Reliance Steel & Aluminium Co. (ticker: RS)

2023-12-16

Reliance Steel & Aluminum Co. (ticker: RS) is a leading metals service center company based in the United States. Established in 1939, the company has grown through numerous acquisitions to become a prominent player within the industry, offering an extensive range of products and services. Reliance provides value-added metals processing services and distributes a vast inventory of over 100,000 metal products, including alloy steel, aluminum, brass, copper, carbon steel, stainless steel, titanium, and specialty steel products. The company caters to a diverse set of customers across various industries such as aerospace, automotive, energy, manufacturing, and construction. Reliance operates through an extensive network of processing and distribution facilities, showcasing its commitment to operational excellence, customer service, and scalable growth. As of the knowledge cutoff date in early 2023, the company has showcased resilience against market fluctuations, adapting to industry trends and sustaining profitability even amidst economic uncertainties. Its strategic focus on high-quality service and just-in-time delivery has contributed to its strong market position and consistent financial performance.

Reliance Steel & Aluminum Co. (ticker: RS) is a leading metals service center company based in the United States. Established in 1939, the company has grown through numerous acquisitions to become a prominent player within the industry, offering an extensive range of products and services. Reliance provides value-added metals processing services and distributes a vast inventory of over 100,000 metal products, including alloy steel, aluminum, brass, copper, carbon steel, stainless steel, titanium, and specialty steel products. The company caters to a diverse set of customers across various industries such as aerospace, automotive, energy, manufacturing, and construction. Reliance operates through an extensive network of processing and distribution facilities, showcasing its commitment to operational excellence, customer service, and scalable growth. As of the knowledge cutoff date in early 2023, the company has showcased resilience against market fluctuations, adapting to industry trends and sustaining profitability even amidst economic uncertainties. Its strategic focus on high-quality service and just-in-time delivery has contributed to its strong market position and consistent financial performance.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 15.55B | 15.36B | 15.90B | 15.11B | 11.88B | 10.29B |

| Enterprise Value | 15.94B | 15.90B | 16.45B | 15.80B | 13.10B | 11.66B |

| Trailing P/E | 11.34 | 10.34 | 9.69 | 8.58 | 6.62 | 5.76 |

| Forward P/E | 15.11 | 15.92 | 11.96 | - | - | 7.75 |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 1.07 | 1.00 | 1.00 | 0.93 | 0.73 | 0.65 |

| Price/Book (mrq) | 2.01 | 2.02 | 2.16 | 2.13 | 1.74 | 1.50 |

| Enterprise Value/Revenue | 1.06 | 4.39 | 4.24 | 3.98 | 3.63 | 2.74 |

| Enterprise Value/EBITDA | 7.13 | 34.70 | 28.29 | 27.22 | 25.03 | 19.43 |

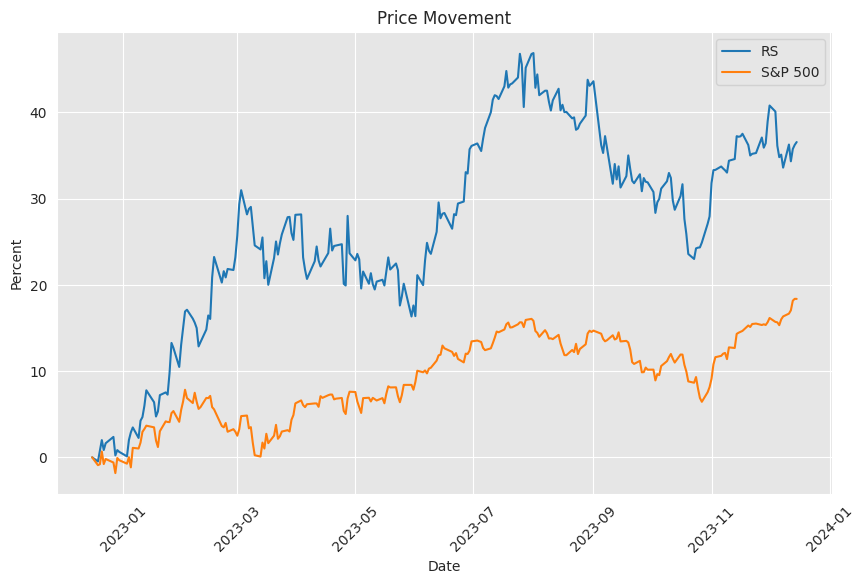

Based on the provided technical analysis data and company fundamentals, we can piece together a nuanced view of the potential stock price movement over the next few months.

Based on the provided technical analysis data and company fundamentals, we can piece together a nuanced view of the potential stock price movement over the next few months.

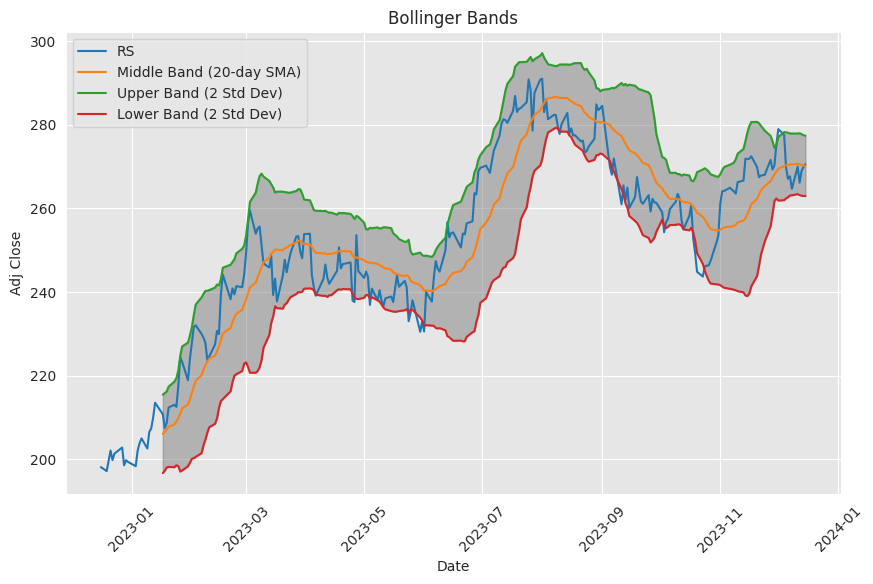

The technical indicators present a picture with mixed signals. The last day's Adjusted Close at 270.52, along with an RSI (Relative Strength Index) of 53.46, suggests the stock is neither oversold nor overbought, residing in a moderate trading zone. The proximity of the closing price to the 20-day Simple Moving Average (SMA) and the 50-day Exponential Moving Average (EMA) corroborates this range-bound perspective, indicating relative equilibrium between buying and selling forces.

However, some caution is warranted as the MACD histogram value is negative, suggesting the momentum is currently bearish. This negative histogram, coupled with the MACD line being above the signal, may imply potential for a short-term downtrend or consolidation. The Bollinger Bands are fairly tight with the price near the middle band, pointing to low volatility and no significant price surge or drop.

In contrast, the relatively low Average Directional Index (ADX) value of 12.46 indicates a weak trend, which could mean that we should not expect strong directional moves imminently. The negative Chaikin Money Flow (CMF) value suggests that there's some selling pressure, but it's not strong enough to assert a firm directional bias.

The Stochastic oscillator values (STOCHk and STOCHd) show the stock isn't in an overbought or oversold condition, sitting in a neutral position midway in its range. As for the Williams %R, it's also positioned in a neutral zone, neither confirming a strong buying nor selling signal.

Given these indicators, the technical analysis would suggest a cautious outlook. The market may continue the current trend or enter a period of consolidation before establishing a definitive movement. Movement outside Bollinger Bands or a decisive turn in MACD could signal a stronger trend direction.

Now lets turn to the fundamental analysis. The company's increasing Market Cap over recent quarters points to investor confidence and potential for further growth. The Trailing and Forward P/E ratios have seen a rise, indicating that the market may be pricing in optimism about future earnings. The Price/Sales and Price/Book ratios are also trending upward, suggesting the stock is becoming relatively more expensive based on its sales and book value, which could restrain future gains.

The strong growth in Net Income, as reflected in the financial summary, provides a solid base for potential appreciation. The company seems to be on a growth trajectory, which bodes well for future stock performance if this trend continues.

When synthesizing both the technicals and fundamentals, one could infer that the stock might experience moderate growth, assuming the company's financial health remains robust and the broader market conditions are favorable. Its crucial to monitor key developments, including earnings reports, market sentiment, and broader economic indicators, which can significantly impact the stock's movement.

In summary, while the technicals don't point to a strong directional move, the solid fundamentals provide a firm foundation that could support gradual stock appreciation. Investors should remain vigilant, watching for shifts in market dynamics and company performance to refine their positions accordingly.

Reliance Steel & Aluminium Co. (NYSE: RS) captures the essence of a resilient player in the niche market of metal service centers. As a company that savors a position akin to what investment mogul Peter Lynch might look for, it stands as a testament to the potential that lurks within the small-cap domain. While the giants of technology inflate the figures of major indices like the S&P 500 and Nasdaq, Lynch steers the investor gaze toward the more unassuming segment of the market, where growth and value may intersectseemingly a perfect backdrop for a company like Reliance Steel & Aluminium Co.

Peter Lynch, famed for his stellar performance at the helm of the Fidelity Magellan Fund, has long advocated for the investment in small-cap stocks due to their often overlooked and undervalued status. These stocks, including Reliance Steel & Aluminium, may represent undiscovered gems compared to their large-cap counterparts, which have reached lofty valuations. In this light, Reliance has the potential to emerge as a compelling option for investors following Lynch's approach, given its status as a small-cap company with a solid track record.

Amid predictions of a slowing economy, the conditions seem ripe for smaller companies to show their mettle. The U.S., powered by a resilient consumer sector and a robust labor market, may very well be the steady stage upon which Reliance Steel & Aluminium can perform. Should inflation ease and interest rate cuts materialize, history suggests that small-caps could outshine their more substantial peers, providing a fertile ground for growth for companies like Reliance.

Analysts keen on the small-cap index, as gauged by instruments like the SPDR Portfolio S&P 600 Small Cap ETF, have noted appreciably lower price-earnings ratios when compared to the broad market averages. This observation posits an environment where reasonable valuations favor the smaller enterprises. Within this bracket, ETFs such as the iShares Russell 2000 and the Vanguard Small-Cap Index Fund ETF Shares invigorate the space with distinct investment methodologies and a conscious omission of overlapping holdings, suggesting an array of approaches to tapping into the potential of small-caps.

RS resides among the chosen holdings of these ETFs, thus bearing the hallmarks of an attractive investment candidate. It has the distinct advantage of functioning in the materials sector, offering a diversified array of metals and services that could benefit from the prospective economic climate. As investors veer away from the incessant buzz surrounding big-ticket tech stocks, companies like Reliance could see a fortuitous realignment in how the market values their contributions.

The very fabric of the economy seems interwoven with avenues for smaller, well-managed firms to excel, particularly during downturns. This could be especially true for Reliance Steel & Aluminium Co., whose balance sheets and strategic niche may well permit it to pivot and adapt in challenging times more adeptly than their larger counterparts. Lynchs investment philosophy, when juxtaposed with an assortment of macroeconomic elements, strongly suggests that small caps could become havens of value in a market disproportionately influenced by technology giants.

In the competitive landscape, Cleveland-Cliffs Inc. has taken an aggressive stance, rapidly expanding through acquisitions to become a major player in the North American steel industry. Notably, the purchases of AK Steel and ArcelorMittal USA in 2020, followed by the strategic acquisition of Ferrous Processing and Trading, have been part of a broader effort to strengthen its vertical integration and theoretically improve margins.

However, Cleveland-Cliff's journey has not been without its challenges. Increased costs and pressures on profitability showcase the inherent risks of such rapid expansion. Their proposal to take over U.S. Steel speaks to their ambitions, yet it casts concerns over the firm's financial stretch and the ability to maximize value from such a large transaction. Skeptics question if the continual pursuit of acquisitions might ultimately serve as a diversion from the need to consolidate and optimize the gains from its already considerable portfolio of companies.

Despite these challenges, Cliffs' strategy conveys an assertive attempt to shape the steel industry through a sweeping, integrated operational model. Although their profitability metrics have not always kept pace with the averages, the company's arc of acquisitions, particularly the elimination of pension liabilities from the ArcelorMittal USA deal, has painted a narrative of acquisition savvy, which could bode well for its future aspirations.

Turning our focus back to Reliance Steel & Aluminium Co., the dividend landscape offers yet another vantage point from which to judge its appeal. Recognized within the universe of Dividend Champions, RS continues its tradition of stable dividend payouts, as noted in Seeking Alpha's weekly dividend summary. This distinction highlights its dependable nature and reverberates with investors who prize consistent returns and signals confidence in the firm's financial health.

Such attributes, amid the spectrum of dividends indicating corporate strength and strategic performance, render a company like Reliance Steel & Aluminium Co. a significant fixture in income-focused portfolios. In contemplating the company's position within the market and its shareholder value proposition, stakeholders might assess RS in light of its peers and the broader investment horizon.

In conclusion, Reliance Steel & Aluminium Co., by benefitting from the nuanced views of investors like Peter Lynch and unfolding macroeconomic sentiments, coupled with its sound operational history and dividend consistency, presents a compelling narrative for investors surveying the small-cap landscape. In the broader constellation of investment opportunities, Reliance sheds light on what could be a prudent pathway for those seeking to navigate an ever-changing, complex market environment.

Similar Companies in Steel:

ArcelorMittal (MT), Nucor Corporation (NUE), Commercial Metals Company (CMC), Steel Dynamics, Inc. (STLD), Report: United States Steel Corporation (X), United States Steel Corporation (X), Worthington Industries, Inc. (WOR), Ryerson Holding Corporation (RYI)

News Links:

https://seekingalpha.com/article/4636682-cleveland-cliffs-us-steel-step-too-far

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: UFLKWn