Taiwan Semiconductor Manufacturing Company Ltd. (ticker: TSM)

2023-12-20

Taiwan Semiconductor Manufacturing Company Ltd., commonly known by its ticker TSM on the stock exchange, represents a global leader in the semiconductor industry. Established in 1987 and headquartered in Hsinchu Science Park, Taiwan, TSMC pioneered the fabless-foundry model, transforming the way microchips were manufactured and effectively enabling the burgeoning growth of fabless semiconductor companies. TSMC specializes in the manufacturing of a diverse array of integrated circuit products, servicing clients from various sectors, including computing, communications, consumer electronics, and automotive industries. As the world's largest dedicated independent semiconductor foundry, TSMC invests heavily in research and development to advance its technology roadmap, consistently scaling down its manufacturing processes to meet the ever-increasing demands for more powerful and energy-efficient chips. The company's strategic importance has escalated in the wake of global supply chain constraints and geopolitical tensions regarding semiconductor supply, underscoring its critical role in the tech industry, where its state-of-the-art fabrication facilities play a vital part in shaping the future of technological innovation and high-tech competitiveness.

Taiwan Semiconductor Manufacturing Company Ltd., commonly known by its ticker TSM on the stock exchange, represents a global leader in the semiconductor industry. Established in 1987 and headquartered in Hsinchu Science Park, Taiwan, TSMC pioneered the fabless-foundry model, transforming the way microchips were manufactured and effectively enabling the burgeoning growth of fabless semiconductor companies. TSMC specializes in the manufacturing of a diverse array of integrated circuit products, servicing clients from various sectors, including computing, communications, consumer electronics, and automotive industries. As the world's largest dedicated independent semiconductor foundry, TSMC invests heavily in research and development to advance its technology roadmap, consistently scaling down its manufacturing processes to meet the ever-increasing demands for more powerful and energy-efficient chips. The company's strategic importance has escalated in the wake of global supply chain constraints and geopolitical tensions regarding semiconductor supply, underscoring its critical role in the tech industry, where its state-of-the-art fabrication facilities play a vital part in shaping the future of technological innovation and high-tech competitiveness.

| As of Date: 12/20/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 483.05B | 422.63B | 479.56B | 455.16B | 378.70B | 345.62B |

| Enterprise Value | 463.83B | 404.88B | 456.13B | 432.16B | 357.75B | 328.10B |

| Trailing P/E | 19.40 | 15.36 | 16.35 | 14.41 | 13.44 | 14.85 |

| Forward P/E | 16.58 | 15.13 | 20.04 | 17.30 | 12.69 | 12.00 |

| PEG Ratio (5 yr expected) | 3.36 | 3.17 | 4.19 | 3.49 | 0.79 | 0.72 |

| Price/Sales (ttm) | 7.83 | 6.49 | 7.15 | 6.47 | 5.71 | 5.99 |

| Price/Book (mrq) | 5.05 | 4.54 | 5.30 | 4.97 | 4.33 | 4.51 |

| Enterprise Value/Revenue | 0.21 | 0.00 | 0.95 | 0.85 | 0.57 | 0.54 |

| Enterprise Value/EBITDA | 0.30 | 0.00 | 1.34 | 1.21 | -5.54 | 0.77 |

| City | Hsinchu City | Country | Taiwan | Phone | 886 3 563 6688 |

| Fax | 886 3 563 7000 | Website | https://www.tsmc.com | Industry | Semiconductors |

| Sector | Technology | Previous Close Price | $103.87 | Open Price | $102.7 |

| Day's Low Price | $101.85 | Day's High Price | $103.085 | Dividend Rate | $1.92 |

| Dividend Yield | 1.85% | Payout Ratio | 33.27% | Five Year Avg Dividend Yield | 2.41% |

| Beta | 1.187 | Trailing PE | 19.183 | Forward PE | 16.770 |

| Volume | 4,081,794 | Market Cap | $532,281,229,312 | 52-Week Low | $72.84 |

| 52-Week High | $110.69 | Price to Sales (TTM) | 0.246 | 50-Day Average Price | $95.191 |

| 200-Day Average Price | $93.664 | Enterprise Value | $2,170,840,809,472 | Profit Margins | 41.434% |

| Shares Outstanding | 5,186,409,984 | Book Value | $129.12 | Price to Book | 0.795 |

| Net Income to Common | $895,689,687,040 | Trailing EPS | $5.35 | Forward EPS | $6.12 |

| Total Cash | $1,551,174,467,584 | Total Debt | $1,003,982,684,160 | Current Ratio | 2.147 |

| Total Revenue | $2,161,738,907,648 | Debt to Equity | 29.767 | Return on Assets | 12.173% |

| Return on Equity | 29.235% | Gross Profits | $1,348,354,806,000 | Free Cash Flow | $87,766,245,376 |

| Operating Cash Flow | $1,334,019,883,008 | Earnings Growth | -24.9% | Revenue Growth | -10.8% |

| Gross Margins | 57.016% | EBITDA Margins | 67.856% | Operating Margins | 41.714% |

Based on the provided technical analysis (TA) data for TSM (Taiwan Semiconductor Manufacturing Company), several prevailing technical indicators offer insights into the potential stock price movement over the next few months. While one must consider that stock price movements are influenced by a multitude of factors and are inherently uncertain, the following analysis deduces interpretations from the TA indicators juxtaposed with the company's fundamentals.

-

The stock's Adjusted Close price stands at 102.63, which is above both the Simple Moving Average (SMA) of the last 20 days (99.88) and the Exponential Moving Average (EMA) over 50 days (96.81). This suggests a short to medium-term bullish trend.

-

The Moving Average Convergence Divergence (MACD) indicator shows a value of 2.183 with a positive histogram value of 0.14. This is indicative of a continued upward momentum. The positive divergence of the MACD line from the signal line reinforces bullish sentiment.

-

The Relative Strength Index (RSI) is at 63.39, edging closer to but not yet beyond the overbought threshold of 70. This could signal strength in the current trend with a note of caution for a potential reversal if it moves into overbought territory.

-

Bollinger Bands suggest price stabilization with the Adjusted Close price between the middle band (BBM) at 103.08 and the lower band (BBL) at 102.07. This narrow range does not indicate significant volatility.

-

The Stochastic oscillators, with %K at 83.00 and %D at 83.36, are in overbought territory, suggesting the stock may be overextended in the short-term and could be subject to a potential pullback.

-

With an Average Directional Index (ADI) of 30.05, the stock shows a moderate trend strength that could support a continuing trend, but it's not strongly enough established to rule out reversals.

-

The Chaikin Money Flow (CMF) stands at 0.231, suggesting a bullish trend as more money is flowing into the stock.

-

The Parabolic SAR (PSAR) indicates an uptrend as the latest point (99.62) is below the current price, confirming further the bullish direction.

Turning to the company's fundamentals:

-

There has been an increase in Market Cap and Enterprise Value over the last year, hinting at growing investor confidence and potentially a higher valuation of TSM.

-

The Trailing Price-to-Earnings (P/E) ratio has increased over the past year, suggesting that the market is willing to pay more for the company's earnings, which potentially signals optimism about the company's future profitability.

-

The Forward P/E has also increased, which may indicate that analysts expect earnings growth.

-

However, the PEG Ratio has significantly risen, potentially signifying that the stock may be overvalued based on expected growth rates.

-

Revenue has significantly grown, which is a positive indicator for company performance.

-

Net Income has also increased, reflecting a solid financial position.

When considering the balance of technical indicators alongside the company fundamentals, the overall narrative leans towards a cautiously optimistic future for TSM's stock price in the months ahead. The trends are generally bullish, and the financial indicators show a company in a sound financial position with growth in key financial metrics.

However, some signs, such as the Stochastic readings and the elevated PEG ratio, suggest that there could be periods of consolidation or pullback before further sustained upward movement. Furthermore, market dynamics are constantly in flux, influenced by global economic conditions, industry performance, investor sentiment, and company-specific news.

Investors and traders should monitor these indicators regularly and adjust their expectations in accordance with real-time developments and a comprehensive analysis of market conditions. It is also advisable to consider a diversified approach to investment to mitigate risks associated with unanticipated market movements.

The semiconductor industry has been instrumental in driving technological advancement and has experienced dynamic shifts in market demand alongside geopolitical tensions. Central to these developments is Taiwan Semiconductor Manufacturing Company Ltd. (TSMC), the foremost contractor for chip manufacturing globally. With market capitalization peaking at nearly $730 billion in early 2022 and a strong projected earnings growth trajectory, there are good reasons to believe that TSMC could escalate towards a $1 trillion valuation by 2030.

TSMC has outrivaled competitors like Samsung and Intel, particularly within advanced semiconductor manufacturing technology. Its capacity to produce chips as small as 3-nanometers, and its plans to leap into 2-nanometer and rumored 1.4-nanometer production indicate a consistent technical lead. These advancements are major factors behind TSMC's projected growth trajectory, providing a structural revenue boost as technology companies seek more efficient chip designs to power their innovations.

The client base of TSMC includes top-tier technology firms such as Apple, Nvidia, and AMD, which depend on TSMC's manufacturing capabilities for the central computing power of their products. TSMC maintains a neutral stance in the market by serving as a third-party manufacturer and not directly competing with client interests. This neutral positioning allows it to be a preferred partner over rivals that also compete in the downstream markets.

Despite a decline in market capitalization to around $539 billion, largely from decreased demand, analysts maintain a bullish outlook, predicting a 20% revenue growth in 2024 and an increase in earnings per share. TSMC trades at a beneficial earnings multiple relative to the market, suggesting significant potential for valuation growth and making it an attractive prospect for investors.

With steady fundamentals, TSMC is primed to grow its earnings at a consistent annual rate, likely exceeding the broader market's long-term trends. It is believed that this could allow TSMC to secure a market cap of over $1 trillion by the onset of 2030, a growth marked by a compound annual rate of nearly 14.9%.

TSMC's strong technical leadership, strategic neutrality, and impressive financial outlook form a solid argument for its ongoing growth trajectory. As a critical part of the supply chain for vital tech sectors, TSMCs pricing strategy and infrastructure investments place it in a strong position. Its enduring demand for chips sets a firm foundation for surpassing the trillion-dollar valuation.

Heading into 2024, TSMC stands at the threshold of significant advancements in the semiconductor sphere. The company's progression in tech, exampled by its 3-nanometer chip, suggests a continued trend of revenue bolstering. With tech giants incorporating next-gen technologies, TSMC's dominance in the high-end chip market is expected to solidify further.

Financial outlooks for investors focus on the appealing stock valuation of TSMC. The company is trading at a multiple that suggests a favourable investment. Management's optimism signals a potential upswing in chip demand. The appeal of TSMC extends beyond just its financials, considering the broader market trend emphasizing tech integration, which supports a strong demand for advanced semiconductors.

The investment community, including platforms like The Motley Fool, reinforces TSMC's standing as a stock with considerable potential for the year 2024. The semiconductor industry is a bellwether for technological adoption and economic prowess, making TSMC's leading role a salient factor. Its advancements significantly influence consumer electronics, automotive, and other sectors, contributing to the company's growth potential.

Updates on the semiconductor landscape spotlight the endeavors of TSMC, amidst global chip shortages and increased demand for semiconductors. TSMC has actively invested in its research and production capacities. This proactive response demonstrates the company's commitment to addressing market needs and propelling it toward an era of increased chip integration and innovation.

TSMC's contribution extends to the AI revolution, serving as a prime vendor for Nvidia's AI chips. Despite general slowdowns, AI chip demand has relatively fortified TSMCs position. This steadfast demand highlights the growing influence of AI in shaping TSMCs business strategy and revenue outlook for the foreseeable future.

Turning a lens on TSMC's financial performance, anticipating a revenue rebound in the year 2024 is prudent. The company's revenue forecasts and capacity expansions in advanced chip packaging are set to enhance its market capitalization. The competitive edge provided by these advancements is conducive to TSMC's promising revenue target of approximately $99 billion by 2025.

Other companies in the AI space, such as Snowflake, are also contributing to the industry's growth. Snowflake's focus on data quality, sharing, and AI-related services underlines the significance of data in the development of AI. With Snowflake updating its revenue forecast and anticipating continued growth, investments in such companies offer exposure to the expansive AI sector, alongside TSMC.

TSMC and ASML, another key industry player, stand as pillars in the semiconductor industry with potential for growth that investors find worth consideration. They are central to cutting-edge chip production and possess strategic technological capabilities. Despite geopolitical risks, particularly those stemming from regional tensions involving Taiwan, the market consensus reflects an optimistic outlook for both companies in the investment realm.

As the semiconductor market continues to grow, partnerships within the industry reflect strategic moves. Nvidia's interest in diversifying its foundry partnerships and exploring a tie-up with Intel for AI chip production is indicative of the evolving landscape. This prospective collaboration signals opportunities for companies to enhance their supply chain and tap into each other's strengths.

TSMC has all the hallmarks of a company poised for significant expansion, with many factors at play that are aligning in favour of its growth outlook. The companys strategic orientation and commitment to innovation are indicative of its potential to capture expanding markets, such as AI, making it a stock to monitor closely as new growth cycles emerge.

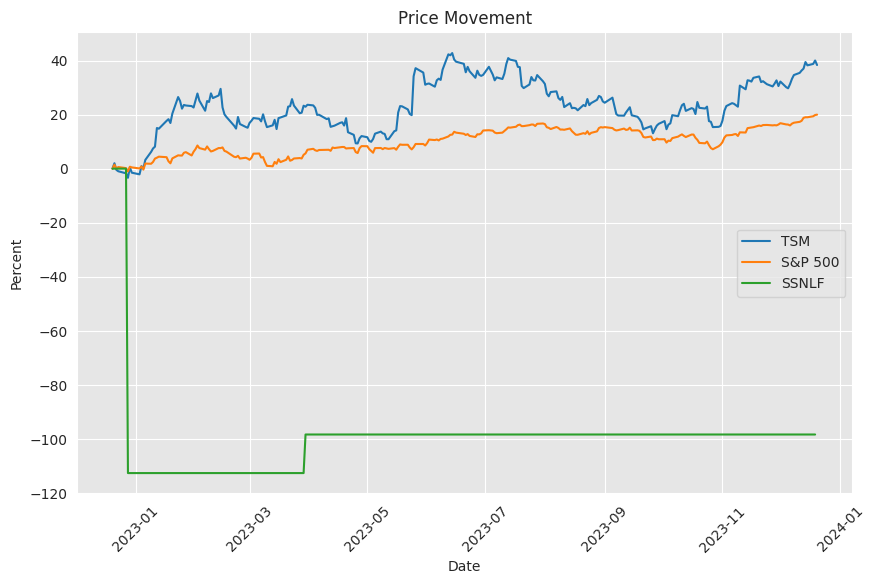

Similar Companies in Semiconductors:

Samsung Electronics Co., Ltd. (SSNLF), Intel Corporation (INTC), Advanced Micro Devices, Inc. (AMD), NVIDIA Corporation (NVDA), Texas Instruments Incorporated (TXN), QUALCOMM Incorporated (QCOM), Broadcom Inc. (AVGO), Report: Micron Technology, Inc. (MU), Micron Technology, Inc. (MU), Applied Materials, Inc. (AMAT), Lam Research Corporation (LRCX)

News Links:

https://www.fool.com/investing/2023/12/19/will-taiwan-semiconductor-be-a-trillion-dollar-sto/

https://www.fool.com/investing/2023/12/16/here-are-my-top-10-stocks-for-2024/

https://www.fool.com/investing/2023/12/14/what-asml-nvidia-and-tsmc-stock-investors-should-k/

https://www.fool.com/investing/2023/12/14/2-top-artificial-intelligence-ai-stocks-ready-for/

https://www.fool.com/investing/2023/12/13/2-phenomenal-chip-stocks-to-buy-in-2024/

https://www.fool.com/investing/2023/12/11/why-comments-by-nvidias-cfo-pushed-intel-stock-int/

https://www.fool.com/investing/2023/12/10/3-undervalued-tech-stocks-set-for-a-great-2024/

https://www.fool.com/investing/2023/12/10/this-will-be-a-trillion-dollar-industry-by-2030-4/

https://www.fool.com/investing/2023/12/09/2-incredible-stocks-youll-regret-not-buying-before/

https://www.fool.com/investing/2023/12/09/3-great-foregin-companies-to-invest-in-right-now/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: a6tZN7E

https://reports.tinycomputers.io/TSM/TSM-2023-12-20.html Home