CNH Industrial N.V. (ticker: CNHI)

2024-01-09

CNH Industrial N.V. (CNHI) is a global leader in the capital goods sector that designs, produces, and sells agricultural and construction equipment, trucks, commercial vehicles, buses, and specialty vehicles, in addition to a broad portfolio of powertrain applications. Founded in 2012 through the merger of CNH Global and Fiat Industrial, CNH Industrial operates through various brands including Case IH, New Holland Agriculture, CASE Construction Equipment, and Iveco. The company has a direct presence in all major markets worldwide with a network of more than 67,000 employees. CNH Industrial is known for its commitment to innovation and sustainability, focusing on developing products that reduce environmental impact while improving efficiency and productivity. The company's shares are listed on the New York Stock Exchange (NYSE) and the Borsa Italiana (Milan Stock Exchange), reflecting a diverse and international investor base. CNH Industrial's strategic vision includes significant investments in technology to propel the group's performance in existing markets and to explore opportunities in emerging sectors such as autonomous and electric vehicles. The resilience of CNH Industrial's business model, combined with a diverse product portfolio and a global footprint, allows it to navigate cyclical markets while positioning the company for long-term growth.

CNH Industrial N.V. (CNHI) is a global leader in the capital goods sector that designs, produces, and sells agricultural and construction equipment, trucks, commercial vehicles, buses, and specialty vehicles, in addition to a broad portfolio of powertrain applications. Founded in 2012 through the merger of CNH Global and Fiat Industrial, CNH Industrial operates through various brands including Case IH, New Holland Agriculture, CASE Construction Equipment, and Iveco. The company has a direct presence in all major markets worldwide with a network of more than 67,000 employees. CNH Industrial is known for its commitment to innovation and sustainability, focusing on developing products that reduce environmental impact while improving efficiency and productivity. The company's shares are listed on the New York Stock Exchange (NYSE) and the Borsa Italiana (Milan Stock Exchange), reflecting a diverse and international investor base. CNH Industrial's strategic vision includes significant investments in technology to propel the group's performance in existing markets and to explore opportunities in emerging sectors such as autonomous and electric vehicles. The resilience of CNH Industrial's business model, combined with a diverse product portfolio and a global footprint, allows it to navigate cyclical markets while positioning the company for long-term growth.

| Address | 25 St. James's Street | City | London | Zip Code | SW1A 1HA |

| Country | United Kingdom | Phone | 44 207 925 1964 | Website | https://www.cnhindustrial.com |

| Industry | Farm & Heavy Construction Machinery | Sector | Industrials | Full Time Employees | 40,000 |

| Previous Close | 12.29 | Open | 12.19 | Day Low | 11.92 |

| Day High | 12.21 | Dividend Rate | 0.40 | Dividend Yield | 3.23% |

| Ex Dividend Date | 1682294400 | Payout Ratio | 23.15% | Five Year Avg Dividend Yield | 1.93% |

| Beta | 1.696 | Trailing PE | 7.11 | Forward PE | 7.81 |

| Volume | 14,523,659 | Average Volume | 13,549,921 | Average Volume 10 Days | 14,154,120 |

| Bid | 11.93 | Ask | 12.09 | Bid Size | 2,900 |

| Ask Size | 36,100 | Market Cap | 15,394,229,248 | Fifty Two Week Low | 9.77 |

| Fifty Two Week High | 17.98 | Price to Sales Trailing 12 Months | 0.62 | Fifty Day Average | 11.08 |

| Two Hundred Day Average | 13.06 | Trailing Annual Dividend Rate | 0.385 | Trailing Annual Dividend Yield | 3.13% |

| Current Price | 11.95 | Target High Price | 25.00 | Target Low Price | 11.50 |

| Target Mean Price | 15.18 | Target Median Price | 15.00 | Recommendation Mean | 2.4 |

| Number of Analyst Opinions | 15 | Total Cash | 2,556,000,000 | Total Cash Per Share | 1.921 |

| EBITDA | 3,392,000,000 | Total Debt | 25,368,000,512 | Quick Ratio | 3.235 |

| Current Ratio | 4.153 | Total Revenue | 24,838,000,640 | Debt to Equity | 312.606 |

| Revenue Per Share | 18.56 | Return on Assets | 4.82% | Return on Equity | 32.47% |

| Gross Profits | 5,247,000,000 | Free Cashflow | -3,618,500,096 | Operating Cashflow | 835,000,000 |

| Earnings Growth | 2.4% | Revenue Growth | 1.8% | Gross Margins | 23.26% |

| EBITDA Margins | 13.66% | Operating Margins | 11.58% | Net Income to Common | 2,347,000,064 |

| Trailing EPS | 1.68 | Forward EPS | 1.53 | PEG Ratio | 0.97 |

| Shares Outstanding | 1,288,220,032 | Shares Short | 23,941,591 | Shares Percent Shares Out | 1.84% |

| Held Percent Insiders | 27.22% | Held Percent Institutions | 51.29% | Short Ratio | 1.21 |

| Short Percent of Float | 2.57% | Implied Shares Outstanding | 1,469,890,048 | Book Value | 6.002 |

| Price to Book | 1.991 | Last Fiscal Year End | 1672444800 | Most Recent Quarter | 1696032000 |

Based on the extensive data provided, a deep technical and fundamental analysis of CNHI stock is conducted to anticipate the potential stock price movement over the next few months.

Technical Analysis Overview:

- The On-Balance Volume (OBV) trend indicates a notable decrease suggesting that selling pressure has been dominant, which typically precedes a bearish price trend.

- The Parabolic SAR currently indicates a bearish trend, as the PSAR is above the price, suggesting that the downtrend may continue in the short term.

- Recent MACD histogram values are showing a negative trend, which indicates bearish momentum that could continue in the immediate future.

Fundamental Analysis Overview:

- The company's gross margins and operating margins are fairly consistent, which indicates stable operations. However, the relatively high trailing PEG ratio suggests that the stock might be overvalued based on its expected growth rates.

- Net income figures have displayed a positive trend in recent years, which is a strong signal for the company's profitability.

- The debt levels have decreased slightly, but net debt continues to be substantial, thereby necessitating close monitoring of the company's ability to manage and service its debts.

Balance Sheet and Cash Flows Overview:

- There has been a year-over-year decrease in cash and cash equivalents, indicating that the company has less liquidity than in the previous period.

- Investment in research and development decreased from the previous year, which could imply a reduced emphasis on future growth opportunities or potential cost-cutting measures.

- Capital expenditure and free cash flow numbers signify disciplined financial management but also suggest a possible slowdown in expansion activities.

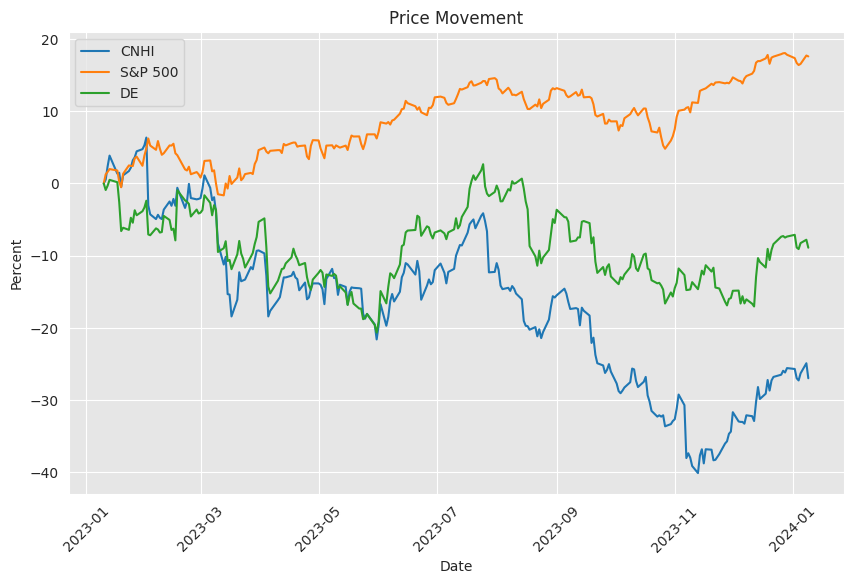

Considering these indicators, the technical analysis is hinting at a continued bearish trend, with fundamentals showcasing a sturdy but perhaps fully valued company profile. The balance sheet and cash flows reveal solid management but also indicate that there might be fewer growth prospects in the immediate pipeline. Combining these analyses, it is reasonable to anticipate that CNHI's stock might face downward pressure in the short term, with potential stabilization or slight recovery over the next few months as the market absorbs the fundamental strength of the company.

Investors should be cautious as the market may have already priced in many of the positive fundamental aspects of the company, and the technical indicators do not currently suggest an immediate reversal of the bearish momentum. Ongoing market dynamics and changes in the broader economic environment could also affect the stock price, so one must consider macroeconomic factors, industry-specific news, and geopolitical events alongside these analyses for a more comprehensive investment decision.

| Statistic Name | Statistic Value |

| Alpha | -0.0205 |

| Beta | 1.2033 |

| R-squared | 0.387 |

| Adj. R-squared | 0.387 |

| F-statistic | 792.3 |

| Prob (F-statistic) | 1.61e-135 |

| Log-Likelihood | -2,649.8 |

| AIC | 5,304 |

| BIC | 5,314 |

| No. Observations | 1,256 |

| Df Residuals | 1,254 |

| Skew | -0.684 |

| Kurtosis | 8.108 |

In the regression of CNHI on SPY, alpha represents the model's intercept, or the point at which the regression line crosses the y-axis when the independent variable (SPY) is zero. The alpha value is approximately -0.0205, indicating that the expected value of CNHI's performance is slightly negative when SPY's performance is neutral. In practical terms, this slight negative alpha suggests that CNHI doesn't systematically outperform or underperform the market, represented by SPY, when market performance is held constant.

The beta of the regression, which measures CNHI's sensitivity to movements in SPY, is approximately 1.2033, signifying that CNHI tends to move, on average, 1.2033 units for every unit change in SPY. The R-squared value of 0.387 indicates that approximately 38.7% of the variation in CNHI's performance can be explained by movements in the SPY, which implies that while there is some linear relationship between CNHI and SPY, a significant portion of CNHI's performance variation is due to factors other than the market.

Executive Summary of CNH Industrial N.V. Q3 Earnings Call

CNH Industrial N.V., a global leader in the capital goods sector, presented its third-quarter earnings for the period ending September 30, 2023. The company's CEO, Scott Wine, and CFO, Oddone Incisa, led the conference call discussing the financial results and providing an outlook for the company.

Performance Overview

CNH Industrial reported a 2% increase in company revenues to $6 billion for the third quarter, despite disappointing aspects likely tied to market challenges in South America. The construction and financial services segments experienced higher volumes and interest revenues, which offset lower agricultural sales. Even with a 1% dip in industrial net salesprimarily driven by reduced agricultural shipmentsthere was notable growth in construction sales.

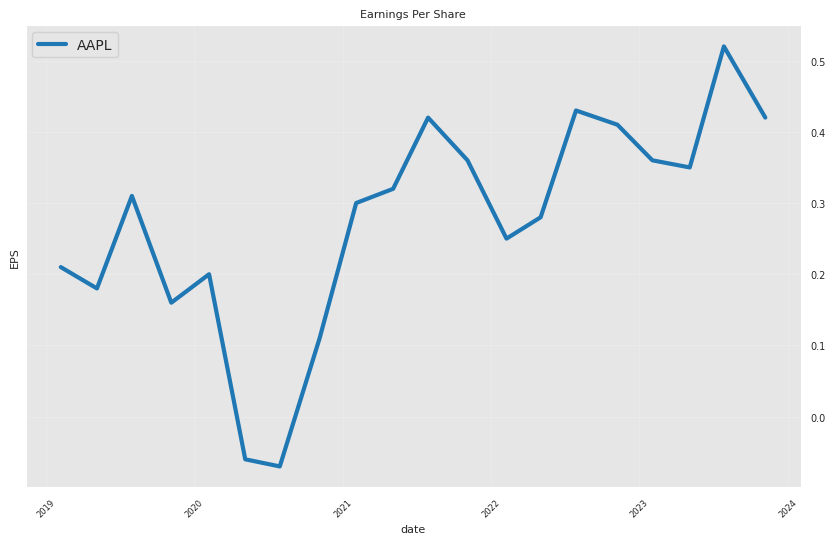

Adjusted EBIT margins held steady year-over-year at 12.3%, showcasing efficiency gains and the potential for consistent earnings despite market volatility. Net income reached $570 million, with earnings per share (EPS) increasing to $0.42. These results highlight the company's robustness amid a varied global demand scenario.

Strategic Adjustments

In response to external pressures, particularly in South America, CNH Industrial proactively adjusted its strategy. A recent downturn in Brazilian markets prompted a review of production levels and inventory management. CNH remains bullish about the long-term prospects in South America, emphasizing its importance in the global Ag economy as well as CNH's strong market position there.

Concurrent with the spinoff of Iveco in 2022, the company implemented a streamlining process, reducing managerial positions by 20%. To further solidify this effort, an immediate restructuring program targeting a 5% reduction in salaried workforce costs was launched, aiming for completion by the end of the year. This move, along with a broader rightsizing initiative planned for the following year, is expected to culminate in a 10-15% run rate reduction of total labor and non-labor SG&A expenses.

Technological Evolution and Acquisitions

CNH Industrial is rapidly evolving its technological capabilities, highlighted by acquisitions and strategic investments. The recent addition of Hemisphere to the CNH family brought precision technology advancements in-house, reducing dependency on third-party providers. This acquisition complements CNH's strategy to develop and own its tech offerings, allowing for faster innovation cycles, better feature performance, and reduced costs. Hemisphere's high-accuracy positioning and heading technology will amplify CNH's journey toward full autonomy in its product offerings.

Financial Services and Spinoff Implications

Oddone Incisa discussed the financial services segment, which maintained a net income of $86 million, comparable to the previous year. Growth in credit portfolios and higher interest revenues characterized this segment's performance, despite increasing interest rates. Retail originations increased, reflecting the critical role of CNH's financial services in supporting equipment investment.

A significant milestone for the company is the application filed with Borsa Italiana to delist CNH Industrial shares from Euronext Milan. The delisting, approved for January 2024, will centralize the company's listing solely on the New York Stock Exchange, simplifying financial reporting and potentially attracting new investors. Accompanying these changes, the company's Board of Directors authorized a new share buyback program of up to $1 billion.

Outlook

The refreshed industry outlook signaled a downward revision of net sales growth projections to 3-6% over 2022, with free cash flow estimates between $1 billion and $1.2 billion. Certain market adjustments led to a shift, such as increased expectations for large tractors in North America versus weaker forecasts for South American markets. In preparation for a more subdued 2024, CNH Industrial is managing its inventories cautiously and is looking forward to additional strategic advancements and showcasing at upcoming industry events.

The conclusion of the call opened the forum for questions, addressing inquiries about dealer inventories, regional pricing strategies, cost control measures amidst global challenges, and impacts of market dynamics on future financial guidance.

CNH Industrial N.V. experienced a notable drop in its stock price following the release of its third-quarter financial results for 2023. Despite achieving a slight improvement in year-on-year sales with revenues climbing to $5.99 billion, surpassing analyst forecasts, the company's earnings per share fell marginally short of the expected $0.43, coming in at $0.42. This mixed performance, featuring a revenue beat but an earnings miss, might have prompted investor concern, leading to the decline in share price. The situation at CNH Industrial mirrored a similar decline in the stock of its industry counterpart, Deere & Company, signaling sector-wide investor sentiments influenced by financial results and market expectations.

Analyzing CNH Industrial's financials more deeply, the construction segment became a highlight, showing a significant leap in profit margin, increasing from 2.7% to 6.3%. Although construction still lags agriculture in profitability per dollar of revenue, the improvement signals substantial growth potential and the possibility of boosting the companys overall margin profile. The agriculture equipment segment was not far behind, with adjusted operating profit margins notching 50 basis points higher, marking record margins for CNH Industrial's two primary divisions.

The company showed confidence in its forward-looking statement, projecting sales growth of 3% to 6% over the previous year and an adjusted earnings target around $1.70 per share. These projections suggest an undervalued stock scenario based on the current price-to-earnings ratio of approximately 6.2, coupled with a 3.5% dividend yield. As such, despite the immediate reaction to the Q3 earnings release, the stock presented attributes that might attract investors, including a robust near-term outlook with an average earnings growth of about 7% projected over the next five years.

Complementing the financial aspects, CNH Industrial has continued to exhibit strong corporate responsibility, particularly with its initiative in Curitiba, Brazil. The company has taken commendable steps to support the local community by donating materials for vocational training to disadvantaged youth. Over 1,500 kilograms of pine and eucalyptus wood, formerly used for shipping machinery parts, were repurposed for a carpentry workshop. This not only showcased CNH Industrial's commitment to sustainability but also its dedication to empowering the next generation with skills that can enhance their employability and contribute to the local economy.

Moreover, in alignment with good corporate governance, CNH Industrial N.V. reported the achievement of a significant milestone in its share buyback program. By completing the 400 million portion of a $1 billion repurchase initiative, the company showcased its ability to efficiently manage capital and bolster shareholder value. The transparent documentation of its share repurchases reflects a strong emphasis on accountability.

Adding to its strategic initiatives, CNH Industrial announced a major reorganization aimed at enhancing efficiency and strategic execution. The formation of the Global Leadership Team (GLT) in replacement of the Senior Leadership Team (SLT) is a move to ensure focused and accountable leadership. This realignment, which emphasizes technological innovation and customer-centric decision-making, signals CNH Industrial's commitment to long-term growth and market leadership.

In an industry-wide context, CNH Industrial exceeded Zacks Consensus Estimates in both earnings and revenues in the first quarter of 2023. Not only did the adjusted earnings per share increase from the prior year, but consolidated revenues also saw a significant year-over-year increase due to higher-than-expected revenues in the Agricultural and Financial Services segments. Updating its guidance for 2023, the company expects greater sales growth and a healthy projection for free cash flow, highlighting management's optimism for continued success.

Sector-wide, the U.S. equity markets experienced a rally driven by strong corporate earnings, where companies like CNH Industrial, with high returns on equity, emerged as attractive to investors. A pause in interest rate hikes by the Federal Reserve, coupled with an anticipated policy meeting in July, sets the stage for future market movements and investment decisions.

Lindsay Corporation's quarterly earnings report, though exceeding EPS estimates, showed a decrease in both earnings and revenue compared to the prior year. This performance contrasts CNH Industrial's recent earnings, where the company beat earnings estimates. These discrepancies within the same industry reflect the volatility and competitive dynamics that companies like CNH Industrial operate under.

In light of low-cost stock analysis, CNH Industrial has been recognized for its potential investment returns, underscoring the appeal of shares trading under $15, such as those of CNH Industrial. With strong pricing power and record-high margins highlighted in its agriculture equipment division, CNH Industrial's stock reflects confidence from hedge funds and investment firms, despite the setbacks in quarterly financials.

Closing the loop on the company's financial narrative, CNH Industrial demonstrated resilience in the second quarter of 2023, with mixed financials leading to a reaffirmation of its full-year guidance. Its Zacks Rank #2 (Buy) status suggests that it could outperform the market, building on solid segmental earnings and steady financial metrics despite revenue shortfalls.

Similar Companies in Farm & Heavy Construction Machinery:

Report: Deere & Company (DE), Deere & Company (DE), AGCO Corporation (AGCO), Report: Caterpillar Inc. (CAT), Caterpillar Inc. (CAT), Komatsu Ltd. (KMTUY), Report: The Toro Company (TTC), The Toro Company (TTC), Terex Corporation (TEX)

https://www.fool.com/investing/2023/11/07/why-cnh-industrial-and-deere-stocks-dropped-today/

https://finance.yahoo.com/news/cnh-industrial-periodic-report-1-213000760.html

https://www.zacks.com/stock/news/2093709/cnh-industrial-cnhi-q1-earnings-revenues-surpass-estimates

https://finance.yahoo.com/news/young-people-curitiba-qualify-carpentry-211500364.html

https://finance.yahoo.com/news/cnh-streamlines-senior-leadership-structure-130000053.html

https://finance.yahoo.com/news/lindsay-lnn-q1-earnings-top-125503266.html

https://finance.yahoo.com/news/13-most-promising-low-cost-195858332.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: vwmGzY

https://reports.tinycomputers.io/CNHI/CNHI-2024-01-09.html Home