Nvidia Corp (ticker: NVDA)

2023-12-22

Nvidia Corporation (ticker: NVDA) is a prominent technology company best known for its graphics processing units (GPUs) for the gaming and professional markets, as well as system on a chip units (SoCs) for the mobile computing and automotive industry. Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, Nvidia has become a major player in the computer hardware sector. Its GPU product lines, including the GeForce for gamers, Quadro for professionals, and Tesla for enterprise and data center markets, are widely used for high-performance computing tasks such as 3D graphics rendering and deep learning. Nvidia's newer ventures into AI and autonomous vehicle tech, with platforms like DRIVE for self-driving vehicles and the CUDA programming model for scientific computing, have helped the company diversify its business and establish itself as a leader in AI and parallel processing technologies. Despite the cyclical nature of the tech industry and stiff competition, Nvidia has managed to maintain a strong market position, evidenced by its robust financial performance and significant market capitalization. As of the knowledge cutoff date in early 2023, Nvidia continues to innovate and explore new markets, adapting to the shifting demands of the technology landscape.

Nvidia Corporation (ticker: NVDA) is a prominent technology company best known for its graphics processing units (GPUs) for the gaming and professional markets, as well as system on a chip units (SoCs) for the mobile computing and automotive industry. Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, Nvidia has become a major player in the computer hardware sector. Its GPU product lines, including the GeForce for gamers, Quadro for professionals, and Tesla for enterprise and data center markets, are widely used for high-performance computing tasks such as 3D graphics rendering and deep learning. Nvidia's newer ventures into AI and autonomous vehicle tech, with platforms like DRIVE for self-driving vehicles and the CUDA programming model for scientific computing, have helped the company diversify its business and establish itself as a leader in AI and parallel processing technologies. Despite the cyclical nature of the tech industry and stiff competition, Nvidia has managed to maintain a strong market position, evidenced by its robust financial performance and significant market capitalization. As of the knowledge cutoff date in early 2023, Nvidia continues to innovate and explore new markets, adapting to the shifting demands of the technology landscape.

| As of Date: 12/22/2023Current | 10/31/2023 | 7/31/2023 | 4/30/2023 | 1/31/2023 | 10/31/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 1.21T | 1.01T | 1.15T | 686.27B | 481.78B | 333.11B |

| Enterprise Value | 1.20T | 1.00T | 1.15T | 685.00B | 480.39B | 327.76B |

| Trailing P/E | 64.63 | 98.50 | 243.38 | 159.48 | 83.14 | 44.11 |

| Forward P/E | 24.75 | 24.51 | 62.89 | 61.73 | 45.45 | 29.76 |

| PEG Ratio (5 yr expected) | 0.49 | 0.82 | 2.66 | 3.45 | 4.64 | 2.58 |

| Price/Sales (ttm) | 27.18 | 31.09 | 45.06 | 25.79 | 17.26 | 11.50 |

| Price/Book (mrq) | 36.38 | 36.57 | 47.05 | 31.05 | 22.57 | 13.97 |

| Enterprise Value/Revenue | 26.81 | 55.22 | 85.18 | 95.25 | 79.39 | 55.26 |

| Enterprise Value/EBITDA | 52.74 | 91.32 | 155.24 | 257.62 | 269.88 | 302.36 |

| Address | 2788 San Tomas Expressway | City | Santa Clara | State | CA |

| Zip Code | 95051 | Country | United States | Phone | 408 486 2000 |

| Website | https://www.nvidia.com | Industry | Semiconductors | Sector | Technology |

| Full Time Employees | 26,196 | Previous Close | 489.90 | Open | 491.95 |

| Day Low | 484.67 | Day High | 493.83 | Dividend Rate | 0.16 |

| Dividend Yield | 0.0003 | Payout Ratio | 0.0211 | Five Year Avg Dividend Yield | 0.16 |

| Beta | 1.691 | Trailing PE | 64.22794 | Forward PE | 23.780006 |

| Volume | 23,080,053 | Average Volume | 43,515,917 | Average Volume 10 Days | 41,343,130 |

| Bid | 486.81 | Ask | 487.00 | Bid Size | 1,000 |

| Ask Size | 800 | Market Cap | $1,204,100,661,248 | Fifty Two Week Low | 138.84 |

| Fifty Two Week High | 505.48 | Price to Sales (TTM) | 26.835316 | Fifty Day Average | 462.4616 |

| Two Hundred Day Average | 399.5272 | Trailing Annual Dividend Rate | 0.16 | Trailing Annual Dividend Yield | 0.00032659725 |

| Enterprise Value | $1,202,798,985,216 | Profit Margins | 0.42097 | Shares Outstanding | 2,470,000,128 |

| Shares Short | 24,938,360 | Shares Percent Shares Out | 0.0101 | Held Percent Insiders | 0.040430002 |

| Held Percent Institutions | 0.68566 | Book Value | 13.489 | Price to Book | 36.139824 |

| Net Income to Common | $18,889,000,960 | Trailing EPS | 7.59 | Forward EPS | 20.5 |

| Peg Ratio | 0.39 | Total Cash | $18,281,000,960 | Total Cash Per Share | 7.401 |

| Ebitda | $22,161,000,448 | Total Debt | $11,027,000,320 | Quick Ratio | 2.922 |

| Current Ratio | 3.588 | Total Revenue | $44,870,000,640 | Debt to Equity | 33.149 |

| Revenue Per Share | 18.179 | Return on Assets | 0.27228 | Return on Equity | 0.69172996 |

| Gross Profits | $15,356,000,000 | Free Cash Flow | $14,114,499,584 | Operating Cash Flow | $18,838,999,040 |

| Earnings Growth | 12.741 | Revenue Growth | 2.055 | Gross Margins | 0.69852996 |

| Ebitda Margins | 0.49389 | Operating Margins | 0.57488996 | Target High Price | 1,100.0 |

| Target Low Price | 439.0 | Target Mean Price | 641.23 | Target Median Price | 627.5 |

| Recommendation Mean | 1.7 | Number of Analyst Opinions | 46 | Current Price | 487.4901 |

Based on the provided technical analysis (TA) data and company fundamentals for NVIDIA Corporation (NVDA), we have a comprehensive overview to predict the possible stock price movement of NVDA in the next few months. Here is a summary of the key indicators and their implications:

- MACD: The MACD line is positive, which is a bullish signal. The MACD histogram value is also positive, suggesting that the current upward momentum may continue.

- RSI: With an RSI of 54.93, NVDA is neither overbought nor oversold, indicating that there is room for the price to move in either direction.

- Bollinger Bands: The stock's closing price is slightly below the middle Bollinger Band (BBM), indicating there is no strong price trend in either direction.

- SMA and EMA: NVDA's price is above both the simple moving average (SMA_20) and the exponential moving average (EMA_50), which typically suggests a bullish trend.

- OBV: The On-Balance Volume (OBV) suggests significant trading volume is accompanying the stocks price movements, which can be a sign of a strong trend.

- Stochastic Oscillator: The STOCHk (65.98) and STOCHd (72.06) indicate a positive momentum, but nearing levels that may suggest the stock is becoming overbought.

- ADX: The low ADX (16.15) suggests the current trend is weak, and we might expect sideways movement or trend reversal.

- Williams %R: The value indicates that the stock is neither overbought nor oversold.

- Chaikin Money Flow (CMF): A positive indicator implies that buying pressure is currently outweighing selling pressure.

- Parabolic SAR: The price is above the Parabolic SAR, indicating an uptrend. There is no bearish signal as the PSARs_0.02_0.2 is NaN.

When interpreting NVDAs fundamentals, we observe:

- Market Cap: The market cap has seen impressive growth, indicating increased market confidence in NVDA's prospects.

- P/E Ratios: Both the trailing and forward P/E ratios have decreased, implying better earnings relative to the stock price.

- PEG Ratio: The PEG ratio is lower than its past values, suggesting the stock is reasonably valued based on expected growth rates.

- Price/Sales and Price/Book Ratios: High ratios may indicate the stock is overvalued, but these should be considered with caution, given the industry norms and growth prospects.

- Enterprise Value multiples: The EV/Revenue and EV/EBITDA ratios are high, implying investors are willing to pay a premium for NVDA's future growth.

The financial summary reveals a strong gross profit and high levels of research and development spending, which is crucial for maintaining NVDA's edge in technology.

When synthesizing data from both the technical indicators and the fundamentals, NVDA appears to retain strong bullish sentiment due to its position above key moving averages and a solid volume indicator (OBV). The correction of P/E ratios signifies a market reassessment of NVDAs value, which combined with high growth and revenue numbers positions NVDA favorably in the eyes of investors.

Despite the overall positive outlook and the company's strong financial performance, the technical indicators are hinting at the possibility of a slight pullback or sideways movement in the nearest term, primarily due to the near-overbought stochastic readings and the low ADX value.

Considering the overall trends and individual indicators, it is reasonable to expect NVDA to experience continued growth, albeit with potential short-term volatility. Investors might witness some price retracement in response to the stochastic indicating a near overbought status. The low ADX further suggests that any immediate trend could be weak, providing opportunities for reevaluation before a stronger trend resumes. Over the next few months, the stock price movement of NVDA could likely follow an upward trend but participants should watch for periods of consolidation and minor pullbacks, providing opportunities to enter the market. The company's strong fundamental outlook supports a bullish perspective in the longer term, presuming consistent industry and economic conditions.

Nvidia Corporation's position as a significant holding within the Invesco QQQ Trust underscores the company's strategic importance to the tech-heavy index. The Invesco QQQ Trustan ETF that mirrors the performance of the Nasdaq-100 Indexis an investment vehicle that consists of some of the market's most innovative and high-growth potential companies, amongst which Nvidia claims a prominent spot. As of December 14, 2023, Nvidia's slice of the QQQ pie stood at 4.3%, reflecting its strong influence on the index's overall performance dynamics. This weightage acknowledges Nvidia's standing as one of the vanguards in tech, leading innovations in fields such as computer graphics, artificial intelligence (AI), and data center operations.

The historical returns of the QQQ have been impressive, with the fund outperforming the broader S&P 500 over a decade-long horizon. The fund's 420% gain over these ten years, as opposed to the S&P's 217%, is a testament to the growth-driven nature of the technology and innovative companies housed within. Nvidia's own growth during this periodeven as it widens its footprint in AI and the data center segmenthas contributed to these impressive fund returns and painted a promising picture for potential follow-up performances. Notably, election years have seen QQQ maintain a strong performance track record, apart from the 2008 financial crisis period.

For investors with a long-term scope, the QQQ, with its roster of strong tech players like Nvidia, presents an alluring proposition. The diversification offered by the fund mitigates the risks ordinarily associated with investments in individual stocks, making it a strategic choice, especially for those wary of volatility in the tech market. The aggregation of risks and rewards across the varied and prominent companies within QQQ can provide more stable and potentially lucrative returns over time.

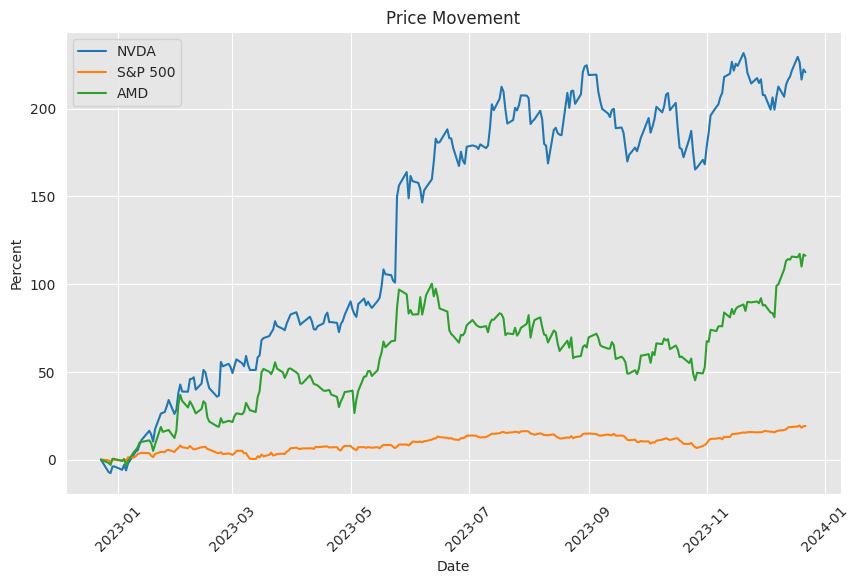

Nvidia's significant share of the rapidly growing artificial intelligence market has been a core driver of its exceptional stock value increasea sentiment reflected in the over 200% surge in its share price within a single year. Nvidia's mastery over the AI chip marketcommanding between an 80% to 95% sharepairs with the sector's considerable growth, offering a lucrative arena for the companys products and services. Furthermore, Nvidia's impressive business performance, characterized by high revenue growth, solidified its role as a market leader in AI applications and GPU sales.

Despite competition from companies like Intel Corporation, which is gaining momentum with the development of its own AI GPU slated for launch in 2024, Nvidia's GPUs remain highly sought-after. Intel's own competitive strides have seen its share prices leap in anticipation of challenging Nvidia's dominance in AI, suggesting a possible reshuffling of market shares in the near future. However, these competitive dynamics could also spell opportunities for investors, as the fight for AI supremacy may drive innovation and growth within the AI sector. Intel's emergence and Nvidia's continued dominance lend credence to the notion that the AI marketand, in turn, the Invesco QQQ Trust's performancehas the potential to be propelled even further.

While AMD is set to challenge Nvidia with its MI300 series data center accelerators, Nvidia continues to showcase robust financials and market dominance in AI chips. The scaling of AI applications to other sectors, like cybersecurityas demonstrated by SentinelOne's generative AI-driven growthpoints toward a burgeoning AI market that holds considerable growth potential. How these dynamics play out could shape the performance of the QQQ fund and, more broadly, the investment strategies pursued by investors who recognize the intersection of growth in AI and larger market indices as investment opportunities.

Nvidia's tech leadership is not only demonstrated through its GPU prowess but also through its significant contributions to AI development and applications. The company's strategy has ventured beyond pure hardware to the integration of software ecosystems, promoting the adoption of Nvidia technologies in massive AI infrastructures. Their largely successful data center revenue stream points to Nvidia's effective capture of the market demand for AI and positions the company as a preferable investment for those looking to capitalize on the AI revolution within the semiconductor sector.

However, Nvidia's journey is not without its challenges. Other leading semiconductor manufacturers, such as Micron Technology, serve as stout competitors whose focus on AI could challenge Nvidia's reign. Despite this, Nvidias comprehensive hardware and software ecosystems give it a comparative advantage and a solid foundation upon which investors could rest their expectations of future growth.

In addition to driving innovation in AI across various industries, Nvidia is also a key player in the gaming market, which remains a significant source of revenue. As gaming evolves with trends such as e-sports and virtual reality, demand for Nvidia's GPUs is likely to remain robust. At the same time, the company's inroads into data center market segments position it to leverage opportunities in cloud computing and high-performance computing, sectors that are experiencing substantial growth.

As 2024 approaches, analysts continue to spotlight Nvidia as an investment prospect of particular interest. The company's past successes in leveraging and shaping AI technologies, coupled with financial stalwartness, indicate a potential road to continued relevance and profitability. When viewed in the context of the rapidly transforming tech landscape, Nvidia's diverse initiatives and research and development investments stand out as noteworthy harbingers of its future potential.

Inside the "Magnificent Seven" of technology stocks that include Apple, Amazon, and others, Nvidia has distinguished itself with remarkable growth, thanks particularly to its AI chip dominance. The ascending stock prices of these tech giants have a profound influence on the market indices they populate. It is worth noting that while Nvidia's contribution to the rise of the tech sector is significant, its increased valuation also draws scrutiny due to concerns over market volatility tied to these high-flying stocks.

Market index funds that are capitalization-weighted give considerable exposure to companies like Nvidia, implicating its high valuation within the context of potential impacts on the index's performance. The burgeoning fascination with AI and other transformative technologies, while beneficial to companies like Nvidia, poses a quandary as investments in these areas teeter between exhilarating potential and the likelihood of overvalued euphoria. Coaching in this regard, Nvidia's stock, amongst its peers, remains one for scrupulous analysis as the landscape unfolds in 2024.

As investment strategies pivot to negotiate this complex market, contemplation grows around the viability of utilizing equal-weighted funds over capitalization-weighted ones. These equal-weighted funds provide an alternative that offers balanced exposure to a variety of stocks, unlike funds like SPY, which may feature a higher concentration of Nvidia and similar stocks. Notwithstanding, even as this diversification strategy may limit exposure to market swings driven by high-value tech stocks, it trades off the potential gains generated by the likes of Nvidia during periods of robust performance.

Looking at Nvidia's market cap and its role amongst the S&P 500's standouts, it is apparent the company has truly distinguished itself. The soaring demand for AI chips, coupled with the record-breaking revenue figures reporting in its data center business, underscores the growth narrative that has propelled Nvidia's stock to new heights. As the market continues its recovery and investor confidence in technology growth stocks remains resilient, Nvidia's dominance in AI positions it as a fascinating contender for long-term investment opportunities, notwithstanding the risks of economic downturns and high valuation.

Investors mulling over Nvidia's stock as we move forward must recognize the dual nature of their position: on one hand, Nvidia's continued growth and dominance in AI make it an attractive long-term prospect; on the other, the heightened valuation and uncertain economic outlook suggest caution. Nvidia's strategic position in the AI chip market, driving automation and cloud-based solution adoption, marks the company as not only a technology leader but also a compelling investment prospect, especially for those focused on the transformative potential of AI over the long haul.

Similar Companies in Semiconductors:

Advanced Micro Devices, Inc. (AMD), Intel Corporation (INTC), Qualcomm Incorporated (QCOM), Broadcom Inc. (AVGO), Report: Micron Technology, Inc. (MU), Micron Technology, Inc. (MU), Texas Instruments Incorporated (TXN), Applied Materials, Inc. (AMAT)

News Links:

https://www.fool.com/investing/2023/12/22/new-to-investing-heres-your-first-investment-2024/

https://www.fool.com/investing/2023/12/22/forget-nvidia-buy-this-magnificent-artificial-inte/

https://www.fool.com/investing/2023/12/22/2-artificial-intelligence-ai-stocks-that-could-go/

https://www.fool.com/investing/2023/12/22/this-semiconductor-stock-is-the-next-artificial-in/

https://www.fool.com/investing/2023/12/22/7-risks-intel-stock-investors-should-know-for-2024/

https://www.fool.com/investing/2023/12/22/magnificent-seven-artificial-intelligence-ai-stock/

https://www.fool.com/investing/2023/12/22/3-magnificent-seven-stocks-50-to-122-upside-2024/

https://www.fool.com/investing/2023/12/21/best-ai-stocks-palantir-stock-vs-nvidia-stock/

https://www.fool.com/investing/2023/12/21/are-the-magnificent-seven-stocks-too-risky-for-you/

https://www.fool.com/investing/2023/12/21/are-the-sp-500s-3-hottest-stocks-of-2023-still-g/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: rlCtClG

https://reports.tinycomputers.io/NVDA/NVDA-2023-12-22.html Home