abrdn Physical Platinum Shares ETF (ticker: PPLT)

2024-03-25

The abrdn Physical Platinum Shares ETF (ticker: PPLT) is a specialized exchange-traded fund designed to offer investors a direct exposure to the physical platinum market. Its primary objective is to reflect the performance of the price of platinum, less the Trust's expenses. PPLT achieves this by holding physically allocated platinum bars in secure vaults. The ETF provides a convenient and cost-effective way for investors to invest in platinum without the need to directly buy, store, and insure physical metal. It is designed to offer a high level of transparency and liquidity, making it an attractive option for both individual and institutional investors seeking to diversify their investment portfolios with precious metals. The shares of PPLT are traded on major stock exchanges, allowing for easy access and trading throughout the trading day. This ETF is managed by abrdn, a global investment company known for its expertise in precious metals and commodities investments.

The abrdn Physical Platinum Shares ETF (ticker: PPLT) is a specialized exchange-traded fund designed to offer investors a direct exposure to the physical platinum market. Its primary objective is to reflect the performance of the price of platinum, less the Trust's expenses. PPLT achieves this by holding physically allocated platinum bars in secure vaults. The ETF provides a convenient and cost-effective way for investors to invest in platinum without the need to directly buy, store, and insure physical metal. It is designed to offer a high level of transparency and liquidity, making it an attractive option for both individual and institutional investors seeking to diversify their investment portfolios with precious metals. The shares of PPLT are traded on major stock exchanges, allowing for easy access and trading throughout the trading day. This ETF is managed by abrdn, a global investment company known for its expertise in precious metals and commodities investments.

| Previous Close | 83.49 | Open | 82.86 | Day Low | 82.17 |

| Day High | 83.18 | Volume | 226,703 | Average Volume | 125,054 |

| Average Volume 10 Days | 171,530 | Bid | 82.0 | Ask | 82.7 |

| Bid Size | 29,200 | Ask Size | 1,000 | Total Assets | 900,154,240 |

| Fifty Two Week Low | 77.68 | Fifty Two Week High | 104.67 | Fifty Day Average | 83.088 |

| Two Hundred Day Average | 84.96025 | NAV Price | 82.90137 | YTD Return | -0.096533604 |

| Beta 3 Year | 0.25 | Three Year Average Return | -0.0946616 | Five Year Average Return | 0.0055301 |

| Sharpe Ratio | -0.4760616834277386 | Sortino Ratio | -7.719752797650915 |

| Treynor Ratio | -0.2502221820424554 | Calmar Ratio | -0.35836899395798427 |

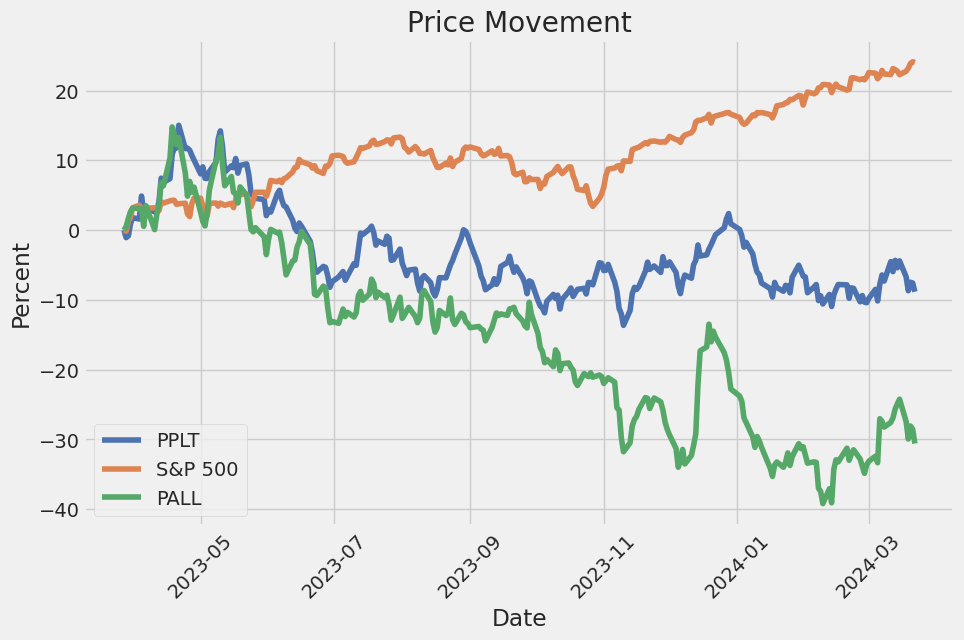

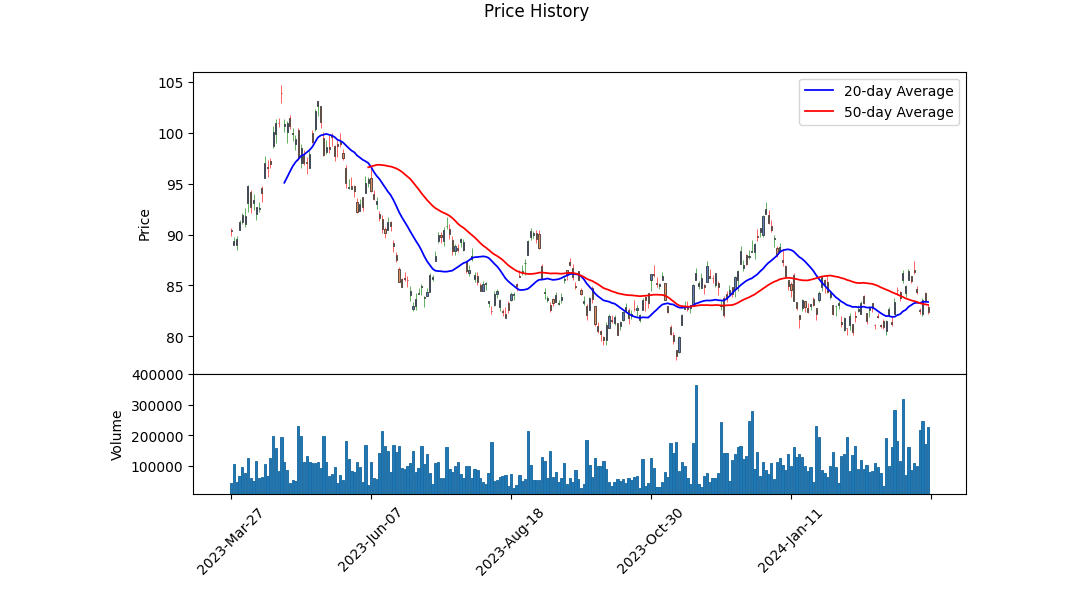

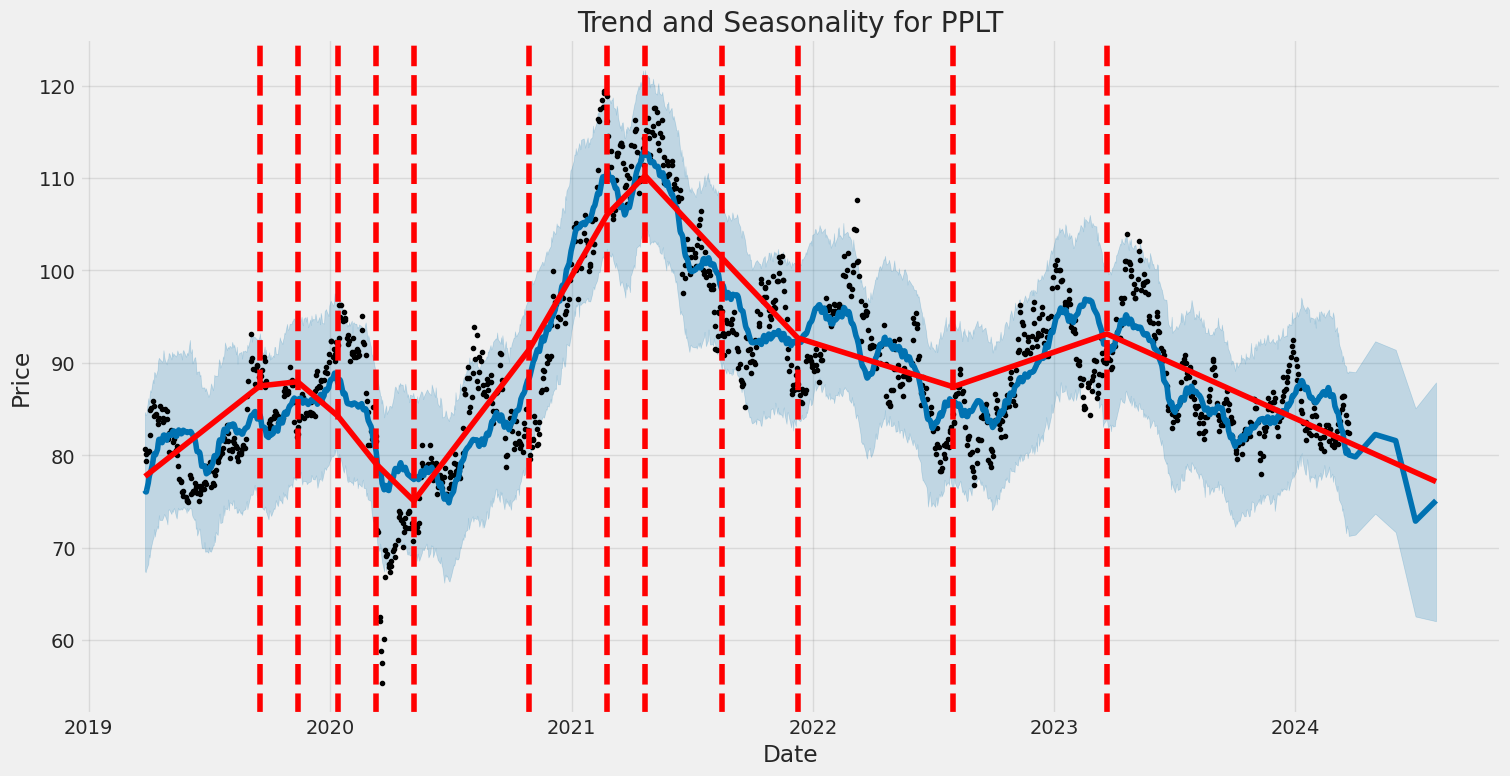

Analyzing the provided data on abrdn Physical Platinum Shares ETF (symbol: PPLT), a comprehensive assessment based on technical analysis, fundamental analysis, and risk-adjusted performance metrics has been conducted to forecast potential stock price movements in the forthcoming months. The technical indicators, combined with fundamental insights and an evaluation of the ETFs risk-return profile, paint a detailed picture of PPLTs market position and future trajectory.

The technical analysis of PPLT shows a fluctuating price movement over the observed period, with an initial uptrend in value, transitioning into a decrease towards the end of the period. Key indicators such as the On Balance Volume (OBV) suggest a varying degree of buying and selling pressure, with the OBV peaking at 0.06249 million on 2024-03-20 before a decline. The Moving Average Convergence Divergence (MACD) histogram presents a shift from potential bullish momentum to a bearish trend, indicated by the transition from positive to negative values.

Fundamental analysis reveals a company with substantial total assets of $900,154,240 and a modest beta of 0.25, suggesting lower volatility compared to the broader market. The ETF's investment focus on physical platinum indicates its performance is closely tied to commodity prices, making it susceptible to market factors affecting platinum supply and demand. The lack of revenue and profit, as highlighted in the summary, underscores the ETF's nature as an investment vehicle rather than a traditional revenue-generating enterprise, focusing on capital appreciation and potentially dividend distributions as the primary means for shareholder returns.

Risk-adjusted performance metrics reveal a challenging year for PPLT, with negative values across the Sharpe, Sortino, Treynor, and Calmar ratios. These indicators suggest that PPLT has not delivered sufficient returns to compensate for the risks taken by investors, with particularly concerning figures presented by the Sortino ratio, indicating poor downside risk management.

Given the observed data and current market dynamics, the forecast for PPLT's stock price movement in the next few months suggests potential volatility, largely influenced by fluctuations in the platinum market. The negative sentiment reflected in risk-adjusted performance metrics and the bearish trend indicated by technical analysis may weigh on the stock price. However, market conditions affecting commodities, particularly platinum, including supply constraints or increased industrial demand, could offer bullish momentum. Investors should remain cautious, considering both the ETFs exposure to commodity price volatility and the broader economic factors influencing platinum prices.

In conclusion, while the potential for appreciation exists, particularly if commodity markets favour platinum, the risk factors and current downward trajectory indicated by technical and performance metrics suggest a cautious approach to PPLT in the short to medium term. Investors should monitor global economic indicators, platinum market trends, and the ETFs performance metrics closely before making investment decisions.

In assessing the financial metrics of abrdn Physical Platinum Shares ETF (PPLT) through the methodologies prescribed in "The Little Book That Still Beats the Market," we encounter a particular anomaly inherent to evaluating commodity ETFs like PPLT. The model primarily hinges on assessing a company's return on capital (ROC) and earnings yield, factors that are critical in determining the efficiency and profitability of a firm through the lens of Joel Greenblatt's magic formula investing strategy. However, for PPLT, these metrics do not apply in the traditional sense. This is because PPLT is an exchange-traded fund that holds physical platinum rather than operating as a company that generates earnings or employs capital in a manner where ROC or earnings yield can be calculated. The value proposition of PPLT is fundamentally tied to the price movements and demand for platinum, rather than the operational efficiency or profit generation of a business entity. Therefore, while the magic formula is a powerful tool for evaluating the intrinsic value of companies, its direct application to PPLT is not feasible, underscoring the importance of tailoring investment analysis to the specific characteristics of the asset in question.

| Statistic Name | Statistic Value |

| R-squared | 0.136 |

| Adj. R-squared | 0.135 |

| F-statistic | 197.1 |

| Prob (F-statistic) | 1.08e-41 |

| Log-Likelihood | -2463.4 |

| No. Observations | 1256 |

| AIC | 4931 |

| BIC | 4941 |

| coef (const) | -0.0162 |

| coef (0) | 0.5174 |

| std err (const) | 0.049 |

| std err (0) | 0.037 |

| t (const) | -0.333 |

| t (0) | 14.039 |

| P>|t| (const) | 0.739 |

| P>|t| (0) | 0.000 |

| [0.025 (const)] | -0.112 |

| [0.025 (0)] | 0.445 |

| [0.975 (const)] | 0.079 |

| [0.975 (0)] | 0.590 |

| Omnibus | 34.973 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 78.304 |

| Prob(JB) | 9.92e-18 |

| Skew | -0.080 |

| Kurtosis | 4.213 |

| Cond. No. | 1.32 |

| Alpha | -0.0162 |

| Beta | 0.5174 |

In the linear regression model analyzing the relationship between PPLT, which represents platinum prices through the ETF PPLT, and SPY, an ETF that mirrors the performance of the S&P 500 and hence acts as a proxy for the entire market, we explore the dynamics and predictive values between these two assets. The alpha () value from the regression analysis is -0.0162, suggesting a slight negative intercept when the markets return is zero. This indicates that, without taking into account the market movement, PPLT tends to underperform by a minor margin, emphasizing an intrinsic behavior independent of market trends.

Furthermore, the beta () value derived from this regression analysis stands at 0.5174, indicating that PPLT has a positive but less than 1-to-1 exposure to market movements represented by SPY. A beta value of less than one suggests that PPLT is less volatile than the market. Therefore, if SPY experiences a 1% increase, PPLT is expected to only increase by approximately 0.5174%, holding other factors constant. This indicates a moderate level of systematic risk in PPLT concerning the overall market, highlighting its partial sensitivity to market fluctuations.

The abrdn Physical Platinum Shares ETF (PPLT), for the quarterly period ending on September 30, 2023, provided a detailed financial disclosure as mandated by the SEC in its 10-Q filing. This document outlines the ETFs financial status, including assets, liabilities, and net assets, alongside its operational activities over the disclosed period.

As of September 30, 2023, PPLT reported total assets of $909,742,000, a decline from $1,097,107,000 on December 31, 2022. This was accompanied by a reduction in liabilities over the same period, from $554,000 to $449,000, illustrating a slight easing in the fund's financial obligations. The resultant net assets stood at $909,293,000, down from $1,096,553,000 at the end of the previous reporting year, indicating an overall contraction in the funds asset base over the nine-month period.

The decrease in the fund's asset base can partly be attributed to the performance of its singular investment focus: platinum. Specific metrics detailed included the total investment in platinum, acknowledged both by cost and fair value, denoting an intricate relationship with market fluctuations. For instance, the cost of platinum investments as of September 30, 2023, was cited as $954,233,000 against a fair value of $909,742,000, illustrating the volatility and impact of market conditions on the fund's principal asset class.

The operational activities of PPLT within the mentioned quarter and the preceding nine-month period also shed light on its financial dynamics. There were notable realized and unrealized gains and losses from its investment in platinum. Specifically, the operational outcome for the quarter ending September 30, 2023, saw a net increase in assets from operations amounting to $26,508,000, pivoting from a decline witnessed in the corresponding period of the previous year.

Additionally, the filing highlights pivotal administrative developments, such as changes in the executive ranks. The transition from Andrea Melia to Brian Kordeck as Treasurer and Chief Financial Officer marked a notable administrative shift during the reported period. This was not just a personnel change but also implied continuity and alteration in financial stewardship.

Through comprehensive quantitative summaries and operational descriptions, the SEC filing of the abrdn Physical Platinum Shares ETF offers significant insights into its financial condition, managerial changes, and overall performance with an emphasis on the intrinsic value derived from its platinum investments. This extensive report underscores the various dimensions influencing the fund's operation, including market fluctuations, administrative adjustments, and asset management strategies tailored towards its singular investment focus.

The abrdn Physical Platinum Shares ETF is a unique investment vehicle that offers investors the opportunity to gain direct exposure to the physical platinum market. This ETF is designed to track the price of physical platinum, held in secure vaults, minus the ETF's expenses. Its primary aim is to reflect the performance of the price of platinum, providing investors with a cost-effective and convenient way to invest in this precious metal. Unlike other commodity investments that may include futures or derivative contracts, this ETF's holdings are purely in physical platinum, making it an intriguing option for investors looking to add precious metals to their portfolio.

Platinum, as a commodity, has a vibrant market due to its rarity and the complex process required for its extraction and refinement. Predominantly used in automotive catalytic converters, it also finds significant application in jewelry, electronics, and as an investment in the form of coins and bars. The demand for platinum is not only tied to its practical applications but also to its status as a precious metal, which can serve as a hedge against inflation or currency devaluation. Due to these factors, investing in platinum through an ETF can be an attractive proposition.

The abrdn Physical Platinum Shares ETF is structured in such a way that the underlying physical platinum is stored in secured vaults on behalf of the ETF. This direct ownership of physical platinum helps to reduce the risks associated with futures contracts, such as contango, which can negatively impact the performance of commodities ETFs that do not hold the physical commodity. Furthermore, this storage arrangement aims to ensure that the physical platinum holdings are secure and fully accounted for, providing investors with peace of mind.

One of the key attributes of this ETF is its transparency. The holdings are regularly audited and reported, ensuring that investors have up-to-date information on the ETF's physical platinum holdings. This level of transparency is crucial for investors who wish to have a clear understanding of where and how their investments are stored.

| company | symbol | percent |

|---|---|---|

| Physical Platinum | N/A | 100 |

Given that the ETF's portfolio solely comprises "Physical Platinum," as detailed in the top ten holdings table, it is unique in the financial market. The simplicity and straightforwardness of the fund's structure make it particularly attractive for investors who are looking for direct exposure to platinum without the complexities and risks associated with commodities trading or investing in mining companies. Furthermore, the fund's 100 percent allocation to physical platinum means its performance is directly tied to the movements in the price of platinum, providing a pure-play investment opportunity in this precious metal.

Liquidity is another critical factor that investors consider when looking at ETFs, and the abrdn Physical Platinum Shares ETF offers adequate liquidity for most investors. This liquidity facilitates easy entry and exit from positions, an important aspect given the sometimes-volatile nature of commodity markets. Additionally, the ETF structure allows for the creation and redemption of shares, which helps to keep the share price closely aligned with the underlying value of the platinum holdings.

In terms of cost, the ETF offers a competitive expense ratio compared to other investment vehicles in the precious metals space. This cost-effectiveness is a key aspect for investors, as lower expenses directly translate to higher net returns over time. Furthermore, for investors seeking exposure to precious metals within a diversified portfolio, platinum can offer uncorrelated returns compared to traditional stocks and bonds, potentially enhancing portfolio diversification and risk management.

The global economic landscape, including shifts in currency values, inflation rates, and industrial demand for platinum, can affect the price of platinum and, by extension, the performance of the abrdn Physical Platinum Shares ETF. Therefore, investors in this ETF need to pay attention to these broader economic indicators and trends that could impact platinum prices.

In summary, the abrdn Physical Platinum Shares ETF provides an accessible, cost-effective, and secure means for investors to gain exposure to the physical platinum market. Its focus on holding actual physical platinum, combined with the transparency, liquidity, and simplicity of its investment approach, makes it a compelling option for those looking to diversify their investment portfolio or hedge against financial market volatility with a tangible asset. While the performance of the ETF will closely track the price movements of platinum, investors should be mindful of the broader economic factors that influence the demand and supply of this precious metal.

The volatility of the abrdn Physical Platinum Shares ETF (PPLT) indicates significant fluctuations in its return over the observed period, as suggested by the ARCH model results. The model outlines that while there was a consistent variance in returns, signified by a non-zero omega coefficient, the actual impact of past squared returns (alpha[1]) on future volatility was less definitive, showing a statistically significant but relatively moderate effect. Notably, the model's overall fit to the data suggests that these volatility features are a prominent aspect of PPLT's behavior, highlighting periods of uncertainty and potential risk for investors.

| Statistic Name | Statistic Value |

|---|---|

| Coefficient (omega) | 3.1134 |

| Standard Error (omega) | 0.301 |

| T-value (omega) | 10.340 |

| P-value (omega) | <0.0001 |

| 95% Confidence Interval (omega) | [2.523, 3.704] |

| Coefficient (alpha[1]) | 0.0934 |

| Standard Error (alpha[1]) | 0.06084 |

| T-value (alpha[1]) | 1.534 |

| P-value (alpha[1]) | 0.125 |

| 95% Confidence Interval (alpha[1]) | [-0.02589, 0.213] |

The analysis of the financial risk associated with a $10,000 investment in abrdn Physical Platinum Shares ETF (PPLT) over a one-year period employs an intricate combination of volatility modeling and machine learning predictions. By integrating these sophisticated techniques, the study aims to provide an insightful exploration of the stock's potential for fluctuation and future returns, with a focus on capturing the essence of its risk profile.

In the realm of understanding the ebbs and flows of the abrdn Physical Platinum Shares ETF's stock volatility, volatility modeling techniques play a crucial role. This model is adept at capturing the persistence of volatility, an essential factor when dealing with financial time series data, especially for commodities such as platinum. It effectively accounts for large swings in prices, which are not uncommon in the metals market, by adjusting its estimates for future volatility based on the latest market movements. This iterative updating process within the volatility modeling framework allows for a dynamic assessment of risk, offering investors a nuanced view of potential price variability over the forecast period.

On the other side of the analytical spectrum, machine learning predictions, particularly through models known to capture nonlinear relationships within vast datasets, contribute significantly to forecasting future returns. The application of a specifically engineered algorithm for this purpose sifts through historical price data and other relevant market indicators to predict the ETF's future performance. This predictive power, combined with the insights from volatility modeling, forms a robust basis for evaluating investment risks and opportunities.

The synthesis of volatility modeling and machine learning predictions culminates in the calculation of the Value at Risk (VaR) at a 95% confidence interval. Based on the analysis, the annual VaR for a $10,000 investment in the abrdn Physical Platinum Shares ETF is pinpointed at $243.22. This figure represents the maximum expected loss over a year that should not be exceeded with a probability of 95%. Essentially, it signifies that there is a 5% chance that the investor could lose more than $243.22 from their initial $10,000 investment over the next year due to price fluctuations in the ETF, under normal market conditions.

The integration of volatility modeling with machine learning predictions offers a forward-looking approach to assessing financial risks. By examining both the historical volatility and potential future returns through these analytical lenses, investors are equipped with a comprehensive view of the investment's risk profile. The calculated VaR provides a tangible figure that encapsulates the essence of this risk, highlighting the potential financial impact of adverse market movements on the investment. Through this rigorous analysis, the intricate dynamics of equity investment risks are laid bare, underlining the importance of leveraging advanced analytics in financial decision-making.

Similar Companies in None:

abrdn Physical Palladium Shares ETF (PALL), abrdn Physical Silver Shares ETF (SIVR), abrdn Physical Gold Shares ETF (SGOL), GraniteShares Platinum Trust (PLTM), VanEck Junior Gold Miners ETF (GDXJ), Report: Sprott Physical Platinum and Palladium Trust (SPPP), Sprott Physical Platinum and Palladium Trust (SPPP), iShares Platinum Trust (PPLT)

https://www.sec.gov/Archives/edgar/data/1460235/000183988223030162/pplt-10q_093023.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: OdJ7LH

Cost: $0.20443

https://reports.tinycomputers.io/PPLT/PPLT-2024-03-25.html Home