SPDR S&P Regional Banking ETF (ticker: KRE)

2023-12-28

The SPDR S&P Regional Banking ETF (ticker: KRE) is a sector-specific exchange-traded fund that offers investors exposure to the regional banking segment of the United States financial sector. The ETF is designed to track the performance of the S&P Regional Banks Select Industry Index, which comprises small to mid-sized regional bank stocks. KRE provides a diversified investment in regional banks, which are typically smaller and more focused on retail and commercial banking within specific geographical regions, as opposed to the national or global operations of larger banks. This focus on regional banking allows investors to potentially benefit from localized economic growth, interest rate differentials, and increased consolidation in the banking industry. The ETF's holdings can include a variety of regional banks ranging in size, but all are characterized by a concentration of operations in their respective local markets. Investors interested in the regional banking sector may consider KRE as a targeted play on domestic banking trends while also benefiting from the liquidity and flexibility that ETFs typically offer.

The SPDR S&P Regional Banking ETF (ticker: KRE) is a sector-specific exchange-traded fund that offers investors exposure to the regional banking segment of the United States financial sector. The ETF is designed to track the performance of the S&P Regional Banks Select Industry Index, which comprises small to mid-sized regional bank stocks. KRE provides a diversified investment in regional banks, which are typically smaller and more focused on retail and commercial banking within specific geographical regions, as opposed to the national or global operations of larger banks. This focus on regional banking allows investors to potentially benefit from localized economic growth, interest rate differentials, and increased consolidation in the banking industry. The ETF's holdings can include a variety of regional banks ranging in size, but all are characterized by a concentration of operations in their respective local markets. Investors interested in the regional banking sector may consider KRE as a targeted play on domestic banking trends while also benefiting from the liquidity and flexibility that ETFs typically offer.

| Previous Close | 53.13 | Open | 52.93 | Day Low | 52.83 |

|---|---|---|---|---|---|

| Day High | 53.29 | Trailing P/E | 9.4728 | Volume | 6,921,875 |

| Average Volume | 16,833,061 | Average Volume 10 Days | 17,722,340 | Bid | 53.23 |

| Ask | 53.38 | Bid Size | 2,900 | Ask Size | 1,800 |

| Yield | 3.43% | Total Assets | 2,934,199,808 | 52 Week Low | 34.52 |

| 52 Week High | 65.32 | 50 Day Average | 45.2162 | 200 Day Average | 43.41335 |

| Trailing Annual Dividend Rate | 0.0 | NAV Price | 53.15371 | YTD Return | -6.34764% |

| Beta 3 Year | 0.94 | Three Year Average Return | 3.80489% | Five Year Average Return | 5.8289498% |

Given the technical analysis and fundamental data for KRE (SPDR S&P Regional Banking ETF), various indicators and market factors can provide insight into the potential movement of KRE's stock price over the next few months.

Technical Analysis:

- On the final trading day, the stock closed above the open, which suggests positive sentiment. The closing price was also near the high of the day, which can be seen as a bullish sign.

- The price experienced an uptrend as evidenced by the increased closing prices from $44.349998 on 2023-08-30 to $53.259998 on 2023-12-28.

- The Parabolic SAR (Stop and Reverse) indicator has the PSAR below the price, which suggests that the trend is bullish.

- The On-Balance Volume (OBV) increased over the period to 5.464317 million, reinforcing the bullish trend as it indicates growing volume behind the price increases.

- The Moving Average Convergence Divergence (MACD) histogram is in the positive zone, which also supports bullish sentiment.

Fundamentals:

- The ETF has a relatively low trailing Price to Earnings (PE) ratio of 9.4728, which can be attractive to value-oriented investors.

- The yield of 0.0343 indicates that investors are receiving dividends, which can be appealing and potentially support the ETFs price.

- The fund has been performing relatively well with positive three-year and five-year average returns, indicating a stable performance history.

Considering the data provided, the technical indicators generally suggest a sustained bullish sentiment while the fundamentals show stability and attractiveness in terms of valuation and yield. The following months could see continued upward momentum if the market conditions remain favourable, given the strong technicals and supportive fundamentals.

However, one must consider external market conditions, such as economic indicators, interest rates, and the overall health of the banking sector, as they can significantly impact the performance of regional banking stocks and ETFs like KRE. Any changes in these factors could alter the current trajectory of KREs stock price.

Despite not having balance sheet or comprehensive financial data, the technicals and available fundamentals are positive, indicating potential for continued bullish movement in the stock price in the near to medium term, barring negative external market forces. Investors are often drawn to stable and well-performing funds with sound management as reflected in KRE's overall profile.

In conclusion, the analysis of KRE indicates the possibility of further upward movement in its stock price over the next few months, contingent on consistent market conditions and the absence of unexpected negative developments within the financial sector. As always, investors are encouraged to exercise due diligence and consider the broader market context when making investment decisions.

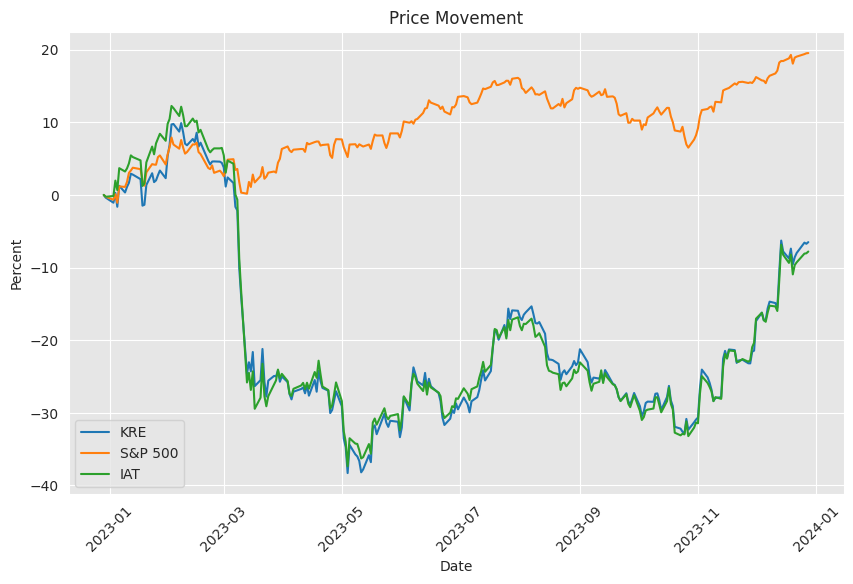

The regional banking sector has witnessed a remarkable rally, with the SPDR S&P Regional Banking ETF (KRE) and the KBW Nasdaq US Regional Banking Index (^KRX) now exceeding their pre-Silicon Valley Bank (SVB) collapse levels. The resurgence of these indexes not only signifies a robust recovery from one of the most challenging periods since 2008 but also reflects a broader momentum within the financial sector, instilling a renewed sense of investor confidence.

Instrumental in this turnaround has been the Federal Reserve's recent dovish pivot. The indications that the central bank may pause its aggressive interest rate hiking cycle and the prospect of rate reductions in 2024 have breathed life into the regional banking industry. Previously, surging rates had squeezed margins, as the cost of deposits climbed, and paper losses on bond holdings mounted, all while borrowers faced increasing strain.

Despite the rally in regional banking stocks, when measured against broader market indices such as the S&P 500, regional banks still lag. From the start of the year to their nadir in May, bank indices plummeted by about 30%. As of this report, the indices remain down year-to-date by 2% to 8%, a clear indication that there is still some distance to cover before declaring a full market recovery.

Banking executives and market analysts temper their optimism with a cautious outlook due to certain persisting headwinds. Rising deposit costs are expected to continue until the Federal Reserve begins to reduce rates. In tandem, segments of the industry exhibit alarming signs, such as increasing delinquency rates on some loans and potential softness in the commercial real estate market, particularly concerning office properties where delinquencies are at a multi-year high.

In the context of the Fed's influence, the performance of the KRE ETF is especially noteworthy. The ETF's valuation is highly responsive to Fed policy statements and other economic indicators. In response to a softer stance on interest rates, KRE surged, highlighting how monetary policy decisions can drive volatility in financial markets.

Market dynamics observed in November displayed a stark pivot; other sectors alongside banking experienced growth as financial conditions relaxed. For instance, the S&P 500 and the other sector ETFs, like those for technology and real estate, rallied after the Federal Reserve signaled a departure from its rate-hiking fervor. However, the optimism within the markets is tenuous, heavily contingent on further economic data and the Fed's future communication.

An undercurrent of concern stems from the commercial real estate market, a significant market segment that could be a "black swan" risk for regional banks. With high exposure to over $6 trillion in outstanding commercial real estate debt, any downturn could be calamitous for these institutions.

Throughout the tumultuous year, bank stocks, including regional ones represented by KRE, have weathered numerous challenges and have emerged with significant gains. The regional banking sector's strength in November, attributable to anticipated Fed policy adjustments, has generated significant interest from market participants. Yet, obstacles remain: the FDIC reported a deceleration in banking profits in the third quarter due to rising funding costs and provisions for potential loan losses.

As the banking sector navigates through these uncertain times, it is doing so amid heightened regulatory attention. The FDIC, in collaboration with other regulators, is seeking to tighten capital requirements for banksa move met with resistance from some within the industry. Concurrently, the FDIC itself is grappling with internal cultural turmoil, which has come under the microscope during recent Senate and House committee hearings. This could notably impact the regional banking landscape and, by extension, KRE's performance.

The crises that unfolded throughout the year, including the fall of Silicon Valley Bank, have ushered in a period of reassessment for regional banks. The migration of deposits, reclassification of safe assets, and the liquidity crunch that ensued have forced banks into a state of strategic realignment. Indeed, the aftereffects of this turbulent period have reshaped operational dynamics and drawn a roadmap for the future of regional banking institutions.

The KRE ETF is identified as a viable component within a diversified, high-yield dividend portfolio. This positioning is strategic, hinging on an anticipated market rotation towards value instead of growth and sector-specific rebounds expected with potential interest rate cuts. The financial outlook for regional banks, as part of this portfolio, ties closely to expected trends in commercial real estate and interest rate fluctuations.

Moreover, the broader market's reaction, particularly that of the KRE ETF, signifies a FOMO dynamic, with investors eager not to miss out on the rallying tide. However, the extent of this resurgence is instrumental in determining if the uptick represents a sustainable trend or temporary euphoria. This keen investor enthusiasm, while palpable, is also measured against prevailing economic headwinds and market uncertainties.

The financial sector's near-term prospects, especially for regional banks, have been buoyed by anticipations of a "soft landing" for the economy. Markets are responding favorably to this sentiment, as reflected in the performance of various indices and ETFs, including KRE. A broad market upswing is indicative of confidence that a severe economic downturn can be averted, an outlook that leans heavily on forthcoming moves by the Federal Reserve.

Regional banking profits came under strain in the latter part of the year, with several institutions reporting stark declines in earnings. The elevated deposit costs attributed to heightened interest rates have pressured margins, causing a downturn in profitability. The performance of KRE reflects these developments, pointing to a cautious industry outlook.

The banking sector's challenges leading into 2024 cannot be overstated. With the severe adjustments banks had to make due to rising interest rates, along with altering their investment strategies, the future landscape remains uncertain. Even as whispers of rate cuts by the Federal Reserve grow, the immediate impact of the existing monetary policy continues to be felt across the banking industry.

In conclusion, U.S. bank stocks, once deemed as the market's Achilles' heel, have demonstrated resilience, even as their recovery is necessary for market stability. The financial world's confidence rests upon the shoulders of the banking sector, with regional banks playing a crucial role in dictating market buoyancy.

In sum, the regional banking industry's trajectory is hinged on a number of factors, including Federal Reserve policy, regulatory adjustments, ongoing profitability challenges, and overall economic conditions. As investors look towards 2024, the recovery and performance of the SPDR S&P Regional Banking ETF (KRE) remain central to understanding the health and direction of the broader financial market.

Similar Companies in Financial:

Report: iShares U.S. Regional Banks ETF (IAT), iShares U.S. Regional Banks ETF (IAT), Invesco KBW Regional Banking ETF (KBWR), First Trust NASDAQ ABA Community Bank Index Fund (QABA), Direxion Daily Regional Banks Bull 3X Shares (DPST), ProShares UltraShort Financials (SKF), Vanguard Financials ETF (VFH)

News Links:

https://seekingalpha.com/article/4659193-6-trillion-black-swan-everyone-forgot

https://seekingalpha.com/article/4655130-spy-powell-friday-speech-kill-rally

https://seekingalpha.com/article/4659839-6-etfs-for-high-yield-dividend-portfolio-2024

https://finance.yahoo.com/news/regional-banks-still-have-a-profitability-problem-201307527.html

https://www.fool.com/investing/2023/12/11/lets-look-back-on-3-bank-trends-that-emerged-2023/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: tOysJF

https://reports.tinycomputers.io/KRE/KRE-2023-12-28.html Home