McDonald's Corporation (ticker: MCD)

2024-01-28

McDonald's Corporation (ticker: MCD) is a global fast-food chain founded in 1940 by Richard and Maurice McDonald and later expanded by Ray Kroc. With its headquarters in Chicago, Illinois, the company has become one of the world's largest restaurant chains, operating over 38,000 locations in more than 100 countries as of 2021. McDonald's is known for its standardized menu items, including the famous Big Mac, French fries, and Chicken McNuggets. The majority of McDonald's restaurants are owned and operated by independent franchisees. The corporation's revenue streams are divided between sales generated by company-operated restaurants and fees collected from franchisees, including royalties and rent. Besides its significant presence in the foodservice industry, McDonald's has also been involved in various sustainability and environmental initiatives to address concerns about fast food's impact on health and the environment. With a strong brand, McDonald's Corporation has continued to focus on innovation, convenience, and adapting to changing consumer tastes to remain a dominant force in the quick-service restaurant sector.

McDonald's Corporation (ticker: MCD) is a global fast-food chain founded in 1940 by Richard and Maurice McDonald and later expanded by Ray Kroc. With its headquarters in Chicago, Illinois, the company has become one of the world's largest restaurant chains, operating over 38,000 locations in more than 100 countries as of 2021. McDonald's is known for its standardized menu items, including the famous Big Mac, French fries, and Chicken McNuggets. The majority of McDonald's restaurants are owned and operated by independent franchisees. The corporation's revenue streams are divided between sales generated by company-operated restaurants and fees collected from franchisees, including royalties and rent. Besides its significant presence in the foodservice industry, McDonald's has also been involved in various sustainability and environmental initiatives to address concerns about fast food's impact on health and the environment. With a strong brand, McDonald's Corporation has continued to focus on innovation, convenience, and adapting to changing consumer tastes to remain a dominant force in the quick-service restaurant sector.

| Full Time Employees | 100,000 | Previous Close | 297.21 | Dividend Rate | 6.68 |

| Dividend Yield | 2.29% | Payout Ratio | 53.62% | Five Year Avg Dividend Yield | 2.24% |

| Beta | 0.708 | Trailing PE | 25.77 | Forward PE | 23.32 |

| Volume | 4,210,521 | Average Volume | 3,023,157 | Market Cap | 215,578,869,760 |

| Fifty Two Week Low | 245.73 | Fifty Two Week High | 302.39 | Price to Sales Trailing 12 Months | 8.618 |

| Enterprise Value | 258,316,156,928 | Profit Margins | 33.31% | Float Shares | 724,152,469 |

| Shares Outstanding | 725,342,016 | Held Percent Insiders | 0.20% | Held Percent Institutions | 70.62% |

| Book Value | (6.693) | Earnings Quarterly Growth | 16.90% | Net Income to Common | 8,333,199,872 |

| Trailing EPS | 11.34 | Forward EPS | 12.53 | Last Dividend Value | 1.67 |

| Total Cash | 3,508,000,000 | Total Cash Per Share | 4.836 | EBITDA | 13,454,000,128 |

| Total Debt | 49,835,700,224 | Quick Ratio | 1.438 | Current Ratio | 1.711 |

| Total Revenue | 25,013,999,616 | Revenue Per Share | 34.281 | Return on Assets | 14.30% |

| Free Cashflow | 6,423,187,456 | Operating Cashflow | 9,324,399,616 | Earnings Growth | 18.30% |

| Revenue Growth | 14.00% | Gross Margins | 57.24% | EBITDA Margins | 53.79% |

| Operating Margins | 47.57% | Current Price | 292.26 | Target High Price | 383.00 |

| Target Low Price | 280.00 | Target Mean Price | 322.66 | Target Median Price | 325.00 |

| Recommendation Mean | 1.9 | Number of Analyst Opinions | 35 | Last Split Factor | 2:1 |

| Sharpe Ratio | -30.170221675238764 | Sortino Ratio | -466.38150091436376 |

| Treynor Ratio | 0.2081604345904561 | Calmar Ratio | 0.6132296353865174 |

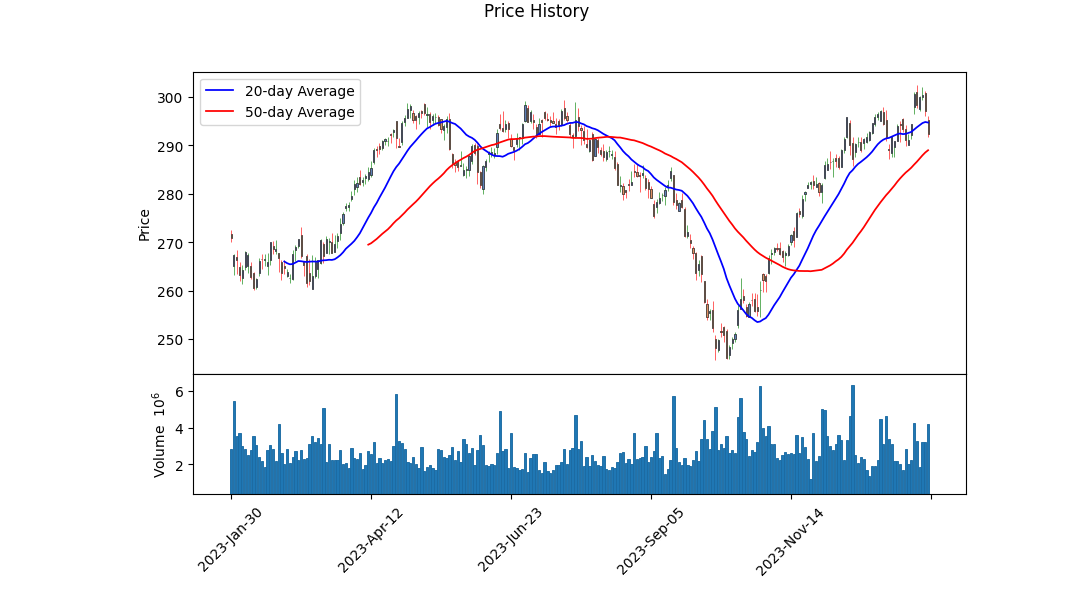

The analysis of McDonald's Corporation (MCD) begins with an examination of the technical indicators observed on the last trading day. According to the pandas_ta Python module's output, we recognize a negative MACD histogram value, which can indicate a bearish momentum entering the next trading period. However, its vital to acknowledge the limitation of a single technical indicator and to consider the broader market context and stock fundamentals for a comprehensive understanding.

In regard to the Sharpe, Sortino, Treynor, and Calmar ratios, the negative figures in Sharpe and Sortino suggest that the risk-adjusted returns have been unsatisfactory and imply a high level of volatility or a poor performance relative to the risk-free benchmark. However, the Treynor and Calmar ratios present a more favorable picture with small positive returns. These mixed outcomes suggest an element of caution is necessary.

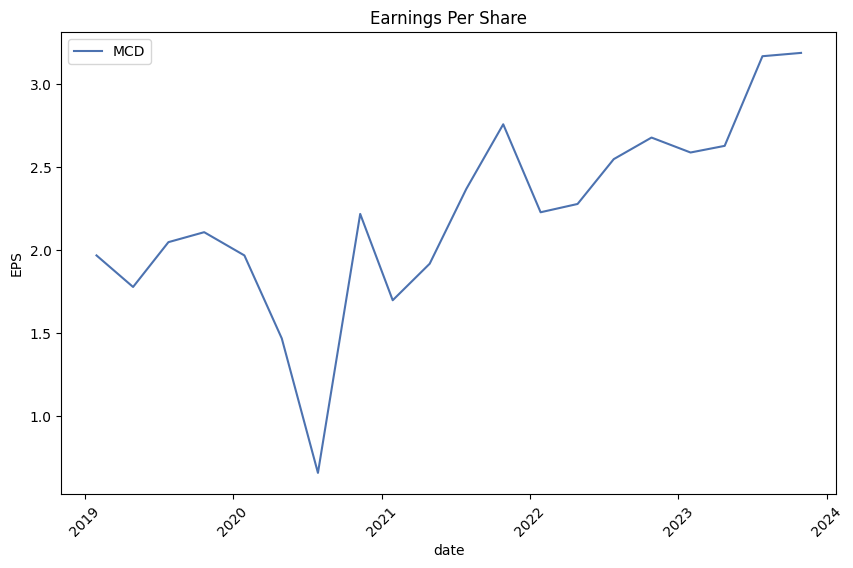

Considering the fundamentals, McDonald's Corporation has demonstrated robust gross, EBITDA, and operating margins. Stable margins are indicative of good management's efficiency and pricing strategies. The strength of their balance sheet is evident in their substantial total assets and retained earnings. Albeit the net debt seems high, McDonald's holds a considerable market capitalization, suggesting a strong position to manage its liabilities effectively. Moreover, the company's working capital and EBIT are solid, underscoring operational health.

The company's Earnings Estimate and Revenue Estimate also reveal a progressive upward trend in analyst expectations for future quarters and years. The consistent upward revisions in EPS projections for the current and next year underscore an optimistic view of McDonalds future profitability. Additionally, notable earnings in previous quarters have surpassed the analysts' expectations, which reflects positively on the company's ability to exceed market projections.

Having considered this comprehensive range of data, including the analyst expectations, historical performance, and risk-adjusted return metrics, the probable path for MCD's stock over the upcoming months leans toward a cautiously optimistic sentiment. The primary reasoning here is the strong fundamental position backed by steady revenue growth, margin stability, and a favorable outlook from analysts. The technical indicators like MACD should be watched for trend confirmations, considering market dynamics and news flow that can swiftly alter investor sentiment.

Investors should be aware of the mixed risk-adjusted return ratios and closely monitor for shifts in fundamentals or market conditions that could impact the future stock price movement. Nonetheless, based upon the robust operational performance and promising growth outlook depicted by analysts, McDonalds stock is positioned to manage potential volatility with an overall positive trajectory in the ensuing months, barring unforeseen macroeconomic headwinds or industry-specific challenges.

In our analysis of McDonald's Corporation (MCD), two key financial metrics have been calculatedReturn on Capital (ROC) and Earnings Yield. The ROC, a measure of the efficiency with which McDonald's employs its capital, stands at an impressive 20.09%. This figure indicates that for every dollar MCD invests in its business, it successfully generates over 20 cents of profit before financing costs. Such a high ROC reflects a strong competitive advantage and effective use of capital within the company. On the other hand, the earnings yield, which can be understood as the inverse of the price-to-earnings ratio, is calculated to be 2.87%. While this yield might appear modest, it provides an indication of the earnings generated for each dollar invested in McDonald's stock at the current market price. When compared to benchmark interest rates or alternative investment yields, this figure could be assessed to determine the relative attractiveness of MCD shares as an investment option. It is important to consider these metrics alongside other financial and strategic assessments of McDonald's to gain a comprehensive understanding of the company's potential for long-term value creation for its shareholders.

| Statistic Name | Statistic Value |

| R-squared | 0.452 |

| Adjusted R-squared | 0.452 |

| F-statistic | 1,035 |

| Prob (F-statistic) | 4.07e-166 |

| Log-Likelihood | -1,873.1 |

| # Observations | 1,257 |

| AIC | 3,750 |

| BIC | 3,761 |

| Alpha | 0.008970848963378835 |

| Beta | 0.7408463947852743 |

| Omnibus | 436.404 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 15,783.806 |

| Skew | 0.920 |

| Kurtosis | 20.262 |

| Cond. No. | 1.32 |

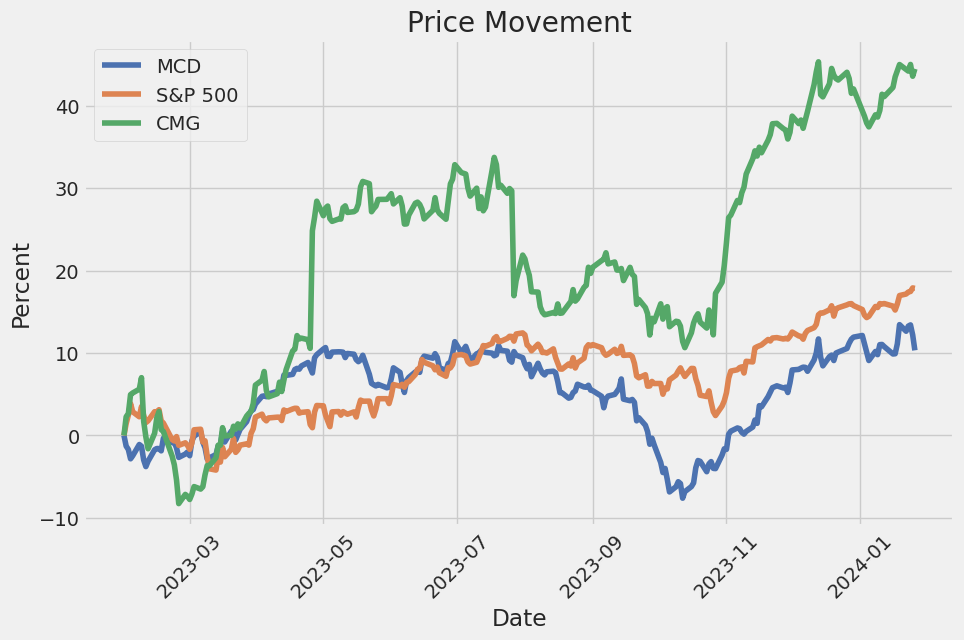

The linear regression model between McDonald's Corporation (MCD) and SPDR S&P 500 ETF Trust (SPY) indicates that MCD has a positive but less than one-to-one relationship with SPY, which represents the general market. The model's beta coefficient is approximately 0.741, which suggests that for every percentage point change in the SPY index, MCD stock changes by about 0.741 percent in the same direction, on average. This indicates that MCD is less volatile than the market. The alpha value of the model, which measures the excess return of MCD stock over the expected market return based on the CAPM model, is approximately 0.009. This positive alpha suggests that MCD provided a small positive return over and above what was predicted by its market exposure alone.

The R-squared value of the model is about 0.452, meaning that approximately 45.2% of the variability in MCD's returns can be explained by the variability in the market returns as represented by SPY. This leaves over half of the variability in MCD's returns unaccounted for by the model, which could be due to firm-specific or other non-market factors. The F-statistic is notably high, and the associated probability indicates that the model is statistically significant, lending credibility to the relationship established between MCD and SPY. Despite the statistical significance, an important consideration is the model's adjusted R-squared, which is also 0.452, reinforcing that the explanatory power of the model hasn't been inflated by the inclusion of multiple variables.

Summary of McDonald's Corporation Q3 2023 Earnings Call

Paragraph 1: Introduction and Strategic Overview The earnings call began with Mike Cieplak, Investor Relations Officer at McDonald's Corporation, introducing CEO Chris Kempczinski and CFO Ian Borden. Kempczinski discussed the companys performance in the face of ongoing economic challenges, highlighting McDonald's position as the industry's market share leader. Despite moderating top-line growth, the company still outpaced competitors thanks to the execution of its "Accelerating the Arches" strategy. He noted that the company's global sales grew by nearly 9% in Q3, and the marketing initiatives were particularly impactful for maintaining consumer relevance.

Paragraph 2: Marketing and Operational Excellence Kempczinski emphasized the success and global reach of the "As Featured In" campaign and the adoption of the "One McDonald's Way" approach that has driven international consistency and local relevance. He provided updates on operational improvements in Australia and New Zealand, particularly in menu discipline and restaurant experience enhancement. Furthermore, the expansion of the "Best Burger" initiative was mentioned as a significant success, and there were plans to expand footprint and integrate new service models like delivery rooms.

Paragraph 3: Financial Performance and Customer Value CFO Ian Borden discussed the financial results, highlighting the nearly 9% global comparable sales growth. The results demonstrated McDonald's resilience and adaptability. He credited the strong performance to restaurant-level execution and customer satisfaction across key markets. Despite pressures like inflation and consumer spending, McDonald's continued to lead in affordability and value perception. Specific market examples included Germany's innovative value offerings and Canada's cost-friendly breakfast options.

Paragraph 4: Digital Growth and Future Outlook Borden addressed the impact of digital sales, which accounted for a significant portion of overall sales. The digital platform's engagement strategies, such as the MONOPOLY campaigns, underscored the importance of leveraging technology to foster customer relationships and increase loyalty. Borden was confident in the brand's marketing approach, as exemplified by the FIFA Women's World Cup campaign. He concluded with an expectation of continued margin growth and a note on the companys dividend increase, reflecting confidence in McDonald's long-term growth and shareholder return.

Paragraph 5: Closing Remarks and Regulatory Challenges

In closing, Kempczinski reaffirmed the brand's commitment to adapting and thriving through its Accelerating the Arches strategy, highlighting the digital loyalty base and modernized restaurant footprint. Despite regulatory challenges like the recent NLRB ruling, which McDonald's opposes, Kempczinski expressed optimism in the company's ability to maintain its success and innovate for the future. He invited everyone to the upcoming investor update for a deeper dive into the companys strategic priorities and plans.

and supply issues, labor shortages, and food safety concerns. Price increases for these and other supplies may require us to increase menu prices, which could result in a loss of guest counts if consumers choose not to absorb the higher prices. Alternatively, if we choose to absorb some or all of the cost increases without raising prices, our profit margins could be negatively impacted. Furthermore, our business and financial results can be adversely affected by cost increases due to factors such as inflation, increased fuel or energy costs, or higher minimum wage and benefit standards.

Our reliance on technology exposes us to risks such as system failures or breaches in network security. These risks include unauthorized access, account takeovers, cyber-attacks, and other disruptive problems caused by hackers. Despite our efforts to secure our networks and systems, if a breach occurs, it could result in disruptions to operations, theft or unauthorized disclosure of customer, employee, or franchisee information, and legal and financial repercussions. Additionally, failures or interruptions in point-of-sale or other operational systems essential to restaurant operations could result in reduced sales, increased costs, or harm to our brand's reputation.

The competitive nature of the quick-service industry requires us to be continually innovative and responsive to consumer preferences, as failure to effectively compete with rivals could lead to decreased guest counts and sales. Additionally, challenges in labor markets, such as recruiting and retaining employees, higher wages, and compliance with employment-related regulations, could increase operational costs and impact McDonalds and its franchisees' profitability.

Legal, regulatory, and tax environments in which we operate add additional layers of complexity to our operations, increasing compliance costs and exposure to possible litigation and regulatory actions. Our ability to adapt to these environments and manage related risks is crucial for our continued success.

Furthermore, the report indicates that adverse economic conditions, epidemics, or pandemics could disrupt our business operations, negatively influence consumer behavior and spending, and result in governmental restrictions that may also impact McDonald's financial performance. Lastly, swings in commodity and other operational costs, like food or labor, could affect our profit margins if not managed properly.

Overall, our success depends on effectively managing these risks, aligning with changing consumer behaviors, and effectively executing our business strategies, including our Accelerating the Arches growth strategy, while ensuring the strength and relevance of the McDonald's brand.

McDonald's Corporation has remained a prominent player in the fast-food industry, not just because of its burgers and fries, but also due to its innovative strategies responding to evolving market dynamics. A testament to this innovative spirit is the launch of the CosMc's brand focused on drink-centric offerings, aimed at capturing the growing beverage market. This pivot reflects changes in consumer behavior, favoring smaller footprint and convenient service models. The introduction of CosMc's, reported by Travis Hoium on The Motley Fool on December 16, 2023, is an emblematic move, showcasing McDonald's recognition of the opportunities within the beverage sector.

Moreover, the company's intent to push the boundaries of the traditional fast-food model is reinforced by its partnership with Alphabets Google to integrate artificial intelligence (AI) into its operations, as detailed during the December 6 investor update. The implementation of AI exemplifies McDonald's innovative approach, aiming to enhance the customer experience and improve efficiency at multiple operational levels. Alphabet's enthusiasm for the collaboration suggests the significance of this technological advancement for McDonald's service delivery mechanisms. The full article on AI and investor insights can be found in a December 15, 2023, Motley Fool article by Demitri Kalogeropoulos.

Strengthening its investment appeal, McDonald's has also been featured as a key stock in multiple investment outlooks for 2024. It has been identified as a solid play for investors by BTI's analyst Peter S, who considers the company's strong fundamentals and highly franchised business model to provide a hedge against economic downturns. Despite the challenges of the current economy, McDonald's $300 price target and plans for accelerating development indicate growth in its market share dominance within the fast-food hamburger segment. Yahoo Finance features an investor guide where Peter S discusses McDonald's positioning in depth.

Further bolstering McDonald's investment credentials is the view of it as one of the attractive options to buy during a market downturn, as expressed by Nicholas Ward on Seeking Alpha. Holding cash reserves for such times, Ward includes McDonald's among high-quality companies with long track records of positive performance and shareholder returns. Similarly, it's also lauded as a retirement stock due to its stable franchise-related fees and potential for consistent income generation, as highlighted in an article by Will Healy on December 26, 2023, on The Motley Fool.

McDonald's revenue generation capacity, especially from its real estate holdings, vastly outstripping that of Yum! Brands, signifies its effective business model, as per an article by Jon Quast on December 31, 2023. The company's real estate strategy primarily drives profitability, showcasing the importance of McDonald's substantial real estate portfolio. Meanwhile, McDonald's cultural relevancy is underscored through its partnership to include Squishmallows in Happy Meals, as reported by Jon Quast on The Motley Fool on December 23, 2023.

McDonald's resilience in uncertain times is further endorsed in Nicholas Robbins' Motley Fool article dated December 30, 2023, which frames the company as a stable choice that can be relied upon for growth and consistent dividend payments. The ambitious plan to grow the franchise to 50,000 restaurants by 2027 substantiates this viewpoint, as reported by Neil Patel on The Motley Fool.

Even as McDonald's explores avenues of growth and adaptation, it is highlighted as an excellent choice for dividend-seeking investors seeking passive income. According to Parkev Tatevosian, CFA, on The Motley Fool dated January 4, 2024, McDonald's technological adaptations signify an evolving enterprise, and its significant market capitalization supports its dividend payment capabilities.

Justin Pope's January 7, 2024, contribution to The Motley Fool punctuates McDonald's status as a millionaire-maker stock with enormous historical returns for long-term holders. Moreover, McDonald's is acknowledged for its wide moata term denoting a sustainable competitive advantageadding to its investment allure. The methodological approach to identifying McDonald's wide-moat status can be found in the Seeking Alpha article from January 10, 2024, by The FALCON Method.

Lastly, McDonald's has maintained impressively high operating profit margins, exceeding 45% of sales. This yield, combined with 47 years of consecutive annual dividend increases, underscores the company's financial fortitude and commitment to shareholder returns. For a detailed account of McDonald's financial health and dividend prowess, you may refer to Demitri Kalogeropoulos' article, "If You Like Dividends, You Should Love These 3 Stocks," on The Motley Fool from January 13, 2024.

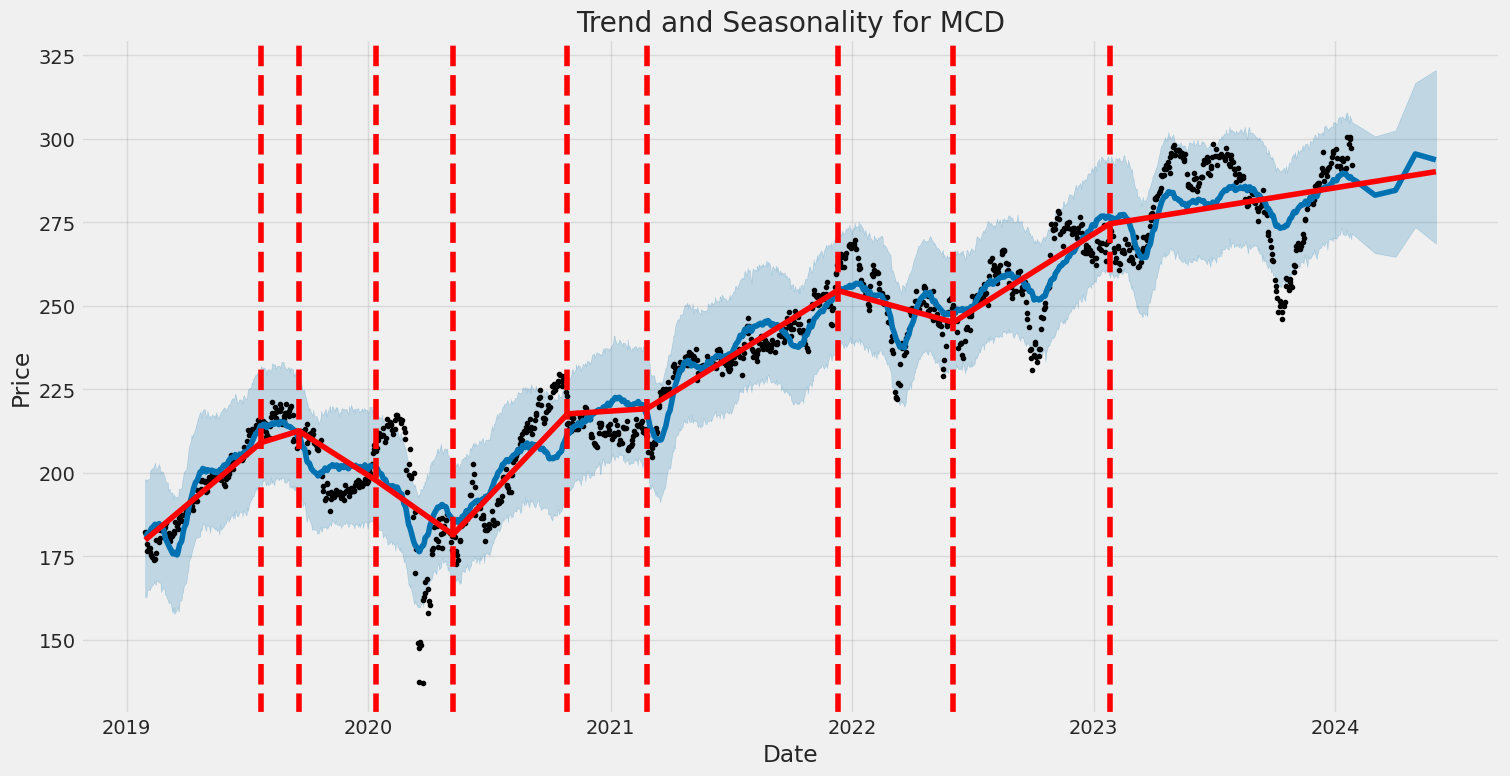

Over the specified period between January 29, 2019, and January 26, 2024, the volatility of McDonald's Corporation (MCD) as captured by the ARCH model suggests that there were fluctuations in the company's asset returns. The omega value of 1.1545 points to a base level of volatility in the absence of any large market events or shocks. The alpha[1] coefficient of 0.3960 indicates that past returns had a significant impact on the current volatility, demonstrating that large changes in returns increased the future volatility.

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -2,057.11 |

| AIC | 4,118.22 |

| BIC | 4,128.50 |

| No. Observations | 1,257 |

| omega | 1.1545 |

| alpha[1] | 0.3960 |

To analyze the financial risk of investing $10,000 in McDonald's Corporation over a one-year period, we apply volatility modeling and machine learning predictions. Volatility modeling is key in understanding historical stock price fluctuations and provides us with an estimate of potential future volatility. This type of statistical model utilizes past returns to forecast the conditional variance of the stock returns, which is a crucial input for various financial risk management tools.

The volatility modeling method we refer to here captures the 'clustering' effect in financial time series, where periods of high volatility are followed by high volatility and periods of low volatility follow low volatility. By fitting this model to the historical price returns of McDonalds Corporation, we can assess the dynamic risk that comes with an investment in the stock over time.

Simultaneously, machine learning predictions leverage a vast array of data, including but not limited to historical stock prices, financial reports, and macroeconomic indicators to predict future stock returns. In this case, a non-linear model that is particularly adept at handling complex interactions between predictor variables is employed to forecast future price movements. This form of analysis can uncover patterns and relationships in the data that are not immediately obvious and provide a forecast that incorporates a broader set of factors influencing stock price.

Upon using these advanced analytics approaches, we focus on the Value at Risk metric, which is a standard financial model to assess the level of financial risk over a set period. This metric tells us that at a 95% confidence interval, there is only a 5% chance that the investment will lose more than the calculated VaR within one year, under normal market conditions.

In the case of the $10,000 investment in McDonald's Corporation, the calculated VaR is $136.58. This suggests that there is a 95% probability that the investor will not lose more than $136.58 over the one-year period, which is a relatively small portion of the total investment. However, it is also important to bear in mind that VaR does not predict potential losses beyond the confidence interval threshold, and it does not account for extreme events, also known as 'tail risks'.

The utilization of volatility modeling provides insights into how McDonald's Corporation's stock may behave in terms of price swings, while machine learning predictions help forecast future returns by interpreting complex data patterns. By combining both methods, we enhance our ability to gauge the risk profile of the investment. Through these advanced analytical tools, investors can obtain a clearer picture of the risk associated with a potential investment in McDonald's Corporation's stock.

Similar Companies in Restaurants:

Chipotle Mexican Grill, Inc. (CMG), Dutch Bros Inc. (BROS), Domino's Pizza, Inc. (DPZ), Yum! Brands, Inc. (YUM), Report: Starbucks Corporation (SBUX), Starbucks Corporation (SBUX), Wingstop Inc. (WING), Shake Shack Inc. (SHAK), Papa John's International, Inc. (PZZA), Darden Restaurants, Inc. (DRI), Yum China Holdings, Inc. (YUMC), The Wendy's Company (WEN), Restaurant Brands International Inc. (QSR), Jack in the Box Inc. (JACK), Dunkin' Brands Group, Inc. (DNKN)

https://www.fool.com/investing/2023/12/15/mcdonalds-gets-into-ai-what-investors-need-to-know/

https://seekingalpha.com/article/4658149-12-stocks-i-hope-to-buy-if-the-market-crashes

https://www.fool.com/investing/2023/12/16/mcdonalds-makes-a-wild-bet-on-the-future-of-food/

https://www.fool.com/investing/2023/12/18/where-will-mcdonalds-stock-be-in-3-years/

https://www.youtube.com/watch?v=BJiSjVkSv90

https://www.fool.com/investing/2023/12/23/squishmallows-just-launched-in-mcdonalds-happy-mea/

https://www.fool.com/investing/2023/12/26/2-retirement-stocks-to-buy-for-2024/

https://www.fool.com/investing/2023/12/30/2-stocks-to-add-to-your-wish-list-for-the-next-mar/

https://www.fool.com/investing/2023/12/31/yum-has-16000-more-restaurants-than-mcdonalds/

https://www.fool.com/investing/2024/01/04/want-500-in-passive-income-buy-75-shares-of-this-s/

https://seekingalpha.com/article/4661160-january-dogs-of-the-dow-2-buyable-6-watchable

https://www.fool.com/investing/2024/01/07/5-magnificent-stocks-that-have-created-millionaire/

https://seekingalpha.com/article/4662189-us-wide-moat-stocks-on-sale-the-january-2024-heat-map

https://www.fool.com/investing/2024/01/13/if-you-like-dividends-should-love-these-3-stocks/

https://www.sec.gov/Archives/edgar/data/63908/000006390823000101/mcd-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 70d8Dy

Cost: $1.18312

https://reports.tinycomputers.io/MCD/MCD-2024-01-28.html Home