The Southern Company (ticker: SO)

2023-12-17

The Southern Company, trading under the ticker symbol SO, is a premier energy company based in the United States, renowned for its robust portfolio of electric and gas utility businesses. Founded in 1945 and headquartered in Atlanta, Georgia, The Southern Company has grown to become one of the nation's largest generators of electricity. It operates through numerous subsidiaries, with significant operations in states such as Alabama, Georgia, and Mississippi, serving millions of customers. The Southern Company's commitment to innovation and sustainability is evident through its investments in clean energy projects, including solar, wind, and nuclear power, as part of its long-term strategy to provide affordable and reliable energy while reducing carbon emissions. Its consistent performance and dividend payouts have made it a staple in many income-oriented investment portfolios. As of the knowledge cutoff date, the company continues to navigate the challenges and opportunities presented by the evolving energy landscape, regulatory environments, and customer expectations, maintaining a strategic focus on both traditional operations and the transition to renewable energy sources.

The Southern Company, trading under the ticker symbol SO, is a premier energy company based in the United States, renowned for its robust portfolio of electric and gas utility businesses. Founded in 1945 and headquartered in Atlanta, Georgia, The Southern Company has grown to become one of the nation's largest generators of electricity. It operates through numerous subsidiaries, with significant operations in states such as Alabama, Georgia, and Mississippi, serving millions of customers. The Southern Company's commitment to innovation and sustainability is evident through its investments in clean energy projects, including solar, wind, and nuclear power, as part of its long-term strategy to provide affordable and reliable energy while reducing carbon emissions. Its consistent performance and dividend payouts have made it a staple in many income-oriented investment portfolios. As of the knowledge cutoff date, the company continues to navigate the challenges and opportunities presented by the evolving energy landscape, regulatory environments, and customer expectations, maintaining a strategic focus on both traditional operations and the transition to renewable energy sources.

| As of Date: 12/17/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 77.28B | 70.58B | 76.61B | 75.87B | 77.74B | 74.03B |

| Enterprise Value | 137.91B | 130.85B | 136.11B | 133.09B | 132.63B | 129.01B |

| Trailing P/E | 25.86 | 23.03 | 22.81 | 21.34 | 22.60 | 24.03 |

| Forward P/E | 17.64 | 16.13 | 19.53 | 19.34 | 19.05 | 17.86 |

| PEG Ratio (5 yr expected) | 2.65 | 3.09 | 3.31 | 3.33 | 2.93 | 3.04 |

| Price/Sales (ttm) | 2.96 | 2.56 | 2.63 | 2.57 | 2.74 | 2.81 |

| Price/Book (mrq) | 2.46 | 2.30 | 2.51 | 2.50 | 2.51 | 2.58 |

| Enterprise Value/Revenue | 5.25 | 18.75 | 23.68 | 20.54 | 18.82 | 15.40 |

| Enterprise Value/EBITDA | 13.31 | 36.23 | 49.78 | 49.09 | 105.09 | 36.85 |

Analyzing the provided technical analysis data and company fundamentals, we can gather insights into the expected stock price movement of the company in question over the next few months.

Analyzing the provided technical analysis data and company fundamentals, we can gather insights into the expected stock price movement of the company in question over the next few months.

Technical Indicators:

- The Adjusted Closing price stands at 70.86, suggesting a recent trading price to consider.

- MACD (Moving Average Convergence Divergence), at 0.776266, is positive but with a negative histogram value of -0.080930, indicating a potential loss of momentum in the upward trend and possibly the start of a bearish reversal.

- The Relative Strength Index (RSI) is at 52.40, which is relatively neutral but leans towards the bullish side, suggesting that the stock is neither overbought nor oversold.

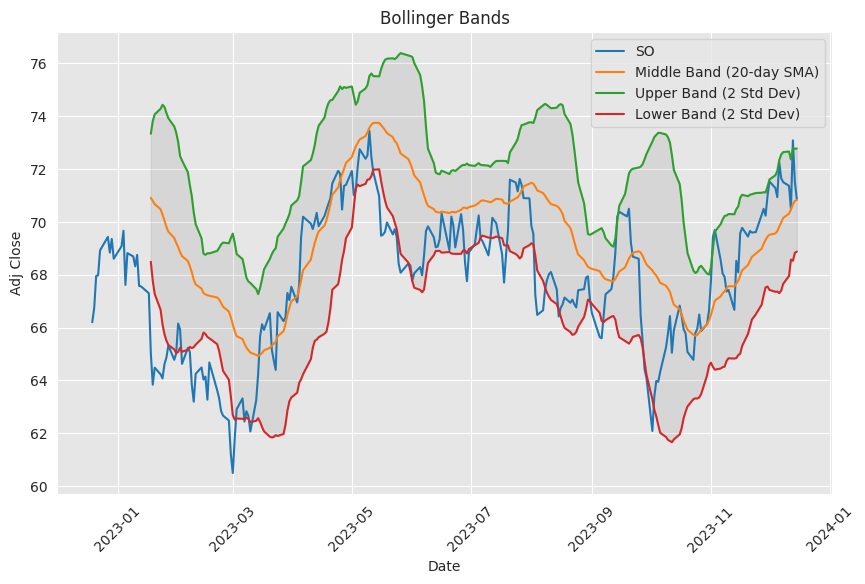

- Bollinger Bands indicate the stock is trading near the middle band of 71.45 and above the lower band of 69.67, suggesting a lack of strong selling pressure.

- The stock is trading below the Simple Moving Average (SMA) 20 (70.82) but above the Exponential Moving Average (EMA) 50 (69.60), pointing to some indecision in the short-term trend but a potential bullish crossover in the medium term.

- On Balance Volume (OBV) is negative, indicating that there may be more volume on down days than up days, potentially a bearish signal.

- Stochastic Oscillator shows the %K line (59.43) is below the %D line (63.61), which could be a bearish momentum signal.

- The Average Directional Index (ADX) at 21.44 shows a weak trend strength, which means that the stock's direction is not strongly defined.

- The Williams %R is at -72.93, which suggests that the stock is neither oversold nor overbought.

- Chaikin Money Flow (CMF) is positive at 0.207106, indicating buying pressure.

- The Parabolic SAR (PSAR) indicator has no value for the support level (PSARl_0.02_0.2) but shows resistance at 73.42, suggesting a potential downward pressure.

Fundamentals:

- While the Market Cap shows a slight decline over the recent quarters, it remains relatively stable.

- The Trailing P/E ratio has increased over the last year, which could mean the stock is getting more expensive relative to its earnings.

- The Forward P/E indicates expectations for increased earnings, as it is lower than the Trailing P/E.

- PEG Ratio and Price/Sales ratios are on the higher side, suggesting a premium valuation for growth expectations.

- The company exhibits a strong Enterprise Value/Revenue ratio, which usually suggests a company's strong future profitability potentials.

Based on the technical indicators combined with the company's fundamentals, we see a potentially mixed signal for the company's stock price movement in the following months. The moderate RSI and the positive Chaikin Money Flow indicate a steady demand for the stock. However, the negative MACD histogram and OBV could be early signs of a bearish sentiment creeping into the market. The Bollinger Bands and the PSAR suggest caution as the stock is currently trading in a range without a clear direction. The fundamentals suggest a company that is relatively costly compared to sales and past earnings growth, which could moderate investor enthusiasm.

Given the mixed technical signals and relatively high valuation ratios, it would be reasonable to expect some price volatility in the near future. The stock may experience some upward movement if the company can justify its premium valuations with strong performance figures or positive news. However, investors might want to watch for any signs of reversal carefully, as the current technicals do not point to a strong bullish sentiment.

In conclusion, careful monitoring of both the technicals and upcoming fundamental announcements (earnings releases, market news, etc.) would be essential to grasp the stock's direction in the coming months. Investors should be cautious, considering the mixed technical signals and the need for the company to justify its current valuations with solid performance to sustain upward momentum.

The Southern Company (SO), a premier utility corporation in the United States, has cemented its reputation as a consistent provider of dividends, thus affirming its commitment to shareholder value. Over the span of more than 70 years, Southern Company has either maintained or grown its dividend payouts, demonstrating a rare consistency in the marketplace. The past 22 years, in particular, have seen annual increases in dividends, underscoring the companys dedication to its investors.

While the stability and reliability of Southern Company's dividend stream is comforting to shareholders, it's noteworthy that the growth rate of these dividends has faced constraints in recent years. Averaging an annual increase of about 3%, the dividend growth has primarily served to offset inflation rather than provide substantial real increases to shareholder income. Despite these limitations, the companys long history of dividend payments remains a strong signal of financial dependability.

The origin of Southern Company's moderate dividend growth can be traced to the logistical and financial complications surrounding the high-profile Vogtle project. The construction of the two nuclear power plants under this project has been beset with cost overruns, delays, and even the bankruptcy of the initial contractor. The challenges were magnified by the onset of the COVID-19 pandemic, which led to further disruptions. These events necessitated the company's prudent financial management, reflected in its modest dividend increments during this time.

The future looks promising for Southern Company with a major milestone reached as the first of the Vogtle power plants is now connected to the grid, and the second plant is expected to be operational by the start of 2024. The anticipated contribution to the operational cash flow post-Vogtle is up to $700 million, which promises an increase in the financial flexibility of the company and potentially more robust dividend growth once the construction phase capital expenditures are behind.

The company has signaled a targeted approach toward dividend growth, conveying that once the payout ratio is optimized below 70%, the growth of dividends could more closely match that of earnings. Currently, with a payout ratio at roughly 77%, there is cautious optimism that the completion and operational efficacy of the Vogtle plants will foster an era of heightened dividend growth subsequent to 2024, provided the financial impacts align with projections.

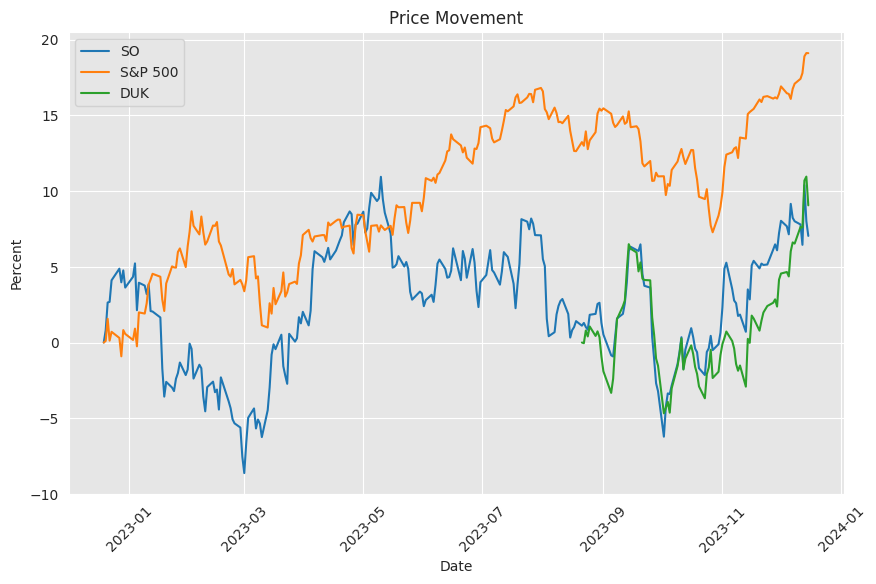

Recent trends in stock market resilience and outperformance relative to the utility sector decline have demonstrated an uptick in investor confidence in Southern Company. This shift signifies a formative change from the skepticism that shrouded the company during the Vogtle project tribulations to a more optimistic assessment that looks toward post-Vogtle possibilities.

The broader market indices have highlighted the utility sector, especially in ETFs like the Utilities Select Sector SPDR Fund (XLU), as a bastion of defensive investment strategies. This focus is a response to cautious economic forecasts and market volatility. Insights from influential investors such as Jeffrey Gundlach, CEO of DoubleLine Capital, who is wary of the future performance of substantial tech stocksthe "Magnificent Seven"underline a potential reallocation of investor interest. Gundlach's recession prediction, bolstered by expectations of continued high-interest rates imposed by the Federal Reserve, underscores the possibility that other sectors may offer more risk-adjusted value.

The XLU ETF, which includes Southern Company among its diversified utilities holdings, offers an investment avenue that is increasingly compelling for those seeking stable revenue in the potential low-interest-rate environment of a recession. With utility companies typically resilient to fluctuations in interest due to their essential service offerings and inelastic demand, the sector carries a traditional orientation toward high dividend payouts.

Southern Company's recent reintegration into renewable energy investments, specifically solar, counterpoints its historical conservative stance. With the acquisition of two solar projects in Texas and Wyoming, each having long-term contracts with financially secure counterparties, the company exhibits a return to engaging with the clean energy market. This diversification into solar, alongside the anticipation of increased cash flow from the Vogtle nuclear reactors, indicates a corporate strategy rooted in progressive energy sector investment and financial security.

The company's current market capitalization of $77 billion, matched with its 4% dividend yield, presents Southern Company as a firm low-risk choice within its sector, reflecting a balance of growth potential and income production. Even when faced with economic turbulence, Southern Company's mix of operational consistency, evolving business investments, and financial health suggests sustained shareholder benefit and an attractive valuation for long-term stability-seeking investors.

Market commentators like "The Motley Fool" advocate for equipping ones portfolio to withstand market cycles, such as periodic bear markets. In this regard, utilities like Southern Company are frequently designated as safe havens, thanks to their regulated and often monopolistic service provision, which leads to largely cycle-resilient financial results. In the case of economic downturns, Southern Company's relatively minor stock depreciation compared to broader markets, as observed during the Great Recession, reinforces the resilience of utilities.

With Southern's dividend generating a steady 4% yield and the company's infrastructural investments promising ongoing growth, there exists a strong positioning for continuing shareholder returns. The company's commitment to sizable capital investments, including the Vogtle project and renewable energy development, indicates a strategic blend of enduring service and proactive adaptation to emerging energy trends.

In light of all these factors, Southern Company, with a prospective increase in financial strength post-Vogtle completion, is set to emerge not only as a beacon of reliability in the utility space but as a potentially more dynamic prospect for income growth. Against a backdrop of global economic uncertainty, the companys capacity for sustaining dividend increments, coupled with cash flow enhancement from the Vogtle project completion, illustrates a paradigm where income-focused investors might anticipate a future punctuated by steady returns and augmented dividends.

Similar Companies in Electric Utilities:

Duke Energy Corporation (DUK), Dominion Energy, Inc. (D), Report: NextEra Energy, Inc. (NEE), NextEra Energy, Inc. (NEE), Exelon Corporation (EXC), American Electric Power Company, Inc. (AEP), FirstEnergy Corp. (FE), Entergy Corporation (ETR), PG&E Corporation (PCG), Edison International (EIX), Public Service Enterprise Group Incorporated (PEG)

News Links:

https://www.fool.com/investing/2023/12/15/southern-co-just-gave-us-a-hint-about-when-its-div/

https://www.fool.com/investing/2023/12/01/southern-company-is-back-in-the-solar-market-is-th/

https://www.fool.com/investing/2023/11/26/got-1500-you-can-confidently-add-these-3-stocks-to/

https://www.fool.com/investing/2023/11/24/buying-stocks-good-way-hedge-against-market-crash/

https://www.fool.com/investing/2023/11/22/want-decades-of-passive-income-3-stocks-to-buy-now/

https://www.fool.com/investing/2023/11/17/is-the-43-billion-growth-plan-just-the-beginning-f/

https://www.fool.com/investing/2023/11/16/3-dividend-stocks-to-double-up-on-right-now/

https://www.fool.com/investing/2023/11/10/things-need-to-know-if-buy-southern-company/

https://seekingalpha.com/article/4648943-dominion-energy-upholds-big-dividend-shares-pop

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: fG9NWT