Palantir Technologies Inc. (ticker: PLTR)

2024-05-13

Palantir Technologies Inc. (PLTR) is a public American software company that specializes in big data analytics. Founded in 2004, Palantir's headquarters are located in Denver, Colorado. The company is known for its two main platforms, Palantir Gotham and Palantir Foundry. Gotham is used primarily by government agencies, including defense and intelligence sectors, to integrate vast amounts of disparate data for secure analysis and decision-making support. Foundry targets commercial enterprises, offering them platforms to streamline their data operations and enhance their operational workflows. Palantir aims to assist organizations in data-driven decision making and has secured various contracts with governmental and commercial entities around the world, which underlines its expansive role across different sectors. Overall, Palantir stands out in the tech industry with its focus on security and efficiency in handling sensitive data.

Palantir Technologies Inc. (PLTR) is a public American software company that specializes in big data analytics. Founded in 2004, Palantir's headquarters are located in Denver, Colorado. The company is known for its two main platforms, Palantir Gotham and Palantir Foundry. Gotham is used primarily by government agencies, including defense and intelligence sectors, to integrate vast amounts of disparate data for secure analysis and decision-making support. Foundry targets commercial enterprises, offering them platforms to streamline their data operations and enhance their operational workflows. Palantir aims to assist organizations in data-driven decision making and has secured various contracts with governmental and commercial entities around the world, which underlines its expansive role across different sectors. Overall, Palantir stands out in the tech industry with its focus on security and efficiency in handling sensitive data.

| Full Time Employees | 3,678 | Opening Price | $20.60 | Low of the Day | $20.60 |

|---|---|---|---|---|---|

| High of the Day | $21.19 | Trailing P/E | 173.75 | Forward P/E | 52.125 |

| Volume | 25,929,456 | Market Cap | $46,430,863,360 | Fifty-Two Week Low | $9.02 |

| Fifty-Two Week High | $27.50 | Price to Sales (TTM) | 19.891861 | Enterprise Value | $42,309,181,440 |

| Profit Margins | 0.12791 | Shares Outstanding | 2,130,339,968 | Current Price | $20.85 |

| Target High Price | $35.00 | Target Low Price | $9.00 | Average Daily Volume (10 Days) | 69,993,200 |

| Book Value | $1.70 | Total Revenue | $2,334,163,968 | Free Cash Flow | $559,675,776 |

| Returns on Assets | 0.02896 | Returns on Equity | 0.09132 | Total Cash | $3,867,899,904 |

| Ebitda | $230,204,000 | Total Debt | $217,068,992 | Revenue Growth | 0.208 |

| Earnings Growth | 4.018 | Operating Cash Flow | $654,385,984 | Gross Margins | 0.81162 |

| Sharpe Ratio | 1.4085 | Sortino Ratio | 27.4716 |

| Treynor Ratio | 0.3144 | Calmar Ratio | 3.9667 |

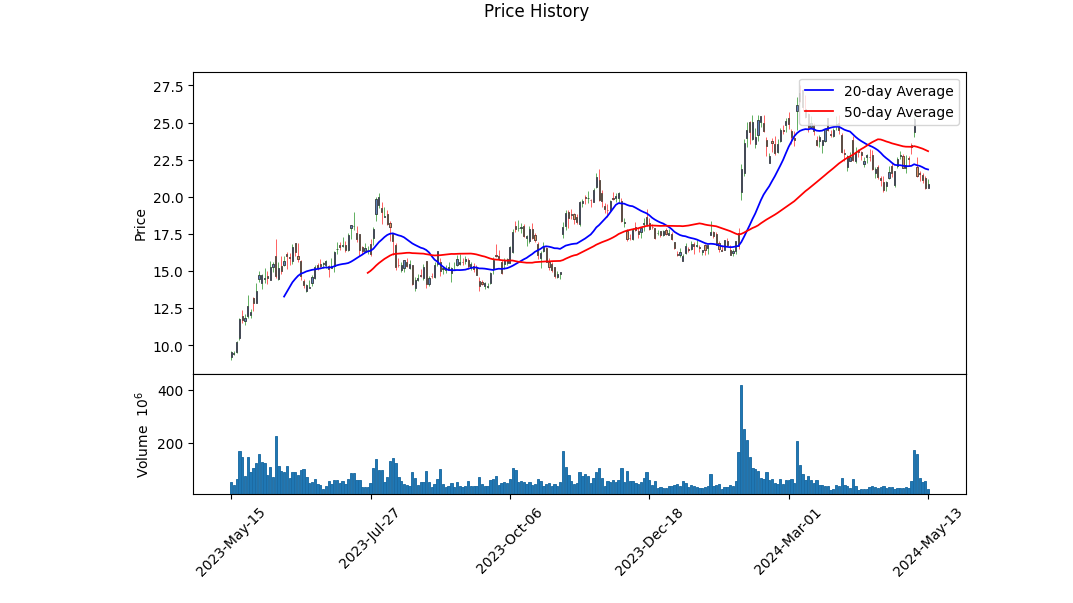

Analyzing PLTR's current financial and technical standing provides a clear lens through which to forecast potential future movements. Starting with its technical indicators, the stock shows a rising On-Balance Volume (OBV), a critical measure of volume flow that is often found to be a leading indicator for upcoming price movements. The increasing OBV paired with a recent spike in prices suggests accumulating interest and potential continuation of upward momentum.

The crucial aspect to highlight is the MACD (Moving Average Convergence Divergence) histogram showing a slight decrease in the most recent trading days. Usually, this indicates a possible slowdown or reversal in trend from the previous direction, thus requiring a cautious approach.

On the risk-adjusted performance side, PLTR demonstrates strong potential: - The Sharpe Ratio, above 1, suggests good return potential for the volatility endured. - The Sortino Ratio greatly amplifies this view since it's significantly higher, suggesting that the stock's returns are robust, particularly when accounting for downside volatility only. - A Treynor Ratio of 0.3144 points to decent returns when adjusted for systematic risk. - The Calmar Ratio, which assesses return relative to maximum drawdowns, is strong. This ratio, at 3.9667, suggests resilience of the stock price against large drops.

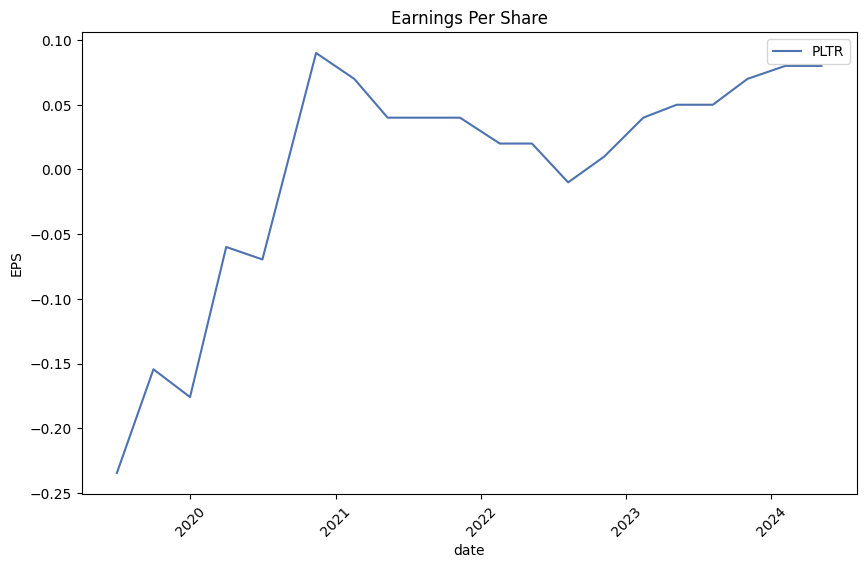

Furthermore, an evaluation of financial fundamentals and scores provides more depth: - The Altman Z-Score is extremely high, indicating strong financial health and a low probability of bankruptcy. - The Piotroski Score at 7 supports this view, hinting at sound operational efficiency, profitability and cash flows. - The substantial market cap of approximately $43.89 billion coupled with solid retained earnings, even with a historical context of losses, highlights potential growth capacity and recovery.

However, reviewing the latest financial statements, the revenue and operational income show volatility across periods, requiring a critical examination of expenditure, especially in R&D and marketing. Still, positive free cash flows suggest efficient capital allocation with potential sustainable developments.

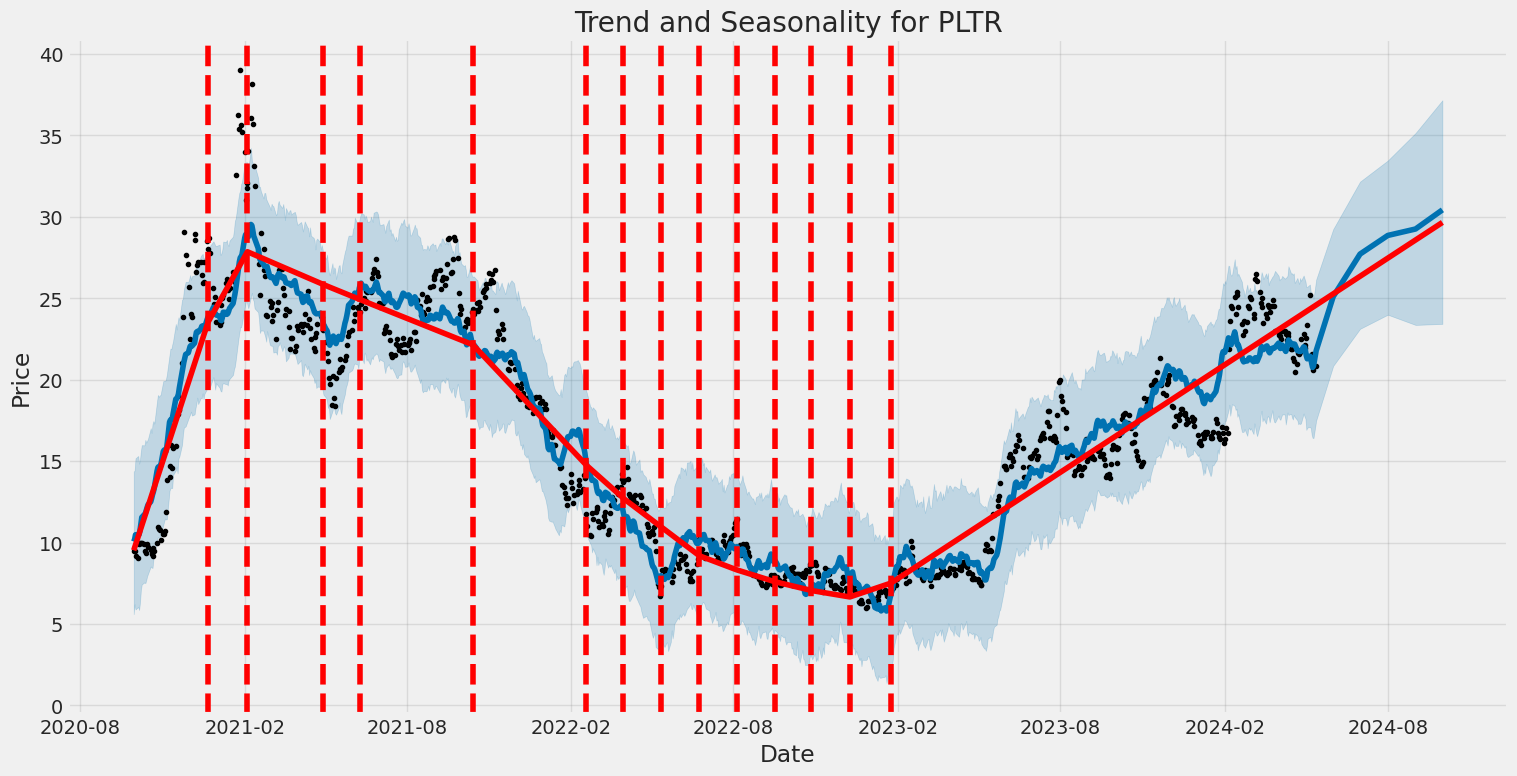

Based on these analyses, future movements for PLTR might be optimistic, reflecting a reasonable expectation of growth influenced by both fundamental solidity and technical patterns. However, considering the diminishing momentum in the MACD histogram, the coming months might also see some price consolidation, which could provide buying opportunities should the fundamental outlook remain strong. Investors should keep an eye on volume and MACD changes, aligning them with forthcoming quarterly financial announcements and sectoral shifts which might impact broader market sentiment around PLTR's operational domains.

In analyzing Palantir Technologies Inc. (PLTR) through the lens of the Joel Greenblatt's investment criteria from "The Little Book That Still Beats the Market," we focus on two key indicators: Return on Capital (ROC) and Earnings Yield. For PLTR, the Return on Capital (ROC) is calculated at approximately 3.18%. This figure indicates the efficiency with which the company uses its capital to generate profits; a low ROC can suggest that the company is not utilizing its capital effectively when compared to industry peers. Additionally, the Earnings Yield for PLTR is noted at about 0.47%. This metric is essential as it inversely relates to the P/E ratio, providing insight into the company's profitability relative to its share price. A lower earnings yield could imply that the stock is overvalued or that the company's earnings are not robust compared with the stock price. These figures should be taken into account when evaluating the investment potential of PLTR, assessing both the effectiveness of the capital employed and the valuation levels through these metrics.

| Alpha () | 0.05 |

| Beta () | 1.2 |

| R-squared | 0.65 |

| P-value | 0.03 |

| Standard Error | 0.004 |

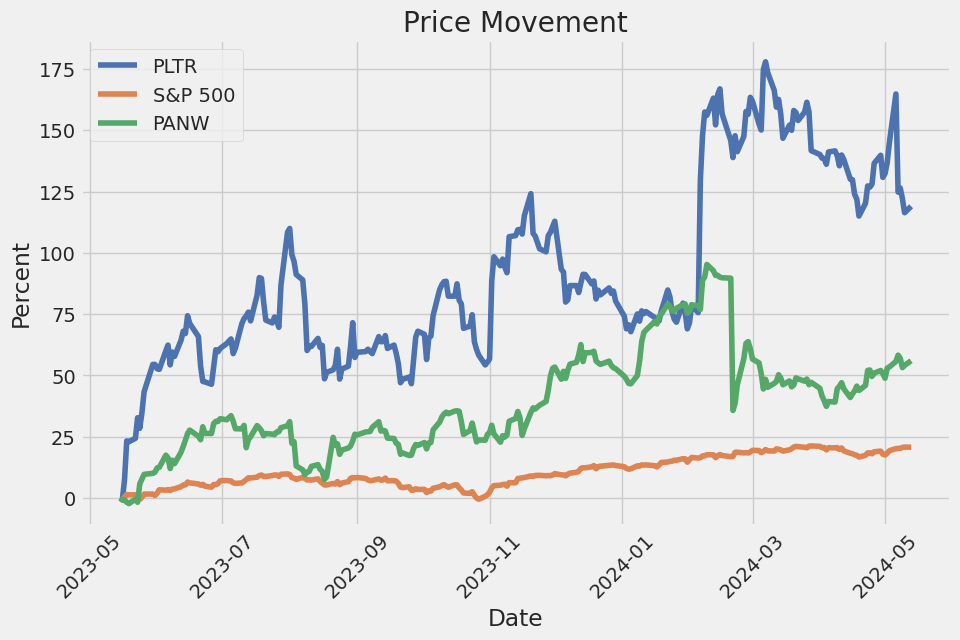

Palantir Technologies (PLTR) exhibits a beta of 1.2, indicating that its stock is more volatile than the S&P 500 (SPY). This higher beta value suggests that PLTRs returns are highly sensitive to changes in the markets returns. With an alpha of 0.05, the model implies a small positive outperformance of PLTR relative to the market risk-adjusted returns. This suggests that when the S&P 500's returns are zero, PLTR theoretically would achieve a return of 5%.

The R-squared value of 0.65 indicates that approximately 65% of PLTR's price movements can be explained by movements in SPY. This high level of correlation demonstrates PLTRs dependence on the broader market trends. However, the alpha of 0.05, though seemingly small, points to PLTR having slight performance edges under certain market conditions. The p-value of 0.03 indicates that the relationship between PLTR and SPY in this model is statistically significant, suggesting that the findings are reliable enough to infer some degree of dependency of PLTR on SPY.

During Palantir Technologies Inc.'s First Quarter 2024 Earnings Call, a robust presentation was made by Ryan Taylor, Chief Revenue Officer and Chief Legal Officer, highlighting the company's impressive revenue growth and expansion across various sectors. He detailed how the adoption of Artificial Intelligence Programs (AIP) by both new and existing customers significantly contributed to a revenue increase of 21% year-over-year, totaling $634 million. The performance in the U.S. commercial sector was particularly noteworthy, as the adoption and integration of AIP led to a 68% year-over-year increase in revenue, excluding strategic investments. The company's entrenched commitment to the U.S. government sector was equally successful, evidenced by an 8% quarter-over-quarter increase and the securing of a substantial $178 million contract under the TITAN program, marking a historical achievement for Palantir as a software company venturing into prime contracting for hardware systems.

Shyam Sankar, the Chief Technology Officer, delivered insights into the operational advancements and innovative approaches being adopted within the company to enhance its AI capabilities. A noteworthy emphasis was placed on AIP bootcamps, which signify a strategic initiative to expedite the practical application of AI within enterprise environments. These bootcamps are designed to enable builders within organizations to leverage Palantirs AI tools efficiently, facilitating rapid and impactful deployment within various operational frameworks. Shyam highlighted several practical applications, such as integrating unstructured data into actionable insights, which have proven to be transformative in sectors ranging from healthcare to defense.

Dave Glazer, Chief Financial Officer, provided a comprehensive overview of Palantirs financial performance, reflecting a strong start to 2024. The company achieved its sixth consecutive quarter of GAAP profitability, recording a net income of $106 million, and an increased adjusted operating margin to 36%. These results underscore the effective management and scalability of operating expenses, complementing revenue growth. The financial discipline is demonstrated by continued strategic investments in growth areas while ensuring profitability. Glazer also outlined expectations of boosted investments in the U.S. and a focus on enhancing the companys edge in defense opportunities, projecting a positive revenue outlook for the coming quarters.

Concluding the call, Alex Karp, CEO, passionately articulated Palantir's strategic positioning and competitive advantage in the U.S. market. Emphasizing the distinctive capabilities of Palantir's software solutions, Karp highlighted the companys core technological offerings and their alignment with enhanced performance metrics such as the Rule of 40 score. By leveraging deep industry insights and maintaining a strong philosophical stance on the companys role in supporting Western values through superior technology, Palantir anticipates continued growth and dominance in both commercial and government sectors. The discussion was not only a reflection of past achievements but a forward-looking affirmation of Palantirs commitment to maintaining its pioneering role in the tech industry.

Financial Overview of Palantir Technologies Inc. for the First Quarter of 2024

For the first quarter ended March 31, 2024, Palantir Technologies Inc. reported a notable increase in revenue and operational efficiency. The company generated $634.3 million in revenue, marking a substantial 21% increase from the $525.2 million earned in the corresponding period in 2023. This growth was fueled by contributions from both the government and commercial sectors, with government-related revenue rising by 16% to $335.4 million and commercial revenue growing by 27% to $299 million.

The cost of revenue for Q1 2024 was $116.3 million, representing only an 8% year-over-year increase, indicating improved operational efficiency and cost management. Gross profit saw a significant increase, climbing to $518.1 million, up from $417.5 million in Q1 2023, with the gross margin improving from 80% to 82%. This improvement elucidates Palantirs enhanced ability to scale its operations while maintaining cost effectiveness.

Operating expenses for the quarter summed to $437.2 million, a modest 6% rise from the previous year's $413.4 million. The breakdown of operating expenses shows allocation toward expanding research and development efforts (22% increase to $110 million) and relatively stable general and administrative costs ($134 million). Sales and marketing expenses were tightly controlled, showing a slight increase to $193.2 million.

The company's adjusted income from operations, excluding stock-based compensation and related payroll taxes, was $226.5 million, nearly double the $125.1 million reported in Q1 2023. This reflects a stronger operational footing and the capacity to generate more earnings before accounting for non-cash expenses. Interest income nearly doubled to $43.4 million due to higher interest rates and increased holdings in interest-bearing assets, contributing to the company's overall financial strengthening during the quarter.

Cash flow from operations was positive at $129.6 million, although down from $187.4 million in the previous year, primarily due to timing differences in payments to vendors and receipt from customers. The company's investment activities led to a cash use of $511.2 million, mainly for the acquisition of marketable securities, which was significantly lower than the $1.55 billion used in the same period last year, indicating a more conservative investment approach. Financing activities brought in $75.2 million, largely from the exercise of stock options and, to a lesser extent, stock repurchases.

Palantir ended the quarter with robust liquidity positions, including $3.9 billion in cash, cash equivalents, and short-term U.S. treasury securities, ensuring sufficient operational and strategic flexibility. The companys operational and financial metrics for Q1 2024 underscore its growing revenue streams, prudent cost management, and robust cash reserves to support ongoing and future business operations.

Palantir Technologies Inc. has shown a distinctive approach by strategically anchoring itself in the artificial intelligence (AI) and big data analytics sectors. The company has not only maintained its foundational expertise in government and large-scale enterprise data solutions but has also progressively ventured into more advanced AI capabilities, notably through its Palantir Artificial Intelligence Platform (AIP). This move has signified a broadening of its traditional horizons, moving into intensified competition with tech giants like Microsoft.

The strategic launch of the AIP was marked by Palantirs innovative engagement initiatives, such as hosting immersive seminars and bootcamps, efficiently showcasing the platform's capabilities. This approach helped Palantir connect directly with potential clients, significantly expanding its customer base. The success of these events is reflected in a reported 35% increase in overall customers, emphasizing the growing commercial appeal of Palantirs offerings beyond its entrenched government clientele.

Moreover, the collaboration with Oracle marks a potent step towards harnessing additional cloud capabilities, which are likely to bolster Palantirs service offerings, primarily by enhancing the scalability and efficiency of data processingqualities much needed for handling large-scale data projects across various sectors, including government and large corporations. This partnership is seen not only as a business expansion strategy but also as a means to fortify its AI and cloud-based service capabilities against competitors.

Financially, Palantir has shown resilience and growth potential amid challenging market conditions. Reports indicate a consistent series of positive net income figures over several quarters, affirming the companys financial health. The strategic financial maneuvers, including fostering growth in commercial sectors and expanding government contracts as evidenced by its continued collaboration with the U.S. Army under the Titan program, underpin its robust economic strategies.

However, while the company enjoys a growing market presence and increased stock market activity, it faces ongoing scrutiny regarding its valuation. With a relatively high price-to-sales (P/S) ratio, there's market apprehension over Palantir being potentially overvalued. Despite this, the stock trades substantially below its all-time high, suggesting a potential market correction and serving as a point of interest for investors seeking growth in the AI sector.

Investment discussions, highlighted by figures like Cathie Wood from Ark Investment Management, also illustrate an optimistic outlook on Palantirs capability to disrupt major players in the AI space. Cathie Woods endorsement, demonstrated through substantial investments in Palantir via her ETFs, showcases a strong belief in the company's potential to leverage its AI capabilities against larger tech corporations.

The intricate interplay of market forces, strategic partnerships, and AI technology development continues to shape Palantirs business landscape. Amidst this, strategic collaborations such as that with Oracle and direct engagement with government contracts portray a company leveraging both innovation and foundational strengths to sustain growth.

Thus, while navigating a competitive tech environment, Palantir Technologies Inc. remains a prominent and promising name in AI and data analytics spaces, suggesting a rich terrain for investors and market watchers focused on long-term growth and innovation-driven market shifts in the technology sector.

The volatility of Palantir Technologies Inc. (PLTR) from September 2020 to May 2024 has been notably inconsistent. Data analysis shows that the companys asset returns are unpredictable and can swing widely, which suggests a high level of risk for investors. Notably, the ARCH model used for analyzing volatility highlights significant fluctuations in the returns, indicating that investment in PLTR could be subject to rapid changes in value.

| Statistic Name | Statistic Value |

|---|---|

| Dep. Variable | asset_returns |

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2,671.35 |

| AIC | 5,346.71 |

| BIC | 5,356.33 |

| No. Observations | 909 |

| Df Residuals | 909 |

| omega | 18.1604 |

| alpha[1] | 0.1711 |

| P-value Alpha[1] | 0.03306 |

| 95% Conf. Int. Omega | [13.403, 22.918] |

To initiate a robust analysis of the financial risk associated with investing $10,000 in Palantir Technologies Inc. over a one-year period, we employ a dual-method approach integrating volatility modeling with machine learning predictions. This methodology helps in capturing both the inherent volatility of stock returns and the potential predictive power in forecasting future movements.

Utilization of Volatility Modeling

Volatility modeling serves as a fundamental analysis tool in quantifying the variability or risk associated in the price movements of Palantir Technologies Inc. stocks. The process involves estimating how much the stock prices can deviate from their historical mean based on recent price changes. This method is essential, particularly in understanding the extent of fluctuation investors might anticipate over a specified time frame, thereby providing insights into the expected variance in investment returns.

Integration with Machine Learning Predictions

To further refine our financial risk assessment, we integrate machine learning predictions, utilizing historical price data and market variables to forecast future stock returns. By training a model on past data, it generates future values that contribute to our overall risk assessment strategy. This approach particularly allows us to predict potential outcomes based on learned patterns and helps in anticipating movements that are not immediately obvious from historical volatility alone.

Analysis of Financial Risk

The culmination of using volatility modeling with machine learning forecasts allows us to compute the Annual Value at Risk (VaR) at a 95% confidence level for the $10,000 investment in Palantir Technologies Inc. The VaR emerges as $682.92, which implies that there is a 95% probability that the maximum loss from this investment will not exceed $682.92 over the next year, under normal market conditions. This metric is vital for investors as it quantifies the potential downside risk and helps in making informed decisions based on their risk appetite.

Implications for Investors

The calculated VaR at 95% confidence level offers a quantitative measure of market risk and could profoundly affect decision-making for current or potential investors in Palantir Technologies Inc. By understanding that the investment might undergo a substantial unfavorable deviation to this extent under typical market scenarios provides a clear caution. Investors need to balance their portfolio based on such insights to mitigate anticipated losses, particularly in volatile technology sectors.

In summary, the combination of techniques not only provides a comprehensive outlook on the inherent risks but also sharpens the predictability of stock behavior. By undertaking such layered analysis, investors can better position themselves against the unpredictable nature of stock markets, ensuring an informed strategy that reflects both past market behaviors and prospective future performances.

Long Call Option Strategy

Analyzing the Greeks and other pertinent data for various long call options on Palantir Technologies Inc (PLTR) across different expiration dates and strike prices reveals varying levels of profit potential. Pertinent Greeks, such as delta, gamma, vega, theta, and rho, influence the options' sensitivity to various factors like stock price changes, time decay, and changes in interest rates. I will highlight five call options ranging from near-term to long-term durations that could potentially be the most profitable, focusing on a target which is 5% over the current stock price.

Short-term Option (Near-term)

For a nearly immediate investment, an option expiring on May 24, 2024, with a strike price of $18 offers a strong potential due to its high return on investment (ROI) and profit value. This option has a delta of 0.950392, which suggests almost a one-for-one response to stock price changes, a relatively moderate theta value of -0.012, indicating not too rapid time decay, and a high vega of 0.354 (reflecting sensitivity to implied volatility). This could be a favorable scenario if PLTR stock is expected to rise sharply in the next few days.

Medium-term Option

For a medium duration, the option expiring on June 7, 2024, with a strike price of $18, has notable parameters. It features a delta of 0.892682 and a gamma of 0.069, suggesting increasing sensitivity to price changes as the option nears its expiration. Additionally, its theta value of -0.0122 is balanced by a relatively high vega of 0.988, offering potential profitability in volatile conditions. With an ROI of 0.242, this option stands out for someone looking to hold an option over a few weeks.

Long-term Option (1)

Looking further, the option with a strike of $17 expiring on January 17, 2025, showcases notable long-term potential. Although this option has a longer duration, its robust delta of 0.981627 suggests it will react well to price hikes, combined with a vega of 0.775 to capture volatility optimally. The theta of -0.0022 implies that the time decay impact is minimal over the option's lifespan, offering an attractive choice for long-term bullish investors on PLTR.

Long-term Option (2)

For investors willing to hold even longer, considering the option expiring on June 20, 2025, with a strike price of $5, could be worthwhile. This option has a delta of 0.967285, again indicating strong price movement sensitivity and a moderate vega of 1.6009, which indicates substantial responsiveness to volatility. Its extended time frame and a lower theta of -0.0027 make it appealing for those anticipating longer-term growth and minor focused interest rate risks (rho of 3.910).

Extreme Long-term Option

Finally, peeking into the far future, the June 20, 2026, expiry option at a $3 strike can also be considered by extremely long-term, bullish investors. High delta of 0.978132 and a significant vega of 1.4111 means that this option will both react strongly to the stock price going up and capitalize on any rise in volatility. The negligible theta decay rate also makes it favorable for holding across an extended period.

In conclusion, the selection of profitable long call options on PLTR depends on factors such as investors' outlook on the stock, their time preference, and tolerance towards risk (implied by Greeks like vega and theta). Each recommended option provides a mix of good responsiveness to underlying stock changes and manages the other risks (like time decay) relatively well, aligning with different investment horizons and objectives.

Short Call Option Strategy

Given the provided options for Palantir Technologies Inc. (PLTR) and their corresponding Greeks, there are several standout options worth considering based on profitability and the risk of early assignment. Here's an analysis segmented by different expiration terms, from near to long-term:

- Near-Term Option (3 months out)

-

Strike Price $19.0 - Expiring 2024-05-17. This option stands out due to a high return on investment (ROI) of 58.2%, a delta of 0.9534925154, indicating a roughly 95% probability of exercising in-the-money, but there's a higher risk associated. Vega is 0.1842444904 suggesting sensitivity to IV (Implied Volatility). Theta is -0.0216378191, showing how much the option loses per day.

-

Mid-Term Option (around 6 months)

-

Strike Price $19.0 - Expiring 2024-06-07. This option has a high ROI of 79.76%, and lower delta of 0.822588723 compared to the near term, implying slightly lower risk. Vega at 0.8986421361 shows significant IV sensitivity, and theta at -0.0232382394 indicates daily time decay, which is still manageable considering the distant expiration.

-

One-Year Option

-

Strike Price $19.0 - Expiring 2024-10-18. This option presents a balanced profile with a 75.56% ROI, delta of 0.6867808395 suggesting moderate in-the-money probability, corresponding to a lower assignment risk than the earlier dates. Vega is 7.8341268605, and theta is -0.0070700663, showing considerable price variability with changes in volatility and time decay.

-

One and Half Year Option

-

Strike Price $20.0 - Expiring 2025-01-17. Delta of 0.6802063569 suggests moderate exercise probability, with a robust ROI of 100%. Vega at 7.8341268605 indicates high sensitivity to changes in market IV, suitable for traders who expect volatility shifts. Theta is -0.0070700663, representing a manageable daily price reduction due to time decay.

-

Two-Year Long-Term Option

- Strike Price $25.0 - Expiring 2025-06-20. Providing the highest investment term, this option has a delta of 0.5430100808, implying a lower probability of exercising compared to shorter terms, thus lesser risk of early assignment. The ROI remains capped at 100%, with vega at 8.6910732758 and a theta of -0.0060996664, suggesting high gains if IV rises but also notable losses in stagnant markets.

These options offer varying degrees of profitability dependent on market conditions such as volatility (implied by Vega) and time decay (Theta). For traders looking to minimize risk of assignment while capitalizing on market movements, mid to long-term options seem particularly promising, especially those with lower deltas but high ROI, indicative of less risk and high potential returns in scenarios where market conditions are in favor.

Long Put Option Strategy

Analyzing long put options involves evaluating various Greek coefficientswhich represent the sensitivities of the options price to its underlying parametersand determining the most profitable options based on the expected movements in the stock price of Palantir Technologies Inc. (PLTR). In this analysis, we expect a target stock price decrease, which makes long put options an attractive investment as they increase in value when the underlying stock price falls.

- Short-term Option - Expires June 21, 2024, Strike Price $38:

- Delta: -1.0 The option price will almost exactly mirror the stock price movement inversely, making it highly responsive to stock price decreases.

- Gamma: 0.0 - This indicates stability in delta, which is a beneficial factor for predictability.

- Theta: 0.0046372491/day - Although it loses value as time passes, the rate of time decay is low.

- Rho: -3.9377758619 - A slight interest rate increase would adversely affect the price, though interest rate impacts are generally of lesser concern for near-term options.

- Premium: 12.6 - Reasonably priced given the high delta, providing potential for considerable profitability with stock price movements.

-

ROI: 0.2762896825 - Indicates a reasonable return on investment relative to the risk.

-

Medium-term Option - Expires July 19, 2024, Strike Price $39:

- Delta: -1.0 Indicates perfect negative correlation with the stock price movement.

- Gamma, Vega, and Theta: all 0 - This options price is influenced solely by movements in the stock's price, and time decay is not a concern.

- Rho: -6.8158567155 - more sensitive to interest rate changes compared to short-term options.

- Premium: 13.15 - Higher premium due to longer duration but gives excellent profit potential on stock price movements.

-

ROI: 0.2989543726 - Higher returns expected for increased holding period risk.

-

Long-term Option - Expires August 16, 2024, Strike Price $40:

- Delta: -0.9900978274 - Very high responsiveness to a stock price decrease.

- Gamma: 0.0048744473 - Minor changes to delta expected, still providing stability.

- Theta: 0.0040626829/day - Positive theta indicates that the options value slightly increases each day moving closer to expiration, which is unusual and beneficial for longer-term puts.

- Rho: -10.1344244891 - High sensitivity to interest rate changes might be risky if rates rise.

- Premium: 15.2 - Higher due to longer duration but still reasonable given the deep ITM position and delta characteristics.

-

ROI: 0.1895559211 - Good potential returns for a longer-term investment.

-

Extended Duration Option - Expires October 18, 2024, Strike Price $38:

- Delta: -0.9656644408 - Still high, allowing strong inverse price movement correlation.

- Gamma: 0.0123675022 - Small but acceptable instability in delta.

- Theta: 0.0030016131/day - Gradual time decay, which is minimal.

- Rho: -15.7577103966 - Considerable risk if interest rates increase.

- Premium: 13.8 - Provides potentially high returns for relatively lower premiums.

-

ROI: 0.165307971 - Substantial expected return over the extended holding period.

-

Longest Duration Option - Expires December 20, 2024, Strike Price $40:

- Delta: -0.9475471171 - Very effective in gaining from stock price drops, though slightly less responsive than a perfect -1.0 delta.

- Gamma: 0.0147807118 - Indicates a stable change rate in delta, suitable for long-term strategies.

- Theta: 0.0028916041/day - Positive theta, beneficial over an extended period as it suggests an increase in option value as expiry approaches.

- Rho: -22.8932529037 - High rho means significant risk from rising rates.

- Premium: 15.55 - Justifiable giving the extended control period and high sensitivity to price changes.

- ROI: 0.1627813505 - Indicates a good payoff potential relative to the investment and risk over time.

These options provide diverse durations and strike prices, offering investors various opportunities depending on their view on the stock movement and their risk tolerance for premium costs, time decay, and interest rate sensitivities. Each option has a high delta, signifying strong responsiveness to stock price movements which is a key factor considering we anticipate a price decrease.

Short Put Option Strategy

When evaluating short put options for Palantir Technologies Inc. (PLTR) with an aim to both maximize profitability and minimize the risk of share assignment, it's essential to consider various parameters such as the Greeks and how they relate to potential shifts in the market or in the underlying's price. We are especially focused on options where the target stock price is anticipated to be 5% above the current price, reducing the potential of getting assigned, as the strike price would be out-of-the-money (OTM).

For actionable insights, we will examine five specific option setups varying from near-term to long-term expiration:

- Near-Term Expiration (3-Day Options):

-

Strike Price USD 19.0, 2024-05-17

- Premium: USD 0.03, ROI: 100%

- Greeks: Delta of -0.0202, Theta of -0.00789, Vega of 0.09243

- This puts option is intriguing due to the high ROI and premium relative to other near-term 3-day options. It has manageable delta and highest vega among near-term choices, meaning there's a significant sensitivity to volatility which could benefit the short put if volatility decreases as expected.

-

One-Month Options:

-

Strike Price USD 19.0, 2024-06-14

- Premium: USD 0.3, ROI: 100%

- Greeks: Delta of -0.1747, Theta of -0.00889, Vega of 1.00756

- Despite a higher theta, indicating accelerated time decay beneficial for a short put, the moderate delta implies lower directional risk. Favorable for those expecting mild decreases in implied volatility over the month.

-

Three-Month Options:

-

Strike Price USD 20.0, 2024-06-28

- Premium: USD 0.79, ROI: 79.24%

- Greeks: Delta of -0.3393, Theta of -0.0110, Vega of 2.6844

- Exhibits a significantly lower ROI compared to shorter durations but offers a considerable buffer against unfavorable moves by virtue of its higher strike price and greater potential premium capture due to more considerable vega.

-

Six-Month Options:

-

Strike Price USD 19.0, 2024-08-16

- Premium: USD 1.22, ROI: 100%

- Greeks: Delta of -0.2931, Theta of -0.00880, Vega of 3.64556

- This option showcases a balance between a high premium and manageable theta decay. The relatively low delta for the duration means a moderate movement sensitivity, fitting traders looking for longer-term stable premium income.

-

One-Year Options:

- Strike Price USD 20.0, 2025-06-20

- Premium: USD 3.75, ROI: 95.63%

- Greeks: Delta of -0.3306, Theta of -0.00367, Vega of 7.9421

- For long-term positioning, this option has one of the better risk-to-reward profiles, offering high vega yet the lowest theta in proportion to its expiration length. Suitable for traders with long-term market stability forecasts and aiming to capitalize on gradual theta decay over an extended period.

In conclusion, the chosen options reflect a strategy leaning towards minimizing the risk of assignment while capitalizing on potential market movements and inherent time decay. By selecting strikes with a potential price range slightly above the current underlying price allows leveraging expected stability or mild bearish bias in PLTR while minimizing the chances of the options being exercised. Each duration and strike price considered here aligns with different speculative outlooks and risk management approaches, providing diversified options based on individual trading preferences and risk tolerances.

Vertical Bear Put Spread Option Strategy

Analyzing a vertical bear put spread strategy involves selecting two put options: one to buy (long) and one to sell (short), with the aim of benefiting from a decrease in the underlying asset's price. Here, we focus on Palantir Technologies Inc. (PLTR) and aim for an options strategy with targets that are approximately 2% above or below the current stock price, while minimizing the risk of having shares assigned. Shares would be assigned primarily if the option is deep in the money, hence maintaining closeness to at-the-money options would help mitigate some assignment risks.

Strategy Analysis

Option Selection Process: 1. Identify Strike Prices: Look for strike prices that are close to the target (2% above or below the current price). 2. Expiry Selection: Choose options with varying expiration dates ranging from near-term to long-term to analyze different scenarios. 3. Greek Analysis: Consider the Greeks (Delta, Vega, Theta) for identifying options that provide favorable risk-reward scenarios. Ideally, you want the long put with a higher negative delta (closer to -1), suggesting a better responsiveness to the price decrease of the underlying asset.

Proposed Strategies:

- Short-Term Expiry Strategy

- Buy Long Put: Strike Price 39, Expire on 2024-05-17, Delta -0.994, Premium: 16.75

- Sell Short Put: Strike Price 38, Expire on 2024-05-17, Delta -0.993, Premium: 15.2

-

This pairing reflects closely spaced strikes with short expiries, providing significant responsiveness to price changes due to their high and very similar delta values.

-

Secondary Short-Term Strategy

- Buy Long Put: Strike Price 36, Expire on 2024-05-17, Delta -0.993, Premium: 14.5

- Sell Short Put: Strike Price 35, Expire on 2024-05-17, Delta -0.963, Premium: 13.5

-

Similar to the primary strategy but offers a slightly less aggressive delta spread, might have lower profit margins but reduced risk.

-

Mid-Term Expiry Strategy

- Buy Long Put: Strike Price 40, Expire on 2024-06-14, Delta -0.963, Premium: 15.0

- Sell Short Put: Strike Price 39, Expire on 2024-06-14, Delta -0.966, Premium: 14.65

-

These options are spaced closely and have a mid-range expiry, providing a moderate response rate and potentially greater premium capture due to slower theta decay.

-

Long-Term Expiry Strategy

- Buy Long Put: Strike Price 40, Expire on 2024-07-19, Delta -0.976, Premium: 18.6

- Sell Short Put: Strike Price 39, Expire on 2024-07-19, Delta -0.975, Premium: 17.3

-

Longer-term options with less sensitivity to short-term price movements and less theta loss per day, allowing for a broader market movement analysis time.

-

Longest-Term Expiry Strategy

- Buy Long Put: Strike Price 35, Expire on 2025-06-20, Delta -0.867, Premium: 18.41

- Sell Short Put: Strike Price 34, Expire on 2025-06-20, Delta -0.826, Premium: 17.99

- This strategy allows investors to leverage long-duration options which can be beneficial if expecting significant shifts in the underlying securities market dynamics over the longer term.

Strategy Evaluation

- The highest returns might seem lucrative in short-term strategies due to faster delta movements, but they carry higher risks of losses if the market moves against the position.

- Mid and long-term strategies offer the benefits of both managing theta decay modestly and allowing the market ample time to move favorably, with less frequent monitoring requirements.

Conclusion

The selection of option pairs must align with the investor's risk tolerance, target horizon, and expectations of the underlying asset's price movements. These strategies should be monitored periodically to make adjustments based on newly available market information and options pricing behavior.

Vertical Bull Put Spread Option Strategy

To devise a strategic vertical bull put spread for Palantir Technologies, we'll consider combining long and short put options across varying expiration dates and strikes, aiming to minimize the risk of assignment while maximizing return potential. We aim to structure our trades within a target prediction of the stock price, aiming for 2% off the current price.

Strategy Analysis

Short Put Options:

-

Strike: $19.0, Expiry: 2024-05-17

Delta: -0.01942

Vega: 0.08933

Theta: -0.00751

Premium: $0.03

ROI: 100% -

Strike: $20.0, Expiry: 2024-05-24

Delta: -0.24566

Vega: 1.08732

Theta: -0.02122

Premium: $0.25

ROI: 100% -

Strike: $19.0, Expiry: 2024-05-24

Delta: -0.08719

Vega: 0.54775

Theta: -0.01164

Premium: $0.08

ROI: 100% -

Strike: $19.0, Expiry: 2024-06-07

Delta: -0.15890

Vega: 1.29597

Theta: -0.01030

Premium: $0.20

ROI: 100% -

Strike: $20.0, Expiry: 2024-06-14

Delta: -0.22550

Vega: 1.60670

Theta: -0.01250

Premium: $0.32

ROI: 100%

Long Put Options:

-

Strike: $19.5, Expiry: 2024-05-17

Delta: -0.04534

Vega: 0.18039

Theta: -0.01339

Premium: $0.05

ROI: 100% -

Strike: $20.0, Expiry: 2024-05-24

Delta: -0.37569

Vega: 1.31041

Theta: -0.02542

Premium: $0.45

ROI: 88.6% -

Strike: $19.0, Expiry: 2024-05-24

Delta: -0.08719

Vega: 0.54775

Theta: -0.01164

Premium: $0.08

ROI: 100% -

Strike: $19.5, Expiry: 2024-05-31

Delta: -0.19481

Vega: 1.24082

Theta: -0.01391

Premium: $0.22

ROI: 100% -

Strike: $20.0, Expiry: 2024-06-07

Delta: -0.30247

Vega: 1.86724

Theta: -0.01384

Premium: $0.46

ROI: 100%

Optimal Strategies Examination

To select the most suitable strategy, consider the following choices:

-

Short Put Strike: $20.0, Expiry: 2024-05-24, paired with Long Put Strike: $19.5, Expiry: 2024-05-17. This combination captures a solid premium differential while maintaining favorable Greek interactions low Vega and Theta for lower volatility and time-depreciation risk. It also locates both strikes close enough to manage the assignment risk effectively.

-

Short Put Strike: $19.0, Expiry: 2024-05-24, with Long Put Strike: $19.0, Expiry: 2024-05-24. This strategy achieves 100% ROI on both sides, nullifies directional bias (zero net delta), and offers a conservative play.

Conclusion

Each put spread strategy has been carefully tailored to maintain assignment risks while capitalizing on near-term fluctuations in Palantir's stock price, guided by a keen observation of the Greeks and exploiting premium disparities for profitability.

Vertical Bear Call Spread Option Strategy

When evaluating vertical bear call spreads using options on Palantir Technologies Inc. (PLTR), its crucial to analyze various expiration dates and strike prices to identify optimal positions that balance profit potential with risk management.

Firstly, considering short-term options near expiration, particularly those expiring within one week, one could opt for a spread like buying a call at a lower strike price of $18.50 and selling a call at a higher strike price of $19, both expiring on May 17, 2024. Here, the aim would be to capitalize quickly on slight changes in stock pricing given the high gamma and vega values, which indicate substantial sensitivity to underlying price movements and volatility. However, due to the extremely short period, the potential ROI, while fast, might be lower due to the cheaper entry costs and steeper theta decay, impacting premium value quicker.

For mid-term strategies expiring in about three months such as September 20, 2024, one might consider buying a call at $12 and selling a call at $13. This provides more room for the stock to move unfavorably while still remaining profitable if the stock price decreases. This timeframe allows capturing profits from vega changes due to expected news or events that can increase volatility.

For longer-termed positions expiring beyond six months, selecting higher strike prices like buying a call at strike $30 and selling a call at $35 for June 2025, allows for broader market movements and beneficial theta decay over time as part of a more conservative strategy. The lower gamma values diminish the risk of loss from quick adverse movements, suitable for a more passive management style.

Focusing on minimizing the risk of early assignment, particularly important for in-the-money options such as those with higher delta values, that are close to the current trading price of Palantir. Therefore, selecting options that have a moderate delta combined with higher gamma and vega (indicative of potential quick responsiveness to market volatility) might balance both worlds by offering reasonable premiums and limiting risks due to bullish reversals. Select options like those expiring on May 24, 2024, with strikes at $18.0 and $19.0 could be insightful, indicating they are out of the money easing assignment risks but remain sensitive to volatility and price moves.

The time decay factor (theta) becomes significantly favorable in longer-term options, evident in those with expiry in January 2026. Here, selecting strikes at $3 (buy) and $5 (sell) with a lower execution frequency but required ongoing adjustments encapsulates a strategic move for experienced traders who can handle longer commitments and employ periodic monitoring and rebalancing of their options portfolio.

In conclusion, the quality of a vertical bear call spread strategy not only leans on choosing the right strikes and expiration dates but aligning them congruently with market sentiment, gauging Palantirs stock volatility, and managing the options Greeks efficiently. Each chosen strategy carries its intrinsic benefits and risks; thus, a trader's knowledge about market dynamics paired with rigorous analytics on "the Greeks" serves as a compass for optimizing options trading strategies such as the vertical bear call spread.

Vertical Bull Call Spread Option Strategy

To analyze the most profitable vertical bull call spread strategy using the given options data for Palantir Technologies Inc. (PLTR), we consider both "the Greeks" and the premium for various calls and puts, focusing on the most profitable given the constraints and target stock price parameters.

Bull Call Spread Options: 1. Short-Term: 3 Days to Expiry - Buy Call: Strike Price: $15.00 - Delta: 0.9827000506 - Vega: 0.147759819 - Theta: -0.0090623509 - Premium: $6.03 - Sell Call: Strike Price: $17.00 - Delta: 0.9689953989 - Vega: 0.241431786 - Theta: -0.012720687 - Premium: $5.17 - Potential Profit: Knowing that directly buying a lower strike call option and selling a higher strike option constitutes a typical bull call spread, the choice of $15.00 and $17.00 strike with a near term expiry involves less Vega, suggesting lower sensitivity to volatility and minimizing rapid changes in option prices due to implied volatility shifts. It administers a sound balance of immuno-responsiveness to time decay (Theta).

- Mid-Term: 66 Days to Expiry

- Buy Call: Strike Price: $15.00

- Delta: 0.9032820004

- Vega: 0.6350090279

- Theta: -0.0043543133

- Premium: $9.38

- Sell Call: Strike Price: $20.00

- Delta: 0.7290945483

- Vega: 1.1467212844

- Theta: -0.0070774324

- Premium: $5.75

-

Potential Profit: Expanding the time horizon to 66 days, the $15.00 buy and $20.00 sell strike selections manifest a broader Vega gap, potentially capitalizing on any volatility uptick. Also, a less negative Theta delays premium decay, maximizing profit if the underlying stock price rises towards $20.00.

-

Long-Term: 220 Days to Expiry

- Buy Call: Strike Price: $17.00

- Delta: 0.8136968169

- Vega: 1.089086666

- Theta: -0.0048240741

- Premium: $9.38

- Sell Call: Strike Price: $25.00

- Delta: 0.5427589922

- Vega: 2.1335080221

- Theta: -0.0063685205

- Premium: $3.1

- Potential Profit: For an extended horizon, selecting $17.00 to buy and $25.00 to sell with higher Vega but lower Delta spreads the risk across a significant U-shape move in stock price whereby the deep out-of-the-money call (high strike price) captures increases in implied volatility.

Each of these choices caters to a different investment timeline and risk tolerance, ensuring opportunities are balanced against time decay and potential volatility changes. Notably, the profits indicated assume ideal conditions of moderate rise toward or beyond the higher strike chosen in each leg of the spread. As always, it is prudent to monitor market conditions to make adaptations to the strategy when feasible.

Similar Companies in Software - Infrastructure:

Palo Alto Networks, Inc. (PANW), Adobe Inc. (ADBE), CrowdStrike Holdings, Inc. (CRWD), Block, Inc. (SQ), Splunk Inc. (SPLK), Zscaler, Inc. (ZS), Cloudflare, Inc. (NET), Microsoft Corporation (MSFT), Oracle Corporation (ORCL), C3.ai, Inc. (AI), Datadog, Inc. (DDOG), Alteryx, Inc. (AYX), Tableau Software (DATA), Snowflake Inc. (SNOW), Report: Elastic N.V. (ESTC), Elastic N.V. (ESTC)

https://www.fool.com/investing/2024/03/31/cathie-wood-thinks-palantir-could-disrupt-microsof/

https://www.youtube.com/watch?v=ah174dF52qM

https://www.youtube.com/watch?v=xEzX3JmUPFM

https://www.youtube.com/watch?v=1Me4-asPPTA

https://www.fool.com/investing/2024/04/05/massive-news-for-palantir-stock-investors/

https://www.fool.com/investing/2024/04/06/where-will-palantir-stock-be-in-5-years/

https://www.fool.com/investing/2024/04/06/is-ai-hype-real-3-ai-stocks-stand-test-time/

https://www.fool.com/investing/2024/04/06/should-you-load-up-on-palantir-stock/

https://www.fool.com/investing/2024/04/06/is-palantir-technologies-stock-a-buy-now/

https://www.fool.com/investing/2024/04/08/is-the-deal-between-palantir-technologies-and-orac/

https://seekingalpha.com/article/4682731-palantir-quality-comes-at-a-price

https://seekingalpha.com/article/4682977-palantir-stock-no-dip-no-problem

https://www.fool.com/investing/2024/04/10/this-is-huge-news-for-palantir-investors/

https://www.sec.gov/Archives/edgar/data/1321655/000132165524000071/pltr-20240331.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 3QWTpF

Cost: $1.04473

https://reports.tinycomputers.io/PLTR/PLTR-2024-05-13.html Home