iShares Silver Trust (ticker: SLV)

2024-02-19

The iShares Silver Trust (SLV) is an exchange-traded fund (ETF) that aims to provide investors with exposure to the day-to-day movement of the price of silver bullion. As such, it is a popular instrument for investors seeking to include silver as part of their investment portfolio without the complexities of direct silver bullion ownership. Managed by BlackRock Fund Advisors, the trust holds physical silver bars in secure vaults, and its performance closely tracks the spot price of silver, minus expenses. SLV offers a liquid, cost-effective means for investors to gain market exposure to silver, making it an attractive option for both individual and institutional investors. Additionally, for traders and those interested in short-term investment strategies, SLV's liquidity means it can be readily bought and sold throughout the trading day on major stock exchanges, providing flexibility in strategy execution and risk management. As with all investments, potential investors should be mindful of the inherent risks associated with commodity investing, including volatility driven by global silver market dynamics.

The iShares Silver Trust (SLV) is an exchange-traded fund (ETF) that aims to provide investors with exposure to the day-to-day movement of the price of silver bullion. As such, it is a popular instrument for investors seeking to include silver as part of their investment portfolio without the complexities of direct silver bullion ownership. Managed by BlackRock Fund Advisors, the trust holds physical silver bars in secure vaults, and its performance closely tracks the spot price of silver, minus expenses. SLV offers a liquid, cost-effective means for investors to gain market exposure to silver, making it an attractive option for both individual and institutional investors. Additionally, for traders and those interested in short-term investment strategies, SLV's liquidity means it can be readily bought and sold throughout the trading day on major stock exchanges, providing flexibility in strategy execution and risk management. As with all investments, potential investors should be mindful of the inherent risks associated with commodity investing, including volatility driven by global silver market dynamics.

| Previous Close | 20.94 | Open | 21.07 | Day Low | 20.91 |

| Day High | 21.5 | Volume | 20,251,776 | Average Volume | 16,721,942 |

| Average Volume 10 Days | 15,867,280 | Bid | 21.41 | Ask | 21.42 |

| Bid Size | 42,300 | Ask Size | 42,300 | Total Assets | $10,131,040,256 |

| Fifty Two Week Low | 18.38 | Fifty Two Week High | 23.94 | Fifty Day Average | 21.1778 |

| Two Hundred Day Average | 21.4252 | NAV Price | 21.05263 | YTD Return | -0.0179063 |

| Beta 3 Year | 0.32 | Three Year Average Return | -0.053924497 | Five Year Average Return | 0.0761493 |

| Sharpe Ratio | 0.20777170977436793 | Sortino Ratio | 3.5746236020711804 |

| Treynor Ratio | 0.16696432820430726 | Calmar Ratio | 0.3407762516212655 |

Analyzing the iShares Silver Trust (SLV) from both technical and fundamental perspectives offers a multi-faceted view into its potential future movements. The trust's main objective is to mirror the price performance and yield of silver in the market, making it a direct play on the underlying commodity's price movements. Given the volatility inherent in commodities, an in-depth look at the trust's recent technical indicators alongside its fundamentals can provide valuable insights.

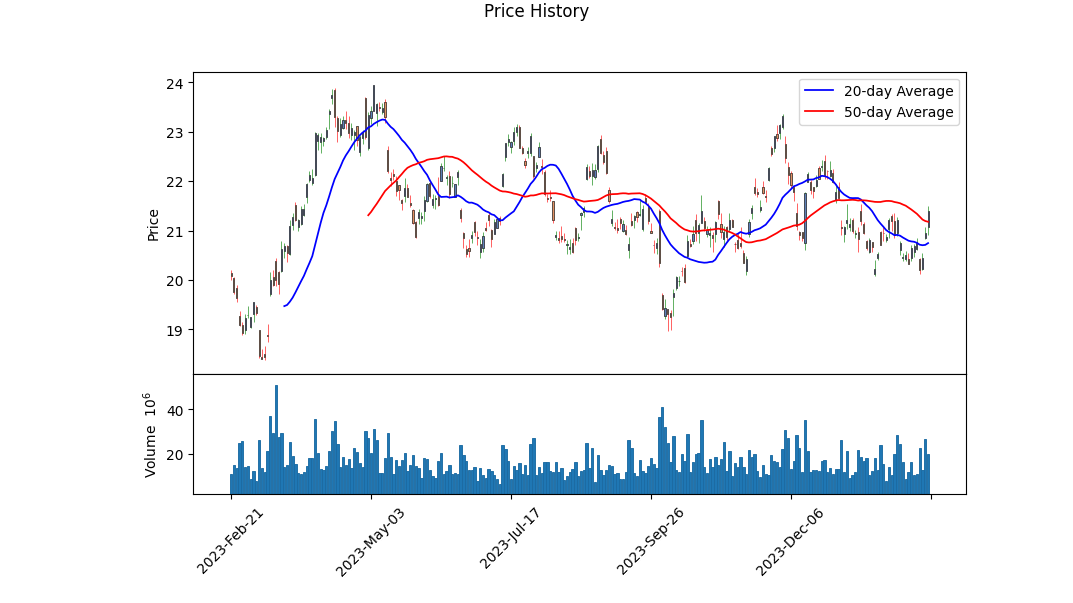

In the latter months spanning from October 2023 to February 2024, SLV exhibited a range of movements with the Open price fluctuating but ultimately showing a slight uptrend in the most recent day of trading. The movement in On-Balance Volume (OBV) from positive to more deeply negative territory during this same period suggests that volume is following the price downwards, typically a bearish indicator. However, a positive uptick in the Moving Average Convergence Divergence (MACD) histogram in the latest entries indicates a potential shift towards a bullish momentum.

Fundamentally, SLV's structure as an Exchange Traded Fund (ETF) tied directly to the price of silver means its performance is heavily reliant on silver market conditions. The financials reveal a robust net asset value of around $10.13B, with a slightly negative Year-to-Date (YTD) return. This snapshot signals that while the fund has sizably managed assets, it has faced recent pressures, possibly due to fluctuating silver prices.

Notably, the risk-adjusted performance metrics provide an additional layer of insight: - The Sharpe Ratio, while positive, represents a relatively low extra return for the taken risk. - The Sortino Ratio is much higher, indicating that the ETF has shown a better upside performance when considering the downside volatility an encouraging sign for risk-averse investors. - The Treynor and Calmar Ratios, though not exceptionally high, point to a reasonable expectation of reward per unit of risk and drawdown, respectively, which suggests moderate efficiency in navigating the market's ups and downs.

Given these observations, the outlook for SLV over the following months suggests cautious optimism. The positive momentum hinted at by the technical indicators, such as the improving MACD, might provide short-term trading opportunities. However, the underlying volatility in silver prices and the ETF's recent struggle to yield substantial positive returns year-to-date necessitate a careful strategy.

Investors should monitor global economic indicators, currency movements (especially USD, as the trust's currency), and silver demand in industrial applications. Political and economic uncertainties, inflationary pressures, and changes in monetary policy can significantly impact silver prices, and by extension, SLV's performance.

In conclusion, while there are technical signals of potential upside, the inherent volatility in commodities and external economic factors warrant a balanced approach. Investors may find opportunities in SLV but should be prepared for the possible fluctuations and incorporate these dynamics into their broader investment strategies.

In our analysis of the iShares Silver Trust (SLV), an essential tool in implementing the principles outlined in "The Little Book That Still Beats the Market," we encountered a unique scenario. The primary investment strategy discussed in the book, focusing on Return on Capital (ROC) and Earnings Yield as critical indicators for stock selection, doesn't directly translate to SLV. This is because SLV is not a traditional corporation with operational capital and earnings, but rather a commodity exchange-traded fund (ETF) that aims to track the price performance of silver.

SLV's financial metrics such as ROC and Earnings Yield, as typically calculated for companies, are not applicable in this case. Unlike companies that generate profits through operational activities yielding returns on capital or through earnings relative to their stock price, SLV's value is derived directly from the current market value of silver it holds. Thus, when assessing SLV's investment potential through the lens of "The Little Book That Still Beats the Market," it's crucial to understand that its performance is tied to silver prices and not to the traditional financial metrics like ROC or Earnings Yield used to evaluate companies. For investors interested in SLV, the focus would instead be on the market dynamics and outlook for silver, rather than the corporate metrics the book emphasizes for stock selection.

| Statistic Name | Statistic Value |

| R-squared | 0.068 |

| Adj. R-squared | 0.067 |

| F-statistic | 91.88 |

| Prob (F-statistic) | 4.74e-21 |

| No. Observations | 1,257 |

| AIC | 5,095 |

| BIC | 5,105 |

| Constant (Alpha) | 0.020758722097862805 |

| Beta | 0.3765197781962821 |

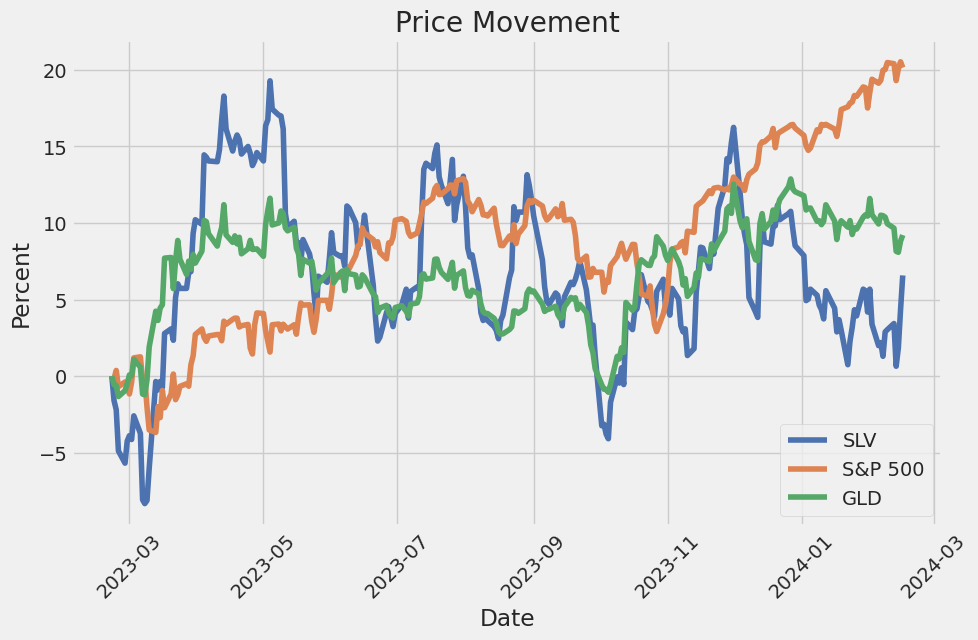

The linear regression model illustrating the relationship between SLV (iShares Silver Trust) and SPY (SPDR S&P 500 ETF Trust) within the defined period shows a notable but relatively weak positive correlation between the two assets. The coefficient of determination, R-squared, stands at 0.068, indicating that only 6.8% of the variability in SLV returns can be explained by changes in the SPY returns. This suggests that while there is some degree of linear association between market movements (represented by SPY) and SLV returns, a significant portion of SLV's price movements is influenced by other factors not captured by this model. The alpha value (constant term) in the model is approximately 0.0208, highlighting a small positive return for SLV that is independent of SPY's performance. This could suggest that SLV has the potential to offer a slight positive return even in scenarios where the broader market does not provide a substantial influence.

Furthermore, the estimated beta value for the model is around 0.3765, reflecting SLV's sensitivity to SPY's movements. A beta value less than 1 signifies that SLV is less volatile compared to the overall market. This implies that for every 1% movement in the SPY, SLV is expected to move by about 0.376%, holding other factors constant. The low sensitivity indicated by beta aligns with the understanding that, although correlated, SLV performance is not heavily dependent on SPY movements. The alpha of approximately 0.0208 further emphasizes SLV's capability to generate a minimal positive performance irrespective of market influences, thereby offering diversification benefits within a broader investment portfolio.

The iShares Silver Trust (SLV), according to its 10-Q filing for the quarter ended September 30, 2023, provides a detailed snapshot of its financial and operational status. The Trust, organized under New York law and managed by the Bank of New York Mellon as trustee, is designed to offer investors a means of participating in the silver market without the necessity of directly investing in physical silver. The main asset of the Trust consists of silver bullion, and the Trust's goal is to reflect the performance of the price of silver, less the Trust's expenses and liabilities.

As of September 30, 2023, the Trust's assets primarily consist of investments in silver bullion valued at $10,196,458,655, a decrease from the $11,164,718,926 reported at the end of the previous year, 2022. This reduction in asset value is reflective of both a change in the fair market value of silver and fluctuations in the amount of silver bullion held. The net assets of the Trust also saw a decrease, ending the quarter at $10,192,205,639 compared to $11,160,084,971 at the end of 2022. This change is attributable to operational activities and the redemption of shares during the period.

During the quarter, the Trust recorded net investment losses alongside realized and unrealized gains from operations. Specifically, net investment losses amounted to $13,376,846 for the quarter, while net realized and unrealized gains summed up to a positive change, thereby illustrating the dynamic nature of the Trust's valuations in response to the silver market's performance. It's important to note that these financial metrics are essential in understanding the performance and operational effectiveness of the Trust in achieving its investment objectives.

Operation-wise, the Trust continues to issue and redeem shares based on the demands of the market. For the quarter ended September 30, 2023, significant share transactions occurred, reflecting investor participation and interest in the silver market via the Trust. Furthermore, the Trust's operations are streamlined such that there are no direct employees, with primary administrative functions being carried out by the Trustee and managed under the oversight of the Sponsor, iShares Delaware Trust Sponsor LLC.

In summary, the iShares Silver Trust's 10-Q filing for the quarter ending September 30, 2023, presents a comprehensive overview of the Trust's financial health, operational activities, and market participation. Despite fluctuations in silver prices and associated market dynamics, the Trust continues to offer investors a vehicle for silver investment. The Trust's performance is directly influenced by the market conditions for silver, and it remains a pivotal player for investors looking to hedge or directly invest in silver without physical ownership.

The iShares Silver Trust (SLV), a prominently recognized exchange-traded fund (ETF), has become a focal point for investors looking to leverage the investment and industrial facets of silver. In a recent discussion on "Fast Money," Carter Braxton Worth highlighted silver's commendable performance over a week, notably outstripping gold, casting a spotlight on its allure as a hedge against inflation and economic uncertainty. As a tangible asset and an industrial metal, silver's unique dual appeal positions it as a strategic investment choice, particularly in periods marked by volatility and uncertainty, which has become increasingly common in the tech-heavy market landscape.

In the context of a broader discussion on investment strategies that spanned various sectors and asset classes, the nod towards the iShares Silver Trust suggests a thoughtful pivot towards commodities. This move could arguably be perceived as a method for portfolio diversification or as a safer haven amidst a tumultuous investment climate. Commodities, by their nature, often exhibit a cyclical pattern and tend to have an inverse relationship with the US dollar, making them an intriguing option for hedging against currency devaluation, and betting on rising metal prices propelled by increased industrial demand or inflationary pressures.

At this juncture, it is pertinent to delve into the operational dynamics, market positioning, and recent performance trends associated with the iShares Silver Trust. The primary investment strategy of the Trust entails the direct acquisition of silver bullion, a methodology that accentuates transparency and simplicity, thereby attracting investors keen on silver. Nonetheless, it is crucial to recognize the challenges faced by the Trust, especially concerning the storage and insurance costs of the physical silver, which could potentially impact its overall performance.

| company | symbol | percent |

|---|---|---|

| Silver | N/A | 100 |

The intricacies governing the performance of the iShares Silver Trust pivot significantly on global economic currents. Typically, silver witnesses a surge in demand during bouts of economic instability or when inflationary pressures mount, enhancing the Trust's value proposition. However, it's imperative to understand that silver's application extends beyond mere investment allure, encapsulating significant industrial utility, especially within the burgeoning sectors of electronics and renewable energy.

Jerome Powell's comments and the Federal Reserve's fiscal maneuvers possess the capacity to substantially sway investor sentiment, particularly within the commodities sector, including silver. An analysis derived from Seeking Alpha sheds light on the implications of Powell's statements for various investment domains. The dynamics of Federal Reserve policies, particularly those affecting interest rates, play a pivotal role in shaping the investment narrative around commodities like silver, integral to the iShares Silver Trust's market strategy.

Exploring the broader precincts of the precious metals market, a nuanced analysis unveils the multifaceted outlook for silver, marked by an intriguing confluence of economic and industrial trends. According to insights articulated by VanEck and an ETF Trends report, while traditional precious metals like gold have experienced a wavering stance, silver's domain has been marked by robust industrial demand, particularly from the photovoltaics sector. This scenario elucidates the burgeoning industrial appetite for silver, contrasted against a backdrop of its investment dynamics.

Conclusively, the iShares Silver Trust embodies a potent instrument for investors navigating the silver market's complexity. Reflecting upon Jerome Powell's fiscal policies, the broader economic indicators, and industrial demand for silver - especially in renewable energy applications - sketches a compelling landscape for the Trust. As the global economy transitions, with renewable energy at the forefront, the iShares Silver Trust's performance and investment allure are poised both for challenges and remarkable opportunities, underscoring the encompassing significance of understanding macroeconomic and sector-specific dynamics.

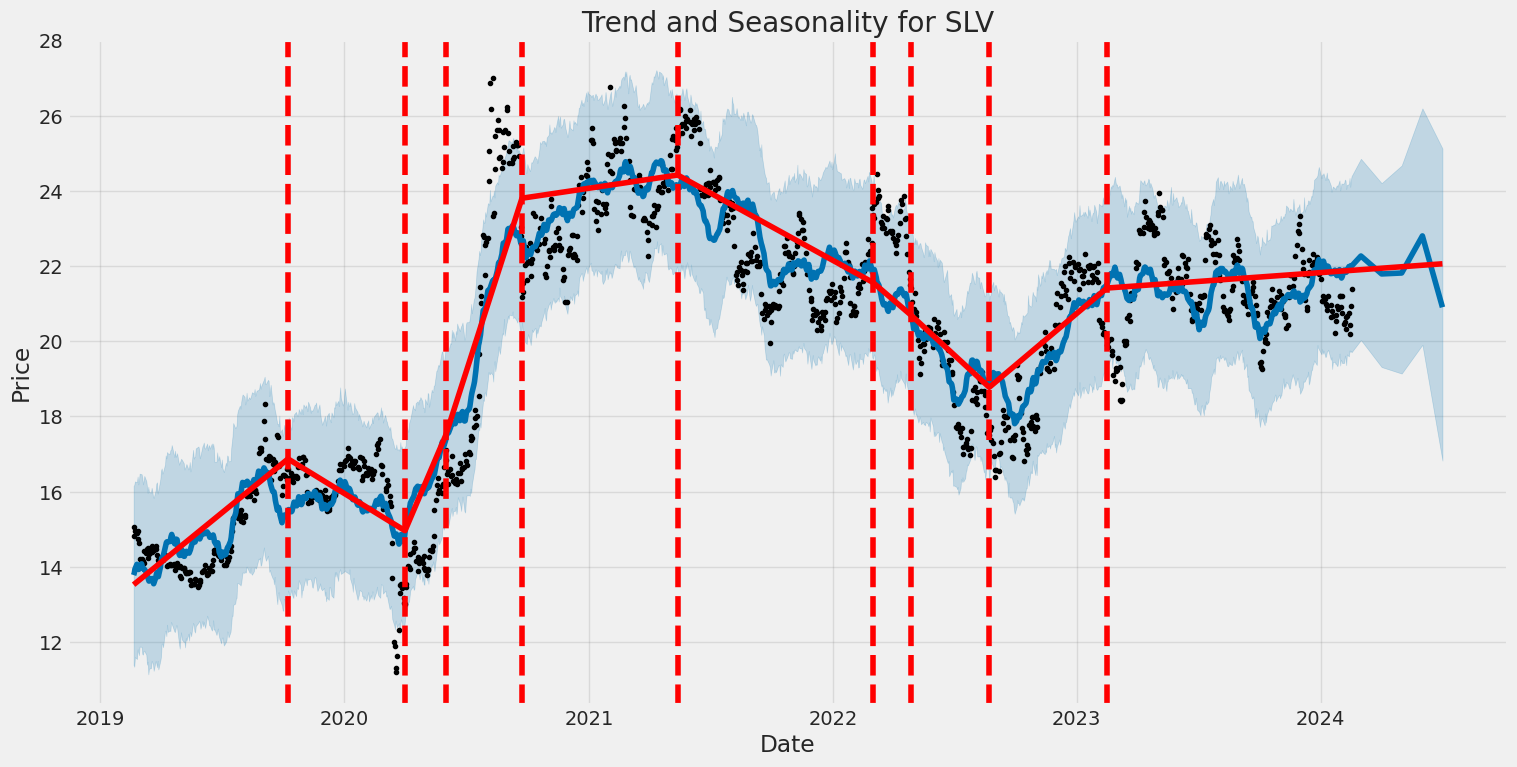

The iShares Silver Trust (SLV) experienced a level of volatility that can be summarized by its ARCH model results. Firstly, the model indicates no predictable pattern in the asset's returns over the observed period, with an R-squared value close to zero. Secondly, the volatility seems to be significantly present, as suggested by the model's omega value of approximately 2.97, indicating consistent fluctuations. Lastly, the alpha value of around 0.18 denotes that past volatility impacts current volatility to a certain extent, highlighting a degree of volatility clustering over the time.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2561.41 |

| AIC | 5126.81 |

| BIC | 5137.09 |

| No. Observations | 1257 |

| omega | 2.9673 |

| alpha[1] | 0.1817 |

To assess the financial risk associated with a $10,000 investment in iShares Silver Trust (SLV), this analysis integrates volatility modeling and machine learning predictions, specifically aiming to quantify potential losses through a detailed examination of stock volatility and predictive analytics.

Volatility Modeling Application: The volatility modeling method is deployed to capture the dynamic nature of the iShares Silver Trust's stock volatility. By understanding the systemic fluctuations in the price of the trust, which primarily invests in silver and thus reflects the metal's price movements, this approach helps in identifying patterns of variance over time. This is crucial because the trust's value can be significantly affected by the volatile nature of silver prices, influenced by factors like changes in supply and demand, geopolitical tensions, and macroeconomic indicators. By fitting this model to the historical price data, we can forecast future volatility, enabling us to estimate the range of potential price movements over the next year.

Machine Learning Predictions Role: The role of machine learning predictions, via a tree-based method, is to analyze historical data and recognize patterns that may not be apparent or are too complex for traditional statistical methods. This approach takes into account multiple variables that could influence the returns of the iShares Silver Trust, offering a forward-looking perspective on potential investment outcomes. By training the model with historical price and volatility data, it can predict future returns, providing a valuable tool for understanding expected investment performance and its variability.

Results Analysis with Value at Risk (VaR): The calculated Annual Value at Risk (VaR) at a 95% confidence interval for the $10,000 investment is $255.60. This metric is pivotal in understanding the investment's potential risk, as it estimates that there is only a 5% chance that the investment will lose more than $255.60 over the next year. This calculation, stemming from the integrated approach of volatility modeling and machine learning forecasts, provides a quantified risk assessment that is essential for making informed investment decisions. The VaR figure is particularly useful for investors seeking to gauge the potential downside of their investment in the volatile silver market, offering a clear view of the maximum expected loss within a given confidence interval.

Comprehensive Risk Overview: This analysis, through the synthesized application of volatility modeling to ascertain the trust's stock volatility, and machine learning predictions to forecast future returns, offers a detailed examination of the financial risk associated with investing in iShares Silver Trust. The employment of these advanced analytical techniques provides a nuanced understanding of both the variability of returns and the potential for future earnings, which is crucial for comprehensively evaluating the risks present in equity investment, especially in commodities like silver with inherent price volatility.

Analyzing the available options chain for iShares Silver Trust (SLV), we notice some intriguing opportunities across various strike prices and expiration dates. To identify the most profitable options, we focus on key Greeks such as Delta, Vega, and Theta, considering our target stock price is to increase by 5% from its current level.

Starting with shorter-term opportunities, we notice an option with a strike price of $20.5, expiring on February 23, 2024. This option has a delta of 0.9201688778, suggesting a strong positive correlation with the underlying asset price movements. Additionally, its vega of 0.2878347915 indicates moderate sensitivity to implied volatility changes, which could be advantageous given the right market conditions. Moreover, a relatively low theta value of -0.0185110942 points towards minimal time decay, making it an attractive option for short-term speculation, given its high Return on Investment (ROI) of 1.0845744681 and a profit of 1.0195.

For those with a medium-term outlook, an interesting option is the one with a strike price of $17.0, expiring on March 1, 2024. This option presents a delta of 0.979426849, showing a strong alignment with the SLV price movements. Its vega, at 0.1755799477, and a theta of -0.0081167241, suggest this option could benefit from volatility while suffering less from time decay compared to shorter-term options. It also offers a solid ROI of 0.3682957393 and a profit of 1.4695.

For long-term investors willing to hold positions for over a year, the option with a strike price of $15.0, expiring on May 17, 2024, stands out. It shows a delta of 0.9327476471, indicating high responsiveness to the underlying asset's price change. The vega of 1.3416201909 reveals a substantial sensitivity to volatility changes, potentially offering significant gains if volatility spikes. Moreover, its relatively mild theta of -0.0057607259 points towards a slower rate of time degradation. This option promises a ROI of 0.1302272727 and a profit of 0.8595.

Therefore, for those with a short-term investment horizon, the option expiring on February 23, 2024, at a strike of $20.5 could be highly profitable if the underlying asset behaves as anticipated. Medium-term investors might find the option expiring on March 1, 2024, at a strike of $17.0, more appealing due to its balance between responsiveness to the SLV price and sensitivity to volatility, coupled with lower time decay. Lastly, for long-term investors, the option expiring on May 17, 2024, at a strike of $15.0 combines high delta and vega with manageable theta decay, offering a promising opportunity for those willing to bet on volatility and directional movement over a more extended period.

Similar Companies in Investment Trusts/Mutual Funds:

Report: SPDR Gold Shares (GLD), SPDR Gold Shares (GLD), VanEck Gold Miners ETF (GDX), United States Oil Fund, LP (USO), iShares Gold Trust (IAU), VanEck Junior Gold Miners ETF (GDXJ), Aberdeen Standard Physical Silver Shares ETF (SIVR), Global X Silver Miners ETF (SIL), iShares MSCI Global Silver and Metals Miners ETF (SLVP), ProShares Ultra Silver (AGQ), Silvercorp Metals Inc. (SVM), First Majestic Silver Corp. (AG), Pan American Silver Corp. (PAAS), Wheaton Precious Metals Corp. (WPM)

https://seekingalpha.com/article/4663690-the-more-it-drops-the-more-i-buy

https://www.youtube.com/watch?v=7ZJ0ZjhdTpA

https://seekingalpha.com/article/4666510-january-2024-key-etf-performance

https://seekingalpha.com/article/4669008-jerome-powell-just-gave-dividend-investors-huge-gift

https://www.etftrends.com/tactical-allocation-channel/silvers-golden-outlook/

https://www.sec.gov/Archives/edgar/data/1330568/000143774923030198/slv20230930_10q.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: uI2PYt

Cost: $0.32853

https://reports.tinycomputers.io/SLV/SLV-2024-02-19.html Home