Synopsys, Inc. (ticker: SNPS)

2024-03-25

Synopsys, Inc. (ticker: SNPS) stands as a pivotal player in the realm of electronic design automation (EDA) and semiconductor IP. The company, headquartered in Mountain View, California, has established itself as an essential resource for engineers and designers in the semiconductor industry, providing state-of-the-art software, IP, and services for the design and manufacturing of complex integrated circuits. With an extensive product portfolio that spans from advanced system-level solutions to verification tools and IP integration, Synopsys aids in expediting innovation and optimizing performance in the digital age. The firm's offerings are crucial in enabling the development of high-performance computing chips, mobile devices, automotive systems, and in securing IoT devices. As technology scales new heights and the demand for more sophisticated electronics grows, Synopsys's role in shaping the future of semiconductor design and manufacturing becomes increasingly significant. This, coupled with its financial performance and strategic acquisitions, underpins its vital presence in the global technology landscape, making it a subject of interest for investors, industry analysts, and technology enthusiasts alike.

Synopsys, Inc. (ticker: SNPS) stands as a pivotal player in the realm of electronic design automation (EDA) and semiconductor IP. The company, headquartered in Mountain View, California, has established itself as an essential resource for engineers and designers in the semiconductor industry, providing state-of-the-art software, IP, and services for the design and manufacturing of complex integrated circuits. With an extensive product portfolio that spans from advanced system-level solutions to verification tools and IP integration, Synopsys aids in expediting innovation and optimizing performance in the digital age. The firm's offerings are crucial in enabling the development of high-performance computing chips, mobile devices, automotive systems, and in securing IoT devices. As technology scales new heights and the demand for more sophisticated electronics grows, Synopsys's role in shaping the future of semiconductor design and manufacturing becomes increasingly significant. This, coupled with its financial performance and strategic acquisitions, underpins its vital presence in the global technology landscape, making it a subject of interest for investors, industry analysts, and technology enthusiasts alike.

| Address | 675 Almanor Avenue | City | Sunnyvale | State | CA |

| Zip | 94085 | Country | United States | Phone | 650-584-5000 |

| Fax | 650-584-8637 | Website | https://www.synopsys.com | Industry | Software - Infrastructure |

| Sector | Technology | Full Time Employees | 20,300 | Year Founded | 1986 |

| CEO Name | Mr. Sassine Ghazi | CEO Pay | $2,537,750 | Previous Close | 594.20 |

| Market Cap | $89,134,514,176 | Volume | 1,327,483 | Average Volume | 1,338,839 |

| Average Volume 10 Days | 1,108,730 | Beta | 1.064 | Trailing PE | 64.71 |

| Forward PE | 40.52 | FiftyTwo Week Low | 360.37 | FiftyTwo Week High | 629.38 |

| Price To Sales Trailing 12 Months | 14.54 | Enterprise Value | $90,073,620,480 | Profit Margins | 22.958% |

| Book Value | 43.734 | Price To Book | 13.36 | Net Income To Common | $1,407,463,936 |

| Trailing Eps | 9.03 | Forward Eps | 14.42 | Earnings Quarterly Growth | 654% |

| Total Cash | $1,273,433,984 | Ebitda | $1,584,184,064 | Total Debt | $669,960,000 |

| Revenue Per Share | 40.3 | Return On Assets | 8.753% | Return On Equity | 22.538% |

| Free Cash Flow | $1,125,314,560 | Operating Cash Flow | $1,500,733,056 | Revenue Growth | 21.1% |

| Statistic Name | Statistic Value | Statistic Name | Statistic Value |

| Sharpe Ratio | 1.5176600585806383 | Sortino Ratio | 27.213310310631826 |

| Treynor Ratio | 0.2984484174292528 | Calmar Ratio | 3.8546926958416976 |

Analyzing SNPS through its technical, fundamental, and balance sheet data provides a comprehensive view of its potential future movements in the market.

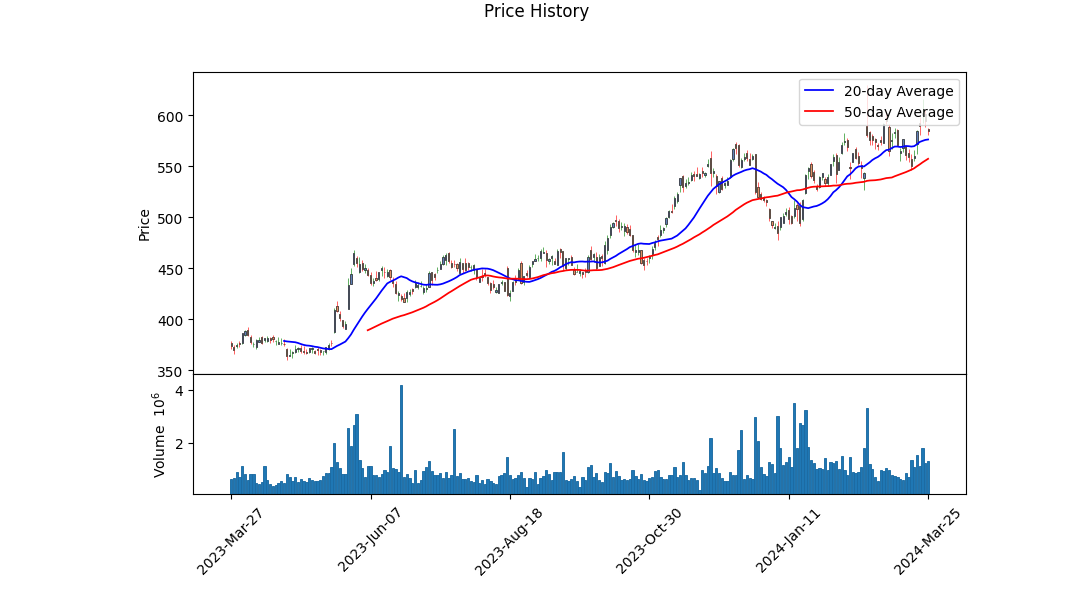

Technical Analysis Insights

The technical indicators reveal a bullish trajectory for SNPS in the recent months, noted by a positive uptick in MACD figures, indicating momentum building up towards the end. An increasing On-Balance Volume (OBV) showcases growing investor interest in the stock, suggestive of a healthy uptrend.

Fundamental Analysis Insights

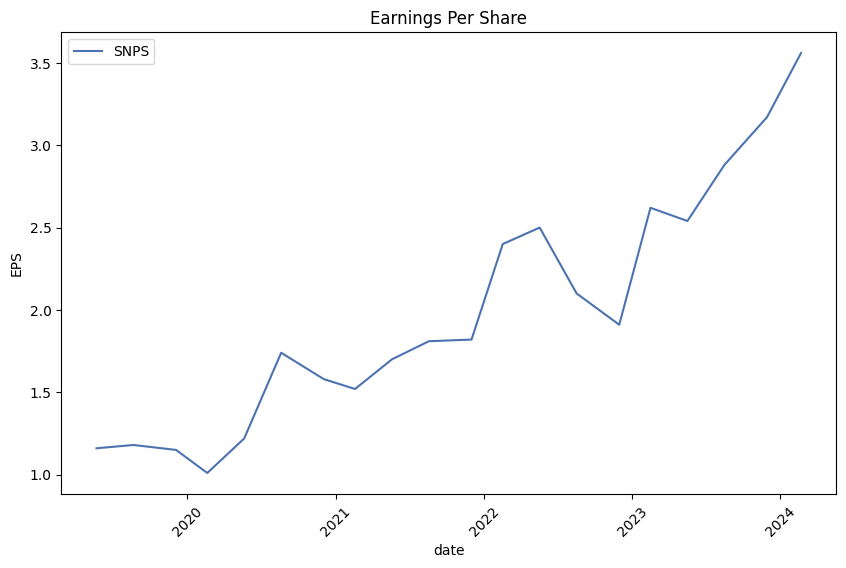

Upon examining the key financial aspects, its noticeable that SNPS has robust gross margins and a positive operating margin, indicating strong operational efficiency and profitability. The consistent growth in earnings, reflected by the Earnings per Share (EPS) estimates and actuals indicating upward revisions, suggests that the company has been outperforming analyst expectations. These positive fundamentals point towards an inherent strength in the companys business model and its potential for sustainable growth.

The financial ratios, including high Altman Z and Piotroski scores, underscore the company's strong financial health and managerial effectiveness. These metrics provide investors with reassurance regarding the minimal risk of financial distress and the solid foundation for future growth.

Risk-Adjusted Performance Measures

The high Sharpe, Sortino, Treynor, and Calmar ratios, significantly above typical benchmarks, emphasize the appealing risk-adjusted returns of SNPS. Such attractive ratios are indicative of the stock providing superior returns per unit of total, downside, and market-related risk, respectively. These measures, particularly the exceptionally high Sortino ratio, suggest that the stock's positive performance overshadows its downside volatility, making it a compelling choice for risk-averse investors.

Financial and Balance Sheet Health

The financial statements reflect a company that's growing its free cash flow significantly, implying greater liquidity and capacity for reinvestment and shareholder returns. With a steady increase in operating income and a well-controlled cost of revenue, SNPS demonstrates operational leverage and scalability.

Market Sentiment and Analyst Expectations

Market sentiment is strongly positive, with revenue and earnings estimates for the next year illustrating confidence in the company's path to growth. Analyst expectations point towards continued EPS growth, bolstering the sentiment that SNPS could achieve even higher valuation multiples moving forward.

Conclusion

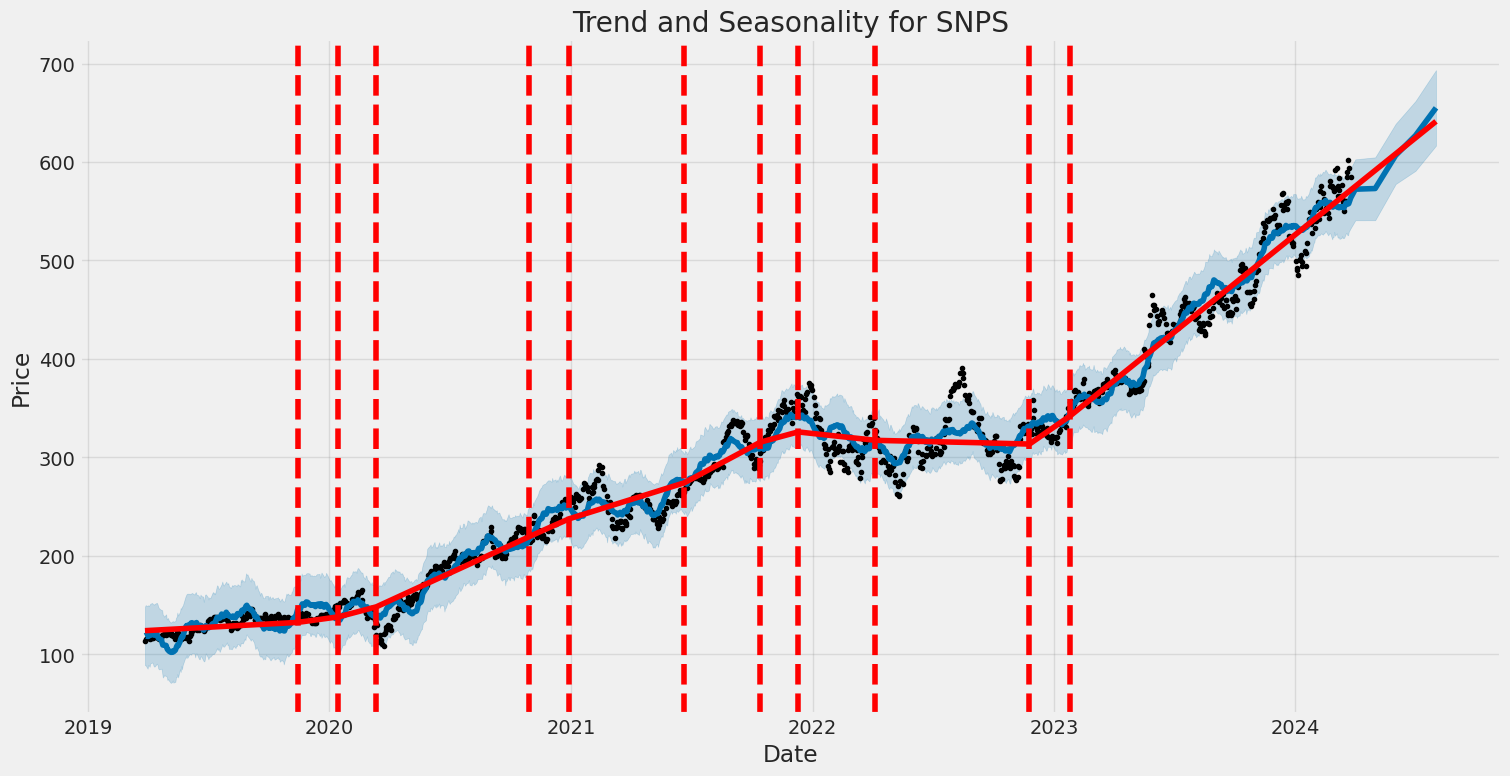

Considering the convergence of strong technical signals, solid fundamental performance, and healthy financials, SNPS is projected to continue its upward trajectory in the coming months. The alignment of internal efficiency metrics and external market conditions places SNPS in a promising position for future price appreciation. Investors might view the current state as an opportune point for entry, with expectations of robust performance in both the short and medium-term horizons.

In the assessment of Synopsys, Inc. (SNPS) through the lens of Joel Greenblatt's principles outlined in "The Little Book That Still Beats the Market," two essential metrics emerge: Return on Capital (ROC) and Earnings Yield. Synopsys exhibits a robust Return on Capital (ROC) of approximately 19.37%, signaling the companys effective use of its capital in generating profits. This high ROC indicates not only a strong management team but also a business model that can efficiently translate investments into profitable outcomes, positioning Synopsys as a potentially attractive investment when considering companies that generate high returns on their capital investments.

On the other hand, Synopsys presents an Earnings Yield of about 1.37%, which is derived by inverting the traditional Price-to-Earnings (P/E) ratio. Although at a glance, this percentage might seem modest, especially when compared to higher yielding assets or investments, the Earnings Yield is a critical component to evaluate in conjunction with the ROC. The Earnings Yield helps investors understand the relative earnings generated for the price paid, with Synopsys's figures suggesting a tighter margin of earnings relative to the company's current share price. This aspect suggests that while the company operates efficiently and profitably, the current market pricing might reflect a premium on its earnings capacity.

When synthesizing both metrics for Synopsys, Inc., investors are provided with a nuanced view: the company efficiently converts its capital into profits, an appealing attribute, but the current valuation in terms of its earnings yield suggests that the stock might not be undervalued by the market. Such an analysis is vital for clients considering investment opportunities, aligning with Greenblatt's investment philosophy that emphasizes both a high return on capital and an attractive earnings yield to identify undervalued stocks with excellent business performances.

Based on the information you provided and analyzing it against Benjamin Graham's investment criteria, let's examine how Synopsys, Inc. (SNPS) measures up to Graham's principles.

Margin of Safety

Given its price-to-earnings (P/E) ratio of 90.312, Synopsys, Inc. appears to be significantly higher than the majority of the industry averages provided, suggesting it might not meet Grahams criterion of buying at a significant discount to intrinsic value. Graham's investment philosophy emphasizes the importance of the margin of safety, which typically involves investing in securities priced well below their intrinsic values. The high P/E ratio indicates a premium pricing for SNPS, potentially offering a smaller margin of safety than Graham would prefer.

Debt-to-Equity Ratio

SNPS has a debt-to-equity ratio of 0.1119, indicating a low reliance on debt for financing its operations. This aligns well with Graham's preference for companies with low debt levels, suggesting financial stability and lower financial risk.

Current and Quick Ratios

With both the current ratio and quick ratio at 1.149, SNPS demonstrates an ability to cover its short-term liabilities with its short-term assets. Graham favored companies with strong liquidity positions, and in this case, SNPS seems to exhibit a decent level of financial health, though Graham typically looked for a current ratio above 1.5.

Earnings Growth

While specific earnings growth information for SNPS over the years isnt provided here, Graham looked for companies that showed consistent earnings growth over several years. Any evaluation of SNPS against this criterion would require historical earnings data for a comprehensive assessment.

Price-to-Earnings (P/E) Ratio

SNPSs P/E ratio of 90.312 is substantially higher than the traditional Graham standards. Graham often preferred P/E ratios that were no higher than 15, as he believed this indicated a stock was reasonably priced relative to its earnings. SNPS's high P/E ratio may suggest it is overvalued from a Graham perspective, especially when comparing it to various industry P/E ratios listed.

Price-to-Book (P/B) Ratio

The P/B ratio of SNPS is 8.626, which indicates the stock is trading at a significant premium to its book value. Graham typically looked for P/B ratios of no more than 1.5 to identify undervalued stocks, suggesting that SNPSs market pricing may be too high compared to its book value for Graham's liking.

Conclusion

While Synopsys, Inc. displays favorable debt-to-equity, current, and quick ratios indicating financial stability, its high P/E and P/B ratios suggest it is priced at a premium far exceeding Benjamin Grahams criteria for value investing. According to Grahams principles, SNPS would likely not be considered an attractive investment due to its high valuation metrics implying a limited margin of safety. Investors following Grahams philosophy might seek opportunities where the market price is significantly below intrinsic value, offering a larger margin of safety and better protection against permanent loss of capital.Analyzing Financial Statements: Investors meticulously scrutinize a company's financial documents to make informed decisions. Understanding the balance sheets, income statements, and cash flow statements is pivotal for grasping a firm's financial health. Graham emphasizes the significance of evaluating a company's assets, liabilities, earnings, and cash flows.

SYNOPSYS, INC. Financial Overview (FY 2021)

Cash and Cash Equivalents

- 2021: $1,432,840,000

- Variation: Increase from the previous year.

Revenue

- 2021: $4,204,193,000

- Demonstrates a strong revenue stream indicative of robust business operations.

Net Income

- 2021: $1,455,900 (Adjustment for Non-Controlling Interest)

- Indicates a profit, demonstrating the company's ability to earn more than its total expenses.

Research and Development Expenses

- 2021: $1,504,823,000

- Emphasizes the company's commitment to innovation and staying at the forefront of technology.

Total Assets

- Before 2021: $8,485,906,000

- Showcases a substantial asset base supporting company operations and future growth.

Share-Based Compensation

- 2021: $248,530,000

- Highlights the companys use of stock options and awards as a part of compensation, which can align employees interests with shareholders.

Debt

- A combination of current and non-current debt totaling $99,812,000 indicates the company has leveraged to fuel its growth. Maintaining a manageable debt level relative to assets and equity is key to financial stability.

Contract with Customer Liability

- 2021: $1,642,015,000

- This liability entry often indicates deferred revenue, representing a commitment to deliver products or services in the future. It's a critical factor for assessing future cash flows.

Observations and Recommendations:

-

Revenue Growth: Synopsys shows consistent revenue growth, marking a solid position in its market. Investors should consider this as a positive indicator of the companys performance and future prospects.

-

R&D Investment: The significant investment in R&D suggests Synopsys is focusing on long-term innovation. This strategy is commendable, yet investors should watch for how these investments translate into marketable products and revenue.

-

Debt Management: While the company carries debt, it's crucial to compare this against its asset base and cash flows. A more detailed analysis of its debt-to-equity ratio and interest coverage ratio would provide insights into financial health and operational risks.

-

Share-Based Compensation: The substantial amount allocated for share-based compensation indicates a strategy to attract and retain talent. However, investors should consider the potential dilution effect on shareholder value.

Conclusion

SYNOPSYS, INC. presents a solid financial standing as illustrated by its consistent revenue growth, substantial investments in R&D, and a healthy asset base. Careful analysis of its debt levels and share-based compensation strategy is advised to assess long-term sustainability. Investors seeking growth and innovation in the technology sector might find SYNOPSYS an appealing addition to their portfolio, given careful consideration to potential risks.Dividend Record: Graham, in his classic investing guide "The Intelligent Investor," emphasized the importance of dividend consistency when evaluating potential stock investments. According to his principles, companies that have maintained a stable and consistent dividend payout over a significant period are generally considered to be financially healthier and more stable. This consistent dividend record is seen as an indicator of the companys ability to generate earnings reliably, which, in turn, suggests a degree of safety for the investor.

The provided information indicates a company symbol "SNPS," but lacks historical dividend data ('historical': []). For investors adhering to Benjamin Graham's principles, the absence of concrete historical dividend information would make it difficult to assess the company's alignment with Graham's criterion of a consistent dividend record. Investors, especially those following Grahams value investing philosophy, would typically seek to review a comprehensive history of dividends paid by the company to evaluate its stability and predictability of earnings, which are key factors in determining the attractiveness of the stock for investment.

For a rigorous application of Graham's principles, it would be necessary to obtain detailed historical dividend data for SNPS. This data would include the frequency and amount of dividends paid over a considerable period, ideally spanning multiple years. Such data would allow investors to assess the consistency and reliability of the company's dividend payments, an essential aspect of the investment evaluation process as outlined by Benjamin Graham.

| Statistic Name | Statistic Value |

| Alpha | 0.0768 |

| Beta | 1.2201 |

| R-squared | 0.532 |

| Adj. R-squared | 0.532 |

| F-statistic | 1428 |

| Prob (F-statistic) | 3.07e-209 |

| Log-Likelihood | -2297.2 |

| No. Observations | 1256 |

| AIC | 4598 |

| BIC | 4609 |

The linear regression model between SNPS and SPY exhibits a significant relationship, as indicated by the analysis for the period ending today. Alpha, the model's intercept term, stands at 0.0768. This figure represents the expected return on the SNPS when the SPY return is zero, suggesting a slight positive expected return independent of the market's movement. Given the coefficient (beta) of 1.2201, there is a proportional relationship between the movements of SNPS and SPY, wherein a 1% return on SPY is associated with an approximate 1.22% return on SNPS, highlighting SNPS's sensitivity and correlation to the overall market.

The model's R-squared value of 0.532 indicates that approximately 53.2% of the variance in the SNPS can be explained by SPY, showcasing a moderate level of predictability from SPY's movements. This moderate correlation suggests that while a significant portion of SNPS's movements can be attributed to the overall market trends represented by SPY, there's still a substantial variance that could be influenced by factors specific to SNPS or sectors it operates within. Given the statistically significant F-statistic and its corresponding low probability, the relationship between SNPS and SPY during the analyzed period is unlikely to have arisen by chance, reinforcing the models' reliability and the importance of market factors in explaining SNPS's movements.

Synopsys, Inc. held its First Quarter Fiscal Year 2024 Earnings Conference Call, outlining strong financial results and future prospects. President and CEO Sassine Ghazi led the briefing, emphasizing significant revenue growth and surpassing non-GAAP EPS expectations. The company's revenue reached $1.65 billion, marking a 21% increase year-over-year, with a notable non-GAAP operating margin improvement. This positive trend underscores Synopsys's continuous focus on strategic business operations for long-term financial success, supported by a robust 17% revenue CAGR over the last three years, an augmented non-GAAP operating margin, and notable non-GAAP EPS growth.

In discussing market trends, Ghazi highlighted the emergence of pervasive intelligence driven by AI, silicon proliferation, and software-defined systems. These trends are propelling demand for enhanced compute capabilities, novel architectures, and innovative design methodologies. Despite challenges from complexity and cost to energy consumption and security, design starts are on the rise, indicative of an expanding semiconductor industry. As a leading silicon to system design solutions provider with top-tier EDA tools and a broad semiconductor IP portfolio, Synopsys is strategically positioned to capitalize on these industry shifts. The intended acquisition of Ansys was spotlighted as a strategic move to significantly expand the companys total addressable market and enhance its silicon to system strategy.

The conference call also included updates on Synopsys's segment highlights, starting with Design Automation. The company has continued to secure significant design win activities across its business segments, further solidifying its leadership in digital EDA. Competitive wins and industry firsts in advanced nodes underscore the critical role of Synopsys's technologies in cutting-edge chip design. Moreover, the discussion covered momentum within the analog mixed-signal customer base and the competitive differentiation offered by Synopsyss comprehensive EDA platform. The company's AI-driven platforms, such as synopsys.ai, were also emphasized for their role in optimizing customer outcomes and driving revenue uplifts.

Financial guidance for the coming periods reflects continued confidence in Synopsys's business model, with CFO Shelagh Glaser providing detailed financial metrics and expectations. The company anticipates solid revenue growth, operating margin improvements, and increased non-GAAP EPS, highlighting the stable and resilient nature of its business model amidst robust customer design activities. The reaffirmed financial projections and upward adjustments in non-GAAP EPS guidance signal strong business health and strategic positioning to leverage emerging market opportunities. The positive customer feedback on the pending Ansys acquisition and the forward-looking investments underscore Synopsyss commitment to addressing complex design challenges and driving innovation in the era of pervasive intelligence.

The first quarter of fiscal 2024 for Synopsys, Inc. (Synopsys) concluded on February 3, 2024, marking a 14-week period, as opposed to the typical 13-week period observed in the first quarter of the previous fiscal year. This additional week contributed approximately $70.5 million to the company's revenue and around $61.0 million to expenses, including an estimated $11.0 million in stock-based compensation costs. The revenue for the quarter reached $1.649 billion, a 21% increase compared to the same period last year, driven by growth across all products and geographies. This achievement underscores Synopsys' ability to adapt and thrive even amidst the uncertainties of the global macroeconomic environment.

The company observed a surge in costs, with a total cost of revenue and operating expenses amounting to $1.3 billion, marking a 17% increase. This was primarily due to a $135.9 million rise in employee-related costs stemming from headcount expansion through organic growth and acquisitions. Operating income also augmented to $359.6 million, evidencing a robust 41% escalation. Synopsys operates through three business segments: Design Automation, Design IP, and Software Integrity, each contributing uniquely to the company's revenue streams and growth mechanisms.

In January 2024, Synopsys announced a major strategic move with its decision to acquire Ansys, Inc., a deal valued at approximately $35.0 billion. This acquisition reflects Synopsys' ambitious expansion strategy and its commitment to enhancing its product portfolio and market reach. The transaction is expected to close in the first half of calendar year 2025, subject to customary closing conditions and regulatory approvals. This bold step is anticipated to enrich Synopsys' technological offerings and consolidate its position in the market.

During the quarter, Synopsys also grappled with the challenges posed by the volatile macroeconomic landscape, including increased global inflationary pressures, potential economic slowdowns, and geopolitical tensions. Despite these headwinds, Synopsys demonstrated resilience, mainly attributed to its business model and the stability it provides.

Furthermore, the company navigated through regulatory landscapes, particularly the U.S. export control regulations, and assessed their potential impact on business operations. Synopsys remains vigilant, monitoring developments closely, especially those related to trade restrictions and geopolitical conflicts that could affect its business operations and financial condition. These efforts encapsulate Synopsys' proactive and strategic approach to maintaining its market leadership and fostering sustainable growth amidst evolving global dynamics.

In the current technological landscape, marked by swift advancements and an increasing reliance on artificial intelligence (AI) and the Internet of Things (IoT), the significance of companies like Synopsys, Inc. (NASDAQ: SNPS) cannot be overstated. As a pioneer in electronic design automation (EDA) software, Synopsys plays an instrumental role in powering the innovation behind semiconductor design, which is at the heart of virtually all modern technology.

The semiconductor industry is undergoing a revolutionary phase, underscored by a burgeoning demand for more sophisticated and power-efficient chips. This demand is propelled by the rapid evolution of technology sectors, including AI and IoT, necessitating advanced semiconductor designs to manage their escalating complexities. Synopsys's suite of software tools facilitates this intricate design process, enabling the production of chips that are both cutting-edge and manufacturable.

A strategic partnership that has recently drawn significant attention is between Synopsys and NVIDIA, highlighting Synopsyss vital role in the semiconductor design and manufacturing domain. This collaboration is crucial for advancing semiconductor technologies that are the bedrock of AI applications, ranging from data centers to autonomous vehicles. Notably, Synopsys's contributions are not limited to NVIDIA but extend across the semiconductor industry, supporting a myriad of companies in navigating the challenges of chip production.

The importance of Synopsys in the semiconductor ecosystem was further illuminated during Nvidia's GTC event, where its collaborative efforts with Synopsys in accelerating chip design were spotlighted. Moreover, Synopsys's decision to divest its Software Integrity Group business reflects a strategic refocusing to bolster its core competencies amid robust industry growth, particularly in AI and automotive prototyping areas.

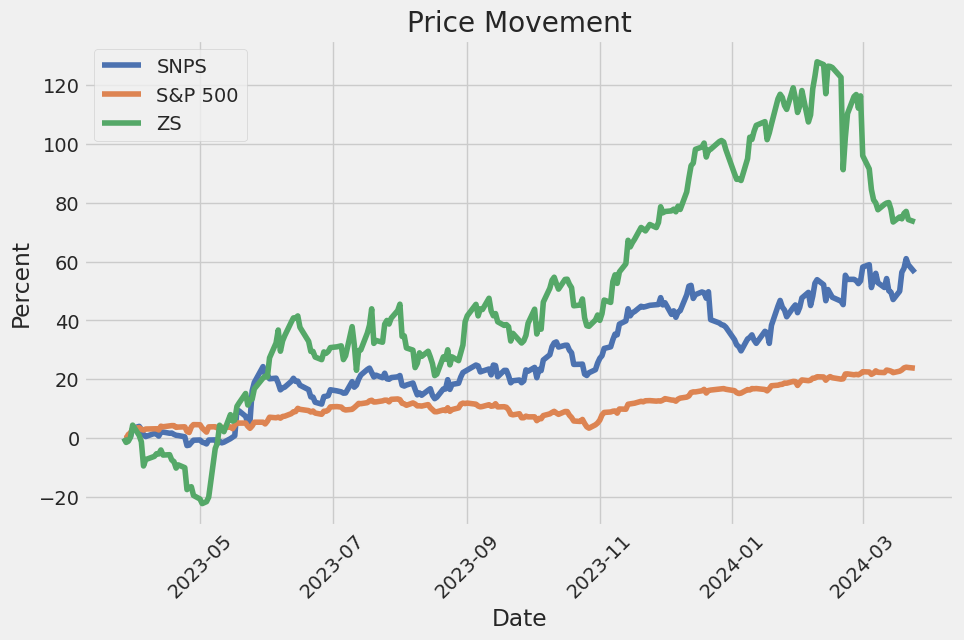

Financially, Synopsys has demonstrated substantial growth and vitality. Its stock performance, having rallied by around 70% over the past 12 months, underscores the market's recognition of Synopsys's growth potential and its pivotal position in the technology sector. This optimistic market sentiment is buoyed by Synopsys's compelling financial growth indicators, robust revenue generation capabilities, and a strategic position within the rapidly expanding semiconductor industry.

Analyses from industry experts, such as those featured on Fool.com and Seeking Alpha, have laid emphasis on Synopsyss consistent revenue growth, strategic partnerships, and acquisitions aimed at expanding its product portfolio and penetrating new market segments. These strategic moves not only underscore Synopsyss commitment to innovation but also position the company to capture emerging opportunities in fast-evolving technologies like AI and 5G.

The company's involvement in the development of AI chips and its strategic acquisition of Ansys for $35 billion, aimed at enhancing its design capabilities, are clear indicators of Synopsys's ambition and its proactive stance on shaping the future of electronics design and manufacturing. These strategic initiatives are instrumental in solidifying Synopsyss role as a leader in the design and simulation of semiconductors, positioning it at the vanguard of ushering in a new era of technology development.

Moreover, Synopsys's financial health, evidenced by a Return on Equity (ROE) of 21% and moderate net income growth over the past five years, reflects its proficient management and growth prospects. Despite a strategic choice to not pay dividends, favoring reinvestment in the company, Synopsys demonstrates a compelling investment opportunity, mirrored in its robust financial performance and strategic positioning.

As the technology sector continues its rapid evolution, driven by the advancement of AI and the burgeoning demand for more sophisticated semiconductor designs, Synopsyss strategic partnerships, financial health, and market positioning underpin its critical role. The company's continuous pursuit of innovation, coupled with a strategic approach to navigating industry complexities, positions Synopsys as a leader in the semiconductor and broader technology industries, poised for sustained growth and influence in the ever-expanding realm of advanced electronics design.

The volatility of Synopsys, Inc. (SNPS) over the observed period demonstrates significant fluctuations, as indicated by the ARCH model analysis. The omega coefficient is substantial, suggesting a high baseline volatility, while the alpha[1] value indicates that past volatility spikes also contribute to future volatility. These statistics underscore the erratic nature of SNPS stock price movements, pointing to potentially significant investment risk or opportunity depending on market conditions.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2752.17 |

| AIC | 5508.34 |

| BIC | 5518.61 |

| No. Observations | 1256 |

| omega | 4.0243 |

| alpha[1] | 0.1733 |

To analyze the financial risk associated with a $10,000 investment in Synopsys, Inc. (SNPS) over a one-year period, a detailed assessment was carried out combining volatility modeling and machine learning predictions. This integrative approach aimed to forecast not just the returns but also the potential volatility, providing a nuanced understanding of investment risks.

The volatility modeling technique plays a pivotal role in quantifying the level of fluctuation in Synopsys, Inc.'s stock price. This model captures the conditional variance, which means it adapts based on past variances and covariances, offering a dynamic view of risk over time. By doing so, it enables the estimation of future volatility based on historical market data, serving as a key indicator of risk. This estimation is crucial because it reflects the degree of spread in a stock's price over time, which is directly linked to the investment's risk profile.

Parallel to this, machine learning predictions were utilized to forecast future returns. This part of the analysis employed a predictive algorithm designed to learn from historical data and identify patterns that could suggest future movements. Specifically, the algorithm used in this study was ingrained with the ability to adjust itself when exposed to new data, thereby improving its accuracy over time. By incorporating numerous factors and variables that influence stock performance, this method provided a forward-looking perspective on expected returns, effectively complementing the volatility analysis.

The convergence of volatility modeling with machine learning predictions furnished a comprehensive view of both the risk (through volatility) and the potential return aspects of the investment. When these two analyses were integrated, they not only offered an insight into the expected movement of Synopsys, Inc.'s stock but also provided a measure of uncertainty or risk attached to these predictions.

The culmination of this intricate analysis was the computation of the Value at Risk (VaR) at a 95% confidence interval for a $10,000 investment in Synopsys, Inc., which stood at $291.27. The VaR metric is particularly informative as it quantifies the maximum expected loss over a specified time frame, considering normal market conditions. In this context, the calculated VaR suggests that there is a 95% probability that the investor would not lose more than $291.27 on their $10,000 investment over a one-year period under normal market conditions.

This calculation leverages the forecasted volatility and expected returns, effectively combining the insights derived from both the volatility modeling and machine learning predictions. By doing so, it provides an empirical basis to the potential financial risk, encapsulating the dual aspects of risk and return in a single, comprehensible figure. This comprehensive approach underscores the significance of employing sophisticated analytical models in modern financial risk assessment.

Analyzing the provided options chain for Synopsys, Inc. (SNPS) with a target stock price increase of 5% over the current stock price reveals several call options that stand out as potentially profitable based on "the Greeks" and other metrics provided.

Firstly, an option with an expiration date on 2024-06-21 and a strike price of 320 USD exhibits particularly promising metrics. This option has a delta close to 1 (1.0), indicating that for every dollar increase in the stock price, the option's price is expected to increase by approximately the same amount. This high delta, combined with a relatively low theta of -0.0369104981, suggests that the option's value decreases slightly over time, allowing for substantial gains if the stock price increases as anticipated. Coupled with a very high vega of 0.0 (indicating low volatility sensitivity), this option stands out due to its impressive return on investment (ROI) of 1.1743407407 and a profit of 158.536 USD, making it an exceptional choice for investors expecting a sharp increase in SNPS's stock price.

Another compelling option expires on 2024-09-20 with a strike price of 410 USD. This option has a delta of 1.0, gamma of 0.0, and a notably low theta of -0.0472915758, which indicates minimal value decay per day. Its high rho of 96.740355058 outlines its sensitivity to interest rate changes, and with a vega of 0.0, it shows no sensitivity to implied volatility changes. This option has a remarkable ROI of 1.8546423562 with a profit of 132.236 USD, rendering it highly attractive for longer-term investors targeting a substantial upside.

An option with an expiration on 2024-12-20 and a strike price of 330 USD also appears attractive. It boasts a delta of 1.0, meaning it moves one-to-one with the stock price, a highly advantageous position given the anticipated stock price increase. The option's theta is -0.0372652379, indicating a favorable slow rate of time decay. Moreover, its extremely high rho of 235.7006705069 suggests strong sensitivity to interest rate changes, a factor that could amplify returns if rates move favorably. Its ROI of 1.9080615385 and a profit of 186.036 USD make it standout for investors bullish on SNPS and seeking high returns.

A standout option with an expiration date on 2025-01-17, with a strike price of 460 USD, is notable for its balanced mix of Greeks conducive to profitability. This option maintains a delta of 0.8753296496, ensuring strong price movement in tandem with the underlying stock. The gamma of 0.0013064974, while modest, helps to control the rate of delta change. A vega of 108.3027621969 suggests high sensitivity to implied volatility, potentially advantageous in a volatile market. With a theta of -0.0964100577, it manages time decay well. Impressively, it has an ROI of 0.7647816092 and a profit of 66.536 USD, positioning it well for investors looking for significant returns within a specific timeframe.

Lastly, considering options with distant expiration dates for those with a longer investment horizon, an option expiring on 2026-01-16 has a strike price of 470 USD displays a promising balance of the Greeks with a delta of 0.8162249928. Although its delta is slightly lower than the previously discussed options, it still indicates that the option's price will move significantly with the underlying stock price. It has an exceptionally high vega of 209.0290152553, suggesting it could benefit substantially from increases in implied volatility. The option's theta is -0.0850055989, indicating a relatively slow rate of time decay, which is beneficial for long-term holdings. With a rho of 536.9919667521, it's highly sensitive to interest rate changes, and a ROI of 0.0780832207 with a profit of 10.396 USD, making it an option worth considering for those with a long-term bullish outlook on SNPS.

In conclusion, these highlighted options within the Synopsys, Inc. (SNPS) chain offer a spectrum of opportunities based on the expiration dates, strike prices, and the Greeks. Each option caters to different investment strategies and outlooks on the stock's future performance. Investors are advised to consider these factors in conjunction with their investment goals and risk tolerance.

Similar Companies in Software - Infrastructure:

Zscaler, Inc. (ZS), Palo Alto Networks, Inc. (PANW), CrowdStrike Holdings, Inc. (CRWD), Okta, Inc. (OKTA), Cloudflare, Inc. (NET), Report: MongoDB, Inc. (MDB), MongoDB, Inc. (MDB), Adobe Inc. (ADBE), UiPath Inc. (PATH), Nutanix, Inc. (NTNX), Splunk Inc. (SPLK), Cadence Design Systems, Inc. (CDNS), ANSYS, Inc. (ANSS), Siemens AG (SIEGY), Autodesk, Inc. (ADSK), PTC Inc. (PTC), Keysight Technologies, Inc. (KEYS), National Instruments Corporation (NATI), Mentor Graphics Corporation (MENT)

https://www.fool.com/investing/2024/02/10/should-investors-buy-synopsys-stock-in-2024/

https://seekingalpha.com/article/4672190-synopsys-inc-snps-q1-2024-earnings-call-transcript

https://www.youtube.com/watch?v=HwSjtnyu5vo

https://www.youtube.com/watch?v=Kk5UpQkhZxU

https://www.youtube.com/watch?v=ycloHzorG4Y

https://finance.yahoo.com/news/synopsys-inc-nasdaq-snps-latest-110015320.html

https://finance.yahoo.com/m/e8c8c8a5-8589-3942-a692-af32ca12b3a6/nvidia-partner-sets-up-after.html

https://finance.yahoo.com/video/tech-companies-cant-build-leading-212447563.html

https://finance.yahoo.com/news/zacks-analyst-blog-highlights-nvidia-095700469.html

https://finance.yahoo.com/news/synopsys-snps-3-6-since-153042167.html

https://finance.yahoo.com/m/864e00f1-a034-3a78-b332-d5f511ddcbe3/high-hopes-for-synopsys-stock.html

https://finance.yahoo.com/news/synopsys-snps-registers-bigger-fall-220019980.html

https://finance.yahoo.com/video/nvidias-chip-reddits-ipo-missed-223424013.html

https://www.youtube.com/watch?v=kIV4BpJ5LVM

https://www.youtube.com/watch?v=Kex6-QmX590

https://www.sec.gov/Archives/edgar/data/883241/000088324124000013/snps-20240131.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: E0hrx3

Cost: $0.91420

https://reports.tinycomputers.io/SNPS/SNPS-2024-03-25.html Home