Mercado Libre, Inc (ticker: MELI)

2023-12-21

Mercado Libre, Inc. (ticker: MELI) is a dominant e-commerce company based in Latin America, operating throughout several countries with a diverse array of services including marketplace platforms, payment processing, and financial technology solutions. Founded in 1999, the company has seen significant growth, capitalizing on the region's increasing internet penetration and a growing shift towards online retail. Mercado Libre offers an online commerce platform similar to that of eBay or Amazon, where users can buy and sell a wide range of products. Additionally, through its service Mercado Pago, it provides digital payment solutions that facilitate transactions both on and off its marketplace platform. The company's strong position in the market, continuous innovation, and expansion through strategic acquisitions have contributed to its robust financial performance, making it a compelling player and often referred to as the "Amazon of Latin America." As of 2023, Mercado Libre continues to invest in logistics and payment infrastructure to support its ecosystem and sustain growth in its extensive user base.

Mercado Libre, Inc. (ticker: MELI) is a dominant e-commerce company based in Latin America, operating throughout several countries with a diverse array of services including marketplace platforms, payment processing, and financial technology solutions. Founded in 1999, the company has seen significant growth, capitalizing on the region's increasing internet penetration and a growing shift towards online retail. Mercado Libre offers an online commerce platform similar to that of eBay or Amazon, where users can buy and sell a wide range of products. Additionally, through its service Mercado Pago, it provides digital payment solutions that facilitate transactions both on and off its marketplace platform. The company's strong position in the market, continuous innovation, and expansion through strategic acquisitions have contributed to its robust financial performance, making it a compelling player and often referred to as the "Amazon of Latin America." As of 2023, Mercado Libre continues to invest in logistics and payment infrastructure to support its ecosystem and sustain growth in its extensive user base.

| As of Date: 12/21/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 80.77B | 63.51B | 59.34B | 66.18B | 42.56B | 41.63B |

| Enterprise Value | 82.28B | 65.74B | 61.65B | 68.56B | 44.54B | 43.45B |

| Trailing P/E | 81.50 | 84.98 | 97.10 | 138.31 | 157.88 | 175.75 |

| Forward P/E | 46.30 | 42.73 | 66.23 | 94.34 | 60.24 | 72.99 |

| PEG Ratio (5 yr expected) | 0.84 | 1.05 | 1.69 | 2.31 | 0.86 | 0.98 |

| Price/Sales (ttm) | 6.11 | 5.40 | 5.39 | 6.42 | 4.47 | 4.69 |

| Price/Book (mrq) | 29.47 | 28.43 | 29.09 | 36.22 | 26.08 | 26.35 |

| Enterprise Value/Revenue | 6.23 | 17.48 | 18.05 | 22.58 | 14.84 | 16.15 |

| Enterprise Value/EBITDA | 32.41 | 84.61 | 89.08 | 126.96 | 84.04 | 112.27 |

| Statistic | Value | Statistic | Value | Statistic | Value |

|---|---|---|---|---|---|

| City | Montevideo | Zip Code | 11300 | Country | Uruguay |

| Phone | 598 2 927 2770 | Industry | Internet Retail | Sector | Consumer Cyclical |

| Full Time Employees | 40,548 | Previous Close | $1,629.99 | Open | $1,625.11 |

| Day Low | $1,595.74 | Day High | $1,643.50 | Market Cap | $80,765,763,584 |

| 52 Week Low | $815.86 | 52 Week High | $1,660.00 | Volume | 321,005 |

| Average Volume | 389,419 | Average Volume 10 days | 351,090 | Shares Outstanding | 50,559,500 |

| Market Cap | $80,765,763,584 | Net Income to Common | $987,000,000 | Trailing EPS | 19.56 |

| Forward EPS | 34.14 | Book Value | 54.281 | Price to Book | 29.429 |

| Total Cash | $5,490,999,808 | Total Debt | $5,240,000,000 | Total Revenue | $13,214,000,128 |

| EBITDA | $2,444,000,000 | Debt to Equity | 191.171 | Return on Assets | 0.08603 |

| Return on Equity | 0.45151 | Gross Profits | $5,953,000,000 | Free Cashflow | $3,513,999,872 |

| Operating Cashflow | $4,753,999,872 | Revenue Growth | 39.8% | Gross Margins | 56.606% |

| EBITDA Margins | 18.496% | Operating Margins | 18.218% | Current Price | $1,597.44 |

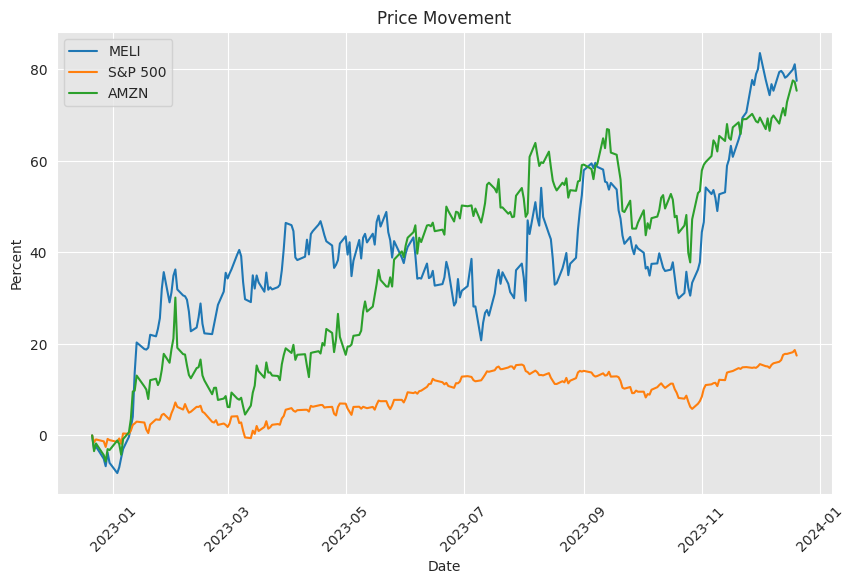

Based on the provided technical analysis data and company fundamentals for MercadoLibre, Inc. (MELI), we observe the following:

Technical Indicators: - The Adjusted Closing Price stands at 1597.44, showcasing a robust position in the market. - The Moving Average Convergence Divergence (MACD) at 49.43 with a negative histogram value suggests a potential slowing of the upward momentum. - The Relative Strength Index (RSI) at 60 indicates neither overbought nor oversold conditions, signalling a stable market sentiment. - Bollinger Bands with the current price close to the middle band (BBM) does not indicate a significant deviation from the norm. - A 20-period Simple Moving Average (SMA) equal to the Adjusted Close reflects a balanced market without significant short-term trends. - The Exponential Moving Average (EMA) over 50 days shows the stock is trading well above the longer-term trend, indicating bullish sentiment. - The On-Balance Volume (OBV) is relatively flat, suggesting an equilibrium between buying and selling pressures. - A moderate Stochastic oscillator (STOCHk) value and its three-day moving average (STOCHd) imply theres room for price movement either way. - Above 25, a high Average Directional Index (ADX) points to a strong trend, the direction of which needs other indicators to confirm. - Williams %R (WILLR_14) implies that the stock is not in oversold territory, potentially leaving room for downward pressure. - The Chaikin Money Flow (CMF) showing positive values indicates buying pressure. - Price Stop and Reverse (PSAR) values demonstrate upward trend stability.

Fundamentals Analysis: - The Market Cap shows a significant increase over the year, reflecting positive investor sentiment and potential stock growth. - The Trailing and Forward P/E ratios have improved, suggesting a better valuation and earnings outlook for the company. - The PEG Ratio under 1 may indicate the stock is undervalued relative to earnings growth expectations. - Price/Sales and Price/Book ratios suggest a premium valuation, though it has come down from the previous year, implying the stock may be more reasonably priced now. - The Enterprise Value multiples are on the higher side, suggesting a strong market presence, but this also means the stock may be richly valued. - Looking at the financials, a significant increase in Normalized EBITDA and net income indicates operational efficiency and profitability improvement. The resolved tax effects of unusual items reflect well on fiscal management.

Combining these technical and fundamental insights, the picture that emerges for MELI over the next few months is cautiously optimistic. Despite a high valuation, the company shows strong growth and improved profitability that could continue to attract investors. The robust trend indicated by the ADX aligns with this view, yet the negative MACD histogram suggests vigilance as the momentum may wane.

The stock is currently in equilibrium, but with solid fundamentals and slight technical bullishness. If MELI maintains its financial trajectory and manages to surpass market expectations, we could see upward price persistence. However, considering the rich valuation, any unexpected poor financial outcomes may lead to price corrections.

In conclusion, while MELI appears to be a strong contender in the market, potential investors should monitor upcoming financial statements and news for signs of sustained growth or emerging weaknesses. The company's fundamental improvements, coupled with decent technical positioning, suggest that the stock may experience continued appreciation, barring any significant market or internal disruptions. Investors should be mindful of the higher valuation metrics and look for confirmatory signs in both technical patterns and fundamental developments.

MercadoLibre, Inc. (MELI), often dubbed the "Amazon of Latin America," has evolved into a cornerstone of various investment portfolios due to its significant expansion in the e-commerce and digital payments space. With operations across 18 countries in Latin America, MercadoLibre provides an extensive suite of services, encompassing online marketplaces, logistics, digital payments, and financial technology solutions. Its comprehensive approach to e-commerce mirrors a blend of Amazon, Shopify, and PayPal, helping it tap into the emerging digital economy of the region.

Despite facing economic and political challenges within its operational landscape, MercadoLibre has showcased notable resilience and growth. The company's revenue saw a 50% increase in 2022, with net income witnessing an impressive 480% rise. This consistent multi-year growth trajectory has positioned MercadoLibre as a robust player capable of navigating and flourishing within the economic complexities of Latin America.

From an investment vantage point, MercadoLibre embodies the potential of emergent markets where long-term growth prospects balance out the risks. Astute investors who recognized and seized this opportunity have been duly rewarded; the stock has appreciated by over 7,300% since 2009. This appreciation underlines the efficacy of a well-informed, risk-weighted investment approach.

The company's performance emphasizes the significance of long-term potential in investment considerations and the advantages of diversification within sectors. Investors have prospered from their stakes in MercadoLibre and other e-commerce leaders such as Amazon and Shopify. Furthermore, the company's journey exemplifies the effectiveness of the buy-and-hold strategy, especially within high-growth emerging markets that may reward patient investors with exponential returns.

MercadoLibre continues to expand its reach and consolidate its position in Latin America, advocating for its significance as a holding for investors aiming to diversify with high-growth international stocks. Its story provides insights into recognizing opportunities in volatile markets and leveraging those prospects for substantial returns, establishing it as a mainstay in the evolution of global e-commerce and digital payments.

Within its dominant niche as a comprehensive marketplace and financial ecosystem, MercadoLibre's revenue growth tenfold over a five-year period stands as testimony to its business model's scalability and relevance. With operating profits rising sharply, the platform is more than just a transient success; it is a clear indication of the digital adoption and market penetration in Latin America.

MercadoLibre's market-leading position in e-commerce and fintech places it at an advantage to benefit from the region's digitalization trend. The large unbanked populations in pursuit of financial inclusion and a rising middle class underline the company's significant market opportunity, which it is well-poised to capitalize on. Mercado Pago, its digital payments platform, creates a competitive moat against potential newcomers to the market, bolstering its financial foothold.

The upward trajectory of MercadoLibre's stock reflects robust business fundamentals and garners investor confidence in the company's continued performance. Withholding rebalancing from prospering stocks aligns with the investment principles proposed by industry titans like Peter Lynch and Warren Buffett. This suggests that by maintaining a stake in consistently performing companies, rather than realizing profits prematurely, investors can further reap the benefits of an ongoing growth narrative.

Looking into the next year, MercadoLibre's diverse consumer base and responsive adaptability to market trends suggest optimistic future prospects. Investors with significant retirement allocations in MELI are banking on potential continuous appreciation, opting to stay invested in the promising landscape of Latin America's e-commerce and digital finance.

Moreover, MercadoLibre forms part of the "Top 10 Stocks to Buy in 2023" as recommended by The Motley Fool. The inclusion of MELI in this prestigious list is based on strong growth metrics and market dominance in Latin America. Despite market turbulence, MercadoLibre's positive performance along with other highlighted stocks such as Airbnb, Amazon, and Lululemon, has driven favorable market outcomes.

The philosophy backing The Motley Fool's recommended stocks is deeply rooted in a long-term, growth-oriented perspective. The conviction is that high-quality stocks, held for an extended duration, can yield substantial returns. This includes MercadoLibre, which consistently maintains high productivity amidst volatility, signaling the appropriateness of its continued presence in investor portfolios aiming for the long haul.

As MercadoLibre establishes its legacy within the fintech and e-commerce sectors, it mirrors the trajectory of companies that not only stand the test of time but propel growth. With sound Q3 financials indicating strong performance across commerce and fintech segments, the future revenue is expected to reflect the company's ability to sustain and surpass growth expectations, underscoring MercadoLibre's resilience.

MercadoLibre's operational scale and technological investment, particularly in fintech services such as Mercado Pago and Mercado Credito, continue to bridge the gap in regions with low banking penetration. This has contributed significantly to overall economic growth in Latin America. The expectation of continued revenue increases support investor confidence in MercadoLibre's stock valuation and anticipates further appreciation.

MercadoLibre's position within the marketplace is bolstered by its integration of e-commerce and financial technology into one convenient platform. The company's swift growth rates point towards an efficient model that capitalizes on both consumer transactions and seamless online experiences. This multi-pronged approach, coupled with strong year-over-year performance, positions MercadoLibre to continue its role as a market leader and a promising investment for the foreseeable future.

With a business model that stretches beyond just an e-commerce platform, MercadoLibre embeds itself into the economic fabric of Latin America through its fintech services. Mercado Pago, in particular, plays a significant role in the company's growth story, providing payment solutions and credit services. This strategic diversification not only broadens the company's revenue base but embeds it into the everyday financial activities of the region.

Despite commanding a premium market valuation, MercadoLibre's outperformance against expectations posits the company as an attractive option for investors considering its potential for sustained business success. Given the company's infrastructure, expansion potential, and critically acclaimed market dominance, MercadoLibre is advocated for a long-term investment, assuming it maintains its growth momentum and the regional economic climate remains conducive.

MercadoLibre's role as a vanguard in fintech is further reinforced by its adoption of cryptocurrency, which has attracted the interest of prominent investment firms such as Ark Invest. This forward-thinking strategy aligns with Ark's bullish perspective on the future value of Bitcoin, projecting substantial appreciation. As cryptocurrencies become more mainstream, MercadoLibre's integration of such assets into its treasury strategy might further its standing as an innovative financial entity in the global market.

In aggregate, MercadoLibre with its durable growth, strategic operations, and commitment to innovation, is viewed not merely as a profitable venture for the upcoming year but as a potential mainstay for long-term investors. The company's maneuvering within the digital transformation of commerce and finance positions it as a prudent choice for engagement in the accelerating digital economy of Latin America.

Similar Companies in Internet Retail:

Report: Amazon.com, Inc. (AMZN), Amazon.com, Inc. (AMZN), eBay Inc. (EBAY), Etsy, Inc. (ETSY), Alibaba Group Holding Limited (BABA), Walmart Inc. (WMT), Shopify Inc. (SHOP), Sea Limited (SE), JD.com, Inc. (JD)

News Links:

https://www.fool.com/investing/2023/12/19/my-6-largest-portfolio-holdings-heading-into-2024/

https://www.fool.com/investing/2023/12/17/headed-into-2024-these-5-stocks-make-up-40-of-my/

https://www.fool.com/investing/2023/12/16/my-top-10-stocks-to-buy-in-2023-beat-the-market-by/

https://www.fool.com/investing/2023/12/16/here-are-my-top-10-stocks-for-2024/

https://www.fool.com/investing/2023/12/14/2-stocks-that-will-make-you-richer-in-2024/

https://www.fool.com/investing/2023/12/14/1-cryptocurrency-to-buy-before-soars-3400-cathie-w/

https://www.fool.com/investing/2023/12/12/here-are-my-5-largest-stock-positions-heading-into/

https://www.fool.com/investing/2023/12/09/got-1000-heres-1-e-commerce-stock-to-buy-in-decemb/

https://www.fool.com/investing/2023/12/09/why-coinbase-stock-is-still-a-great-buy/

https://www.fool.com/investing/2023/12/09/3-great-foregin-companies-to-invest-in-right-now/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: 5ssQEZZ

https://reports.tinycomputers.io/MELI/MELI-2023-12-21.html Home