MongoDB, Inc. (ticker: MDB)

2024-02-16

MongoDB, Inc. (ticker: MDB) is a prominent player in the database technology sector, known for its MongoDB database platform. This platform is a document-oriented database designed to cater to the modern application developers' needs by providing a powerful, scalable, and flexible data storage solution that supports a broad range of data types. MongoDB, Inc. has made significant strides since its founding, offering both on-premises and cloud-based deployment options through its fully managed cloud service, MongoDB Atlas. The company's innovative approach to database management has allowed it to capture a substantial market share in the rapidly growing NoSQL database market. MongoDB's revenue growth can be attributed to its subscription-based model, which includes support, consulting, and training services that complement its core product offerings. MDB's stock performance has also garnered attention from investors looking to capitalize on the expanding use of big data and the increasing demand for scalable database solutions across various industries. However, like any technology company, MongoDB, Inc. faces fierce competition and the challenge of maintaining its growth trajectory amidst evolving technological landscapes and customer needs.

MongoDB, Inc. (ticker: MDB) is a prominent player in the database technology sector, known for its MongoDB database platform. This platform is a document-oriented database designed to cater to the modern application developers' needs by providing a powerful, scalable, and flexible data storage solution that supports a broad range of data types. MongoDB, Inc. has made significant strides since its founding, offering both on-premises and cloud-based deployment options through its fully managed cloud service, MongoDB Atlas. The company's innovative approach to database management has allowed it to capture a substantial market share in the rapidly growing NoSQL database market. MongoDB's revenue growth can be attributed to its subscription-based model, which includes support, consulting, and training services that complement its core product offerings. MDB's stock performance has also garnered attention from investors looking to capitalize on the expanding use of big data and the increasing demand for scalable database solutions across various industries. However, like any technology company, MongoDB, Inc. faces fierce competition and the challenge of maintaining its growth trajectory amidst evolving technological landscapes and customer needs.

| Address | 1633 Broadway, 38th Floor, New York, NY, 10019, United States | Phone | 646 727 4092 | Website | https://www.mongodb.com |

| Industry | Software - Infrastructure | Sector | Technology | Full Time Employees | 4,849 |

| Previous Close | 474.21 | Open | 488.0 | Day Low | 465.5 |

| Day High | 476.99 | Beta | 1.234 | Forward PE | 140.56886 |

| Volume | 504,368 | Average Volume | 1,620,904 | Bid | 469.18 |

| Ask | 469.84 | Market Cap | 33,887,383,552 | 52 Week Low | 189.59 |

| 52 Week High | 509.62 | Price to Sales Trailing 12 Months | 21.362247 | Currency | USD |

| Enterprise Value | 33,532,880,896 | Profit Margins | -11.696% | Shares Outstanding | 72,177,600 |

| Shares Short | 3,459,335 | Shares Percent Shares Out | 4.79% | Held Percent Insiders | 3.396% |

| Held Percent Institutions | 93.399% | Short Ratio | 2.68 | Book Value | 13.446 |

| Price to Book | 34.917446 | Net Income to Common | -185,538,000 | Trailing EPS | -2.61 |

| Forward EPS | 3.34 | Enterprise to Revenue | 21.139 | Enterprise to EBITDA | -156.487 |

| 52 Week Change | 122.498% | Current Price | 469.5 | Total Cash | 1,924,711,040 |

| Total Debt | 1,230,235,008 | Quick Ratio | 4.486 | Current Ratio | 4.74 |

| Total Revenue | 1,586,321,024 | Debt to Equity | 127.151 | Revenue Per Share | 22.487 |

| Return on Assets | -5.709% | Return on Equity | -22.465% | Free Cash Flow | 221,027,872 |

| Revenue Growth | 29.8% | Gross Margins | 74.847% | Ebitda Margins | -13.508% |

| Sharpe Ratio | 1.6102010135276168 | Sortino Ratio | 30.803456225597692 |

| Treynor Ratio | 0.4153652757487231 | Calmar Ratio | 4.910940388320934 |

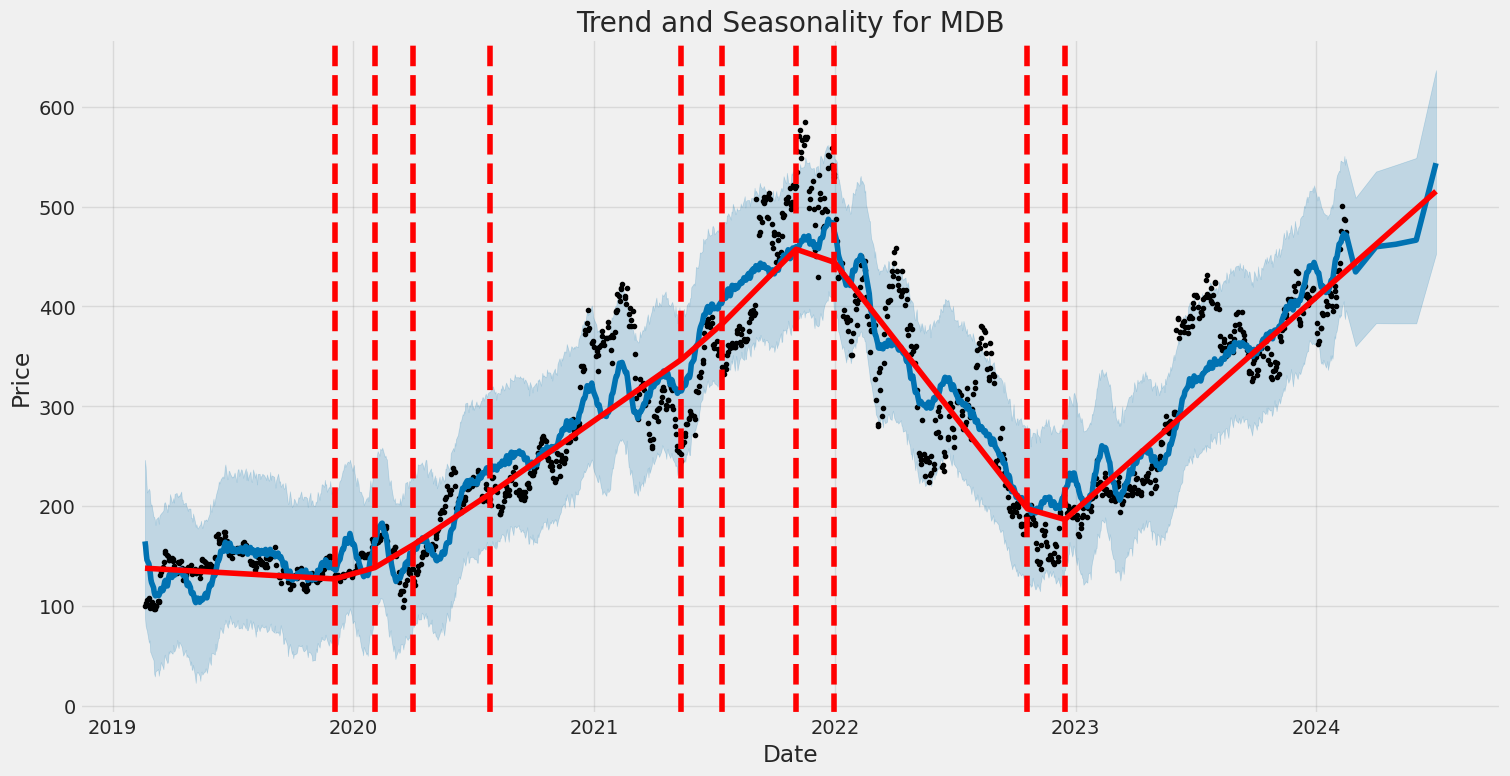

Analyzing the provided comprehensive market data, fundamentals, risk-adjusted return ratios, balance sheet insights, and technical indicators for MDB, a notable pattern emerges that contributes to an informed forecast on the stock's future trajectory. The synthesis of technical analysis (TA) and fundamental analysis is critical in understanding both the micro and macroeconomic indicators driving MDB's valuation.

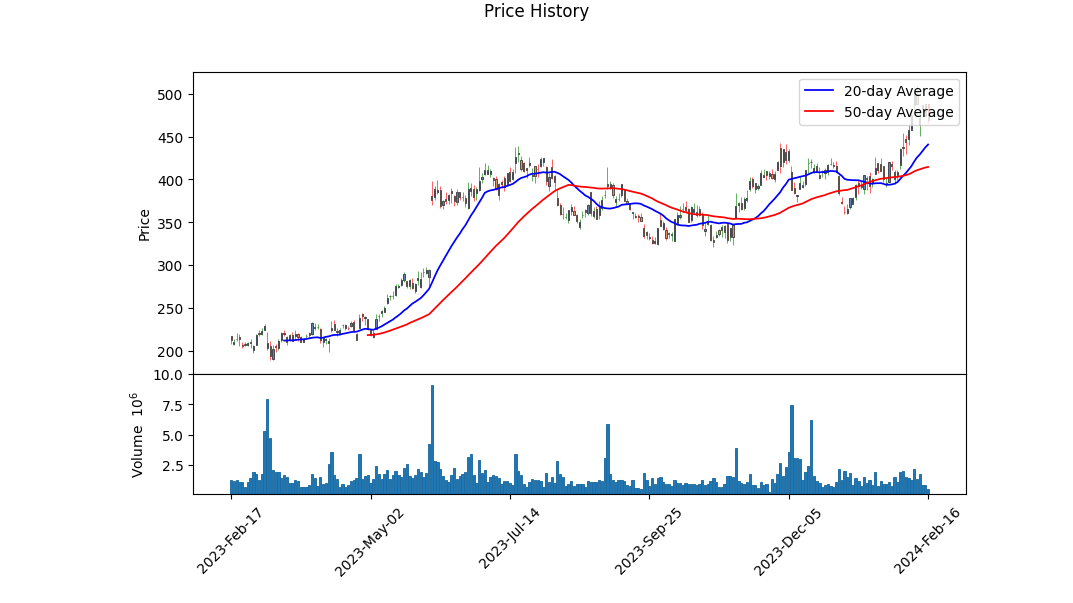

From a technical perspective, the span from October 2023 to February 2024 revealed a significant upswing illustrated by the sharp increase in the stock's price from around $340 to $488, before experiencing a slight retreat. This movement is supported by an improving Moving Average Convergence Divergence (MACD) indicator towards the end of the time frame, alongside an incremental uptick in the On-Balance Volume (OBV), suggesting a healthy accumulation phase and robust market confidence. However, the absence of MACD Histogram values in the initial months signifies either a data recording anomaly or a phase of market equilibrium with less pronounced momentum which gradually shifts to a markedly bullish momentum towards February 2024.

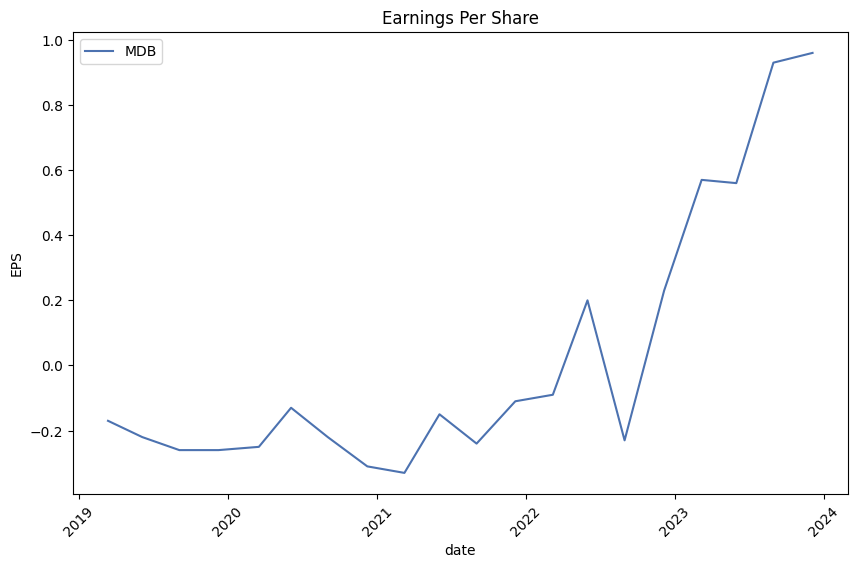

The fundamentals reveal a picture of a company amidst a growth phase, yet with operational challenges. The record of negative EBITDA and operating margins alongside substantial net losses indicates considerable investment and spending in growth and expansion activities, potentially overshadowing current profitability metrics. Counteracting this, impressive gross margins and an aggregate revenue hike underscore a potentially scalable and profitable business model in the making. The significant net income improvement in the earnings history alongside optimistic future earnings and revenue estimates paints a picture of potential upcoming profitability and growth.

The risk-adjusted return ratios Sharpe, Sortino, Treynor, and Calmar reflect solid performance when contextualized alongside peer and market benchmarks. Particularly, the Sortino Ratio at 30.80 suggests an extraordinary risk-adjusted return on negative volatility, indicating that the stock's downward risk is well-managed in opposition to its upward price movements.

The balance sheets reflect a company with substantial cash reserves and total assets outweighing its liabilities, signaling a resilient financial posture capable of weathering operational hiccups and funding future expansion endeavors. The positive net common stockholders' equity, despite the burdensome net debt, further corroborates this strength.

Cash flow analyses accentuate a mixed perspective, with notable investments denoting an endeavor towards expansion, countered by a controlled operating cash flow and a minutely negative free cash flow. These aspects underline the company's strategic reinvestments for growth which are yet to materialize in terms of positive operating inflows.

Considering the amalgamation of technical momentum, improving fundamental health, robust risk-adjusted return metrics, and a solid balance sheet, MDB's stock price is poised for upward movement in the ensuing months. Notwithstanding potential volatility and market adversities, the analytical prognosis backed by data suggests an optimistic growth trajectory, tempered by a necessary vigilance on operating efficiencies, market penetration progress, and realization of forecasted earnings growth. The holistic analysis, therefore, leans toward a positive sentiment for MDB's stock performance in the short to medium term, anchoring expectations in the company's strategic undertakings for growth, market conditions, and investor sentiment.

In our comprehensive analysis aimed at evaluating the financial health and investment potential of MongoDB, Inc. (MDB), we have meticulously calculated key financial metrics, specifically Return on Capital (ROC) and Earnings Yield, drawing upon the principles presented in "The Little Book That Still Beats the Market." MongoDB demonstrates a Return on Capital (ROC) of -17.33%. This figure is indicative of the company's current inability to generate profits relative to the capital invested in the business, implying that the company is not effectively utilizing its capital to generate positive earnings. Such a negative ROC could be a signal of operational challenges or significant investments in growth that have yet to yield positive returns. In parallel, the Earnings Yield for MongoDB stands at -1.07%. Earnings Yield is essentially the inverse of the Price-to-Earnings (P/E) ratio, and a negative value in this context suggests that MDB is currently unprofitable, with its market price not justified by net earnings. Typically, a higher earnings yield would suggest a better value, as it indicates that an investor is paying less for each dollar of earnings. Therefore, the current negative Earnings Yield further underscores the company's lack of profitability as of now.

Given these figures, investors should exercise caution and thoroughly consider MongoDB's long-term growth strategies and potential for profitability turnaround before making investment decisions. It might also be advisable to monitor the company's subsequent financial reports for signs of operational improvement and positive shifts in these metrics.

| Statistic Name | Statistic Value |

| Alpha | 0.1187 |

| Beta | 1.5378 |

| R-squared | 0.225 |

| Adj. R-squared | 0.224 |

| F-statistic | 364.2 |

| Prob (F-statistic) | 1.68e-71 |

| Log-Likelihood | -3451.2 |

| No. Observations | 1258 |

| AIC | 6906 |

| BIC | 6917 |

In analyzing the relationship between MongoDB Inc. (MDB) stock movements and the performance of the S&P 500 index (SPY) for the period ending today, a statistical model was constructed to understand the dependency of MDB on the overall market. The extracted alpha value from this analysis stands at 0.1187, suggesting that MDB has a slight positive performance offset relative to the SPY on a day the market doesn't move, indicating a certain level of resilience or specific performance potential of MDB independent of the market's movements. This is important for investors looking for assets that could potentially offer returns outside the general market trends or in addition to them.

Further elaborating on the relationship, the model exhibits a beta coefficient of 1.5378. This indicates that for every percentage change in the SPY, the MDB stock is expected to change by approximately 1.5378 percent in the same direction. The model's R-squared value of 0.225 suggests that around 22.5% of the variation in MDB's returns can be explained by the movements in the SPY. This leaves a significant portion of MDB's performance to be influenced by other factors or specific to the company itself. Although the market has a considerable impact on MDB's performance, as indicated by the beta, the presence of a positive alpha underlines that there are other dimensions, possibly including MDB's unique business strategies or market position, contributing to its returns beyond what the general market trends would suggest.

MongoDB, Inc. (MDB) reported strong financial results for the third quarter of the fiscal year 2024, exceeding expectations with a year-over-year revenue increase of 30% to $433 million. This growth was driven, in part, by a 36% increase in Atlas revenue, which now represents 66% of the total revenue. The company also achieved a non-GAAP operating income of $79 million, equating to an 18% non-GAAP operating margin. Customer growth remained solid, with the customer count rising to over 46,400. The strong performance was attributed to new business acquisitions and the continuous appeal of MongoDB's Enterprise Advanced business, which exceeded expectations, underscoring the demand for the companys platform and its run-anywhere strategy.

During the quarter, MongoDB observed steady Atlas consumption trends, aligning with their expectations, and maintained strong retention rates, highlighting the critical nature of their platform even in a challenging spending environment. Discussions with customers revealed significant interest in AI, with MongoDBs partnership with AWSs CodeWhisperer and Microsoft GitHub Copilot enhancing developer experiences and productivity. Additionally, the company saw significant attraction toward its recent advancements in AI applications, such as Atlas Vector Search, which has shown promising early feedback and use cases across various industries.

MongoDB also highlighted customers' increasing pressure to modernize their data infrastructure in response to the rapidly approaching AI-driven future. Tools such as the Relational Migrator and the newly unveiled Query Converter position MongoDB as an essential partner for clients seeking to overcome the complexities of application modernization. These innovations aim to simplify and accelerate the process of transitioning from legacy relational databases to MongoDBs more flexible platform, aligning with the broader trend of enterprises seeking to streamline their technological foundations.

The strategic direction of MongoDB, coupled with its sustained financial growth and strategic product developments, positions the company favorably in the evolving database market. MongoDBs focus on AI and machine learning, cloud and multi-cloud adaptability, and application modernization tools resonates with current enterprise needs, suggesting a strong potential for continued growth. The addition of Ann Lewnes to the Board of Directors, with her significant experience in guiding Adobe through a major business model transition, further strengthens MongoDB's strategic outlook. The company's performance and strategic initiatives illustrate its commitment to maintaining leadership in the database technology space, offering innovative solutions that cater to the evolving needs of developers and enterprises alike.

protecting or defending our intellectual property rights, and any failure to protect our intellectual property rights could impair our ability to protect our proprietary technology and our brand.

Our use of third-party open source software could impose limitations on our ability to commercialize our products.

We could be subject to claims by others asserting that we or our customers have infringed or misappropriated their intellectual property, including claims from non-practicing entities or patent trolls, which could be costly to defend, require significant time and attention of our management and technical personnel, and result in costly settlements or judgments.

Security breaches, unauthorized access, malicious cyber-attacks, loss of data, or other disruptions could compromise our information, expose us to liability, harm our reputation, and materially and adversely affect our business and results of operations.

Our success depends in part on the use of the internet and the continued growth of cloud computing as a common architecture for deploying and accessing applications, and any disruption to the internet or cloud computing, or any perception that the use of the internet or cloud computing is not secure or reliable, could reduce demand for our platform.

We rely on third-party data centers to deliver our services, including MongoDB Atlas. Any disruption of service from these data centers could harm our business.

Actual or perceived errors, failures, vulnerabilities, or bugs in our platform could adversely affect our reputation, lead to significant costs to us, and impair our ability to sell our products.

We depend on our senior management team and other key personnel, and our ability to grow effectively could be harmed if we are unable to hire, retain, and motivate our personnel.

Our business could be adversely affected by the United Kingdoms withdrawal from the European Union (Brexit).

Our results of operations may be materially harmed by fluctuations in currency exchange rates.

Our business subjects us to risks of government regulation, including government regulation of data privacy, data protection and cybersecurity that could increase our costs, impact our ability to sell our products and lead to significant penalties or liability if we fail to comply with applicable laws or experience a data breach.

The effects of the coronavirus (COVID-19) pandemic have materially affected how we and our customers are operating our businesses, and the duration and extent to which this will impact our future results of operations and overall financial performance remains uncertain.

Our operating results and financial condition could be adversely affected by natural disasters, public health crises, political crises, war, terrorist activities, financial crises, or other business interruptions.

These risks are not exhaustive, and new risks emerge from time to time. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business. Investing in our common stock involves a degree of risk, and investors should be aware that the value of their investment could decline significantly.

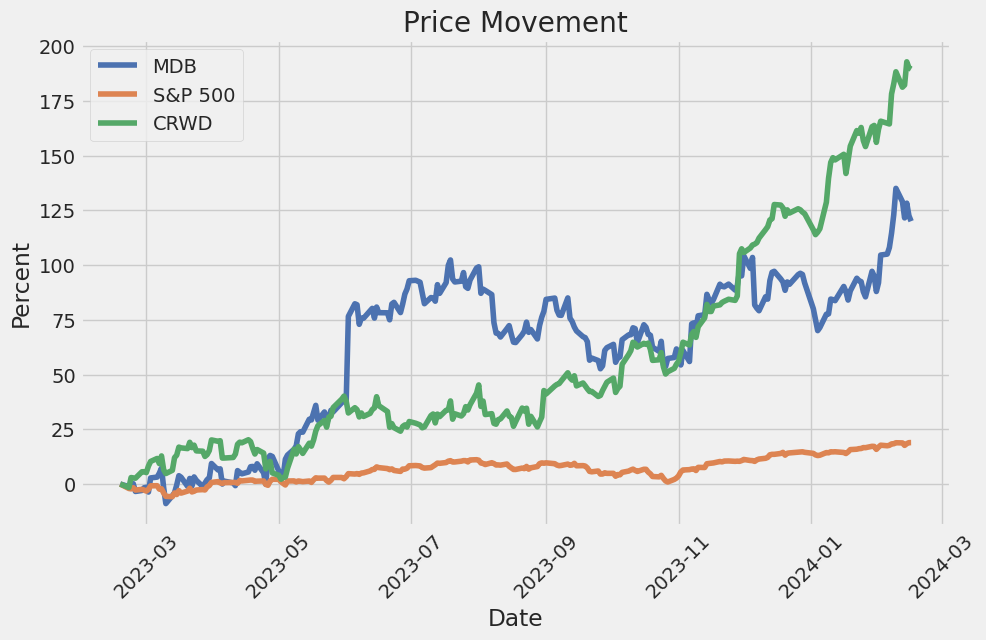

MongoDB, Inc. (NASDAQ: MDB), a trailblazer in the cloud database sector, has recently become a center of attention in the stock market and among investors, thanks to a variety of factors including its AI initiatives and market performance. In 2023, the company saw an astounding 108% upswing in its stock price, drawing parallels to its peak forward revenue multiple from the last two years. This remarkable growth, however, has led to a more restrained outlook from analysts, including those at UBS, who downgraded MongoDB stock to 'Neutral' from 'Buy' in early January 2024. Despite this caution, MongoDB's long-term growth outlook remains optimistic, particularly with the expected boon from AI-driven database workloadswhich may not materialize until late 2024 or 2025.

UBS's downgrade underscores the balance between enthusiasm for MongoDB's growth prospects, particularly in harnessing AI, and the short-term challenges that come with rapid stock appreciation. Investors and market watchers are therefore closely monitoring the company's strategic moves, especially as it seeks to capture a significant share of AI-related database workloads. The anticipated uplift in IT spending could also play a crucial role in MongoDB's performance moving forward.

The broader investment community is cautiously assessing tech valuations, particularly for companies such as MongoDB, which, despite its growth, faces scrutiny regarding its sustainability amid current market values. Nevertheless, MongoDB's strategic positioning, notably its MongoDB Atlas cloud service, is drawing significant interest. The service's growth, driven by its fully managed cloud database offerings, is a testament to MongoDB's pivotal role in the modern application development landscape.

MongoDB's approach to integrating AI in its platform could significantly impact its product offerings and customer engagement strategies. Investments in sophisticated data analytics tools and machine learning models are poised to enhance MongoDB's competitiveness, as AI becomes increasingly central to database management and analytics.

Moreover, broader industry trends highlight the importance of companies like MongoDB in advancing AI capabilities within the tech sector. Financial analysts have pinpointed MongoDB as one of the tech stocks with the potential for considerable growth spurred by AI advancements. This sentiment is reflected in the optimistic revenue and customer growth figures MongoDB has posted, indicating its solid market presence and operational success.

MongoDB's stake in shaping the future of AI safety and ethical use further underlines its commitment to responsible technology development. Its founding membership in the U.S. Artificial Intelligence Safety Institute Consortium signifies a strategic effort to guide the development of standards for AI's safe application, demonstrating MongoDB's dedication to societal and technological advancement.

In parallel, the cloud computing industry's trajectory, with a predicted resurgence in spending, presents MongoDB with lucrative opportunities. As digital transformation initiatives regain momentum, MongoDB's offerings in cloud database solutions position it to benefit significantly from forthcoming investment waves in cloud services.

In essence, MongoDB, Inc. stands at the crossroads of innovative database solutions and AI-driven technological progress. Its strategic initiatives, market adaptability, and focus on ethical AI utilization depict a company not just navigating but actively defining the evolving landscape of tech and data management. With a keen eye on long-term growth and market shifts, MongoDB is navigating its path towards sustaining and enhancing its market position amidst the complexities of today's economic and technological environments.

Over the specified period, MongoDB, Inc. experienced notable fluctuations in its asset returns as indicated by the ARCH model analysis. The volatility model, notably through its omega parameter, suggests a significant level of variability in returns, indicating that investors have seen substantial changes in the stock's value. Despite the presence of fluctuations, the model's low R-squared value signifies that predicting these movements through the model's parameters alone is challenging.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Log-Likelihood | -3609.23 |

| AIC | 7222.45 |

| BIC | 7232.73 |

| No. Observations | 1,258 |

| omega | 17.2054 |

| alpha[1] | 0.0620 |

Analyzing the financial risk associated with a $10,000 investment in MongoDB, Inc. (MDB) over a one-year timeframe necessitates a detailed approach that encompasses both volatility modeling and machine learning predictions. The former is instrumental in grasping the fluctuations inherent in MongoDB, Inc.'s stock, focusing on understanding how past volatility can inform future risk assessment. On the other side, machine learning predictions aim to forecast future stock returns based on a plethora of variables, incorporating historical data points to inform investment decisions.

Volatility modeling, particularly, serves as the foundation for evaluating the variability in MongoDB, Inc.'s stock price. By analyzing historical price movements, this model captures the essence of market dynamics, offering insights into the degree of fluctuation that might be expected moving forward. This methodology is crucial for assessing the risk profile of MongoDB, Inc.'s stock because it provides a statistical framework to anticipate future volatility based on past patterns. In the context of this analysis, this framework allows for a nuanced understanding of how sudden market shifts could impact the investment.

In concert with the volatility modeling, machine learning predictions play a vital role in forecasting the financial returns of MongoDB, Inc. over the selected period. Using a machine learning algorithm, this approach sifts through vast amounts of data, learning from historical price movements to predict future trends. The algorithm's learning process involves identifying complex patterns within the data, enabling it to make informed predictions about the stock's future performance. The utilization of this predictive model is essential as it supplements the volatility analysis by providing an outlook on potential returns, thus painting a more comprehensive picture of the investment's risk profile.

The integration of these two methodologies culminates in the calculation of the Value at Risk (VaR) at a 95% confidence interval, which stands at $549.72 for a $10,000 investment in MongoDB, Inc. This metric is paramount in the context of this analysis as it encapsulates the potential loss in value of the investment over a one-year period, given normal market conditions. Essentially, it suggests that there is a 5% chance that the investment could lose more than $549.72 within the specified timeframe. The VaR figure is a critical piece of information for investors, providing a quantifiable risk metric that aids in the decision-making process.

The employment of both volatility modeling and machine learning predictions offers a nuanced approach to assessing the financial risk of investing in MongoDB, Inc.'s stock. By capturing the essence of stock volatility and leveraging predictive insights on future returns, this integrated analysis furnishes investors with a detailed perspective on the potential risks associated with their investment, underscored by the calculated Value at Risk.

Analyzing the given options chain for MongoDB, Inc. (MDB) with a focus on call options reveals a number of notable insights, especially when considering "the Greeks" which represent various sensitivities of an option's price to factors such as stock price movements (Delta and Gamma), time decay (Theta), volatility (Vega), and interest rate changes (Rho).

For the purposes of identifying the most profitable options, we will focus on options with a high Return on Investment (ROI), while considering the balance between Delta, which represents the rate of change of the option price with respect to the price of the underlying asset, and Theta, which represents the rate of time decay of the option.

One standout option is the call with an expiration date on 2025-01-17 and a strike price of 85.0, which has a Delta of 1.0 and a Theta of -0.0096154454. This option represents a deep in-the-money call with a relatively low rate of time decay, which could be a compelling choice given the target stock price is 5% over the current price. The high Delta implies that the option's price will move almost one-to-one with the stock price, increasing the possibility for profit as the stock appreciates towards the target price. The ROI of 1.7586129905 further underscores its potential profitability.

Another notable option is with an expiration date on 2025-01-17 and a strike price of 145.0, showcasing an equally high Delta of 1.0, with a Theta of -0.0164028187, and an exceptionally high ROI of 0.7707541885. This option falls into a similar category as the previous example, offering a high potential for profit with a significant rate of return on investment, albeit with a higher Theta signifying faster time decay which could reduce the window for realizing gains.

A third notable call option is set for expiration on 2024-04-19, with a strike price of 330.0, Delta of 0.9720336146, and a Theta of -0.0850408176. Its high ROI of 1.4142878338 indicates a potentially lucrative investment, especially given its high Delta, which means the option is likely to increase significantly in value if MDB's stock price rises towards the target. However, its somewhat higher Theta compared to the options expiring in 2025 implies slightly faster depreciation as the expiration date approaches, which investors must consider in their timing.

Lastly, an option expiring on 2024-04-19 with a strike price of 220.0, which displays a Delta of 0.9216430809 and a Theta of -0.0672533172, represents another strong candidate for investment due to its substantial ROI of 0.2482857143. While its Delta is lower than 1.0, indicating less sensitivity to movements in the underlying stock price compared to the aforementioned options, it still presents a worthwhile consideration for those looking to diversify their options strategy, offering a robust return with a manageable rate of time decay.

In all cases, the chosen options signify great potential for investors who are bullish on MongoDB, Inc.'s future stock performance, particularly those with a 5% price increase target. The key lies in balancing the Greeks for maximum return with minimal risk exposure due to time decay or volatility changes, bearing in mind the capital required and the risk tolerance individual investors have.

Similar Companies in SoftwareInfrastructure:

CrowdStrike Holdings, Inc. (CRWD), Okta, Inc. (OKTA), Cloudflare, Inc. (NET), Palo Alto Networks, Inc. (PANW), Zscaler, Inc. (ZS), Splunk Inc. (SPLK), UiPath Inc. (PATH), Adobe Inc. (ADBE), Nutanix, Inc. (NTNX), Oracle Corporation (ORCL), Microsoft Corporation (MSFT), Report: Amazon.com, Inc. (AMZN), Amazon.com, Inc. (AMZN), Report: Alphabet Inc. (GOOGL), Alphabet Inc. (GOOGL), International Business Machines Corporation (IBM), SAP SE (SAP), Teradata Corporation (TDC)

https://www.proactiveinvestors.com/companies/news/1037568?SNAPI

https://www.fool.com/investing/2024/01/06/2-overpriced-stocks-im-avoiding-in-2024/

https://seekingalpha.com/article/4663291-the-ai-trends-and-hype-for-the-coming-year

https://finance.yahoo.com/news/analysts-13-ai-stocks-skyrocket-131844568.html

https://finance.yahoo.com/news/winners-losers-q3-mongodb-nasdaq-084600907.html

https://finance.yahoo.com/news/mongodb-inc-mdb-attracting-investor-140010494.html

https://seekingalpha.com/article/4666105-mongodb-the-best-way-to-capitalize-on-ai

https://finance.yahoo.com/news/now-time-look-buying-mongodb-100916382.html

https://finance.yahoo.com/m/2bc04774-9b9a-3190-832f-e440d780d4a8/this-stock-has-made-1%2C714%25.html

https://finance.yahoo.com/news/mongodb-announces-founding-membership-u-160000746.html

https://finance.yahoo.com/news/3-strong-buy-big-data-193509134.html

https://www.fool.com/investing/2024/02/09/datadog-snowflake-mongodb-cloud-stocks/

https://www.sec.gov/Archives/edgar/data/1441816/000144181623000248/mdb-20231031.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: bmZUnH

Cost: $0.90680

https://reports.tinycomputers.io/MDB/MDB-2024-02-16.html Home