PPG Industries, Inc. (ticker: PPG)

2023-12-17

PPG Industries, Inc. (ticker: PPG) is a global supplier of paints, coatings, and specialty materials. Founded in 1883, the company has grown to become one of the leading players in the coatings market, serving customers in construction, consumer products, industrial, and transportation markets and aftermarkets. Headquartered in Pittsburgh, Pennsylvania, PPG operates in more than 70 countries around the world. The company's extensive product line includes well-known brands such as Glidden, Olympic, and Dulux, offering a diverse range of products that include interior and exterior paints, stains, sealants, and adhesives, as well as industrial and automotive coatings. PPG is committed to innovation and sustainability, focusing on developing technologies that provide environmentally friendly solutions. With a steadfast approach to quality and customer service, PPG Industries maintains a solid position in the market, offering investors a balance between stability and growth potential in the vast coatings industry.

PPG Industries, Inc. (ticker: PPG) is a global supplier of paints, coatings, and specialty materials. Founded in 1883, the company has grown to become one of the leading players in the coatings market, serving customers in construction, consumer products, industrial, and transportation markets and aftermarkets. Headquartered in Pittsburgh, Pennsylvania, PPG operates in more than 70 countries around the world. The company's extensive product line includes well-known brands such as Glidden, Olympic, and Dulux, offering a diverse range of products that include interior and exterior paints, stains, sealants, and adhesives, as well as industrial and automotive coatings. PPG is committed to innovation and sustainability, focusing on developing technologies that provide environmentally friendly solutions. With a steadfast approach to quality and customer service, PPG Industries maintains a solid position in the market, offering investors a balance between stability and growth potential in the vast coatings industry.

| As of Date: 12/17/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 35.06B | 30.57B | 34.93B | 31.45B | 29.55B | 26.02B |

| Enterprise Value | 40.79B | 37.00B | 41.55B | 37.93B | 36.06B | 32.94B |

| Trailing P/E | 24.90 | 23.30 | 27.67 | 30.85 | 28.26 | 24.65 |

| Forward P/E | 17.73 | 15.65 | 20.66 | 19.19 | 17.54 | 13.37 |

| PEG Ratio (5 yr expected) | 1.53 | 1.34 | 1.68 | 1.54 | 1.83 | 1.29 |

| Price/Sales (ttm) | 1.95 | 1.72 | 1.98 | 1.80 | 1.69 | 1.50 |

| Price/Book (mrq) | 4.52 | 4.02 | 4.89 | 4.77 | 4.90 | 4.21 |

| Enterprise Value/Revenue | 2.26 | 7.97 | 8.53 | 8.66 | 8.62 | 7.37 |

| Enterprise Value/EBITDA | 15.34 | 48.50 | 49.12 | 69.59 | 71.41 | 54.99 |

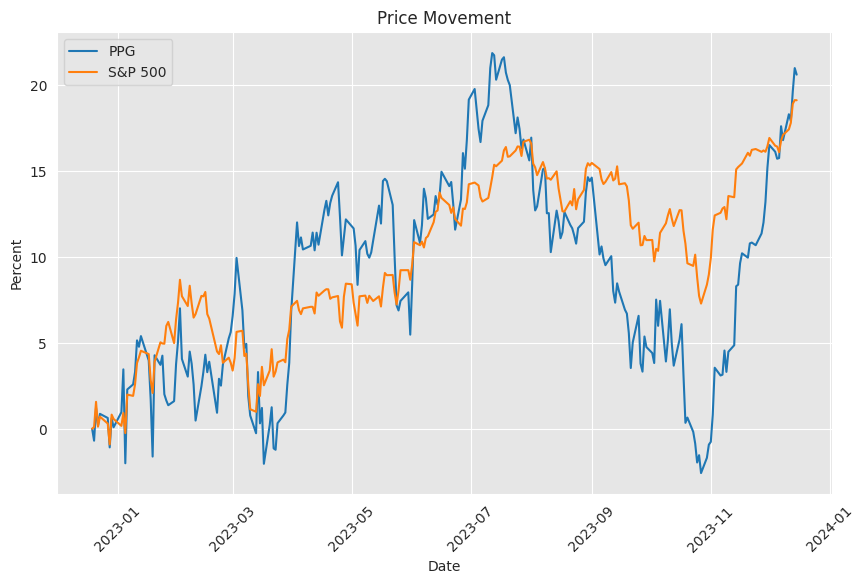

Based on the provided technical indicators, we can infer the following insights into the stock's price movement:

Based on the provided technical indicators, we can infer the following insights into the stock's price movement:

- The Adjusted Close of $148.68 reflects the recent trading price after accounting for corporate actions such as dividends or splits.

- The MACD (Moving Average Convergence Divergence) value is positive at 4.31, and the histogram value is also positive at 0.42. This often indicates a strong bullish trend in the stock.

- An RSI (Relative Strength Index) of 77.22 is above the common threshold of 70, suggesting the stock may be overbought, which could lead to a reversal or pullback in the near term.

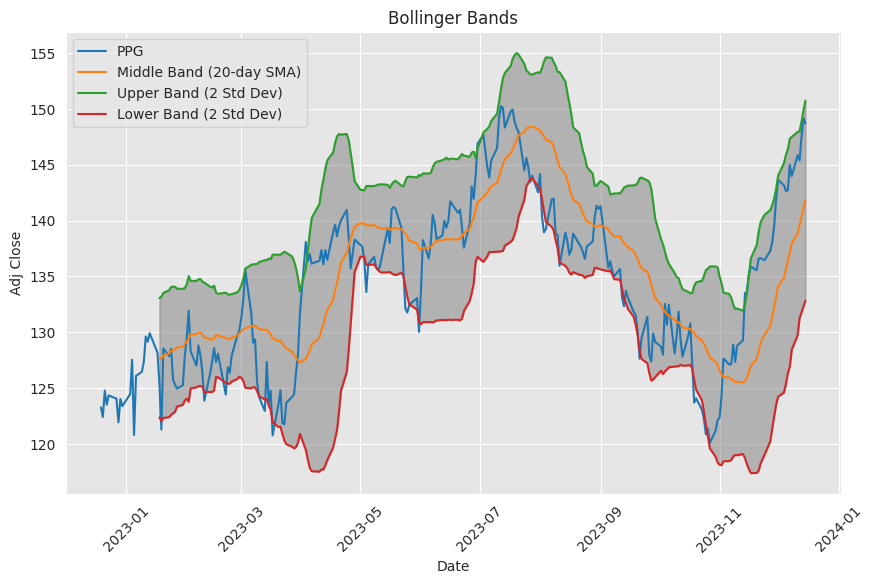

- Bollinger Bands (BB) show the stock price nearing the upper band ($150.30), indicating that the stock might be considered overvalued from a volatility standpoint and could revert to the mean.

- The stock price is above the Simple Moving Average (SMA) of 20 days and Exponential Moving Average (EMA) of 50 days, which are $141.78 and $137.36, respectively. This typically signals a continuing uptrend.

- On Balance Volume (OBV) at 1.328 million suggests that there is considerable trading volume behind the recent price trends, reinforcing the strength of the current trend.

- The Stochastic Oscillator (%K at 89.89 and %D at 91.14) indicates that the stock is in overbought territory.

- The Average Directional Index (ADX) of 49.17 is indicative of a strong trend, which currently is bullish.

- The Williams %R indicator (-16.88) is within the overbought territory, similarly suggesting a possible correction.

- The Chaikin Money Flow (CMF) at 0.04 is relatively low. It indicates that there is not significant buying pressure, despite the uptrend.

- The Parabolic SAR (PSAR) is currently below the price, signaling ongoing bullish momentum.

Turning to the fundamentals:

- The market cap has shown an increase over the last year, indicating that the company is gaining value and investor confidence.

- The Trailing P/E and Forward P/E ratios have both decreased, potentially making the stock more attractive to value-based investors.

- The PEG ratio suggests expectations of growth, albeit at a moderate pace.

- Lower Price/Sales and Price/Book ratios compared to earlier periods may indicate undervaluation.

- The Enterprise Value/Revenue and Enterprise Value/EBITDA ratios have decreased substantially, pointing towards a company that may be undervalued relative to its earnings and revenue.

In summary, the technical analysis portrays a stock experiencing strong bullish momentum, but with multiple overbought signals that can precede a potential pullback or consolidation in price. Investors might see profit-taking, which could lead to short-term price correction. However, given the consistent increase in market capitalization and improvements in fundamental ratios, investor sentiment appears to be positive, and any pullback may be viewed as a buying opportunity for long-term growth.

In the context of interpreting financials, healthy EBITDA and consistent net income suggest solid underlying business performance. Revenue growth and operating income point to an efficient operational structure. These factors combine to reflect a strong company from a fundamental perspective, which is likely to uphold positive investor sentiment.

Given the current technical and fundamental positions, the stock price could experience minor corrections in the short term due to profit-taking from its recent rise. Still, the overall trend appears to show potential for continued growth over the next few months. However, investors should be mindful of the overbought conditions and look out for signs of trend reversal. If market conditions remain favorable and no external shocks impact investor sentiment, shareholders may see sustained upward momentum tempered with potential periods of consolidation.

PPG Industries, Inc. (PPG), a reputable name in the coatings and specialty materials sector, has captured the attention of the investment community as a standout Dividend Aristocrat in the latter part of 2023. Amidst a fluctuating market, PPG has distinguished itself not merely as a long-standing dividend payer but as a company whose financial performance has outstripped certain benchmarks. Specifically, PPG was one of only 32 Dividend Aristocrats to outpace the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) after September, achieving a positive total return of 4.68% within the year. In contrast, NOBL has suffered from a noticeable downturn, with three consecutive months of negative returns starting from August, cumulating in a total drop of 11.6%.

Investors with a conservative bent have traditionally embraced dividend investing for stability and consistent income returns. The Dividend Aristocrat category, which PPG falls under, has historically been desirable for these investors, bearing in mind the prerequisite of 25 consecutive years of dividend increases. Surprisingly, over the last eight years, the S&P 500 Dividend Aristocrats Index, which includes PPG, has underperformed the S&P 500. However, one cannot ignore the long-term perspective, which shows the Dividend Aristocrats Index outperforming the broader S&P 500 by a yearly average of 2.18% between 1990 and 2022.

PPG's recent resilience is a testament to its potential to be a valuable portfolio constituent for long-term investors, particularly in a volatile market. Seeking Alpha has pointed out various investment strategies that could possibly do better than the Dividend Aristocrat index. Such strategies might entail selecting undervalued stocks based on the dividend yield theory, focusing on stocks with the fastest expected growth as per analyst forecasts, or adopting a blended method of the two. PPGs success shows that it is weathering the market storms better than its average peer, with its favorable dividend yield alluding to a possibly undervalued status.

The stability that PPG has demonstrated affirms its appeal as a potential investment. Even though the Dividend Aristocrats have faced uncharacteristic volatility, PPG's comparatively solid performance could be indicative of its robustness, and it may continue to be a reliable dividend growth stock. In the face of persistent market uncertainties, investors will likely keep a close watch on how stocks like PPG fare, focusing on both income generation and capital appreciation.

PPGs exceptional financial results in the third quarter of 2023 may be a harbinger for the company's adaptability and resilient business model. Posting record-breaking sales of $4.6 billion and an adjusted earnings per share of $2.07a striking 25% increase from the previous yearPPG has demonstrated its capacity for strong performance in trying times. The significant cash generation of over $1.5 billion in this period sets yet another record. These numbers attest to PPGs enduring business model and its ability to weather economic adversities.

The technological advancements within PPGs various segments, such as aerospace and automotive, have fueled much of this high performance. Despite facing cautious consumer spending and a dip in global industrial production, PPG has succeeded in implementing strategic selling price increases. As PPG looks to the remainder of 2023, it strives to maintain momentum in positive selling prices, although a leveling out is anticipated as price increases have been in place for a full cycle.

PPG's commitment to enhancing margins can be seen in the significant year-over-year improvement in operating margins, signaling four quarters of continuous growth. Reflecting a 260 basis point boost in operating margins, both the performance and industrial coatings segments have enjoyed at least a 25% profits increase. These advances can be attributed not only to PPG's effective margin recovery tactics but also to reductions in working capital and the strategic handling of costs.

The company's forward-looking approach involves a sustained emphasis on sales advancement and earnings momentum. Growth-oriented initiatives such as capitalizing on electric vehicle trends in China, investments in powder coatings technologies, and an expanded product distribution through the PPG Comex network signal an aggressive pursuit of market opportunities. Additionally, judicious capital management, inclusive of potential share repurchases and debt reduction, anchors PPG's strategy aimed at achieving record adjusted earnings by year's end.

In line with strategic business positioning, PPG has embarked on a divestiture of certain non-core assets, sharpening its focus on primary growth areas. This selective portfolio refinement is indicative of a larger effort to realign with strategic objectives and maximized financial outcomes. It is evident in moves like the recent divestment of specific international operations within the traffic solutions segment.

The insight PPG provides for the remainder of the fourth quarter and the outlook for 2024 offers both caution and optimism. While the company notes potentially slowing demand in the U.S. architectural coatings sector and other headwinds, PPG is expectant of organic growth in its performance coatings and other industry segments. The normalization of commodity material costs, along with productivity enhancements and moderated input prices, will likely support the overall positive trajectory of the companys financial performance. Aware of the varying factors that may affect its OEM business, particularly union actions, PPG is nevertheless hiking its full-year earnings forecast with a continued focus on margin growth.

PPG's display of financial strength during tough economic times, coupled with strategic initiatives geared toward sustainable growth, sets the stage for PPG's future success. The company's efforts to leverage new commercial opportunities and drive volume growth in the following year illustrate a strategic blueprint designed to bolster its market position and continue its legacy of innovation and service.

Similar Companies in Chemicals:

Akzo Nobel N.V. (AKZOY), Report: Sherwin-Williams Company (SHW), Sherwin-Williams Company (SHW), RPM International Inc. (RPM), Axalta Coating Systems Ltd. (AXTA), Nippon Paint Holdings Co., Ltd. (NPCPF), BASF SE (BASFY)

News Links:

https://seekingalpha.com/article/4645269-my-best-dividend-aristocrats-for-november-2023

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: sb85j1

https://reports.tinycomputers.io/PPG/PPG-2023-12-17.html Home