PennyMac Financial Services, Inc. (ticker: PFSI)

2024-01-14

PennyMac Financial Services, Inc. (ticker: PFSI) is an American financial services company specializing in residential mortgage finance and services. Established in 2008, the company operates through three segments: Loan Production, Loan Servicing, and Investment Management. Its Loan Production segment is engaged in the origination, acquisition, and sale of mortgage loans, while the Loan Servicing segment involves the servicing of newly originated loans and the execution of loss mitigation activities and loan workouts. Through its Investment Management segment, PennyMac manages investments in mortgage-related assets and provides investment management services to entities such as PennyMac Mortgage Investment Trust (PMT). Headquartered in Westlake Village, California, PennyMac has positioned itself as a prominent mortgage lender and servicer, navigating the evolving U.S. housing market, and aiming to provide efficient mortgage solutions to its diverse customer base. The company has a reputation for leveraging advanced technology and a customer-focused approach to support homeownership and investment needs in a dynamic financial landscape.

PennyMac Financial Services, Inc. (ticker: PFSI) is an American financial services company specializing in residential mortgage finance and services. Established in 2008, the company operates through three segments: Loan Production, Loan Servicing, and Investment Management. Its Loan Production segment is engaged in the origination, acquisition, and sale of mortgage loans, while the Loan Servicing segment involves the servicing of newly originated loans and the execution of loss mitigation activities and loan workouts. Through its Investment Management segment, PennyMac manages investments in mortgage-related assets and provides investment management services to entities such as PennyMac Mortgage Investment Trust (PMT). Headquartered in Westlake Village, California, PennyMac has positioned itself as a prominent mortgage lender and servicer, navigating the evolving U.S. housing market, and aiming to provide efficient mortgage solutions to its diverse customer base. The company has a reputation for leveraging advanced technology and a customer-focused approach to support homeownership and investment needs in a dynamic financial landscape.

| Address | 3043 Townsgate Road | City | Westlake Village | State | CA |

| Zip Code | 91361 | Country | United States | Phone | 818 224 7442 |

| Website | https://ir.pennymacfinancial.com | Industry | Mortgage Finance | Sector | Financial Services |

| Full Time Employees | 4,129 | Market Cap | $4,306,599,424 | 52-Week Low | $54.00 |

| 52-Week High | $93.50 | P/E Ratio (Trailing) | 20.30 | P/E Ratio (Forward) | 9.33 |

| Average Daily Volume 10 Day | 224,800 | Bid | $85.52 | Ask | $86.68 |

| Price to Sales (TTM) | 2.84 | Enterprise Value | $16,949,379,072 | Dividend Yield | 0.93% |

| Payout Ratio | 18.82% | Beta | 1.63 | Profit Margins | 14.47% |

| Held Percent Insiders | 39.46% | Held Percent Institutions | 58.29% | Book Value | $71.56 |

| Price to Book | 1.21 | Trailing EPS | $4.25 | Forward EPS | $9.25 |

| Revenue Per Share | $30.29 | Return on Assets | 1.24% | Return on Equity | 6.21% |

| Gross Profits | $1,395,243,000 | Debt to Equity Ratio | 389.70 | Total Revenue | $1,514,835,968 |

| Operating Cash Flow | -$1,523,099,008 | Revenue Growth | -53.1% | Operating Margins | 71.01% |

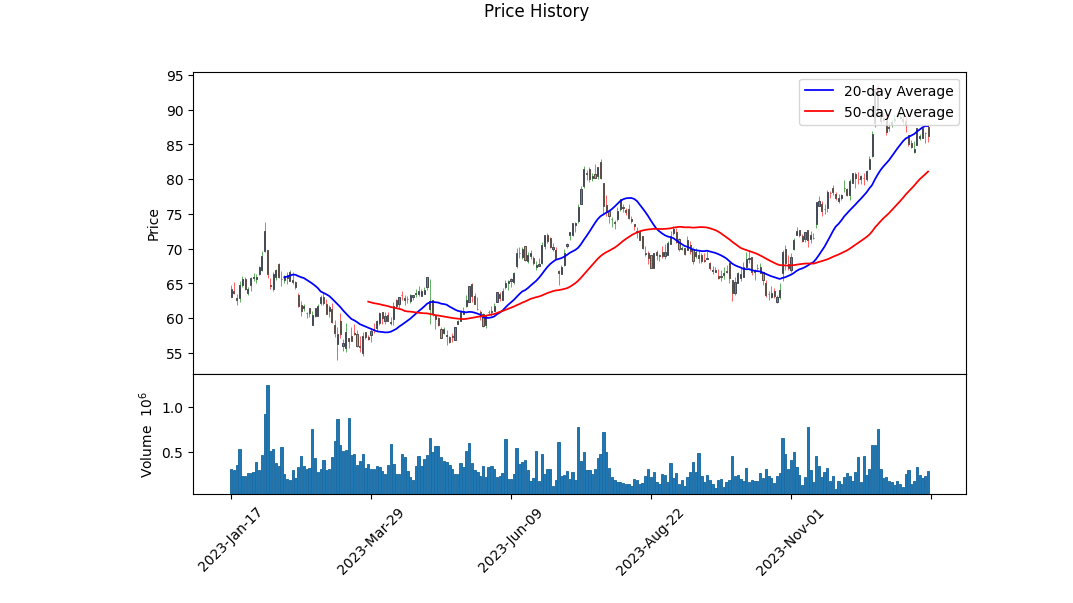

Technical Analysis (TA) of PFSI (PennyMac Financial Services, Inc.) displays noteworthy information that could be used to predict the next few months' stock price movement. The examination encompasses varied indicators and financial data.

Technical Analysis (TA) of PFSI (PennyMac Financial Services, Inc.) displays noteworthy information that could be used to predict the next few months' stock price movement. The examination encompasses varied indicators and financial data.

Upon evaluating the closing prices from the provided technical data, a notable trend of increasing closing prices is apparent. Specifically, an upward trend from $68.23 to $86.26 is seen between September 18th, 2023, and January 12th, 2024. The Overall Balance Volume (OBV) in millions is on an upward trend as well, signifying an increase in volume on days when the stock price closed higher.

The Parabolic SAR (PSAR) indicatoruseful for identifying potential reversals in the market price directionpossesses an acceleration factor of 0.02 and a maximum step of 0.2. During the last displayed trading day, the PSAR is in a bearish position which could indicate that the uptrend is weakening.

On the other hand, the Moving Average Convergence Divergence (MACD) histogram, a trend-following momentum indicator, has been negative as of the last trading day but the value is increasing towards the zero line. This could imply that while the current trend is bearish, there is potential for a reversal if the MACD crosses above the signal line.

Turning attention to the fundamental analysis, the financials portray a mixed picture. The company's recent balance sheets indicate a substantial amount of debt and a negative tangible book value. However, the cash flows demonstrate resilience, with a significant amount of free cash flow indicating robust operational efficiency.

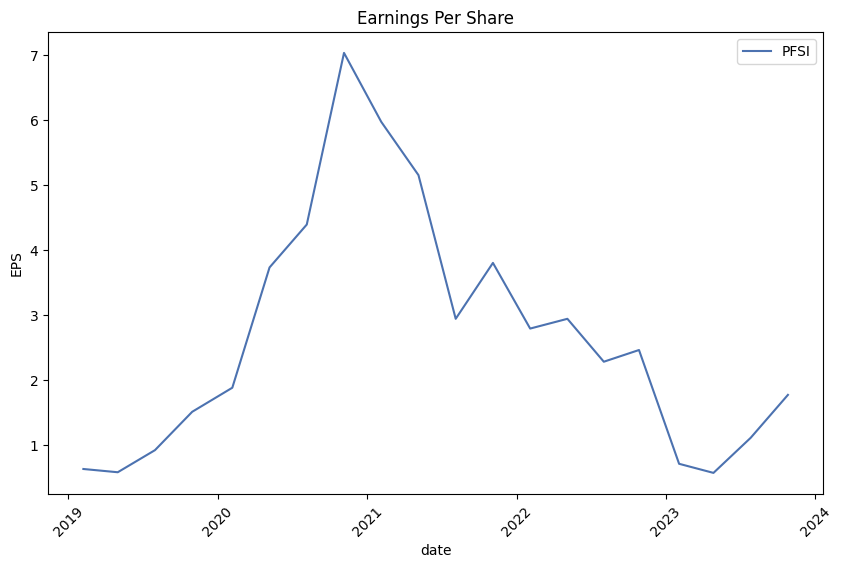

The earnings and revenue estimates from analysts point towards a favorable outlook in the immediate quarters, with substantial growth expectations for the next year. Earnings per share (EPS) estimates for the current and next year exhibit an upward revision, hinting at growing confidence among analysts regarding the company's earnings potential. These expectations, especially if met or exceeded, could serve as catalysts for a bullish sentiment among investors.

The growth estimates also provide a sanguine view, emphasizing strong growth anticipated for the current and next quarters, although current year growth is expected to diminish when compared to the previous year. A noteworthy outlook for the next five years with an estimated annual growth rate of 20.73% further strengthens the long-term optimism around the company's stock performance.

In summation, the combined insights from technical and fundamental analyses suggest that PFSI's stock could experience growth in the coming months. While some technical indicators such as the PSAR and MACD indicate a need for cautious optimism in the immediate term, the progressively increasing price trend, strong analysts' earnings predictions, as well as robust free cash flow, may contribute to a bullish outlook on the stock price movement over the next few months. Investors should monitor how the stock responds to the approaching earnings reports and whether the company can meet or exceed the growth estimates set forth by the analysts.

| Statistic Name | Statistic Value |

| Intercept (Alpha) | 0.0872 |

| Beta | 1.0971 |

| R-squared | 0.277 |

| Adj. R-squared | 0.276 |

| F-statistic | 479.6 |

| Prob (F-statistic) | <0.001 |

| Log-Likelihood | -2848.7 |

| AIC | 5,701 |

| BIC | 5,712 |

| No. Observations | 1,256 |

| Df Residuals | 1,254 |

| Df Model | 1 |

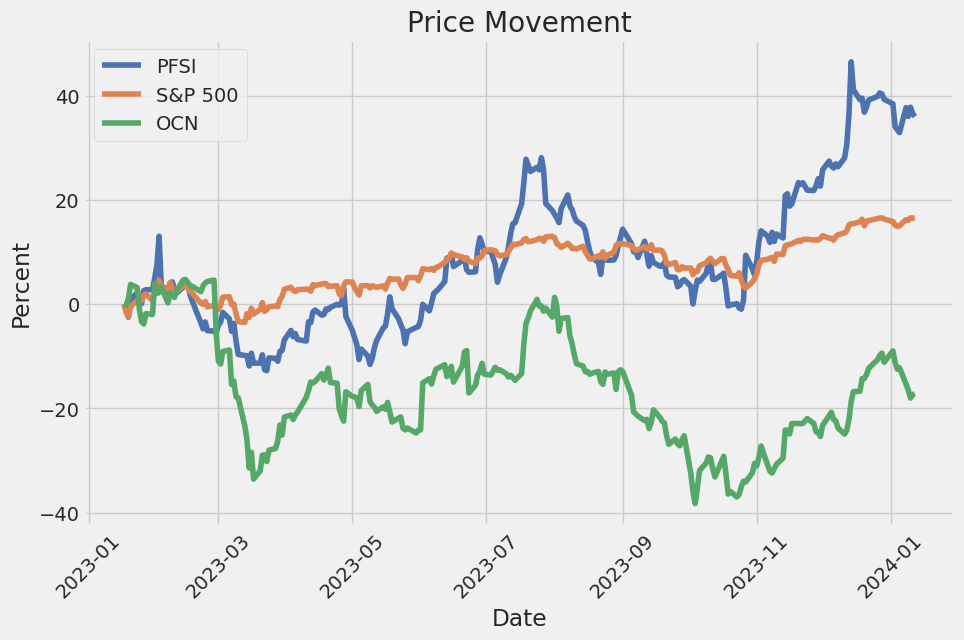

The estimated alpha (intercept) of the linear regression model evaluating the relationship between PFSI (PennyMac Financial Services, Inc.) and SPY (SPDR S&P 500 ETF Trust, a proxy for the S&P 500 market index) is approximately 0.0872. As a measure of the excess return of PFSI over the expected market return (assuming SPY represents the market), this alpha signifies that PFSI theoretically could have returned a small positive percentage above the market's performance regardless of SPY's movements, according to the model's time frame ending today. However, the alpha's t-statistic of 1.319 and corresponding P-value of around 0.187 do not provide sufficient statistical evidence to conclude that this estimated alpha is significantly different from zero.

Alongside the alpha, the linear regression presents a beta (slope) coefficient of approximately 1.0971. This indicates that for every 1% move in SPY, PFSI is expected to move by approximately 1.097%. The statistical significance of this relationship is strong, evidenced by a low Prob (F-statistic) of less than 0.001, suggesting that the observed relationship between PFSI and SPY is highly unlikely to be due to random chance. The R-squared of the model is 0.277, indicating that about 27.7% of the variability in PFSI's returns can be explained by movements in SPY, which points to a moderate degree of correlation between these two securities over the observed period.

PennyMac Financial Services, Inc. reported strong results for the third quarter of 2023, which were detailed in their earnings call led by David Spector, Chairman and CEO, and Dan Perotti, CFO. Despite a 50 basis point increase in average mortgage rates from the previous quarter, the company was able to showcase the strength of its balanced business model. This model allowed for significant operating income from their considerable servicing business, as well as sustained profitability in production. As a result, the company experienced a 3% growth in book value per share from the prior quarter. The rising mortgage rates, however, have led to a lower inventory of homes for sale and expectations for a significant drop in unit origination volumes.

David Spector highlighted the resilience of mortgage banking companies with large servicing portfolios against lower origination volumes. PennyMac's own servicing portfolio has grown to around $600 billion in unpaid principal balance, serving 2.4 million customers. The consistent growth of their servicing portfolio has been attributed to the company's capabilities as an outstanding producer of mortgage loans. PennyMac Financial is thus capable of navigating various interest rate cycles profitably due to their top positions as a servicer and producer.

In his presentation, Dan Perotti reported a net income of $93 million for the third quarter, which translates to $1.77 earnings per share and an annualized return on equity of 11%. The board also declared a third quarter cash dividend of $0.20 per share. PennyMac maintained a strong position in correspondent lending, with profit-making acquisition and origination volumes despite the challenging market. The strong results in the servicing segment led to a pretax income contribution of $101 million, up from the previous quarter. A sizable portion of the revenue comes from servicing fees and placement fee income.

With mortgage rates expected to stay higher, Spector expressed optimism about the company's strategic initiatives for driving stronger returns over time. In particular, he mentioned the expansion of their closed-end second lien product, which has seen about $450 million in originations. Plans are underway to market this product beyond their current servicing portfolio, hinting at a significant opportunity for growth. The management team is committed to maneuvering the challenging mortgage landscape effectively.

As to questions raised during the earnings call, David Spector addressed concerns about the correspondent market, noting the withdrawal of banks and increased delivery of whole loans to aggregators like PennyMac. He also shared that the company is continuously being seen as a strong alternative in the broker direct market. Dan Perotti clarified expectations around servicing fee trends, suggesting they are likely to rise. In response to questions about gain on sale margins, Spector indicated that they have stabilized and rational pricing is ongoing in all channels. The company is monitoring its leverage ratio and capital deployment opportunities carefully, looking to optimize its position for potential unsecured debt opportunities in the future.

The call concluded with the operator opening the floor for questions and Spector thanking everyone for their participation and encouraging them to reach out with any further inquiries. The company is looking forward to ongoing communication with its investors and stakeholders.

The residential mortgage services market has seen considerable activity from PennyMac Financial Services, Inc. in recent months, as evidenced by a flurry of strategic and financial steps taken to align with evolving economic conditions and capitalize on market opportunities. A standout among the company's new ventures is the home equity loan offering known as the second mortgage. Introduced through its broker division, PennyMac TPO, this product is designed to enable homeowners to unlock the equity in their homes without affecting the advantageous rates on their primary mortgages. With the debut of this financial tool on December 5, 2023, as reported by Connie Kim, PennyMac is poised to meet the growing demand in a market ripe with nearly peak levels of tappable home equity, which stood at $10.6 trillion in the United States.

The loan product targets owners of primary residences, with borrowing amounts available between $50,000 and $500,000 at an LTV of up to 85%. With fixed-rate repayment over up to 30 years, this presents an attractive option for homeowners in the context of rising mortgage rates, which have surpassed the 7% mark, making cash-out refinancing less attractive. By the end of the third quarter of 2023, homeowners had approximately $16.4 trillion in equity, making products like PennyMacs timely and pertinent.

PennyMac's presence in the mortgage market is further underscored by its latest financial disclosures, revealing $19 billion in total loan acquisitions and originations for the fourth quarter, as indicated in its 8-K filing. These figures not only convey the scale of PennyMacs operations but also its diverse penetration across different service categories within the sector.

On December 6, 2023, the company also revealed key financial restructuring strategies as part of its ongoing effort to strengthen its capital structure. The planned offer of $650 million in Senior Notes due in 2029 was a significant announcement, originated to ensure continued growth and stability for the company. These notes will be unconditionally guaranteed by PennyMac Financials wholly owned domestic subsidiaries, barring certain exceptions, fortifying the company's financial footing. The substantial assemblage of funds from this offering aims to repay portions of the companys existing secured debt, which points to a strategy of improved debt management and a push for financial agility. For further details on this offering, an in-depth report can be found here.

The debt market strategy taken by PennyMac amidst a challenging housing market underscores their agility. The $650 million Senior Notes, as disclosed in SEC filings, will be privately placed, reflecting a move to diversify the financing structure and improve liquidity. This aligns with a discernible pattern in the mortgage industry to strengthen financial positions through such instruments. Industry peers have also turned to market debt offerings to spur investment into their operations, and this suggests a level of optimism amongst lenders about a future recovery in the market, as detailed in the report provided here.

Continuing this momentum, on December 7, 2023, PennyMac upsized and priced its private offering of senior notes, expanding the aggregate principal amount to $750 million of 7.875% Senior Notes due in 2029. The increase from the initial $650 million demonstrates the companys ability to attract significant capital investment, bolstering its aim of repaying secured term debt and supporting corporate ventures. This move also highlights PennyMacs growth and market dominance, having generated $96 billion in newly originated loans over the previous twelve months, making it the second-largest mortgage lender. The overall offering details can be accessed on Business Wires website here.

Amidst these developments, insider trading activities have drawn attention as well. Sales of company stock by executives such as James Follette, Chief Mortgage Fulfillment Officer, and Steven Bailey, Chief Servicing Officer, hint at personal perspectives on the companys future prospects. With PennyMac trading at high valuations, such as having a P/E ratio exceeding the industry median, these sales may be signaling an opinion about the stock's current pricing. GuruFocus comprehensive reports and analyses on these insider activities can be found here and here.

Furthermore, Chief Capital Markets Officer William Chang's sale of 9,900 shares continues the pattern of insider selling observed within the past year. His role and the positional whereabouts of these transactions offer additional insight into the executive cadres stance on PennyMacs valuation. For more specifics on Chang's insider selling, the report from GuruFocus is available at this link.

Lastly, in an unexpected change of direction, PennyMac has rescinded its plans to extend its workforce in North Carolina. Initially intending to increase staff by over 300 and invest $4.3 million into a new mortgage fulfillment production center, the company faced headwinds due to persistently high-interest rates and challenging market conditions. Despite this, PennyMac remains a formidable force, ranking second-largest mortgage lender for the first nine months of 2023. The full account of PennyMac's strategic re-evaluation in North Carolina can be found in a HousingWire article here.

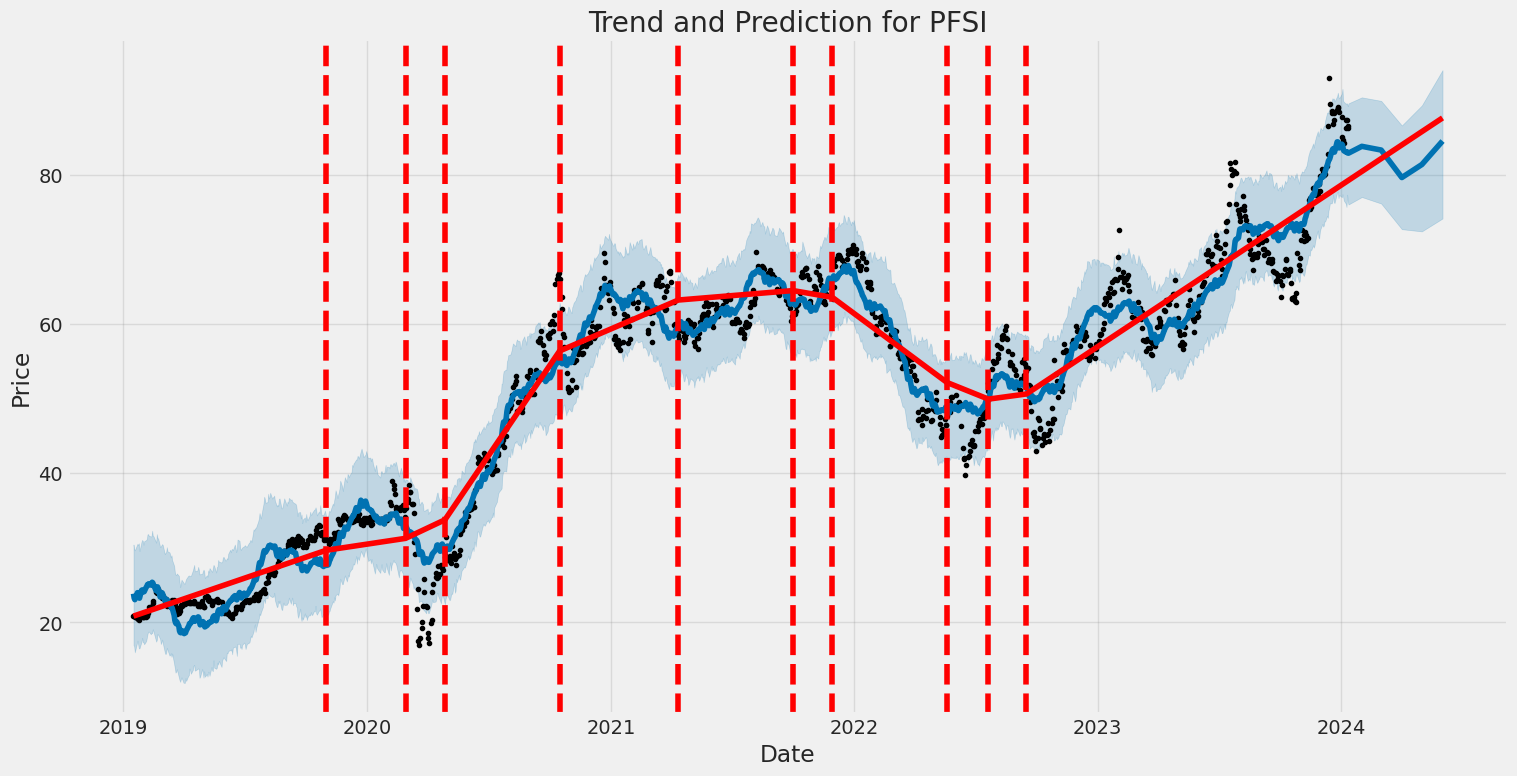

PennyMac Financial Services, Inc. (PFSI) has exhibited significant volatility between 2019 and 2024, with the volatility being unpredictable as indicated by an R-squared of virtually zero. The model, which attempts to explain the changes in the return values of the asset, shows that these returns do not follow a pattern that can be captured by a simple statistical mean (Zero Mean Model). The coefficients related to the model (specifically omega and alpha[1]) suggest that there are sizable variations, with omega representing the long-term average variance and alpha[1] indicating the impact of past return shocks on current volatility.

| Statistic | Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -2,941.79 |

| AIC | 5,887.59 |

| BIC | 5,897.86 |

| No. Observations | 1,256 |

| Df Residuals | 1,256 |

| omega | 4.7748 |

| alpha[1] | 0.3964 |

To assess the financial risk of investing $10,000 in PennyMac Financial Services, Inc. (PFSI), an integrated approach leveraging both volatility modeling and machine learning predictions is employed. The volatility of PFSI's stock is crucial to comprehending the range of potential outcomes for this investment over the coming year. Here, volatility modeling serves to forecast the level of fluctuation in the stock price of PFSI, providing an estimate of future variability based on past performance.

The volatility model uses historical stock prices to measure and predict the changing variance over time, ultimately leading to a dynamic assessment of risk. By fitting the volatility model to PFSI's past price data, it captures the clustering of volatility, a common characteristic in financial time series where periods of high volatility tend to be followed by high volatility and vice versa. Through this process, the model adapts to changing market conditions and offers a refined estimate of future volatility.

In parallel, machine learning predictions come into play by incorporating a suite of input features, possibly including past returns, volume data, and even exogenous variables such as macroeconomic indicators, to forecast future returns of PFSI. A specific implementation, here referred to as machine learning predictions, effectively learns from historical data to identify complex, non-linear patterns that can help predict the direction and magnitude of future stock returns.

Both methods are integrated to form a comprehensive view of the risk profile for the PFSI investment. The volatility model's forecasted volatility is essential in calculating the Value at Risk (VaR), which is a statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over a specific timeframe. In this context, the annual VaR at a 95% confidence interval signifies that there is a 5% chance that the investment could lose more than this value over the course of a year due to market fluctuations.

The calculated annual VaR for the $10,000 investment in PFSI at a 95% confidence level is determined to be $332.25. This figure suggests that, with a 95% confidence level, the investor would not expect to lose more than $332.25 over a one-year horizon, under normal market conditions. The relatively low VaR in the context of the total investment indicates a moderate level of risk, acknowledging, however, that higher or lower volatility projected by the volatility modeling could alter this risk level.

In summary, by combining the predictive prowess of volatility modeling with the forward-looking insights from machine learning predictions, investors can gauge the potential financial risk with greater precision. The integration of these methodologies culminates in the Value at Risk metric, which provides a quantifiable and tangible statistic framing the expected maximum loss with a specified confidence level, in this case, illustrating a moderate risk profile for a $10,000 investment in PennyMac Financial Services, Inc. over one year.

Similar Companies in Mortgage Finance:

Ocwen Financial Corporation (OCN), Encore Capital Group, Inc. (ECPG), Greystone Housing Impact Investors LP (GHI), Guild Holdings Company (GHLD), Security National Financial Corporation (SNFCA), Timbercreek Financial Corp. (TBCRF), CNFinance Holdings Limited (CNF), Rocket Companies, Inc. (RKT), Wells Fargo & Company (WFC), LoanDepot, Inc. (LDI), JPMorgan Chase & Co. (JPM), United Wholesale Mortgage (UWMC), Guild Holdings Company (GHLD), Mr. Cooper Group Inc. (COOP), Home Point Capital Inc. (HMPT), Report: Bank of America Corporation (BAC), Bank of America Corporation (BAC), U.S. Bancorp (USB), Quicken Loans (RKT)

https://finance.yahoo.com/news/pennymac-rolls-home-equity-loan-202738390.html

https://finance.yahoo.com/news/pennymac-financial-services-inc-announces-125700552.html

https://finance.yahoo.com/news/pennymac-issue-650m-unsecured-debt-155716034.html

https://finance.yahoo.com/news/pennymac-financial-services-inc-announces-234300446.html

https://finance.yahoo.com/news/insider-sell-chief-mort-fulfillment-060544335.html

https://finance.yahoo.com/news/insider-sell-alert-chief-servicing-162029725.html

https://finance.yahoo.com/news/insider-sell-alert-chief-capital-040101258.html

https://finance.yahoo.com/news/pennymac-pulls-back-2021-plan-205720509.html

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: B7jgoT

https://reports.tinycomputers.io/PFSI/PFSI-2024-01-14.html Home