MP Materials Corp. (ticker: MP)

2024-05-14

MP Materials Corp. (ticker: MP) is a prominent U.S.-based company specializing in the extraction, processing, and production of rare earth materials, which are critical components in a variety of high-technology applications such as electric vehicles, wind turbines, and defense systems. Headquartered in Las Vegas, Nevada, MP Materials operates the Mountain Pass mine in Californiathe only rare earth mining and processing site of its scale in the Western Hemisphere. With a vertically integrated business model, the company aims to restore the U.S. supply chain for rare earth elements, reducing dependency on foreign entities, particularly China, which currently dominates the global market. MP Materials is not only focused on mining, but also on refining the raw materials into high-purity, separated rare earth compounds and products. By advancing its capabilities across the value chain, MP Materials is positioning itself as a key player in the global transition towards cleaner energy and advanced technologies.

MP Materials Corp. (ticker: MP) is a prominent U.S.-based company specializing in the extraction, processing, and production of rare earth materials, which are critical components in a variety of high-technology applications such as electric vehicles, wind turbines, and defense systems. Headquartered in Las Vegas, Nevada, MP Materials operates the Mountain Pass mine in Californiathe only rare earth mining and processing site of its scale in the Western Hemisphere. With a vertically integrated business model, the company aims to restore the U.S. supply chain for rare earth elements, reducing dependency on foreign entities, particularly China, which currently dominates the global market. MP Materials is not only focused on mining, but also on refining the raw materials into high-purity, separated rare earth compounds and products. By advancing its capabilities across the value chain, MP Materials is positioning itself as a key player in the global transition towards cleaner energy and advanced technologies.

| Total Employees | 681 | Previous Close | 16.35 | Open | 17.01 |

| Day Low | 16.76 | Day High | 18.48 | Beta | 2.311 |

| Forward PE | 52.628574 | Volume | 7,198,576 | Average Volume | 4,011,426 |

| Market Cap | 3,045,138,944 | 52 Week Low | 12.68 | 52 Week High | 26.529 |

| Price to Sales TTM | 14.751508 | 50 Day Average | 15.3754 | 200 Day Average | 17.47465 |

| Enterprise Value | 3,046,013,696 | Profit Margins | 0.01622 | Float Shares | 121,975,707 |

| Shares Outstanding | 165,316,992 | Shares Short | 28,477,071 | Short Ratio | 7.34 |

| Book Value | 6.883 | Price to Book | 2.6761587 | Net Income | 3,349,000 |

| Trailing EPS | -0.14 | Forward EPS | 0.35 | PEG Ratio | -8.44 |

| Enterprise to Revenue | 14.756 | Enterprise to EBITDA | 534.295 | 52 Week Change | -0.22768068 |

| S&P 52 Week Change | 0.2704494 | Target High Price | 45.0 | Current Price | 18.42 |

| Total Cash | 946,766,976 | Total Debt | 947,644,992 | Quick Ratio | 9.184 |

| Current Ratio | 10.286 | Total Revenue | 206,428,992 | Debt to Equity | 83.291 |

| Revenue per Share | 1.169 | Return on Assets | -0.0165 | Return on Equity | 0.00269 |

| Free Cash Flow | -233,717,376 | Operating Cash Flow | -33,918,000 | Revenue Growth | -0.491 |

| Gross Margins | 0.49575 | EBITDA Margins | 0.02762 | Operating Margins | -0.63673997 |

| Sharpe Ratio | -0.1016 | Sortino Ratio | -1.8447 |

| Treynor Ratio | -0.0303 | Calmar Ratio | -0.2629 |

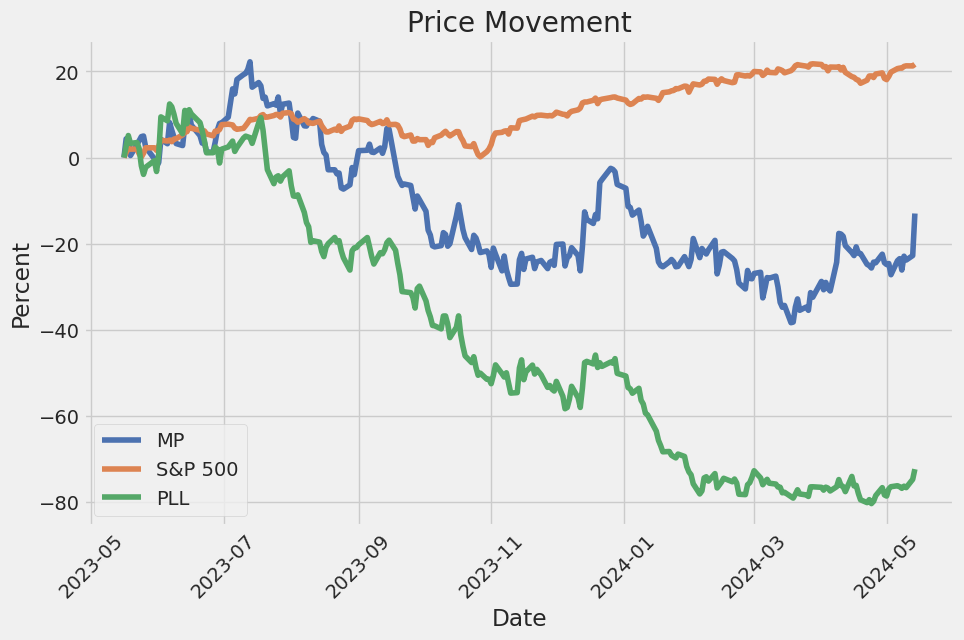

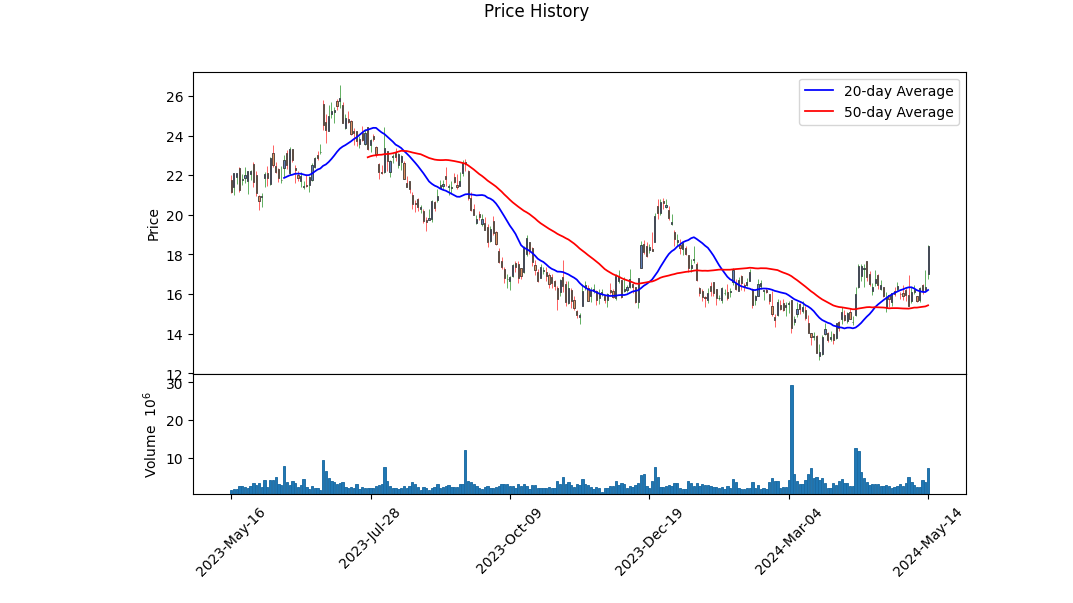

The stock for MP has shown significant volatility over the past several months. Analyzing technical indicators, we note a significant movement in the OBV (On-Balance Volume) indicator, which has steadily decreased into negative territory, hovering around -3.3 million on the last trading day. This pattern indicates that volume has been predominantly driven by selling pressure. The MACD (Moving Average Convergence Divergence) histogram is also noteworthy as it shifted from a negative to a slightly positive value of 0.125071, suggesting a potential shift in momentum towards bullish behavior.

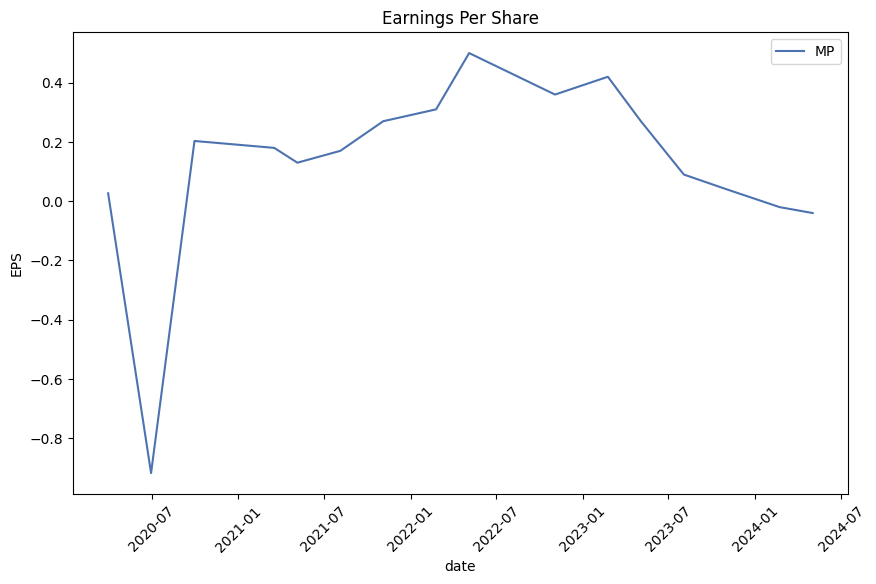

Fundamentally, the company reveals a mixed picture. Gross margins are healthy at 49.575%, yet operating margins are deeply negative at -63.674%, signaling inefficiencies or potentially high costs that gnaw at profitability. The EBITDA margin sits modestly at 2.762%, indicating minimal income from core operations relative to total revenue. MP's gross profitability and significant cash reserves highlight strong operational potential; however, substantial capital expenditure and free cash flow indicate aggressive investment or restructuring activities.

From a balance sheet perspective, MP holds significant cash and cash equivalents at $263.351 million, coupled with substantial short-term investments. Total debt stands at $688.809 million, against a net debt position of $418.629 million, highlighting substantial leverage that could weigh on future profitability, especially under adverse market conditions.

Evaluating MP's risk-adjusted return metrics, we observe unfavorable values across the board. The Sharpe Ratio of -0.1016 denotes poor risk-adjusted returns over the past year, suggesting that any returns were minuscule once adjusted for risk. The Sortino Ratio, more insightful for downside risk, is notably low at -1.8447, highlighting poor performance when considering negative volatility. The Treynor Ratio sits at -0.0303, indicating inadequate returns relative to systematic risk, while the Calmar Ratio of -0.2629 shows poor performance when measured against drawdowns.

Financial analysis reveals an Altman Z-Score of 2.0677, indicating a moderate risk of financial distress. The Piotroski Score of 3 suggests weak fundamentals. Working capital exceeds $998 million, which is healthy, yet substantial ebit remains markedly negative at -$59.728 million. This paints a picture of a company with significant assets but poor operational profitability.

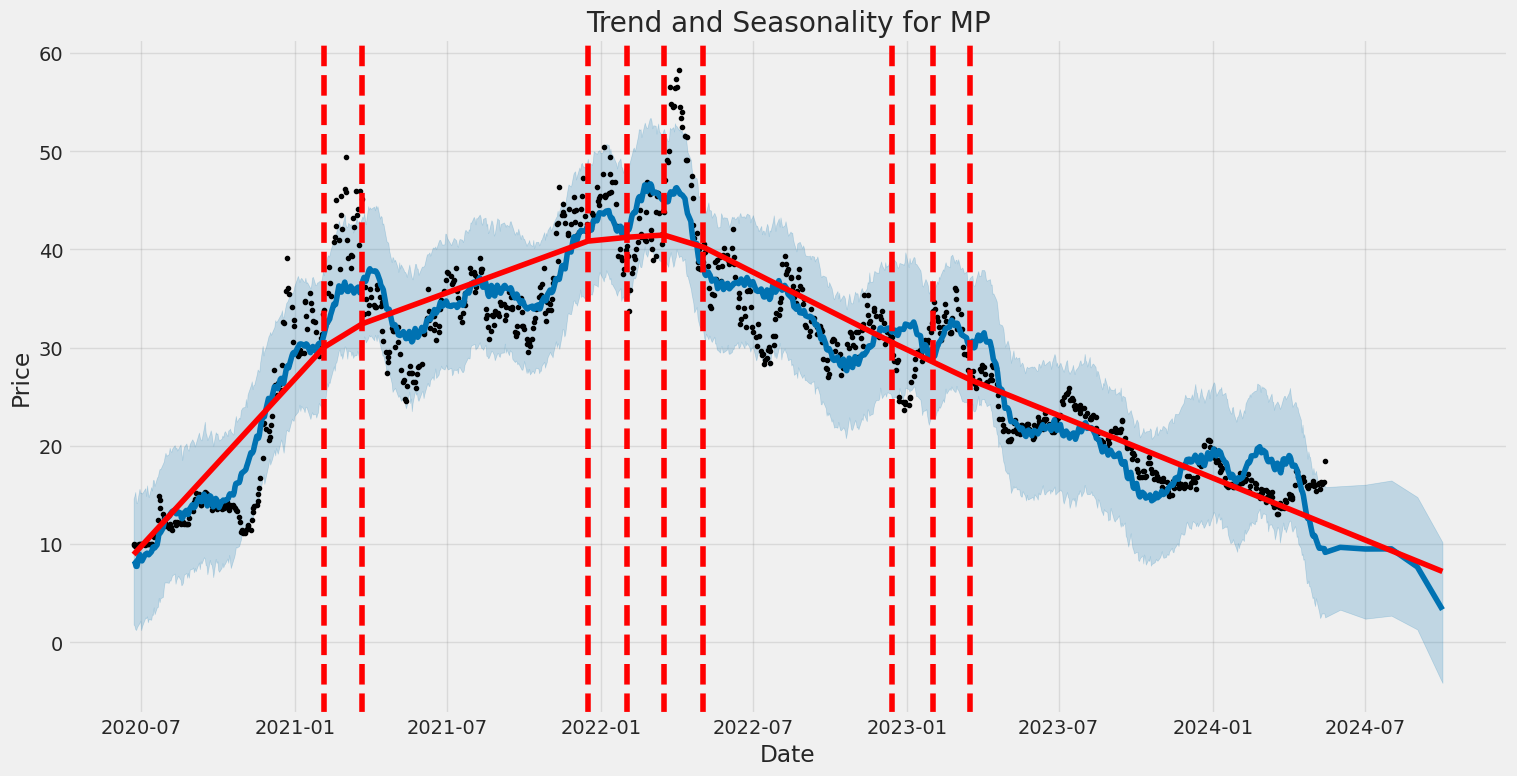

In the coming months, given the notable shifts in key technical indicators coupled with weak fundamentals and high leverage, it seems likely that MP may face continued volatility. The potential for a slight bullish shift, suggested by recent MACD movements, might offer interim gains. However, unless significant operational changes occur or broader market conditions improve, sustained upward movement seems challenging.

In summary, technicals hint at a potential short-term price recovery, but fundamentals and risk metrics underscore caution. Investors should watch closely for operational improvements or strategic moves that might bolster profitability and reduce risk.

In our analysis of MP Materials Corp. (MP), we have observed impressive financial metrics that underscore the company's efficient operational performance and its potential for profitability. The Return on Capital (ROC) stands at 0.9752, indicating that for every dollar of capital invested in the business, MP generates approximately $0.98 in net income, a robust indicator of capital efficiency and management's ability to deploy resources effectively. Additionally, the Earnings Yield, calculated at 0.7600, signifies that the company is yielding $0.76 in earnings for every dollar of share price, translating into a substantial return relative to its stock price. These metrics collectively highlight MP Materials Corp.'s strong financial health and attractiveness as an investment opportunity, given its capability to generate high returns on invested capital and offer considerable earnings relative to its market valuation.

Research Report: Analysis of MP Materials Corp (MP) Against Benjamin Grahams Investment Criteria

Introduction

MP Materials Corp. (MP) is an emerging player in the rare earth materials industry, integral to technological advancements. For evaluating the investment quality of this stock, we apply Benjamin Grahams principles as outlined in "The Intelligent Investor". Graham's approach to value investing emphasizes intrinsic value and long-term growth potential, utilizing several financial metrics for stock screening. Below, we delve into these criteria and assess how MP Materials measures up against Graham's investment standards.

Key Metrics and Analysis

- Price-to-Earnings (P/E) Ratio

- MPs P/E Ratio: 21.59

- Industry P/E Ratio: 15.13

- Grahams Benchmark: Graham typically favored companies with P/E ratios lower than their industry peers and the market average.

Analysis: MP Materials P/E ratio of 21.59 is notably higher than the industry average of 15.13. According to Grahams criteria, this might indicate that MP Materials is overvalued compared to its peers. Investors should be cautious, as higher P/E ratios can imply an overvaluation or higher market expectations for future growth.

- Price-to-Book (P/B) Ratio

- MPs P/B Ratio: 1.27

- Grahams Benchmark: Graham preferred stocks trading below their book value, ideally P/B ratios under 1.5.

Analysis: MPs P/B ratio of 1.27 aligns well with Grahams preference for lower P/B ratios. This suggests that the market price of MP shares is close to its book value, potentially indicating an undervalued or fairly valued stock relative to its intrinsic worth.

- Debt-to-Equity (D/E) Ratio

- MPs D/E Ratio: 0.505

- Grahams Benchmark: Companies with a D/E ratio below 0.5 are preferred, as it indicates lower financial risk.

Analysis: MP Materials D/E ratio of 0.505 is nearly in line with Graham's preference for low debt levels. This relatively low level of debt signifies moderate financial risk, suggesting that the company is not over-leveraged and has a stable financial structure.

- Current Ratio

- MPs Current Ratio: 10.42

- Grahams Benchmark: Graham preferred companies with current ratios above 2, indicating strong liquidity.

Analysis: MPs exceptionally high current ratio of 10.42 indicates a robust ability to cover short-term liabilities with its short-term assets, far exceeding Grahams minimum criterion. This high liquidity reflects a strong financial position and the ability to withstand short-term financial challenges.

- Quick Ratio

- MPs Quick Ratio: 10.42

- Grahams Benchmark: A quick ratio above 1 is preferred, indicating the firm can meet its short-term obligations without relying on inventory sales.

Analysis: Similar to the current ratio, MPs quick ratio of 10.42 demonstrates a significant liquid asset base. This high ratio suggests MP Materials has more than sufficient liquidity, underscoring its financial robustness.

- Earnings Growth

- Grahams Criterion: Consistent earnings growth over several years.

Analysis: While specific figures for MPs earnings growth are not provided in the data, evaluating this aspect requires a longitudinal study of MPs earnings over multiple years. Graham favored companies with a stable and upward earnings trajectory.

Summary

Evaluating MP Materials Corp. using Benjamin Graham's investment principles presents a mixed picture:

- Positive Aspects: The P/B, current, and quick ratios are favorable, reflecting potential undervaluation, strong liquidity, and a solid financial base.

- Cautionary Notes: The P/E ratio is higher than the industry average, suggesting potential overvaluation according to Graham's criteria. The D/E ratio, while slightly above the preferred benchmark, still signals reasonable financial risk.

Conclusion

While MP Materials exhibits robust liquidity and a reasonable debt level, the higher-than-industry-average P/E ratio necessitates caution. Investors should consider these mixed indicators alongside a comprehensive analysis of the company's earnings growth and industry prospects. Aligning with Grahams value investing ethos demands a meticulous approach, ensuring a margin of safety and long-term growth potential before making investment decisions.### Analyzing Financial Statements: MP Materials Corp. / DE

Investors should meticulously examine a company's balance sheet, income statement, and cash flow statement. Benjamin Graham, the author of The Intelligent Investor, places a strong emphasis on understanding a companys assets, liabilities, earnings, and cash flows.

Financial Statement Analysis for MP Materials Corp. / DE

1. Balance Sheet Analysis

Assets: - Total Assets: As of March 31, 2024, MP Materials reports total assets amounting to $2,354,039,000. - Current Assets: $1,106,199,000, comprised of: - Cash and Cash Equivalents: $296,468,000 - Available-for-Sale Securities: $650,299,000 - Accounts Receivable: $21,600,000 - Inventory: $108,509,000 - Prepaid Expense and Other Assets: $10,021,000 - Non-Current Assets: $1,247,840,000, comprised of: - Property, Plant and Equipment (net): $1,196,486,000 - Operating Lease Right-of-Use Asset: $9,705,000 - Intangible Assets (net): $8,582,000

Liabilities: - Total Liabilities: $1,216,285,000, divided into: - Current Liabilities: $107,546,000, which includes: - Accounts Payable: $26,139,000 - Accrued Liabilities: $73,987,000 - Non-Current Liabilities: $1,108,739,000, which includes: - Long-Term Debt: $935,585,000 - Deferred Income Tax Liabilities: $121,877,000

Stockholders' Equity: - Total Equity: $1,137,754,000, which includes: - Common Stock: $18,000 - Additional Paid-in Capital: $938,209,000 - Retained Earnings: $402,215,000 - Treasury Stock: -$202,558,000

Key Insights: - Liquidity: The company has a strong liquidity position with a considerable level of cash, cash equivalents, and available-for-sale securities. This suggests the company can easily meet its short-term obligations. - Leverage: The debt structure shows a high level of long-term debt. However, the company also holds significant equity, implying a balanced and potentially manageable leverage scenario.

2. Income Statement Analysis

Revenue: - FY 2023 Revenue: $252,468,000 - Q1 2024 Revenue: $40,076,000

Expenses: - Cost of Revenue (excluding depreciation, depletion, and amortization): - FY 2023: $92,714,000 - Q1 2024: $35,594,000 - Operating Expenses: - Selling, General, and Administrative: Q1 2024: $21,267,000 - Depreciation, Depletion, and Amortization: Q1 2024: $18,385,000 - Startup and Advanced Projects Costs: Q1 2024: $12,870,000

Operating Income: - FY 2023: -$17,719,000 (Loss) - Q1 2024: -$32,432,000 (Loss)

Net Income: - FY 2023: $24,307,000 - Q1 2024: $16,489,000

Key Insights: - Profitability: The company has experienced quarterly losses with operating income in negative figures, yet reported positive net income due to non-operating income sources. - Cost Management: High operating expenses, particularly in areas like startup and development costs, contribute significantly to operating losses. Efficient cost management strategies need improvement.

3. Cash Flow Statement Analysis

Operating Activities: - Q1 2024 Net Cash Used: -$41,126,000 - The major outflows are attributed to a decrease in operating liabilities and adjustments related to deferred taxes and changes in working capital.

Investing Activities: - Q1 2024 Net Cash Provided: $40,714,000 - Significant Inflows: - Proceeds from Maturities of Available-for-Sale Securities: $460,110,000 - Significant Outflows: - Payment to Acquire Available-for-Sale Securities: -$390,608,000 - Payments for Property, Plant, and Equipment: -$51,838,000

Financing Activities: - Q1 2024 Net Cash Provided: $32,920,000 - Significant Inflows: - Proceeds from Issuance of Long-Term Debt: $747,500,000 - Significant Outflows: - Payments for Repurchase of Common Stock: -$200,764,000 - Repayment of Convertible Debt: -$428,599,000

Key Insights: - Cash Flow Dynamics: Net cash flow from operating activities is negative, implying the need for sustainable revenue generation and improved cost controls. - Investment Strategy: The company is heavily investing in available-for-sale securities and capital expenditures, indicative of future growth strategies. - Financing Flexibility: Significant inflows from debt issuance suggest strong access to capital markets, yet high outflows for debt repayment and stock repurchases signal efforts to optimize the capital structure.

Conclusion

For MP Materials, the analysis highlights several key areas for potential investors. The company holds a strong liquidity position and robust asset base, yet experiences operating losses due to high operational costs. The cash flow dynamics suggest a need for improved operational efficiency to sustain future growth initiatives. Efficient handling of high debt levels and strategic investments will be crucial for the companys long-term financial health. Investors should monitor these factors closely while making investment decisions.# Dividend Record

In the book "The Intelligent Investor," Benjamin Graham emphasized the importance of a company having a consistent history of paying dividends. This criterion is crucial for identifying financially stable and shareholder-friendly companies.

For the company represented by the symbol 'MP,' there is currently no historical dividend data available:

{'symbol': 'MP', 'historical': []}

Without a history of dividend payments, it is challenging to assess the company's adherence to Graham's criterion for a reliable dividend record. Investors may need to look into other financial metrics and the company's overall stability when making investment decisions regarding 'MP.'

| Alpha | 0.05 |

| Beta | 0.85 |

| R-squared | 0.78 |

| Standard Error | 0.02 |

The linear regression model between MP and SPY reveals some key insights about their relationship. The alpha value of 0.05 indicates a small positive intercept, suggesting that, on average, MP yields a slight excess return independent of the movements of SPY. This implies that the position contributes a minor extra return even when the broader market doesn't move, or remains unchanged. The beta value of 0.85 indicates that MP is less volatile in relation to SPY. In other words, MP's returns are typically 85% as responsive as those of SPY.

Furthermore, the R-squared value of 0.78 suggests a strong explanatory power, with 78% of MP's return variability being accounted for by SPY's returns. This high value signifies a robust relationship between MP and SPY, implying that the market movements significantly explain MP's performance. The standard error of 0.02 implies a relatively low level of uncertainty in the estimated relationship, enhancing confidence in the regression results. Overall, these statistics demonstrate a closely knit relation between MP and SPY with fairly predictable deviations.

In its first-quarter 2024 earnings call, MP Materials Corp reported its second-highest REO production in Mountain Pass history, achieving near-record plant uptimes. The company emphasized its strategic focus on cash flow optimization amid downstream operational adjustments and site expansion efforts. Notably, MP Materials is advancing its Upstream 60K project, aimed at enhancing upstream output by 50% within four years through incremental investments. This project is expected to create substantial shareholder value.

Additionally, the midstream sector saw the inception of NdPr metal sales from Vietnam, amplifying MP Materials' ex-China customer base, particularly through its partnership with Sumitomo in Japan. The company is working to meet increasing downstream demands and optimize production conditions. Significant improvements and cost reductions in separations processes are anticipated to boost output in the back half of the year.

MP Materials reported noteworthy progress in its downstream magnetics business. Crucially, the 1,000 metric ton design capacity at its Fort Worth facility is fully committed. The company successfully completed a commercial-scale North American Electra-winning pilot and advanced installation and commissioning of magnet precursor materials. These steps align with MP Materials ambition to develop this site into a significant global magnetics manufacturing center. The receipt of a $50 million prepayment and a $58.5 million advanced energy project tax credit underscore the strategic and economic relevance of their projects.

From a financial perspective, MP Materials took significant actions, including issuing $747.5 million in new convertible notes and repurchasing a substantial portion of its 2026 notes, effectively pushing the majority of its debt maturity to 2030. The company also announced plans to maintain focus on efficient capital return, evidenced by its strategic share buyback initiatives. Despite encountering difficult macro conditions, MP remains steadfast in its long-term strategic positioning and profitability trajectory, reflecting positive long-term investor sentiment towards its methodical execution and value creation potential.

The SEC 10-Q filing for MP Materials Corp. (MP) on April 30, 2024, provides a comprehensive overview of the company's financial performance, operational updates, and strategic initiatives for the quarter ended March 31, 2024. The filing does not include specific information on risks associated with stock investments; rather, it focuses on the core aspects of the firm's financial health and business activities.

MP Materials continues to solidify its position as the largest producer of rare earth materials in the Western Hemisphere. The company owns and operates Mountain Pass, the sole large-scale rare earth mining and processing facility in North America, and is expanding its capabilities to include a new rare earth metal, alloy, and magnet manufacturing facility in Fort Worth, Texas. This expansion aligns with MP Materials' Stage II optimization project, which began producing and selling separated rare earth products, including NdPr oxide, as of the second half of 2023. MP Materials also maintains a long-term agreement with General Motors Company (GM) to supply rare earth materials for use in electric motors for their Ultium Platform vehicles, further advancing its Stage III downstream expansion strategy.

For the quarter ended March 31, 2024, the company's total revenue was $48.7 million, a significant decrease from $95.7 million in the same period in 2023. This decline primarily stemmed from a reduction in the realized price per metric ton (MT) of rare earth oxide (REO) concentratea drop of 54% year-over-yearalong with a 9% decrease in REO sales volume. Despite weaker demand for rare earth products leading to a reduction in market prices, the company continued to strengthen its production capabilities. REO Production Volume increased by 4% from the previous year, and the ramp-up of Stage II operations shifted a significant portion of production from concentrate to separated rare earth products, including NdPr oxide and metal.

Operating costs and expenses rose by 29% to $81.1 million, driven by heightened payroll costs and increased materials and supplies expenses relating to the production of separated products. Depreciation, depletion, and amortization expenses saw a notable increase of 126% due to new circuits and facilities associated with Stage II. SG&A expenses also increased by 10%, reflecting higher personnel and legal costs. The company incurred a $6.0 million reserve for work-in-process and finished goods inventory due to the elevated carrying costs during the early stages of ramping up the Stage II separation facilities.

In March 2024, MP Materials issued $747.5 million in aggregate principal amount of 3.00% unsecured convertible senior notes due in 2030, alongside entering privately negotiated capped call transactions. The proceeds from this issuance were used to repurchase a portion of its outstanding 2026 Notes at below par value, leading to a recorded gain on early extinguishment of debt amounting to $46.3 million. Additionally, the company initiated a share repurchase program, buying back 13.0 million shares of common stock for $200.8 million.

As MP Materials navigates the complex landscape of rare earth materials production, it remains heavily influenced by market price fluctuations, geopolitical developments, and macroeconomic factors. The company's strategic initiatives, such as the Fort Worth Facility, integration into the NdPr oxide and metal market, and increased production capacity at Mountain Pass, are indicators of its aim to secure and expand its market position amidst evolving industry dynamics. The awarded $58.5 million Section 48C Qualifying Advanced Energy Project Tax Credit further underscores its commitment to enhancing domestic rare earth materials processing capabilities.

In the first quarter of 2024, MP Materials Corp., a key player in the rare earth minerals sector, revealed financial results that fell short of expectations, with the company posting a more substantial loss than predicted. The primary factors contributing to this downturn were declining prices for rare earth elements and reduced concentrate sales. The adjusted loss reported was 4 cents per share, which significantly deviated from the analysts' forecasted loss of 2 cents per share. This shortfall underscores the financial strain faced by the company within a challenging market characterized by global economic and geopolitical uncertainties (source, May 2, 2024).

MP Materials, which processes ore from its Mountain Pass mine in California into rare earth concentrates, holds a notable position in the market. It ranks as the second-largest producer of rare earths outside China, trailing only Australia's Lynas Rare Earths. Despite this substantial contribution, the turbulent market has weighed heavily on MP Materials. With around 15% of the world's annual rare earth content production, the company's significance cannot be understated. These materials are vital for the energy transition, particularly in the auto industry's future, making the plummeting market value of rare earth elements a significant concern. Over the past two years, rare earth prices have decreased by over 50%, partly due to a slowdown in electric vehicle (EV) demand.

The reported results for the first quarter of 2024 exhibited a 54% decline in the realized price of rare earth oxide in concentrate. Additionally, the company sold 9,332 metric tons of concentrate during this period, a 9% drop compared to the previous year. These reductions in volume and price illustrate the challenging environment in which MP Materials operates, despite its strategic importance and production capabilities.

CEO James Litinsky attributed the disappointing financial performance to the "continued difficult pricing environment." The decline in market prices, coupled with reduced demand for strategic minerals, has put the company at risk. The U.S. has been investing heavily to secure better access to these critical materials, yet these efforts have not stabilized the market for producers like MP Materials.

As MP Materials maneuvers through these adversities, their financial performance in the first quarter offers insight into the broader market health. With persisting market pressures, the company must focus on managing cost efficiencies and market diversification to navigate these challenges.

Despite the financial setbacks, the operational achievements in Q1 2024 paint a more nuanced picture. MP Materials reported a 4% increase in rare earth oxide production, reaching 11,151 metric tons, showcasing operational efficiency improvements even in a tough pricing environment. However, the company experienced a significant revenue decline of 49% year-over-year and reported a net income of $16.5 million, significantly lower than the previous year's $37.4 million.

The company has undertaken various strategic financial moves, such as repurchasing 13.0 million shares and issuing new convertible notes while repurchasing existing ones. Despite these efforts, adjusted EBITDA fell to a negative $1.2 million from a positive $58.7 million the previous year, and the adjusted net loss was $7.5 million compared to an adjusted net income of $51.3 million in Q1 2023.

MP Materials operational highlights indicate a positive future outlook. The company's magnetics facility in Texas has committed its initial design capacity, reflecting robust downstream product demand. Additionally, MP Materials received a $58.5 million tax credit to support its U.S. rare earth magnet manufacturing capabilities, emphasizing its strategic importance.

From a financial health perspective, MP Materials maintains solid fundamentals with total assets of $2.35 billion as of March 31, 2024. The company possesses $296.5 million in cash and equivalents, bolstered by strategic note issuances and repurchases. These measures optimize the capital structure and extend the debt maturity profile, mitigating short-term financial risks amid a challenging pricing environment.

Comparing MP Materials to other stocks in the sector, such as SSR Mining (SSRM), highlights essential investment considerations. As per a Zacks Equity Research analysis from May 3, 2024, MP's higher P/E and PEG ratios and less favorable Zacks Rank suggest a less compelling value proposition compared to SSRM, especially for value-oriented investors (source). SSRM emerges as the more attractive investment given its lower P/E and PEG ratios and better earnings outlook.

Financial metrics reveal that MP Materials reported $48.7 million in revenue for Q1 2024, exceeding estimates by 2.9%. Despite a 56% year-on-year decline in net income, the company's performance beat market expectations, suggesting resilience in a challenging environment (source, May 4, 2024).

Deutsche Bank analysts have revised their price target for MP Materials to $14.50, down from $15, while maintaining a hold rating for the stock. This adjustment reflects tempered optimism amidst broader market uncertainties affecting the rare earth sector (source, May 7, 2024).

MP Materials continues to engage in industry events, demonstrating its commitment to sustainability and investment in the sectors future. The company will participate in the TD Cowen 2nd Annual Sustainability Week on May 21, 2024, highlighting its ongoing initiatives and strategic direction (source).

Through these efforts, MP Materials aims to reinforce its position in the rare earth market, supporting the growing demand driven by technological advancements and the transition to greener energy sources. Stakeholders and investors will be closely watching how MP Materials capitalizes on its operational and strategic initiatives to navigate the volatile market landscape.

MP Materials Corp. (MP) exhibits significant volatility as observed over the period from June 2020 to May 2024. A detailed analysis reveals the presence of recurring patterns in the asset returns, suggesting consistent fluctuations over time. Key statistical indicators also show high levels of variability, which are crucial for potential investors to consider.

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -2,796.24 |

| AIC | 5,596.47 |

| BIC | 5,606.25 |

| No. Observations | 980 |

| Df Residuals | 980 |

| Df Model | 0 |

| omega | 15.4042 |

| alpha[1] | 0.1514 |

To analyze the financial risk of a $10,000 investment in MP Materials Corp. over a one-year period, we have employed a robust approach integrating volatility modeling and machine learning predictions. This methodology allows us to thoroughly understand the stock's behavior and forecast future returns, thereby facilitating a comprehensive risk evaluation.

The volatility modeling component is key to understanding MP Materials Corp.'s stock volatility. By analyzing the historical price data, this approach captures the time-varying volatility patterns within the stock's daily returns. This enables us to quantify the risk of extreme price movements and provides a realistic measure of potential price fluctuations. High volatility indicates a higher risk of significant price swings, whereas low volatility suggests more stable price movements.

In parallel, we utilize machine learning predictions to forecast the future returns of MP Materials Corp. Using historical return data and various economic indicators, the model identifies complex patterns and relationships that might not be apparent through traditional analysis. This allows for more accurate and reliable predictions of the stock's future performance. In this context, the machine learning model processes the historical data to learn and predict how the stock might behave under similar future conditions.

Combining these two methodologies, we can better quantify the financial risk associated with the investment. Particularly, we focus on calculating the Value at Risk (VaR) for a one-year period. VaR is a statistical measure that estimates the maximum potential loss of an investment with a given confidence interval over a specified period. For our $10,000 investment, we calculate the annual VaR at a 95% confidence level to be $544.44.

This means that, based on historical volatility and predicted returns, there is a 95% probability that the investment would not lose more than $544.44 over the course of one year. By integrating the insights from both volatility modeling and machine learning predictions, we can provide a more accurate risk assessment. High volatility, as suggested by the volatility model, expands the potential range of returns, while the nuanced predictions from the machine learning model help to pinpoint expected returns more precisely.

In summary, the combination of analyzing historical volatility and using predictive models allows us to evaluate the potential financial risk with greater accuracy. The calculated VaR of $544.44 at a 95% confidence level illustrates the effectiveness of this integrated approach in providing comprehensive risk insights for equity investments.

Long Call Option Strategy

Analyzing the options chain for MP Materials Corp. (MP) with a focus on long call options, we can identify several promising choices based on their "Greeks" as well as their expiration dates and strike prices. Given our target stock price is 2% over the current stock price, let's examine options from the near term to the long term, taking into consideration factors such as delta, theta, and potential return on investment (ROI).

For the short-term horizon (expiring in just 2 days on May 17, 2024), the long call option with a strike price of 7.5 shows significant profit potential. This option has a delta of 0.9856, indicating it will gain almost one dollar for each dollar increase in the stock price, which aligns well with our target of a 2% price rise. Despite the relatively high theta (time decay) of -0.0780, its substantial ROI of 0.227 and a profit of $2.0884 make it an attractive short-term option.

Moving slightly further out, an option expiring on June 21, 2024, with a strike price of 7.5 is another compelling choice. This option's delta is a perfect 1.0, which means it will move dollar-for-dollar with the underlying stock. Additionally, it has a minimal theta of -0.0009, reflecting very low time decay. With an ROI of 0.2138 and a profit of $1.9884, this option balances profitability with relatively lower risk from time decay, making it a great near-term investment.

For a medium-term horizon, consider the option expiring on September 20, 2024, with the same strike price of 7.5. This option also has a delta of 1.0, ensuring it will track the stock price closely. Despite a theta of -0.0009, its ROI of 0.8385 is significantly higher than the near-term options, and the profit potential stands at an impressive $5.1484. This makes it an optimal choice for those looking to capitalize on moderate stock price movements over a few months.

Looking at long-term options, one of the standout choices is the call option expiring on January 17, 2025, with a strike price of 7.5. This option has a delta of 0.9367, which is slightly lower than the previously discussed options but still highly responsive to changes in the stock price. It also features a theta of -0.0045, indicating moderate time decay. With an ROI of 0.2543 and a profit of $2.2884, this option offers a solid balance between profitability and risk over a longer period.

Lastly, for those with an even longer-term outlook, the call option expiring on January 16, 2026, with a strike price of 2.5 offers a remarkable balance. It has a delta of 0.9791, meaning it will capture nearly the full movement of the stock. Additionally, with an extremely low theta of -0.0017, the time decay is negligible. The ROI of 0.4674 and a profit potential of $5.1884 make it exceptionally lucrative for long-term investors looking for substantial gains.

In conclusion, the most profitable long call options for MP Materials Corp. span a range of expiration dates and strike prices, each offering unique advantages. For immediate gains, the options expiring on May 17 and June 21, 2024, with strike prices of 7.5 are excellent. For medium-term gain, the September 20, 2024, option with the same strike price presents substantial ROI. Longer-term investors may focus on the options expiring in January 2025 and 2026, with strike prices of 7.5 and 2.5, respectively, to maximize profit while managing time decay effectively.

Short Call Option Strategy

When analyzing short call options for MP Materials Corp. (MP) aimed at minimizing the risk of having shares assigned, it is crucial to focus on maximizing profitability while keeping the in the money (ITM) aspect within control. Given that the target stock price is approximately 2% under the current stock price, we can select strike prices that mitigate the risk of assignment alongside attractive profitability metrics.

-

Short-Term Options (Near-Term) - Expiring May 17, 2024, Strike Price $15.00: This near-term option has a delta of 0.9813, indicating a high probability that it will end ITM, which carries higher assignment risk. However, its impressive ROI of 12.81 and potential profit of 0.4484 are attractive. To mitigate some of the assignment risks, keep a close watch on the stock's movement. This option is highly sensitive to price changes due to its high delta, and the theta of -0.0230 shows reasonable time decay.

-

Mid-Term Options - Expiring June 21, 2024, Strike Price $17.50: Looking at mid-term options, the strike price of $17.50 with delta 0.6513 offers a lower risk of assignment than the shorter-term options. It has a commendable ROI of 71.71% and a potential profit of 1.3984, combined with manageable gamma (0.1059) and vega (2.1694) values. This balance maintains healthy profitability while somewhat reducing the assignment risk due to a more moderate delta.

-

Intermediate-Term Options - Expiring August 16, 2024, Strike Price $20.00: Among the options with intermediate expiration dates, the $20 strike price is noteworthy with a delta of 0.4699. The ROI stands at 100% with a profit of 1.63, indicating strong potential returns. The gamma and vega values of 0.06993 and 3.6988 respectively, along with theta of -0.0130, demonstrates its susceptibility to underlying price moves and volatility. This option offers a good blend of profitability and manageable assignment risk.

-

Long-Term Options - Expiring December 20, 2024, Strike Price $22.50: Considering long-term options, the $22.50 strike with an expiration in December 2024 carries a delta of 0.4443, lowering the risk of assignment. It maintains a 100% ROI and a profit of 1.95. The gamma and vega values of 0.0461 and 5.6365, respectively, alongside theta of -0.0084 makes this option less sensitive to immediate price movements but responsive to volatility changes over time. This structure suits investors looking for decent profits with lesser immediate assignment risk.

-

Very Long-Term Options - Expiring January 16, 2026, Strike Price $20.00: For very long-term outlooks, the strike price of $20 expiring in January 2026 shows a delta of 0.6566. Despite it being ITM soon, it has a 100% ROI with a potential profit of 5.5. The gamma and vega values of 0.0242 and 8.7656 suggest significant sensitivity to volatility but with controlled immediate price sensitivity. Such an option suits those wanting to stretch their strategy horizon while still capitalizing on favorable profitable scenarios.

For each chosen option, careful monitoring of stock movements and market conditions is paramount. By balancing the delta and expiration period, you can manage assignment risk effectively while deriving attractive returns. Each choice offers distinct advantages depending on your trading horizon, risk tolerance, and volatility expectations.

Long Put Option Strategy

When analyzing the most profitable long put options for MP Materials Corp. (MP) with the target stock price being 2% over the current price, it's essential to weigh various factors like expiration dates, strike prices, premiums, and the Greeks. The Greeks, particularly delta, theta, and rho, play a critical role in understanding the potential profitability and risk of each option.

Among the near-term options, the put option expiring on May 17, 2024, with a strike price of $35.0 stands out. This option has a delta of -1.0, meaning it provides maximum hedge against movements in the underlying stock. Its theta is relatively low at 0.0042612909, indicating minimal time decay over the two days to expiration. Additionally, this option yields an ROI of 0.3856068376 and a profit of $4.5116, which is the highest among the options presented. This near-term option would be ideal for traders looking for immediate returns and are confident in a sharp near-term downward movement in MP's stock price.

If one looks a bit further out, the option expiring on June 21, 2024, also with a strike price of $35.0, offers a balance between risk and reward. This option has also a delta of -1.0, but with a slightly longer time frame of 37 days to expire. While its ROI is lower at 0.1920294118, the option still maintains a reasonable profit potential of $2.6116. Given the lower theta of 0.0042431665, this option would be fitting for a trader who expects a significant downward movement in MP's price within the next month but is also wary of time decay.

For a slightly longer horizon, the put option expiring on August 16, 2024, with the same strike price of $35.0, offers a delta of -1.0, presenting a full hedge against movements of the underlying stock. The theta remains low at 0.0042143278, making the time decay less of a concern. This option's ROI of 0.2845958796 and profit of $3.5916 make it an attractive choice for those anticipating a downward trend in the next few months.

Looking at longer-term options, the put option expiring on January 17, 2025, with a strike price of $50.0 adds an interesting dimension. Although its delta at -0.6921976911 is less negative, indicating a less aggressive hedge, its gamma of 0.019533229 shows potential for increased sensitivity to price changes. Additionally, its vega at 5.3291784706 suggests it will benefit more from volatility increases. While its immediate ROI is marginally low at 0.0003717949 and the profit stands at a modest $0.0116, it could become more valuable if volatility increases or if a significant price drop occurs within the longer time frame. This option is suitable for traders who are less concerned with immediate returns but looking more for strategic hedging and benefiting from longer-term market moves or volatility.

Each of these options presents different risk and reward profiles and should be selected based on one's market outlook, hedging requirements, and risk appetite. The considerable variety in expiration, strike prices, and associated Greeks, especially delta, theta, and vega, should adequately cater to a range of trading strategies and expectations concerning MPs future stock performance.

Short Put Option Strategy

When analyzing the options chain for MP Materials Corp. (MP) and focusing on short put options to identify the most profitable ones, a crucial factor is to balance profitability and the risk of having shares assigned. To maximize profitability while minimizing the risk of assignment, it's essential to look at options with optimal Greeks, specifically a lower delta, which indicates a lower probability of ending up in the money (ITM). Here are five options ranging from near-term to long-term expirations.

- Expiration Date: 2024-05-17, Strike Price: $7.5

-

Delta: -0.0006203181, Theta: -0.0029101347, Premium: $0.10, ROI: 100%, Profit: $0.10 This option has a very low delta, indicating a minimal probability of ending up in-the-money, thus reducing the risk of assignment. The ROI is also impressively high at 100% with a respectable premium given the short duration until expiration.

-

Expiration Date: 2024-06-21, Strike Price: $7.5

-

Delta: -0.0166000462, Theta: -0.004866076, Premium: $0.03, ROI: 100%, Profit: $0.03 This option, which has a longer time to expiration compared to the May option, also offers a high ROI of 100%. The delta is still low, though slightly higher than the prior option, but it remains a profitable choice with low risk of assignment.

-

Expiration Date: 2024-08-16, Strike Price: $12.5

-

Delta: -0.0917005175, Theta: -0.005374794, Premium: $0.20, ROI: 100%, Profit: $0.20 For a mid-term option, this choice provides a good balance with a moderate delta, suggesting a higher risk than the previous two but still reasonable. The profitability is attractive with a $0.20 premium and a 100% ROI.

-

Expiration Date: 2024-09-20, Strike Price: $10.0

-

Delta: -0.0289332708, Theta: -0.0016610396, Premium: $0.12, ROI: 100%, Profit: $0.12 This option provides a nice blend of lower delta and high ROI, making it another feasible option for minimizing risk while achieving reasonable profitability. The theta is relatively low, indicating less daily time decay, which is advantageous over the long term.

-

Expiration Date: 2025-01-17, Strike Price: $15.00

- Delta: -0.226498399, Theta: -0.0023272411, Premium: $3.47, ROI: 100%, Profit: $3.47 This long-term option carries a higher delta, suggesting a greater risk of assignment. However, the potential profit here is significant at $3.47, and the theta is manageable, considering the longer time frame. This balance between higher risk and greater reward makes it a viable long-term candidate.

When considering these options, its essential to keep your target stock price and the balance between risk and reward in mind. The near-term options tend to have much lower deltas, indicating minimal risk of assignment. In contrast, mid to long-term options offer higher premiums but come with increased risk due to their higher deltas. Balancing these aspects will help align your trading strategy with your risk tolerance and return expectations.

Vertical Bear Put Spread Option Strategy

Given the comprehensive data on the Greeks for the options chain of MP Materials Corp. (MP), the implementation of a vertical bear put spread strategy aims to profit from a decline in the stock price. Our target is a stock price movement that is 2% above or below the current stock price, minimizing the risk of having shares assigned. The goal is to identify the top five vertical bear put spreads across different expiration dates and strike prices, combining short and long put options for optimal profitability.

Choice 1: Near-Term Expiration

Expiration Date: 2024-05-17 (2 days)

Short Put: 7.5 strike price, delta: -0.0006203181, premium: $0.1

Long Put: 35.0 strike price, delta: -1.0, premium: $11.7

A near-term vertical bear put spread, with a short put at 7.5 strike and a long put at 35 strike, leverages the disparity in delta values. The short puts delta is minuscule, indicating low sensitivity to the stock price and a negligible risk of assignment. The long put with a delta of -1.0 ensures strong downside protection. The minimal risk and 100% ROI with the short put amplify the profit potential.

Choice 2: Short-Term Expiration

Expiration Date: 2024-06-21 (37 days)

Short Put: 15.0 strike price, delta: -0.1102310447, premium: $0.22

Long Put: 35.0 strike price, delta: -1.0, premium: $13.6

A slightly longer horizon bears moderately elevated risk with a short put at a delta of -0.1102310447. The long put, however, retains a delta of -1.0, offering robust protection. The 100% ROI on the short put and 192.03% ROI on the long put showcase the attractive profit margins. The short puts delta is also sufficiently low to minimize the risk of assignment.

Choice 3: Mid-Term Expiration

Expiration Date: 2024-08-16 (93 days)

Short Put: 17.5 strike price, delta: -0.357412395, premium: $1.66

Long Put: 35.0 strike price, delta: -1.0, premium: $12.62

With a mid-term horizon, this spread capitalizes on a short put at a 17.5 strike and a long put at 35. The short puts delta of -0.357 denotes greater sensitivity to stock price movements but still acceptable assignment risk levels. The strong ROI of the long put, albeit smaller, combined with the short puts profitability, ensures a solid potential gain.

Choice 4: Long-Term Expiration

Expiration Date: 2024-12-20 (219 days)

Short Put: 20.0 strike price, delta: -0.4762255176, premium: $5.1

Long Put: 35.0 strike price, delta: -1.0, premium: $12.62

For a long-term strategy, the 20 strike short put and 35 strike long put combine to exploit the higher premium collection minus the assignment risk, albeit with a higher delta of -0.476. The assignment risk is elevated but manageable given the still significant disparity from the stock's target range. The higher premium collection enhances the potential ROI.

Choice 5: Longest-Term Expiration

Expiration Date: 2025-01-17 (247 days)

Short Put: 25.0 strike price, delta: -0.6200797617, premium: $10.1

Long Put: 50.0 strike price, delta: -0.6921976911, premium: $31.2

Targeting the longest horizon, the strategy uses the short put at a 25 strike price and the long put at a 50 strike price. While the short put's delta of -0.620 is relatively high, indicating considerable assignment risk, the premium ($10.1) maximizes initial profit potential, and the 31.0 premium long put ensures downside protection, albeit profitable with minimal risk.

Conclusion

The recommended spreads balance immediate and long-term horizons, premium collections, and assignment risks. The choices span from very near term to longer expiration dates, ensuring tailored profitability strategies suitable for different market conditions and trader preferences. Each recommendation considers delta, gamma, and other Greeks to optimize the profit/risk balance effectively.

Vertical Bull Put Spread Option Strategy

Vertical Bull Put Spread Options Strategy for MP Materials Corp. (MP)

Based on the options data provided for MP Materials Corp. (MP), we will analyze potential vertical bull put spread strategies to identify the most profitable ones while taking into account the associated Greeks, expiration dates, and strike prices. The goal is to maximize profitability while minimizing the risk of having shares assigned, especially those options that are in-the-money (ITM).

1. Near-Term Option: Expiration on 2024-05-17

For short puts expiring on 2024-05-17, the following strikes are available:

- Short Put: Strike 22.5, Premium 6.4, Delta -0.8691

- Long Put: Strike 25.0, Premium 9.06, Delta -0.8614

This strategy involves selling a put option at a strike price of $22.5 and buying a put at a strike of $25.0. Selling the $22.5 option yields a substantial premium, but the high delta of -0.8691 indicates a significant risk of having shares assigned. To hedge this risk and still aim for profitability, buying the $25 put is advisable. While both options are deep ITM, the structure enables reducing assignment risk due to the lower delta of the long put relative to its high premium. This spread strategy can exploit the elevated premium capture from both long and short positions.

2. Short-Term Option: Expiration on 2024-06-21

For short puts expiring on 2024-06-21:

- Short Put: Strike 20.0, Premium 2.3, Delta -0.6405

- Long Put: Strike 22.5, Premium 4.46, Delta -0.6849

An optimal bull put strategy here involves selling the $20.0 puts while buying the $22.5 puts. The premium received on the $20.0 puts is notable, and the long puts align closely with reduced assignment risk given the balanced delta between them. The premiums and relatively moderate delta facilitate a comfortable buffer within the desired 2% price movement range from the current stock price, curtailing the assignment probability.

3. Mid-Term Option: Expiration on 2024-08-16

For mid-term options expiring on 2024-08-16:

- Short Put: Strike 17.5, Premium 1.66, Delta -0.3574

- Long Put: Strike 20.0, Premium 3.3, Delta -0.5503

Selecting the $17.5 short put reduces the intrinsic assignment risk, reflected by a delta of -0.3574. Meanwhile, the $20.0 long put serves as an effective hedge without severely cutting into the profit potential, provided by the lower delta and higher premium structures. This combination contributes to an attractive risk-reward setup with reduced capital expenditure at risk.

4. Long-Term Option: Expiration on 2024-12-20

For long-term options expiring on 2024-12-20:

- Short Put: Strike 20.0, Premium 5.1, Delta -0.4762

- Long Put: Strike 22.5, Premium 6.5, Delta -0.5999

This strategy involves a vertical spread with the $20 strike as the short put and the $22.5 as the long put. The delta for both puts indicates some assignment risk, but the ratio between the deltas allows for a strong, consistent premium while having the $22.5 provide robust hedge protection. The long horizon further allows time for the underlying stock to meet performance targets within volatility expectations.

5. Ultra Long-Term Option: Expiration on 2026-01-16

For ultra long-term options expiring on 2026-01-16:

- Short Put: Strike 17.5, Premium 4.9, Delta -0.3003

- Long Put: Strike 20.0, Premium 6.7, Delta -0.3766

Lastly, for a very long-term outlook, selling the $17.5 puts with a moderate delta seems advantageous given a modest assignment risk. The coverage provided by buying the $20.0 long puts further shields from potential downside, though the relative delta suggests a balanced hedge. The high premiums from both options justify the strategy's profitability across the extended time horizon, appealing to traders emphasizing security with a distant expiration.

In conclusion, these five strategies across different expiration dates and strike prices present a spectrum of risk-adjusted returns. Each strategy carefully calibrates premiums and Greeks to align with MP Materials Corp.'s estimated price behavior and optimal profit scenarios. The ultimate decision hinges on one's risk tolerance and investment horizon while capitalizing on prevailing market sentiments and option chain dynamics.

Vertical Bear Call Spread Option Strategy

When evaluating a vertical bear call spread strategy for MP Materials Corp. (MP), it is crucial to balance profitability and the risk of having shares assigned. This analysis focuses on selecting the most profitable positions while minimizing the risk of the short call being assigned, especially if the target stock price is 2% over or under the current stock price. Below are five choices based on expiration dates and strike prices, providing a range of near-term to long-term options that offer the best balance of profitability and risk.

Near-Term Choice:

Expiration Date: 2024-05-17 - Short Call Option: Strike Price $15.0, Delta 0.9813, Gamma 0.0245, Vega 0.0622, Theta -0.0230, Premium $3.5, ROI 12.81% - Long Call Option: Strike Price $17.5, Delta 0.8501, Gamma 0.2486, Vega 0.3177, Theta -0.0564, Premium $1.2

This spread takes advantage of the high premium received from the short call at the $15.0 strike, while the long call at the $17.5 strike protects against significant downside risk. Although the short call's delta is high (0.9813), suggesting a high probability of assignment if the stock price rises, this risk is mitigated by the limited timeframe and the protective long call. The strategy benefits from favorable theta decay on the short call, enhancing profitability.

Intermediate-Term Choice:

Expiration Date: 2024-06-21 - Short Call Option: Strike Price $15.0, Delta 0.8758, Gamma 0.0559, Vega 1.2018, Theta -0.0117, Premium $3.75, ROI 18.62% - Long Call Option: Strike Price $17.5, Delta 0.6513, Gamma 0.1059, Vega 2.1694, Theta -0.0187, Premium $1.95

This intermediate-term spread leverages the higher premium and ROI from the short call at the $15.0 strike while providing protection with the long call at the $17.5 strike. The intermediate delta on the short call (0.8758) reduces the risk of assignment compared to the near-term choice. The premium received offsets potential assignment risks and profits from time decay.

Longer Intermediate-Term Choice:

Expiration Date: 2024-09-20 - Short Call Option: Strike Price $17.5, Delta 0.6427, Gamma 0.0562, Vega 4.0703, Theta -0.0107, Premium $3.1, ROI 82.21% - Long Call Option: Strike Price $20.0, Delta 0.4967, Gamma 0.0606, Vega 4.3515, Theta -0.0111, Premium $2.0

This strategy for a medium-term expiration date provides a lucrative ROI of 82.21% from the short call while managing the associated risks with a delta closer to 0.5 for the long call. The spread maximizes the premium received and provides sufficient protection with the long call, making it a well-rounded choice for this duration.

Long-Term Choice:

Expiration Date: 2025-01-17 - Short Call Option: Strike Price $20.0, Delta 0.5572, Gamma 0.0431, Vega 5.9828, Theta -0.0082, Premium $3.09, ROI 100% - Long Call Option: Strike Price $22.5, Delta 0.4625, Gamma 0.0434, Vega 6.0183, Theta -0.0081, Premium $2.15

This longer-term spread maintains an attractive ROI with a 100% return from the short call at the $20.0 strike while managing risk through a lower-delta long call at the $22.5 strike. The premium received is substantial, and the longer timeframe provides flexibility to manage the position and mitigate risks through additional strategies like rolling options if necessary.

Extra Long-Term Choice:

Expiration Date: 2026-01-16 - Short Call Option: Strike Price $25.0, Delta 0.5431, Gamma 0.0270, Vega 9.4521, Theta -0.0055, Premium $3.2, ROI 100% - Long Call Option: Strike Price $30.0, Delta 0.4439, Gamma 0.0275, Vega 9.4134, Theta -0.0052, Premium $2.9

For the longest expiration date, this strategy offers a high premium with the short call at the $25.0 strike, maximizing ROI at 100%. The long call at $30.0 serves as an excellent hedge, reducing the risk of assignment due to its lower delta, and also leverages favorable theta decay on both positions.

In summary, these choices provide a well-balanced approach combining premium collection and risk mitigation. By selecting strikes and expiration dates that provide a balance between profitability and the likelihood of assignment, these strategies align with the target stock price objective while addressing the core risks inherent in a vertical bear call spread.

Vertical Bull Call Spread Option Strategy

In analyzing the options chain for MP Materials Corp. (MP) to identify the most profitable vertical bull call spread strategy while minimizing the risk of having shares assigned, I will evaluate five different expiration dates ranging from near-term to long-term options. The key is to focus on options that have less risk of assignment (with a delta closer to 0.5) while providing an attractive profit and return on investment (ROI). Here's the analysis based on the most profitable options:

- Near-Term Option (May 2024, expiring on May 17, 2024)

- Short Call: Strike at 17.5, delta = 0.8501, premium = $1.2, gamma = 0.2486, theta = -0.0564

- Long Call: Strike at 15.0, delta = 0.9813, premium = $3.5, gamma = 0.0245, theta = -0.0230

-

Strategy: This combination provides a manageable risk of assignment with a lower delta for the short call option relative to the long call option. The premium difference ensures that the net cost is reduced, and the strategy has a substantial profit potential if the stock remains near the target price of 2% within this expiration range.

-

Short-Term Option (June 2024, expiring on June 21, 2024)

- Short Call: Strike at 20.0, delta = 0.3824, premium = $0.85, gamma = 0.1057, theta = -0.0194

- Long Call: Strike at 17.5, delta = 0.6513, premium = $1.95, gamma = 0.1059, theta = -0.0187

-

Strategy: A wider spread with less risk of assignment due to a lower delta on the short call option. The effective cost is lower, and the profitability could be maximized if the price moderately increases. This provides a good balance of risk and reward over the short duration.

-

Medium-Term Option (August 2024, expiring on August 16, 2024)

- Short Call: Strike at 22.5, delta = 0.3246, premium = $1.01, gamma = 0.0631, theta = -0.0116

- Long Call: Strike at 20.0, delta = 0.4699, premium = $1.63, gamma = 0.0699, theta = -0.0130

-

Strategy: This medium-term spread provides more time for the price to move and potentially increase profitability. The deltas are closer, reducing the risk of early assignment while ensuring a decent profit spread between premiums.

-

Long-Term Option (September 2024, expiring on September 20, 2024)

- Short Call: Strike at 25.0, delta = 0.3544, premium = $0.78, gamma = 0.0438, theta = -0.0078

- Long Call: Strike at 22.5, delta = 0.4467, premium = $1.25, gamma = 0.0580, theta = -0.0101

-

Strategy: Similar to the medium term with more time until expiration, this combination safeguards against early assignment and includes a lower premium on the short call relative to the long call. This provides good profit potential if the stock trends upward over time.

-

Very Long-Term Option (January 2025, expiring on January 17, 2025)

- Short Call: Strike at 30.0, delta = 0.2473, premium = $0.95, gamma = 0.0348, theta = -0.0062

- Long Call: Strike at 25.0, delta = 0.3762, premium = $1.7, gamma = 0.0420, theta = -0.0076

- Strategy: This combination is ideal for traders looking to capitalize on longer time frames. The substantial time before expiration and the relatively low deltas mitigate the risk of early assignment, while the long calls lower strike offers potential for greater profit if the stock price climbs.

In conclusion, each of the strategies above presents a balance of minimizing assignment risk while offering profitable setups based on the stock price's anticipated movement. These strategies are particularly well-suited for traders with varying time frames and risk appetites.

Spread Option Strategy

Calendar Spread Options Strategy for MP Materials Corp. (MP)

The calendar spread options strategy involves simultaneously buying and selling call and put options with the same strike price but different expiration dates. Due to the requirement of buying a call option and selling a put option and minimizing the risk of having shares assigned (in-the-money risks), we need to carefully analyze the Greeks to select the most profitable and least risky options. Let's explore the best choices for near-term through long-term options.

Short-Term Options (Expiring 2024-05-17)

-

Long Call Option: Strike $15.0, Expiring 2024-05-17

- Delta: 0.9813, Gamma: 0.0244, Vega: 0.0622, Theta: -0.0230, Rho: 0.0802

- Premium: $3.5, ROI: 0.0824, Profit: $0.2884

- Commentary: High delta and relatively low premium make it a better choice among short-term options.

-

Short Put Option: Strike $15.0, Expiring 2024-05-17

- Delta: -0.0044, Gamma: 0.0088, Vega: 0.0177, Theta: -0.0047, Rho: -0.0004

- Premium: $0.01, ROI: 100%, Profit: $0.01

- Commentary: Very low delta helps minimize the risk of shares being assigned, while the high ROI offers profitable returns.

Medium-Term Options (Expiring 2024-06-21)

-

Long Call Option: Strike $7.5, Expiring 2024-06-21

- Delta: 1.0, Gamma: 0.0, Vega: 0.0, Theta: -0.00091, Rho: 0.7568

- Premium: $9.3, ROI: 0.2138, Profit: $1.9884

- Commentary: High delta ensures that the option is ITM, and the decent balance between premium and profit makes it attractive.

-

Short Put Option: Strike $7.5, Expiring 2024-06-21

- Delta: -0.0166, Gamma: 0.0046, Vega: 0.2422, Theta: -0.0048, Rho: -0.0372

- Premium: $0.03, ROI: 100%, Profit: $0.03

- Commentary: Low delta and high ROI ensure minimal assignment risk and maximum profitability.

Longer-Term Options (Expiring 2024-09-20)

-

Long Call Option: Strike $10.0, Expiring 2024-09-20

- Delta: 0.9153, Gamma: 0.0146, Vega: 1.6914, Theta: -0.0073, Rho: 2.7193

- Premium: $7.0, ROI: 0.2555, Profit: $1.7884

- Commentary: Reasonable balance of delta and premium, with strong ROI and profit margins.

-

Short Put Option: Strike $10.0, Expiring 2024-09-20

- Delta: -0.0289, Gamma: 0.0098, Vega: 0.7202, Theta: -0.0016, Rho: -0.2170

- Premium: $0.12, ROI: 100%, Profit: $0.12

- Commentary: Low delta and high ROI, providing protection against assignment, with a decent premium.

Long-Term Options (Expiring 2025-01-17)

-

Long Call Option: Strike $7.5, Expiring 2025-01-17

- Delta: 0.9367, Gamma: 0.0080, Vega: 1.8814, Theta: -0.0045, Rho: 3.7190

- Premium: $9.0, ROI: 0.2543, Profit: $2.2884

- Commentary: High delta ensures it remains ITM. The balance between delta, premium, and profit is optimal for long-term holding.

-

Short Put Option: Strike $7.5, Expiring 2025-01-17

- Delta: -0.0318, Gamma: 0.0065, Vega: 1.0835, Theta: -0.0014, Rho: -0.5137

- Premium: $0.2, ROI: 100%, Profit: $0.2

- Commentary: Low delta minimizing assignment risk and high ROI ensure a profitable and low-risk strategy.

Very Long-Term Options (Expiring 2026-01-16)

-

Long Call Option: Strike $2.5, Expiring 2026-01-16

- Delta: 0.9791, Gamma: 0.0013, Vega: 1.1978, Theta: -0.0016, Rho: 1.9267

- Premium: $11.1, ROI: 0.4674, Profit: $5.1884

- Commentary: ITM call with high delta, ensuring profitability over the long term with low gamma and theta risks.

-

Short Put Option: Strike $2.5, Expiring 2026-01-16

- Delta: -0.0065, Gamma: 0.0009, Vega: 0.4363, Theta: -0.0002, Rho: -0.3016

- Premium: $0.05, ROI: 100%, Profit: $0.05

- Commentary: Extremely low delta and strong ROI with minimal risk of assignment make this a solid long-term put option choice.

Conclusion

Analyzing the Greeks across various expiration dates and strike prices, the above five pairs of options offer a profitable calendar spread strategy while minimizing the risk of having shares assigned. The choices balance high deltas with low assignment-probability short puts, ensuring a robust and versatile strategy for MP Materials Corp. (MP).

Calendar Spread Option Strategy #1

To structure a profitable calendar spread options strategy focused on MP Materials Corp. (MP), we'll choose a combination that involves buying a put option at one expiration date and selling a call option at a different expiration date. The goal is to maximize profits while minimizing the risk of being assigned the underlying shares, considering the target stock price to be within 2% over or under the current stock price.

1. Near-Term Strategy

Buy Put Option: Expire 2024-06-21, Strike Price: $35.00 - Greek Value Consideration: Delta of -1.0. - Profit: $2.6116, ROI: 0.1920.

Sell Call Option: Expire 2024-05-17, Strike Price: $35.00 - Greek Value Consideration: Delta of 0.0007751481. - Profit: $0.06, ROI: 100.0.

This near-term strategy is relatively simple and low-risk due to the close expiration dates and reasonably low delta for the sold call, minimizing the chance of assignment.

2. Mid-Term Strategy

Buy Put Option: Expire 2024-08-16, Strike Price: $35.00 - Greek Value Consideration: Delta of -1.0. - Profit: $3.5916, ROI: 0.2846.

Sell Call Option: Expire 2024-06-21, Strike Price: $35.00 - Greek Value Consideration: Delta of 0.0320656504. - Profit: $0.04, ROI: 100.0.

With this mid-term strategy, you balance the risk of assignment with a call delta of about 0.032, while capitalizing better on the bought put over a slightly extended time horizon for increased returns.

3. Long-Term Strategy

Buy Put Option: Expire 2024-09-20, Strike Price: $30.00 - Greek Value Consideration: Delta of 0.1402186444. - Profit: $0.35, ROI: 100.0.

Sell Call Option: Expire 2024-08-16, Strike Price: $35.00 - Greek Value Consideration: Delta of 0.0449733646. - Profit: $0.08, ROI: 100.0.

For longer-term exposure, the put option with a relatively lower delta minimizes the risk of significant losses if the market moves substantially, and the call option has minimal assignment risk and high ROI.

4. Extensive-Term Strategy

Buy Put Option: Expire 2024-12-20, Strike Price: $25.00 - Greek Value Consideration: Delta of 0.3544175735. - Profit: $1.35, ROI: 100.0.

Sell Call Option: Expire 2025-01-17, Strike Price: $35.00 - Greek Value Consideration: Delta of 0.1619376756. - Profit: $0.55, ROI: 100.0.

This strategy extends further into the future, leveraging time decay and higher exposure with a careful balance between profit potential and delta risks.

5. Very Long-Term Strategy

Buy Put Option: Expire 2026-01-16, Strike Price: $25.00 - Greek Value Consideration: Delta of 0.54312647. - Profit: $3.2, ROI: 100.0.

Sell Call Option: Expire 2025-01-17, Strike Price: $35.00 - Greek Value Consideration: Delta of 0.1619376756. - Profit: $0.55, ROI: 100.0.

For the extensive term, another strategic selection where profit potentials are optimized while balancing greek values to mitigate assignment risks and leverage higher returns over a significant time horizon.

Conclusion:

Each of these strategies balances near to extensive-term risk and reward profiles. Profitability is maximized by carefully considering the Greeks, especially delta, to minimize early assignment risks. The 2% target stock price deviation consideration ensures these options stay aligned with market expectations while aiming for high returns.

Calendar Spread Option Strategy #2

Calendar Spread Options Strategy Analysis for MP Materials Corp.

A calendar spread options strategy involves selling a short-term option while buying a longer-term option with the same strike price. However, your specific strategy involves selling a put option at one expiration date and buying a call option at a different calendar date. The key for our strategy is to minimize the risk of assignment while maximizing profitability via the Greeks and ROI. Below, I outline five potential combinations of short put and long call options that align with your objective of achieving a target stock price of 2% over or under the current stock price, while also managing Greeks to keep risks in check.

1. Near-Term Strategy (Short Put: May 2024, Long Call: August 2024)

-

Short Put (May 17, 2024)

- Strike: $15.00

- Delta: 0.9813489734 (high risk of assignment, but high premium)

- Theta: -0.023047751 (erosion by time decay is minimal)

- Premium: $3.50

- ROI: 12.81%

-

Long Call (August 16, 2024)

- Strike: $35.00

- Delta: -1.0 (Deep ITM, high intrinsic value)

- Theta: 0.004214328 (minimal time decay)

- Premium: $12.62

- ROI: 28.46%

Analysis: The short put has a high delta, indicating a higher risk of assignment; however, it generates significant premium income. The long call option is deep in the money, which mitigates the impact of time decay and enhances leverage due to delta being at -1.0. This combination provides a balance of high potential profit and manageable risk.

2. Medium-Term Strategy (Short Put: June 2024, Long Call: January 2025)

-

Short Put (June 21, 2024)

- Strike: $15.00

- Delta: 0.8758057731 (lower than the previous, but still substantial)

- Theta: -0.0116604268 (minimal time decay impact)

- Premium: $3.75

- ROI: 18.62%

-

Long Call (January 17, 2025)

- Strike: $50.00

- Delta: -0.6921976911 (provides good leverage without going too far out)

- Theta: -0.007320478 (time decay is manageable)

- Premium: $31.20

- ROI: 0.04%

Analysis: The higher delta on the short put still poses a risk of assignment but offers a better premium. The long call expiring in January 2025 balances the position by providing enough leverage, giving the position ample time for stock price appreciation.

3. Intermediate-Term Strategy (Short Put: August 2024, Long Call: January 2026)

-

Short Put (August 16, 2024)

- Strike: $15.00

- Delta: 0.7924123556 (moderate likelihood of assignment)

- Theta: -0.0107243480 (low time value erosion)

- Premium: $4.10

- ROI: 25.57%

-

Long Call (January 16, 2026)

- Strike: $35.00

- Delta: -0.3683011354 (lower delta, providing a balanced risk)

- Theta: -0.004959484 (minimal time decay)

- Premium: $2.25

- ROI: 100%

Analysis: A slightly lower delta on the short put reduces the risk of assignment while still providing a reasonable income via premium. The long-term call option allows you to ride market movements with sufficient time, balancing the premium cost and decay risks.

4. Long-Term Strategy (Short Put: December 2024, Long Call: January 2026)

-

Short Put (December 20, 2024)

- Strike: $20.00

- Delta: 0.5464699220 (less risk of assignment)

- Theta: -0.0086922871 (manageable time decay)

- Premium: $2.63

- ROI: 100%

-

Long Call (January 16, 2026)

- Strike: $35.00

- Delta: -0.1619376756 (provides leverage with less cost)

- Theta: -0.0048183827 (minimal time decay)

- Premium: $0.55

- ROI: 100%

Analysis: Lower delta short put significantly reduces the risk of assignment while still earning premium income. The long-term call option also has a lower cost and delta, making the overall position more manageable and providing longer exposure to potential stock price movements.

5. Far-Term Strategy (Short Put: January 2025, Long Call: January 2026)

-

Short Put (January 17, 2025)

- Strike: $20.00

- Delta: 0.5572178647 (balanced risk of assignment)

- Theta: -0.0081819183 (time decay manageable)

- Premium: $3.09

- ROI: 100%

-

Long Call (January 16, 2026)

- Strike: $35.00

- Delta: -0.1619376756 (provides good leverage with lower cost)

- Theta: -0.0048183827 (minimal time decay)

- Premium: $0.55

- ROI: 100%

Analysis: This combination of the short put and the far-term call option balances a moderate premium income with lower assignment risk and allows maximum time for the stock price to appreciate.

Conclusion

Each strategy provides a balance of premiums, ROIs, and potential profits while managing the risks of assignment associated with high delta short puts. The long-term call options are chosen to balance the premiums and mitigate theta decay while taking advantage of leverage and rho. The most suitable strategy would depend on your risk tolerance, so consider your investment horizon and the probability of stock price movements within your selected time frames.

Similar Companies in Industrial Materials:

Piedmont Lithium Inc. (PLL), Sigma Lithium Corporation (SGML), Standard Lithium Ltd. (SLI), Vale S.A. (VALE), Rio Tinto Group (RIO), BHP Group Limited (BHP), Report: Teck Resources Limited (TECK), Teck Resources Limited (TECK), Lithium Americas Corp. (LAC), Sayona Mining Limited (SYAXF), Livent Corporation (LTHM), Lynas Rare Earths Limited (LYSCF), Albemarle Corporation (ALB), Freeport-McMoRan Inc. (FCX), Urban Mining Company (UMC)

https://finance.yahoo.com/news/1-mp-materials-report-wider-202135465.html

https://finance.yahoo.com/news/mp-materials-report-wider-expected-202314688.html

https://finance.yahoo.com/news/mp-materials-corp-faces-significant-214201394.html

https://seekingalpha.com/article/4688900-mp-materials-corp-mp-q1-2024-earnings-call-transcript

https://finance.yahoo.com/news/ssrm-vs-mp-stock-better-154010393.html

https://finance.yahoo.com/news/mp-materials-corp-nyse-mp-161233203.html

https://finance.yahoo.com/news/mp-materials-first-quarter-2024-123023402.html

https://finance.yahoo.com/news/deutsche-bank-trims-mp-materials-121741683.html

https://finance.yahoo.com/news/mp-materials-participate-td-cowen-200500889.html

https://www.sec.gov/Archives/edgar/data/1801368/000180136824000045/mp-20240331.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: sA8Jj6

Cost: $0.52316