Twilio Inc. (ticker: TWLO)

2024-02-01

Twilio Inc. (ticker: TWLO), founded in 2008, is a cloud communications platform as a service (PaaS) company that allows software developers to programmatically make and receive phone calls, send and receive text messages, and perform other communication functions using its web service APIs. Headquartered in San Francisco, California, Twilio has democratized communications channels like voice, text, chat, video, and email by virtualizing the world's telecommunications infrastructure through APIs that are simple enough for any developer to use yet robust enough to power the world's most demanding applications. Twilio's services are used by a variety of businesses, from startups to large enterprises, to incorporate communication functions into their software solutions without the need to build backend infrastructure and interfaces. As of my knowledge cutoff in 2023, Twilio continues to expand its suite of communication tools and platforms, offering scalable solutions and maintaining a notable presence in the field of cloud-based communication.

Twilio Inc. (ticker: TWLO), founded in 2008, is a cloud communications platform as a service (PaaS) company that allows software developers to programmatically make and receive phone calls, send and receive text messages, and perform other communication functions using its web service APIs. Headquartered in San Francisco, California, Twilio has democratized communications channels like voice, text, chat, video, and email by virtualizing the world's telecommunications infrastructure through APIs that are simple enough for any developer to use yet robust enough to power the world's most demanding applications. Twilio's services are used by a variety of businesses, from startups to large enterprises, to incorporate communication functions into their software solutions without the need to build backend infrastructure and interfaces. As of my knowledge cutoff in 2023, Twilio continues to expand its suite of communication tools and platforms, offering scalable solutions and maintaining a notable presence in the field of cloud-based communication.

| Address Line 1 | 101 Spear Street | City | San Francisco | Country | United States |

| Address Line 2 | Fifth Floor | State | CA | Phone | 415 390 2337 |

| ZIP Code | 94105 | Website | https://www.twilio.com | Industry | Internet Content & Information |

| Sector | Communication Services | Full Time Employees | 8,156 | Market Cap | 12,825,085,952 |

| Beta | 1.465 | Forward P/E | 28.914284 | Volume | 1,136,030 |

| Average Volume | 2,927,083 | Mkt Cap | 12,825,085,952 | 52 Week Low | 45.02 |

| 52 Week High | 79.7 | P/S (ttm) | 3.126111 | Profit Margin | -21.437% |

| Enterprise Value | 10,069,749,760 | Shares Outstanding | 181,043,008 | Book Value | 54.812 |

| Price/Book | 1.2924176 | Net Income | -879,454,976 | EPS | -4.77 |

| Forward EPS | 2.45 | Peg Ratio | 0.32 | Enterprise/Revenue | 2.454 |

| Enterprise/EBITDA | -38.463 | Shares Short | 4,011,566 | Short Ratio | 1.57 |

| Short % of Float | 2.23% | Held by Insiders | 1.804% | Held by Institutions | 78.64% |

| Total Cash | 3,857,409,024 | Total Debt | 1,194,413,952 | Current Ratio | 6.53 |

| Total Revenue | 4,102,568,960 | Debt/Equity | 11.969 | Revenue Per Share | 22.279 |

| ROA | -2.82% | ROE | -8.576% | Free Cash Flow | 398,327,008 |

| Operating Cash Flow | 133,752,000 | Revenue Growth | 5.2% | Gross Margin | 48.615% |

| EBITDA Margin | -6.381% | Operating Margin | -9.879% | Current Price | 70.84 |

| Sharpe Ratio | 0.4200860699438784 | Sortino Ratio | 7.211437841310433 |

| Treynor Ratio | 0.1251214933958226 | Calmar Ratio | 0.3404831415288464 |

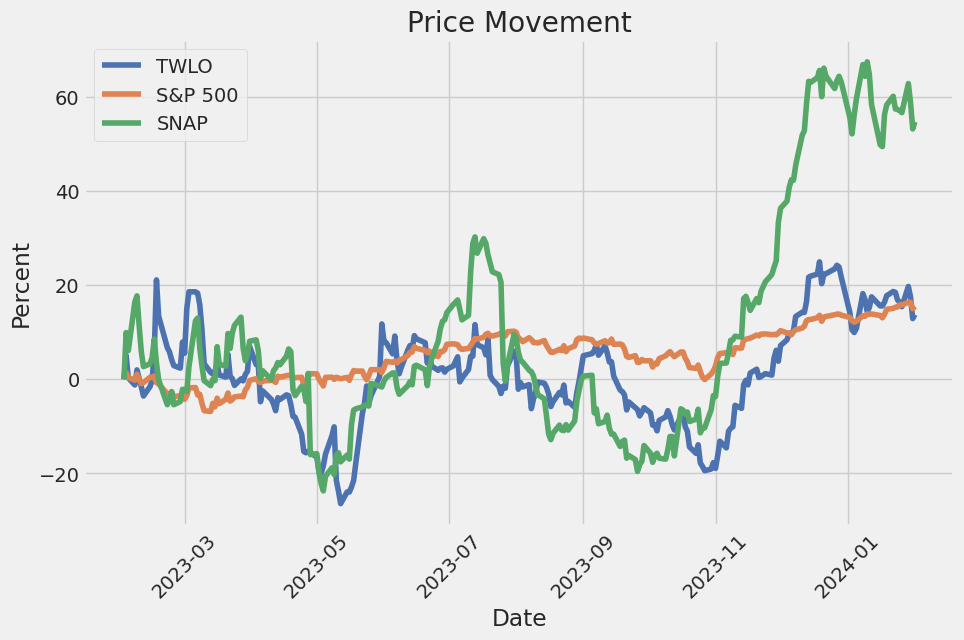

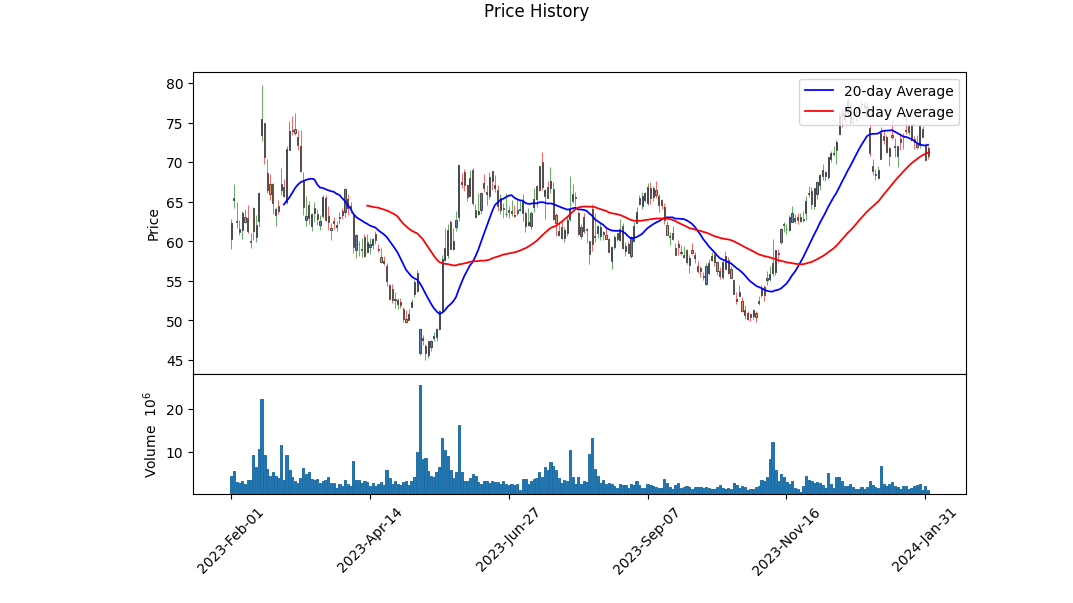

Technical Analysis of TWLO suggests a progressive momentum reflected by the gradual increase in the stock's opening price from $56.69 to $71.78 over several months. Analyses based on the On-Balance Volume (OBV) indicator, which climbed from 0.199 million to 6.583 million, indicate a substantial level of accumulation, typically a bullish signal for price momentum. However, recent negative MACD histogram values suggest a potential slowing of upward momentum or an impending pullback.

The risk-adjusted performance metrics paint a nuanced picture of TWLO's positioning. A Sharpe Ratio of 0.4200860699438784 shows that the investment provides a reasonable excess return over the risk-free rate when considering the standard deviation of the stock price, indicating a decent performance. However, the Sortino Ratio at 7.211437841310433, which focuses on downside deviation, ironically implies robust risk-adjusted returns despite TWLO's inherent volatility, signaling that positive gains have sufficiently compensated for negative returns. The Treynor Ratio at 0.1251214933958226 indicates the excess return that could have been gained per unit of market risk, presenting a modest score. Lastly, a Calmar Ratio of 0.3404831415288464 implies the return earned relative to the maximum drawdown, suggesting the company has weathered significant market fluctuations somewhat effectively.

The Balance Sheets denote a substantial increase in Tangible Book Value over the years, indicating growth in the company's physical worth, and a stable base of other assets, such as Cash, Cash Equivalents, and Short Term Investments, which may provide a buffer in volatile market conditions. However, there is a notable level of net debt, suggesting a financial obligation that needs to be watched closely.

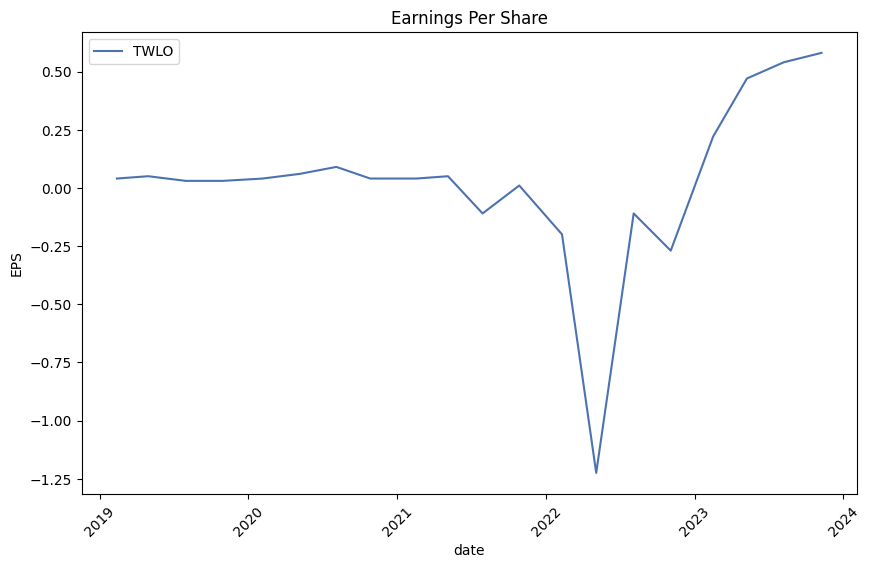

Fundamentals are mixed, with the presence of negative normalized EBITDA, operating margin, and substantial net income losses, which raise questions on corporate profitability and operational efficiency. Nonetheless, gross margins are strong, hinting that the company can retain a significant portion of sales after deducting the cost of goods sold.

The Analyst Expectations show potential optimism with an Earnings Estimate for next year (2024) suggesting a sizeable increase to $2.45 from the $2.14 EPS a year ago. Revenue Estimates also project growth, indicating a healthy demand for the companys offerings.

The Summary of Score reveals an Altman Z-Score of 4.264480799104594, reassuring the low likelihood of bankruptcy and suggesting good financial health. Additionally, a Piotroski Score of 7 out of 9 indicates a healthy fiscal state and operational momentum.

In conclusion, TWLO presents a complex investment thesis. Positive technical indicators like OBV growth are counterbalanced by negative MACD histograms. Strong Sharpe and Sortino Ratios suggest adequate risk-adjusted returns, yet fundamentals show a company grappling with profitability. Analyst expectations, however, seem promising, indicating potential growth in earnings and revenue. Weighing these factors, the stock may continue to see upward momentum in the near term, though the sustainability of this trajectory largely depends on improved profitability and effective management of its debt profile. Investors should carefully monitor financial and operational developments to navigate this intricate landscape effectively.

In our analysis of Twilio Inc. (TWLO), we have computed two key financial metrics based on the principles outlined in "The Little Book That Still Beats the Market." The first metric, Return on Capital (ROC), stands at -8.77%. This negative figure indicates that Twilio Inc. is not currently generating a positive return on the capital it has invested in its business operations, which is potentially a cause for concern as it suggests the company may be losing value on its invested capital. The second metric we calculated is the Earnings Yield, which also presents a negative value at -9.69%. This means that the companys earnings relative to its share price are negative, signifying that the company is not making a profit based on its current market valuation. This typically implies that investors are not gaining any earnings from their investment through company profits. Both of these metrics suggest that Twilio Inc. is experiencing challenges in generating profitable returns and operational efficiency at the time of this analysis. Investors should closely scrutinize the company's strategies for future profitability and consider the risk factors associated with Twilio's current negative financial performance.

Based on our calculations regarding Twilio Inc. (TWLO) and considering the principles set forth by Benjamin Graham in "The Intelligent Investor," let us evaluate the key metrics as they relate to Graham's criteria for stock screening and selection:

-

Price-to-Earnings (P/E) Ratio: The P/E ratio calculated for Twilio Inc. is negative, at approximately -13.56. This negative P/E ratio indicates that the company is currently not profitable, which means it does not meet Graham's criteria of looking for stocks with low but positive P/E ratios. A negative P/E ratio would generally disqualify a stock from consideration by a strict adherent to Graham's principles, as it suggests the company is experiencing earnings difficulties.

-

Price-to-Book (P/B) Ratio: The P/B ratio for Twilio Inc. is about 1.02, suggesting that the market price is closely in line with the company's book value. According to Graham, a P/B ratio under 1.5 could be considered attractive, as it may imply that the stock is trading below its intrinsic value, depending on other factors. Thus, the P/B ratio for TWLO may be seen as somewhat aligned with Graham's principles, signaling potential value.

-

Debt-to-Equity Ratio: Twilio Inc. has a debt-to-equity ratio of approximately 0.116, indicating that the company has a low level of debt relative to its equity. This is in keeping with Graham's preference for companies with low debt-to-equity ratios, as it shows a lower financial risk and a potentially stronger balance sheet position.

-

Dividend History: The dividend history for Twilio Inc. indicates that there have been no consistent dividend payments, as the 'historical' list is empty. Graham favored companies that had a history of paying dividends, considering them a sign of financial stability and shareholder-friendliness. The lack of dividends from Twilio Inc. would make it unsuitable for investors seeking the assurance of regular dividend income, and as such, it would not align with Graham's criteria in this regard.

In summary, while Twilio Inc. exhibits a low debt-to-equity ratio, which is in line with Graham's principles, and a P/B ratio that may suggest value, the negative P/E ratio and lack of dividend history are significant departures from Graham's criteria. Defensive investors, as characterized by Graham, would likely avoid a stock like Twilio based on these metrics, due to the apparent absence of profitability and dividend payments. Enterprising investors, if they see other compelling reasons to invest, such as prospects for future growth or turnaround potential, might consider a deeper analysis, weighing the margin of safety and other qualitative factors before making an investment decision. However, they would have to be prepared to undertake thorough due diligence, going beyond the simple quantitative measures Graham typically employed.

| Statistic Name | Statistic Value |

| R-squared | 0.203 |

| Adjusted R-squared | 0.202 |

| F-statistic | 318.8 |

| Prob (F-statistic) | 1.02e-63 |

| Log-Likelihood | -3,344.4 |

| AIC | 6,693 |

| BIC | 6,703 |

| Alpha | -0.0423 |

| Beta | 1.3252 |

| No. Observations | 1,257 |

| Df Residuals | 1,255 |

| Df Model | 1 |

| Skew | 0.134 |

| Kurtosis | 25.408 |

The alpha (intercept) value of the linear regression model is -0.0423, which indicates that when SPY, the representation of the market, has a value of zero, the expected value of TWLO is slightly lower than zero, before considering other variables. This negative alpha suggests that TWLO tends to underperform the market baseline by a small margin. The R-squared of 0.203, which represents the proportion of TWLO's variance that can be explained by its relationship with SPY, points to a moderate level of fit for the linear model, indicating that the market explains around 20% of the variance of TWLO's returns.

Continuing, the beta (slope) value of 1.3252 indicates a positive relationship between TWLO and SPY, where for every one unit increase in SPY, TWLO is expected to increase by approximately 1.3252 units, showcasing a greater sensitivity to market movements. However, the confidence intervals for beta suggest that this estimate is statistically significant, assuring that the relationship between TWLO and the market is stable and that the beta value is likely not due to random chance within the sample period.

In this summarized report on Twilio Inc.'s third quarter 2023 earnings call, the company's SVP of Investor Relations, Bryan Vaniman, opened the proceedings before handing over to CEO Jeff Lawson and other executives. Twilio reported exceeding expectations in revenue and non-GAAP profitability, signaling another record quarter for non-GAAP income from operations and free cash flow. The reported revenue for the quarter was $1.034 billion, non-GAAP income from operations was $136 million, and free cash flow was $195 million. Following the year-to-date performance, Twilio raised its full-year non-GAAP income from operations guidance to between $475 million and $485 million. Jeff Lawson emphasized the results as evidence of efficiency gains in the company's core Communications business, which comprised 88% of the Q3 revenue. Twilio's Communications business was recognized by Gartner as a leader in the Magic Quadrant for CPaaS, reflecting its market position and platform strength. The company also secured an extended partnership with Softbank to increase market share.

The call detailed Twilio's efforts to foster growth within its Communications segment, led by Khozema Shipchandler, President of Twilio Communications. The segment generated $907 million in revenue, witnessing an organic growth of 8% year-over-year with a non-GAAP gross margin of 49.8%. Shipchandler asserted Twilio's success in cross-selling and innovation, along with efficiency enhancements bolstered by strategic partnerships and a focus on self-service capabilities. The 10 DLC registration deadline was also confirmed as successfully executed, mitigating revenue risks. The company expressed optimism for continued progress in the Communications business.

On the Data & Applications (TD&A) side, Jeff Lawson noted improvements with modest uptick in bookings, but acknowledged the need for more work to reaccelerate growth as TD&A represents 12% of total revenue. TD&A's Q3 revenue was up by 9% year-over-year, with positive market feedback and customer wins. The company also saw the transition of Elena Donio from her role as President of Twilio Data & Applications into an advisory role. Lawson highlighted Segment's recognition as a leader by IDC and Segment's capabilities foundational to CustomerAI. Twilio introduced predictive and generative AI features that pair customer data with large language models through CustomerAI, which has started to generate interest.

Finally, Chief Financial Officer Aidan Viggiano provided a detailed overview of Twilio's financials, noting significant achievements in terms of free cash flow and share repurchase progress. While acknowledging certain industry-specific headwinds affecting growth, such as those in the crypto industry, Viggiano highlighted Twilios prudent planning and emphasis on driving efficiencies. Guidance for Q4 was given with anticipated revenue of $1.03 billion to $1.04 billion and non-GAAP income from operations forecasted to be between $115 million and $125 million.

The Q&A session underscored inquiries regarding Twilio's data and applications business performance, strategies to counter churn and boost bookings, margin expectations, and customer trends during the holiday season. The executives underscored the stable volumes, growth across various industries, and strategic focus on product innovation and market leadership.

Twilio Inc., a leading cloud communications platform, filed its SEC Form 10-Q for the third quarter ended September 30, 2023. In this period, Twilio reported robust revenue growth yet experienced a net loss. The revenue was $1.034 billion, reflecting a 5% year-over-year increase compared to $983 million in the same quarter of the previous year. However, the company's net loss amounted to $141.7 million for the third quarter, revealing a significant reduction in losses compared to the net loss of $482.3 million reported in the comparable period last year.

The company's revenue was generated through a mix of usage-based and subscription-based models, with products like Messaging and Voice dominating the usage-based category. Cost of Revenue primarily consisted of expenditures paid to network service providers and encompassed associated costs such as cloud infrastructure fees, personnel costs, and depreciation of equipment. As a percentage of revenue, Gross Margin was 50% for the third quarter in 2023, showing a slight improvement from 47% in the third quarter of 2022.

Twilio reported an Active Customer Accounts metric, revealing a customer base growth from 280,000 at the end of Q3 2022 to 306,000 at the end of the current reporting period. In terms of customer account growth scale, Twilio's Dollar-Based Net Expansion Rate decreased from 122% in Q3 2022 to 101% in Q3 2023, suggesting a slower pace of revenue growth from existing customers year over year.

The company also reported progress in its strategic organizational objectives. Twilio underwent a business unit reorganization, dividing its operations into two core segments: Twilio Communications and Twilio Data & Applications, aligning with the company's intent to streamline operations and focus resources more strategically.

Twilio has positioned itself for future financial discipline by implementing a share repurchase program approved by its Board of Directors in February 2023, authorizing an aggregate of up to $1.0 billion in share repurchases. For the current period, the company purchased nearly 9.2 million shares at $551 million, leaving $449 million available under the program.

In alignment with the overarching industry trend and their business strategy, Twilio opted to become a remote-first company, leading to permanent office closures and an associated impairment charge of $34.3 million for the nine months ended September 30, 2023. Operational adjustments due to workforce reduction were also noted, with restructuring charges predominantly related to these actions amounting to $140.3 million over the same nine-month period.

The Form 10-Q filing also includes various other financial and operational details, such as information on legal matters, tax provisions, and related party transactions. Notable among these, Twilio reported on a favorable settlement agreement regarding the Telephone Users Tax litigation with San Francisco, awaiting final approval as of this reporting. Overall, the filing highlighted Twilio's resilience amidst challenging economic times, with a focused approach to strategic reorientation and cost-efficiency initiatives. However, the company is navigating through uncertain macroeconomic conditions, which factor prominently in its forward-looking strategies. The filing date of the 10-Q was not provided in the excerpt.

The recent developments surrounding Twilio Inc. present a multifaceted view of the company's position and efforts within the cloud communications industry. Investors have been tuning back into Twilio after a hiatus, showing renewed confidence in its stock. This change in sentiment is largely credited to Twilio's ability to demonstrate leadership under the guidance of its CEO, and to its response to past critiques by diversifying its product portfolio.

Financial optimism prevails as Twilios stock price has experienced a significant upswing, boosted by investors' anticipation of better financial results in the coming periods. While the past has shown some investor hesitancy due to concerns about growth sustainability and profitability, especially as monetary policies tightened, current investment patterns suggest that Twilio is navigating these challenges effectively.

The internal restructuring of Twilio has taken center stage in January 2024, following the impactful decisions made by the company's leadership. Jeff Lawson's resignation from his CEO and board member roles opened the way for Khozema Shipchandler, a Twilio veteran, to take on the CEO mantle. Shipchandler's move to CEO comes amid Twilio's operational shifts, including layoffs aimed at streamlining the business. These changes could further catalyze strategic directions shaped by demands from activist investors like Anson Funds and Legion Partners, who have been pressing for a company-wide overhaul.

As Twilio appointments Shipchandler and Epstein step into their new roles, the boardroom reshuffle seems only to incite ongoing endeavors to optimize Twilio's profitability and operating efficiency. The focus now pivots to the companys future under this new regime, with Shipchandler's leadership expected to steer Twilio through the pressures of the industry and the specific demands of activist involvement.

In the broader market perspective, discussions among financial analysts indicate that companies like Twilio may be approaching a pivotal moment in their stock performance. Although specifics on Twilio's rumored "breakout" are not thoroughly detailed, such sentiments hint at an underlying optimism about the companys prospects for growth.

Engagement with the AI startup ecosystem further underscores Twilio's innovative spirit, as seen in the hosting of the 2024 AI Startup Searchlight Awards. The celebration of startups merging AI with Twilio's comprehensive suite of services underscores the companys commitment to nurturing transformative technologies in the industry. Notably, the selection of startups indicates the breadth and versatility of Twilio's platform.

These optimisms are echoed in investment analyses where Twilio is identified as a strong growth candidate. The Motley Fool report, penned by analysts like Anders Bylund, sees Twilio's current market valuation as a bargain. Attribution is given to the company's significant growth in 2023, despite some market skepticism. Strategic investments, operational cost reductions, and a posited uptick in the overall economy are factors contributing to this bullish outlook.

Twilio's financial performance, according to a report from The Motley Fool, seems to indicate the company is ready for maturation from a trailblazing startup to a business with a heightened focus on profitability. The management changes could signal a move to address the sustainability of its operations, align managerial incentives more intricately with company performance, and ultimately deliver shareholder value.

However, comparisons with other cloud giants signal caution. Despite Lawsons early involvement in AWS and initial forecasts similating remarkable growth, Twilio's stock and growth rates have shown a significant slowdown. The competitive landscape, revenue model challenges, carrier fees, and dependency on AWS for infrastructure further intensify the difficulties Twilio faces in aspiring to become a respected name alongside the likes of AWS.

Yet, Twilio's market share and the projected expansion of the global CPaaS market imply that there are still robust opportunities ahead for the company. Analysts have been upping Twilio's growth projections with the anticipation of an earnings acceleration from 2025 onwards. Therefore, Twilio is deemed a potentially compelling stock for those looking to harness what seems to be a highly promising sector.

Investors who follow methodologies similar to Timothy Green of Motley Fool might view Twilio with caution, duly noting the challenges and restructuring efforts. A focus on Achieving GAAP profitability by 2027 showcases an unexpected dedication to financial rigor that is laudable. However, Green suggests a potential consideration for investment if and when Twilios valuation becomes more fitting, reflecting its growth perspectives and effectiveness.

Twilio, as identified by Cathie Wood of Ark Invest, garners belief not just because of its recent share price increases but for its entrenched presence within the cloud-based contact center sector. Analysts are anticipating substantial revenue growth in subsequent years, suggesting that the current valuation represents a potentially lucrative entry point for long-term growth seekers.

However, these strategic considerations and individual company performance metrics must be viewed in context with the broader market conditions of the tech sector. Reports detailing the performance of peer companies such as Atlassian, aligned with projected increases in revenues and earnings driven by persistent trends like remote work adoption and AI integration, offer a hopeful prediction for Twilio's future expansion and alignment with market demand.

Twilio's robust position in an expanding market, combined with its clear forward-looking strategy, should invite a comprehensive evaluation of its potential. Analysts cite Twilio's anticipated improvements in both revenue and earnings as indicators of a promising investment. This narrative is reinforced by the resilience shown in Twilios latest financial reports, surpassing consensus estimates for both revenue and earnings.

Overall, Twilio Inc. stands at an intriguing juncture, balancing its transformation into a mature, profit-focused enterprise while still harnessing growth momentum. As the landscape of cloud communications evolves, Twilio's approaches to growth, profitability, and innovation remain under close scrutiny from investors, analysts, and the industry at large.

For a full account of Twilios stock recommendations and financial evaluations, along with sector trends and the impact on similar companies such as 8x8 Inc., readers can further explore the original articles and reports from The Motley Fool and Zacks Equity Research respectively. These sources provide deeper insights into the financial dynamics and forecasts that underpin Twilios current market position and future prospects.

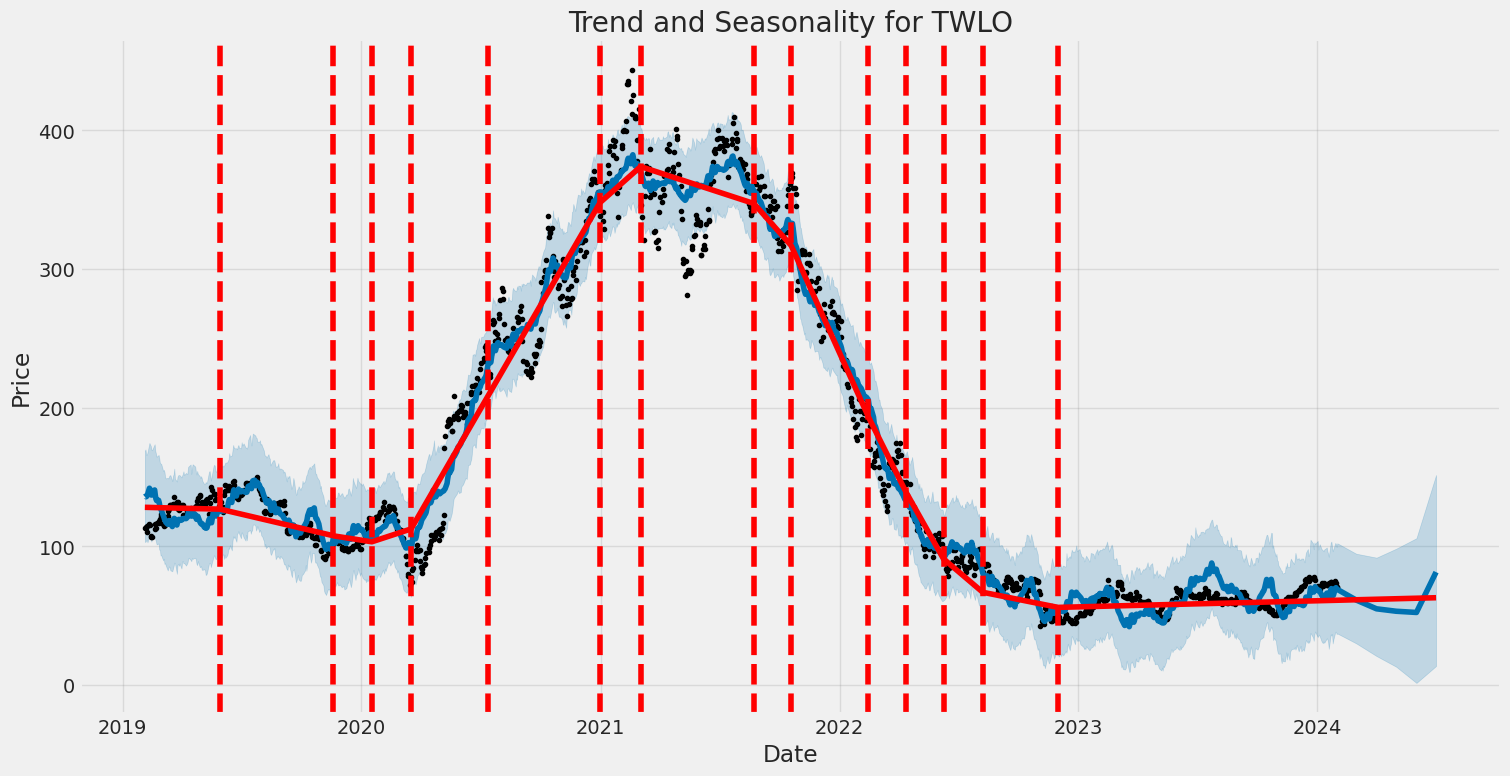

In plain language, the volatility summary of Twilio Inc. (TWLO) from February 4, 2019, to February 1, 2024, shows the following three key features:

-

The model used to analyze the stock's volatility does not predict the future returns based on past information (Zero Mean), implying that knowing past price movements doesn't necessarily help in predicting future movements according to this model.

-

The coefficient

omegais significant with a value of approximately 10.97, which indicates that the baseline level of volatility in the stock is fairly high. This value represents an overall constant risk when no other market influences or events are considered. -

The

alpha[1]value, which measures how much past volatility affects current volatility, is not statistically significant based on the model (p-value above the typical significance level of 0.05). This suggests that past fluctuations in the stock's returns have a limited impact on future volatility, according to this model.

Here is the corresponding HTML table summarizing the key statistics:

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3465.14 |

| AIC | 6934.28 |

| BIC | 6944.55 |

| No. Observations | 1257 |

| Df Residuals | 1257 |

| omega | 10.9696 |

| alpha[1] | 0.3702 |

To analyze the financial risk associated with a $10,000 investment in Twilio Inc. over a year, a dual approach involving volatility modeling and machine learning predictions is employed.

The volatility modeling technique is key in understanding the dynamic nature of Twilio Inc.'s stock volatility. This statistical tool captures the variances in stock price returns that cluster over time, allowing for a more informed prediction of future volatility levels. By fitting the model to Twilio Inc.'s historical stock returns, we obtain a time series of the conditional variance. This conditional variance serves as an estimate of the expected level of risk or volatility in the near future, which is crucial for financial risk assessment.

On the other hand, machine learning predictions, utilizing algorithms such as the one inspired by random decision forests, contribute to the understanding of potential future returns. This method involves ingesting a variety of features, including historical price data and potentially other market or company-specific indicators, to extrapolate patterns that have predictive power regarding stock performance. The algorithm's ability to account for nonlinear relationships and interactions between variables can enhance the accuracy of return predictions.

Combining the insights gained from volatility modeling with predictive outputs from machine learning allows for a nuanced risk assessment. Notably, an important metric to derive from these analyses is the Value at Risk (VaR), which provides an estimate of the maximum expected loss over a set time frame at a certain confidence level.

For Twilio Inc., the one-year VaR at a 95% confidence interval, as calculated through this hybrid approach, stands at $505.80 on a $10,000 investment. This figure implies that there is only a 5% probability that the investor would experience a loss exceeding $505.80 over the course of a year under normal market conditions. It essentially gives investors a quantifiable risk threshold, allowing them to evaluate the potential downside they might face.

It is important to note that these models provide a snapshot based on current and historical data. Unexpected market events or changes in the company's operations can greatly influence actual outcomes. Therefore, while the calculated VaR and the methods used to acquire it offer useful risk parameters, they should be considered as part of a holistic risk management strategy rather than as standalone evaluations.

Similar Companies in Internet Content & Information:

Snap Inc. (SNAP), Fiverr International Ltd. (FVRR), Spotify Technology S.A. (SPOT), Baidu, Inc. (BIDU), Pinterest, Inc. (PINS), Report: Meta Platforms, Inc. (META), Meta Platforms, Inc. (META), Alphabet Inc. (GOOG), Alphabet Inc. (GOOGL), Tencent Holdings Limited (TCEHY), Bandwidth Inc. (BAND), Vonage Holdings Corp. (VG), RingCentral, Inc. (RNG), 8x8, Inc. (EGHT), Zoom Video Communications, Inc. (ZM)

https://www.youtube.com/watch?v=g0GMTg-9Bdc

https://www.fool.com/investing/2023/12/21/3-growth-stocks-to-buy-that-could-be-massive-long/

https://www.youtube.com/watch?v=1agf7NIRIYs

https://www.fool.com/investing/2023/12/29/2-stocks-on-my-watchlist-for-2024/

https://www.fool.com/investing/2023/12/30/this-cathie-wood-stock-is-soaring-magnificently-an/

https://www.cnbc.com/2024/01/08/twilio-ceo-lawson-steps-down-after-bruising-activist-battles.html

https://www.fool.com/investing/2024/01/11/twilio-getting-new-management-team-time-shop-stock/

https://www.fool.com/investing/2024/01/20/could-twilio-become-the-next-amazon/

https://www.fool.com/investing/2024/01/21/2-top-bargain-stocks-ready-for-a-bull-run/

https://seekingalpha.com/article/4664509-twilio-a-rare-value-stock-in-the-tech-sector

https://finance.yahoo.com/news/twilio-announces-honorees-2024-ai-140000269.html

https://finance.yahoo.com/news/twilio-inc-twlo-trending-stock-140005051.html

https://finance.yahoo.com/news/hedge-fund-anson-gains-18-140159095.html

https://finance.yahoo.com/news/atlassian-team-report-q2-earnings-145500561.html

https://finance.yahoo.com/news/8x8-eght-report-q3-earnings-163900662.html

https://www.sec.gov/Archives/edgar/data/1447669/000144766923000226/twlo-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: mXxc3LK

Cost: $1.00491

https://reports.tinycomputers.io/TWLO/TWLO-2024-02-01.html Home