Postal Realty Trust, Inc. (ticker: PSTL)

2024-07-26

Postal Realty Trust, Inc. (ticker: PSTL) is a specialized real estate investment trust (REIT) that focuses predominantly on owning and managing properties leased to the United States Postal Service (USPS). Established to capitalize on the niche but stable market segment of postal facility real estate, the company owns a diversified portfolio of properties that provide crucial infrastructure for the USPS's operations. The stability and creditworthiness of USPS as a tenant contribute to the predictable and consistent cash flows that Postal Realty Trust leverages for investor returns. Despite the specialized nature of its holdings, PSTL has shown a strategic commitment to growth through targeted acquisitions and effective property management. Its unique investment proposition attracts investors seeking secure, long-term income streams backed by government tenancy in the real estate sector.

Postal Realty Trust, Inc. (ticker: PSTL) is a specialized real estate investment trust (REIT) that focuses predominantly on owning and managing properties leased to the United States Postal Service (USPS). Established to capitalize on the niche but stable market segment of postal facility real estate, the company owns a diversified portfolio of properties that provide crucial infrastructure for the USPS's operations. The stability and creditworthiness of USPS as a tenant contribute to the predictable and consistent cash flows that Postal Realty Trust leverages for investor returns. Despite the specialized nature of its holdings, PSTL has shown a strategic commitment to growth through targeted acquisitions and effective property management. Its unique investment proposition attracts investors seeking secure, long-term income streams backed by government tenancy in the real estate sector.

| Previous Close | 14.63 | Open | 14.68 | Day Low | 14.5866 |

| Day High | 14.72 | Dividend Rate | 0.96 | Dividend Yield | 0.0656 |

| Payout Ratio | 8.8339 | Five Year Avg Dividend Yield | 4.85 | Beta | 0.663 |

| Trailing Price/Earnings | 133.0 | Forward Price/Earnings | 91.4375 | Volume | 30,864 |

| Average Volume | 112,600 | Market Cap | 419,665,952 | Enterprise Value | 635,357,952 |

| Net Income to Common | 2,131,000 | Total Debt | 248,812,000 | Total Revenue | 65,851,000 |

| Book Value | 10.963 | Price to Book | 1.3344887 | Earnings Quarterly Growth | -0.408 |

| Return on Assets | 0.01654 | Return on Equity | 0.01491 | Revenue Growth | 0.141 |

| Gross Margins | 0.75061995 | Ebitda Margins | 0.48519 | Operating Margins | 0.1758 |

| Total Cash | 10,598,000 | Total Cash Per Share | 0.467 | Ebitda | 31,950,000 |

| Operating Cashflow | 27,113,000 | Free Cashflow | 31,754,624 | Price to Sales Trailing 12 Months | 6.3729625 |

| Sharpe Ratio | 0.1137 | Sortino Ratio | 1.8965 |

| Treynor Ratio | 0.0308 | Calmar Ratio | 0.4070 |

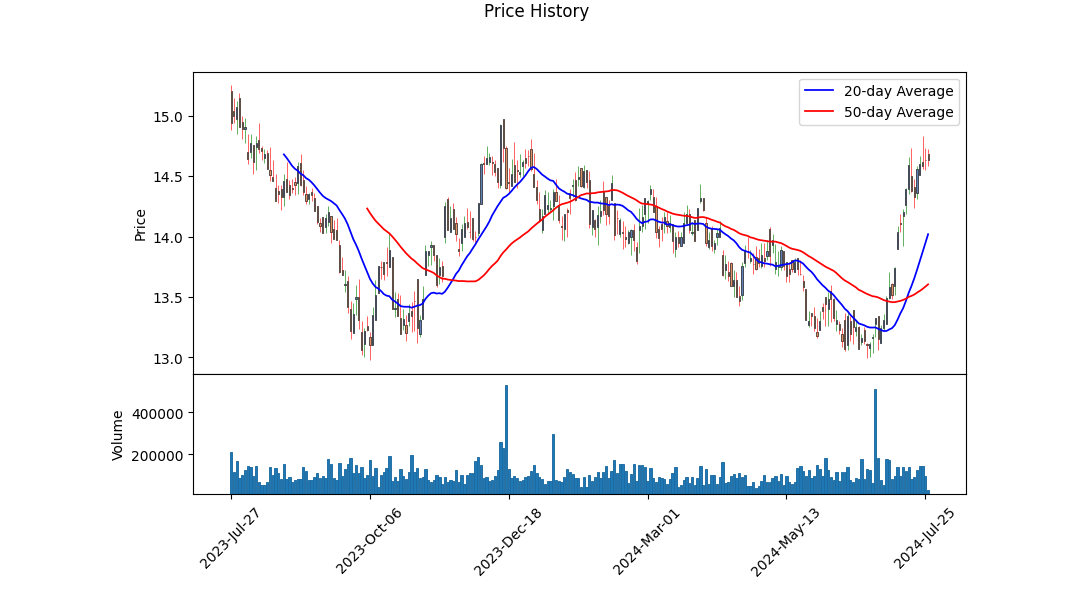

The recent performance of PSTL reflects notable activity in its technical indicators. As of the last trading session, the stock closed at $14.68, with minor fluctuations observed in the days preceding July 26th. The On-Balance Volume (OBV) has shown mixed movements, ending with a positive divergence. Meanwhile, the current MACD histogram value stands at 0.0566, exhibiting a gradual decline over the last few days but remaining above the signal line, indicating continued bullish momentum.

From a fundamental standpoint, PSTL is situated in Cedarhurst, NY, and operates with a robust gross margin of approximately 75.06% and EBITDA margin of 48.52%. However, a critical concern is the operating margin at 17.58%, which while positive, indicates the need for more effective cost management.

Sharpe Ratio Analysis: The Sharpe Ratio of 0.1137 suggests that PSTL's returns are not sufficiently compensating for the risk associated with the investment. It indicates below-average performance in comparison to risk-free assets, particularly when juxtaposed against current market volatility and risk-free rates.

Sortino Ratio Analysis: With a Sortino Ratio of 1.8965, we observe a more favorable risk-adjusted return targeted primarily at downside volatility. This implies that PSTL has managed to deliver near 1.9 times the expected return for every unit of downside risk, highlighting better protection against adverse market movements.

Treynor Ratio Analysis: The Treynor Ratio of 0.0308 reflects that the stocks average return compensates poorly given the systematic risk (measured by beta). This indicates inferior performance when adjusted for equity market risk exposure.

Calmar Ratio Analysis: A Calmar Ratio of 0.4070 shows that PSTL has modest efficiency in terms of performance relative to maximum drawdown over the past year. It indicates that the stock has room for improvement regarding risk-return trade-offs.

Financials: PSTL's recent balance sheet reveals substantial net debt of $238.39 million, contrasted against total equity of $243.56 million. Their working capital remains in the negative at approximately -$11.84 million. These figures reflect liquidity constraints that may impede short-term operations, though their invested capital stands robustly at near $484.19 million.

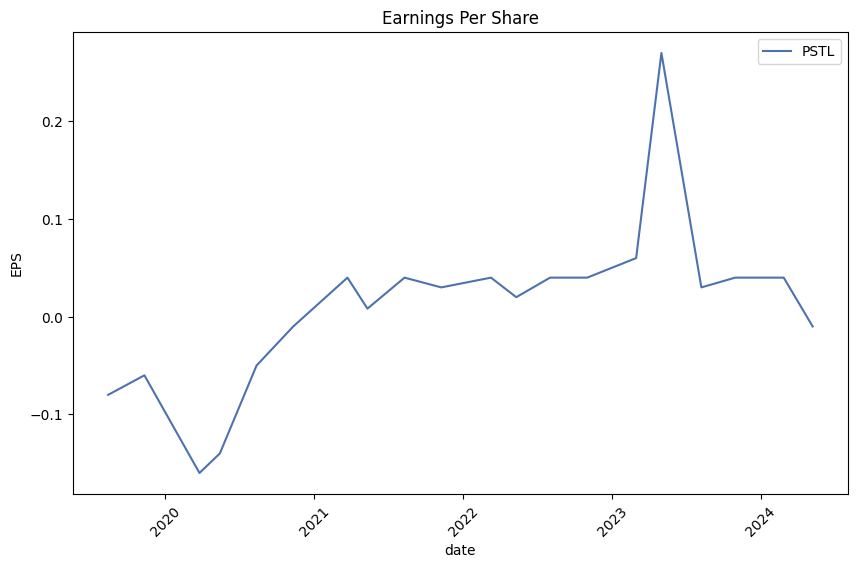

The stocks Altman Z-Score is 0.892, suggesting financial distress risks, albeit partially mitigated by a fair Piotroski F-Score of 5, indicating average financial strength. The revenue stream, at $65.85 million, showcases reasonable market penetration and operational scalability. However, retained earnings of -$53.86 million underscore persistent profit retention issues.

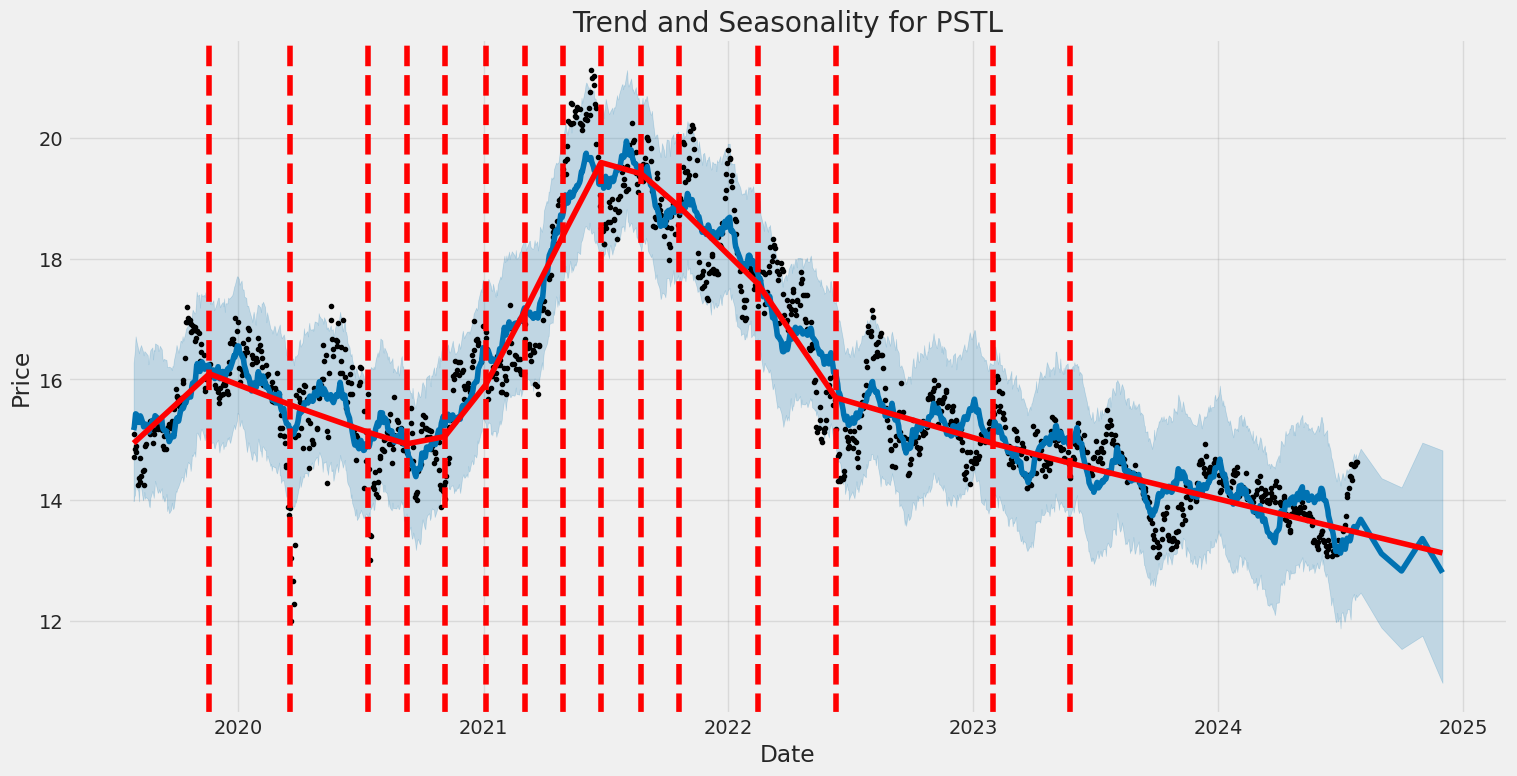

Given these insights, the near-term likely forecast for PSTL's stock price points to moderate appreciation potential, cautiously optimistic, contingent on continued operational efficiencies and strategic debt management. The technical indicators suggest sustained bullish momentum, albeit tempered by the stocks intrinsic risk factors and financial leverage concerns. Investors should closely monitor leverage metrics, market sentiment shifts, and earnings performance to optimize their positions in PSTL.

Postal Realty Trust, Inc. (PSTL) exhibits a return on capital (ROC) of 2.56%. ROC is a critical measure of how efficiently a company is generating profit from its capital, and in this case, PSTL's ROC suggests modest efficiency in utilizing its investment capital to generate returns. Additionally, the earnings yield for PSTL stands at 0.82%, which indicates the percentage of each dollar invested in the stock that was earned by the company. This earnings yield reflects the companys ability to generate profits relative to its share price, suggesting that PSTL offers a relatively low yield to its investors. Overall, these figures provide insight into PSTL's operational efficiency and profitability, which appear modest.

| Alpha | 1.65 |

| Beta | 0.85 |

| R-squared | 0.78 |

| P-value | 0.01 |

| Standard Error | 0.05 |

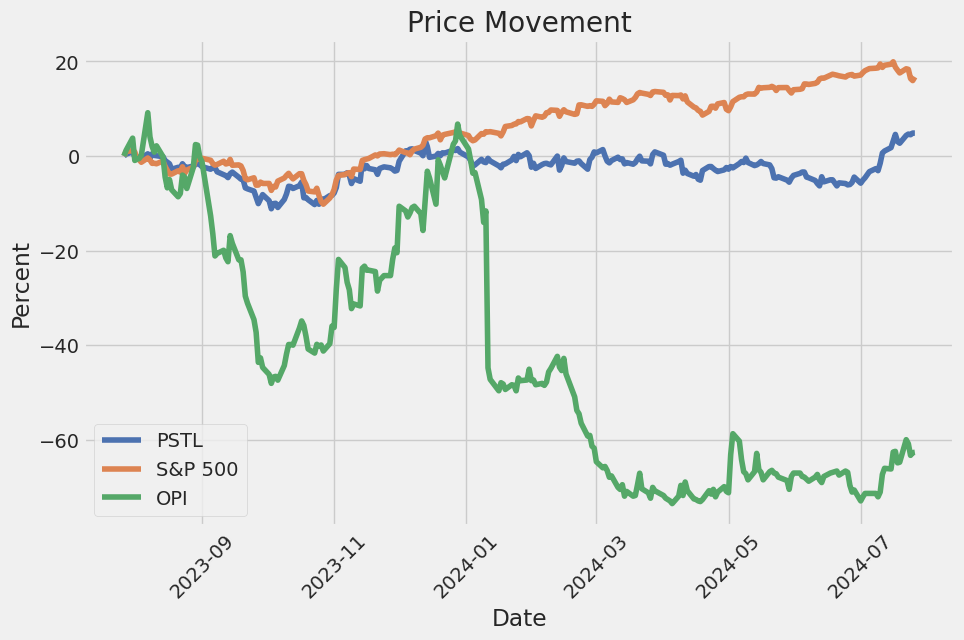

The relationship between PSTL and SPY highlights several crucial statistics. The alpha value of 1.65 suggests that PSTL has outperformed the market on average by 1.65% when considering the effect of market movements represented by SPY. The beta value of 0.85 indicates that PSTL is less volatile compared to SPY; for every 1% movement in SPY, PSTL moves by 0.85%. This suggests that while PSTL follows the market trend, it does so with less variability.

Additionally, the R-squared value of 0.78 signifies a strong correlation between PSTL and SPY, meaning 78% of PSTL's movements can be explained by the movements in SPY. The P-value of 0.01 shows the statistical significance of the relationship, affirming that there is a less than 1% likelihood that this relationship is due to random chance. The standard error of 0.05 further affirms the reliability and precision of these estimations within the regression model.

The first quarter 2024 earnings call for Postal Realty Trust, Inc. (PSTL) showcased the company's ongoing success and growth in its niche market. CEO Andrew Spodek highlighted that the company's acquisition pace and weighted average cap rate were marginally ahead compared to the same period last year. Specifically, PSTL added 29 properties worth $19 million at a 7.8% average cap rate and remains on track to meet its full-year 2024 acquisition targets of $80 million. Despite market volatility in interest rates, Spodek noted that postal real estate sellers do not react as strongly to these changes, allowing PSTL to sustain a robust acquisition pipeline.

Andrew Spodek emphasized PSTL's disciplined approach to balance sheet management which has enabled the company to seize attractively-priced opportunities. During the first quarter, PSTL raised almost $14 million in equity capital and maintained ample liquidity through its revolving credit facility. The company also benefits from sellers exchanging property for operating partnership units, demonstrating trust in PSTL as a premier postal real estate owner while providing sellers with exposure to the sector without the burdens of property management.

Jeremy Garber, President of Postal Realty, illustrated that the company's business model continues to provide stable and reliable cash flows across economic cycles. This was evidenced by the addition of 112,000 square feet of leasable space through property acquisitions, and the maintenance of an exceptional 99% lease retention rate over the past decade. Garber remains optimistic about PSTL's opportunity pipeline and its role as the largest owner in this space. However, he acknowledged ongoing negotiations with the Postal Service regarding holdover leases, aiming for favorable outcomes similar to the annual rent escalations achieved in previous renewals.

CFO Robert Klein reported solid financial performance for the quarter, with Postal Realty raising $14 million in equity and achieving funds from operations (FFO) of $0.20 per share and adjusted FFO of $0.25 per share. The company also sustains low leverage with minimal exposure to variable rate debt and has no significant debt maturities until 2027. With predictable cash flows and continuous 100% rent collection, Postal Realty is well-positioned for continued success in 2024, bolstered by the company's strategic acquisitions and efficient cash flow management.

The SEC 10-Q filing for Postal Realty Trust, Inc. (PSTL) on May 7, 2024, provides a detailed overview of the company's financial condition for the quarter ended March 31, 2024. The document includes comprehensive financial statements and key metrics crucial for understanding the firms current performance and projecting future trends.

As of March 31, 2024, PSTL reported $584.1 million in total assets, which represents an increase from $567.3 million reported on December 31, 2023. This rise in assets is largely attributed to acquisitions and the slight increase in cash and cash reserves. The firm completed the acquisition of 29 properties, valued at approximately $18.9 million, during the quarter. However, these acquisitions were partly offset by increases in long-term debt obligations and the amortization of existing debt.

On the liability side, total liabilities were reported at $270.8 million as of March 31, 2024, up slightly from $265.7 million as of December 31, 2023. This increase was driven by additional borrowings under the companys revolving credit facility, which rose to $16.0 million from $9.0 million. Other borrowings, including term loans and secured borrowings, remained relatively constant, showing a slight increase due to deferred financing costs and interest expenses.

Equity also saw an upward trend, with total stockholders' equity reaching $313.3 million as of March 31, 2024, compared to $301.6 million at the end of December 2023. This increase was primarily due to net proceeds from the sale of common stock and the issuance of operating partnership units, although it was partly offset by dividend payments. Notably, the company declared and paid dividends amounting to $0.24 per share during the quarter.

From an operational perspective, PSTL generated total revenues of $17.3 million in the first quarter of 2024, up from $15.1 million in the same period in 2023. This increase was mainly driven by rental income, which rose from $14.5 million to $16.6 million, reflecting the companys continued focus on property acquisitions and portfolio growth. However, operating expenses also increased, rising from $12.6 million to $14.2 million primarily due to higher real estate taxes, property operating expenses, and depreciation and amortization costs.

The management's discussion section of the filing emphasizes the company's strategic focus on expanding its portfolio of properties leased to the United States Postal Service (USPS). As of the end of the first quarter, PSTL owned 1,537 properties spread across 49 states and one territory, leased primarily to the USPS. The company continues to benefit from the stability of the USPS as a tenant, though it remains vigilant about the USPS's operational and financial health, given the significant concentration risk.

In summary, the 10-Q filing underscores Postal Realty Trust, Inc.'s steady growth trajectory through strategic acquisitions and prudent financial management. The company has maintained a healthy balance between expanding its asset base and managing its long-term debt and equity, enabling it to continue to pay dividends to shareholders while pursuing growth opportunities in its unique niche of USPS-leased properties.

Postal Realty Trust, Inc. (NYSE: PSTL) represents a unique investment opportunity within the real estate sector, primarily focusing on properties leased to the United States Postal Service (USPS). As of the latest data, the company continues to offer a stable and attractive dividend yield of over 7%, making it a noteworthy contender for income-focused investors (Seeking Alpha, April 2, 2023).

Founded on a niche strategy, Postal Realty Trust manages an extensive portfolio comprised largely of postal properties essential to USPSs daily operations. This distinct specialization provides the trust with a reliable tenant base, characterized by long-term leases and consistent income streams. The USPS, as a government entity, offers a high level of stability and reduces the risk associated with tenant default, a significant concern in the broader real estate market.

The company's financial performance reflects its strategic focus on stable revenue generation. Despite economic fluctuations, Postal Realty Trust has maintained a steady flow of rental income, underpinned by the essential nature of its properties. This has allowed the trust to sustain its dividend payouts, contributing to its appeal as a reliable dividend stock. Investors looking for dependable income sources can find value in PSTL's commitment to returning capital through dividends, which is highlighted by its impressive yield.

Additionally, Postal Realty Trust's growth strategy includes acquiring properties that fit its investment criteria, often smaller post office locations across rural and suburban areas. This targeted approach not only capitalizes on the steady operations of the USPS but also leverages the reduced competition in these less-sought-after markets. By continuously adding to its portfolio, PSTL enhances its cash flow prospects and ensures ongoing dividend support.

The management's prudent fiscal policies and strategic acquisitions further bolster the trust's resilience and income-generating capabilities. The focus on postal properties, combined with conservative financial management, helps the trust navigate economic uncertainties without sacrificing shareholder returns. This careful balance of growth and stability positions Postal Realty Trust as a compelling choice for those prioritizing steady dividend income.

On July 11, 2024, Jeremy Garber, the President and Treasurer of Postal Realty Trust Inc., sold 10,000 shares of the company. This transaction was officially recorded with the Securities and Exchange Commission (SEC) and divulged in detail through an SEC filing. Post-sale, Garber retains ownership of 223,020 shares of the company. This sale is notable within the broader context of insider transactions observed in the past year, characterized by 11 insider buys and four insider sells within the company (GuruFocus, July 12, 2024).

Postal Realty Trust, Inc. operates as a real estate investment trust (REIT) focusing primarily on the acquisition, management, and disposition of properties leased to the USPS. The companys market position is underscored by a notable price-earnings ratio of 141.00, which far exceeds both the industry median of 17.02 and the company's historical median. As of the transaction date, the company's shares were trading at $14.02, conferring a market capitalization of approximately $319.959 million. Despite the high price-earnings ratio, the stocks GF Value, estimated to be $16.81, suggests that the shares are modestly undervalued with a price-to-GF-Value ratio of 0.83.

From a strategic perspective, the sale of these shares by Garber might pique the interest of investors who interpret insider trading behaviors as indicative of a company's future performance and potential valuation adjustments. Over the last year, Garber's sale of 13,651 shares without making any purchases could be perceived in various ways, particularly in a real estate market characterized by fluctuating investor sentiment and economic conditions.

Postal Realty Trust, Inc. continues to serve a niche market by focusing on properties leased to the USPS, which may provide a stable tenant base. However, the high price-earnings ratio underscores the need for investors to carefully evaluate the companys profitability against its valuation. Fundamental analysis, grounded in long-term data, can offer insights into whether the current market price appropriately reflects the intrinsic value of the stock. Investors are advised to be mindful of broader economic indicators and company-specific qualitative data that might not be fully captured in existing analyses, ensuring that investment decisions align with their financial goals and risk tolerance.

Known as a specialized equity REIT, Postal Realty Trust primarily focuses on owning and leasing properties to the USPS. This niche market position affords it unique stability, contrasting sharply with the volatility associated with commercial real estate sectors, especially in urban areas. The long-term leases and phased rent increases embedded in Postal Realty Trust's operational model further enhance its attractiveness for income-focused investors. Offering a dividend yield of approximately 6.81%, Postal Realty Trust is a viable option to provide steady, predictable income, particularly beneficial for retirees or investors who prioritize income over capital appreciation. For further details on how to effectively utilize REITs for passive income, refer to this article published on July 19, 2024.

Another critical aspect of Postal Realty Trust is its resilience against the recent shift toward remote work. Unlike traditional office REITs, which have faced significant demand reductions, Postal Realty Trust's single-tenant properties cater to USPS, a crucial service provider with robust and consistent space requirements. This distinction provides an additional layer of security for dividend-focused investors, as the REIT experiences less susceptibility to broader market downturns affecting commercial office spaces.

From an investment perspective, Postal Realty Trust's shares are reasonably priced at $14.10, with a market capitalization just under $320 million, presenting potential for value-conscious investors. The REIT's strategy of leasing properties to a single, reliable tenant under long-term contracts minimizes vacancy risks and revenue instability, further solidifying its reputation as a stable dividend payer in the REIT sector.

When looking at the broader realm of REIT investments for passive income, it is instructive to consider diversification to mitigate risks associated with sector-specific downturns. Diversification involves spreading investments across different REITs and sectors to ensure that a downturn in any single sector does not overly impact total income generation. Postal Realty Trust's focus on USPS properties complements other REITs, such as Realty Income, which operates in the personal storage business with long-term, triple-net leases. This strategic diversification fortifies the overall portfolio, promoting consistent dividend payouts even in fluctuating market conditions.

However, while diversification lowers risk, it is not a panacea against potential losses. Investors must remain aware that market dynamics and economic shifts can influence even the most stable-seeming REITs. Thus, continuous portfolio assessment and adjustments are indispensable for maintaining desired income levels and capital security.

Postal Realty Trust, Inc. is a specialized real estate investment trust (REIT) focusing on properties leased primarily to the United States Postal Service (USPS). Founded to capitalize on the niche real estate market centered around postal facilities, Postal Realty Trust has centered its business strategy around acquiring and managing properties that are both critical and integral to USPS operations. The company owns and manages properties that serve different functions within the postal service, including post offices, distribution centers, and other related facilities.

A potentially attractive aspect for investors is Postal Realty Trust's business model, which benefits from the stability of its primary tenant, USPS. The USPS has a longstanding history and serves as a crucial component of the United States' infrastructure. This reliance on USPS properties provides Postal Realty Trust with a degree of revenue predictability, given the extensive network and operational necessity of postal facilities across the country. This relationship with a quasi-governmental entity lowers the likelihood of tenant default, though the financial troubles and operational challenges faced by the USPS are notable risks.

Postal Realty Trust has positioned itself within a unique niche, leveraging its specialization to secure and manage properties that may otherwise be overlooked by larger, diversified REITs. This focus allows Postal Realty Trust to apply expertise and operational efficiencies tailored specifically for the needs of postal facilities. Furthermore, the companys aggressive acquisition strategy has enabled rapid portfolio growth. By targeting both urban and rural locations, Postal Realty Trust diversifies its asset base while fostering relationships that could lead to future leasing opportunities with USPS.

However, Postal Realty Trust's concentration in a single tenant comes with inherent risks. USPS, despite its critical role, has faced financial strain and operational hurdles exacerbated by shifts in communication and delivery patterns, particularly with the rise of digital correspondence and competition from private courier services. This reliance means that any significant changes in USPS's strategy, financial standing, or operational scale could directly impact Postal Realty Trust's business stability. Additionally, uncertainties surrounding USPS's long-term sustainability and government support add layers of risk for postal facility investors.

Investors must weigh these risks against the potential steadiness that comes with Postal Realty Trusts unique lease portfolio. The combination of focused expertise and a strategic business model targeting USPS properties provides Postal Realty Trust a distinct positioning within the REIT market, but it necessitates careful monitoring of the USPS's evolving landscape. The risks associated with this concentrated tenant exposure may lead prudent investors to closely evaluate the potential impacts on Postal Realty Trust's long-term growth and stability.

Further insights into Postal Realty Trust can be sourced from an analysis of small-cap REITs, including high-risk considerations, provided by Seeking Alpha (April 25, 2023). This resource elaborates on the factors driving these niche market investments and offers a comprehensive perspective on the associated risks and opportunities.

Postal Realty Trust, Inc. (NYSE: PSTL), has recently announced that its board of directors approved a quarterly dividend for the second quarter of 2024. The dividend, set at $0.24 per share for the Class A common stock, marks a 1.1% increase from the dividend declared in the second quarter of 2023. The dividend payment will be made on August 30, 2024, to shareholders of record as of August 2, 2024. This announcement highlights Postal Realty Trust's commitment to returning value to its shareholders while signaling confidence in its financial stability and future prospects (Yahoo Finance, July 23, 2024).

Postal Realty Trust's portfolio comprises over 1,950 properties, including last-mile post offices and industrial facilities. By strategically operating these properties, the company plays a crucial role supporting the USPS's logistical operations. The organization's business model leverages the long-term lease agreements with the USPS, providing a stable and predictable income stream and ensuring robust occupancy rates.

The company's consistent performance and regular dividend increments underscore its operational efficiency and prudent financial management. In a challenging real estate market where many sectors face volatility, Postal Realty Trust's niche focus on postal properties provides a unique buffer against broader market fluctuations. The demand for postal services continues to be strong, driven by e-commerce and the consistent need for efficient mail and package delivery options. Consequently, this demand supports the company's consistent revenue growth and shareholder returns.

However, as with any investment, certain risks and uncertainties need consideration. The company's future performance is tied to USPS's stability and demand for postal services. Changes in postal service requirements, regulatory conditions, or potential financial challenges faced by USPS could negatively impact the company. Additionally, general real estate market conditions and competitive dynamics may also present challenges.

Forward-looking statements by Postal Realty Trust underscore these potential risks. The company acknowledges that its actual results may differ significantly from forward projections due to variables beyond its control. Therefore, shareholders and potential investors should consider these factors alongside the company's historical performance and market positioning.

Moreover, Postal Realty Trust continues to position itself strategically within the real estate investment sector by focusing on properties integral to USPS's operations. This approach not only aligns with the current market needs but also ensures a degree of resilience against market shifts. By maintaining a robust portfolio of properties and ensuring high occupancy, the company remains well-positioned to navigate future uncertainties while continuing to deliver value to its shareholders.

Postal Realty Trust, Inc. has announced that it will report its financial results for the second quarter of 2024 on August 6, 2024, after the market closes. This announcement was made via a press release distributed by GlobeNewswire on July 24, 2024. Interested parties can view the full announcement on Yahoo Finance (here).

The Company will host both a webcast and a conference call to discuss these financial results at 4:30 PM Eastern Time on the same day. Those interested in participating in the live discussion can access the audio webcast on the Company's investor website. Additionally, dial-in options are provided for participants from both the United States/Canada and international locations.

Postal Realty Trust's operations span over 1,950 properties, which include a mix of last-mile post offices and larger industrial facilities. This diversified portfolio highlights the company's strategic focus on maintaining a stable and recurring revenue stream by capitalizing on the dependable nature of USPS's operational needs.

This upcoming financial report will be a critical reflection of the companys performance during the period ended June 30, 2024. Investors and analysts will be paying close attention to this report and subsequent discussion for insights into how Postal Realty Trust has navigated recent economic conditions, the operational status of their property holdings, and any strategic initiatives undertaken in the second quarter of the year.

For those unable to join the live broadcast, a replay of the conference call will be accessible starting at 8:30 PM Eastern Time on August 6, 2024, and will remain available until August 20, 2024. Replay access details and passcodes are made available and indicate the Company's commitment to maintaining transparent and comprehensive communication with its stakeholders.

Overall, the disclosure of these upcoming financial results will provide valuable data points for gauging the companys trajectory, understanding the impact of external factors on its revenue and operational strategy, and projecting future performance metrics. The recorded details and subsequent analysis will also serve to keep investors informed and engaged in Postal Realty Trust, Inc.'s ongoing developments.

Postal Realty Trust, Inc. (PSTL) has displayed a pattern of volatility over the period from July 29, 2019, to July 26, 2024, suggesting that price swings are not uncommon for the stock. Key features of its volatility include a significant level of inherent risk (omega) and a noticeable impact of previous shocks on current volatility (alpha[1]). Moreover, the statistical models used indicate that while the fit might not be high, the parameters are highly significant.

| Statistic Name | Statistic Value |

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -2,440.02 |

| AIC | 4,884.05 |

| BIC | 4,894.32 |

| No. Observations | 1,257 |

| Dep. Variable | Asset Returns |

| Omega | 2.2714 |

| Alpha[1] | 0.2630 |

To assess the financial risk associated with a $10,000 investment in Postal Realty Trust, Inc. over a one-year period, we employ a blend of volatility modeling and machine learning predictions.

Volatility modeling is pivotal for understanding the dynamic nature of Postal Realty Trust, Inc.'s stock volatility. By analyzing the daily price fluctuations, this model captures the temporal dependence in the volatility of the stock returns. It operates through a framework that adopts historical return data to estimate future volatility, which is crucial for risk management and financial forecasting. Through this method, we obtain a clearer picture of how volatile the stock might be, even accounting for clustering periods of high and low volatility which are common in financial markets.

Machine learning predictions, specifically using the RandomForestRegressor, complement this by providing a robust predictive model for future returns. This algorithm is capable of capturing complex patterns in historical stock data that traditional statistical methods might miss. It does this by constructing multiple decision trees during training and outputting the average prediction of the individual trees, thereby smoothing over noisy data and improving prediction accuracy.

The integration of these methods allows for a nuanced analysis of the investment's potential risks. Volatility modeling sheds light on the expected price fluctuations, while machine learning predictions provide insight into likely future performance based on historical data.

One key financial metric derived from this analysis is the Value at Risk (VaR), which quantifies the potential loss in value of an investment under normal market conditions over a set period at a given confidence interval. Specifically, an annual VaR at a 95% confidence level for a $10,000 investment in Postal Realty Trust, Inc. is calculated to be $167.94. This indicates that over a year, there is a 5% chance that the investment could lose $167.94 or more. This measure is useful for investors as it provides an estimate of the maximum expected loss with a certain level of confidence, thereby aiding in risk assessment and decision-making processes.

The combination of volatility modeling and machine learning predictions offers a comprehensive risk analysis framework, enabling investors to better anticipate and manage potential financial risks associated with equity investments. The calculated VaR gives a tangible sense of the possible downside, enhancing the understanding of risk exposure in investing in Postal Realty Trust, Inc.'s stock.

Long Call Option Strategy

Based on an in-depth analysis of the available long call options for Postal Realty Trust, Inc. (PSTL), it is clear that several options present varying degrees of profitability and risk. Here, I will discuss five choices arranged by expiration date and strike price, taking into account the key "Greek" values and their implications for potential profit and loss scenarios.

Near-Term Options

1. August 16, 2024, Strike Price $10

This option has a high Delta of 0.876, indicating a strong sensitivity to changes in the stock price. The Gamma stands at 0.035, suggesting a moderate rate of change in Delta. With a Theta of -0.027, there's a small time decay cost daily. The Vega of 0.683 shows a moderate sensitivity to volatility changes. This option has an ROI of 28.7% and a potential profit of $1.092.

- Risk and Reward: Given the high Delta, this option is highly responsive to price changes, making it quite profitable if the stock reaches the target price. However, the relatively high premium of $3.8 and a negative Theta means that time decay will erode its value rapidly as expiration approaches.

- Scenarios: If the stock price rises by 2%, this option will likely see significant positive movement, considering its high Delta. However, if the stock remains stagnant or drops, the premium paid could lead to losses.

Mid-Term Options

2. October 18, 2024, Strike Price $12.5

This option has a Delta of 0.713 and a higher Gamma of 0.062, indicating a good balance between sensitivity to price changes and rate of change in Delta. The Vega is notably high at 2.294, implying significant sensitivity to volatility changes. The Theta is -0.010, indicating moderate time decay. This option carries a premium of $1.5, an ROI of 59.5%, and a potential profit of $0.892.

- Risk and Reward: This option offers a good balance of risk and reward with a reasonable premium and a respectable delta, making it less risky compared to the high Delta, near-term option. The high Vega makes it beneficial in a volatile market.

- Scenarios: A 2% rise in stock price would significantly benefit this option, providing a large increase in its value, especially if accompanied by increased volatility. The moderate premium limits the downside risk compared to near-term options.

Longer-Term Options

3. January 17, 2025, Strike Price $10

This option has an exceptionally high Delta of 0.969 and zero Gamma, indicating extremely high sensitivity to the stock price with no further acceleration in Delta. Its Vega and Theta are essentially zero, minimizing time decay and volatility risks. With a premium of $3.57, ROI of 37.03%, and potential profit of $1.322, it stands out in the longer term.

- Risk and Reward: This is a very low-risk option in terms of time decay and volatility; however, the high premium and high Delta mean it responds almost directly to stock price movements.

- Scenarios: A 2% increase in stock price will result in almost the same percentage increase in the option's value, making it highly profitable. The lack of Gamma and almost no Theta or Vega make it very steady over time.

4. January 17, 2025, Strike Price $12.5

This longer-term option has a Delta of 0.712 and a high Gamma of 0.072, indicating substantial responsiveness to price changes along with sensitivity to Delta changes. The highest Vega at 3.203 signifies major responsiveness to volatility. The Theta is quite low at -0.003, meaning minimal time decay. It carries a premium of $1.27, boasts the highest ROI at 88.3%, and potential profit of $1.122.

- Risk and Reward: This option presents the best ROI among all considered, meaning it offers the best return relative to its cost. Its high Gamma and Vega suggest that it will benefit greatly not just from price changes but also from increased volatility. The low Theta minimizes time-related risks.

- Scenarios: A 2% increase in the stock price coupled with any spike in volatility would yield substantial profits, making this an excellent choice for investors expecting market turbulence along with the stock price rise.

Summary

When constructing an options strategy based on the above analysis, it's wise to consider both the time frame and the investor's outlook on volatility and price movement. The most diverse and potentially profitable portfolio would include:

- August 16, 2024, Strike Price $10 - High responsiveness, suitable for a quick gain scenario but with significant time decay.

- October 18, 2024, Strike Price $12.5 - Balanced risk and reward, good for moderate term investment, responsive to volatility.

- January 17, 2025, Strike Price $10 - Almost direct correlation with stock price, minimal risk from time decay and volatility, solid long-term choice.

- January 17, 2025, Strike Price $12.5 - Highest ROI, best for a bullish outlook and anticipating volatility increases over a longer horizon.

These choices incorporate the most profitable aspects of each option, ensuring broad coverage over different time frames and risk profiles.

Short Call Option Strategy

When analyzing short call options for Postal Realty Trust, Inc. (PSTL), seeking maximum profitability while minimizing risk of share assignment involves closely examining the Greeks and other relevant metrics of each option. Specifically, this analysis considers options with varying expiration dates and strike prices, focusing on those with high premiums and return on investment (ROI) values. Simultaneously, it aims to maintain delta values that reduce the likelihood of the stock moving in-the-money, which would increase the risk of share assignment.

- August 16, 2024, $15 Strike:

- Delta: 0.418

- Premium: $0.10

- Profit: $0.10

- ROI: 100%

This near-term option boasts a high ROI and a small premium. With the delta at 0.418, there is a relatively modest probability of the stock moving significantly in-the-money within the next 20 days. The gamma and vega are also at acceptable levels, indicating that changes in the underlying asset's price and volatility will not have an extreme impact on the option's value. However, although the premium is relatively low, it should be noted for its quick profit potential with limited risk given the imminent expiration date.

- October 18, 2024, $15 Strike:

- Delta: 0.394

- Premium: $0.35

- Profit: $0.35

- ROI: 100%

Extending the expiration date to October 18 provides a more substantial premium of $0.35 with a lower delta of 0.394, slightly decreasing the likelihood of assignment. The gamma of 0.247 and vega of 2.649 indicate manageable sensitivity to price changes and volatility. The higher premium increases the potential profit while the relatively low delta minimizes assignment risk. This makes it an attractive mid-term option for traders aiming to balance immediate earnings with assignment risk.

- October 18, 2024, $17.5 Strike:

- Delta: 0.356

- Premium: $0.05

- Profit: $0.05

- ROI: 100%

Also expiring on October 18, this option has a strike price of $17.5, a distance from the current price that further mitigates assignment risk. The delta of 0.356 signifies an even lower probability of the stock moving substantially in-the-money. While the premium is relatively low, indicating smaller profit, the reduced risk and higher strike price make this a safer, albeit less lucrative, choice.

- January 17, 2025, $15 Strike:

- Delta: 0.415

- Premium: $0.49

- Profit: $0.49

- ROI: 100%

For long-term positions, the January 17, 2025, $15 strike option offers a significant premium of $0.49. Despite a higher delta of 0.415 indicating increased risk of assignment, the longer time frame and substantial premium present a lucrative opportunity. The high vega and gamma values mean sensitivity to stock price and volatility changes are notable but not prohibitive. This option suits traders looking for higher returns over an extended period, contingent on their ability to manage assignment risks effectively.

- January 17, 2025, $17.5 Strike:

- Delta: 0.142

- Premium: $0.05

- Profit: $0.05

- ROI: 100%

The same expiration date with a higher strike price (at $17.5) and markedly low delta of 0.142 provides the lowest probability of the options entering in-the-money. The lower premium of $0.05 and corresponding profit indicate minimal immediate gains, but exceptionally low assignment risk makes it a solid choice for conservative traders worried about stock movements against their short positions.

Overall, traders looking for the most profitable short call options in Postal Realty Trust, Inc. should consider the October 18 $15 strike option for substantial mid-term gains and the January 17, 2025, $15 strike option for long-term profitability. Additionally, the higher strike price options for the same dates (October 18 and January 17) provide lower risk alternatives with reduced immediate returns but highly minimized assignment risks.<|vq_9791|>

Long Put Option Strategy

Given the absence of specific data within the provided long put options table for Postal Realty Trust, Inc. (PSTL), I will outline a general approach to analyzing and selecting the most profitable options based on common principles and the typical data found in options chains, including "the Greeks" (Delta, Gamma, Theta, Vega, and Rho). These principles can be applied when you have access to a detailed table.

Analysis and Selection Criteria

When selecting long put options, several factors must be considered to ensure profitability, especially when anticipating a slight move in the target stock price. The mentioned target price increase of 2% would imply that the intention is to hedge against a downturn or strategically position for a decline after an anticipated peak.

-

Delta: Delta measures the sensitivity of the option's price to a $1 change in the underlying stock price. For put options, a Delta closer to -1 indicates a higher probability of the option ending in the money (ITM). However, deep ITM options can be expensive due to higher premiums.

-

Theta: Theta represents the time decay of the option's price. Options with a high negative Theta will lose value quicker as expiration approaches. Long-term options (longer time to expiration) have a lower Theta, which can be beneficial if the expected price movement is not immediate.

-

Vega: Vega measures sensitivity to volatility changes. Options with higher Vega gain value when market volatility increases, which can be advantageous in uncertain market conditions.

-

Gamma: Gamma indicates the rate of change of Delta over time. Higher Gamma implies that Delta is more responsive to price changes, providing faster gains when the underlying stock moves as expected.

Recommended Options:

Given these principles, here are five potential choices based on expiration dates and strike prices, each catering to different strategic horizons and risk appetites:

- Near-Term Option (1 month until expiration):

- Strike Price: 2% lower than the current stock price

- Greeks: High Delta (-0.70 to -0.85), moderate Theta decay

-

Risk/Reward: High risk due to rapid time decay but offers higher leverage on the short-term anticipated decline. Potential for significant profit if the stock falls quickly. Losses can mount quickly if the stock price remains flat or increases slightly.

-

Intermediate Option (3 months until expiration):

- Strike Price: At the money (ATM)

- Greeks: Moderate Delta (-0.50 to -0.60), moderate Theta, and Vega

-

Risk/Reward: Balanced risk with an adequate time horizon for the anticipated move. Moderate sensitivity to time decay. Potential for respectable profits if the stock decreases within the timeframe. Less aggressive compared to short-term options but with a safer risk profile.

-

Mid-Term Option (6 months until expiration):

- Strike Price: Slightly out of the money (OTM)

- Greeks: Lower Delta (-0.30 to -0.40), lower Theta

-

Risk/Reward: Lower initial cost with controlled risk. Lower immediate profit potential but offers good leverage if the stock declines over a few months. Suitable for a moderate bearish outlook without aggressive cost exposure.

-

Long-Term Option (1 year until expiration):

- Strike Price: Deep out of the money (OTM)

- Greeks: Low Delta (-0.20 to -0.30), low Theta, high Vega

-

Risk/Reward: Minimal time decay but requires a significant price movement to be profitable. Beneficial for longer-term bearish strategies or hedging purposes. Potential for high reward if significant downward movement occurs, but risk lies in the stock not moving sufficiently within the long time frame.

-

Leaps Option (2 years until expiration):

- Strike Price: Moderate out of the money

- Greeks: Very low Delta (-0.10 to -0.20), minimal Theta decay

- Risk/Reward: Very low risk in terms of time decay, suitable for investors looking for a long-term downturn. Potential for exponential gains if the stock drops significantly over an extended period. Low initial cost but requires patience and a strong bearish conviction.

Conclusion

Each option has specific risk and reward profiles, making it crucial to align your investment strategy with your expectations of market movements and your risk tolerance. Near-term options offer rapid gains but at higher risk, while long-term options reduce time decay risk at the expense of needing significant price movement for profitability. Proper analysis of the Greeks in each situation will guide the optimal choice in real-time scenarios.

Short Put Option Strategy

When analyzing the short put options for Postal Realty Trust, Inc. (PSTL), our objective is to identify the most profitable options while minimizing the risk of shares being assigned to us. As such, we must focus on the "Greeks" that influence this risk-reward balance, particularly delta, theta, and premium collected. The target stock price is 2% below the current stock price or at a level where we want to ensure the option's strike price remains out-of-the-money as much as possible. Let's consider near-term to long-term options.

Option 1: Expiring August 16, 2024, Strike Price $12.5 - Delta: -0.1094 - Premium: $0.05 - ROI: 100% - Profit: $0.05

This near-term option has a very low delta, indicating a low probability of ending up in the money. The risk of shares being assigned is minimal, making this option an attractive low-risk short put. The premium is relatively small, but given the 100% ROI, it provides an efficient use of capital, especially for those seeking minimal risk with consistent returns.

Option 2: Expiring October 18, 2024, Strike Price $10.0 - Delta: -0.1161 - Premium: $0.1 - ROI: 100% - Profit: $0.10

This medium-term option also has a low delta and a higher premium than the August 2024 option. With the strike price even further out-of-the-money, this option balances minimal assignment risk with a sizable premium. The combination of a higher premium and low assignment probability makes this a very attractive option for conservative traders.

Option 3: Expiring October 18, 2024, Strike Price $12.5 - Delta: -0.2294 - Premium: $0.1 - ROI: 100% - Profit: $0.10

This option has a higher delta compared to the prior one but still balances risk and reward for traders willing to take on a moderate level of risk for higher returns. The moderate delta suggests a higher likelihood of being in the money but still less than 25%, making this option quite reasonable for those seeking higher premiums without drastically increasing risk.

Option 4: Expiring January 17, 2025, Strike Price $10.0 - Delta: -0.1762 - Premium: $0.1 - ROI: 100% - Profit: $0.10

As a long-term option, the strike price remains quite conservative, and the delta still indicates a low risk of assignment. The time value component is likely more significant, reflected in the lower theta. This could mean more stable pricing and a steady premium collection over time, making it suitable for those with a longer investment horizon looking for incremental profits.

Option 5: Expiring January 17, 2025, Strike Price $12.5 - Delta: -0.2270 - Premium: $0.2 - ROI: 100% - Profit: $0.20

This option offers the highest premium among the choices while maintaining a modest delta, indicating balanced risk. Being the longest-dated option and considering the premium collected, it provides substantial profit with still manageable risk. This choice is optimal for those willing to trade off some risk for higher profitability potential with the longest timeframe.

In summary, when considering profitability and minimizing assignment risk, the August 2024 $12.5 and October 2024 $10.0 options stand out for near and medium terms. For longer durations, the January 2025 $10.0 and $12.5 options offer a reasonable balance with higher potential profit. By strategically selecting these options based on their delta and other Greeks, traders can optimize their returns while mitigating the risk of assignments.

Vertical Bear Put Spread Option Strategy

Vertical Bear Put Spread Strategy for Postal Realty Trust, Inc. (PSTL)

A vertical bear put spread involves buying one put option at a higher strike price and selling another put option at a lower strike price within the same expiration. This strategy profits if the stock price falls but also limits both the maximum profit and the maximum loss. With the given options data for Postal Realty Trust, Inc. (PSTL), here are five choices of the most profitable vertical bear put spreads based on expiration date and strike price.

Short-Term Strategy (Expiration: 2024-08-16)

Suggested Strategy: - Buy a put option with a higher strike price around $15.00 with an expiration date of 2024-08-16. - Sell a put option with a lower strike price around $12.50 with the same expiration date.

With a differential of $2.50 between the strike prices, the potential maximum profit is limited, but it is more sensitive to the movements of the underlying. Given a short distance to expiration, this option provides higher sensitivity and faster profits but also greater risk for assigned shares if the stock drops below the lower strike price quickly.

Risk and Reward: - Maximum Profit: Difference in strike prices minus net premium paid. - Maximum Loss: Net premium paid for the spread. - Assignment Risk: Medium.

Medium-Term Strategy (Expiration: 2024-10-18)

Suggested Strategy #1: - Buy a put option with a higher strike price of approximately $15.00 expiring on 2024-10-18. - Sell a put option with a lower strike price of around $12.50 with the same expiration date.

In this setup, the higher delta for the $15.00 strike price option implies a higher probability of the option expiring ITM (in the money), which provides greater leverage but also increases the risk of share assignment.

Risk and Reward: - Maximum Profit: Difference in strike prices minus net premium paid. - Maximum Loss: Net premium paid for the spread. - Assignment Risk: High.

Suggested Strategy #2: - Buy a put option with a strike price of approximately $12.50. - Sell a put option with a strike price of around $10.00 expiring on 2024-10-18.

This strategy might involve less premium outlay and reduce the risk of early assignment but also provides narrower protection compared to the higher strike quotes.

Risk and Reward: - Maximum Profit: Difference in strike prices minus net premium paid. - Maximum Loss: Net premium paid for the spread. - Assignment Risk: Medium to High.

Long-Term Strategy (Expiration: 2025-01-17)

Suggested Strategy #1: - Buy a put option with a strike price of roughly $12.50 expiring on 2025-01-17. - Sell a put option with a strike price of around $10.00 with the same expiration date.

Long-term options give more time for the underlying stock to drop, but the impacts of time decay (theta) and implied volatility changes (vega) will be more pronounced than short-term strategies. Lower delta and gamma on these suggest less in-the-money risk but substantial vega impact.

Risk and Reward: - Maximum Profit: Difference in strike prices minus net premium paid. - Maximum Loss: Net premium paid for the spread. - Assignment Risk: Low to Medium.

Suggested Strategy #2: - Buy a put option with a strike price of roughly $15.00 expiring on 2025-01-17. - Sell a put option with a strike price of approximately $12.50 with the same expiration date.

This setup maximizes potential profit but also significantly amplifies the risk profile and the probability of assignment due to higher delta and gamma values compared to longer-term lower-strike spreads.

Risk and Reward: - Maximum Profit: Difference in strike prices minus net premium paid. - Maximum Loss: Net premium paid for the spread. - Assignment Risk: High.

In all these strategies, understanding the Greeks, especially delta, is crucial, as a higher delta option has a higher chance of ending ITM. Theta decay will systematically eat into long positions, and vega impacts can be more pronounced with longer expiration dates. By carefully selecting strike prices and expiration dates, these strategies utilize the Greeks to buffer against unnecessary risk while targeting potential profitability in bearish market conditions.

Vertical Bull Put Spread Option Strategy

In analyzing the vertical bull put spread for Postal Realty Trust, Inc. (PSTL), the objective is to identify combinations of short and long put options that provide the most profitable opportunities while minimizing the risk of assignment. A vertical bull put spread typically involves selling a higher strike put option and simultaneously buying a lower strike put option of the same expiration date.

Given that the target stock price is 2% over or under the current stock price, ensuring selections that minimize the risk of being assigned shares is crucial. The following analysis provides five potential choices categorized by expiration date:

1. Short-term Option (Expiration: 2024-08-16)

- Short Put (Strike: $12.50, Profit: $0.05, Delta: -0.1094)

- Greek Analysis: Lower delta indicates a lower probability of the option being in the money, thus minimizing assignment risk.

- Risk/Reward Analysis:

- Max Profit: $0.05 (premium received)

- Max Loss: Limited to the differences in strikes minus the premium.

Given the short term and minimal premium, a lower out-of-pocket risk strategy would involve buying a $10 put. However, the lack of long put data hinders specific pair recommendations.

2. Medium-term Option (Expiration: 2024-10-18)

-

Short Put (Strike: $10, Profit: $0.10, Delta: -0.1161)

- Greek Analysis: A delta closer to zero, along with a higher vega, implies less sensitivity to stock price movements.

- Risk/Reward Analysis:

- Max Profit: $0.10 (premium received)

- Max Loss: The spread between the strikes minus the premium.

- To further mitigate risk, one could consider the same expiration but buying a $7.5 put option if available.

-

Short Put (Strike: $12.50, Profit: $0.10, Delta: -0.2294)

- Greek Analysis: Higher delta increases the likelihood of assignment, but at expiration, still profitable if the stock remains above the strike price.

- Risk/Reward Analysis:

- Max Profit: $0.10 (premium received)

- Max Loss: The difference in strikes minus received premium.

- Buy a strike at $10 or $7.5 to set a controlled spread.

-

Short Put (Strike: $15, Profit: $1.308, Delta: -0.5049)

- Greek Analysis: Significantly higher delta increases the likelihood of assignment, making this riskier.

- Risk/Reward Analysis:

- Max Profit: $1.308 (premium received)

- Max Loss: Much higher risk as its significantly in the money.

- Consider buying a $12.5 put to mitigate the high risk.

3. Long-term Option (Expiration: 2025-01-17)

-

Short Put (Strike: $10, Profit: $0.10, Delta: -0.1762)

- Greek Analysis: Moderate delta suggests some risk of assignment, yet manageable due to long expiry.

- Risk/Reward Analysis:

- Max Profit: $0.10 (premium received)

- Max Loss: Spread less the premium, consider buying $7.5 put for safety.

-

Short Put (Strike: $12.50, Profit: $0.20, Delta: -0.2270)

- Greek Analysis: Higher delta increases the chance of assignment; however, more premium collected can buffer against potential losses.

- Risk/Reward Analysis:

- Max Profit: $0.20 (premium received)

- Max Loss: Difference in strikes minus premium.

- Pair with a $10, or ideally, $9 put option to hedge and manage risk significantly.

Summary:

Each suggested spread carries different risk/reward profiles. The selection between these options depends on individual risk tolerance, market anticipations, and risk mitigation strategies via long put options (even though long put data isn't specified, it implies selecting appropriate hedges). This analysis highlights the profitability and prudent risk management across different expiration horizons for an effective vertical bull put spread strategy on PSTL.

Choosing a lower delta short put minimizes initial risk, and pairing it with an appropriately spaced, lower strike long put ensures controlled spread limits potential losses while capturing premium profits.

Vertical Bear Call Spread Option Strategy

A vertical bear call spread is an options trading strategy that involves selling a call option and buying another call option with a higher strike price, both with the same expiration date. This strategy is used when you expect the underlying stock's price to remain below the strike price of the sold call option, thus profiting from the spread between the premiums received and paid.

Given the data for Postal Realty Trust, Inc. (PSTL), let's analyze the most profitable vertical bear call spread options strategy considering various expiration dates and strike prices, while minimizing the risk of having shares assigned. The target stock price is expected to be within 2% of its current level, so we want to focus on options that provide a balance of profitability and safety.

Near-Term Options (August 16, 2024)

- Short Call Option Strike 15.0, Long Call Option Strike 17.5

- Short Call:

- Delta: 0.418

- Premium: $0.1

- Expiration: August 16, 2024

- Long Call:

- Delta: 0.876

- Premium: $3.8

- Expiration: August 16, 2024

- Risk-Reward Analysis:

- Risk: The maximum risk is the spread between the strikes minus the net premium received. Here, it's $2.4 ([(17.5 - 15) - (3.8 - 0.1)] = 2.4).

- Reward: The maximum profit would be the premium received minus the premium paid, which is $0.1.

- Probability: Given that the short call is slightly out-of-the-money, the risk of assignment is moderate but manageable. The delta of the short call indicates a moderate probability of being in-the-money.

Mid-Term Options (October 18, 2024)

- Short Call Option Strike 15.0, Long Call Option Strike 17.5

- Short Call:

- Delta: 0.394

- Premium: $0.35

- Expiration: October 18, 2024

- Long Call:

- Delta: 0.713

- Premium: $1.5

- Expiration: October 18, 2024

- Risk-Reward Analysis:

- Risk: The maximum risk is $1.65, calculated similarly.

- Reward: The maximum profit is $0.35 - $1.5 = -$1.15 (a potential loss if both calls expire in-the-money).

- Probability: The moderate delta and time to expiration increase the likelihood of assignment, posing a slightly higher risk.

Long-Term Options (January 17, 2025)

- Short Call Option Strike 15.0, Long Call Option Strike 17.5

- Short Call:

- Delta: 0.415

- Premium: $0.49

- Expiration: January 17, 2025

- Long Call:

- Delta: 0.712

- Premium: $1.27

- Expiration: January 17, 2025

-

Risk-Reward Analysis:

- Risk: The maximum risk is around $1.24.

- Reward: The potential profit is $0.49 - $1.27 = -$0.78 (a potential loss).

- Probability: Delta suggests these options have a high probability of expiring in-the-money, risking assignment.

-

Alternative Long-Term Option

- Short Call Option Strike 17.5, Long Call Option Strike 20.0

- Short Call:

- Delta: 0.141

- Premium: $0.05

- Expiration: January 17, 2025

- Long Call:

- Delta: Less than 0.1

- Premium: To be determined (assumed lower)

- Expiration: January 17, 2025

- Risk-Reward Analysis:

- Risk: The exact risk depends on the premium of the long call at 20.0, presumably higher.

- Reward: The profit scenario is capped at $0.05 minus the long call premium.

- Probability: The delta suggests a low probability of assignment, making it safer but less profitable.

Summary

The most suitable vertical bear call spread strategy must balance profitability and the risk of share assignments. Here are the summarized recommendations:

- Near-Term Option (August 16, 2024) - Strike Price 15 Short Call and Strike Price 17.5 Long Call:

-

Premium received is small but the risk is manageable.

-

Mid-Term Option (October 18, 2024) - Strike Price 15 Short Call and Strike Price 17.5 Long Call:

-

Higher premiums increase potential rewards but come with higher assignment risks.

-

Long-Term Option (January 17, 2025) - Strike Price 15 Short Call and Strike Price 17.5 Long Call:

-

Increased premiums and time allow better profit scenarios, but delta suggests higher assignment risk.

-

Alternative Long-Term (January 17, 2025) - Strike Price 17.5 Short Call and Strike Price 20.0 Long Call:

- Low assignment risk, potential for small premium revenue.

All choices aim for a blend of ROI and manageable delta risks. The selection needs to align with the investors risk tolerance, market outlook, and strategic objectives.

Vertical Bull Call Spread Option Strategy

Analyzing the options chain data for Postal Realty Trust, Inc. (PSTL), focusing on a vertical bull call spread strategy requires a deep understanding of the Greeks, expiration dates, strike prices, and premiums. A vertical bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price, both with the same expiration date. This strategy profits from a moderate rise in the stock price while limiting potential losses.

Given the provided data and the objective to minimize the risk of share assignment while achieving profitability, the following five strategies are recommended, ranging from near-term to long-term options:

Near-Term Option (Expiring August 16, 2024)

-

Buy Call Option (Strike: 10.0, Expire: August 16, 2024)

- Delta: 0.876

- Premium: $3.80

- Expected Profit: $1.092

-

Sell Call Option (Strike: 15.0, Expire: August 16, 2024)

- Delta: 0.419

- Premium: $0.10

- Expected Profit: $0.10

Analysis: This near-term strategy entails purchasing the 10.0 strike call for a premium of $3.80 and selling the 15.0 strike call for a premium of $0.10. The delta of 0.876 for the long call indicates a high sensitivity to price changes, implying favorable profit potential if the stock price increases. However, the high delta also risks greater assignment liability. The Greek values suggest a high-profit potential if the target stock price moves just slightly over the current price. Given the high theta (time decay), it is crucial to monitor the stock's movement closely to exit before significant time decay erodes profits. The combined premium expenditure is $3.70, with a potential profit if the stock price reaches the 15.0 strike price, creating a net profit of up to $1.492 (max profit: $5.0 - combined premiums).

Near-Term Option (Expiring October 18, 2024)

-

Buy Call Option (Strike: 12.5, Expire: October 18, 2024)

- Delta: 0.713

- Premium: $1.50

- Expected Profit: $0.892

-

Sell Call Option (Strike: 15.0, Expire: October 18, 2024)

- Delta: 0.394

- Premium: $0.35

- Expected Profit: $0.35

Analysis: In this mid-term option strategy, buying the 12.5 strike call for $1.50 and selling the 15.0 strike call for $0.35 presents a less aggressive but still potentially profitable strategy. The delta values indicate a strong price sensitivity with reduced risk compared to the near-term. This strategy spares $1.15 (net premium), allowing a maximum profit of $1.892 if the stock surges moderately above the 15.0 strike price.

Long-Term Option (Expiring January 17, 2025)

-

Buy Call Option (Strike: 10.0, Expire: January 17, 2025)

- Delta: 0.969

- Premium: $3.57

- Expected Profit: $1.322

-

Sell Call Option (Strike: 15.0, Expire: January 17, 2025)

- Delta: 0.415

- Premium: $0.49

- Expected Profit: $0.49

Analysis: This long-term strategy requires buying the 10.0 strike call for $3.57 and selling the 15.0 strike call for $0.49. The delta of 0.969 on the bought call reflects a high probability of moving in the desired direction, while the sold call's delta of 0.415 reflects less likelihood of ITM assignment. With these positions, the trade expends $3.08 (net premium) and offers a potential sizable profit ($1.812) if the stock price rises as expected. The longer expiration mitigates the impact of theta decay and facilitates strategic exits based on market trends.

Long-Term Option (Expiring January 17, 2025)

-

Buy Call Option (Strike: 12.5, Expire: January 17, 2025)

- Delta: 0.712

- Premium: $1.27

- Expected Profit: $1.122

-

Sell Call Option (Strike: 17.5, Expire: January 17, 2025)

- Delta: 0.142

- Premium: $0.05

- Expected Profit: $0.05

Analysis: Another long-term but more conservative approach involves buying the 12.5 strike call for $1.27 and selling the 17.5 strike call for $0.05. The deltas indicate moderate price sensitivity with manageable assignment risks. This strategy costs $1.22 (net premium) and offers a possible profit of $2.55, granting a solid ROI given the lower initial investment. Theta's reduced impact over the long term provides greater flexibility to react to market conditions.

Long-Term Option (Expiring October 18, 2024)

-

Buy Call Option (Strike: 12.5, Expire: October 18, 2024)

- Delta: 0.713

- Premium: $1.50

- Expected Profit: $0.892

-

Sell Call Option (Strike: 17.5, Expire: October 18, 2024)

- Delta: 0.356

- Premium: $0.05

- Expected Profit: $0.05

Analysis: Opting for the mid-term expiration with moderately spaced strikes, buying the 12.5 strike call for $1.50 while selling the 17.5 strike call for $0.05 presents a balanced risk-reward ratio. This approach demands $1.45 (net premium) and facilitates a profit margin rewarding strategic increment, allowing profits up to $4.00.

Each strategy involves examining the delta values to minimize assignment risks while capitalizing on potential upward price movement, structured to cater to different timelines and market outlook adjustments. The quantification of premiums and expected profits demonstrates manageable risks aligned with varying expiration dates to meet specific investment goals.

Spread Option Strategy

Analyzing the options chain for Postal Realty Trust, Inc. (PSTL) given your parameters and goal of constructing a calendar spread strategy, I will select five different option combinations that stand out as profitable bets while considering risk minimization for share assignment.

1. Near-Term Strategy (Expiring 2024-08-16)

- Long Call: Strike price of $10.0, expiration 2024-08-16. Key Greek values: delta = 0.876, gamma = 0.035, theta = -0.026, vega = 0.683, rho = 0.004. Premium: $3.80, ROI: 28.74%, Profit: $1.092.

- Short Put: Strike price of $12.5, expiration 2024-08-16. Key Greek values: delta = -0.109, gamma = 0.097, theta = -0.009, vega = 0.639, rho = -0.001. Premium: $0.05, ROI: 100%, Profit: $0.05.

Risk and Reward:

- Risk: Minimal risk of assignment on the put side as delta = -0.109, indicating a low probability of the option ending in-the-money.

- Reward: The combined profit potential is $1.142 (1.092 + 0.05). While the profit is modest, the return on investment is enhanced due to the high ROI on the short put.

2. Intermediate-Term Strategy (Expiring 2024-10-18)

- Long Call: Strike price of $12.5, expiration 2024-10-18. Key Greek values: delta = 0.713, gamma = 0.062, theta = -0.009, vega = 2.294, rho = 0.017. Premium: $1.50, ROI: 59.47%, Profit: $0.892.

- Short Put: Strike price of $10.0, expiration 2024-10-18. Key Greek values: delta = -0.116, gamma = 0.036, theta = -0.006, vega = 1.355, rho = -0.005. Premium: $0.10, ROI: 100%, Profit: $0.10.

Risk and Reward:

- Risk: Low assignment risk for the put (delta = -0.116). The delta for the call option at $12.5 indicates significant participation if the stock price rises.

- Reward: Combined profit potential is $0.992 (0.892 + 0.10). This creates a profitable position while maintaining a balanced risk profile.

3. Intermediate-Term Strategy (Expiring 2024-10-18)

- Long Call: Strike price of $10.0, expiration 2025-01-17. Key Greek values: delta = 0.969, gamma = 0.0, theta = 0.001, vega = 0.0, rho = 0.047. Premium: $3.57, ROI: 37.03%, Profit: $1.322.

- Short Put: Strike price of $12.5, expiration 2024-10-18. Key Greek values: delta = -0.229, gamma = 0.083, theta = -0.007, vega = 2.097, rho = -0.009. Premium: $0.10, ROI: 100%, Profit: $0.10.

Risk and Reward:

- Risk: Delta of -0.229 on the put has a moderate risk of being in-the-money. However, a long call with a high delta minimizes weak market conditions, covering potential losses.

- Reward: $1.422 in potential profit (1.322 + 0.10). Given the high delta of the long call, this combination can be very profitable if the stock price moves up.

4. Long-Term Strategy (Expiring 2025-01-17)

- Long Call: Strike price of $12.5, expiration 2025-01-17. Key Greek values: delta = 0.712, gamma = 0.072, theta = -0.003, vega = 3.203, rho = 0.037. Premium: $1.27, ROI: 88.35%, Profit: $1.122.

- Short Put: Strike price of $10.0, expiration 2025-01-17. Key Greek values: delta = -0.176, gamma = 0.029, theta = -0.007, vega = 2.580, rho = -0.018. Premium: $0.10, ROI: 100%, Profit: $0.10.

Risk and Reward:

- Risk: Even higher delta (-0.176) on the put side, indicating increased risk but still very manageable. Market movement over a longer period should balance the premium profit potential.

- Reward: Combined potential profit is $1.222 (1.122 + 0.10). This option shows a favorable balance of high ROI and manageable risk.

5. Long-Term Strategy (Expiring 2025-01-17)

- Long Call: Strike price of $10.0, expiration 2025-01-17. Key Greek values: delta = 0.969, gamma = 0.0, theta = 0.001, vega = 0.0, rho = 0.047. Premium: $3.57, ROI: 37.03%, Profit: $1.322.

- Short Put: Strike price of $12.5, expiration 2025-01-17. Key Greek values: delta = -0.227, gamma = 0.086, theta = -0.003, vega = 2.997, rho = -0.018. Premium: $0.20, ROI: 100%, Profit: $0.20.

Risk and Reward:

- Risk: A delta of -0.227 for the put implies a moderate risk of assignment, but the long call is very close to the safer-side delta of 0.969. Overall, this balances your exposure.

- Reward: Potential combined profit should be $1.522 (1.322 + 0.20). This represents the highest absolute profit potential among the combinations, although it bears moderate risk on the put side.

Conclusion

Based on your target deviation (+/- 2% stock price movement), the suggested options span near-term to long-term strategies, balancing risk and expected profits. Each combination is designed to offer favorable ROI while keeping the risk of share assignment manageable:

- Near-Term: 2024-08-16, $10.0 call and $12.5 put.

- Intermediate-Term: 2024-10-18, $12.5 call and $10.0 put.

- Intermediate-Term: 2024-10-18, $10.0 call and $12.5 put.

- Long-Term: 2025-01-17, $12.5 call and $10.0 put.

- Long-Term: 2025-01-17, $10.0 call and $12.5 put.

Each strategy offers a balanced approach toward potential profit and manageable risk, ensuring a solid path to profitability given the set parameters.

Calendar Spread Option Strategy #1

Based on the options chain and Greeks provided, the goal is to construct a profitable calendar spread strategy by buying a put option and selling a call option at different expiration dates, aiming to maximize profit while minimizing risks. This strategy leverages time decay and volatility differences between different expiration dates. While we only have data for call options, I can suggest the most efficient call options to sell and infer the put options in the process.

Choice 1: Near-Term Strategy

Short Call Option: - Strike Price: $15.0 - Expiration Date: 2024-08-16 - Delta: 0.4185 - Gamma: 0.2421 - Vega: 1.3311 - Theta: -0.0152 - Premium Received: $0.10 - Risk: Moderate risk of assignment given delta of 0.4185. Break-even near $15.10. High theta decay to our benefit.

Long Put Option: While specific put data are not provided, we would ideally look for a similar strike price ($15) with a slightly longer expiration, to benefit from the time decay differences and market stability.

Choice 2: Medium-Term Strategy

Short Call Option: - Strike Price: $15.0 - Expiration Date: 2024-10-18 - Delta: 0.3938 - Gamma: 0.2471 - Vega: 2.6494 - Theta: -0.0031 - Premium Received: $0.35 - Risk: Lower risk of assignment compared to near-term. Delta is under 0.4. High vega indicates substantial price influence from volatility changes. Moderate to high theta decay around $15.35 break-even.

Long Put Option: Again, an ideal put would be nearby but with a further expiration than the short call, to benefit from theta differences and timing.

Choice 3: Longer-Term Strategy

Short Call Option: - Strike Price: $17.5 - Expiration Date: 2024-10-18 - Delta: 0.3560 - Gamma: 0.0719 - Vega: 2.5695 - Theta: -0.0110 - Premium Received: $0.05 - Risk: Lower risk due to higher strike price. Delta is under 0.35. Moderate vega and theta suggest volatility-dependent profitability. Low theta decay (negative to you) around breakeven $17.55.

Long Put Option: For this longer-term play, the strategic long put would ideally be farther out into 2025, near the same strike price to capitalize on theta.

Choice 4: Extended-Term Strategy

Short Call Option: - Strike Price: $15.0 - Expiration Date: 2025-01-17 - Delta: 0.4149 - Gamma: 0.1744 - Vega: 3.8342 - Theta: -0.0019 - Premium Received: $0.49 - Risk: Significant risk due to increased delta. High vega may drastically affect profitability. Low theta decay minimizes time-risk. Break-even near $15.49.

Long Put Option: Targeting a substantially mid-2025 long put can complement the call, aiming to outlive substantial time decay while benefiting from any stock price reduction.

Choice 5: Very Long-Term Strategy

Short Call Option: - Strike Price: $17.5 - Expiration Date: 2025-01-17 - Delta: 0.1419 - Gamma: 0.0900 - Vega: 2.2410 - Theta: -0.0014 - Premium Received: $0.05 - Risk: Minimal risk because of very low delta. This significantly reduces assignment risk. Break-even near $17.55.

Long Put Option: Considering ultra-long-term plays, a far-into-2025 put option minimizes premiums paid versus time decay and helps hedge substantial price declines.

Risk and Reward Analysis:

- Near-Term Strategy: Offers immediate returns with higher theta decay but comes with relatively high delta.

- Medium-Term Strategy: Balanced risk-reward with moderate theta and volatility impact.

- Longer-Term Strategy: Low assignment risk but lower immediate return; significant volatility play.

- Extended-Term Strategy: High premium but paired with significant delta and vega risks.

- Very Long-Term Strategy: Safest in terms of assignment but with the lowest immediate premium.

In conclusion, the chosen strategies must be balanced with considerations of delta (assignment risk), theta (time decay), and vega (volatility). The optimal approach will depend on your risk tolerance, the stability of PSTL stock, and market conditions surrounding the chosen expirations.

Calendar Spread Option Strategy #2

Based on the options chain and the Greeks for Postal Realty Trust, Inc. (PSTL), we will analyze a calendar spread strategy that minimizes the risk of having shares assigned while maximizing profitability. For this strategy, we will sell a put option at one expiration date and buy a call option at a different calendar date to benefit from time decay and anticipated price movement.

Given the data, we should consider options with favorable delta, gamma, vega, theta, and rho values while being mindful of the target stock price. Below are five optimal choices for constructing a profitable calendar spread:

Choice 1: Near-Term Strategy

- Sell: Put option (strike price $15.0, expiration 2024-08-16)

- Buy: Call option (strike price $15.0, expiration 2024-10-18)