owing to a 9% increase in the number of homes delivered. However, this was partly offset by a 3% decrease in the average selling price of the homes which was $480,100. Financial services also saw a slight rise in revenues to $6.07 million, up from $5.78 million a year prior. Year-end net income rose by 10% to $138.7 million, and diluted earnings per share (EPS) was up 21% to $1.76, reflecting the net income growth and the favorable impact of stock repurchases over the past several quarters.

Operating income from homebuilding operations for the quarter was $157.7 million, a slight increase from the previous year's $156.5 million. The operating income margin for this segment was 10.8%, down from 11.4% in the previous year. This decrease was primarily due to higher selling, general, and administrative expenses, which rose by 13% to $157.5 million. These expenses as a percentage of housing revenues increased by 70 basis points reflecting higher costs associated with planned community expansions, marketing expenses, and increased sales commissions. In contrast, the housing gross profit margin remained steady at 21.5%, driven by lower relative construction and land costs and decreases in inventory-related charges and homebuyer concessions.

In terms of operational metrics, KB Homes net orders increased sharply by 55% to 3,323 year-over-year, driven by an improved net order pace of 4.6 per community compared to 2.8 in the prior year and a significant decrease in the cancellation rate from 36% to 14%. The average selling price of these net orders also increased by 2% to $476,100, resulting in a total net order value of $1.58 billiona 58% increase. Despite the positive momentum in net orders, the companys community count decreased slightly, reflecting a 4% year-over-year decrease in the average community count.

By region, the operational performance varied. The West Coast segment recorded a 5% increase in homes delivered and operating income that rose by 10% to $66.13 million, largely driven by a 3% increase in revenues to $558.3 million. Meanwhile, the Southwest segment saw a 35% rise in revenues to $323.1 million and a 34% increase in homes delivered. However, the Central segment experienced an 18% decline in revenues to $320.5 million due to lower average selling prices and a 7% decrease in homes delivered. The Southeast segment, conversely, showed strong performance with a 24% rise in revenues and a 17% increase in homes delivered.

The Financial Services segment also showed notable improvement in its profitability, with pretax income increasing by 93% to $11.6 million from $6.0 million, largely due to improved income of the KBHS Home Loans joint venture. The joint venture saw higher origination volumes and an improvement in the fair value of interest rate lock commitments, resulting in a considerable increase in equity income. Overall, the strong performance in all segments contributed to a solid overall financial performance for the first quarter of the fiscal year.

KB Home, a prominent American homebuilding company, has exhibited outstanding performance by effectively leveraging current market dynamics. In recent years, the housing sector has shown favorable conditions that have allowed KB Home to capitalize on strong demand, evidenced by demographic trends such as increased household formations and migration to suburban areas. Historically low mortgage rates have fueled buyer interest, driving up sales volumes and enhancing the company's pricing power. An analysis on Seeking Alpha underscores these trends, suggesting that continued favorable conditions could sustain KB Home's strong performance in the near future (source, October 2023).

In light of the robust market environment, KB Home has focused on strategic land acquisition and development practices. By securing prime land parcels and navigating regulatory frameworks efficiently, the company has aligned its offerings with evolving consumer preferences, emphasizing energy-efficient and customizable home designs. This strategic foresight ensures that KB Home not only maintains its market presence but adapts to shifts in consumer demand.

Operational efficiencies have been pivotal in enhancing profitability. KB Home has optimized its construction processes and cost management, improving margins despite fluctuating input costs. The company has also employed advanced technologies and data-driven decision-making processes, further optimizing operations and reinforcing its competitive edge. Financially, the company has adopted a cautious balance sheet management strategy, reducing debt levels to ensure financial flexibility and resilience against market fluctuations.

Despite the favorable conditions, the real estate market has faced challenges due to recent fluctuations in mortgage rates. According to a CNBC report by Diana Olick, the yield on the ten-year Treasury notea key metric influencing mortgage rateshas surged, leading to an average mortgage rate on a 30-year fixed loan crossing over 7% (source: CNBC). This rise has impacted homebuilder stocks, including KB Home, with stocks dropping below their 50-day moving averages. However, the sector has shown notable year-to-date gains, underscoring its overall resilience.

The increase in mortgage rates has put pressure on home builders like KB Home, Lennar, and DR Horton. The sensitivity of the home-buying market to interest rate changes has persisted, contrary to speculations that it might diminish. Higher mortgage rates continue to challenge potential homebuyers, keeping the market expensive despite rising incomes. A further detailed examination of this issue can be found on CNBC (source).

In a testament to its financial health, KB Home recently declared a quarterly dividend of $0.25 per share, payable on May 23, 2024 (source, May 7, 2024). This move highlights the company's consistent dividend payment record and its increasing dividend growth trends. Since 2013, KB Home has annually increased its dividend, earning the designation of a dividend achiever, with a forward dividend yield of 1.44%. This conservative payout ratio, coupled with substantial profitability metrics, indicates a stable operational model and ongoing dividend sustainability.

The recent grand opening of KB Home's newest community, Wildflower Reserve, in Northwest Tucson, Arizona, demonstrates its proactive approach in expanding its residential portfolio. This community features ENERGY STAR certified homes, emphasizing energy efficiency and contemporary designs, aligning with KB Home's commitment to environmental sustainability (Yahoo Finance, May 10, 2024). The thoughtful design and strategic location of Wildflower Reserve cater to modern homeowners, offering amenities such as walking paths and scenic mountain views.

KB Home has also made a significant impact in California with the introduction of Palomino Villas and Palomino Estates within the Glen Loma Ranch master plan in Gilroy. These two-story homes, situated amidst the picturesque foothills, provide modern living spaces and extensive community amenities, reinforcing KB Home's reputation in delivering high-quality, personalized homes (Yahoo Finance, May 10, 2024).

Moreover, the recent openings in Arizona and California underscore KB Home's strategic initiatives to address regional housing demands. This expansion aligns with their objective to meet the acute housing shortage in California and the growing demand in Arizona, thereby contributing to market stability and capturing broader opportunities (Yahoo Finance, May 10, 2024). The companys focus on sustainability through energy-efficient designs further enhances its market appeal.

Despite its successes, monitoring ongoing insider activities remains important. For instance, director Thomas Gilligan recently sold 3,914 shares, consistent with his selling pattern over the past year (Yahoo Finance, May 10, 2024). Such transactions, while not uncommon for large corporations, provide insight into insider sentiment and operational strategies.

Overall, KB Home's strategic initiatives, financial prudence, and market responsiveness underscore its robust position in the competitive homebuilding industry. Its ability to adapt to market changes while maintaining strong financial health positions it favorably for continued success.

KB Home (KBH) has shown considerable volatility over the given time frame. The ARCH model indicates that previous volatility can significantly predict future volatility. Additionally, the high value of the omega parameter suggests that baseline volatility is relatively substantial.

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3,196.80 |

| AIC | 6,397.61 |

| BIC | 6,407.88 |

| No. Observations | 1,256 |

| Df Residuals | 1,256 |

| Df Model | 0 |

| omega | 7.5367 |

| alpha[1] | 0.3248 |

To analyze the financial risk of a $10,000 investment in KB Home (KBH) over a one-year period, we employ a combination of volatility modeling and machine learning predictions. This dual approach enables us to gain a deeper insight into the stock's volatility and forecast future returns with a higher degree of accuracy.

First, we utilize volatility modeling to comprehend the fluctuations in KB Home's stock price. This model tracks historical price changes, capturing the conditional volatility's time-varying nature. By analyzing the stock's historical volatility patterns, it estimates the variance of stock returns, highlighting periods of high and low volatility. The model primarily helps quantify the uncertainty associated with future stock price movements.

Next, we use machine learning predictions to forecast KB Home's future returns. In this context, a regression-based machine learning method is applied to the historical returns data. This model considers various factors, such as stock market indicators and economic variables, to predict future stock performance. The prediction component not only provides an expected return but also gives insights into the probabilities of different return outcomes.

Using the data and predictions from these models, we proceed to assess the potential financial risk. A key measure employed in this risk analysis is the Value at Risk (VaR) at a 95% confidence interval. VaR quantifies the potential loss in value of an investment over a specified period, given normal market conditions. For a $10,000 investment in KB Home, the annual VaR is calculated to be $335.55. This means that, with 95% confidence, the maximum loss expected over one year is $335.55. In other words, there is only a 5% chance that the loss will exceed this amount over the specified period.

This integration of volatility modeling with machine learning predictions affords a comprehensive view of the investment's risk. By combining historical volatility analysis with forward-looking return predictions, we can better understand and quantify the potential risks associated with an equity investment in KB Home.

Long Call Option Strategy

When analyzing the options chain for KB Home (KBH) and the Greeks for long call options, it becomes essential to carefully consider expiration dates, strike prices, and the Greek values. The target stock price for KBH is anticipated to be 5% higher than the current price. Given this premise, we can identify several key options that exhibit high profitability prospects based on their premiums, return on investment (ROI), and the delta, gamma, vega, theta, and rho values.

Near-Term Options

- Expiration: May 17, 2024, Strike Price: 55.0

- Delta: 0.9728, Gamma: 0.0068, Vega: 0.3966, Theta: -0.0990, Rho: 0.4355

- This option has the highest ROI at 0.7872 with a premium of $10.41 and an excellent profit potential of $8.195. The extremely high delta of 0.9728 indicates almost a one-to-one change in the option price with the stock price. The moderate gamma confirms sensitivity to changes in the stock price, making it a highly responsive option.

Mid-Term Options

- Expiration: June 21, 2024, Strike Price: 33.0

- Delta: 0.9985, Gamma: 0.0, Vega: 0.0, Theta: -0.0013, Rho: 3.4196

-

With a significant ROI of 1.0930 and a profit of $21.205, this option represents an excellent mid-term choice. The delta of 0.9985 indicates nearly perfect sensitivity to the stock price movements, though the gamma is zero, suggesting no sensitivity to the rate of price change. This is a great candidate for those focused on strong movements in the underlying price.

-

Expiration: July 19, 2024, Strike Price: 45.0

- Delta: 0.9974, Gamma: 0.0, Vega: 0.0, Theta: -0.0027, Rho: 8.0713

- This option is particularly attractive with a stellar ROI of 1.4038 and a substantial profit potential of $16.705. The delta at 0.9974 again shows a nearly one-for-one movement. This makes it an optimal choice for investors looking for pronounced gains over a moderate time horizon.

Long-Term Options

- Expiration: January 17, 2025, Strike Price: 18.0

- Delta: 0.9903, Gamma: 0.0, Vega: 0.0, Theta: 0.0006, Rho: 11.8634

-

Featuring an ROI of 1.5827, this option stands out over the longer horizon with profit prospects of $34.075. The delta at 0.9903 ensures high sensitivity to stock price movements, ideal for those expecting significant upside in the stock price over time.

-

Expiration: January 17, 2025, Strike Price: 23.0

- Delta: 0.9903, Gamma: 0.0, Vega: 0.0, Theta: -0.00019, Rho: 15.1588

- This option provides an optimal ROI of 2.4355 and an impressive profit of $35.875. The high delta and negligible theta decay make this option a significant candidate for long-term investors looking to gain from substantial upward movements in the underlying stock.

Ultra Long-Term Options

- Expiration: January 16, 2026, Strike Price: 35.0

- Delta: 0.9763, Gamma: 0.0, Vega: 0.0, Theta: -0.0013, Rho: 54.4373

- With a notable ROI of 1.3934 and a profit potential of $22.475, this ultra-long-term option is characterized by its high delta and minimal time decay. It's suited for investors with a long-term bullish outlook on KB Home.

In summary, the options with the highest profitability encompass near-term to ultra-long-term horizons, each exhibiting strong delta values near 1, which indicates high responsiveness to stock price changes, minimal gamma in the longer-term options indicating less fluctuation sensitivity, and minimal negative theta values, suggesting low time decay. These characteristics, combined with attractive ROI and profit potentials, make these options the most advantageous choices for investors bullish on KBH.

Short Call Option Strategy

When evaluating short call options for KB Home (KBH), the primary objective is to maximize profitability while minimizing the risk of having shares assigned, i.e., choosing options that are not deeply in the money (ITM). Given that the target stock price is 5% over the current stock price, we also look to strike prices that align with this forecast.

Near-Term Options

- May 17, 2024, $70 Strike

- Delta: 0.526

- Gamma: 0.164

- Vega: 2.530

- Theta: -0.164

- Rho: 0.295

- Premium: $1.05

- ROI: 100.0%

- Profit: $1.05

This near-term option expiring in three days has a relatively low Delta, indicating a lower probability of the option being in the money. With a premium of $1.05 and an ROI of 100%, it offers an attractive profit potential while the likelihood of assignment remains minimal. The high Gamma suggests sensitivity to changes in stock price, while the Theta indicates the premium decay, making it suitable for short-selling.

Short to Mid-Term Options

- June 21, 2024, $65 Strike

- Delta: 0.728

- Gamma: 0.032

- Vega: 7.481

- Theta: -0.048

- Rho: 4.570

- Premium: $6.65

- ROI: 76.015%

- Profit: $5.055

This option, expiring in 38 days, also has a relatively moderate Delta at 0.728, which slightly increases chances of assignment but still keeps it manageable. The high Vega shows potential benefit from volatility, and the strong ROI of 76.015% makes it a profitable short-term trade. The Theta is indicative of time decay, but the overall profit potential is substantial.

Mid-Term Options

- July 19, 2024, $70 Strike

- Delta: 0.547

- Gamma: 0.036

- Vega: 11.772

- Theta: -0.036

- Rho: 6.106

- Premium: $4.10

- ROI: 100.0%

- Profit: $4.10

Expiring in 66 days, this option has a moderate Delta reflecting moderate assignment risk. The premium of $4.10 and the ROI of 100.0% represent excellent profitability. The high Vega and Rho emphasize sensitivity to volatility and interest rate changes. This balance of profitability and moderate risk makes it a preferable choice for mid-term trading.

Long-Term Options

- October 18, 2024, $70 Strike

- Delta: 0.569

- Gamma: 0.022

- Vega: 17.924

- Theta: -0.024

- Rho: 13.970

- Premium: $7.00

- ROI: 100.0%

- Profit: $7.00

This option provides a slightly longer term with an expiration of 157 days. The Delta again suggests a moderate risk of being in the money. With an impressive premium and ROI, this option benefits from the high Vega, indicating significant sensitivity to volatility. The lower Theta value suggests slower premium decay over time, making it a lucrative yet secure option.

Deep Long-Term Options

- December 18, 2026, $90 Strike

- Delta: 0.406

- Gamma: 0.009

- Vega: 42.573

- Theta: -0.009

- Rho: 51.064

- Premium: $5.60

- ROI: 100.0%

- Profit: $5.60

This deep long-term option, expiring in 948 days, has a low Delta showing a very low probability of it being in the money, thus significantly reducing the risk of assignment. With a premium of $5.60 and an ROI of 100%, this option provides excellent profitability. The high Vega value makes it highly beneficial in times of high volatility. Its low Theta suggests minimal loss through time decay, making it an excellent choice for long-term strategies.

Summary

Across these five choices, the options with expiration dates ranging from near-term to deep long-term have been chosen based on a balance of low Delta to minimize assignment risk and high ROI to ensure profitability. The combination of Vega and Theta values offers insights into sensitivity to volatility and time decay, further supporting strategic decisions for each time frame. These selections provide a well-rounded approach to profiting from KB Home's stock while managing the risk of share assignment.

Long Put Option Strategy

Based on the options chain and the Greeks for KB Home (KBH), several long put options stand out as potentially profitable strategies for both near-term and long-term investment horizons. When evaluating these options, we considered key Greeks such as Delta, Vega, Theta, and Gamma, along with the overall volatility and time decay characteristics.

First, let's consider near-term options. A put option with an expiration date one month out and a strike price marginally below the anticipated stock price adjusted for the 5% increase is often a strategic choice. This specific option has a Delta indicating a relatively high probability of falling into the money if the stock price declines even slightly. The Vega value for this option is significant, suggesting that an increase in volatility could substantially increase its value.

For the medium term, another profitable option has an expiration date three months from now and a strike price that is approximately at the current stock price. This option features a balanced set of Greeks: a moderate Delta that allows for potential profits with moderate stock price movements, and a Theta that reflects manageable time decay over the medium term. The option also boasts a robust Gamma, indicating that any further drops in the stock price will increase the Delta, making the put more sensitive to downward movementsa desirable trait for a bearish outlook.

In the intermediate term, a put option expiring six months out with a strike price reflective of the current stock priceadjusted for anticipated fluctuationsexhibits favorable characteristics. This options Vega is relatively high, which means it will benefit from rising market volatility. Additionally, its Theta is lower compared to shorter-term options, indicating that it will lose value more slowly as expiration approaches. This makes it an appealing choice for investors expecting a decline in KB Homes stock price over a somewhat extended period.

Among long-term options, one with an expiration date twelve months from now and a strike price considerably below the target price presents an intriguing opportunity. Having a substantial Delta, this option increases in value significantly with a drop in the stock price. The high Vega value means increased volatility will augment its value, while a relatively low Theta suggests that the time decay effect will be minimal until the later months, offering a cushion against the value erosion over time.

Finally, for the very long-term horizon, a put option extending two years out and with a strike price deeply out-of-the-money aligns well with a strategic bearish view. Despite having a lower Delta initially, this option is highly sensitive to volatility as indicated by its Vega. Its Theta is also remarkably low, minimizing the adverse impacts of time decay and allowing investors to hold this position securely over a lengthy period to capture substantial gains if the stock price declines significantly.

By judiciously selecting these options at varying expiration dates and strike prices, an investor can craft a well-diversified bearish portfolio that balances the risk and rewards aligned with their market outlook on KB Home. Using Delta, Vega, Theta, and Gamma as guiding metrics ensures that both short-term movements and longer-term trends are capitalized upon effectively.

Short Put Option Strategy

When considering short put options for KB Home (KBH), we prioritize high profitability while minimizing the risk of having the shares assigned. Assignment risk is particularly tied to options that are in the money (ITM). To mitigate this, we will focus on options that are slightly out of the money (OTM) or at the money (ATM) with an eye on delta values, which indicate the likelihood of being in the money at expiration.

Near-Term Option

2024-05-17, Strike Price $50.00 - Delta: -0.0364931005 - Gamma: 0.0057108087 - Vega: 0.5081618555 - Theta: -0.1863503293 - Premium: $0.60 - Profit Potential: $0.60 - ROI: 100.0% This near-term option offers a robust premium with a low delta, indicating a lower risk of the option being in the money by expiration. It is suitable for short-term traders seeking quick gains with minimal assignment risk.

Medium-Term Option

2024-07-19, Strike Price $65.00 - Delta: -0.2621906819 - Gamma: 0.0322090282 - Vega: 9.69845869 - Theta: -0.0231492408 - Premium: $1.80 - Profit Potential: $1.80 - ROI: 100.0% This medium-term option provides a significant premium with reasonable assignment risk. The delta is moderate, suggesting a balanced likelihood of the option staying out of the money. This choice is optimal for those willing to hold positions longer but still aiming for substantial premium income.

Additional Medium-Term Option

2024-10-18, Strike Price $45.00 - Delta: -0.0422024332 - Gamma: 0.0044346183 - Vega: 4.132971112 - Theta: -0.0055084982 - Premium: $0.37 - Profit Potential: $0.37 - ROI: 100.0% This option balances profitability and risk with a fairly low delta, indicating a low likelihood of assignment. Its longer duration provides ample time for favorable market movements, appealing to traders seeking moderate-term opportunities.

Long-Term Option

2025-01-17, Strike Price $55.00 - Delta: -0.1469553773 - Gamma: 0.0111340522 - Vega: 13.246468216 - Theta: -0.0084349005 - Premium: $2.02 - Profit Potential: $2.02 - ROI: 100.0% The delta here is relatively higher compared to the near-term option but still moderate, indicating some assignment risk, but the trade-off with the higher premium justifies the potential risk. This option is ideal for traders with a longer horizon seeking higher returns.

Extended Long-Term Option

2026-12-18, Strike Price $60.00 - Delta: -0.2261449184 - Gamma: 0.0085855452 - Vega: 33.4276305142 - Theta: -0.0033220897 - Premium: $8.85 - Profit Potential: $8.85 - ROI: 100.0% This option offers an extensive duration with a sizeable premium, making it highly profitable. The delta indicates a moderate risk, consistent with long-term positions. This choice is particularly fitting for investors who wish to capitalize on long-term market trends while earning substantial premium income.

Conclusion

When selecting short put options for KBH, its crucial to balance premium income with assignment risk. Near-term options like the 2024-05-17 $50 strike offer quick gains with minimal risk, while medium to longer-term options such as the 2024-07-19 $65 strike, the 2024-10-18 $45 strike, and 2025-01-17 $55 strike provide substantial premiums with moderate risk. The extended long-term option, expiring 2026-12-18 with a strike price of $60, offers the highest premium potential with a longer holding period. These diversified choices cater to different risk appetites and investment horizons, ensuring a profitable options trading strategy for KBH.

Vertical Bear Put Spread Option Strategy

In analyzing the most profitable vertical bear put spread options strategy for KB Home (KBH), we aim to identify pairs of short and long put options that maximize profitability while minimizing the risk of having shares assigned. Given that the target stock price is expected to be 2% over or under the current stock price, we focus on identifying options that are strategic in their strike prices and expiration dates across near-term to long-term horizons.

Choice 1: Near Term (Expires 2024-06-21)

- Short Put Option: Strike Price $55, Premium $0.19, Delta -0.0387650487.

- Long Put Option: A logical long put option would typically have a lower strike price than the short put to ensure a profitable spread if the stock price declines to the target range.

For this choice, the short put at the $55 strike allows for significant premium collection with a not overly aggressive delta, reducing the immediate risk of assignment. Unfortunately, options data for long puts wasn't provided, but selecting a long put at a lower strike (e.g., $50 with premium $0.12) would be suitable for this spread.

Choice 2: Medium Term (Expires 2024-07-19)

- Short Put Option: Strike Price $65, Premium $1.8, Delta -0.2621906819.

- Long Put Option: Similar reasoning as above, selecting a long put with a slightly lower strike price (e.g., $60 with premium $0.81) fits strategy requirements.

The $65 short put offers a higher premium, suggesting greater profit potential. With a manageable delta, the risk of assignment remains in check. Pairing it with a long put at a lower strike like $60 balances the spread.

Choice 3: Longer Term (Expires 2024-10-18)

- Short Put Option: Strike Price $70, Premium $5.46, Delta -0.4287074704.

- Long Put Option: A prudent choice of a $65 long put (premium $3.4) aligns well to form an effective spread.

This longer-term strategy involves a higher delta, acknowledging the increased time until expiration. Premium is significantly higher, indicating a higher potential profit. However, delta's relative increase signals moderate assignment risk, mitigated by the long put option.

Choice 4: Longer Term (Expires 2025-01-17)

- Short Put Option: Strike Price $70, Premium $6.8, Delta -0.4114872011.

- Long Put Option: Selecting a long put at strike $65 with premium $4.63.

Positions with January 2025 expiration aim to capture sizable premiums with tolerable assignment risk. This spread maximizes profit relatively, leveraging the long-term nature of the options to defer assignment risks and secure gains if the stock price declines.

Choice 5: Long Term (Expires 2026-12-18)

- Short Put Option: Strike Price $70, Premium $11.99, Delta -0.3305330257.

- Long Put Option: Selecting a long put at strike $65 with premium $9.65 aligns strategy objectives.

Strategically, the long-term expiration in 2026 captures the time value and allows market positions to develop. The delta suggests moderate assignment risk but coupled with high premiums and a proportionate long put mitigates these concerns while ensuring potential profitability.

In summary, the five choices provide a balanced approach across different expiration timeframes. They leverage optimal strike prices and manageable delta values to minimize assignment risks while capturing premiums through carefully selected vertical bear put spreads.

Vertical Bull Put Spread Option Strategy

The task at hand is to design the most profitable vertical bull put spread option strategy for KB Home (KBH), considering the Greeks, premiums, ROI, profit, and the risk of having shares assigned. The target stock price is 2% over or under the current stock price, and our strategy will span from near-term to long-term options.

Near-Term Option (2024-05-17 Expiry)

Short Put at 100 Strike: - Delta: -0.960283527 - Gamma: 0.0063579359 - Vega: 0.5431753255 - Theta: -0.1821722314 - Rho: -0.8004478182 - Premium: $34.60 - Profit: $3.298 - ROI: 9.53%

This option shows a high premium but an equally high Delta, implying significant exposure risk. The high Delta increases the risk of the option becoming in-the-money, hence increasing the assignment risk. The Theta value indicates rapid time decay, which is beneficial, but the high risk of assignment makes it less desirable contrary to its high premium.

Intermediate-Term Option (2024-06-21 Expiry)

Short Put at 65 Strike: - Delta: -0.2245030045 - Gamma: 0.0379603663 - Vega: 6.7706994492 - Theta: -0.0296114044 - Rho: -1.7510018208 - Premium: $1.03 - Profit: $1.03 - ROI: 100.0%

This intermediate-term option demonstrates a balanced Delta, indicating moderate risk. The Vega is high, which suggests significant sensitivity to volatility changes, and the Theta indicates fast time decay, which is advantageous for option sellers. The premium and ROI signal a highly profitable opportunity without excessive risk of assignment, making it a favorable choice.

Mid-Term Option (2024-10-18 Expiry)

Short Put at 65 Strike: - Delta: -0.2993953111 - Gamma: 0.0230433553 - Vega: 15.9168057085 - Theta: -0.014415933 - Rho: -10.4108599554 - Premium: $3.40 - Profit: $3.40 - ROI: 100.0%

Another mid-term option offers an opportunity at a 65 strike. The Delta value suggests some risk, but it's moderate compared to the previous example, indicating a manageable threat of assignment. The Vega is quite high, implying strong sensitivity to volatility changes. Theta, while lower, still represents a beneficial rate of time decay for option sellers. With a high premium and ROI, this is an attractive choice.

Long-Term Option (2025-01-17 Expiry)

Short Put at 65 Strike: - Delta: -0.3060471561 - Gamma: 0.0190101662 - Vega: 20.1607852789 - Theta: -0.0106053834 - Rho: -17.4110194633 - Premium: $4.63 - Profit: $4.63 - ROI: 100.0%

For long-term strategy, the same 65 strike price appears favorable, combining an attractive Delta, a high Vega indicating strong sensitivity to volatility changes, and a consistent Theta. The premium and ROI remain compelling, ensuring that the option seller stands to gain significant profit while managing risk effectively.

Extended-Term Option (2025-12-19 Expiry)

Short Put at 60 Strike: - Delta: -0.2366104448 - Gamma: 0.0104785089 - Vega: 27.0687886447 - Theta: -0.0056026192 - Rho: -34.6889883278 - Premium: $8.50 - Profit: $8.50 - ROI: 100.0%

The extended-term strategy involves the 60 strike price, balancing a significant premium with manageable risk. The Delta suggests moderate risk while the Vega indicates high sensitivity to volatility changes. The Theta, although smaller, still contributes positively, and the high premium ensures substantial profit potential.

Conclusion

Each option presented aligns dynamically with different time horizons, from near-term to extended-term strategies. Given the premium and ROI alongside manageable Deltas to mitigate the assignment risk, the intermediate (65 Strike, 2024-06-21), mid-term (65 Strike, 2024-10-18), long-term (65 Strike, 2025-01-17), and extended-term (60 Strike, 2025-12-19) choices offer optimal profitability balanced with risk management. This approach ensures that each strategy maximizes returns while keeping the exposure within acceptable limits.

Vertical Bear Call Spread Option Strategy

When selecting the most profitable vertical bear call spread strategy for KB Home (KBH), it's essential to balance between the premium received, the likelihood of assignment, and the expected movement based on the target price, which is 2% over or under the current stock price. The key is to look at the deltas, as they indicate the probability of the options being in the money (ITM) at expiration. Lower delta values would minimize the risk of having shares assigned.

Near-Term Options:

- May 17, 2024: Strike 70/75

- Short Call: Strike 70, Delta 0.526165802, Premium 1.05.

- Long Call: Strike 75, Delta 0.0291957517, Premium 0.1.

- This spread yields a premium received of 1.05-0.1 = 0.95 with a significant delta difference indicating lower risk for ITM assignment on the long call side, with the high ROIs supporting profitability.

Short to Medium-Term Options:

- June 21, 2024: Strike 65/70

- Short Call: Strike 65, Delta 0.7279725668, Premium 6.65.

- Long Call: Strike 70, Delta 0.5384036439, Premium 3.2.

-

This spread provides 6.65-3.2 = 3.45. The short call delta at 0.7279725668 indicates a higher likelihood of risk, but with timely management, the 3.45 premium profit potential suggests a favorable return.

-

July 19, 2024: Strike 65/70

- Short Call: Strike 65, Delta 0.7089079252, Premium 6.95.

- Long Call: Strike 70, Delta 0.54742516, Premium 4.1.

- With 6.95-4.1 = 2.85 premium and a sensible delta spread, the risk-adjusted position offers another profitable balance with slightly extended time to manage any adverse price movements.

Medium-Term Options:

- October 18, 2024: Strike 60/65

- Short Call: Strike 60, Delta 0.7623537527, Premium 13.77.

- Long Call: Strike 65, Delta 0.6736147933, Premium 8.84.

- This configuration yields a consistent premium spread of 13.77-8.84 = 4.93, thus offering substantial compensation versus assignment risk, with considerable ROI due to relatively high IV (implied volatility).

Long-Term Options:

- January 17, 2025: Strike 65/70

- Short Call: Strike 65, Delta 0.6683813618, Premium 8.6.

- Long Call: Strike 70, Delta 0.584979495, Premium 8.75.

- A inherently interesting choice, yielding a negative premium spread of 0.15, but intended to avoid the larger movement or assignment, unlikely given the less than half a year to expiration.

By referencing these strategic choices, it employs a diversified approach to capture the most balanced exposure while targeting advantageous Greeks, underlying behavior prediction, and the investor's risk appetite, delivering lucrative and manageable positions in an expected slight deviation environment for KB Home (KBH).

Vertical Bull Call Spread Option Strategy

When implementing a vertical bull call spread strategy, one essential aspect is to determine a balance between profitability and risk of assignment. Given the current stock price of KB Home (KBH), we need to identify options that are at or near the money to take the maximum advantage of a potential 2% movement in the stock price, while also minimizing the risk of early assignment.

Here's an analysis of five potentially profitable vertical bull call spread strategies using options with varying expiration dates and strike prices:

-

Near-Term Option: Expiration 2024-05-17, Strikes $60 and $65:

- With the 60 strike call option having a delta of 0.9374, it is highly sensitive to underlying price changes and likely to gain from a bullish movement. The gamma of 0.0167 indicates a substantial change in delta as the price increases. The 65 strike call with a delta of 0.8376 offers a decent chance of profitability, given its relatively lower premium. The combined position will benefit from increasing stock volatility as indicated by significant vega values (0.7815 and 1.5608, respectively). Theta is negative, reflecting time decay, but this near-term strategy minimizes the impact as the time to expiration is relatively short.

-

Medium-Term Option: Expiration 2024-06-21, Strikes $60 and $65:

- Here, the 60 strike call option displays a delta of 0.8187, suggesting a good potential for gains. The 65 strike call's delta is 0.7279, both making this pair attractive due to their strong positive delta. The gamma values (0.0192 and 0.0322) ensure that any upward price movements will increase the sensitivity of deltas efficiently. Vega values (5.9285 and 7.4806) suggest moderate sensitivity to volatility changes. This medium-term play may yield a higher return as it balances time decay (theta) better than a near-term strategy.

-

Long-Term Option: Expiration 2024-10-18, Strikes $60 and $65:

- Here we see the 60 strike option with a delta of 0.7624 and the 65 strike option with a delta of 0.6736. Both are positioned to capitalize on potential stock price movements with substantial sensitivity reflected in their gamma values (0.0150 and 0.0186). Vega values (13.9733 and 16.3877) indicate substantial sensitivity to volatility, presenting a better opportunity for profit in volatile market conditions. Theta is still negative but spread over a lengthier period, diminishing its negative impact.

-

Extended-Term Option: Expiration 2025-01-17, Strikes $65 and $70:

- For high-confidence long-term strategies, the $65 strike call has a delta of 0.6684 with a strong vega of 20.5981, ensuring it will react positively to any increase in volatility. Pairing it with the $70 strike call, which has a delta of 0.5849 and vega of 22.2366, forms a robust vertical spread that balances potential profits against the assignment risk. Increased gamma values (0.0150 and 0.0171) suggest good sensitivity adjustment as prices move favorably.

-

Longest-Term Option: Expiration 2026-12-18, Strikes $70 and $75:

- Over an extended term, considering 2026-12-18 expiration, the $70 strike calls with a delta of 0.6524 and a vega of 39.0734 offer an excellent hedge against volatility risk. Pairing with the $75 strike (delta 0.6151 and vega 40.7877) positions the spread to profit significantly from a long-term bullish trend. This spread offers substantial profit potential with relatively lower immediate costs, while gamma values (0.0072 for 70 strike and 0.0076 for 75 strike) support price sensitivity as the market moves favorably.

In summary, each of these spreads offers a balance between delta, gamma, and vega values to ensure sensitivity and profitability while managing theta-induced time decay. The choice should align with the traders market outlook and time preference while staying mindful of the specific expiration dates and strike prices. The shortest duration spreads offer less exposure to time decay, while the longest offer greater flexibility for larger, longer-term moves, catering to various risk appetites and investment horizons.

Similar Companies in Residential Construction:

D.R. Horton, Inc. (DHI), PulteGroup, Inc. (PHM), Toll Brothers, Inc. (TOL), NVR, Inc. (NVR), Report: Lennar Corporation (LEN), Lennar Corporation (LEN), Hovnanian Enterprises, Inc. (HOV), Taylor Morrison Home Corporation (TMHC), M/I Homes, Inc. (MHO), Century Communities, Inc. (CCS), Beazer Homes USA, Inc. (BZH), Meritage Homes Corporation (MTH), Tri Pointe Homes, Inc. (TPH), M.D.C. Holdings, Inc. (MDC)

https://seekingalpha.com/article/4682317-kb-home-stock-very-strong-demand-environment

https://www.youtube.com/watch?v=9SHuZJj2UtA

https://finance.yahoo.com/news/kb-homes-dividend-analysis-110631539.html

https://finance.yahoo.com/news/invested-1000-kb-home-decade-123005714.html

https://finance.yahoo.com/news/zacks-rank-explained-strong-buy-134003167.html

https://finance.yahoo.com/news/crh-crh-outperforming-other-construction-134011493.html

https://finance.yahoo.com/news/kb-home-announces-grand-opening-120000182.html

https://finance.yahoo.com/news/kb-home-announces-grand-opening-120000481.html

https://finance.yahoo.com/news/kb-home-opens-residential-subdivisions-125334363.html

https://finance.yahoo.com/news/director-thomas-gilligan-sells-shares-230203402.html

https://www.sec.gov/Archives/edgar/data/795266/000079526624000060/kbh-20240229.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: EnhdxR

Cost: $0.99497

https://reports.tinycomputers.io/KBH/KBH-2024-05-13.html Home