Lowe's Companies Inc. (ticker: LOW)

2023-12-17

Lowe's Companies Inc. (ticker: LOW) is a prominent home improvement retailer that operates across the United States and Canada. Founded in 1946 and headquartered in Mooresville, North Carolina, Lowe's has grown to become the second-largest hardware chain in the United States, behind The Home Depot. As of the last reporting period, Lowe's runs approximately 2,197 home improvement and hardware stores that offer a wide variety of products for maintenance, repair, remodeling, and decorating. The company serves a diverse clientele, including do-it-yourself (DIY) customers, professional contractors, and individual homeowners. Lowe's has made significant investments in e-commerce and technology to improve customer experience and operational efficiency, which have become increasingly important in a competitive retail landscape. The company's financial performance typically reflects the health of the housing market and the broader economy, making it an indicator of consumer spending and home improvement trends. Lowe's is publicly traded on the New York Stock Exchange and is a component of the S&P 500 index, highlighting its status as a major player in the retail industry.

Lowe's Companies Inc. (ticker: LOW) is a prominent home improvement retailer that operates across the United States and Canada. Founded in 1946 and headquartered in Mooresville, North Carolina, Lowe's has grown to become the second-largest hardware chain in the United States, behind The Home Depot. As of the last reporting period, Lowe's runs approximately 2,197 home improvement and hardware stores that offer a wide variety of products for maintenance, repair, remodeling, and decorating. The company serves a diverse clientele, including do-it-yourself (DIY) customers, professional contractors, and individual homeowners. Lowe's has made significant investments in e-commerce and technology to improve customer experience and operational efficiency, which have become increasingly important in a competitive retail landscape. The company's financial performance typically reflects the health of the housing market and the broader economy, making it an indicator of consumer spending and home improvement trends. Lowe's is publicly traded on the New York Stock Exchange and is a component of the S&P 500 index, highlighting its status as a major player in the retail industry.

| As of Date: 12/17/2023Current | 10/31/2023 | 7/31/2023 | 4/30/2023 | 1/31/2023 | 10/31/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 129.74B | 109.98B | 137.28B | 123.94B | 125.93B | 119.11B |

| Enterprise Value | 168.58B | 147.06B | 174.86B | 160.59B | 160.95B | 151.24B |

| Trailing P/E | 17.30 | 18.45 | 22.46 | 20.44 | 20.10 | 15.30 |

| Forward P/E | 16.42 | 12.92 | 17.79 | 14.99 | 14.73 | 13.14 |

| PEG Ratio (5 yr expected) | 1.47 | 1.11 | 1.50 | 1.23 | 1.42 | 0.93 |

| Price/Sales (ttm) | 1.48 | 1.23 | 1.50 | 1.35 | 1.41 | 1.37 |

| Price/Book (mrq) | - | - | - | - | - | - |

| Enterprise Value/Revenue | 1.87 | 7.18 | 7.01 | 7.19 | 7.17 | 6.44 |

| Enterprise Value/EBITDA | 12.43 | 46.22 | 40.09 | 42.79 | 73.97 | 106.06 |

Analyzing the most recent technical and fundamental data reveals several aspects about Lowe's Companies, Inc. (Ticker: LOW) that might influence its stock price movement over the next few months. A technical analysis may not provide a full picture, but combined with company fundamentals, we can assess likely scenarios.

Analyzing the most recent technical and fundamental data reveals several aspects about Lowe's Companies, Inc. (Ticker: LOW) that might influence its stock price movement over the next few months. A technical analysis may not provide a full picture, but combined with company fundamentals, we can assess likely scenarios.

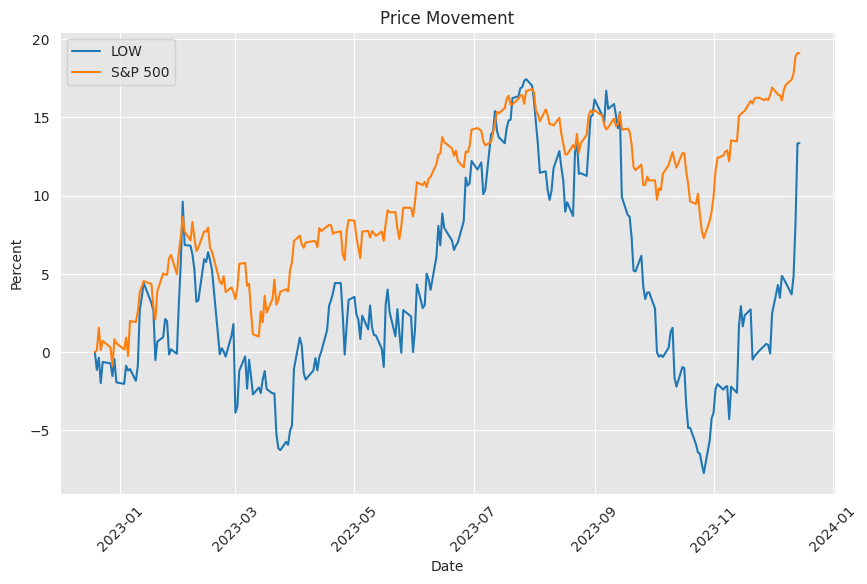

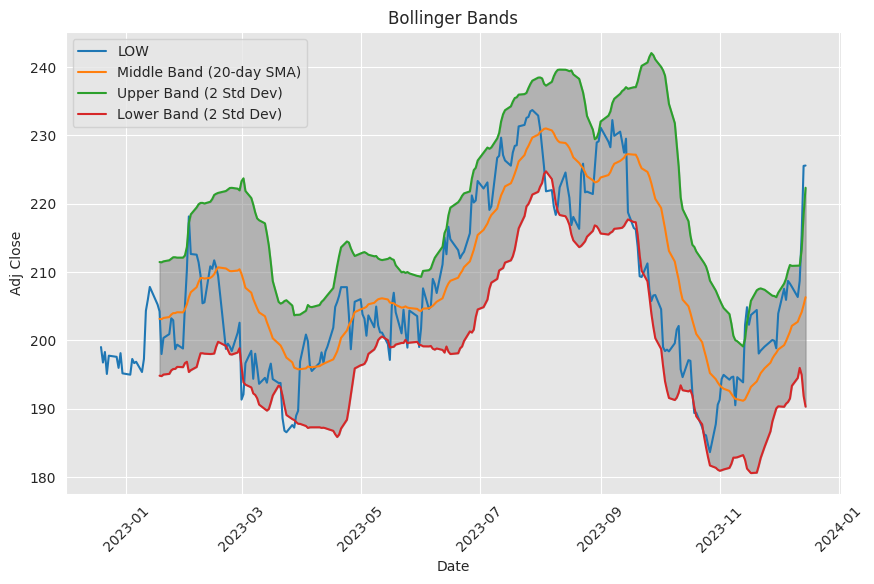

Technical Analysis Observations: - The stock's Adjusted Close at $225.59 is above both the 20-day Simple Moving Average (SMA_20) at $206.31 and the 50-day Exponential Moving Average (EMA_50) at $206.45, indicating the stock is in a short- to intermediate-term uptrend. - The Moving Average Convergence Divergence (MACD) value is positive at 5.502108 with a MACD histogram reading of 2.207293, both of which are bullish signs suggesting a strong upward momentum. - A very high Relative Strength Index (RSI_14) value of 78.10 is indicating that the stock is in an overbought region, which could be a precursor to a trend reversal or price pullback. - The stock has closed near the upper Bollinger Band (BBU_5_2.0 at $232.56), and preceding candlesticks are progressively higher, suggesting robust demand but also raising the risk of a mean-reversion move. - Stochastic indicators (STOCHk_14_3_3 and STOCHd_14_3_3) echo the overbought condition, suggesting caution. - The Average Directional Index (ADX_14) at 26.44 denotes a moderate but established upwards trend strength. - The Chaikin Money Flow (CMF_20) reading of 0.305330 is positive, indicating buying pressure. - Williams %R (WILLR_14) is at -4.595841, which is in the overbought territory, aligning with the RSI for potential forthcoming price correction. - The Parabolic SAR (PSAR) is below the price, supporting the ongoing uptrend.

Fundamental Analysis Observations: - With a market capitalization of $129.74B and an operational trend of increasing EBITDA and net income, the company is financially robust. - An attractive trailing P/E of 17.30 compared to earlier in the year may indicate that the stock is reasonably valued on an earnings basis. - Revenue growth is evident from the financial summary, which shows a marked increase in total revenue and gross profit compared to previous years. - The enterprise value to revenue and EBITDA ratios have normalized from the peaks seen earlier in the year, suggesting the market has started to recognize the company's inherent value more accurately. - The company has maintained steady profitability with no significant unusual expenses affecting its bottom line, reflecting a strong operational performance.

Stock Price Movement Outlook: Considering the technical analysis, LOW's stock shows signs of a continued uptrend with strong momentum on the last trading day. However, overbought conditions suggest that there may be a price pullback or consolidation in the short term before the stock can sustain further gains.

In the medium- to long-term scenario, the fundamental strength of LOW indicates that any dip may be seen as a buying opportunity, provided the company's growth trajectory remains consistent and the market conditions are favorable. The solid financials could act as a backstop against significant downward movements, with investors likely to show confidence in the company's consistent profitability and growth prospects.

It will be crucial for investors to monitor company news and broader market sentiment, as well as to be vigilant for signs of trend reversals or continuation patterns. With strong fundamentals in place, any technical pullbacks can be seen within the wider context of a fundamentally stable and flourishing enterprise.

Lowe's Companies Inc., a major player in the home improvement retail sector, faces current challenges attributable to broader economic pressures, which hold significant implications for its stock performance. The macroeconomic backdrop is characterized by high interest rates and persistent inflation, creating a tough landscape for retailers like Lowe's. Consumers are confronting weakened purchasing power as inflation erodes living costs, while higher borrowing costs dampen credit-dependent purchase demand, influencing segments such as home renovations. This environment has precipitated a decrease in retail sector spending, most notably in discretionary and big-ticket domains.

The cooling down of the housing market, intricately tied to the home improvement industry, further compounds Lowes challenges. With both interest rate hikes and inflationary pressures mounting, demand for products and services from companies like Lowe's has witnessed a downturn, potentially reflecting in the company's financial results. Consequently, analysts and investors are encouraged to exercise caution when appraising the investment potential of Lowe's, particularly against the backdrop of other ultra-popular stocks.

Despite this, Lowe's maintains a solid dividend yield, albeit remaining modest at 2.3% in comparison to investment opportunities in the market. The uncertain growth catalysts for the stock and economic headwinds expected to persist into subsequent quarters pose a formidable challenge for Lowe's to justify any significant dividend hikes. Therefore, amid these pressures, Lowes valuation necessitates careful consideration, balancing qualitative aspects such as its brand and industry reputation against the quantitative realities of its current valuation. Particularly given the market's proclivity for assigning premium valuations based on historical successes and future growth prospects, investors must adopt a discerning stance concerning Lowes investment attractiveness.

Contrasting Lowe's with its prime competitor, Home Depot, further illustrates the pressures on the former. Although both Home Depot and Lowe's have long-term growth potential and could benefit from market stabilization or improvement, investors should closely monitor Lowes response to current macroeconomic trends and the efficacy of its strategies in mitigating the challenges prevalent in its operational landscape.

Moreover, living off dividends as a strategy for financial independence has grown in popularity, and Lowe's is frequently considered a viable component in such an investment approach. The method of dividend-growth investing posits that sturdy companies with a consistent trend of dividend increments provide a stable base for an investment portfolio. Lowes, thanks to its history of paying and strategically growing dividends, adheres to this stable paradigm, in conjunction with offering capital appreciation and a natural hedge against inflation.

Diversification remains a bedrock principle in constructing an investment portfolio. It's critical to spread investments across varied sectors, thereby decreasing the risk and enhancing income stability notwithstanding economic convulsions. Companies like Lowe's, domiciled in the retail home improvement domain, offer a mix of stability and potential expansion, endearing themselves to income-centric investors. For those investors, dividend growth rather than high yields is paramount, with the latter possibly indicating a company's financial distress, potentially leading to dividend cuts and stark drops in stock price.

Another pivotal consideration is the prudent structuring of withdrawal rates. Adequate rates ensure that dividend income covers living expenses over prolonged periods. The balance required involves establishing a rate that meets current income needs while preserving portfolio capability for generating future income. Rules such as the commonly referenced 4% rule demand critical evaluation and potentially necessitate adjustments based on individual circumstances and prevailing market health.

Portfolio reviews stand out as essential to ensuring ongoing income through dividend growth investing. These reviews, performed regularly, enable an investor to spot and react to underperforming assets, reallocate resources accordingly, and maintain an optimized flow of income. Sample portfolios typically include a mixture of ETFs (such as SCHD and VYM), energy infrastructure companies (ENB), and REITs (like O). Selections are made based on historical dividend consistency and growth potential, providing a holistic structure for a diversified, dividend-generating portfolio.

The pursuit of financial independence through dividend growth investing, as exemplified by a company like Lowe's, demands meticulous planning and financial savvy. It necessitates adapting the investment strategy in response to shifts in the broader economic landscape, personal financial goals, and evolving market conditions. This approach, when diligently executed, can establish a reliable income stream that keeps pace with or surpasses inflation and fosters financial security and freedom from traditional employment constraints.

The retail industry experienced significant shifts throughout 2023, with changes noticed in consumer spending habits despite overarching economic challenges. Despite concerns surrounding inflation and the restart of student loan repayments, consumer spending persisted, though there was a noticeable shift away from larger purchases towards smaller, immediate gratifications. This "lipstick effect" is characteristic of economic downturns, where consumers prioritize minor, more accessible indulgences. Notably, Lowe's, akin to Home Depot, observed decreased demand for ambitious DIY projects paralleling a reversion of consumers back to workplaces. In contrast, demand remained stable among professional contractors, hinting at a potential strategy pivot toward serving professional clientele.

Another noteworthy trend involved the electronics sector, which saw a decline partially due to prior saturation during the peak pandemic years. However, the anticipated replacement of outdated electronics purchased during the height of remote work might signal a recovery for this sector and correlated retailers. Additionally, the issue of retail shrink, entailing losses due to theft, prompted varied strategies across the retail sector to lower these impacts. These strategies are expected to evolve further as the phenomenon of shrink becomes less sensational and as retailers adapt to consumer behavioral changes.

In 2024, trends such as the lipstick effect and heightened interest in home improvement and electronics might persist. Moreover, "showroom shopping" is expected to gain traction, impacting logistical firms as retailers adjust their distribution models. Concurrently, the fast fashion industry is experiencing an upswing, with younger consumer demographics dictating trends through social media platforms, driving demand for affordable, trend-aligned fashion.

Lowe's Companies, Inc., a member of the esteemed dividend aristocrats group, has demonstrated resilience and potential growth, even amid daunting economic signs. With its significant share of the home improvement market and strategic growth plans, analysts are optimistic about Lowe's capacity for recovery, attributable to factors such as potential interest rate reductions and strategic market segment penetration. Lowe's consistent dividend payments, attractive yield, and sustainable payout ratio underline its financial robustness and prospective dividend expansion. Analysts also suggest that Lowe's stock might be currently undervalued and that realization of growth prospects could yield substantial returns, possibly outpacing broader market indices.

Management has delineated a clear growth trajectory for Lowe's, indicating a sound prospect for long-term capital appreciation and dependable dividend payouts. By emphasizing judicious investment decisions over emotional impulses, experts are confident in Lowe's's potential to leverage Americans' persistent aspiration for homeownership.

Lowe's reported third-quarter fiscal results for 2023, revealing mixed outcomes drawn from the existing economic climate. A notable reduction in comparable sales of 7.4% characterized the report, with a pullback in spending by DIY customers cited as a principal factor. The decline in discretionary consumer spending was recognized, tied to consumers allocating more towards travel and entertainment instead of goods such as home improvement items. Despite setbacks in the DIY segment, the Pro segment delivered positive sales, buoyed by constant demand for essential repairs and maintenanceessential against the backdrop of the aging U.S. housing stock.

Management has pursued several strategies to navigate the market conditions and stimulate growth, including expanding services for Pro customers and launching smaller format outlet stores. These initiatives allow the company to dispense discounts on select products while enhancing profitability. Furthermore, Lowe's operational focus on enhancing efficiency has translated into improved customer service scores in both the DIY and Pro segments. The incorporation of same-day delivery partnerships and advancements in digital platforms have marked significant progress toward a more modern shopping experience. Financially, Lowe's increased its operating margin rate, achieving an improved diluted earnings per share despite the sales slump, attributing this to disciplined expense management.

Lowe's looks to the medium to long-term with an optimistic lens, expecting favorable housing and demographic trends to precipitate growth in the home improvement industry. This presumption is backed by a strategy to highlight everyday value and capture emergent growth avenues, aiming to redefine itself as a preeminent omnichannel retailer.

When viewing Lowe's through a comparative lens, observation of the rival dynamics between Lowe's and Home Depot reveals key differentiators integral to investment analysis. Lowe's sustenance primarily from a 25% revenue share from professional contractors juxtaposes against Home Depot's 50% reliance, marking a distinct commercial focus. Home Depot's recent financial results show a lesser same-store sales decline than Lowe's, indicating its comparatively higher resilience through economic challenges.

Investment considerations hold that Home Depot, with its strategic makeup and customer mix, emerges as a more defensible investment under recent economic and market conditions, buttressed by a higher dividend yield. Hence, while prospects for Lowe's remain contingent on an array of complex factors, Home Depot's alignment with construction and new housing demand bestows it with a hedged position superior in adverse market climates.

One investor acting on wider market and portfolio strategies is Nicholas Ward from Seeking Alpha, who adjusted his investment strategy in response to personal circumstances. Upon purchasing a new house, Ward became a net stock seller to facilitate financing for renovations and down payments, differing from his longstanding approach toward passive income generation. However, he valued the enhancement of his family's living standards above the continued build-out of his investment portfolio.

Ward's selling strategy entailed a focus on improving the quality of his holdings and reducing portfolio duplication. His trade decisions included divesting from companies he viewed as having low growth prospects or being less impactful within his portfolio, such as Comcast and various REITs. The adjustments to Ward's portfolio remain aligned with his enduring objectives of financial independence and a high-quality, manageable portfolio.

In the sphere of well-known investors, one notable development concerns Bill Ackman, as reported by The Motley Fool, and his positioning toward Lowe's. Through Pershing Square, Ackman's hedge fund, a concentrated investment in Lowe's was revealed, part of a $10 billion commitment spread narrowly across just seven stocks. Ackman's approach focuses on spatially confined portfolios, embedding confidence in Lowe's growth potential and value prospect from an investment vantage. Lowe's commands a notable standing within Ackman's portfolio, with the company's performance and investor confidence in its strategic direction being primary factors driving Ackman's interests.

Investors focusing on dividend income and growth trajectories often acknowledge the potential resident within Lowe's and its broader industry context. Though overshadowed by the heftier revenue and performance of The Home Depot, Lowe's retains its commitment to dividends and shareholder value. Lowe's capability to improve its market share and operations portends a strong dividend outlook, supplementing its potential for income generation and growth for shareholders. Despite pressures from competitive forces and market fluctuations, Lowe's showcases the dexterity for persistence and the creation of shareholder value through dividends and business strategies, holding firm as an investment consideration within the dividend-focused equity space.

Similar Companies in Home Improvement Retail:

Report: The Home Depot, Inc. (HD), The Home Depot, Inc. (HD), Ace Hardware Corporation (Private), Menard, Inc. (Private), Builders FirstSource, Inc. (BLDR), 84 Lumber Company (Private), True Value Company (Private), Tractor Supply Company (TSCO), Sherwin-Williams Company (SHW)

News Links:

https://www.fool.com/investing/2023/11/08/proceed-with-caution-when-considering-these-5-ultr/

https://seekingalpha.com/article/4656281-how-to-live-off-of-dividends-life-changing-passive-income

https://www.fool.com/investing/2023/12/13/retails-year-in-review/

https://seekingalpha.com/article/4649985-3-dividend-aristocrat-bargains-for-a-rich-retirement

https://seekingalpha.com/article/4648144-7-dividend-aristocrats-you-should-buy-before-too-late

https://www.fool.com/investing/2023/11/24/better-stock-buy-lowes-vs-home-depot/

https://seekingalpha.com/article/4654898-why-i-made-big-changes-to-my-dividend-growth-portfolio

https://www.fool.com/investing/2023/12/15/bill-ackman-invested-10-billion-in-just-6-companie/

https://www.fool.com/investing/2023/12/15/3-overlooked-dividend-stocks-with-upside-in-2024/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: nxq4fQ

https://reports.tinycomputers.io/LOW/LOW-2023-12-17.html Home